444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC epoxy resins market represents one of the most dynamic and rapidly expanding segments within the global chemical industry. Epoxy resins have emerged as critical materials across diverse applications, from automotive manufacturing to electronics, construction, and aerospace industries throughout the Asia-Pacific region. The market demonstrates exceptional growth momentum, driven by increasing industrialization, infrastructure development, and technological advancement across key economies including China, India, Japan, South Korea, and Southeast Asian nations.

Regional dynamics indicate that the APAC epoxy resins market is experiencing robust expansion at a CAGR of 6.8%, significantly outpacing global averages. This growth trajectory reflects the region’s position as a manufacturing powerhouse and its increasing focus on high-performance materials. China dominates the regional landscape, accounting for approximately 45% of total market consumption, followed by India and Japan as significant contributors to market development.

Industrial applications continue to drive market expansion, with the automotive sector representing the largest consumption segment, followed by electronics and electrical applications. The construction industry’s growing demand for advanced composite materials and protective coatings further strengthens market fundamentals across the region.

The APAC epoxy resins market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of epoxy-based polymer materials across Asia-Pacific countries. Epoxy resins are thermosetting polymers formed through the reaction of epoxide groups with various curing agents, creating cross-linked polymer networks with exceptional mechanical properties, chemical resistance, and adhesive capabilities.

Market scope includes various epoxy resin types such as bisphenol A epoxy resins, bisphenol F epoxy resins, novolac epoxy resins, and specialty formulations designed for specific industrial applications. The market encompasses both liquid and solid epoxy resin forms, along with associated curing agents, modifiers, and additives that enhance performance characteristics.

Geographic coverage spans major APAC economies including China, India, Japan, South Korea, Taiwan, Thailand, Malaysia, Indonesia, Singapore, and other emerging markets. Each region contributes unique demand patterns based on local industrial development, regulatory frameworks, and economic conditions that shape market dynamics.

Market fundamentals reveal a highly competitive and innovation-driven landscape where technological advancement and application diversification drive sustained growth. The APAC epoxy resins market benefits from strong industrial demand, particularly in automotive lightweighting initiatives, electronics miniaturization trends, and infrastructure modernization projects across the region.

Key growth drivers include increasing automotive production, expanding electronics manufacturing, growing wind energy installations, and rising construction activities. The market demonstrates resilience through economic cycles, supported by essential applications in critical industries. Sustainability initiatives are increasingly influencing product development, with bio-based epoxy resins gaining 12% annual adoption growth among environmentally conscious manufacturers.

Competitive dynamics feature both global chemical giants and regional specialists competing through product innovation, cost optimization, and strategic partnerships. Market leaders focus on developing high-performance formulations while emerging players target niche applications and cost-sensitive segments.

Future prospects remain highly favorable, with emerging applications in renewable energy, electric vehicles, and advanced composites expected to drive next-generation growth opportunities throughout the forecast period.

Strategic insights reveal several critical factors shaping the APAC epoxy resins market landscape:

Market maturity varies significantly across the region, with developed markets like Japan and South Korea focusing on high-value applications while emerging economies prioritize volume growth and infrastructure development applications.

Industrial growth across APAC countries serves as the primary catalyst for epoxy resins market expansion. The region’s position as a global manufacturing hub creates sustained demand for high-performance materials across multiple industries. Automotive sector expansion particularly drives market growth, with increasing vehicle production and lightweighting initiatives requiring advanced composite materials.

Electronics manufacturing represents another significant growth driver, as the region hosts major electronics production facilities requiring specialized epoxy formulations for circuit boards, semiconductors, and electronic components. The ongoing miniaturization trend in electronics demands increasingly sophisticated epoxy resin solutions with enhanced thermal and electrical properties.

Infrastructure development across emerging APAC economies creates substantial demand for construction-grade epoxy resins used in protective coatings, structural adhesives, and composite materials. Government infrastructure investment programs in countries like India, Indonesia, and Vietnam directly translate into increased epoxy resin consumption.

Renewable energy expansion significantly impacts market dynamics, with wind turbine blade manufacturing requiring large quantities of specialized epoxy resins. The region’s commitment to clean energy targets drives consistent demand growth in this high-value application segment.

Technological advancement in manufacturing processes enables the development of new applications and improved product performance, creating additional market opportunities and driving premium product adoption across various industries.

Raw material volatility poses significant challenges for epoxy resin manufacturers, with fluctuating prices of key inputs like bisphenol A and epichlorohydrin affecting production costs and profit margins. These price variations create uncertainty in long-term supply contracts and impact market stability.

Environmental regulations increasingly restrict the use of certain epoxy resin formulations, particularly those containing volatile organic compounds or hazardous substances. Compliance with evolving environmental standards requires substantial investment in research and development, potentially limiting market growth in some segments.

Health and safety concerns associated with epoxy resin handling and curing processes create additional regulatory burdens and increase operational costs. Worker safety requirements and exposure limits necessitate specialized handling equipment and training programs.

Competition from alternatives such as polyurethane resins, polyester resins, and other thermosetting materials challenges epoxy resin market share in certain applications. Cost-sensitive applications may migrate to lower-cost alternatives when performance requirements allow substitution.

Economic uncertainties in key APAC markets can impact industrial demand and delay capital investment projects, affecting epoxy resin consumption patterns. Trade tensions and geopolitical factors may disrupt supply chains and market dynamics.

Electric vehicle adoption creates substantial opportunities for specialized epoxy resin applications in battery systems, electric motor components, and lightweight structural elements. The rapid growth of EV manufacturing across APAC countries represents a high-value market segment with significant expansion potential.

Bio-based epoxy resins present emerging opportunities as sustainability concerns drive demand for environmentally friendly alternatives. Companies developing plant-based epoxy formulations can capture premium market segments and align with corporate sustainability initiatives.

3D printing applications offer new market opportunities as additive manufacturing technologies advance and require specialized photopolymer resins. The growing adoption of 3D printing in manufacturing and prototyping creates demand for high-performance epoxy-based materials.

Aerospace industry growth in APAC countries creates opportunities for advanced epoxy resin formulations meeting stringent performance requirements. The expansion of commercial aviation and defense aerospace programs drives demand for certified high-performance materials.

Marine applications present opportunities in shipbuilding and offshore industries, where epoxy resins provide essential corrosion protection and structural reinforcement. The growth of maritime trade and offshore energy development supports market expansion in these specialized segments.

Smart materials development opens new application areas where epoxy resins can be modified with functional additives to create responsive or self-healing materials for advanced industrial applications.

Supply chain dynamics in the APAC epoxy resins market reflect the region’s complex industrial ecosystem, with raw material suppliers, resin manufacturers, and end-users forming interconnected networks. Vertical integration strategies among major players help ensure supply security and cost control, while smaller manufacturers rely on strategic partnerships and long-term supply agreements.

Pricing dynamics demonstrate cyclical patterns influenced by raw material costs, demand fluctuations, and competitive pressures. Market participants employ various pricing strategies, from cost-plus models to value-based pricing for specialized applications. Price elasticity varies significantly across application segments, with high-performance applications showing lower sensitivity to price changes.

Innovation cycles drive continuous product development, with manufacturers investing heavily in research and development to create differentiated offerings. The typical product development cycle spans 18-24 months from concept to commercial launch, requiring substantial investment in testing and validation processes.

Customer relationships play crucial roles in market dynamics, with long-term partnerships between resin suppliers and major industrial customers providing stability and growth opportunities. Technical support and application development services increasingly differentiate suppliers in competitive markets.

Regulatory dynamics continue evolving across APAC countries, with harmonization efforts improving market access while environmental regulations drive product innovation toward more sustainable formulations.

Comprehensive analysis of the APAC epoxy resins market employs multiple research methodologies to ensure accurate and reliable insights. Primary research includes extensive interviews with industry executives, technical experts, and key stakeholders across the value chain, providing firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry publications, company reports, government statistics, and trade association data to validate primary findings and establish market baselines. MarkWide Research analysts utilize proprietary databases and analytical tools to process large datasets and identify meaningful patterns in market behavior.

Market modeling techniques incorporate econometric analysis, trend extrapolation, and scenario planning to develop robust market forecasts. Multiple validation methods ensure forecast accuracy and reliability across different market segments and geographic regions.

Industry expert validation provides additional verification of research findings through peer review processes and expert panel discussions. This approach ensures that analysis reflects current market realities and incorporates diverse perspectives from industry participants.

Data triangulation methods cross-reference multiple information sources to verify key findings and eliminate potential biases in research conclusions. This rigorous approach enhances the credibility and reliability of market analysis and forecasts.

China dominates the APAC epoxy resins market with approximately 45% market share, driven by massive manufacturing capacity and strong domestic demand across automotive, electronics, and construction sectors. The country’s position as a global manufacturing hub creates sustained demand for epoxy resins while local production capabilities ensure competitive supply.

India represents the fastest-growing regional market, with consumption increasing at 8.2% annually supported by expanding automotive production, growing electronics manufacturing, and substantial infrastructure development programs. The country’s focus on manufacturing localization creates opportunities for both domestic and international epoxy resin suppliers.

Japan maintains its position as a technology leader in high-performance epoxy resin applications, particularly in electronics and automotive sectors. Despite mature market conditions, Japan continues driving innovation in specialty formulations and advanced applications, maintaining 15% regional market share.

South Korea demonstrates strong market fundamentals supported by major automotive and electronics manufacturers. The country’s focus on advanced materials and technology innovation creates demand for premium epoxy resin products, representing approximately 12% of regional consumption.

Southeast Asian markets including Thailand, Malaysia, Indonesia, and Vietnam show robust growth potential driven by industrial development and foreign investment in manufacturing facilities. These emerging markets collectively account for 18% of regional demand with significant expansion opportunities.

Market leadership in the APAC epoxy resins sector features a combination of global chemical giants and regional specialists competing across different market segments. The competitive landscape demonstrates varying strategies from cost leadership to differentiation through innovation and specialized applications.

Strategic positioning varies among competitors, with global players leveraging technology leadership and brand recognition while regional manufacturers compete through cost advantages and local market knowledge. Innovation focus remains critical for maintaining competitive advantage in premium market segments.

By Product Type:

By Application:

By End-Use Industry:

Automotive applications continue driving the largest share of epoxy resin consumption, with increasing focus on lightweighting and electric vehicle components. Structural adhesives represent the fastest-growing automotive segment, with adoption rates increasing 9.5% annually as manufacturers seek alternatives to traditional joining methods.

Electronics segment demonstrates consistent growth driven by miniaturization trends and increasing electronic content in various products. High-frequency applications require specialized low-loss epoxy formulations, creating premium market opportunities for technology leaders.

Construction applications show steady growth supported by infrastructure development across emerging APAC economies. Protective coatings represent the largest construction segment, with increasing demand for long-lasting and environmentally resistant formulations.

Renewable energy applications emerge as high-growth segments, particularly in wind turbine blade manufacturing where epoxy resins provide essential structural properties. Solar panel applications also contribute to market growth through encapsulant and backsheet applications.

Specialty applications including 3D printing, smart materials, and advanced composites represent emerging opportunities with significant growth potential as technologies mature and commercial adoption increases.

Manufacturers benefit from diverse application opportunities and growing market demand across multiple industries. Product differentiation through specialized formulations enables premium pricing and stronger customer relationships, while scale advantages provide cost competitiveness in volume segments.

End-users gain access to advanced materials enabling improved product performance, reduced weight, and enhanced durability. Technical support from epoxy resin suppliers helps optimize application processes and achieve desired performance characteristics.

Distributors enjoy stable demand patterns and opportunities for value-added services including technical consultation and inventory management. Regional distribution networks provide competitive advantages in serving local markets efficiently.

Investors find attractive opportunities in a growing market with diverse application segments and technological innovation driving long-term growth prospects. Market stability across economic cycles provides relatively predictable returns compared to more volatile chemical segments.

Research institutions benefit from collaboration opportunities with industry participants, driving innovation in new formulations and applications while advancing fundamental understanding of epoxy resin chemistry and performance.

Government stakeholders gain from industrial development, job creation, and technology advancement supporting economic growth objectives while addressing environmental and safety regulatory requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as the dominant trend shaping the APAC epoxy resins market, with manufacturers increasingly developing bio-based formulations and recyclable products. Circular economy principles drive innovation in product design and end-of-life management, creating new market segments focused on environmental responsibility.

Digital transformation impacts market dynamics through advanced manufacturing processes, predictive maintenance applications, and smart material development. Industry 4.0 adoption enables more efficient production processes and quality control systems, improving overall market competitiveness.

Customization trends reflect growing demand for application-specific formulations tailored to unique performance requirements. Co-development partnerships between resin suppliers and end-users become increasingly common, driving innovation and market differentiation.

Regional localization continues as companies establish production facilities closer to major consumption centers, reducing logistics costs and improving supply chain resilience. Technology transfer from developed to emerging markets accelerates local capability development.

Performance enhancement remains a key focus area, with continuous improvements in thermal stability, mechanical properties, and processing characteristics. Nanotechnology integration enables development of advanced composite materials with superior performance characteristics.

Capacity expansions across the region reflect strong market confidence, with major manufacturers announcing significant production facility investments. Strategic partnerships between global and regional players create synergies in technology sharing and market access.

Technology innovations include development of fast-curing formulations, low-temperature curing systems, and enhanced adhesion properties. Research collaborations between industry and academic institutions drive breakthrough developments in epoxy resin chemistry.

Regulatory developments across APAC countries increasingly focus on environmental protection and worker safety, driving industry adaptation and innovation in safer formulations. Standardization efforts improve product quality consistency and facilitate international trade.

Market consolidation activities include strategic acquisitions and joint ventures aimed at expanding geographic reach and technological capabilities. Vertical integration strategies help companies secure raw material supply and improve cost competitiveness.

Sustainability initiatives gain momentum with companies investing in bio-based raw materials and developing recycling technologies for epoxy resin products. Certification programs for sustainable products create new market differentiation opportunities.

MarkWide Research analysts recommend that market participants focus on developing sustainable product portfolios to address growing environmental concerns and regulatory requirements. Investment priorities should emphasize bio-based formulations and recycling technologies to capture emerging market opportunities.

Strategic positioning should leverage regional manufacturing advantages while building technological capabilities for high-performance applications. Partnership strategies with key end-users can provide market stability and drive innovation in application-specific formulations.

Market entry strategies for new participants should focus on niche applications or underserved regional markets where established players may have limited presence. Differentiation through specialization offers better prospects than competing directly in commodity segments.

Supply chain optimization remains critical for maintaining competitiveness, with emphasis on securing reliable raw material sources and developing flexible production capabilities. Digital transformation investments can improve operational efficiency and customer service capabilities.

Risk management strategies should address raw material price volatility, regulatory changes, and economic uncertainties through diversification and flexible business models. Scenario planning helps prepare for various market conditions and maintain business resilience.

Long-term prospects for the APAC epoxy resins market remain highly favorable, supported by continued industrialization, technological advancement, and expanding application opportunities. Market evolution will likely favor companies that successfully balance performance, sustainability, and cost-effectiveness in their product offerings.

Growth acceleration is expected in emerging applications including electric vehicles, renewable energy, and advanced manufacturing technologies. Regional market development will continue as emerging economies expand their industrial capabilities and infrastructure investments.

Technology convergence between epoxy resins and other advanced materials will create new application possibilities and market segments. Smart materials integration represents a significant opportunity for companies investing in next-generation product development.

Sustainability transformation will reshape competitive dynamics, with companies developing comprehensive environmental strategies gaining competitive advantages. Circular economy adoption will drive innovation in product design and lifecycle management approaches.

Market maturation in developed APAC countries will shift focus toward high-value applications and specialized formulations, while emerging markets continue driving volume growth. Innovation cycles will accelerate as companies compete for technological leadership in next-generation applications.

The APAC epoxy resins market represents a dynamic and rapidly evolving industry landscape characterized by strong fundamentals, diverse application opportunities, and significant growth potential. Regional advantages including manufacturing capabilities, cost competitiveness, and growing industrial demand create a favorable environment for sustained market expansion.

Market participants who successfully navigate the evolving landscape through innovation, sustainability focus, and strategic partnerships will capture the most significant opportunities in this growing market. Technology leadership and application expertise remain critical differentiators in an increasingly competitive environment.

Future success will depend on companies’ ability to balance traditional market strengths with emerging trends in sustainability, digitalization, and advanced applications. The APAC epoxy resins market continues offering substantial opportunities for growth and innovation across multiple industry segments and geographic regions.

What is Epoxy Resins?

Epoxy resins are a class of reactive polymers and prepolymers that contain epoxide groups. They are widely used in coatings, adhesives, and composite materials due to their excellent mechanical properties and chemical resistance.

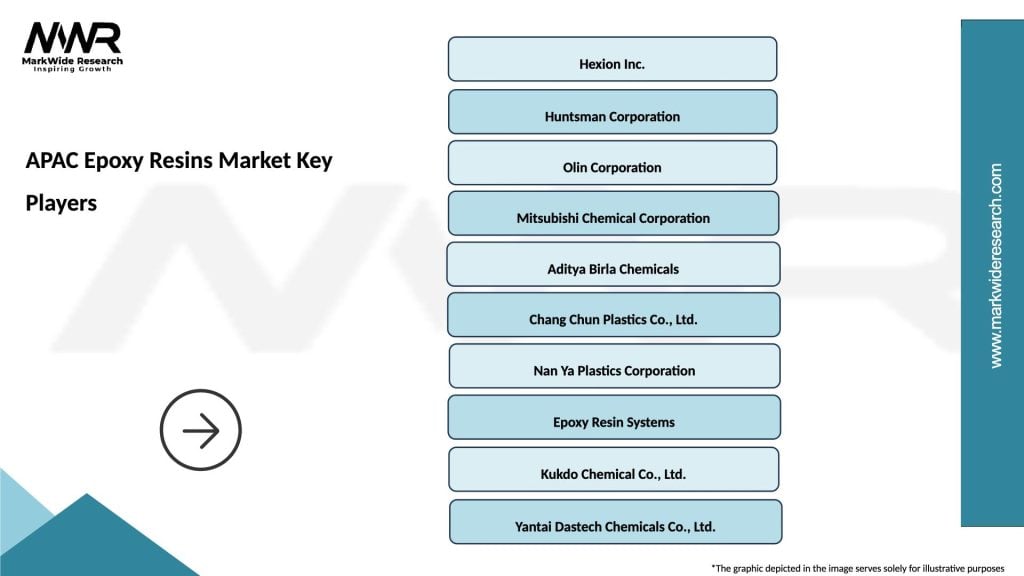

What are the key players in the APAC Epoxy Resins Market?

Key players in the APAC Epoxy Resins Market include companies like Hexion Inc., BASF SE, and Huntsman Corporation, among others. These companies are known for their innovative products and extensive distribution networks.

What are the growth factors driving the APAC Epoxy Resins Market?

The growth of the APAC Epoxy Resins Market is driven by increasing demand from the automotive and construction industries, as well as the rising popularity of lightweight materials in manufacturing. Additionally, advancements in epoxy formulations are enhancing their application scope.

What challenges does the APAC Epoxy Resins Market face?

The APAC Epoxy Resins Market faces challenges such as fluctuating raw material prices and environmental regulations regarding the use of certain chemicals. These factors can impact production costs and market stability.

What opportunities exist in the APAC Epoxy Resins Market?

Opportunities in the APAC Epoxy Resins Market include the growing demand for bio-based epoxy resins and the expansion of the electronics sector, which requires high-performance materials. Additionally, increasing investments in infrastructure development present further growth potential.

What trends are shaping the APAC Epoxy Resins Market?

Trends in the APAC Epoxy Resins Market include the shift towards sustainable and eco-friendly formulations, as well as the integration of advanced technologies in production processes. The rise of smart materials and composites is also influencing market dynamics.

APAC Epoxy Resins Market

| Segmentation Details | Description |

|---|---|

| Product Type | Liquid Epoxy, Solid Epoxy, Waterborne Epoxy, Powder Epoxy |

| Application | Coatings, Adhesives, Composites, Electrical Encapsulation |

| End Use Industry | Aerospace, Automotive OEMs, Construction, Marine |

| Grade | Standard Grade, High-Performance Grade, Specialty Grade, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Epoxy Resins Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at