444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC media and entertainment market represents one of the most dynamic and rapidly evolving sectors in the global entertainment landscape. This comprehensive market encompasses traditional media platforms, digital streaming services, gaming industries, music distribution, film production, and emerging entertainment technologies across the Asia-Pacific region. Market dynamics in this sector are characterized by unprecedented digital transformation, changing consumer preferences, and the integration of advanced technologies such as artificial intelligence, virtual reality, and blockchain.

Regional diversity within the APAC media and entertainment market creates unique opportunities and challenges. Countries like China, Japan, South Korea, India, and Australia lead in different segments, with China dominating in digital entertainment and mobile gaming, while Japan excels in anime and manga production. Growth trajectories indicate that the market is expanding at a robust CAGR of 8.2%, driven by increasing internet penetration, smartphone adoption, and rising disposable incomes across emerging economies.

Digital transformation has fundamentally reshaped content consumption patterns throughout the region. Traditional broadcasting models are evolving to accommodate on-demand streaming services, while social media platforms are becoming primary content distribution channels. The market demonstrates significant potential for continued expansion, supported by favorable demographic trends, technological infrastructure development, and increasing investment in original content production.

The APAC media and entertainment market refers to the comprehensive ecosystem of content creation, distribution, and consumption across the Asia-Pacific region, encompassing traditional broadcasting, digital streaming platforms, gaming, music, film production, publishing, and emerging entertainment technologies that serve diverse audiences through multiple channels and formats.

Market scope includes various entertainment verticals such as over-the-top (OTT) streaming services, mobile gaming applications, music streaming platforms, film and television production, digital advertising, social media content, and interactive entertainment experiences. This definition encompasses both business-to-consumer and business-to-business segments, including content licensing, distribution partnerships, and technology infrastructure services.

Geographic coverage spans major economies including China, Japan, India, South Korea, Australia, Southeast Asian nations, and other Pacific territories. Each market within this region demonstrates unique cultural preferences, regulatory environments, and technological adoption patterns that collectively contribute to the overall market dynamics and growth potential.

Strategic positioning of the APAC media and entertainment market reflects its emergence as a global entertainment powerhouse, driven by technological innovation, demographic advantages, and increasing content localization efforts. The market benefits from a large and growing middle-class population with increasing purchasing power and digital literacy, creating substantial opportunities for content creators and technology providers.

Key performance indicators demonstrate strong market momentum, with digital entertainment segments showing particularly impressive growth rates. Mobile gaming revenues account for approximately 65% of the total gaming market in the region, while streaming services have achieved penetration rates exceeding 45% in major urban markets. These metrics highlight the shift toward mobile-first and on-demand entertainment consumption patterns.

Investment trends indicate significant capital allocation toward original content production, technology infrastructure, and strategic acquisitions. Major global entertainment companies are establishing regional headquarters and production facilities to capitalize on local market opportunities and cultural nuances. This investment influx supports market expansion and enhances competitive dynamics across various entertainment segments.

Future projections suggest continued robust growth, supported by 5G network deployment, artificial intelligence integration, and the development of immersive entertainment experiences. The market is expected to maintain its growth trajectory through strategic partnerships, technological innovation, and expanding content libraries that cater to diverse regional preferences and languages.

Consumer behavior analysis reveals significant shifts in entertainment consumption patterns across the APAC region. The following insights highlight critical market developments:

Technology integration continues to reshape market dynamics, with emerging technologies creating new entertainment formats and distribution channels. These insights provide strategic guidance for market participants seeking to optimize their positioning and capitalize on evolving consumer preferences.

Digital infrastructure expansion serves as a primary catalyst for market growth throughout the APAC region. Rapid deployment of high-speed internet networks, 5G technology rollout, and improved mobile connectivity enable seamless content streaming and interactive entertainment experiences. This infrastructure development supports the proliferation of bandwidth-intensive applications such as ultra-high-definition video streaming, cloud gaming, and virtual reality entertainment.

Demographic advantages provide substantial growth momentum for the entertainment market. The region’s large youth population, increasing urbanization rates, and growing middle-class segment create favorable conditions for entertainment consumption. Rising disposable incomes and changing lifestyle preferences contribute to increased spending on premium entertainment services and digital content subscriptions.

Content localization initiatives drive market expansion by addressing diverse cultural preferences and language requirements across the region. Major entertainment companies invest heavily in producing original content tailored to local markets, including regional films, television series, and gaming content that resonates with specific cultural contexts and consumer preferences.

Government support policies in various APAC countries encourage digital transformation and creative industry development. Regulatory frameworks that promote foreign investment, intellectual property protection, and digital innovation create conducive environments for entertainment industry growth. These supportive policies facilitate market entry for international players while fostering domestic content creation capabilities.

Technological convergence enables new entertainment formats and business models. The integration of artificial intelligence, augmented reality, blockchain technology, and Internet of Things capabilities creates innovative entertainment experiences that attract tech-savvy consumers and generate new revenue streams for content creators and platform operators.

Regulatory complexities present significant challenges for market participants operating across multiple APAC jurisdictions. Varying content censorship requirements, broadcasting regulations, and foreign investment restrictions create compliance burdens that can limit market access and increase operational costs. These regulatory differences require companies to develop market-specific strategies and maintain separate compliance frameworks for different countries.

Content piracy concerns continue to impact revenue generation and intellectual property protection throughout the region. Despite improved enforcement mechanisms, unauthorized content distribution remains prevalent, particularly in emerging markets with limited digital rights management infrastructure. This challenge affects both local and international content creators, reducing potential revenues and discouraging investment in original content production.

Infrastructure limitations in certain markets constrain growth potential, particularly in rural and remote areas where internet connectivity remains inconsistent or expensive. These digital divide issues limit market penetration for streaming services and online gaming platforms, creating uneven growth patterns across different geographic segments within the region.

Cultural and language barriers complicate content distribution strategies for companies seeking regional expansion. The need to adapt content for multiple languages, cultural contexts, and local preferences increases production costs and complexity. These localization requirements can delay market entry and reduce economies of scale for content creators and platform operators.

Intense competition among numerous market participants creates pricing pressures and increases customer acquisition costs. The proliferation of entertainment platforms and services leads to market fragmentation, making it challenging for individual companies to achieve sustainable profitability while maintaining competitive positioning in multiple market segments.

Emerging technology adoption creates substantial opportunities for innovative entertainment experiences and new business models. Virtual reality, augmented reality, and mixed reality technologies enable immersive content formats that can command premium pricing and attract early adopters. These technologies particularly appeal to gaming enthusiasts and tech-savvy consumers seeking novel entertainment experiences.

Cross-border content collaboration presents opportunities for regional content creators to expand their reach and share production costs. Co-production agreements between different APAC countries can leverage diverse cultural perspectives while accessing broader distribution networks and funding sources. This collaborative approach enables smaller markets to participate in high-quality content creation initiatives.

Subscription economy expansion offers sustainable revenue models for entertainment platforms seeking predictable income streams. The growing acceptance of subscription-based services across the region creates opportunities for tiered pricing strategies, premium content offerings, and bundled service packages that increase customer lifetime value and reduce churn rates.

Social commerce integration enables entertainment platforms to monetize user engagement through direct product sales and brand partnerships. Live streaming platforms, gaming applications, and social media entertainment channels can incorporate e-commerce features that generate additional revenue streams beyond traditional advertising and subscription models.

Educational entertainment convergence creates opportunities for content that combines learning objectives with entertainment value. This edutainment segment appeals to parents seeking educational content for children and adults pursuing skill development through engaging formats. The growing emphasis on lifelong learning supports demand for entertaining educational content across various age groups.

Competitive landscape evolution reflects the dynamic nature of the APAC media and entertainment market, with traditional media companies, technology giants, and emerging startups competing across multiple entertainment segments. This competition drives innovation, improves content quality, and creates more diverse entertainment options for consumers while challenging established business models and market positions.

Consumer preference shifts toward personalized, on-demand content consumption patterns influence platform development strategies and content creation approaches. Entertainment companies must balance global content appeal with local cultural preferences, creating complex content portfolios that serve diverse audience segments while maintaining operational efficiency and brand consistency.

Technology disruption cycles continuously reshape market dynamics as new platforms, distribution methods, and content formats emerge. Companies must adapt quickly to technological changes while managing legacy systems and traditional revenue streams. This constant evolution requires significant investment in research and development, strategic partnerships, and talent acquisition to maintain competitive advantages.

Monetization model diversification enables entertainment companies to reduce dependence on single revenue streams while maximizing value extraction from content assets. Hybrid models combining advertising, subscriptions, transactions, and merchandise sales provide more resilient business foundations and enable companies to serve different consumer segments with appropriate pricing strategies.

Regional integration trends facilitate content sharing, technology transfer, and collaborative production initiatives across APAC markets. These integration efforts reduce barriers to market entry, enable economies of scale in content production, and create opportunities for smaller entertainment companies to access broader distribution networks and funding sources.

Comprehensive data collection methodologies employed in analyzing the APAC media and entertainment market incorporate both primary and secondary research approaches to ensure accurate and reliable market insights. Primary research includes structured interviews with industry executives, content creators, technology providers, and consumer surveys across major APAC markets to understand current trends, challenges, and future expectations.

Secondary research analysis encompasses extensive review of industry reports, financial statements, regulatory filings, and market databases to validate primary research findings and provide historical context for market development patterns. This approach ensures comprehensive coverage of market segments, competitive dynamics, and regulatory environments across different APAC jurisdictions.

Quantitative analysis techniques include statistical modeling, trend analysis, and market sizing methodologies that provide accurate growth projections and market share assessments. These analytical approaches consider various economic indicators, demographic trends, and technology adoption rates to develop reliable forecasts for different market segments and geographic regions.

Qualitative research methods focus on understanding consumer behavior patterns, cultural preferences, and industry expert opinions through in-depth interviews, focus group discussions, and observational studies. This qualitative insight complements quantitative data to provide comprehensive understanding of market dynamics and strategic implications for industry participants.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and statistical verification techniques. These validation methods maintain research integrity and provide confidence in market projections and strategic recommendations presented in the analysis.

China dominates the APAC media and entertainment landscape, representing approximately 42% of regional market activity. The Chinese market demonstrates exceptional growth in mobile gaming, short-form video content, and live streaming platforms. Major domestic companies like Tencent, ByteDance, and Alibaba have established strong market positions while international companies face regulatory challenges and intense local competition.

Japan maintains its position as a content creation powerhouse, particularly in anime, manga, and gaming segments. The Japanese market shows strong preference for premium content and demonstrates willingness to pay for high-quality entertainment experiences. Traditional media companies are successfully transitioning to digital platforms while maintaining their cultural influence and creative excellence.

India represents the fastest-growing entertainment market in the region, driven by increasing smartphone adoption and affordable data plans. The Indian market shows strong demand for local language content across multiple regional languages, creating opportunities for content creators who can address diverse linguistic and cultural preferences. Bollywood content continues to influence regional entertainment trends.

South Korea has emerged as a global entertainment influencer through K-pop, K-dramas, and gaming content that achieves international success. The Korean Wave (Hallyu) demonstrates the potential for regional content to achieve global reach, inspiring other APAC markets to invest in original content production with international appeal.

Southeast Asian markets including Indonesia, Thailand, Vietnam, and the Philippines show rapid growth in digital entertainment adoption. These markets benefit from young demographics, increasing internet penetration, and growing middle-class populations. Regional streaming platforms are gaining traction alongside international services, creating competitive and diverse entertainment ecosystems.

Australia and New Zealand represent mature markets with high digital adoption rates and strong regulatory frameworks that support both domestic and international entertainment companies. These markets serve as testing grounds for new technologies and business models before broader regional deployment.

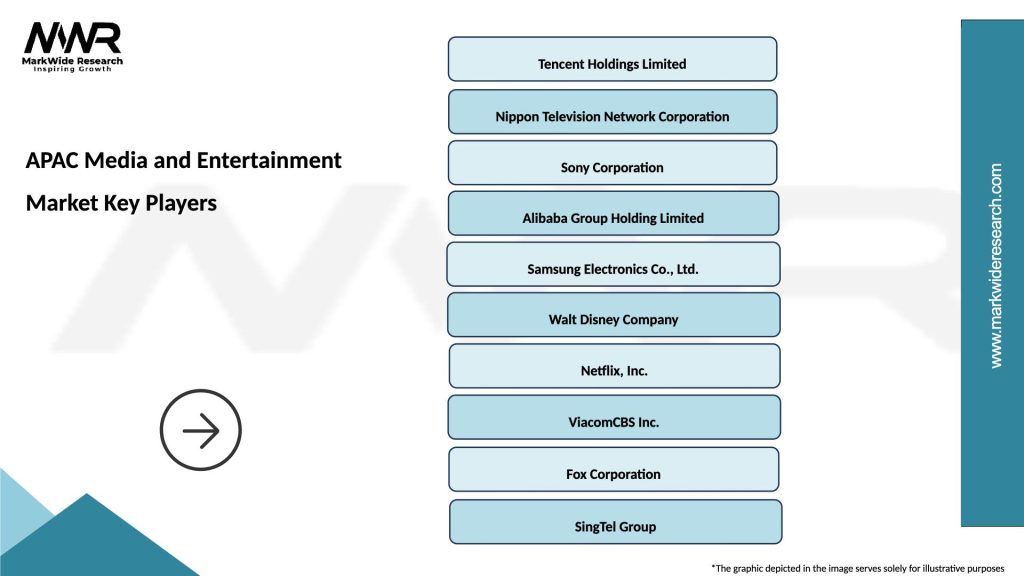

Market leadership in the APAC media and entertainment sector is distributed among various types of companies, including global technology giants, regional entertainment conglomerates, and specialized content creators. The competitive environment encourages innovation and drives continuous improvement in content quality, technology capabilities, and user experience design.

Major market participants include:

Competitive strategies focus on content differentiation, technology innovation, strategic partnerships, and market localization efforts. Companies invest heavily in original content production, exclusive licensing agreements, and advanced recommendation algorithms to attract and retain subscribers while building sustainable competitive advantages.

Strategic alliances between international and domestic companies enable market access, content sharing, and technology transfer that benefit all participants. These partnerships help overcome regulatory barriers, cultural differences, and resource constraints while accelerating market development and consumer adoption.

By Content Type:

By Platform Type:

By Revenue Model:

Video Streaming Services represent the most visible segment of the APAC entertainment market, with both international and domestic platforms competing for subscriber attention. Original content production has become a key differentiator, with platforms investing heavily in local language productions that reflect regional cultural preferences and storytelling traditions.

Mobile Gaming dominates revenue generation across most APAC markets, particularly in China, Japan, and South Korea. The segment benefits from widespread smartphone adoption, improved mobile processing capabilities, and innovative monetization strategies including in-app purchases, battle passes, and virtual item trading systems.

Music Streaming shows strong growth potential as digital music consumption replaces physical sales and illegal downloading. Regional platforms compete with global services by offering local artist content, exclusive releases, and culturally relevant playlists that resonate with specific market preferences.

Social Media Entertainment has emerged as a significant category, with platforms like TikTok, Instagram, and regional alternatives becoming primary entertainment destinations for younger demographics. These platforms enable user-generated content creation while providing monetization opportunities for creators and advertising revenue for platform operators.

Live Streaming represents a rapidly growing category that combines entertainment with social interaction and e-commerce capabilities. Gaming streams, lifestyle content, and educational programming attract dedicated audiences while generating revenue through virtual gifts, subscriptions, and product sales integration.

Traditional Media continues to adapt to digital transformation by developing online presence, creating digital-first content, and exploring new distribution channels. Television broadcasters and print media companies are successfully transitioning to hybrid models that combine traditional and digital revenue streams.

Content Creators benefit from expanded distribution opportunities, direct audience engagement capabilities, and diverse monetization options that enable sustainable creative careers. Digital platforms provide global reach potential while analytics tools offer insights into audience preferences and content performance metrics that inform creative decisions.

Technology Providers gain access to large and growing markets for entertainment infrastructure, content delivery networks, and innovative platform solutions. The demand for scalable, reliable technology services creates opportunities for cloud computing providers, cybersecurity companies, and software developers specializing in entertainment applications.

Investors can participate in a high-growth market with diverse investment opportunities ranging from established entertainment companies to emerging technology startups. The market’s growth trajectory and increasing consumer spending on entertainment services provide attractive returns potential for various investment strategies and risk profiles.

Advertisers access sophisticated targeting capabilities, engaged audiences, and innovative advertising formats that improve campaign effectiveness and return on investment. Entertainment platforms provide rich user data and engagement metrics that enable precise audience targeting and performance measurement.

Consumers enjoy unprecedented access to diverse entertainment content, personalized recommendations, and interactive experiences that enhance entertainment value. Competitive market dynamics drive continuous improvement in content quality, platform features, and pricing options that benefit end users.

Governments benefit from creative industry development, job creation, and cultural export opportunities that enhance national soft power and economic diversification. The entertainment industry contributes to tourism, education, and technology sector development while promoting cultural exchange and understanding.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration transforms content recommendation systems, personalization algorithms, and automated content creation processes. AI-powered tools enable platforms to deliver more relevant content suggestions, optimize user engagement, and reduce content discovery friction while supporting creators with automated editing and production assistance.

Short-Form Content Dominance reflects changing attention spans and consumption preferences, particularly among younger demographics. Platforms optimized for brief, engaging content experiences gain popularity while traditional long-form content adapts to include shorter segments and interactive elements that maintain audience attention.

Interactive Entertainment Evolution blurs boundaries between passive consumption and active participation through gaming elements, choose-your-own-adventure narratives, and real-time audience interaction features. This trend creates more engaging experiences while generating additional data insights about user preferences and behavior patterns.

Cross-Platform Integration enables seamless content access across multiple devices and platforms, allowing users to start content on one device and continue on another. This trend improves user convenience while creating opportunities for deeper engagement and increased platform loyalty.

Localization Excellence goes beyond simple translation to include cultural adaptation, local talent development, and region-specific content creation that resonates with local audiences. MarkWide Research indicates that localized content achieves significantly higher engagement rates compared to generic international content.

Sustainability Focus influences content themes, production practices, and corporate responsibility initiatives as entertainment companies respond to growing environmental awareness. Green production techniques, sustainable business practices, and environmentally conscious content themes appeal to socially responsible consumers and investors.

Strategic Acquisitions reshape the competitive landscape as major entertainment companies acquire smaller platforms, content creators, and technology providers to expand capabilities and market reach. These consolidation activities create larger, more integrated entertainment ecosystems while potentially reducing competition in certain market segments.

Original Content Investment reaches unprecedented levels as platforms compete for exclusive content that differentiates their offerings and attracts subscribers. This investment trend benefits content creators, production companies, and local talent while raising overall content quality standards across the industry.

Technology Infrastructure Expansion includes content delivery network improvements, cloud computing adoption, and edge computing deployment that enhance streaming quality and reduce latency. These infrastructure investments support higher resolution content, real-time interactive features, and improved user experiences across diverse geographic locations.

Regulatory Framework Evolution addresses content standards, data privacy, and market competition concerns as governments adapt policies to digital entertainment realities. New regulations impact platform operations, content creation guidelines, and international market access while attempting to balance innovation encouragement with consumer protection.

Partnership Ecosystem Development creates collaborative networks between content creators, technology providers, distribution platforms, and marketing agencies that enable more efficient content production and distribution processes. These partnerships reduce individual company risks while expanding collective market reach and capabilities.

Monetization Innovation introduces new revenue models including virtual goods, non-fungible tokens, creator economy platforms, and integrated e-commerce features that diversify income streams beyond traditional advertising and subscription models. These innovations provide more sustainable business models while creating new value propositions for users.

Market Entry Strategies should prioritize local partnerships, cultural understanding, and gradual market penetration rather than aggressive expansion approaches. Companies entering APAC markets benefit from collaborating with established local players who understand regulatory requirements, consumer preferences, and distribution channels that ensure successful market entry.

Content Investment Priorities should focus on original productions that reflect local cultural values while maintaining production quality standards that appeal to international audiences. MWR analysis suggests that content with strong local relevance achieves higher retention rates and subscriber loyalty compared to generic international content offerings.

Technology Adoption Timing requires careful consideration of market readiness, infrastructure capabilities, and consumer acceptance levels before implementing advanced features. Early adoption of emerging technologies can provide competitive advantages, but premature deployment may result in poor user experiences and market rejection.

Revenue Diversification strategies should incorporate multiple monetization approaches to reduce dependence on single income streams and improve financial stability. Successful entertainment companies typically combine subscription revenues, advertising income, transaction fees, and ancillary services to create resilient business models.

Regulatory Compliance planning must anticipate changing government policies and maintain flexibility to adapt operations according to evolving legal requirements. Proactive compliance strategies reduce regulatory risks while enabling sustained market participation across multiple jurisdictions with different regulatory frameworks.

Competitive Differentiation should emphasize unique value propositions, superior user experiences, and exclusive content offerings that create sustainable competitive advantages. Generic platform approaches struggle to compete effectively against established players with strong market positions and extensive content libraries.

Growth trajectory for the APAC media and entertainment market remains strongly positive, supported by continued digital transformation, infrastructure development, and evolving consumer preferences. The market is expected to maintain robust expansion rates as emerging technologies mature and new entertainment formats gain mainstream acceptance across diverse regional markets.

Technology integration will accelerate with 5G network deployment, artificial intelligence advancement, and immersive technology adoption creating new entertainment experiences and business opportunities. These technological developments enable more sophisticated content delivery, personalized user experiences, and innovative monetization strategies that drive market growth and evolution.

Content globalization trends suggest increased cross-border content sharing, collaborative production initiatives, and cultural exchange programs that expand market opportunities for content creators and distributors. Regional content with international appeal demonstrates potential for global success, encouraging investment in high-quality original productions.

Market consolidation may continue as successful platforms acquire smaller competitors, content creators, and technology providers to build comprehensive entertainment ecosystems. This consolidation trend could create larger, more integrated companies while potentially reducing market competition and increasing barriers to entry for new participants.

Regulatory evolution will likely address emerging challenges related to content standards, data privacy, market competition, and international trade considerations. Government policies will continue adapting to digital entertainment realities while balancing innovation encouragement with consumer protection and cultural preservation objectives.

Consumer expectations will continue rising regarding content quality, platform functionality, and personalized experiences, driving continuous innovation and improvement across the entertainment industry. Companies must invest in technology capabilities, content production, and user experience design to meet evolving consumer demands and maintain competitive positioning.

The APAC media and entertainment market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological innovation, demographic advantages, and changing consumer preferences. Market participants benefit from diverse opportunities across multiple entertainment segments, geographic regions, and emerging technology platforms that create numerous paths to success and sustainable growth.

Strategic success in this market requires careful attention to local cultural preferences, regulatory requirements, and competitive dynamics while maintaining operational efficiency and technological innovation capabilities. Companies that effectively balance global scale advantages with local market adaptation demonstrate the strongest performance and growth potential across diverse APAC markets.

Future market development will be shaped by continued digital transformation, emerging technology adoption, and evolving consumer expectations that demand higher quality content, more personalized experiences, and innovative entertainment formats. The market’s growth trajectory remains positive, supported by favorable demographic trends, infrastructure improvements, and increasing investment in original content production that serves diverse regional audiences while achieving international appeal.

What is Media and Entertainment?

Media and Entertainment refers to the various forms of content and experiences that entertain, inform, and engage audiences, including television, film, music, gaming, and digital media.

What are the key players in the APAC Media and Entertainment Market?

Key players in the APAC Media and Entertainment Market include companies like Tencent, Sony, Walt Disney, and Alibaba, which are involved in various segments such as streaming services, film production, and gaming, among others.

What are the growth factors driving the APAC Media and Entertainment Market?

The APAC Media and Entertainment Market is driven by factors such as increasing internet penetration, the rise of mobile streaming, and growing consumer demand for diverse content across platforms.

What challenges does the APAC Media and Entertainment Market face?

Challenges in the APAC Media and Entertainment Market include intense competition, regulatory hurdles, and the need to adapt to rapidly changing consumer preferences and technological advancements.

What opportunities exist in the APAC Media and Entertainment Market?

Opportunities in the APAC Media and Entertainment Market include the expansion of virtual reality experiences, the growth of localized content production, and the increasing popularity of subscription-based streaming services.

What trends are shaping the APAC Media and Entertainment Market?

Trends in the APAC Media and Entertainment Market include the rise of influencer marketing, the integration of artificial intelligence in content creation, and the growing importance of social media platforms for content distribution.

APAC Media and Entertainment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Streaming Services, Video Games, Digital Advertising, Music Distribution |

| End User | Consumers, Businesses, Educational Institutions, Government Agencies |

| Technology | Augmented Reality, Virtual Reality, Artificial Intelligence, Blockchain |

| Distribution Channel | Online Platforms, Cable Networks, Satellite Services, Mobile Applications |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Media and Entertainment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at