444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC gypsum board market represents one of the most dynamic and rapidly expanding construction material sectors in the global economy. This comprehensive market encompasses the production, distribution, and application of gypsum-based wallboard products across diverse Asia-Pacific regions, including China, India, Japan, South Korea, Australia, and Southeast Asian nations. Market dynamics indicate robust growth driven by unprecedented urbanization rates, infrastructure development initiatives, and evolving construction methodologies throughout the region.

Regional expansion has been particularly pronounced in emerging economies, where construction activities are experiencing remarkable acceleration. The market demonstrates significant potential for continued growth, with adoption rates increasing by approximately 8.5% annually across major APAC territories. Construction industry transformation continues to drive demand for lightweight, fire-resistant, and environmentally sustainable building materials, positioning gypsum board as a preferred solution for modern architectural applications.

Technological advancements in manufacturing processes have enhanced product quality while reducing production costs, making gypsum board increasingly accessible to diverse market segments. The integration of advanced manufacturing techniques and sustainable production methods has strengthened the market’s competitive position globally, with APAC manufacturers capturing approximately 45% of worldwide production capacity.

The APAC gypsum board market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, marketing, and application of gypsum-based construction panels throughout Asia-Pacific regions. Gypsum board, also known as drywall or plasterboard, consists of a gypsum plaster core sandwiched between two layers of paper or fiberglass matting, creating versatile building materials suitable for interior walls, ceilings, and partition systems.

Market scope extends beyond simple product manufacturing to include specialized applications such as fire-resistant boards, moisture-resistant variants, and acoustic panels designed for specific construction requirements. The market encompasses various stakeholders including raw material suppliers, manufacturers, distributors, contractors, and end-users across residential, commercial, and industrial construction sectors.

Geographic coverage spans major APAC economies with varying levels of market maturity and growth potential. Developed markets like Japan and Australia demonstrate stable demand patterns, while emerging economies including India, Vietnam, and Indonesia exhibit rapid expansion characteristics driven by urbanization and infrastructure development initiatives.

Strategic analysis reveals the APAC gypsum board market as a cornerstone of regional construction industry growth, characterized by robust demand fundamentals and expanding application scope. Market leadership is distributed among both international corporations and regional manufacturers, creating a competitive landscape that drives innovation and cost optimization across the value chain.

Growth trajectories indicate sustained expansion driven by urbanization trends, government infrastructure investments, and evolving construction practices favoring modern building materials. The market benefits from construction sector growth rates exceeding 6.2% annually in key regional economies, supported by demographic shifts and economic development initiatives.

Innovation focus centers on developing enhanced product formulations that address specific regional requirements, including improved moisture resistance for tropical climates, enhanced fire safety characteristics, and sustainable manufacturing processes. Manufacturing capacity expansion continues across multiple countries, with new production facilities incorporating advanced automation and environmental management systems.

Market consolidation trends suggest increasing collaboration between international technology providers and regional manufacturers, facilitating knowledge transfer and capacity building initiatives that strengthen overall market competitiveness and product quality standards.

Fundamental market insights reveal several critical factors shaping the APAC gypsum board industry’s trajectory and competitive dynamics:

Primary growth drivers propelling the APAC gypsum board market encompass diverse economic, demographic, and technological factors that create sustained demand across multiple market segments. Urbanization acceleration remains the most significant driver, with millions of people migrating to urban centers annually, necessitating extensive residential and commercial construction activities.

Infrastructure investment programs launched by governments throughout the region create substantial demand for construction materials, including gypsum board applications in public buildings, transportation facilities, and institutional projects. These initiatives often include budget allocations increasing by 12-15% annually for construction and infrastructure development.

Construction industry modernization drives adoption of efficient building materials that reduce construction time and labor costs. Gypsum board offers significant advantages over traditional plastering methods, including faster installation, consistent quality, and improved surface finishes that meet contemporary architectural standards.

Regulatory compliance requirements increasingly mandate fire-resistant and environmentally safe building materials, positioning gypsum board as a preferred solution for meeting stringent building codes. Energy efficiency standards also favor gypsum board applications that contribute to improved thermal performance and reduced energy consumption in buildings.

Market constraints affecting APAC gypsum board industry growth include several structural and operational challenges that require strategic management and innovative solutions. Raw material availability represents a primary concern, as gypsum deposits are geographically concentrated, creating supply chain vulnerabilities and transportation cost pressures for manufacturers in resource-limited regions.

Competition from alternative materials poses ongoing challenges, particularly from traditional construction methods and emerging building technologies. In some markets, traditional plastering methods retain approximately 35% market share due to established practices, lower initial costs, and skilled labor availability.

Environmental regulations create compliance costs and operational constraints for manufacturers, requiring investments in emission control systems, waste management infrastructure, and sustainable production processes. These requirements can significantly impact production costs and market competitiveness, particularly for smaller regional manufacturers.

Economic volatility in certain APAC markets affects construction activity levels and gypsum board demand patterns. Currency fluctuations, interest rate changes, and political uncertainties can create demand volatility that challenges production planning and inventory management strategies.

Emerging opportunities within the APAC gypsum board market present significant potential for expansion and innovation across multiple dimensions. Green building initiatives create substantial demand for environmentally certified construction materials, with gypsum board manufacturers developing sustainable product lines that meet international environmental standards and certification requirements.

Smart building integration offers opportunities for developing advanced gypsum board products that incorporate technology features such as embedded sensors, improved acoustic properties, and enhanced thermal performance characteristics. These innovations address growing demand for intelligent building solutions in commercial and residential applications.

Export market development presents opportunities for established APAC manufacturers to expand into global markets, leveraging cost advantages and manufacturing expertise to compete internationally. Regional trade agreements facilitate market access and reduce trade barriers, enabling manufacturers to pursue export-oriented growth strategies.

Specialized application segments including healthcare facilities, educational institutions, and hospitality projects require customized gypsum board solutions with specific performance characteristics. These niche markets often command premium pricing and offer opportunities for differentiated product development and market positioning strategies.

Dynamic market forces shaping the APAC gypsum board industry create complex interactions between supply and demand factors, technological developments, and competitive pressures. Supply chain evolution continues transforming market structure, with manufacturers developing integrated operations that control raw material sourcing, production processes, and distribution networks.

Competitive intensity varies significantly across different APAC markets, with mature economies experiencing price-based competition while emerging markets focus on capacity expansion and market share growth. Market concentration levels differ regionally, with some markets dominated by few large players while others maintain fragmented competitive structures.

Technology adoption rates influence market dynamics through improved production efficiency, product quality enhancements, and cost reduction initiatives. Advanced manufacturing technologies enable production efficiency improvements of approximately 18-22% compared to traditional manufacturing methods, creating competitive advantages for technology-adopting manufacturers.

Customer behavior evolution reflects changing preferences toward quality, sustainability, and performance characteristics rather than purely price-based purchasing decisions. This trend supports premium product development and brand differentiation strategies that create value beyond commodity-level competition.

Comprehensive research methodology employed for analyzing the APAC gypsum board market incorporates multiple data collection and analysis techniques to ensure accuracy, reliability, and actionable insights. Primary research activities include extensive interviews with industry executives, manufacturers, distributors, contractors, and end-users across major APAC markets to gather firsthand market intelligence and trend insights.

Secondary research components encompass analysis of industry publications, government statistics, trade association reports, and company financial statements to establish market baselines and validate primary research findings. Data triangulation methods ensure consistency and accuracy across multiple information sources and analytical approaches.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop market projections and identify key growth drivers and constraints. Regional analysis frameworks account for specific market characteristics, regulatory environments, and economic conditions that influence gypsum board demand patterns in different APAC countries.

Quality assurance processes include peer review, expert validation, and cross-referencing with established industry benchmarks to ensure research findings meet professional standards and provide reliable foundation for strategic decision-making by market participants and stakeholders.

Regional market dynamics across the APAC gypsum board industry demonstrate significant variation in growth patterns, competitive structures, and development opportunities. China dominates regional production with approximately 52% of total APAC manufacturing capacity, leveraging abundant raw materials, advanced manufacturing infrastructure, and strong domestic demand from construction and infrastructure development activities.

India represents the fastest-growing market segment, with construction activities expanding rapidly due to urbanization, government infrastructure initiatives, and growing middle-class housing demand. Market growth rates in India exceed 11% annually, driven by both residential and commercial construction projects across major metropolitan areas and emerging urban centers.

Japan and South Korea maintain mature markets characterized by stable demand patterns, advanced product specifications, and emphasis on high-quality, specialized applications. These markets focus on premium products with enhanced performance characteristics, including fire resistance, acoustic properties, and environmental certifications.

Southeast Asian markets including Indonesia, Thailand, Vietnam, and Malaysia demonstrate strong growth potential driven by economic development, infrastructure investment, and increasing construction activity levels. Combined market share of Southeast Asian countries approaches 18% of total APAC gypsum board consumption, with growth rates consistently exceeding regional averages.

Australia and New Zealand represent developed markets with stringent quality standards, environmental regulations, and sophisticated distribution networks. These markets emphasize sustainable products, advanced building codes compliance, and innovative applications in commercial and institutional construction projects.

Competitive market structure within the APAC gypsum board industry encompasses diverse players ranging from multinational corporations to regional specialists, creating dynamic competitive environment that drives innovation and market development. Market leadership positions are established through combination of manufacturing scale, product quality, distribution reach, and technological capabilities.

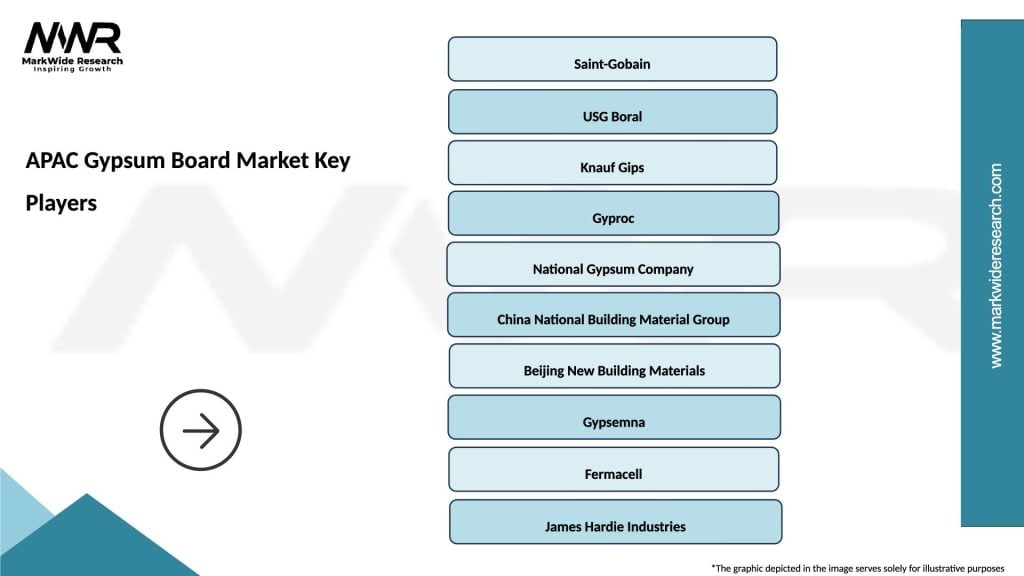

Major international players operating in the APAC market include:

Regional manufacturers maintain significant market positions through local market knowledge, cost advantages, and specialized product development. These companies often focus on specific geographic markets or application segments, creating competitive advantages through customization and customer service excellence.

Strategic partnerships between international technology providers and regional manufacturers facilitate market expansion, technology transfer, and capacity development initiatives that strengthen overall market competitiveness and innovation capabilities.

Market segmentation analysis reveals diverse categorization approaches that reflect varying customer needs, application requirements, and market dynamics across the APAC gypsum board industry. Product-based segmentation encompasses standard wallboard, moisture-resistant boards, fire-resistant variants, and specialized acoustic panels designed for specific performance requirements.

By Product Type:

By Application:

By End-User:

Detailed category analysis provides comprehensive understanding of specific market segments and their unique characteristics, growth patterns, and competitive dynamics within the APAC gypsum board market. Standard gypsum board represents the largest market category, accounting for the majority of volume sales across residential and commercial applications.

Moisture-resistant board category demonstrates strong growth potential, particularly in tropical and subtropical APAC regions where high humidity levels create specific performance requirements. This segment benefits from adoption rates increasing by approximately 14% annually as construction practices evolve to address climate-specific challenges.

Fire-resistant board applications expand rapidly due to strengthening building codes and safety regulations across major APAC markets. Commercial and institutional construction projects increasingly specify fire-resistant products, creating premium pricing opportunities and market differentiation potential for manufacturers.

Acoustic board segment serves specialized applications in commercial, educational, and healthcare facilities where noise control represents critical performance requirement. This category commands premium pricing and requires specialized manufacturing capabilities, creating barriers to entry and competitive advantages for established producers.

Residential application category benefits from sustained housing demand driven by urbanization and demographic trends. Market penetration rates in residential construction exceed 68% in developed APAC markets, while emerging economies demonstrate significant growth potential as modern construction methods gain adoption.

Strategic advantages available to APAC gypsum board market participants encompass multiple dimensions of value creation and competitive positioning. Manufacturers benefit from expanding market opportunities, technological advancement potential, and economies of scale that reduce production costs while improving product quality and performance characteristics.

Construction industry stakeholders gain access to efficient building materials that reduce construction time, labor costs, and project complexity while delivering consistent quality and performance. Installation efficiency improvements of approximately 25-30% compared to traditional plastering methods create significant value for contractors and project developers.

End-users and building owners benefit from improved building performance, including enhanced fire safety, acoustic properties, and environmental characteristics that contribute to occupant comfort and building value. Long-term durability and low maintenance requirements provide ongoing cost advantages throughout building lifecycle.

Distributors and retailers participate in growing market with diverse product portfolio opportunities, recurring demand patterns, and potential for value-added services including technical support and installation training. Market stability and growth trends support sustainable business development and expansion strategies.

Regional economic development benefits from gypsum board industry growth through job creation, technology transfer, and supply chain development that strengthens local construction industry capabilities and competitiveness.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the APAC gypsum board market reflect evolving construction industry practices, technological advancement, and changing customer expectations. Sustainability integration represents a dominant trend, with manufacturers developing environmentally certified products that meet green building standards and reduce environmental impact throughout product lifecycle.

Digital transformation influences market dynamics through advanced manufacturing technologies, supply chain optimization, and customer engagement platforms that improve operational efficiency and market responsiveness. Industry 4.0 adoption rates in manufacturing operations increase by approximately 16% annually, driving productivity improvements and quality enhancements.

Customization demand grows as construction projects require specialized solutions for specific applications, climate conditions, and performance requirements. This trend supports premium product development and market differentiation strategies that create competitive advantages beyond commodity-level competition.

Regional specialization emerges as manufacturers develop products optimized for specific APAC market conditions, including tropical climate formulations, seismic resistance characteristics, and compliance with local building codes and standards.

Supply chain integration trends include vertical integration strategies, strategic partnerships, and collaborative relationships that improve market efficiency, reduce costs, and enhance customer service capabilities across the value chain.

Recent industry developments demonstrate the dynamic nature of the APAC gypsum board market and ongoing evolution in competitive strategies, technological capabilities, and market expansion initiatives. Manufacturing capacity expansion continues across multiple countries, with new production facilities incorporating advanced automation, environmental management systems, and quality control technologies.

Strategic acquisitions and partnerships reshape market structure as companies pursue growth through market consolidation, technology acquisition, and geographic expansion strategies. MarkWide Research analysis indicates increasing collaboration between international corporations and regional manufacturers to leverage complementary strengths and market access capabilities.

Product innovation initiatives focus on developing enhanced formulations that address specific regional requirements, including improved moisture resistance, enhanced fire safety characteristics, and sustainable manufacturing processes that reduce environmental impact while maintaining performance standards.

Regulatory developments across APAC markets strengthen building codes, safety standards, and environmental requirements that influence product specifications and market demand patterns. These changes often create opportunities for manufacturers with advanced product capabilities and compliance expertise.

Technology investments in manufacturing automation, quality control systems, and supply chain management platforms improve operational efficiency and competitive positioning while supporting market expansion and customer service enhancement initiatives.

Strategic recommendations for APAC gypsum board market participants emphasize the importance of balanced growth strategies that address both immediate market opportunities and long-term competitive positioning requirements. Market expansion strategies should prioritize high-growth emerging markets while maintaining strong positions in mature economies through product differentiation and customer service excellence.

Technology investment priorities should focus on manufacturing automation, product innovation capabilities, and supply chain optimization systems that create sustainable competitive advantages and operational efficiency improvements. Digital transformation initiatives can enhance customer engagement, market responsiveness, and operational visibility across the value chain.

Sustainability integration represents critical success factor as environmental regulations strengthen and customer preferences evolve toward environmentally responsible products. Companies should develop comprehensive sustainability strategies that address manufacturing processes, product characteristics, and supply chain environmental impact.

Partnership development opportunities include strategic alliances with technology providers, distribution partners, and regional manufacturers that facilitate market expansion, capability enhancement, and risk mitigation strategies. MWR analysis suggests that successful partnerships often combine complementary strengths and shared strategic objectives.

Risk management strategies should address supply chain vulnerabilities, market volatility, and regulatory compliance requirements through diversification, contingency planning, and proactive stakeholder engagement initiatives that strengthen business resilience and adaptability.

Long-term market prospects for the APAC gypsum board industry remain highly favorable, supported by sustained urbanization trends, infrastructure development initiatives, and evolving construction practices that favor modern building materials. Market growth projections indicate continued expansion at compound annual growth rates exceeding 7.2% over the next decade, driven by demographic trends and economic development across the region.

Technology evolution will continue transforming market dynamics through advanced manufacturing processes, smart building integration, and sustainable product development that addresses environmental concerns while improving performance characteristics. Innovation investments are expected to accelerate as companies compete for market leadership in emerging application segments.

Regional market development patterns suggest increasing differentiation between mature and emerging economies, with developed markets focusing on premium products and specialized applications while emerging markets emphasize capacity expansion and market penetration strategies. Cross-border trade is likely to increase as regional integration deepens and trade barriers diminish.

Sustainability requirements will become increasingly important competitive factors, with environmental certifications, carbon footprint reduction, and circular economy principles influencing product development and market positioning strategies. Companies that successfully integrate sustainability into their business models are expected to achieve superior long-term performance.

Market consolidation trends may accelerate as companies pursue scale advantages, technology capabilities, and geographic expansion through strategic acquisitions and partnerships. MarkWide Research projects that market concentration levels will increase moderately while maintaining competitive dynamics that drive innovation and customer value creation.

The APAC gypsum board market represents a dynamic and rapidly evolving industry sector with substantial growth potential driven by urbanization, infrastructure development, and construction industry modernization across diverse regional markets. Market fundamentals remain strong, supported by demographic trends, economic development, and evolving building practices that favor efficient, high-performance construction materials.

Competitive dynamics continue evolving through technology advancement, market consolidation, and strategic partnership development that reshape industry structure while driving innovation and customer value creation. Companies that successfully navigate these changes through strategic positioning, operational excellence, and customer focus are well-positioned for sustained growth and market leadership.

Future success factors include sustainability integration, technology adoption, regional market expertise, and strategic partnership development that create competitive advantages and support long-term business resilience. The market’s trajectory toward increased sophistication, environmental responsibility, and performance optimization creates opportunities for companies with advanced capabilities and strategic vision to achieve superior results in this expanding and dynamic industry sector.

What is Gypsum Board?

Gypsum board, also known as drywall or plasterboard, is a building material made from gypsum plaster sandwiched between two sheets of heavy paper. It is widely used in construction for interior walls and ceilings due to its fire resistance and ease of installation.

What are the key players in the APAC Gypsum Board Market?

Key players in the APAC Gypsum Board Market include Saint-Gobain, USG Corporation, Boral Limited, and Knauf Gips. These companies are known for their innovative products and extensive distribution networks, among others.

What are the growth factors driving the APAC Gypsum Board Market?

The APAC Gypsum Board Market is driven by factors such as rapid urbanization, increasing construction activities, and a growing demand for sustainable building materials. Additionally, the rise in residential and commercial projects contributes to market growth.

What challenges does the APAC Gypsum Board Market face?

Challenges in the APAC Gypsum Board Market include fluctuating raw material prices and competition from alternative materials like cement boards. Additionally, regulatory compliance and environmental concerns can pose challenges for manufacturers.

What opportunities exist in the APAC Gypsum Board Market?

Opportunities in the APAC Gypsum Board Market include the increasing focus on green building practices and the development of innovative gypsum board products. The expansion of the construction sector in emerging economies also presents significant growth potential.

What trends are shaping the APAC Gypsum Board Market?

Trends in the APAC Gypsum Board Market include the adoption of lightweight and moisture-resistant boards, as well as the integration of smart technologies in building materials. Additionally, there is a growing emphasis on eco-friendly production processes.

APAC Gypsum Board Market

| Segmentation Details | Description |

|---|---|

| Product Type | Regular, Moisture-Resistant, Fire-Resistant, Soundproof |

| End User | Residential, Commercial, Industrial, Institutional |

| Thickness | 9mm, 12mm, 15mm, 18mm |

| Application | Ceilings, Partitions, Wall Linings, Acoustic Treatments |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Gypsum Board Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at