444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC fashion accessories market represents one of the most dynamic and rapidly evolving segments within the global fashion industry. This comprehensive market encompasses a diverse range of products including handbags, jewelry, watches, belts, scarves, sunglasses, and footwear accessories across the Asia-Pacific region. Market dynamics indicate substantial growth potential driven by rising disposable incomes, urbanization trends, and evolving consumer preferences across key economies including China, India, Japan, South Korea, and Southeast Asian nations.

Regional diversity characterizes this market, with each country presenting unique consumer behaviors, cultural preferences, and purchasing patterns. The market demonstrates remarkable resilience and adaptability, with digital transformation accelerating adoption of e-commerce platforms and omnichannel retail strategies. Growth projections suggest the market will expand at a robust CAGR of 8.2% through the forecast period, supported by increasing fashion consciousness and lifestyle aspirations among millennials and Gen Z consumers.

Manufacturing capabilities across the region, particularly in China, Vietnam, and Bangladesh, provide competitive advantages in production costs and supply chain efficiency. The market benefits from both domestic consumption growth and export opportunities, creating a dual-engine growth model that enhances market stability and expansion prospects.

The APAC fashion accessories market refers to the comprehensive ecosystem of non-clothing fashion items designed to complement and enhance personal style across the Asia-Pacific region. This market encompasses both luxury and mass-market segments, covering traditional accessories like jewelry and handbags as well as contemporary items including smartwatches and tech-enabled fashion products.

Market scope includes manufacturing, distribution, retail, and consumption of fashion accessories across diverse product categories. The definition extends beyond physical products to include associated services such as customization, repair, and styling consultation. Geographic coverage spans developed markets like Japan and Australia alongside emerging economies including India, Indonesia, and Vietnam, each contributing unique market characteristics and growth opportunities.

Value chain integration represents a key aspect of this market, encompassing raw material sourcing, design development, manufacturing processes, brand marketing, retail distribution, and after-sales services. The market definition also includes digital platforms, social commerce, and direct-to-consumer channels that increasingly shape consumer purchasing behaviors and brand engagement strategies.

Strategic positioning of the APAC fashion accessories market reveals exceptional growth momentum supported by demographic dividends, economic development, and cultural shifts toward fashion-forward lifestyles. Key performance indicators demonstrate consistent market expansion with online sales penetration reaching 42% of total market volume, reflecting accelerated digital adoption across the region.

Market leadership remains distributed among international luxury brands, regional champions, and emerging direct-to-consumer brands that leverage digital marketing and social media influence. Consumer preferences increasingly favor sustainable materials, ethical manufacturing practices, and personalized products, driving innovation in design and production methodologies.

Investment flows into the sector continue growing, with venture capital and private equity firms recognizing the potential of fashion-tech startups and sustainable accessory brands. Supply chain optimization remains a critical success factor, with companies investing in automation, quality control, and logistics efficiency to maintain competitive positioning in price-sensitive market segments.

Consumer behavior analysis reveals significant insights driving market evolution across the APAC region. The following key insights shape strategic decision-making for industry participants:

Economic prosperity across major APAC economies serves as the primary catalyst for fashion accessories market expansion. Rising disposable incomes enable consumers to allocate larger portions of their budgets toward discretionary fashion purchases, with accessories representing an accessible entry point into luxury and premium lifestyle segments.

Urbanization trends continue reshaping consumer lifestyles and fashion preferences across the region. Urban populations demonstrate higher fashion consciousness, greater exposure to international trends, and increased willingness to experiment with diverse accessory styles. Professional development in urban centers creates demand for sophisticated accessories that complement business and social occasions.

Digital infrastructure development enables broader market access and consumer engagement through e-commerce platforms, social media marketing, and mobile payment systems. Technological integration in accessories, including smartwatches and connected jewelry, attracts tech-savvy consumers and creates new product categories with premium pricing potential.

Cultural evolution toward Western fashion sensibilities, combined with growing appreciation for local craftsmanship and heritage designs, creates diverse market opportunities. Social media influence accelerates trend adoption and brand awareness, particularly among younger demographics who drive significant purchasing volume and frequency.

Economic volatility in certain APAC markets creates uncertainty that impacts consumer spending on non-essential items like fashion accessories. Currency fluctuations affect import costs for international brands and create pricing pressures that may limit market accessibility for price-sensitive consumer segments.

Counterfeit products represent a persistent challenge, particularly for luxury and premium brands operating in the region. Intellectual property protection varies across different countries, creating enforcement challenges that impact brand value and consumer trust in authentic products.

Supply chain disruptions stemming from geopolitical tensions, trade disputes, and pandemic-related restrictions create operational challenges and cost pressures for manufacturers and retailers. Raw material price volatility affects production costs and profit margins, particularly for accessories requiring precious metals, leather, or specialized synthetic materials.

Regulatory complexity across different APAC markets creates compliance challenges for companies operating regionally. Import duties and trade barriers impact pricing strategies and market entry decisions for international brands seeking to expand their regional presence.

Sustainable fashion movement presents significant opportunities for brands that prioritize environmental responsibility and ethical manufacturing practices. Eco-conscious consumers demonstrate willingness to pay premium prices for accessories made from recycled materials, sustainable leather alternatives, and ethically sourced components.

Technology integration offers expansive opportunities for innovation in smart accessories, wearable technology, and connected fashion products. Internet of Things applications in accessories create new value propositions and recurring revenue opportunities through software services and data analytics.

Emerging market penetration in countries like Vietnam, Indonesia, and Bangladesh presents untapped growth potential as economic development accelerates and consumer purchasing power increases. Rural market expansion through improved logistics and digital payment infrastructure opens new customer segments previously underserved by fashion accessory brands.

Customization and personalization trends create opportunities for premium pricing and enhanced customer loyalty through bespoke design services, made-to-order products, and personalized shopping experiences. Direct-to-consumer models enable brands to capture higher margins while building stronger customer relationships through data-driven insights and targeted marketing.

Competitive intensity continues escalating as traditional retailers, luxury brands, and digital-native companies compete for market share across diverse consumer segments. Market consolidation trends emerge as larger players acquire innovative startups and regional brands to expand their product portfolios and geographic reach.

Innovation cycles accelerate driven by consumer demand for novelty and differentiation in accessory designs, materials, and functionality. Fast fashion principles increasingly apply to accessories, with brands launching frequent collections and limited-edition products to maintain consumer engagement and drive repeat purchases.

Supply chain evolution emphasizes flexibility, sustainability, and responsiveness to changing consumer preferences. Near-shoring trends see some production moving closer to key consumer markets to reduce lead times and transportation costs while improving quality control and customization capabilities.

Digital transformation reshapes every aspect of the value chain, from design and manufacturing to marketing and customer service. Data analytics enable more precise demand forecasting, inventory optimization, and personalized marketing strategies that improve operational efficiency and customer satisfaction.

Comprehensive research approach combines primary and secondary data sources to provide accurate and actionable insights into the APAC fashion accessories market. Primary research includes structured interviews with industry executives, retail partners, and consumer focus groups across major markets to understand current trends and future expectations.

Secondary research encompasses analysis of industry reports, company financial statements, trade association data, and government statistics to establish market baselines and validate primary findings. Market sizing methodologies utilize multiple approaches including top-down analysis from global fashion industry data and bottom-up calculations based on regional consumption patterns.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, expert consultations, and statistical verification methods. Forecasting models incorporate economic indicators, demographic trends, and historical growth patterns to project future market developments with appropriate confidence intervals.

Regional analysis methodology accounts for cultural, economic, and regulatory differences across APAC markets while identifying common trends and growth drivers that influence the overall market trajectory.

China dominates the APAC fashion accessories market, representing approximately 45% of regional consumption driven by its massive population, growing middle class, and sophisticated e-commerce infrastructure. Luxury consumption in tier-one cities contrasts with value-oriented preferences in smaller cities, creating diverse market segments with distinct characteristics and growth potential.

India emerges as the fastest-growing market with annual growth rates exceeding 12%, supported by demographic advantages, increasing urbanization, and rising fashion consciousness among young consumers. Traditional jewelry markets coexist with modern accessory preferences, creating unique opportunities for brands that successfully blend heritage and contemporary design elements.

Japan maintains its position as a premium market with sophisticated consumer preferences and high-quality standards. Aging demographics influence product development toward comfort and functionality, while younger consumers drive demand for innovative and technology-integrated accessories.

Southeast Asian markets including Indonesia, Thailand, and Vietnam demonstrate strong growth potential with combined market share reaching 18% of regional volume. Economic development and improving infrastructure support market expansion, while cultural diversity creates opportunities for localized product strategies.

South Korea serves as a trendsetting market with significant influence on regional fashion preferences through K-pop culture and Korean beauty trends. Digital adoption rates exceed regional averages, making it an ideal testing ground for new e-commerce strategies and social media marketing approaches.

Market leadership remains fragmented across different product categories and price segments, with no single company dominating the entire APAC fashion accessories market. Competitive positioning varies significantly between luxury, premium, and mass-market segments, each requiring distinct strategies and capabilities.

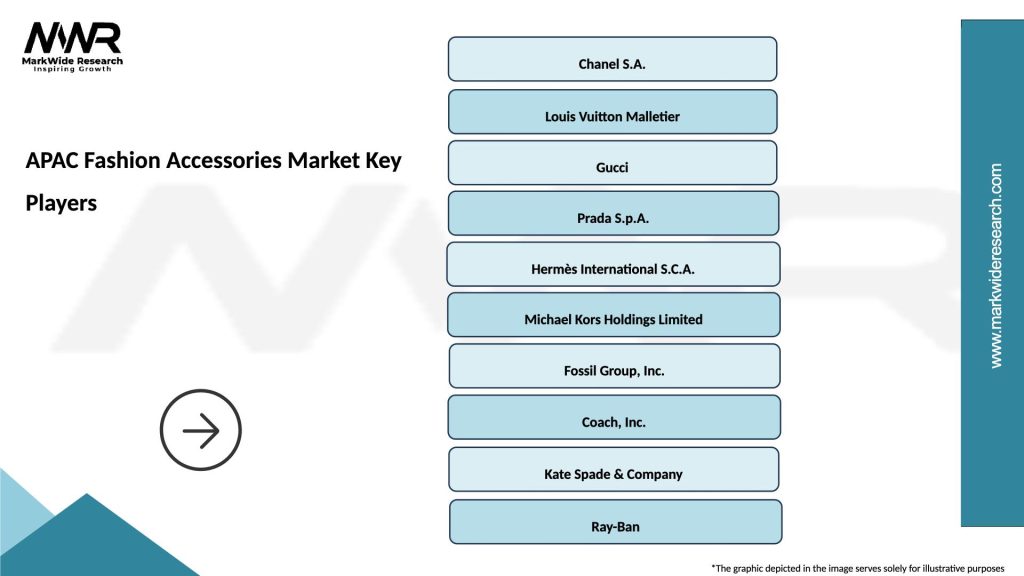

International luxury brands maintain strong positions in premium segments through established brand equity, exclusive distribution networks, and sophisticated marketing strategies. Key players include:

Regional champions leverage local market knowledge, cultural understanding, and cost advantages to compete effectively against international brands. Fast fashion retailers including Zara, H&M, and Uniqlo expand their accessories offerings to capture value-conscious consumers seeking trendy products at accessible price points.

Digital-native brands emerge as significant competitors by utilizing direct-to-consumer models, social media marketing, and data-driven customer insights to build strong brand communities and achieve rapid growth.

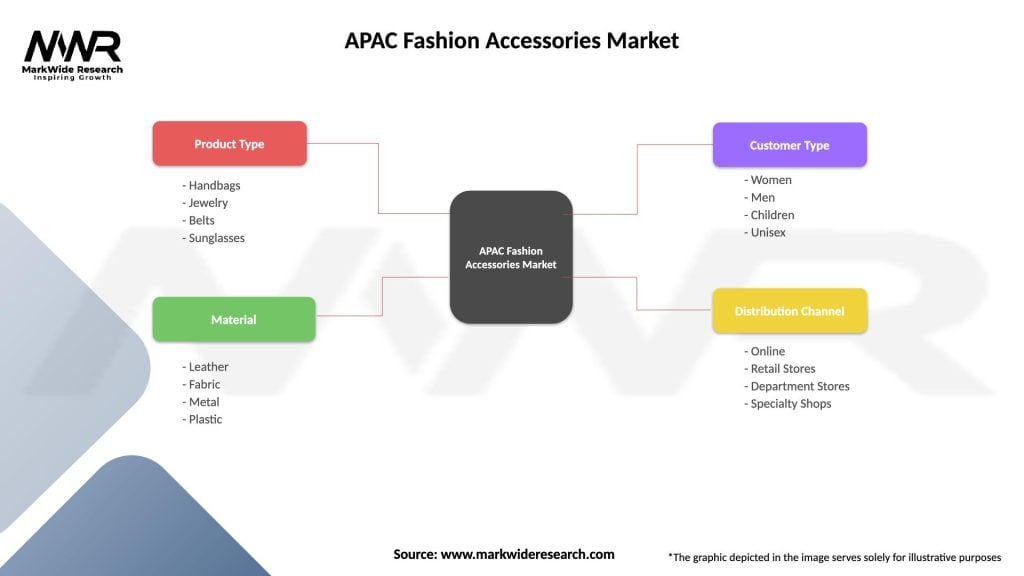

Product category segmentation reveals distinct growth patterns and consumer preferences across different accessory types. Handbags and purses represent the largest segment, accounting for approximately 28% of market volume, driven by functional necessity and fashion statement purposes.

By Product Type:

By Price Segment:

By Distribution Channel:

Handbags and purses demonstrate remarkable diversity in design, materials, and pricing across the APAC region. Cultural preferences influence size, color, and style choices, with compact designs popular in urban markets and larger bags preferred in suburban areas. Sustainability trends drive demand for vegan leather alternatives and recycled materials, particularly among environmentally conscious consumers.

Jewelry categories reflect deep cultural significance and traditional craftsmanship heritage across different APAC markets. Gold jewelry maintains cultural importance in markets like India and China, while contemporary designs incorporating alternative materials gain popularity among younger demographics. Customization services create premium pricing opportunities and enhanced customer engagement.

Watch segments experience transformation through smartwatch adoption and traditional timepiece appreciation. Luxury mechanical watches serve as investment pieces and status symbols, while smartwatches capture 31% of unit sales through health monitoring and connectivity features. Hybrid products combining traditional aesthetics with smart functionality represent emerging opportunities.

Eyewear accessories benefit from increasing screen time and outdoor lifestyle trends. Blue light filtering technology addresses digital eye strain concerns, while UV protection remains essential for outdoor activities. Fashion-forward designs enable frequent replacement cycles and multiple pair ownership among style-conscious consumers.

Manufacturers benefit from economies of scale, technological advancement opportunities, and expanding market access through digital platforms. Production efficiency improvements through automation and quality control systems enhance competitiveness while reducing labor dependency and operational risks.

Retailers gain from diverse product portfolios, higher margin opportunities, and customer traffic generation through accessory categories. Cross-selling potential with apparel and footwear creates comprehensive fashion solutions and increased transaction values.

Consumers enjoy expanding product choices, improved quality standards, and enhanced shopping experiences through omnichannel retail strategies. Price accessibility across different segments ensures fashion accessories remain attainable for diverse income levels and lifestyle preferences.

Investors recognize attractive returns through market growth, innovation potential, and scalability opportunities in both traditional and digital-native brands. Portfolio diversification across different product categories and geographic markets reduces investment risks while capturing growth opportunities.

Supply chain partners including raw material suppliers, logistics providers, and technology vendors benefit from market expansion and increasing sophistication in operations and customer service requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable fashion movement fundamentally reshapes product development and consumer expectations across the APAC fashion accessories market. Circular economy principles drive innovation in recyclable materials, repair services, and product lifecycle extension strategies that appeal to environmentally conscious consumers.

Personalization and customization trends enable premium pricing and enhanced customer loyalty through bespoke design services and made-to-order products. 3D printing technology facilitates on-demand production and unique design possibilities that differentiate brands in competitive markets.

Social commerce integration transforms how consumers discover, evaluate, and purchase fashion accessories through social media platforms and influencer partnerships. Live streaming sales events create urgency and entertainment value that drives impulse purchases and brand engagement.

Gender-neutral designs reflect evolving social attitudes and expand target markets beyond traditional gender-specific categories. Inclusive sizing and adaptive designs address diverse consumer needs and demonstrate brand commitment to accessibility and social responsibility.

Technology convergence creates hybrid products combining traditional accessories with smart functionality, health monitoring, and connectivity features. Augmented reality applications enhance online shopping experiences through virtual try-on capabilities and personalized styling recommendations.

Strategic partnerships between traditional fashion brands and technology companies accelerate innovation in smart accessories and wearable devices. Collaboration initiatives enable knowledge transfer, resource sharing, and market access that benefit all participating parties.

Sustainability certifications become increasingly important for brand credibility and consumer trust, with companies investing in third-party verification of environmental and social responsibility claims. Supply chain transparency initiatives provide consumers with detailed information about product origins and manufacturing processes.

Artificial intelligence applications enhance demand forecasting, inventory management, and personalized customer experiences through machine learning algorithms and predictive analytics. Chatbot integration improves customer service efficiency while providing 24/7 support across multiple languages and time zones.

Blockchain technology addresses authenticity concerns through immutable product provenance records and anti-counterfeiting measures that protect brand value and consumer confidence. Digital certificates enable verification of luxury products and limited-edition items.

Subscription models create recurring revenue streams and enhanced customer relationships through curated product selections and personalized styling services. Rental platforms address sustainability concerns while making luxury accessories accessible to broader consumer segments.

MarkWide Research recommends that industry participants prioritize digital transformation initiatives to capture growing online market opportunities and enhance customer engagement through data-driven insights. Investment priorities should focus on e-commerce capabilities, social media marketing, and customer relationship management systems.

Sustainability integration represents a critical success factor for long-term market positioning and brand differentiation. Environmental responsibility initiatives should encompass product design, manufacturing processes, packaging, and end-of-life disposal to create comprehensive sustainability value propositions.

Market expansion strategies should consider emerging economies within the APAC region where economic development and urbanization create new consumer segments with growing purchasing power. Localization approaches must balance global brand consistency with cultural sensitivity and local preference adaptation.

Innovation investments in smart accessories and wearable technology offer significant growth potential as consumers increasingly value functionality alongside fashion appeal. Partnership opportunities with technology companies can accelerate product development while sharing risks and costs.

Supply chain resilience requires diversification strategies that reduce dependency on single countries or suppliers while maintaining cost competitiveness and quality standards. Near-shoring considerations may provide strategic advantages in certain market segments and product categories.

Long-term growth prospects for the APAC fashion accessories market remain highly positive, supported by demographic trends, economic development, and evolving consumer preferences toward fashion-forward lifestyles. Market maturation in developed economies will be offset by rapid expansion in emerging markets, maintaining overall growth momentum.

Technology integration will accelerate across all product categories, with smart accessories becoming mainstream rather than niche products. Artificial intelligence and machine learning applications will enhance personalization, demand forecasting, and operational efficiency throughout the value chain.

Sustainability requirements will become mandatory rather than optional, with consumers and regulators demanding transparent and responsible business practices. Circular economy models will gain traction through product-as-a-service offerings, rental platforms, and comprehensive recycling programs.

Market consolidation trends may accelerate as larger players acquire innovative startups and regional brands to expand their capabilities and market reach. Direct-to-consumer models will continue growing, with online penetration expected to reach 55% within the next five years according to MWR projections.

Regional market dynamics will evolve as economic development progresses in emerging markets and consumer preferences mature in developed economies. Cross-border e-commerce will facilitate market access and brand expansion across the region, creating new competitive dynamics and growth opportunities.

The APAC fashion accessories market presents exceptional opportunities for growth and innovation, driven by favorable demographic trends, economic development, and evolving consumer preferences across diverse regional markets. Market dynamics favor companies that successfully combine traditional craftsmanship with modern technology, sustainable practices, and customer-centric strategies.

Strategic success requires understanding of local market nuances while maintaining global brand consistency and operational efficiency. Digital transformation emerges as a critical enabler for market access, customer engagement, and operational optimization across all business functions.

Future market leaders will be those who anticipate and respond to changing consumer expectations around sustainability, personalization, and technology integration while maintaining product quality and brand authenticity. The APAC fashion accessories market continues evolving toward a more sophisticated, sustainable, and digitally-enabled ecosystem that rewards innovation and customer focus.

What is Fashion Accessories?

Fashion accessories are items that complement and enhance an outfit, including jewelry, bags, belts, hats, and scarves. They play a significant role in personal style and can influence fashion trends.

What are the key players in the APAC Fashion Accessories Market?

Key players in the APAC Fashion Accessories Market include companies like LVMH, Kering, and Fossil Group, which offer a wide range of products from luxury to everyday accessories. These companies are known for their innovative designs and strong brand presence, among others.

What are the growth factors driving the APAC Fashion Accessories Market?

The APAC Fashion Accessories Market is driven by increasing disposable incomes, changing fashion trends, and a growing interest in personal grooming among consumers. Additionally, the rise of e-commerce has made these products more accessible.

What challenges does the APAC Fashion Accessories Market face?

Challenges in the APAC Fashion Accessories Market include intense competition, fluctuating raw material prices, and changing consumer preferences. These factors can impact profitability and market stability.

What opportunities exist in the APAC Fashion Accessories Market?

The APAC Fashion Accessories Market presents opportunities for growth through sustainable product offerings and the expansion of online retail channels. Additionally, collaborations with influencers can enhance brand visibility and reach.

What trends are shaping the APAC Fashion Accessories Market?

Current trends in the APAC Fashion Accessories Market include a focus on sustainability, the rise of personalized accessories, and the integration of technology in products. Consumers are increasingly seeking unique and eco-friendly options.

APAC Fashion Accessories Market

| Segmentation Details | Description |

|---|---|

| Product Type | Handbags, Jewelry, Belts, Sunglasses |

| Material | Leather, Fabric, Metal, Plastic |

| Customer Type | Women, Men, Children, Unisex |

| Distribution Channel | Online, Retail Stores, Department Stores, Specialty Shops |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Fashion Accessories Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at