444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific fuel cell market represents one of the most dynamic and rapidly evolving sectors in the global clean energy landscape. This comprehensive market encompasses various fuel cell technologies, including proton exchange membrane fuel cells, solid oxide fuel cells, alkaline fuel cells, and phosphoric acid fuel cells, serving diverse applications across automotive, stationary power generation, portable devices, and industrial sectors. The region’s commitment to carbon neutrality and sustainable energy transition has positioned APAC as a global leader in fuel cell innovation and deployment.

Market dynamics in the Asia-Pacific region are characterized by substantial government investments, technological advancements, and increasing adoption across multiple industries. Countries like Japan, South Korea, China, and Australia are leading the charge with ambitious hydrogen strategies and fuel cell deployment programs. The market is experiencing robust growth driven by declining technology costs, improving performance metrics, and expanding infrastructure development.

Regional leadership in fuel cell technology is evident through the presence of major manufacturers, research institutions, and government initiatives. The market benefits from strong supply chain integration, advanced manufacturing capabilities, and significant research and development investments. MarkWide Research analysis indicates that the APAC fuel cell market is growing at a compound annual growth rate of 12.4%, reflecting the region’s strategic focus on clean energy technologies and hydrogen economy development.

The APAC fuel cell market refers to the comprehensive ecosystem of fuel cell technologies, systems, components, and services across the Asia-Pacific region, encompassing research, development, manufacturing, deployment, and maintenance of electrochemical devices that convert hydrogen and oxygen into electricity through chemical reactions. This market includes various stakeholders from technology developers and manufacturers to end-users and service providers, creating a complex value chain that supports the transition to clean energy solutions.

Fuel cell systems in the APAC context represent advanced energy conversion technologies that offer high efficiency, low emissions, and versatile applications across transportation, stationary power, and portable applications. The market encompasses both established technologies and emerging innovations, including next-generation fuel cell designs, advanced materials, and integrated systems that address specific regional requirements and applications.

Strategic positioning of the APAC fuel cell market reflects the region’s leadership in clean energy innovation and deployment. The market demonstrates exceptional growth potential driven by supportive government policies, technological breakthroughs, and increasing commercial viability across multiple applications. Key market segments including automotive fuel cells, stationary power systems, and portable applications are experiencing significant expansion with improving cost competitiveness and performance characteristics.

Investment trends indicate substantial capital allocation toward fuel cell research, manufacturing capacity expansion, and infrastructure development. Major automotive manufacturers, energy companies, and technology firms are establishing strategic partnerships and joint ventures to accelerate market development. The market benefits from government support representing 35% of total investment in fuel cell projects, demonstrating strong policy commitment to hydrogen economy development.

Technology advancement continues to drive market evolution with improvements in efficiency, durability, and cost reduction. The integration of artificial intelligence, advanced materials, and manufacturing innovations is enhancing fuel cell performance while reducing production costs. Market participants are focusing on scalable solutions that address diverse application requirements across the APAC region.

Market segmentation reveals diverse opportunities across technology types, applications, and geographic regions within APAC. The following key insights highlight critical market dynamics:

Government policy support serves as the primary catalyst for APAC fuel cell market expansion. National hydrogen strategies, carbon neutrality commitments, and clean energy mandates are creating favorable regulatory environments that encourage fuel cell adoption. Countries across the region are implementing comprehensive policy frameworks that include research funding, deployment incentives, and infrastructure development programs.

Environmental regulations and emission reduction targets are driving demand for clean energy alternatives across transportation and industrial sectors. The increasing focus on air quality improvement in major urban centers is accelerating the adoption of fuel cell vehicles and stationary power systems. Corporate sustainability commitments and environmental, social, and governance considerations are influencing procurement decisions toward clean energy technologies.

Technological advancement continues to improve fuel cell performance while reducing costs, making the technology more competitive with conventional alternatives. Innovations in catalyst materials, membrane technologies, and system integration are enhancing efficiency and durability. The development of next-generation fuel cell systems with improved power density and reduced complexity is expanding application possibilities.

Energy security concerns are motivating governments and enterprises to diversify energy sources and reduce dependence on fossil fuel imports. Fuel cells offer the potential for domestic energy production using renewable hydrogen, contributing to energy independence and supply chain resilience. The strategic importance of hydrogen as an energy carrier is driving long-term investments in fuel cell infrastructure.

High initial costs remain a significant barrier to widespread fuel cell adoption across various applications. Despite recent cost reductions, fuel cell systems still require substantial upfront investments compared to conventional alternatives. The total cost of ownership calculations often favor traditional technologies, particularly in price-sensitive market segments and developing economies within the APAC region.

Infrastructure limitations pose challenges for fuel cell deployment, particularly in transportation applications. The limited availability of hydrogen refueling stations restricts the practical adoption of fuel cell vehicles, creating a chicken-and-egg problem between vehicle deployment and infrastructure development. The high cost of establishing hydrogen infrastructure requires coordinated investments from multiple stakeholders.

Technical challenges including durability, reliability, and performance consistency continue to impact market confidence. Fuel cell systems require specialized maintenance and technical expertise, which may not be readily available in all markets. The complexity of fuel cell technology can create operational challenges for end-users, particularly in industrial and commercial applications.

Supply chain constraints for critical materials and components can limit production scalability and increase costs. The dependence on rare earth elements and specialized materials creates supply security concerns. Limited manufacturing capacity for key components may constrain market growth during periods of high demand.

Automotive sector transformation presents substantial opportunities for fuel cell technology adoption, particularly in commercial vehicles, buses, and heavy-duty transportation. The growing emphasis on zero-emission transportation solutions is creating demand for fuel cell vehicles that offer longer range and faster refueling compared to battery electric alternatives. Fleet operators are increasingly considering fuel cell solutions for logistics and public transportation applications.

Industrial applications offer significant growth potential as manufacturers seek clean energy solutions for material handling, backup power, and process applications. The integration of fuel cells in manufacturing facilities, warehouses, and data centers provides opportunities for reliable, clean power generation. Industrial fuel cell applications benefit from controlled operating environments and professional maintenance capabilities.

Distributed energy systems represent emerging opportunities as utilities and commercial customers seek resilient power solutions. Fuel cells can provide grid support services, peak shaving, and emergency backup power while contributing to decarbonization goals. The combination of fuel cells with renewable energy sources creates hybrid systems that address intermittency challenges.

Export opportunities are expanding as APAC manufacturers develop competitive fuel cell products for global markets. The region’s manufacturing capabilities and cost advantages position local companies to serve international demand for fuel cell systems and components. Technology transfer and joint venture opportunities with international partners can accelerate market expansion.

Competitive landscape in the APAC fuel cell market is characterized by intense innovation and strategic partnerships among technology developers, manufacturers, and end-users. Major automotive companies are forming alliances with fuel cell specialists to accelerate product development and market entry. The market dynamics are influenced by government policies, technology breakthroughs, and changing customer preferences toward sustainable solutions.

Supply chain evolution is reshaping market dynamics as companies work to establish reliable sources for critical materials and components. Vertical integration strategies are becoming more common as manufacturers seek to control costs and ensure quality. Regional supply chain development is reducing dependence on international suppliers while improving cost competitiveness.

Technology convergence is creating new market dynamics as fuel cells are integrated with other clean energy technologies, including renewable energy systems, energy storage, and smart grid solutions. The development of hydrogen ecosystems is connecting fuel cell applications across transportation, industrial, and power generation sectors, creating synergies and economies of scale.

Market maturation is evident in the transition from demonstration projects to commercial deployments across various applications. The increasing standardization of fuel cell systems and components is reducing costs and improving interoperability. Customer acceptance is growing as fuel cell technology demonstrates reliability and performance in real-world applications.

Comprehensive analysis of the APAC fuel cell market employs multiple research methodologies to ensure accuracy and reliability of market insights. Primary research includes interviews with industry executives, technology developers, government officials, and end-users across major markets in the region. Secondary research encompasses analysis of government publications, industry reports, patent databases, and financial disclosures from public companies.

Data collection processes involve systematic gathering of market information from diverse sources including trade associations, research institutions, and regulatory bodies. Market sizing and forecasting utilize bottom-up and top-down approaches to validate findings and ensure consistency. Regional market analysis considers local factors including policy environments, economic conditions, and cultural preferences that influence fuel cell adoption.

Analytical frameworks incorporate quantitative and qualitative assessment methods to evaluate market trends, competitive dynamics, and growth opportunities. Technology assessment includes evaluation of performance metrics, cost structures, and development roadmaps. Market segmentation analysis considers multiple dimensions including technology type, application, end-user, and geographic region.

Validation processes ensure research findings are accurate and representative of market conditions. Cross-referencing of data sources, expert review, and statistical analysis help identify and correct potential biases or errors. Regular updates to research methodologies incorporate new data sources and analytical techniques as the market evolves.

Japan maintains its position as a technology leader in the APAC fuel cell market, with advanced research capabilities and strong government support for hydrogen society initiatives. The country’s fuel cell market benefits from early commercialization efforts, established supply chains, and comprehensive policy frameworks. Japanese companies lead in fuel cell vehicle development and residential fuel cell systems, with market share of 28% in the regional automotive fuel cell segment.

South Korea demonstrates rapid market growth driven by aggressive government policies and substantial investments in fuel cell infrastructure. The country’s focus on fuel cell vehicles and power generation applications has created a dynamic market environment. Korean manufacturers are expanding production capacity and developing cost-competitive fuel cell solutions for domestic and export markets.

China represents the largest potential market in the region with massive government investments in hydrogen infrastructure and fuel cell vehicle deployment. The country’s manufacturing capabilities and scale advantages are driving cost reductions across the fuel cell value chain. Chinese companies are rapidly developing domestic fuel cell technologies while establishing partnerships with international technology providers.

Australia is emerging as a significant market for fuel cell applications, particularly in mining, remote power generation, and transportation sectors. The country’s abundant renewable energy resources and hydrogen export ambitions are creating opportunities for fuel cell technology deployment. Government support for clean energy initiatives is accelerating market development.

Other APAC markets including India, Southeast Asian countries, and New Zealand are showing increasing interest in fuel cell technology for various applications. These markets represent long-term growth opportunities as economic development and environmental awareness drive demand for clean energy solutions.

Market leadership in the APAC fuel cell sector is distributed among established automotive companies, specialized fuel cell manufacturers, and emerging technology developers. The competitive landscape is characterized by strategic partnerships, technology licensing agreements, and joint ventures that combine complementary capabilities and market access.

Strategic initiatives among market participants include capacity expansion, technology development partnerships, and market entry strategies for emerging applications. Companies are investing in research and development to improve performance while reducing costs. The competitive environment encourages innovation and accelerates technology advancement across the fuel cell value chain.

Technology segmentation of the APAC fuel cell market reveals distinct characteristics and applications for different fuel cell types:

By Technology:

By Application:

By End-User:

Automotive fuel cells represent the most dynamic category within the APAC market, driven by government mandates for zero-emission vehicles and automotive industry transformation. The category benefits from substantial investments in research and development, manufacturing scale-up, and infrastructure development. MWR analysis indicates that automotive fuel cell adoption is accelerating with vehicle deployment growing at 15% annually across major markets.

Stationary fuel cells are gaining traction as utilities and commercial customers seek reliable, clean power solutions. This category includes residential combined heat and power systems, commercial backup power, and utility-scale power generation. The integration of fuel cells with renewable energy systems is creating new market opportunities for grid support and energy storage applications.

Industrial fuel cells are finding applications in material handling, process industries, and specialized equipment where clean, reliable power is essential. The category benefits from controlled operating environments and professional maintenance capabilities. Industrial users are attracted to fuel cells’ high efficiency, low emissions, and operational flexibility.

Portable fuel cells represent an emerging category with applications in consumer electronics, military equipment, and remote power systems. While currently a smaller market segment, portable fuel cells offer unique advantages for applications requiring lightweight, long-duration power sources. The category is expected to grow as technology costs decrease and performance improves.

Technology developers benefit from the expanding APAC fuel cell market through increased demand for innovative solutions and components. The market provides opportunities for intellectual property licensing, technology partnerships, and joint development programs. Research institutions and universities can leverage industry collaboration to advance fuel cell science and engineering.

Manufacturers gain access to growing markets for fuel cell systems, components, and materials. The regional manufacturing ecosystem offers cost advantages, skilled workforce, and supply chain integration opportunities. Companies can achieve economies of scale through increased production volumes and market expansion.

End-users benefit from improved fuel cell performance, reduced costs, and expanded application possibilities. The technology offers operational advantages including high efficiency, low emissions, and operational flexibility. Users can achieve sustainability goals while maintaining or improving operational performance.

Investors find attractive opportunities in the fuel cell value chain, from technology development to manufacturing and deployment. The market offers potential for significant returns as the technology achieves commercial viability and market scale. Government support and policy frameworks provide additional investment security.

Governments can achieve policy objectives including emission reduction, energy security, and industrial development through fuel cell market support. The technology contributes to economic development through job creation, technology advancement, and export opportunities. Fuel cells support broader hydrogen economy development and clean energy transition goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology convergence is emerging as a dominant trend in the APAC fuel cell market, with integration of artificial intelligence, advanced materials, and digital technologies enhancing system performance and reducing costs. Smart fuel cell systems incorporate predictive maintenance, optimized operation, and remote monitoring capabilities that improve reliability and reduce operational costs.

Hydrogen ecosystem development is creating interconnected markets for fuel cell applications across transportation, industrial, and power generation sectors. The establishment of hydrogen valleys and industrial clusters is fostering collaboration and economies of scale. Regional hydrogen strategies are aligning fuel cell deployment with broader energy transition goals.

Manufacturing localization is accelerating as companies establish regional production capabilities to serve growing markets and reduce costs. Local manufacturing provides supply chain security, reduces transportation costs, and enables customization for regional requirements. Government policies often favor domestic production through incentives and procurement preferences.

Application diversification is expanding fuel cell markets beyond traditional automotive applications to include marine, aviation, industrial, and residential sectors. New applications are driving technology development and creating additional revenue streams for fuel cell manufacturers. The diversification reduces market risk and accelerates technology advancement through cross-sector innovation.

Cost competitiveness is improving as fuel cell technology achieves economies of scale and manufacturing efficiency gains. The trend toward cost parity with conventional alternatives is accelerating market adoption across price-sensitive applications. Continued cost reduction is essential for mass market penetration and sustainable growth.

Strategic partnerships between automotive manufacturers, fuel cell developers, and energy companies are accelerating market development and technology advancement. Recent collaborations focus on joint research programs, manufacturing partnerships, and market development initiatives. These partnerships combine complementary capabilities and resources to address market challenges and opportunities.

Infrastructure investments by governments and private companies are expanding hydrogen refueling networks and production capabilities across the APAC region. Major infrastructure projects include hydrogen highways, industrial hydrogen clusters, and renewable hydrogen production facilities. These investments address critical infrastructure barriers to fuel cell adoption.

Technology breakthroughs in catalyst materials, membrane technologies, and system integration are improving fuel cell performance while reducing costs. Recent developments include platinum-free catalysts, advanced membrane materials, and integrated system designs that enhance efficiency and durability. These innovations are essential for achieving commercial viability across diverse applications.

Market expansion into new geographic regions and application sectors is creating additional growth opportunities for fuel cell technology. Companies are establishing operations in emerging markets and developing solutions for specialized applications. The expansion strategy includes technology adaptation, local partnerships, and market education initiatives.

Regulatory developments including emission standards, safety regulations, and certification requirements are shaping market development and technology advancement. New regulations often drive market demand while ensuring safety and performance standards. Harmonized international standards facilitate technology transfer and market expansion.

Investment priorities should focus on technology development, manufacturing scale-up, and infrastructure development to capture market opportunities. Companies should prioritize research and development investments that address cost, performance, and durability challenges. Strategic partnerships and joint ventures can accelerate market entry and reduce development risks.

Market entry strategies should consider regional differences in policy environments, customer preferences, and competitive landscapes. Successful market entry requires understanding of local regulations, supply chain capabilities, and customer requirements. Companies should develop flexible business models that can adapt to changing market conditions and customer needs.

Technology roadmaps should align with market requirements and customer expectations for performance, cost, and reliability. Development priorities should focus on applications with the highest commercial potential and strongest policy support. Technology differentiation through innovation and intellectual property development is essential for competitive advantage.

Supply chain strategies should address critical material sourcing, component availability, and manufacturing capacity requirements. Companies should develop resilient supply chains that can support market growth while managing cost and quality requirements. Vertical integration and strategic supplier partnerships can provide competitive advantages.

Market development requires coordinated efforts in customer education, demonstration projects, and infrastructure development. Companies should invest in market development activities that build customer confidence and demonstrate technology benefits. Collaboration with government agencies, industry associations, and research institutions can accelerate market acceptance.

Long-term growth prospects for the APAC fuel cell market remain highly positive, driven by supportive government policies, technology advancement, and increasing commercial viability. The market is expected to achieve significant scale over the next decade as costs continue to decline and performance improves. MarkWide Research projects that fuel cell deployment will accelerate with adoption rates increasing by 20% annually across key application segments.

Technology evolution will continue to drive market development through improvements in efficiency, durability, and cost competitiveness. Next-generation fuel cell systems will incorporate advanced materials, artificial intelligence, and integrated designs that address current limitations. The convergence of fuel cells with other clean energy technologies will create new market opportunities and applications.

Market maturation is expected to transition from demonstration projects to commercial deployments across diverse applications. The establishment of supply chains, service networks, and customer support capabilities will enable sustainable market growth. Standardization and certification processes will facilitate technology adoption and market expansion.

Regional leadership in fuel cell technology will continue to provide competitive advantages for APAC companies in global markets. The region’s manufacturing capabilities, technology expertise, and market scale position local companies for international expansion. Export opportunities will contribute to market growth and technology advancement.

Infrastructure development will accelerate to support growing fuel cell deployment across transportation and industrial applications. Coordinated investments in hydrogen production, distribution, and refueling infrastructure will address critical market barriers. The development of hydrogen ecosystems will create synergies and economies of scale that benefit all market participants.

The APAC fuel cell market represents a transformative opportunity in the global transition to clean energy solutions, characterized by strong government support, technological innovation, and expanding commercial applications. The market’s robust growth trajectory reflects the region’s strategic commitment to hydrogen economy development and sustainable energy transition. With improving cost competitiveness and performance characteristics, fuel cell technology is positioned to capture significant market share across transportation, industrial, and power generation sectors.

Strategic market positioning requires understanding of regional dynamics, technology trends, and customer requirements that drive fuel cell adoption. The market’s evolution from demonstration projects to commercial deployments demonstrates the technology’s maturation and increasing viability. Companies that invest in technology development, manufacturing capabilities, and market development will be well-positioned to capitalize on the substantial growth opportunities in the APAC fuel cell market.

Future success in the APAC fuel cell market will depend on continued innovation, cost reduction, and infrastructure development that address current market barriers while expanding application possibilities. The convergence of supportive policies, technology advancement, and market demand creates a favorable environment for sustained growth and market development across the diverse and dynamic Asia-Pacific region.

What is Fuel Cell?

Fuel cells are devices that convert chemical energy from fuels, such as hydrogen, into electricity through an electrochemical reaction. They are known for their efficiency and low emissions, making them suitable for various applications including transportation and stationary power generation.

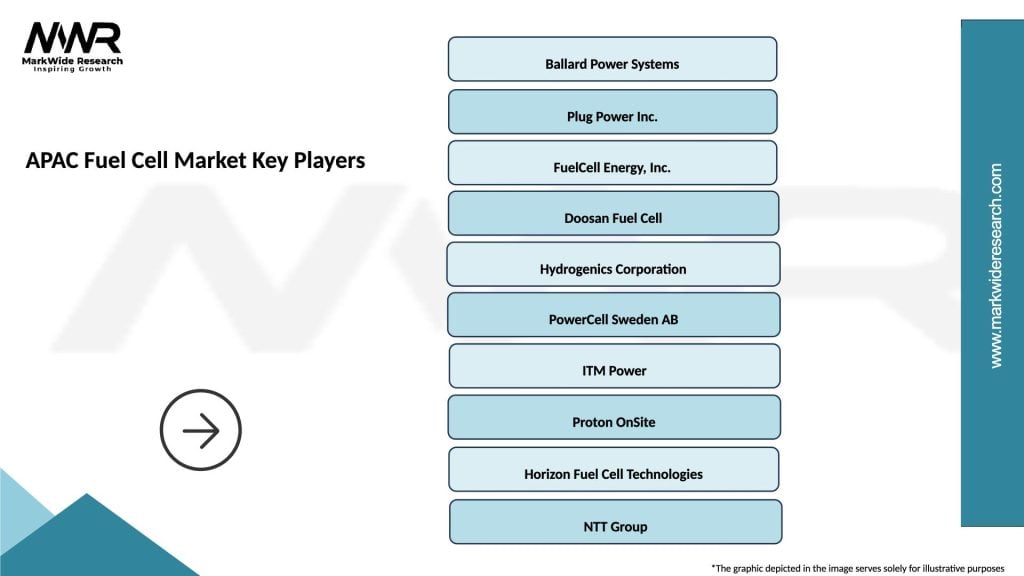

What are the key players in the APAC Fuel Cell Market?

Key players in the APAC Fuel Cell Market include companies like Ballard Power Systems, Hyundai Motor Company, Toshiba Corporation, and Panasonic Corporation, among others. These companies are involved in the development and commercialization of fuel cell technologies across different sectors.

What are the growth factors driving the APAC Fuel Cell Market?

The APAC Fuel Cell Market is driven by increasing demand for clean energy solutions, government initiatives promoting hydrogen fuel technologies, and advancements in fuel cell efficiency. Additionally, the rising need for energy storage and backup power systems contributes to market growth.

What challenges does the APAC Fuel Cell Market face?

The APAC Fuel Cell Market faces challenges such as high production costs, limited hydrogen infrastructure, and competition from alternative energy sources. These factors can hinder widespread adoption and commercialization of fuel cell technologies.

What opportunities exist in the APAC Fuel Cell Market?

Opportunities in the APAC Fuel Cell Market include the expansion of hydrogen infrastructure, increasing investments in renewable energy, and the potential for fuel cells in transportation and industrial applications. These factors can enhance market penetration and innovation.

What trends are shaping the APAC Fuel Cell Market?

Trends in the APAC Fuel Cell Market include the integration of fuel cells with renewable energy sources, advancements in solid oxide fuel cell technology, and growing interest in fuel cell vehicles. These trends are expected to drive innovation and adoption in various sectors.

APAC Fuel Cell Market

| Segmentation Details | Description |

|---|---|

| Type | Proton Exchange Membrane, Solid Oxide, Alkaline, Direct Methanol |

| Application | Transportation, Stationary Power, Portable Power, Backup Power |

| End User | Automotive OEMs, Industrial Users, Residential Customers, Commercial Users |

| Technology | Electrochemical, Hydrogen Production, Fuel Processing, Energy Storage |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Fuel Cell Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at