444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC green buildings market represents one of the most dynamic and rapidly evolving sectors in the Asia-Pacific region’s construction industry. This market encompasses sustainable construction practices, energy-efficient building materials, renewable energy integration, and environmentally conscious design methodologies that are transforming the regional built environment. Green building initiatives across APAC countries are experiencing unprecedented growth, driven by stringent environmental regulations, rising energy costs, and increasing awareness of climate change impacts.

Market dynamics in the APAC region reflect a strong commitment to sustainable development, with countries like Singapore, Australia, Japan, and South Korea leading the adoption of green building standards. The market is characterized by robust growth in LEED-certified buildings, BREEAM certifications, and local green building rating systems such as Green Star and CASBEE. Current trends indicate that the market is expanding at a compound annual growth rate of 11.2%, significantly outpacing traditional construction methods.

Regional governments are implementing comprehensive policies to promote sustainable construction, including tax incentives, building code modifications, and mandatory green building requirements for public projects. The market encompasses various building types, from residential complexes and commercial offices to industrial facilities and institutional buildings, all incorporating advanced sustainability features and energy-efficient technologies.

The APAC green buildings market refers to the comprehensive ecosystem of sustainable construction practices, environmentally friendly building materials, energy-efficient technologies, and certification systems that promote reduced environmental impact throughout a building’s lifecycle in the Asia-Pacific region. This market encompasses the design, construction, operation, and maintenance of buildings that significantly reduce or eliminate negative environmental impacts while creating healthier and more productive environments for occupants.

Green buildings in the APAC context integrate multiple sustainability elements including energy efficiency, water conservation, waste reduction, indoor environmental quality improvement, and sustainable site development. These structures utilize renewable energy sources, implement advanced building management systems, incorporate recycled and locally sourced materials, and feature innovative design elements that minimize resource consumption while maximizing occupant comfort and productivity.

The APAC green buildings market is experiencing transformative growth as regional economies prioritize sustainable development and environmental responsibility. Key market drivers include government mandates for energy-efficient construction, rising utility costs, corporate sustainability commitments, and growing consumer awareness of environmental issues. The market spans multiple segments including residential, commercial, industrial, and institutional buildings, each adopting green technologies and sustainable practices at varying rates.

Technology adoption in the sector is accelerating, with smart building systems, renewable energy integration, and advanced building materials gaining widespread acceptance. The market benefits from strong government support through policy frameworks, financial incentives, and regulatory requirements that favor sustainable construction practices. Regional variations exist, with developed markets like Australia and Japan leading in certification adoption, while emerging economies focus on energy efficiency and resource conservation.

Investment flows into green building projects are increasing substantially, supported by green financing initiatives, sustainability-linked loans, and ESG investment criteria. The market faces challenges including higher upfront costs, skills gaps in sustainable construction, and varying regulatory standards across countries, but these are being addressed through industry collaboration and knowledge sharing initiatives.

Market penetration of green building practices varies significantly across APAC countries, with several key insights emerging from current market analysis:

Government regulations serve as the primary catalyst for APAC green buildings market expansion, with countries implementing mandatory energy efficiency standards, green building codes, and sustainability reporting requirements. These regulatory frameworks create a supportive environment for sustainable construction practices while establishing minimum performance standards that drive market adoption.

Economic incentives play a crucial role in market growth, including tax credits, rebates, expedited permitting processes, and preferential financing terms for green building projects. Many APAC governments offer substantial financial benefits to developers and building owners who achieve recognized green building certifications, making sustainable construction economically attractive.

Corporate sustainability commitments are driving significant demand for green buildings as multinational corporations establish environmental targets and seek LEED or BREEAM-certified office spaces. Companies are increasingly recognizing that sustainable buildings enhance their brand reputation, attract environmentally conscious employees, and contribute to corporate social responsibility goals.

Rising energy costs across the APAC region make energy-efficient buildings increasingly attractive to owners and tenants. Green buildings typically achieve substantial operational cost savings through reduced energy consumption, lower water usage, and decreased waste generation, providing compelling financial returns on sustainable investments.

Climate change awareness and environmental consciousness among consumers and businesses are creating strong market demand for sustainable building solutions. This awareness translates into preference for green-certified buildings, driving premium rents and higher property values for sustainable developments.

Higher upfront costs represent the most significant barrier to green building adoption across the APAC region. Sustainable construction typically requires premium investments of 5-15% above conventional building costs, creating financial challenges for developers and building owners, particularly in price-sensitive markets.

Skills and knowledge gaps in sustainable construction practices limit market growth, as many construction professionals lack expertise in green building technologies, certification processes, and sustainable design principles. This shortage of qualified professionals can lead to project delays, increased costs, and suboptimal performance outcomes.

Regulatory inconsistencies across APAC countries create complexity for regional developers and international investors. Varying green building standards, certification requirements, and compliance procedures increase project complexity and costs, particularly for companies operating across multiple markets.

Limited availability of sustainable building materials and technologies in some APAC markets constrains project development and increases costs. Supply chain challenges, import dependencies, and limited local manufacturing capacity for green building products can significantly impact project timelines and budgets.

Market perception challenges persist in some regions where green buildings are viewed as experimental or unproven technologies. Conservative construction practices and risk-averse investment approaches can slow adoption rates, particularly in emerging markets with less experience in sustainable construction.

Retrofit and renovation markets present substantial opportunities as existing building stock across APAC requires energy efficiency upgrades and sustainability improvements. The vast inventory of older buildings creates a significant addressable market for green building technologies, energy management systems, and sustainable retrofitting solutions.

Smart city initiatives across major APAC urban centers are creating unprecedented demand for integrated green building solutions. Government-led smart city projects require sustainable buildings that incorporate IoT technologies, renewable energy systems, and advanced building management capabilities, opening new market segments for innovative solutions.

Green financing growth is expanding access to capital for sustainable building projects through green bonds, sustainability-linked loans, and ESG-focused investment funds. Financial institutions are increasingly offering preferential terms for green building projects, reducing financing costs and improving project economics.

Technology convergence opportunities exist at the intersection of green buildings, renewable energy, and digital technologies. Integration of solar panels, energy storage systems, electric vehicle charging infrastructure, and AI-powered building management creates new value propositions and revenue streams.

Regional expansion into emerging APAC markets offers significant growth potential as countries like Vietnam, Thailand, and Indonesia develop green building policies and certification programs. Early market entry in these developing markets can establish competitive advantages and market leadership positions.

Supply chain evolution is reshaping the APAC green buildings market as manufacturers develop local production capabilities for sustainable building materials and technologies. This localization trend reduces costs, improves supply reliability, and supports regional economic development while meeting growing demand for green building products.

Certification system maturation is driving market standardization and quality improvements across the region. Established rating systems like LEED and BREEAM are expanding their presence, while local certification programs such as Green Star Australia and Singapore’s Green Building Masterplan are gaining international recognition and adoption.

Technology integration is accelerating as building owners recognize the operational benefits of smart building systems, IoT sensors, and AI-powered optimization platforms. These technologies enable real-time monitoring, predictive maintenance, and automated energy management, delivering measurable performance improvements and cost savings.

Market consolidation trends are emerging as larger construction companies acquire specialized green building expertise through partnerships, acquisitions, and joint ventures. This consolidation is improving project delivery capabilities while expanding market reach for sustainable construction services.

Performance verification is becoming increasingly important as building owners demand measurable results from green building investments. Post-occupancy evaluation, energy performance monitoring, and certification maintenance requirements are creating new service opportunities and ensuring long-term market credibility.

Primary research for the APAC green buildings market analysis involved comprehensive interviews with industry stakeholders including developers, architects, construction companies, certification bodies, and government officials across major regional markets. This primary data collection provided insights into market trends, challenges, opportunities, and future outlook from key market participants.

Secondary research encompassed analysis of government publications, industry reports, certification databases, and academic studies related to sustainable construction practices in the Asia-Pacific region. This research foundation provided quantitative data on market size, growth rates, certification trends, and regulatory developments across different countries.

Market segmentation analysis examined the green buildings market across multiple dimensions including building type, certification system, technology category, and geographic region. This segmentation approach enabled detailed understanding of market dynamics within specific sub-sectors and identification of high-growth opportunities.

Competitive landscape assessment involved analysis of major market participants, their service offerings, geographic presence, and strategic initiatives. This competitive intelligence provided insights into market structure, key success factors, and emerging competitive trends shaping the industry.

Trend analysis incorporated examination of technological developments, regulatory changes, and market evolution patterns to identify emerging opportunities and potential disruptions. This forward-looking analysis supports strategic planning and investment decision-making for market participants.

Australia and New Zealand lead the APAC green buildings market with mature regulatory frameworks, widespread certification adoption, and strong government support for sustainable construction. These markets demonstrate highest green building penetration rates in the region, with comprehensive building codes and established industry expertise driving continued growth.

Singapore represents a model market for green building development, with government-mandated sustainability requirements and comprehensive support programs. The city-state’s Green Building Masterplan has achieved remarkable success, with over 85% of new buildings meeting green building standards, establishing Singapore as a regional leader in sustainable construction.

Japan focuses on energy efficiency and disaster resilience in its green building approach, with the CASBEE certification system gaining widespread adoption. The market emphasizes technological innovation and high-performance building systems, particularly in response to energy security concerns and seismic safety requirements.

South Korea has implemented aggressive green building policies as part of its Green New Deal initiative, driving rapid market expansion and technology adoption. The country’s focus on smart city development and carbon neutrality goals creates substantial opportunities for sustainable building solutions.

China represents the largest growth opportunity in the APAC green buildings market, with government commitments to carbon neutrality and massive urbanization driving demand for sustainable construction. The market is characterized by rapid scaling of green building technologies and increasing adoption of international certification standards.

India shows strong growth potential with expanding green building certification programs and increasing corporate adoption of sustainable construction practices. The market benefits from government initiatives promoting energy efficiency and growing awareness of environmental sustainability among developers and building owners.

Southeast Asian markets including Thailand, Vietnam, Malaysia, and Indonesia are emerging as high-growth opportunities with developing green building policies and increasing international investment in sustainable construction projects.

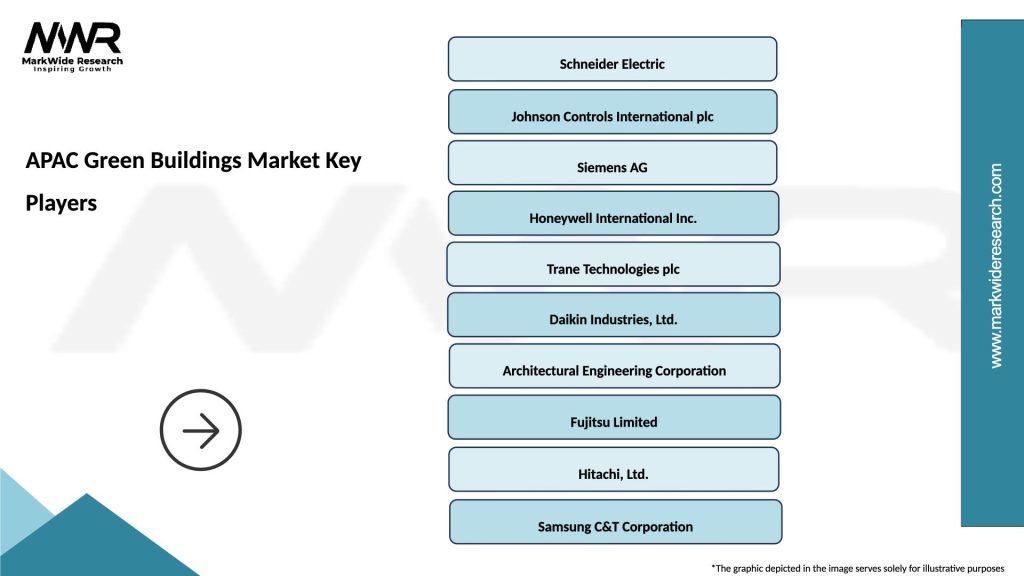

Market leadership in the APAC green buildings sector is distributed among various categories of companies, each contributing specialized expertise and capabilities to the sustainable construction ecosystem.

Strategic partnerships are common in the market as companies collaborate to combine construction expertise with specialized green building technologies, certification knowledge, and sustainable design capabilities. These partnerships enable comprehensive project delivery while sharing risks and expanding market reach.

Technology providers including building management system manufacturers, renewable energy companies, and sustainable material suppliers play crucial roles in the competitive ecosystem by providing the technologies and products that enable green building performance.

By Building Type:

By Certification System:

By Technology Category:

Commercial green buildings dominate the APAC market due to strong corporate demand for sustainable office spaces and retail environments. These projects typically achieve the highest certification levels and incorporate advanced building technologies, making them showcase examples of green building best practices. Tenant demand for certified green space is driving premium rents and higher occupancy rates.

Residential green buildings are experiencing rapid growth as developers respond to consumer preferences for energy-efficient homes and sustainable living environments. This segment benefits from government incentives, utility rebate programs, and growing awareness of health and environmental benefits associated with green residential construction.

Industrial green buildings focus primarily on energy efficiency and operational cost reduction, with manufacturers and logistics companies recognizing the substantial savings potential from sustainable facility design. These projects often achieve rapid payback periods through reduced utility costs and improved operational efficiency.

Institutional green buildings serve as market leaders and demonstration projects, with government agencies, educational institutions, and healthcare organizations setting sustainability examples for the broader market. These projects often achieve the highest certification levels and incorporate innovative technologies that influence broader market adoption.

Technology integration varies significantly across building categories, with commercial buildings leading in smart building system adoption while residential projects focus more on energy efficiency and indoor environmental quality improvements.

Building owners realize substantial benefits from green building investments including reduced operating costs, higher property values, improved tenant retention, and enhanced asset performance. MarkWide Research analysis indicates that certified green buildings typically achieve 10-20% higher rental rates and superior occupancy levels compared to conventional buildings.

Tenants and occupants benefit from improved indoor air quality, enhanced comfort levels, reduced utility costs, and healthier work environments. Green buildings demonstrate measurable improvements in occupant productivity, satisfaction, and well-being, creating value for businesses and residents.

Developers and contractors gain competitive advantages through green building expertise, access to new market segments, and differentiation from competitors. Sustainable construction capabilities enable premium pricing and access to environmentally conscious clients and investors.

Government agencies achieve policy objectives including carbon emission reductions, energy security improvements, and economic development through green building market growth. Sustainable construction contributes to job creation, technology innovation, and environmental protection goals.

Financial institutions benefit from reduced risk profiles of green building investments, access to green financing opportunities, and alignment with ESG investment criteria. Green buildings typically demonstrate superior performance during economic downturns and maintain higher asset values over time.

Technology providers access expanding markets for sustainable building products, energy management systems, and renewable energy technologies. The growing green building market creates substantial opportunities for innovation and technology commercialization.

Strengths:

Weaknesses:

Opportunities:

Threats:

Net-zero building adoption is accelerating across APAC markets as governments and corporations establish carbon neutrality commitments. These ultra-high-performance buildings incorporate advanced energy efficiency measures, renewable energy systems, and carbon offset strategies to achieve net-zero energy consumption and emissions.

Biophilic design integration is gaining prominence as building designers recognize the health and productivity benefits of incorporating natural elements into built environments. This trend includes living walls, natural lighting optimization, indoor gardens, and materials that connect occupants with nature.

Circular economy principles are being integrated into green building design and construction through material reuse, waste reduction strategies, and end-of-life planning. This approach minimizes resource consumption and environmental impact throughout the building lifecycle.

Health and wellness focus is expanding beyond traditional green building criteria to encompass occupant health, indoor air quality, and wellness features. Certification systems are incorporating health-focused criteria, and building owners are investing in technologies that support occupant well-being.

Digital twin technology is being adopted for building performance optimization, predictive maintenance, and energy management. These digital replicas enable real-time monitoring, simulation, and optimization of building systems for improved efficiency and performance.

Resilience planning is becoming integral to green building design as climate change impacts require buildings to withstand extreme weather events, power outages, and other disruptions while maintaining occupant safety and comfort.

Certification system evolution continues with updates to LEED, BREEAM, and local rating systems incorporating new technologies, performance metrics, and sustainability criteria. These updates reflect advancing knowledge and technology capabilities while maintaining market relevance and credibility.

Government policy expansion includes new mandates for green building certification, energy performance disclosure, and carbon emission reporting. Many APAC countries are strengthening building codes and implementing mandatory sustainability requirements for public and private construction projects.

Technology integration advances include widespread adoption of IoT sensors, AI-powered building management systems, and integrated renewable energy solutions. These technologies enable unprecedented levels of building performance optimization and operational efficiency.

Financial market development encompasses growth in green bonds, sustainability-linked financing, and ESG investment criteria specifically targeting sustainable building projects. Financial institutions are developing specialized products and expertise for green building investments.

Industry collaboration initiatives include formation of green building councils, industry associations, and knowledge-sharing platforms that promote best practices, standardization, and market development across the APAC region.

Supply chain localization efforts are expanding local manufacturing capabilities for sustainable building materials and technologies, reducing costs and improving supply reliability while supporting regional economic development.

Market participants should prioritize development of integrated service offerings that combine traditional construction expertise with specialized green building knowledge, certification capabilities, and technology integration skills. This comprehensive approach enables competitive differentiation and access to premium market segments.

Investment strategies should focus on markets with strong government support, established certification programs, and growing corporate demand for sustainable buildings. Early entry into emerging markets with developing green building policies can establish competitive advantages and market leadership positions.

Technology adoption should emphasize solutions that deliver measurable performance improvements and rapid payback periods. Building owners increasingly demand quantifiable results from green building investments, making performance verification and monitoring capabilities essential.

Partnership development with technology providers, certification bodies, and financial institutions can expand market reach and capabilities while sharing risks and costs. Strategic alliances enable access to specialized expertise and new market opportunities.

Skills development initiatives should address the growing shortage of qualified green building professionals through training programs, certification courses, and knowledge transfer initiatives. Investment in human capital development is essential for sustainable market growth.

Regional expansion strategies should consider local market conditions, regulatory requirements, and cultural preferences while leveraging successful approaches from established markets. Adaptation to local conditions is crucial for successful market entry and growth.

Market growth is expected to accelerate over the next decade as APAC countries strengthen environmental policies, implement carbon pricing mechanisms, and establish mandatory green building requirements. MWR projections indicate that green building adoption rates will increase substantially across all market segments and geographic regions.

Technology evolution will drive next-generation green building capabilities including artificial intelligence optimization, advanced materials, and integrated renewable energy systems. These technological advances will improve building performance while reducing costs and complexity.

Regulatory expansion will include mandatory energy performance disclosure, carbon emission reporting, and green building certification requirements for larger construction projects. Government policies will continue to be the primary driver of market growth and standardization.

Market maturation will result in improved cost competitiveness, standardized practices, and widespread industry expertise in green building development. As the market matures, sustainable construction will become the standard approach rather than a premium option.

Integration opportunities with smart city initiatives, renewable energy development, and digital infrastructure will create new value propositions and market segments. Green buildings will become integral components of broader sustainability and technology ecosystems.

Performance optimization will become increasingly sophisticated through advanced monitoring, artificial intelligence, and predictive analytics. Buildings will achieve higher levels of efficiency and occupant satisfaction through continuous optimization and adaptive management systems.

The APAC green buildings market represents a transformative force in the regional construction industry, driven by government policies, corporate sustainability commitments, and growing environmental awareness. Market growth is supported by proven performance benefits, mature technologies, and comprehensive certification systems that provide credible standards for sustainable construction.

Regional diversity creates varied opportunities across APAC markets, with developed countries leading in certification adoption while emerging economies focus on energy efficiency and cost-effective sustainability solutions. This diversity requires tailored approaches but offers substantial growth potential for market participants with appropriate strategies and capabilities.

Technology integration and innovation continue to drive market evolution, with smart building systems, renewable energy, and advanced materials creating new possibilities for building performance and occupant satisfaction. The convergence of green building practices with digital technologies and smart city initiatives opens new market segments and value propositions.

Future success in the APAC green buildings market will require comprehensive capabilities spanning traditional construction expertise, sustainability knowledge, technology integration, and certification management. Companies that develop these integrated capabilities while adapting to local market conditions will be best positioned to capitalize on the substantial growth opportunities ahead in this dynamic and rapidly evolving market.

What is Green Buildings?

Green buildings refer to structures that are designed, constructed, and operated to minimize their environmental impact. They focus on energy efficiency, sustainable materials, and water conservation, contributing to a healthier environment and reduced carbon footprint.

What are the key players in the APAC Green Buildings Market?

Key players in the APAC Green Buildings Market include companies like Lendlease, Gensler, and Skanska, which are known for their innovative approaches to sustainable architecture and construction practices, among others.

What are the main drivers of the APAC Green Buildings Market?

The main drivers of the APAC Green Buildings Market include increasing government regulations promoting sustainability, rising awareness of environmental issues among consumers, and the growing demand for energy-efficient buildings in urban areas.

What challenges does the APAC Green Buildings Market face?

Challenges in the APAC Green Buildings Market include high initial costs of green technologies, lack of awareness and expertise in sustainable building practices, and regulatory hurdles that can slow down project approvals.

What opportunities exist in the APAC Green Buildings Market?

Opportunities in the APAC Green Buildings Market include advancements in green technologies, increasing investment in sustainable infrastructure, and the potential for retrofitting existing buildings to meet green standards.

What trends are shaping the APAC Green Buildings Market?

Trends shaping the APAC Green Buildings Market include the integration of smart building technologies, the use of renewable energy sources, and a focus on biophilic design that enhances the connection between occupants and nature.

APAC Green Buildings Market

| Segmentation Details | Description |

|---|---|

| Product Type | Insulation Materials, Windows, HVAC Systems, Lighting Solutions |

| End User | Commercial Buildings, Residential Properties, Educational Institutions, Healthcare Facilities |

| Technology | Smart Building Technologies, Renewable Energy Systems, Energy Management Systems, Building Automation |

| Application | New Construction, Renovation, Retrofitting, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Green Buildings Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at