444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC mobile health market represents one of the fastest-growing segments in the global digital healthcare ecosystem, driven by rapid smartphone adoption, increasing healthcare awareness, and supportive government initiatives across the region. Mobile health solutions encompass a comprehensive range of digital healthcare services delivered through mobile devices, including telemedicine platforms, health monitoring applications, medication management systems, and remote patient monitoring tools.

Regional dynamics indicate that the Asia-Pacific mobile health landscape is experiencing unprecedented growth, with countries like China, India, Japan, and South Korea leading the adoption of innovative healthcare technologies. The market is characterized by a growing emphasis on preventive healthcare, chronic disease management, and improved healthcare accessibility in both urban and rural areas. Digital transformation initiatives across healthcare systems are accelerating the integration of mobile health solutions into traditional healthcare delivery models.

Market penetration varies significantly across different APAC countries, with developed markets showing higher adoption rates of approximately 68% for health-related mobile applications, while emerging markets are rapidly catching up with growing smartphone penetration and improving digital infrastructure. The convergence of artificial intelligence, Internet of Things, and mobile technologies is creating new opportunities for personalized healthcare delivery and patient engagement across the region.

The APAC mobile health market refers to the comprehensive ecosystem of healthcare services, applications, and solutions delivered through mobile devices and platforms across Asia-Pacific countries. This market encompasses various digital health technologies including telemedicine applications, health monitoring devices, electronic health records, medication adherence tools, and wellness management platforms specifically designed for mobile deployment.

Mobile health solutions in the APAC region serve diverse healthcare needs, from basic health information access to sophisticated remote patient monitoring and diagnostic support systems. These technologies enable healthcare providers to extend their reach beyond traditional clinical settings, offering patients convenient access to medical consultations, health tracking, and preventive care services through smartphones, tablets, and wearable devices.

Key components of the APAC mobile health ecosystem include patient-facing applications for health management, provider-focused platforms for clinical decision support, and integrated systems that connect patients, healthcare professionals, and healthcare institutions. The market also encompasses supporting infrastructure such as cloud-based health data storage, secure communication platforms, and interoperability solutions that enable seamless healthcare delivery across different mobile platforms and devices.

Strategic analysis reveals that the APAC mobile health market is positioned for substantial expansion, driven by demographic shifts, technological advancement, and evolving healthcare delivery models. The region’s large population base, increasing prevalence of chronic diseases, and growing middle-class segment create significant opportunities for mobile health solution providers and healthcare technology companies.

Market dynamics are influenced by several key factors including government digitization initiatives, rising healthcare costs, shortage of healthcare professionals in rural areas, and increasing consumer preference for convenient healthcare access. Countries across the region are implementing supportive regulatory frameworks and investing in digital health infrastructure to accelerate mobile health adoption.

Growth projections indicate that the market will experience robust expansion with an estimated compound annual growth rate of 12.4% over the forecast period. This growth is supported by increasing venture capital investments in health technology startups, strategic partnerships between technology companies and healthcare providers, and growing acceptance of digital health solutions among both patients and healthcare professionals across the APAC region.

Primary market drivers include the region’s rapidly aging population, increasing smartphone penetration rates, and growing awareness of preventive healthcare benefits. The COVID-19 pandemic has significantly accelerated digital health adoption, with telemedicine usage increasing by approximately 85% across major APAC markets during 2020-2022.

Demographic transformation across the APAC region represents a fundamental driver of mobile health market growth. The region’s aging population, particularly in countries like Japan, South Korea, and Singapore, is creating increased demand for accessible healthcare solutions that can support independent living and chronic disease management. Population aging is driving innovation in remote monitoring technologies and telehealth platforms designed to serve elderly patients effectively.

Healthcare accessibility challenges in rural and remote areas across APAC countries are spurring mobile health adoption as a solution to bridge healthcare gaps. Many regions face shortages of healthcare professionals and limited medical infrastructure, making mobile health solutions essential for delivering basic healthcare services. Telemedicine platforms are particularly valuable in countries like India, Indonesia, and the Philippines, where geographic barriers often prevent timely access to healthcare services.

Rising healthcare costs and the need for cost-effective healthcare delivery models are encouraging both governments and private healthcare providers to invest in mobile health technologies. These solutions offer potential for reducing healthcare expenses while improving patient outcomes through preventive care and early intervention strategies. Economic factors are driving healthcare systems to adopt mobile health solutions that can deliver care more efficiently and at lower costs than traditional healthcare models.

Technology advancement in mobile devices, including improved processing power, better sensors, and enhanced connectivity, is enabling more sophisticated mobile health applications. The proliferation of wearable devices and Internet of Things technologies is creating new opportunities for continuous health monitoring and real-time health data collection across the APAC region.

Regulatory complexity across different APAC countries presents significant challenges for mobile health solution providers seeking to operate across multiple markets. Varying data privacy regulations, medical device approval processes, and telemedicine licensing requirements create barriers to market entry and expansion. Compliance requirements differ substantially between countries, requiring companies to navigate complex regulatory landscapes and adapt their solutions to meet local requirements.

Digital divide issues persist across the region, with significant disparities in smartphone adoption, internet connectivity, and digital literacy between urban and rural populations. While major cities enjoy advanced digital infrastructure, many rural areas still lack reliable internet connectivity necessary for mobile health applications. Infrastructure limitations in certain regions restrict the effectiveness of mobile health solutions and limit market penetration.

Data security concerns and privacy issues remain significant barriers to mobile health adoption, particularly in countries with limited data protection frameworks. Healthcare data sensitivity requires robust security measures, and concerns about data breaches or misuse can limit patient willingness to adopt mobile health solutions. Trust factors play a crucial role in market acceptance, and security incidents can significantly impact adoption rates.

Healthcare professional resistance to digital health technologies in some markets creates adoption challenges. Traditional healthcare providers may be reluctant to integrate mobile health solutions into their practice due to concerns about technology complexity, liability issues, or changes to established workflows. Change management requirements for healthcare organizations can slow the adoption of mobile health technologies.

Artificial intelligence integration presents substantial opportunities for enhancing mobile health applications with advanced diagnostic capabilities, personalized treatment recommendations, and predictive health analytics. AI-powered mobile health solutions can provide more accurate health assessments and enable early detection of health issues, creating significant value for both patients and healthcare providers across the APAC region.

Rural healthcare expansion represents a major opportunity for mobile health solution providers to address underserved populations across the region. Many APAC countries have large rural populations with limited access to healthcare services, creating demand for mobile health solutions that can deliver basic healthcare, health education, and chronic disease management services to remote areas.

Chronic disease management opportunities are expanding as the prevalence of diabetes, hypertension, and cardiovascular diseases increases across the region. Mobile health solutions specifically designed for chronic disease monitoring and management can help patients better control their conditions while reducing healthcare costs and improving quality of life. Disease-specific applications represent a growing market segment with significant potential for specialized mobile health solutions.

Corporate wellness programs are creating new market opportunities as employers across the region recognize the value of employee health management. Companies are increasingly investing in mobile health solutions to support employee wellness, reduce healthcare costs, and improve productivity. Enterprise health solutions represent a growing market segment with potential for scalable mobile health platforms.

Competitive landscape in the APAC mobile health market is characterized by a mix of global technology companies, regional healthcare providers, and innovative startups. Major technology companies are leveraging their mobile platforms and cloud infrastructure to deliver comprehensive health solutions, while healthcare organizations are developing specialized applications for their patient populations.

Innovation cycles in mobile health are accelerating, with new applications and features being introduced regularly to meet evolving user needs and technological capabilities. The integration of emerging technologies such as augmented reality, blockchain, and advanced analytics is creating new possibilities for mobile health applications and services.

Partnership dynamics are evolving as companies recognize the need for collaboration to deliver comprehensive mobile health solutions. Strategic partnerships between technology companies, healthcare providers, pharmaceutical companies, and government organizations are becoming increasingly common to leverage complementary capabilities and expand market reach.

User behavior patterns are shifting toward greater acceptance of digital health solutions, with younger generations leading adoption while older populations gradually embracing mobile health technologies. Adoption rates vary by application type, with wellness and fitness applications showing higher adoption rates of approximately 72% among smartphone users compared to clinical applications.

Comprehensive market analysis for the APAC mobile health market involves multiple research approaches including primary research through industry expert interviews, healthcare provider surveys, and consumer adoption studies across key regional markets. Primary research activities focus on understanding market dynamics, adoption barriers, and growth opportunities from the perspectives of various stakeholders including patients, healthcare providers, and technology companies.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, and company financial statements to gather comprehensive market intelligence. This research approach provides insights into market trends, competitive positioning, and regulatory developments across different APAC countries.

Data validation processes ensure accuracy and reliability of market insights through cross-referencing multiple data sources, expert validation, and statistical analysis. MarkWide Research employs rigorous data verification methodologies to ensure that market analysis reflects current market conditions and provides reliable projections for future market development.

Market segmentation analysis involves detailed examination of different mobile health categories, application types, end-user segments, and geographic markets to provide comprehensive understanding of market structure and growth opportunities. This analysis includes evaluation of market size, growth rates, and competitive dynamics within each segment.

China dominates the APAC mobile health market with the largest user base and most developed mobile health ecosystem in the region. The country’s advanced mobile payment infrastructure, large smartphone user base, and supportive government policies have created favorable conditions for mobile health adoption. Chinese market characteristics include strong integration between mobile health applications and existing digital platforms, with major technology companies like Alibaba and Tencent playing significant roles in health technology development.

India represents the fastest-growing mobile health market in the region, driven by increasing smartphone adoption, growing middle-class population, and government digitization initiatives. The country’s large population and healthcare accessibility challenges create substantial opportunities for mobile health solutions, particularly in rural areas. Indian market dynamics are characterized by price-sensitive consumers and increasing acceptance of digital health solutions among younger demographics.

Japan and South Korea lead in advanced mobile health technology adoption, with high smartphone penetration rates and sophisticated healthcare systems that support digital health integration. These markets show strong adoption of wearable health devices and AI-powered health applications, with approximately 58% of adults using health-related mobile applications regularly.

Southeast Asian markets including Indonesia, Thailand, Vietnam, and the Philippines are experiencing rapid growth in mobile health adoption, supported by improving digital infrastructure and increasing healthcare awareness. These markets present significant opportunities for mobile health solution providers, particularly for basic healthcare services and health education applications.

Market leadership in the APAC mobile health sector is distributed among various types of companies, including global technology giants, regional healthcare providers, and specialized health technology startups. The competitive environment is characterized by rapid innovation, strategic partnerships, and increasing investment in research and development.

By Application Type: The APAC mobile health market encompasses diverse application categories serving different healthcare needs and user segments. Telemedicine applications represent the largest segment, providing remote consultation services, prescription management, and follow-up care. Health monitoring applications focus on tracking vital signs, fitness metrics, and chronic disease indicators through smartphone sensors and connected devices.

By End User: Market segmentation by end user reveals distinct usage patterns and requirements across different demographic groups. Individual consumers represent the largest user segment, utilizing mobile health applications for personal health management, fitness tracking, and accessing healthcare services. Healthcare providers use mobile health platforms for patient management, clinical decision support, and care coordination.

By Technology Platform: The market includes various technology platforms supporting different mobile health functionalities. Native mobile applications provide optimized user experiences for specific operating systems, while web-based platforms offer cross-platform compatibility and easier maintenance. Hybrid solutions combine native and web technologies to balance performance and development efficiency.

Telemedicine segment dominates the APAC mobile health market, accounting for approximately 42% of total market activity. This category has experienced accelerated growth due to COVID-19 pandemic impacts and increasing acceptance of remote healthcare delivery. Telemedicine platforms are particularly popular in countries with healthcare accessibility challenges, providing essential healthcare services to underserved populations.

Health monitoring applications represent a rapidly growing category, driven by increasing health consciousness and widespread adoption of wearable devices. These applications integrate with various health sensors and devices to provide comprehensive health tracking capabilities. Chronic disease management within this category shows strong growth potential, particularly for diabetes and cardiovascular disease monitoring.

Wellness and fitness applications maintain strong user engagement rates, with many users accessing these applications daily for fitness tracking, nutrition management, and lifestyle optimization. This category benefits from gamification features and social sharing capabilities that enhance user motivation and retention.

Mental health solutions are emerging as a significant category, addressing growing awareness of mental health issues across the region. These applications provide stress management tools, meditation guidance, and access to mental health professionals through mobile platforms. Mental health adoption rates are increasing particularly among younger demographics, with usage growing by approximately 67% annually in major APAC markets.

Healthcare providers benefit from mobile health solutions through improved patient engagement, reduced administrative costs, and enhanced care delivery capabilities. These platforms enable providers to extend their reach beyond traditional clinical settings, monitor patients remotely, and provide more personalized care services. Operational efficiency improvements include streamlined appointment scheduling, automated patient communications, and digital health record management.

Patients gain access to convenient healthcare services, improved health monitoring capabilities, and better health education resources through mobile health platforms. These solutions enable patients to take more active roles in managing their health, access healthcare services from remote locations, and receive timely medical interventions. Patient empowerment through mobile health tools leads to better health outcomes and increased satisfaction with healthcare services.

Technology companies can leverage the growing mobile health market to expand their healthcare portfolios, develop new revenue streams, and create strategic partnerships with healthcare organizations. The market provides opportunities for companies to apply their technological expertise to address healthcare challenges and develop innovative solutions for diverse user needs.

Government stakeholders benefit from mobile health adoption through improved public health outcomes, reduced healthcare costs, and enhanced healthcare system efficiency. Mobile health solutions can support government health initiatives, improve healthcare accessibility in underserved areas, and provide valuable health data for policy development and resource allocation decisions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming mobile health applications across the APAC region, with AI-powered features becoming standard in health monitoring, diagnostic support, and personalized treatment recommendations. Machine learning algorithms are being incorporated into mobile health platforms to provide more accurate health assessments, predict health risks, and deliver personalized health insights to users.

Wearable device integration continues to expand, with mobile health applications increasingly connecting with smartwatches, fitness trackers, and specialized health monitoring devices. This integration enables continuous health monitoring and provides users with comprehensive health data analysis through their mobile devices. IoT connectivity is creating new possibilities for remote patient monitoring and real-time health data collection.

Blockchain technology adoption is emerging as a solution for secure health data management and interoperability between different mobile health platforms. Blockchain applications in mobile health focus on ensuring data privacy, enabling secure health data sharing, and creating trusted networks for healthcare information exchange.

Voice-enabled interfaces are becoming more prevalent in mobile health applications, providing users with hands-free interaction capabilities and improving accessibility for elderly users or those with mobility limitations. Voice technology integration is particularly valuable for medication reminders, health status reporting, and emergency assistance features.

Strategic partnerships between major technology companies and healthcare organizations are accelerating mobile health innovation across the region. Recent collaborations focus on developing integrated health platforms that combine technology expertise with clinical knowledge to deliver comprehensive mobile health solutions. Partnership activities include joint development of AI-powered diagnostic tools, telemedicine platforms, and chronic disease management applications.

Regulatory developments across APAC countries are creating more supportive environments for mobile health adoption, with governments implementing digital health policies and telemedicine regulations. Policy changes include recognition of telemedicine consultations, digital prescription systems, and mobile health data privacy frameworks that enable broader adoption of mobile health solutions.

Investment activities in APAC mobile health startups have increased significantly, with venture capital and private equity firms recognizing the growth potential of digital health solutions in the region. Funding trends show particular interest in AI-powered health applications, telemedicine platforms, and chronic disease management solutions, with investment levels growing by approximately 89% year-over-year.

Technology advancement in 5G networks is enabling more sophisticated mobile health applications with real-time video consultations, high-resolution medical imaging, and instant health data transmission. 5G deployment across major APAC markets is creating new opportunities for advanced mobile health services that require high-speed, low-latency connectivity.

Market entry strategies for mobile health companies should focus on understanding local regulatory requirements, cultural preferences, and healthcare system structures in target APAC markets. MarkWide Research analysis indicates that successful market entry requires partnerships with local healthcare providers and adaptation of solutions to meet specific regional needs and preferences.

Technology investment priorities should emphasize artificial intelligence capabilities, data security features, and interoperability solutions that can work across different healthcare systems and mobile platforms. Companies should invest in developing robust security frameworks and compliance capabilities to address varying regulatory requirements across APAC markets.

User experience optimization remains critical for mobile health application success, with emphasis on intuitive interfaces, multilingual support, and cultural sensitivity in application design. Localization strategies should consider language preferences, cultural health practices, and local healthcare delivery models to ensure applications meet user expectations and needs.

Partnership development with healthcare providers, insurance companies, and government organizations can accelerate market adoption and provide credibility for mobile health solutions. Strategic partnerships enable companies to leverage existing healthcare relationships and integrate mobile health solutions into established healthcare delivery systems.

Growth projections for the APAC mobile health market indicate continued robust expansion over the next five years, driven by increasing smartphone adoption, improving healthcare infrastructure, and growing acceptance of digital health solutions. Market evolution will be characterized by more sophisticated applications, better integration with healthcare systems, and expanded coverage of rural and underserved populations.

Technology advancement will continue to drive innovation in mobile health applications, with artificial intelligence, machine learning, and advanced analytics becoming standard features. Future applications will offer more personalized health recommendations, predictive health analytics, and seamless integration with various health monitoring devices and healthcare systems.

Regulatory environment improvements across APAC countries will create more favorable conditions for mobile health adoption, with standardized data privacy frameworks, telemedicine regulations, and digital health policies supporting market growth. Policy development will focus on ensuring patient safety while enabling innovation and expanding access to digital health services.

Market consolidation is expected as the industry matures, with larger companies acquiring innovative startups and forming strategic partnerships to expand their mobile health capabilities. This consolidation will lead to more comprehensive mobile health platforms that offer integrated solutions for various healthcare needs and user segments, with market concentration expected to reach approximately 35% among top five players by 2028.

The APAC mobile health market represents a dynamic and rapidly evolving sector with substantial growth potential driven by demographic trends, technological advancement, and changing healthcare delivery models. The region’s large population, increasing smartphone adoption, and growing health consciousness create favorable conditions for continued market expansion and innovation in mobile health solutions.

Strategic opportunities exist for companies that can successfully navigate the complex regulatory environment, develop culturally appropriate solutions, and establish strong partnerships with healthcare providers and government organizations. The market’s diversity across different countries requires tailored approaches that consider local healthcare needs, technological infrastructure, and regulatory requirements.

Future success in the APAC mobile health market will depend on companies’ ability to deliver secure, user-friendly, and clinically effective solutions that integrate seamlessly with existing healthcare systems while providing measurable value to patients, healthcare providers, and healthcare systems. As the market continues to mature, companies that prioritize innovation, user experience, and strategic partnerships will be best positioned to capture the significant growth opportunities in this expanding market.

What is Mobile Health?

Mobile Health, often referred to as mHealth, encompasses the use of mobile devices and applications to support medical and public health practices. This includes health monitoring, disease management, and health education through smartphones and wearable technologies.

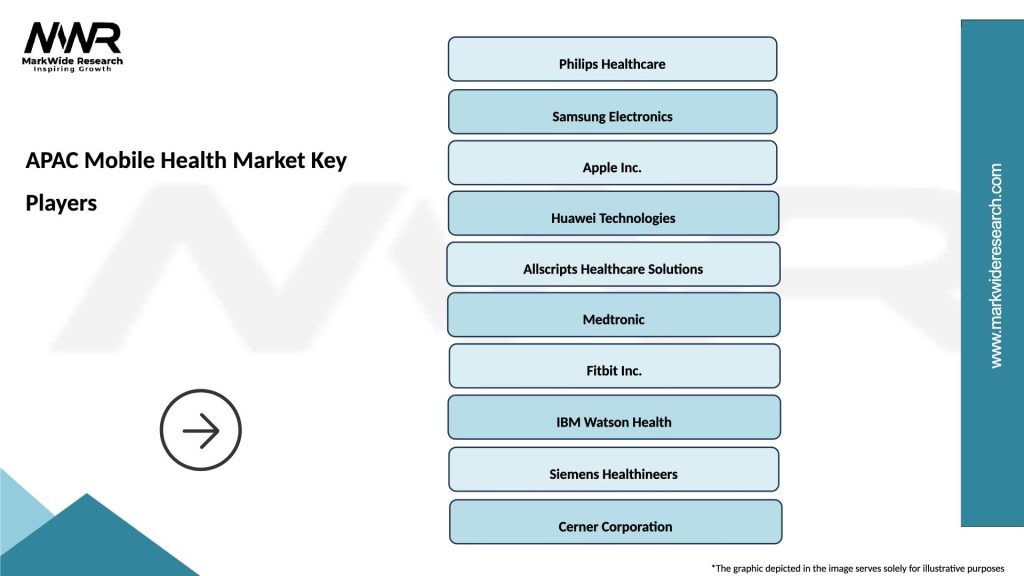

What are the key players in the APAC Mobile Health Market?

Key players in the APAC Mobile Health Market include companies like Philips Healthcare, Samsung Health, and Tencent, which are known for their innovative health solutions and mobile applications, among others.

What are the main drivers of growth in the APAC Mobile Health Market?

The growth of the APAC Mobile Health Market is driven by increasing smartphone penetration, rising health awareness among consumers, and the demand for remote patient monitoring solutions. Additionally, the integration of AI and big data analytics in health applications is enhancing user engagement.

What challenges does the APAC Mobile Health Market face?

The APAC Mobile Health Market faces challenges such as data privacy concerns, regulatory hurdles, and the need for interoperability among different health systems. Additionally, varying levels of technological adoption across the region can hinder market growth.

What opportunities exist in the APAC Mobile Health Market?

Opportunities in the APAC Mobile Health Market include the expansion of telehealth services, the development of personalized health applications, and the increasing collaboration between tech companies and healthcare providers. These trends are expected to enhance patient engagement and improve health outcomes.

What trends are shaping the APAC Mobile Health Market?

Trends shaping the APAC Mobile Health Market include the rise of wearable health devices, the integration of artificial intelligence in health apps, and the growing focus on mental health solutions. These innovations are transforming how healthcare is delivered and accessed in the region.

APAC Mobile Health Market

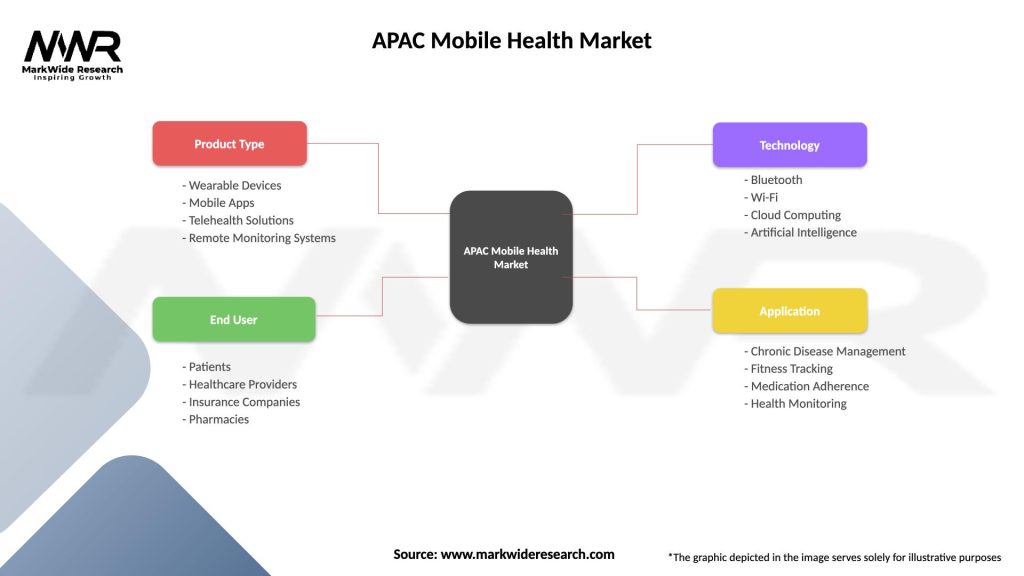

| Segmentation Details | Description |

|---|---|

| Product Type | Wearable Devices, Mobile Apps, Telehealth Solutions, Remote Monitoring Systems |

| End User | Patients, Healthcare Providers, Insurance Companies, Pharmacies |

| Technology | Bluetooth, Wi-Fi, Cloud Computing, Artificial Intelligence |

| Application | Chronic Disease Management, Fitness Tracking, Medication Adherence, Health Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Mobile Health Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at