444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The APAC NDT Equipment Market refers to the market for Non-Destructive Testing (NDT) equipment in the Asia-Pacific region. NDT is a crucial process used in various industries to evaluate the properties and integrity of materials, components, and structures without causing any damage. The market for NDT equipment in the APAC region is witnessing significant growth due to increasing industrialization, infrastructural development, and stringent quality regulations across industries such as oil and gas, aerospace, automotive, power generation, and manufacturing.

Meaning

Non-Destructive Testing (NDT) is a methodical process that allows the evaluation and analysis of materials, components, and structures without causing any damage. This testing technique is employed across different industries to ensure the integrity and quality of products, reduce the risk of failure, and enhance safety standards. NDT equipment includes a wide range of devices and instruments such as ultrasonic testing, radiography testing, visual inspection, magnetic particle testing, and eddy current testing.

Executive Summary

The APAC NDT Equipment Market is experiencing substantial growth driven by factors such as increased demand for quality assurance, the need for efficient inspection processes, and rising safety concerns. The market offers immense opportunities for manufacturers and service providers, especially in emerging economies such as China, India, and Southeast Asian countries. However, the market also faces challenges related to high initial investment costs and the availability of skilled professionals. Despite these challenges, the market is expected to witness steady growth in the coming years.

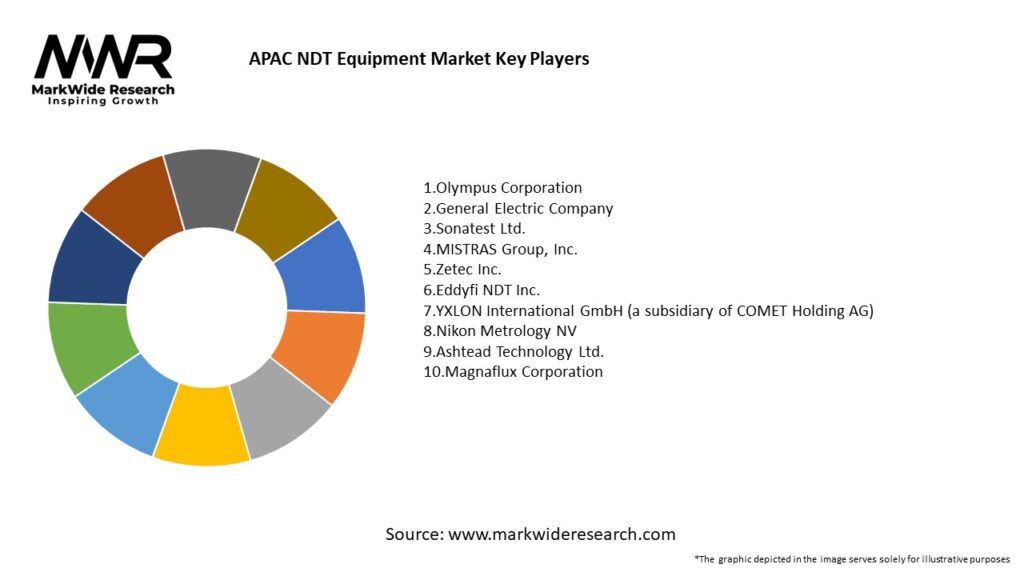

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The APAC NDT Equipment Market is characterized by intense competition, technological advancements, and evolving customer requirements. Manufacturers and service providers need to focus on product innovation, cost-effectiveness, and expanding their service networks to stay competitive in the market. Collaboration with research institutions and industry partners can facilitate the development of advanced NDT technologies tailored to specific industry needs. Furthermore, market players should invest in training programs to address the shortage of skilled professionals and ensure efficient utilization of NDT equipment.

Regional Analysis

The APAC NDT Equipment Market can be segmented into several key regions, including China, Japan, India, South Korea, Australia, and Southeast Asian countries. China holds a significant market share due to its robust industrial base and large-scale infrastructure projects. India is also a prominent market driven by its expanding manufacturing sector and government initiatives promoting quality control standards. Southeast Asian countries, such as Thailand, Indonesia, and Vietnam, are experiencing rapid industrialization, creating opportunities for NDT equipment manufacturers and service providers.

Competitive Landscape

Leading Companies in APAC NDT Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The APAC NDT Equipment Market can be segmented based on equipment type, industry verticals, and end-users. Equipment types include ultrasonic testing, radiography testing, visual inspection, magnetic particle testing, and eddy current testing. Industry verticals encompass oil and gas, automotive, aerospace, power generation, manufacturing, and infrastructure. End-users of NDT equipment include equipment manufacturers, service providers, and government agencies.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the APAC NDT Equipment Market. The initial outbreak led to temporary disruptions in manufacturing, construction, and other industrial activities, resulting in a decline in demand for NDT equipment. However, as the situation stabilized and industries resumed operations with precautionary measures, the demand for NDT equipment rebounded. The pandemic also highlighted the importance of quality control and safety measures, leading to increased investment in NDT equipment to ensure the integrity of products and minimize risks. The adoption of remote inspection technologies and digital solutions witnessed accelerated growth during the pandemic, enabling uninterrupted inspections and reducing human contact.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the APAC NDT Equipment Market remains positive, with steady growth expected in the coming years. The market will be driven by factors such as increasing industrialization, infrastructure development, and the implementation of stringent quality regulations. Technological advancements, including the integration of AI and ML, portable and handheld devices, and digital NDT solutions, will continue to shape the market. Market players who focus on innovation, strategic partnerships, and addressing the skilled labor shortage will be well-positioned to capitalize on the opportunities in the APAC NDT equipment market.

Conclusion

The APAC NDT Equipment Market is witnessing significant growth driven by factors such as industrialization, quality control regulations, and the need for safety assurance. Despite challenges related to initial investment costs and skilled labor shortages, the market offers immense opportunities for manufacturers and service providers. Technological advancements, emerging economies, infrastructure development projects, and the adoption of sustainable practices are key trends shaping the market. The COVID-19 pandemic has highlighted the importance of NDT equipment in ensuring product quality and safety. By embracing technological advancements, addressing skill gaps, and focusing on customer needs, market players can thrive in this dynamic market and contribute to the growth and success of the APAC NDT equipment industry.

What is NDT Equipment?

NDT Equipment refers to non-destructive testing tools and technologies used to evaluate the properties of materials, components, or assemblies without causing damage. This equipment is essential in various industries, including aerospace, automotive, and construction, to ensure safety and quality.

What are the key players in the APAC NDT Equipment Market?

Key players in the APAC NDT Equipment Market include companies like Olympus Corporation, GE Inspection Technologies, and Mistras Group, among others. These companies are known for their innovative solutions and extensive product offerings in non-destructive testing.

What are the growth factors driving the APAC NDT Equipment Market?

The APAC NDT Equipment Market is driven by increasing demand for quality assurance in manufacturing, stringent safety regulations, and the growing adoption of advanced technologies such as ultrasonic and radiographic testing. Additionally, the expansion of industries like oil and gas and aerospace contributes to market growth.

What challenges does the APAC NDT Equipment Market face?

The APAC NDT Equipment Market faces challenges such as the high initial investment costs for advanced testing equipment and the need for skilled personnel to operate these technologies. Furthermore, the varying regulatory standards across different countries can complicate market entry for new players.

What opportunities exist in the APAC NDT Equipment Market?

Opportunities in the APAC NDT Equipment Market include the increasing focus on infrastructure development and maintenance, which drives demand for reliable testing solutions. Additionally, advancements in automation and digital technologies present new avenues for growth and innovation in non-destructive testing.

What trends are shaping the APAC NDT Equipment Market?

Trends shaping the APAC NDT Equipment Market include the integration of artificial intelligence and machine learning in testing processes, the rise of portable and easy-to-use equipment, and a growing emphasis on sustainability in testing practices. These trends are enhancing efficiency and accuracy in non-destructive testing.

APAC NDT Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Ultrasonic Testing, Radiographic Testing, Magnetic Particle Testing, Eddy Current Testing |

| End User | Aerospace, Oil & Gas, Manufacturing, Power Generation |

| Technology | Digital Radiography, Automated Ultrasonic Testing, Thermography, Visual Inspection |

| Application | Pipeline Inspection, Weld Inspection, Structural Integrity, Aerospace Components |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in APAC NDT Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at