444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC insurtech market represents one of the most dynamic and rapidly evolving segments within the global financial technology landscape. This transformative sector encompasses innovative digital solutions that are revolutionizing traditional insurance practices across the Asia-Pacific region. Digital transformation initiatives are driving unprecedented growth, with the market experiencing a robust CAGR of 12.8% as traditional insurers and emerging startups collaborate to deliver enhanced customer experiences.

Regional dynamics across APAC countries showcase varying levels of insurtech adoption, with developed markets like Singapore, Australia, and Japan leading in regulatory frameworks and technological infrastructure. Meanwhile, emerging economies including India, Indonesia, and Vietnam are witnessing explosive growth in mobile-first insurance solutions. The convergence of artificial intelligence, blockchain technology, and advanced analytics is creating new opportunities for risk assessment, claims processing, and customer engagement.

Market penetration varies significantly across different insurance verticals, with health insurance and motor insurance leading adoption rates at approximately 35% and 28% respectively. The COVID-19 pandemic has accelerated digital adoption, with contactless insurance services becoming increasingly essential for maintaining business continuity and meeting evolving customer expectations.

The APAC insurtech market refers to the comprehensive ecosystem of technology-driven innovations that are transforming insurance services delivery, customer engagement, and operational efficiency across Asia-Pacific countries. This market encompasses digital platforms, mobile applications, artificial intelligence solutions, blockchain implementations, and data analytics tools specifically designed to enhance insurance processes from policy origination to claims settlement.

Insurtech solutions bridge the gap between traditional insurance methodologies and modern consumer expectations by leveraging cutting-edge technologies to create more accessible, transparent, and efficient insurance experiences. These innovations include automated underwriting systems, chatbot-driven customer service, telematics-based pricing models, and peer-to-peer insurance platforms that collectively reshape how insurance products are conceived, distributed, and managed.

Digital ecosystems within this market facilitate seamless integration between insurance providers, technology partners, regulatory bodies, and end consumers, creating value chains that prioritize customer-centricity while maintaining regulatory compliance and operational excellence across diverse APAC jurisdictions.

Strategic transformation across the APAC insurtech landscape is being driven by increasing smartphone penetration, growing digital literacy, and evolving consumer preferences for on-demand services. The market demonstrates significant potential for continued expansion, supported by favorable regulatory environments in key markets and substantial venture capital investment in innovative insurance technologies.

Key growth drivers include the rising middle class population, increasing awareness of insurance benefits, and the need for more efficient risk management solutions. Traditional insurers are increasingly partnering with insurtech startups to accelerate their digital transformation journeys, while pure-play insurtech companies are scaling their operations to capture market share in underserved segments.

Technology adoption patterns reveal that mobile-first solutions dominate customer acquisition strategies, with approximately 68% of new insurance customers preferring digital channels for initial policy research and purchase. The integration of IoT devices, wearable technology, and real-time data analytics is enabling more personalized insurance products and dynamic pricing models that better reflect individual risk profiles.

Competitive dynamics are intensifying as established insurance giants invest heavily in digital capabilities while nimble startups continue to disrupt traditional business models with innovative approaches to customer engagement, product design, and operational efficiency.

Market segmentation reveals distinct patterns of insurtech adoption across different insurance categories and geographical regions within APAC. The following key insights demonstrate the market’s current trajectory:

Emerging trends indicate that the convergence of insurtech with other fintech sectors is creating comprehensive financial services ecosystems that offer integrated solutions for consumers across multiple touchpoints and life stages.

Digital transformation imperatives are fundamentally reshaping the APAC insurance landscape, driven by multiple interconnected factors that create compelling business cases for insurtech adoption. The primary drivers include technological advancement, changing consumer behaviors, regulatory evolution, and competitive pressures that collectively accelerate market growth.

Smartphone penetration across APAC countries has reached unprecedented levels, creating opportunities for mobile-first insurance solutions that can reach previously underserved populations. The proliferation of affordable smartphones and improving internet connectivity infrastructure enables insurtech companies to deploy scalable digital solutions that reduce operational costs while expanding market reach.

Consumer expectations have evolved significantly, with customers demanding instant gratification, transparent pricing, and seamless digital experiences similar to those provided by leading e-commerce and social media platforms. This shift in expectations compels insurance providers to invest in user-friendly interfaces, real-time processing capabilities, and omnichannel service delivery models.

Regulatory modernization across key APAC markets is creating favorable environments for insurtech innovation. Governments are recognizing the potential of technology-driven insurance solutions to improve financial inclusion, enhance consumer protection, and strengthen overall market stability through better risk management practices.

Cost optimization pressures are driving traditional insurers to seek more efficient operational models through automation, artificial intelligence, and streamlined processes that reduce administrative overhead while improving service quality and response times.

Regulatory complexity across diverse APAC jurisdictions presents significant challenges for insurtech companies seeking to scale their operations regionally. Each country maintains distinct regulatory frameworks, compliance requirements, and licensing procedures that create barriers to entry and increase operational complexity for cross-border expansion initiatives.

Data privacy concerns and cybersecurity risks pose substantial challenges as insurtech platforms handle sensitive personal and financial information. Increasing regulatory scrutiny around data protection, coupled with growing consumer awareness of privacy rights, requires substantial investments in security infrastructure and compliance management systems.

Legacy system integration challenges continue to impede rapid digital transformation within established insurance organizations. Many traditional insurers operate on outdated technology platforms that require significant modernization investments before they can effectively leverage advanced insurtech solutions.

Talent shortage in specialized areas such as actuarial science, data analytics, and insurance technology creates competitive pressures for skilled professionals and increases operational costs for companies seeking to build comprehensive insurtech capabilities.

Consumer trust issues, particularly in emerging markets, can slow adoption rates as potential customers may prefer traditional insurance channels due to familiarity and perceived reliability. Building trust in digital insurance platforms requires sustained marketing efforts and demonstrated track records of reliable service delivery.

Untapped market segments across APAC countries present substantial growth opportunities for innovative insurtech solutions. Rural populations, small business owners, and gig economy workers represent underserved demographics that could benefit significantly from accessible, affordable digital insurance products tailored to their specific needs and risk profiles.

Emerging technologies such as Internet of Things (IoT), artificial intelligence, and blockchain create opportunities for developing next-generation insurance products that offer more accurate risk assessment, dynamic pricing models, and automated claims processing capabilities. These technologies enable insurtech companies to differentiate their offerings and create competitive advantages.

Cross-industry partnerships with e-commerce platforms, ride-sharing services, and financial technology companies offer opportunities to embed insurance products within existing customer journeys and create seamless, integrated experiences that increase adoption rates and customer lifetime value.

Government initiatives promoting financial inclusion and digital transformation create supportive environments for insurtech expansion. Public-private partnerships and regulatory sandbox programs provide opportunities for testing innovative solutions while building relationships with key stakeholders and demonstrating value propositions.

Climate change adaptation needs are driving demand for innovative insurance solutions that can address emerging risks related to extreme weather events, environmental changes, and sustainability concerns. Insurtech companies can develop specialized products that serve these evolving market needs while contributing to broader societal resilience.

Competitive intensity within the APAC insurtech market continues to escalate as traditional insurers, technology startups, and international players compete for market share across diverse customer segments and geographical regions. This dynamic environment drives continuous innovation and service improvement while creating challenges for market positioning and differentiation.

Technology evolution cycles are accelerating, requiring insurtech companies to maintain agile development capabilities and strategic technology partnerships to remain competitive. The rapid pace of change in artificial intelligence, machine learning, and data analytics creates both opportunities for innovation and risks of technological obsolescence.

Customer acquisition costs are increasing as competition intensifies and digital marketing channels become more saturated. Successful insurtech companies are focusing on customer retention strategies, referral programs, and value-added services to improve unit economics and build sustainable competitive advantages.

Regulatory evolution continues to shape market dynamics as governments balance innovation promotion with consumer protection and market stability concerns. MarkWide Research analysis indicates that regulatory clarity and support significantly influence insurtech investment flows and expansion strategies across different APAC markets.

Partnership ecosystems are becoming increasingly important as companies recognize the benefits of collaborative approaches to market development, technology sharing, and risk distribution. Strategic alliances enable faster market entry, reduced development costs, and enhanced service offerings that benefit all stakeholders.

Comprehensive analysis of the APAC insurtech market employs multiple research methodologies to ensure accuracy, reliability, and depth of insights. The research framework combines quantitative data collection with qualitative analysis to provide a holistic understanding of market dynamics, trends, and future prospects.

Primary research activities include structured interviews with industry executives, technology providers, regulatory officials, and end customers across major APAC markets. These interviews provide firsthand insights into market challenges, opportunities, and strategic priorities that shape industry development and investment decisions.

Secondary research encompasses analysis of company financial reports, regulatory filings, industry publications, and academic studies to validate primary research findings and identify broader market patterns. This approach ensures comprehensive coverage of market developments and emerging trends.

Data triangulation techniques are employed to cross-verify information from multiple sources and ensure the reliability of market insights and projections. Statistical analysis and modeling techniques help identify correlations, trends, and potential future scenarios that inform strategic recommendations.

Expert validation processes involve review and feedback from industry specialists, academic researchers, and market practitioners to ensure the accuracy and relevance of research findings and conclusions.

China dominates the APAC insurtech landscape with the largest market share of approximately 42%, driven by massive population, advanced mobile payment infrastructure, and supportive government policies promoting digital financial services. Chinese insurtech companies are pioneering innovative solutions in health insurance, motor insurance, and micro-insurance segments.

India represents the fastest-growing insurtech market within APAC, experiencing rapid expansion due to increasing smartphone adoption, growing middle class, and government initiatives promoting financial inclusion. The market benefits from a large uninsured population and increasing awareness of insurance benefits.

Japan and Australia maintain mature insurtech markets characterized by sophisticated regulatory frameworks, high consumer trust in digital services, and strong partnerships between traditional insurers and technology providers. These markets focus on advanced analytics, personalized products, and seamless customer experiences.

Southeast Asian markets including Singapore, Thailand, and Indonesia are experiencing significant growth in insurtech adoption, with Singapore serving as a regional hub for innovation and regulatory excellence. These markets benefit from increasing digital literacy and supportive government policies.

South Korea demonstrates strong potential for insurtech growth, supported by advanced telecommunications infrastructure, high smartphone penetration, and a tech-savvy population that readily adopts digital financial services.

Market leadership within the APAC insurtech sector is distributed among various categories of players, including traditional insurance giants, pure-play insurtech startups, and technology companies expanding into insurance services. The competitive environment continues to evolve as new entrants challenge established players with innovative business models and customer-centric approaches.

Strategic positioning varies among competitors, with some focusing on specific insurance verticals while others pursue comprehensive platform approaches that serve multiple customer segments and product categories.

Technology-based segmentation reveals distinct categories of insurtech solutions that address different aspects of the insurance value chain and customer journey. Each segment demonstrates unique growth patterns and competitive dynamics that influence overall market development.

By Technology:

By Insurance Type:

By Business Model:

Health insurance technology represents the largest and fastest-growing segment within APAC insurtech, driven by increasing health consciousness, aging populations, and the COVID-19 pandemic’s impact on healthcare awareness. Digital health platforms are integrating telemedicine, wellness tracking, and preventive care services to create comprehensive health ecosystems.

Motor insurance innovation focuses heavily on telematics and usage-based insurance models that leverage GPS tracking, driving behavior analysis, and real-time risk assessment. These solutions appeal to younger demographics and cost-conscious consumers seeking personalized pricing based on actual usage patterns.

Life insurance digitization emphasizes simplified underwriting processes, reduced paperwork, and faster policy issuance through automated risk assessment tools. Digital life insurance platforms are making coverage more accessible to younger consumers who prefer online interactions and transparent pricing structures.

Property insurance technology incorporates smart home devices, satellite imagery, and predictive analytics to improve risk assessment accuracy and enable proactive risk management. These innovations help reduce claims costs while providing customers with valuable insights about their property risks.

Commercial insurance solutions are evolving to serve small and medium enterprises with simplified application processes, industry-specific coverage options, and integrated risk management tools that help businesses better understand and mitigate their operational risks.

Insurance companies benefit from insurtech adoption through improved operational efficiency, reduced processing costs, and enhanced customer acquisition capabilities. Digital platforms enable insurers to reach new customer segments, streamline underwriting processes, and develop innovative products that better serve evolving market needs.

Technology providers gain access to substantial market opportunities as insurance companies invest in digital transformation initiatives. The growing demand for specialized insurance technology solutions creates revenue opportunities for software developers, data analytics companies, and cloud service providers.

Consumers experience significant benefits including improved accessibility, transparent pricing, faster claims processing, and personalized insurance products that better match their individual risk profiles and coverage needs. Digital platforms provide convenient self-service options and 24/7 accessibility.

Regulatory bodies benefit from improved market transparency, better consumer protection mechanisms, and enhanced ability to monitor market activities through digital platforms that provide comprehensive data and audit trails.

Distribution partners including agents and brokers can leverage insurtech platforms to improve their service offerings, access better product information, and provide enhanced customer experiences while maintaining their advisory roles in the insurance value chain.

Investors find attractive opportunities in the growing insurtech sector, with potential for significant returns as successful companies scale their operations and capture market share in large, underserved markets across the APAC region.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is becoming increasingly sophisticated, with insurtech companies deploying advanced machine learning algorithms for risk assessment, fraud detection, and customer service automation. These AI-powered solutions enable more accurate pricing, faster claims processing, and personalized customer experiences that drive competitive differentiation.

Embedded insurance models are gaining traction as insurtech companies partner with e-commerce platforms, ride-sharing services, and other digital ecosystems to offer insurance products at the point of need. This approach increases insurance penetration by making coverage more accessible and relevant to consumers’ daily activities.

Parametric insurance products are emerging as innovative solutions for covering specific risks such as weather events, flight delays, and other measurable occurrences. These products offer transparent, automated payouts based on predefined parameters, reducing claims processing complexity and improving customer satisfaction.

Sustainability focus is driving development of green insurance products that incentivize environmentally responsible behaviors and support climate change adaptation efforts. Insurtech companies are creating products that reward sustainable practices while addressing emerging environmental risks.

Ecosystem partnerships are becoming more strategic as insurtech companies recognize the value of integrated service offerings that combine insurance with complementary financial services, healthcare, and lifestyle products to create comprehensive customer value propositions.

Regulatory sandbox programs launched by governments across Singapore, Hong Kong, and Australia are facilitating insurtech innovation by providing controlled environments for testing new products and services. These initiatives demonstrate regulatory commitment to supporting technological advancement while maintaining consumer protection standards.

Strategic acquisitions and partnerships between traditional insurers and insurtech startups are accelerating digital transformation across the industry. Major insurance companies are investing in or acquiring technology companies to enhance their digital capabilities and competitive positioning.

Venture capital investment in APAC insurtech companies continues to grow, with investors recognizing the sector’s potential for disrupting traditional insurance models and creating new value propositions for underserved market segments.

Cross-border expansion initiatives are increasing as successful insurtech companies seek to replicate their business models across multiple APAC markets, adapting their solutions to local regulatory requirements and customer preferences.

Technology infrastructure investments by cloud service providers and telecommunications companies are improving the foundation for insurtech platform deployment and scalability across the region, enabling more sophisticated and reliable digital insurance services.

Market entry strategies should prioritize understanding local regulatory requirements, cultural preferences, and competitive landscapes before launching insurtech solutions in new APAC markets. Successful companies invest significant time in market research and local partnership development to ensure appropriate product-market fit.

Technology investment priorities should focus on mobile-first platforms, artificial intelligence capabilities, and robust security infrastructure that can support scalable operations while maintaining customer trust and regulatory compliance. MWR analysis suggests that companies with strong technology foundations achieve better long-term market positioning.

Partnership development represents a critical success factor for insurtech companies seeking rapid market penetration and sustainable growth. Strategic alliances with traditional insurers, distribution partners, and technology providers can accelerate market entry while reducing operational risks and capital requirements.

Customer acquisition strategies should emphasize digital marketing channels, referral programs, and value-added services that differentiate insurtech platforms from traditional insurance offerings. Building strong brand recognition and customer loyalty requires sustained investment in customer experience and service quality.

Regulatory engagement should be proactive and collaborative, with insurtech companies participating in industry associations, regulatory consultations, and policy development processes to help shape favorable regulatory environments while demonstrating commitment to consumer protection and market stability.

Market expansion across APAC countries is expected to continue at an accelerated pace, driven by increasing digital adoption, supportive regulatory environments, and growing consumer acceptance of digital insurance solutions. The market is projected to maintain strong growth momentum with an estimated CAGR of 14.2% over the next five years.

Technology evolution will continue to drive innovation in insurance product design, customer engagement, and operational efficiency. Emerging technologies such as quantum computing, advanced IoT applications, and next-generation artificial intelligence will create new opportunities for insurtech companies to differentiate their offerings and create competitive advantages.

Regulatory harmonization efforts across APAC countries may facilitate cross-border expansion and reduce compliance complexity for regional insurtech players. Increased regulatory cooperation and standardization could accelerate market integration and enable more efficient capital allocation across the region.

Customer expectations will continue to evolve toward more personalized, transparent, and convenient insurance experiences. Insurtech companies that successfully anticipate and respond to these changing expectations will be best positioned to capture market share and build sustainable competitive advantages.

Industry consolidation may accelerate as successful insurtech companies seek to expand their market presence through acquisitions while traditional insurers continue to invest in or acquire technology capabilities to enhance their digital transformation initiatives.

The APAC insurtech market represents a transformative force that is reshaping the traditional insurance landscape through innovative technology solutions, customer-centric approaches, and collaborative business models. The convergence of favorable demographic trends, supportive regulatory environments, and advancing technology infrastructure creates compelling opportunities for continued growth and innovation across the region.

Strategic success in this dynamic market requires careful attention to local market conditions, regulatory requirements, and customer preferences while maintaining focus on technological excellence and operational efficiency. Companies that can effectively balance innovation with compliance, scalability with personalization, and growth with sustainability will be best positioned to capitalize on the substantial opportunities ahead.

The future of insurance in the APAC region will be increasingly digital, data-driven, and customer-focused, with insurtech solutions playing a central role in making insurance more accessible, affordable, and relevant to diverse customer segments across this economically vital region.

What is Insurtech?

Insurtech refers to the use of technology innovations designed to enhance and streamline the insurance industry. This includes applications in underwriting, claims processing, and customer service, among others.

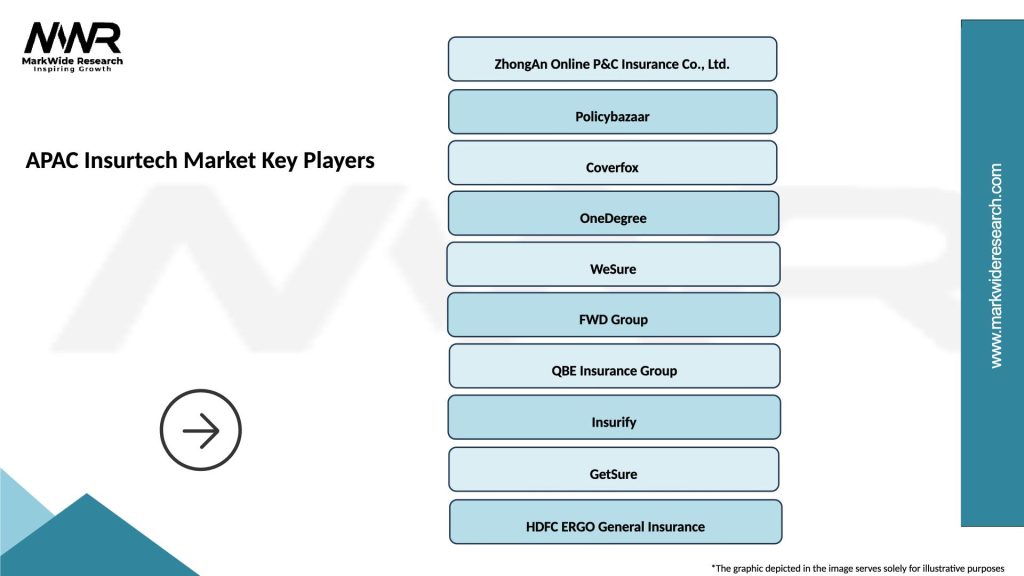

What are the key players in the APAC Insurtech Market?

Key players in the APAC Insurtech Market include companies like ZhongAn, Policybazaar, and WeSure, which are leveraging technology to improve insurance offerings and customer experiences, among others.

What are the growth factors driving the APAC Insurtech Market?

The APAC Insurtech Market is driven by factors such as increasing smartphone penetration, a growing demand for personalized insurance products, and advancements in data analytics and artificial intelligence.

What challenges does the APAC Insurtech Market face?

Challenges in the APAC Insurtech Market include regulatory hurdles, data privacy concerns, and the need for traditional insurers to adapt to rapidly changing technology landscapes.

What opportunities exist in the APAC Insurtech Market?

The APAC Insurtech Market presents opportunities for innovation in areas like microinsurance, on-demand insurance products, and the integration of blockchain technology for enhanced security and transparency.

What trends are shaping the APAC Insurtech Market?

Trends in the APAC Insurtech Market include the rise of digital-only insurance providers, the use of artificial intelligence for risk assessment, and the growing importance of customer-centric insurance solutions.

APAC Insurtech Market

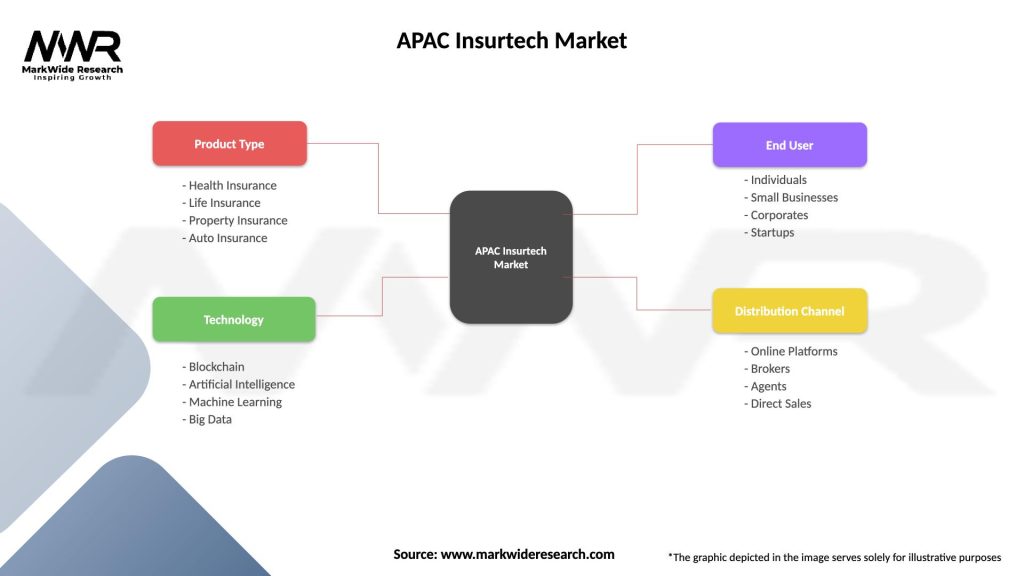

| Segmentation Details | Description |

|---|---|

| Product Type | Health Insurance, Life Insurance, Property Insurance, Auto Insurance |

| Technology | Blockchain, Artificial Intelligence, Machine Learning, Big Data |

| End User | Individuals, Small Businesses, Corporates, Startups |

| Distribution Channel | Online Platforms, Brokers, Agents, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Insurtech Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at