444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC energy bar market represents one of the most dynamic and rapidly expanding segments within the Asia-Pacific region’s health and wellness industry. This market encompasses a diverse range of nutritional bars designed to provide sustained energy, protein supplementation, and convenient nutrition for active consumers across various demographics. The region’s growing health consciousness, urbanization trends, and increasing participation in fitness activities have collectively driven substantial growth in energy bar consumption.

Market dynamics indicate that the APAC energy bar sector is experiencing robust expansion, with several countries leading the charge in both consumption and innovation. The market benefits from a unique blend of traditional nutritional ingredients and modern food technology, creating products that cater to both local tastes and international standards. Consumer preferences are shifting toward natural, organic, and functional ingredients, driving manufacturers to innovate continuously.

Regional variations play a significant role in market development, with countries like Japan, Australia, and South Korea demonstrating mature market characteristics, while emerging economies such as India, Thailand, and Vietnam show tremendous growth potential. The market is characterized by increasing penetration of international brands alongside the emergence of strong local players who understand regional taste preferences and dietary requirements.

Distribution channels have evolved significantly, with traditional retail outlets being complemented by e-commerce platforms, specialty health stores, and direct-to-consumer models. This diversification has enhanced product accessibility and contributed to market expansion across urban and semi-urban areas throughout the Asia-Pacific region.

The APAC energy bar market refers to the commercial ecosystem encompassing the production, distribution, and consumption of nutritional energy bars across Asia-Pacific countries. These products are specifically formulated to provide quick energy, essential nutrients, and convenient nutrition for consumers leading active lifestyles or seeking healthy snacking alternatives.

Energy bars in this context include various subcategories such as protein bars, meal replacement bars, sports nutrition bars, and wellness-focused bars that incorporate functional ingredients. The market encompasses both manufactured products from established food companies and artisanal offerings from smaller, specialized producers who focus on organic, natural, or locally-sourced ingredients.

Geographic scope includes major economies such as China, Japan, India, Australia, South Korea, and Southeast Asian nations, each contributing unique consumer preferences, regulatory environments, and market dynamics. The market definition also encompasses the entire value chain from ingredient sourcing and manufacturing to retail distribution and consumer consumption patterns.

Product innovation within this market focuses on addressing specific regional nutritional needs, taste preferences, and lifestyle requirements, making it distinct from global energy bar markets in terms of flavor profiles, ingredient selection, and marketing approaches.

The APAC energy bar market stands as a testament to the region’s evolving health and wellness landscape, driven by increasing consumer awareness about nutrition and the growing adoption of active lifestyles. The market has demonstrated remarkable resilience and growth potential, supported by demographic trends, urbanization, and rising disposable incomes across key regional economies.

Key growth drivers include the expanding fitness culture, busy urban lifestyles demanding convenient nutrition solutions, and increasing health consciousness among millennials and Gen Z consumers. The market benefits from strong innovation in product formulations, with manufacturers incorporating traditional Asian ingredients alongside modern nutritional science to create unique value propositions.

Market segmentation reveals diverse opportunities across protein bars, meal replacement options, sports nutrition products, and wellness-focused formulations. Each segment demonstrates distinct growth patterns and consumer preferences, with protein bars showing particularly strong momentum in fitness-conscious demographics.

Competitive dynamics feature a mix of international brands establishing regional presence and local companies leveraging cultural understanding and ingredient expertise. This competition has fostered innovation and improved product quality while maintaining competitive pricing structures that support market accessibility.

Future prospects remain highly positive, with continued urbanization, health awareness campaigns, and lifestyle changes expected to sustain long-term growth momentum across the Asia-Pacific region.

Consumer behavior analysis reveals several critical insights that shape the APAC energy bar market landscape. The following key insights provide strategic direction for market participants:

Market penetration varies significantly across different countries, with developed markets showing higher per-capita consumption while emerging markets demonstrate faster growth rates. This dynamic creates opportunities for both premium positioning and value-oriented product strategies.

Health and wellness trends serve as the primary catalyst driving APAC energy bar market expansion. Increasing awareness about nutrition, preventive healthcare, and lifestyle diseases has created a substantial consumer base seeking convenient, healthy food alternatives. This trend is particularly pronounced in urban areas where busy professionals and health-conscious individuals prioritize functional foods.

Urbanization and lifestyle changes significantly impact market growth, with rapid urban development across Asia-Pacific creating time-constrained consumers who value convenience without compromising nutrition. The growing number of working professionals, students, and dual-income households drives demand for portable, nutritious snacking options that fit busy schedules.

Fitness culture expansion represents another crucial driver, with increasing gym memberships, sports participation, and fitness awareness campaigns across the region. The growing popularity of activities such as running, cycling, yoga, and strength training creates dedicated consumer segments seeking specialized sports nutrition products.

Rising disposable incomes across emerging APAC economies enable consumers to invest in premium health and wellness products. This economic development supports market premiumization and allows for innovation in high-quality formulations using superior ingredients.

E-commerce growth facilitates market expansion by improving product accessibility, especially in tier-2 and tier-3 cities where traditional retail infrastructure may be limited. Online platforms enable direct consumer engagement and support niche product categories.

Government health initiatives and public awareness campaigns about nutrition and active lifestyles indirectly support market growth by educating consumers about the importance of proper nutrition and regular physical activity.

High product costs present a significant challenge for market expansion, particularly in price-sensitive segments and emerging economies. Premium ingredients, specialized manufacturing processes, and quality certifications contribute to higher retail prices that may limit accessibility for budget-conscious consumers.

Regulatory complexities across different APAC countries create barriers for market entry and expansion. Varying food safety standards, labeling requirements, and import regulations increase compliance costs and complexity for manufacturers seeking regional presence.

Cultural dietary preferences and traditional eating habits in some regions may resist adoption of Western-style energy bars. Consumers accustomed to traditional snacks and meals may require significant education and product adaptation to embrace energy bar consumption.

Ingredient sourcing challenges affect product consistency and cost management, particularly for organic and specialty ingredients. Supply chain disruptions, seasonal availability, and quality variations can impact production schedules and pricing strategies.

Market saturation in developed segments creates intense competition and pressure on profit margins. Established markets like Japan and Australia show signs of maturity, requiring innovative approaches to maintain growth momentum.

Shelf life limitations and storage requirements pose logistical challenges, particularly in hot and humid climates common across the Asia-Pacific region. These factors increase distribution costs and complexity while potentially affecting product quality.

Consumer skepticism regarding processed foods and artificial ingredients requires continuous education and transparency in product formulations and manufacturing processes.

Emerging market penetration offers substantial growth opportunities, particularly in countries like India, Indonesia, and Vietnam where rising middle-class populations and increasing health awareness create expanding consumer bases. These markets present opportunities for both premium and value-oriented product positioning strategies.

Product innovation using traditional Asian ingredients presents unique opportunities to create differentiated products that appeal to local tastes while offering functional benefits. Incorporating ingredients like matcha, ginseng, turmeric, and various superfruits can create compelling value propositions.

Specialized formulations for specific demographic segments offer targeted growth opportunities. Products designed for seniors, children, pregnant women, or individuals with specific dietary restrictions can command premium pricing while serving underserved market segments.

E-commerce expansion enables direct-to-consumer strategies and subscription models that can improve customer loyalty and lifetime value. Digital platforms also facilitate market testing for new products and flavors with reduced risk and investment.

Partnership opportunities with fitness centers, sports clubs, and wellness programs can create dedicated distribution channels and build brand credibility within target consumer segments. Corporate wellness programs also present bulk sales opportunities.

Sustainable packaging and environmentally conscious formulations align with growing environmental awareness among consumers, particularly younger demographics. This trend creates opportunities for brands to differentiate through sustainability initiatives.

Functional ingredient integration allows for premium positioning by incorporating probiotics, adaptogens, vitamins, and minerals that address specific health concerns prevalent in the region.

Supply chain evolution significantly influences market dynamics, with manufacturers increasingly focusing on local sourcing to reduce costs and improve sustainability credentials. This shift toward regional supply chains enhances responsiveness to market demands while supporting local agricultural communities.

Technology integration transforms manufacturing processes, enabling better quality control, customization capabilities, and cost optimization. Advanced food processing technologies allow for improved texture, taste, and nutritional profiles while extending shelf life and reducing production costs.

Consumer education initiatives play a crucial role in market development, with successful brands investing in educational content about nutrition, fitness, and healthy lifestyle choices. These efforts help build brand credibility and expand the overall market by converting traditional snack consumers to energy bar users.

Seasonal demand patterns create dynamic market conditions, with higher consumption during fitness seasons, exam periods for students, and outdoor activity months. Understanding and planning for these patterns enables better inventory management and targeted marketing strategies.

Competitive pricing pressures drive continuous innovation in cost management and value engineering. Manufacturers must balance quality maintenance with competitive pricing to succeed in price-sensitive market segments while preserving profit margins.

Distribution channel evolution reflects changing consumer shopping behaviors, with traditional retail being complemented by online platforms, subscription services, and direct sales models. This diversification requires adaptive marketing and distribution strategies.

Regulatory landscape changes influence product formulations and marketing approaches, with increasing focus on health claims substantiation, ingredient transparency, and nutritional labeling accuracy across the region.

Primary research methodology employed comprehensive data collection through structured surveys, in-depth interviews, and focus group discussions with key market stakeholders including consumers, retailers, distributors, and industry experts across major APAC countries. This approach ensured diverse perspective gathering and regional insight validation.

Secondary research involved extensive analysis of industry reports, government publications, trade association data, and company financial statements to establish market baselines and identify growth trends. Academic research papers and nutrition studies provided scientific backing for market trend analysis.

Market sizing methodology utilized bottom-up and top-down approaches, analyzing production data, import-export statistics, and retail sales information across different product categories and geographic segments. Cross-validation techniques ensured data accuracy and reliability.

Consumer behavior analysis incorporated digital analytics from e-commerce platforms, social media sentiment analysis, and purchase pattern studies to understand evolving consumer preferences and decision-making factors.

Competitive intelligence gathering involved systematic monitoring of competitor activities, product launches, pricing strategies, and marketing initiatives across the region. This information provided insights into market dynamics and competitive positioning strategies.

Expert validation processes included consultation with industry veterans, nutritionists, food technologists, and retail experts to verify findings and gain additional insights into market trends and future projections.

Data triangulation methods ensured research reliability by comparing findings from multiple sources and methodologies, identifying discrepancies, and validating conclusions through cross-referencing various data points.

China represents the largest market opportunity within the APAC region, driven by massive population, growing health consciousness, and increasing disposable incomes. The market shows strong growth in tier-1 cities with gradual expansion to smaller urban centers. E-commerce penetration reaches approximately 78% of energy bar sales, making digital marketing crucial for success.

Japan demonstrates mature market characteristics with sophisticated consumer preferences for high-quality, innovative products. The market emphasizes functional ingredients and premium positioning, with consumers willing to pay higher prices for superior formulations. Traditional retail channels maintain strong presence alongside growing online sales.

India shows tremendous growth potential with expanding middle-class population and increasing fitness awareness. The market benefits from growing gym culture and sports participation, particularly in metropolitan areas. Local flavor preferences and price sensitivity require adapted product strategies.

Australia exhibits well-established market dynamics with high per-capita consumption and strong brand loyalty. The market emphasizes natural, organic ingredients and sustainable packaging, reflecting environmental consciousness among consumers.

South Korea demonstrates strong innovation adoption and premium product acceptance. The market benefits from high smartphone penetration and social media influence on purchasing decisions, making digital marketing particularly effective.

Southeast Asian markets including Thailand, Malaysia, Singapore, and Indonesia show rapid growth potential driven by urbanization and lifestyle changes. These markets require localized approaches considering diverse cultural preferences and economic conditions.

Market share distribution indicates that developed markets account for approximately 65% of regional consumption, while emerging markets contribute 35% but demonstrate faster growth rates exceeding 12% annually.

Market leadership features a diverse mix of international corporations and regional specialists, each bringing unique strengths and market approaches. The competitive environment encourages continuous innovation and strategic positioning to capture market share across different consumer segments.

Competitive strategies vary significantly across market segments, with premium brands emphasizing quality and innovation while value-oriented players focus on accessibility and affordability. Many companies pursue hybrid approaches, offering product lines across different price points to capture broader market segments.

Innovation focus areas include plant-based proteins, functional ingredients, sustainable packaging, and flavor localization. Companies investing in research and development demonstrate stronger market performance and consumer loyalty.

Distribution partnerships play crucial roles in competitive success, with companies establishing relationships with major retail chains, e-commerce platforms, and specialty health stores to maximize market reach and accessibility.

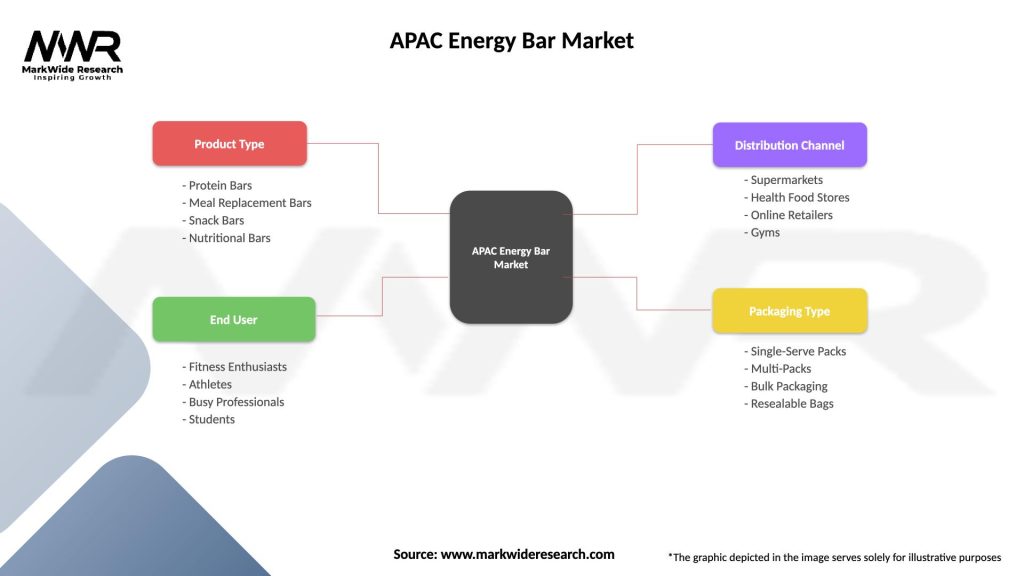

By Product Type: The market segments into distinct categories based on primary nutritional focus and consumer use cases. Each segment demonstrates unique growth patterns and consumer preferences.

By Distribution Channel: Channel diversification reflects changing consumer shopping behaviors and accessibility requirements across different market segments.

By Consumer Demographics: Age and lifestyle segmentation reveals distinct preferences and consumption patterns across different consumer groups.

Protein Bars Category demonstrates the strongest growth momentum, driven by expanding fitness culture and increasing awareness about protein’s role in muscle development and weight management. This category shows approximately 15% annual growth across major APAC markets, with particular strength in urban areas where gym culture is well-established.

Consumer preferences within the protein bar segment favor products containing 15-25 grams of protein per serving, with whey protein and plant-based alternatives both showing strong acceptance. Flavor innovation focuses on chocolate, vanilla, and fruit combinations that appeal to regional taste preferences.

Meal Replacement Bars serve busy urban professionals who require convenient, nutritionally complete options for breakfast or lunch replacement. This category emphasizes balanced macronutrient profiles and sustained energy release, appealing to consumers seeking weight management solutions.

Sports Nutrition Bars target dedicated athletes and fitness enthusiasts with specialized formulations including pre-workout energy, post-workout recovery, and endurance support products. This premium segment commands higher prices but demonstrates strong brand loyalty among target consumers.

Wellness Bars incorporate functional ingredients such as probiotics, vitamins, minerals, and herbal extracts to address specific health concerns. This category shows growing popularity among health-conscious consumers seeking preventive nutrition solutions.

Organic and Natural Bars represent the fastest-growing subcategory, with approximately 23% annual growth driven by increasing consumer awareness about ingredient quality and environmental sustainability. Premium pricing in this segment reflects consumer willingness to pay for perceived health and environmental benefits.

Manufacturers benefit from expanding market opportunities across diverse geographic and demographic segments, enabling revenue diversification and growth acceleration. The market’s innovation-friendly environment rewards companies that invest in research and development, creating competitive advantages through unique formulations and superior products.

Retailers gain from high-margin product categories that attract health-conscious consumers and encourage repeat purchases. Energy bars serve as traffic drivers for specialty health stores while providing profitable impulse purchase opportunities in convenience retail formats.

Distributors benefit from growing demand across multiple channels, creating opportunities for specialized distribution services and value-added logistics solutions. The market’s expansion into emerging regions provides growth opportunities for regional distribution networks.

Ingredient suppliers experience increased demand for specialized proteins, functional ingredients, and natural additives, creating opportunities for innovation and premium positioning. The market’s focus on quality ingredients supports sustainable pricing for superior raw materials.

Consumers gain access to convenient, nutritious food options that support active lifestyles and health goals. Product innovation provides increasingly diverse choices that cater to specific dietary requirements, taste preferences, and nutritional needs.

Healthcare professionals benefit from having evidence-based nutritional products to recommend to patients seeking convenient ways to improve their dietary intake and support specific health objectives.

Fitness industry participants including gyms, personal trainers, and sports clubs gain additional revenue streams through product partnerships and retail opportunities while providing value-added services to their members.

Strengths:

Weaknesses:

Opportunities:

Threats:

Plant-based protein adoption represents a major trend reshaping product formulations across the APAC energy bar market. Consumers increasingly seek alternatives to animal-based proteins, driving innovation in pea protein, rice protein, and other plant-derived protein sources that offer comparable nutritional benefits with environmental sustainability advantages.

Functional ingredient integration continues expanding beyond basic nutrition to include adaptogens, probiotics, and traditional Asian medicinal ingredients. Products incorporating ginseng, turmeric, matcha, and other functional components command premium pricing while addressing specific health concerns prevalent in the region.

Sustainable packaging solutions gain importance as environmental consciousness grows among consumers, particularly younger demographics. Brands investing in biodegradable, recyclable, or minimal packaging demonstrate competitive advantages and align with consumer values.

Personalized nutrition emerges as a significant trend, with companies exploring customized formulations based on individual dietary needs, fitness goals, and health conditions. This trend leverages digital technology and consumer data to create tailored product offerings.

Clean label movement drives demand for products with simple, recognizable ingredient lists and minimal processing. Consumers increasingly scrutinize product labels and prefer items with natural, organic, and non-GMO ingredients.

Subscription commerce models gain traction as consumers seek convenience and consistent product access. Direct-to-consumer subscription services enable better customer relationships and predictable revenue streams for manufacturers.

Flavor localization becomes increasingly sophisticated, with brands developing region-specific flavors that incorporate local taste preferences and traditional ingredients while maintaining nutritional integrity.

Strategic partnerships between energy bar manufacturers and fitness chains have expanded significantly, creating dedicated distribution channels and building brand credibility within target consumer segments. These collaborations often include co-branded products and exclusive retail arrangements that benefit both parties.

Manufacturing capacity expansion across the region reflects growing market confidence, with several major players establishing local production facilities to reduce costs, improve supply chain efficiency, and better serve regional markets with fresh products.

Acquisition activities have intensified as larger corporations seek to expand their health and wellness portfolios through acquiring successful regional brands with strong local market presence and consumer loyalty.

Technology investments in food processing and packaging equipment enable better product quality, extended shelf life, and cost optimization. Advanced manufacturing technologies also support customization capabilities and smaller batch production for niche products.

Regulatory approvals for new functional ingredients expand formulation possibilities, with several countries updating their approved ingredient lists to include innovative nutritional components that enhance product functionality.

E-commerce platform partnerships have become crucial for market access, with brands establishing relationships with major online retailers and developing direct-to-consumer capabilities to reach broader audiences.

Research collaborations with universities and nutrition institutes support product development and provide scientific backing for health claims, enhancing brand credibility and regulatory compliance.

Market entry strategies should prioritize understanding local consumer preferences and regulatory requirements before launching products in new APAC markets. MarkWide Research analysis indicates that successful market entry requires significant investment in consumer education and brand building activities.

Product development focus should emphasize functional ingredients and flavor profiles that resonate with regional preferences while maintaining nutritional integrity. Companies should invest in local ingredient sourcing and traditional flavor integration to create differentiated products.

Distribution strategy optimization requires multi-channel approaches that balance traditional retail with rapidly growing e-commerce opportunities. Brands should develop channel-specific marketing strategies and product positioning to maximize effectiveness across different retail environments.

Investment priorities should include manufacturing capabilities, supply chain optimization, and digital marketing infrastructure to support sustainable growth and competitive positioning. Companies should also consider sustainability initiatives that align with growing environmental consciousness.

Partnership development with fitness centers, health clubs, and wellness programs can create valuable distribution channels and build brand credibility within target consumer segments. These relationships often provide insights into consumer preferences and usage patterns.

Innovation investment in functional ingredients, sustainable packaging, and personalized nutrition capabilities will become increasingly important for maintaining competitive advantages and meeting evolving consumer expectations.

Market monitoring systems should track regulatory changes, competitive activities, and consumer trend evolution to enable rapid response to market developments and opportunities.

Long-term growth prospects for the APAC energy bar market remain highly positive, supported by fundamental demographic trends, increasing health consciousness, and continued urbanization across the region. MWR projections indicate sustained growth momentum with emerging markets contributing increasingly larger shares of regional consumption.

Technology integration will reshape the market through improved manufacturing processes, personalized nutrition capabilities, and enhanced consumer engagement through digital platforms. Artificial intelligence and data analytics will enable better demand forecasting and customized product development.

Sustainability initiatives will become increasingly important competitive factors, with consumers showing growing preference for environmentally responsible brands and products. Companies investing early in sustainable practices will likely gain competitive advantages.

Market consolidation may accelerate as larger corporations seek to expand their health and wellness portfolios through acquisitions of successful regional brands. This trend could lead to increased investment in innovation and market development.

Regulatory evolution will likely support market growth through clearer guidelines for functional ingredients and health claims, reducing uncertainty and enabling more aggressive marketing strategies for evidence-based product benefits.

Consumer sophistication will continue increasing, driving demand for more specialized products that address specific health concerns, dietary requirements, and lifestyle needs. This trend supports market premiumization and innovation investment.

Geographic expansion into smaller cities and rural areas will provide additional growth opportunities as infrastructure development and income growth extend market accessibility beyond current urban concentrations.

The APAC energy bar market represents a dynamic and rapidly evolving sector within the region’s broader health and wellness industry. Strong fundamental drivers including urbanization, health consciousness, fitness culture expansion, and rising disposable incomes create a solid foundation for sustained long-term growth across diverse geographic and demographic segments.

Market opportunities remain substantial, particularly in emerging economies where growing middle-class populations and increasing lifestyle awareness create expanding consumer bases. The market’s innovation-friendly environment rewards companies that invest in research and development, creating competitive advantages through unique formulations and superior products that address specific regional preferences and nutritional needs.

Success factors include understanding local consumer preferences, developing effective distribution strategies across multiple channels, investing in quality ingredients and manufacturing capabilities, and building strong brand recognition through targeted marketing and consumer education initiatives. Companies that balance global expertise with local market adaptation demonstrate the strongest performance and growth potential.

Future market development will likely emphasize sustainability, personalization, and functional ingredient innovation as key differentiating factors. The continued expansion of e-commerce and digital marketing capabilities will enable more direct consumer relationships and market reach extension beyond traditional retail limitations.

Strategic positioning for long-term success requires continuous innovation, supply chain optimization, and adaptive marketing strategies that respond to evolving consumer preferences and competitive dynamics. The APAC energy bar market offers significant opportunities for companies willing to invest in understanding and serving this diverse, growing, and increasingly sophisticated consumer base across the Asia-Pacific region.

What is Energy Bar?

Energy bars are convenient snack options designed to provide a quick source of energy, often made from a blend of carbohydrates, proteins, and fats. They are popular among athletes and health-conscious consumers for their portability and nutritional benefits.

What are the key players in the APAC Energy Bar Market?

Key players in the APAC Energy Bar Market include companies like Nestlé, Clif Bar & Company, and General Mills, which offer a variety of energy bar products catering to different consumer preferences and dietary needs, among others.

What are the growth factors driving the APAC Energy Bar Market?

The APAC Energy Bar Market is driven by increasing health awareness, a growing trend towards on-the-go snacking, and the rising popularity of fitness and sports activities. Additionally, the demand for convenient and nutritious food options is contributing to market growth.

What challenges does the APAC Energy Bar Market face?

Challenges in the APAC Energy Bar Market include intense competition among brands, fluctuating raw material prices, and consumer skepticism regarding the health benefits of processed snacks. These factors can impact pricing strategies and market penetration.

What opportunities exist in the APAC Energy Bar Market?

Opportunities in the APAC Energy Bar Market include the potential for product innovation, such as the introduction of plant-based and organic energy bars, as well as expanding distribution channels to reach a broader audience. The growing trend of personalized nutrition also presents new avenues for growth.

What trends are shaping the APAC Energy Bar Market?

Trends in the APAC Energy Bar Market include the rise of clean label products, increased focus on sustainability in packaging, and the incorporation of superfoods into energy bar formulations. These trends reflect changing consumer preferences towards healthier and environmentally friendly options.

APAC Energy Bar Market

| Segmentation Details | Description |

|---|---|

| Product Type | Protein Bars, Meal Replacement Bars, Snack Bars, Nutritional Bars |

| End User | Fitness Enthusiasts, Athletes, Busy Professionals, Students |

| Distribution Channel | Supermarkets, Health Food Stores, Online Retailers, Gyms |

| Packaging Type | Single-Serve Packs, Multi-Packs, Bulk Packaging, Resealable Bags |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Energy Bar Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at