444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC confectionery market represents one of the most dynamic and rapidly evolving segments within the global food industry, characterized by diverse consumer preferences, innovative product development, and substantial growth potential across multiple countries. Market dynamics in the Asia-Pacific region reflect a unique blend of traditional confectionery preferences and modern consumption patterns, driven by increasing disposable income, urbanization, and changing lifestyle preferences among consumers.

Regional diversity plays a crucial role in shaping market trends, with countries like China, India, Japan, South Korea, and Southeast Asian nations each contributing distinct flavor profiles, consumption habits, and growth trajectories. The market encompasses various product categories including chocolate confectionery, sugar confectionery, gum and jellies, and traditional Asian sweets that cater to local tastes while embracing international brands and innovations.

Growth momentum continues to accelerate across the region, with emerging markets showing particularly strong expansion rates of approximately 8.5% CAGR in certain segments. This growth is supported by increasing consumer spending power, expanding retail infrastructure, and growing awareness of premium and artisanal confectionery products among urban populations.

The APAC confectionery market refers to the comprehensive ecosystem of sweet food products manufactured, distributed, and consumed across Asia-Pacific countries, encompassing chocolate products, sugar-based candies, chewing gums, jellies, and traditional regional confections that serve both everyday consumption and special occasion purposes.

Market scope includes both mass-market and premium segments, covering domestic and international brands that compete across various distribution channels including modern retail, traditional trade, e-commerce platforms, and specialty confectionery stores. The market represents a complex interplay of global confectionery trends adapted to local preferences, regulatory requirements, and cultural celebrations.

Product categories within this market range from internationally recognized chocolate brands to region-specific traditional sweets, seasonal confections, and innovative fusion products that combine Western confectionery techniques with Asian flavors and ingredients, creating unique value propositions for diverse consumer segments.

Strategic positioning of the APAC confectionery market demonstrates remarkable resilience and growth potential, driven by demographic advantages, economic development, and evolving consumer preferences toward premium and health-conscious confectionery options. The market benefits from a large and growing middle-class population with increasing purchasing power and willingness to experiment with new flavors and formats.

Key market drivers include rapid urbanization affecting approximately 62% of the regional population, rising disposable income levels, and growing influence of Western confectionery culture combined with strong preservation of traditional sweet preferences. E-commerce penetration has emerged as a significant growth catalyst, enabling both established and emerging brands to reach consumers across diverse geographic markets.

Competitive landscape features a mix of global confectionery giants, regional champions, and innovative local players who leverage unique flavor profiles, cultural connections, and distribution advantages to capture market share. The market shows increasing consolidation in some segments while maintaining space for niche and artisanal producers who cater to specific consumer preferences.

Future prospects remain highly positive, with analysts projecting sustained growth across multiple product categories, supported by continued economic development, demographic trends, and increasing consumer sophistication in confectionery preferences and purchasing decisions.

Consumer behavior patterns reveal significant insights into market dynamics and growth opportunities across the APAC confectionery landscape:

Economic prosperity across the Asia-Pacific region serves as the fundamental driver for confectionery market expansion, with rising GDP per capita enabling increased discretionary spending on premium food products and treats. Urbanization trends continue to reshape consumption patterns, as city dwellers adopt more Westernized eating habits while maintaining appreciation for traditional confections.

Demographic advantages provide substantial growth momentum, particularly the expanding middle-class population and increasing number of young consumers who are more open to trying new products and brands. The region’s large population base, combined with improving economic conditions, creates a massive addressable market for both domestic and international confectionery companies.

Cultural celebrations and gifting traditions deeply embedded in Asian societies drive consistent demand for confectionery products throughout the year. Major festivals, weddings, and business relationships often involve confectionery gifts, creating predictable demand cycles and opportunities for premium product positioning.

Retail infrastructure development has significantly improved product accessibility, with modern retail formats expanding rapidly across urban and semi-urban areas. E-commerce growth has further enhanced market reach, allowing consumers to access international brands and specialty products that were previously unavailable in their local markets.

Innovation in flavors and formats continues to attract consumer interest, with manufacturers successfully introducing products that blend familiar Asian tastes with international confectionery styles, creating unique market positioning and competitive advantages.

Health concerns regarding sugar consumption and obesity rates present significant challenges for traditional confectionery products, particularly as governments implement stricter labeling requirements and health awareness campaigns. Regulatory pressures in several countries have introduced sugar taxes and restrictions on marketing to children, impacting product formulations and promotional strategies.

Raw material price volatility affects production costs and profit margins, particularly for chocolate-based products that depend on cocoa imports. Currency fluctuations and trade tensions can further complicate cost management for companies operating across multiple countries in the region.

Cultural dietary restrictions in certain markets limit product acceptance and require specialized formulations to meet religious and cultural requirements. Supply chain complexities across diverse markets with varying infrastructure quality, regulatory requirements, and distribution networks create operational challenges for manufacturers.

Intense competition from both established players and new entrants puts pressure on pricing and marketing investments, while counterfeit products in some markets undermine brand integrity and consumer trust. Seasonal demand fluctuations can create inventory management challenges and impact cash flow for manufacturers and retailers.

Health-focused innovation presents substantial opportunities for companies that can successfully develop confectionery products with reduced sugar content, added functional ingredients, or organic certifications while maintaining taste appeal. Premium positioning strategies offer significant margin improvement potential as consumers increasingly seek high-quality, artisanal, and imported confectionery products.

E-commerce expansion continues to create new distribution channels and direct-to-consumer opportunities, particularly for niche brands and specialty products that can leverage digital marketing to reach targeted consumer segments. Cross-border trade facilitation through improved logistics and reduced trade barriers opens new market access opportunities for regional manufacturers.

Sustainability initiatives can differentiate brands and appeal to environmentally conscious consumers, particularly in developed markets where sustainability concerns influence purchasing decisions. Customization trends create opportunities for personalized confectionery products and limited-edition offerings that command premium pricing.

Emerging market penetration in rural and tier-2 cities offers significant growth potential as infrastructure development and income levels improve. Strategic partnerships with local distributors, retailers, and e-commerce platforms can accelerate market entry and expansion for both domestic and international brands.

Supply chain evolution reflects the complex interplay between global sourcing strategies and local market requirements, with companies increasingly adopting flexible manufacturing and distribution approaches to serve diverse consumer preferences efficiently. Technology integration in production processes has improved quality consistency and enabled mass customization capabilities that support premium product positioning.

Consumer engagement strategies have shifted toward digital platforms and social media marketing, with successful brands leveraging influencer partnerships and user-generated content to build brand awareness and loyalty. Seasonal marketing campaigns remain crucial for driving sales during peak consumption periods, requiring sophisticated inventory planning and promotional coordination.

Competitive dynamics show increasing consolidation among major players while maintaining space for innovative smaller companies that can identify and serve niche market segments effectively. Price sensitivity varies significantly across different consumer segments and geographic markets, requiring tailored pricing strategies and product portfolios.

Regulatory compliance continues to evolve, with companies investing in quality assurance systems and supply chain transparency to meet increasing government and consumer demands for food safety and ingredient disclosure. Market research insights from MarkWide Research indicate that successful companies are those that can balance global scale advantages with local market responsiveness and cultural sensitivity.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and actionable insights into the APAC confectionery market landscape. Primary research includes extensive surveys and interviews with industry stakeholders, including manufacturers, distributors, retailers, and consumers across major markets in the region.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and company financial statements to validate primary findings and provide comprehensive market context. Quantitative analysis utilizes statistical modeling and trend analysis to project market growth patterns and identify emerging opportunities.

Qualitative insights are gathered through focus groups, expert interviews, and ethnographic studies that provide deeper understanding of consumer behavior, cultural influences, and market dynamics. Cross-validation techniques ensure data accuracy and reliability by comparing findings across multiple sources and research methodologies.

Market segmentation analysis employs advanced analytical techniques to identify distinct consumer groups, product categories, and geographic markets with unique characteristics and growth potential. Competitive intelligence gathering includes monitoring of company strategies, product launches, pricing changes, and market positioning across key players in the industry.

China dominates the regional market with approximately 35% market share, driven by its massive population, rapid economic growth, and increasing consumer sophistication in confectionery preferences. Traditional Chinese sweets coexist with international chocolate brands, creating a diverse and dynamic market environment with significant growth potential in both premium and mass-market segments.

India represents the fastest-growing market with strong demand for both traditional mithai and modern confectionery products, supported by a young demographic profile and increasing urbanization. Regional preferences vary significantly across different states, requiring localized product development and marketing strategies to achieve market success.

Japan maintains a sophisticated confectionery market characterized by high-quality products, seasonal variations, and strong consumer loyalty to both domestic and premium international brands. Innovation leadership in unique flavors and packaging formats often influences trends across the broader Asia-Pacific region.

Southeast Asian markets including Thailand, Malaysia, Indonesia, and the Philippines show robust growth potential, with approximately 28% combined regional share and increasing consumer spending on premium confectionery products. Cultural diversity across these markets creates opportunities for both regional and international brands to develop targeted product offerings.

South Korea demonstrates strong preference for premium and imported confectionery products, with consumers willing to pay higher prices for quality and unique flavor experiences. Australia and New Zealand represent mature markets with stable consumption patterns and growing interest in artisanal and sustainable confectionery options.

Market leadership is distributed among several key players who have established strong positions through different strategies and market approaches:

Competitive strategies focus on product innovation, local flavor development, strategic acquisitions, and building strong distribution networks across diverse market conditions. Brand positioning varies from mass-market accessibility to premium positioning, with successful companies often maintaining portfolios that serve multiple consumer segments effectively.

Product Category Segmentation:

Distribution Channel Segmentation:

Consumer Demographic Segmentation:

Chocolate Confectionery maintains the largest category share with consistent growth driven by premium product introductions and expanding consumer acceptance of dark chocolate varieties. Innovation trends focus on unique flavor combinations, organic ingredients, and sustainable sourcing practices that appeal to health-conscious and environmentally aware consumers.

Sugar Confectionery shows resilient performance despite health concerns, with manufacturers successfully introducing reduced-sugar formulations and functional ingredients that maintain taste appeal while addressing nutritional concerns. Traditional sweets continue to hold significant market positions, particularly during cultural celebrations and festivals.

Chewing Gum category demonstrates steady growth with approximately 15% market share, supported by sugar-free variants and functional products that offer oral health benefits. Innovation focus includes longer-lasting flavors, natural ingredients, and biodegradable formulations that address environmental concerns.

Premium Segments across all categories show above-average growth rates, with consumers increasingly willing to pay higher prices for superior quality, unique flavors, and artisanal production methods. Seasonal products create significant revenue spikes during key celebration periods, requiring sophisticated supply chain planning and marketing coordination.

Health-focused variants including sugar-free, organic, and functional confectionery products are gaining traction, particularly among urban consumers who seek indulgence without compromising their health and wellness goals.

Manufacturers benefit from the large and growing consumer base across the APAC region, offering substantial scale opportunities and revenue growth potential through both organic expansion and strategic acquisitions. Operational advantages include access to diverse raw material sources, competitive manufacturing costs in certain locations, and opportunities for regional production optimization.

Retailers gain from confectionery products’ high turnover rates, attractive margins, and ability to drive impulse purchases that increase overall basket values. Category management opportunities allow retailers to optimize shelf space allocation, seasonal merchandising, and promotional strategies to maximize profitability.

Distributors enjoy stable demand patterns, diverse product portfolios, and opportunities to build strong relationships with both suppliers and retailers across multiple market segments. Logistics efficiency can be optimized through consolidated shipments and strategic warehouse positioning to serve diverse geographic markets effectively.

Consumers receive increasing product variety, improved quality standards, competitive pricing through market competition, and access to both traditional and innovative confectionery options that meet diverse taste preferences and dietary requirements.

Investors find attractive opportunities in a market with strong fundamentals, growing consumer base, and potential for both organic growth and consolidation strategies that can generate superior returns through market expansion and operational efficiency improvements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and Wellness Integration represents the most significant trend reshaping the confectionery landscape, with manufacturers investing heavily in reformulation efforts to reduce sugar content while maintaining taste appeal. Functional confectionery products that offer additional health benefits beyond basic nutrition are gaining consumer acceptance and premium pricing opportunities.

Sustainability Focus has become increasingly important, with companies implementing sustainable sourcing practices, eco-friendly packaging solutions, and carbon footprint reduction initiatives that resonate with environmentally conscious consumers. Transparency demands require clear ingredient labeling and supply chain visibility to build consumer trust and brand loyalty.

Digital Transformation continues to reshape marketing strategies, with successful brands leveraging social media platforms, influencer partnerships, and direct-to-consumer e-commerce channels to build brand awareness and drive sales growth. Personalization trends enable customized products and targeted marketing messages that enhance consumer engagement.

Flavor Innovation focuses on fusion concepts that combine traditional Asian flavors with Western confectionery formats, creating unique products that appeal to adventurous consumers seeking new taste experiences. Seasonal and limited-edition products generate excitement and urgency that drive purchase decisions and brand engagement.

Premium Positioning strategies continue to gain traction, with approximately 38% growth in premium segment sales as consumers increasingly view confectionery as an affordable luxury that enhances their lifestyle and social experiences.

Strategic acquisitions have reshaped the competitive landscape, with major international players acquiring regional brands to gain local market expertise and distribution capabilities. Manufacturing investments in local production facilities have improved supply chain efficiency and enabled better responsiveness to local market preferences and regulatory requirements.

Product innovation initiatives have accelerated across the industry, with companies launching sugar-free variants, organic products, and functional confectionery that addresses health concerns while maintaining indulgent appeal. Packaging innovations focus on sustainability, convenience, and shelf appeal to differentiate products in competitive retail environments.

Digital marketing evolution has transformed brand communication strategies, with successful companies investing in social media presence, influencer collaborations, and content marketing that resonates with younger consumer demographics. E-commerce partnerships with major platforms have expanded market reach and enabled direct consumer relationships.

Regulatory compliance improvements have enhanced food safety standards and quality assurance processes across the industry, building consumer confidence and enabling market expansion into previously restricted segments. Supply chain optimization initiatives have reduced costs and improved product availability across diverse geographic markets.

Research and development investments continue to increase, with companies allocating significant resources to flavor development, nutritional enhancement, and production process improvements that support competitive differentiation and margin expansion.

Market entry strategies should prioritize understanding local consumer preferences, regulatory requirements, and distribution channel dynamics before committing significant resources to new market expansion. Partnership approaches with established local players can accelerate market penetration while reducing risks associated with cultural and operational unfamiliarity.

Product portfolio optimization requires careful balance between global brand consistency and local market adaptation, with successful companies maintaining core brand values while adjusting flavors, packaging, and positioning to meet regional preferences. Innovation investments should focus on health-conscious formulations and sustainable practices that align with evolving consumer values.

Distribution strategy development must account for the diverse retail landscape across APAC markets, with effective approaches typically combining modern retail partnerships, traditional trade relationships, and emerging e-commerce channels. Supply chain resilience becomes increasingly important as companies expand across multiple countries with varying infrastructure capabilities.

Digital marketing integration should leverage platform-specific strategies that resonate with local consumer behavior patterns and cultural communication preferences. Brand building efforts require long-term commitment and consistent messaging that builds trust and emotional connections with target consumer segments.

Financial planning must account for currency fluctuations, regulatory changes, and economic volatility that can impact profitability and growth projections. Risk management strategies should address supply chain disruptions, competitive pressures, and changing consumer preferences that could affect market position and financial performance.

Growth projections remain highly positive for the APAC confectionery market, with MarkWide Research analysis indicating sustained expansion across multiple product categories and geographic markets. Demographic trends including urbanization, rising income levels, and changing lifestyle patterns will continue to support market growth and evolution toward premium product segments.

Technology integration will increasingly influence production processes, supply chain management, and consumer engagement strategies, with successful companies leveraging digital tools to improve efficiency and market responsiveness. Sustainability initiatives will become competitive necessities rather than optional differentiators as consumer awareness and regulatory requirements continue to evolve.

Market consolidation is expected to continue, with larger players acquiring regional brands and innovative smaller companies to strengthen market positions and expand product portfolios. Innovation acceleration will focus on health-conscious formulations, functional ingredients, and sustainable packaging solutions that address evolving consumer priorities.

E-commerce growth will reshape distribution strategies and enable new business models that connect manufacturers directly with consumers, creating opportunities for personalization and premium positioning. Cross-border trade facilitation will expand market access opportunities and enable more efficient regional supply chain strategies.

Consumer sophistication will drive demand for higher quality products, unique flavor experiences, and transparent supply chain practices, creating opportunities for brands that can effectively communicate their value propositions and build emotional connections with target audiences.

The APAC confectionery market represents a compelling growth opportunity characterized by favorable demographic trends, increasing consumer purchasing power, and evolving preferences toward premium and health-conscious products. Market dynamics reflect the complex interplay between traditional consumption patterns and modern lifestyle influences, creating opportunities for both established players and innovative newcomers who can effectively navigate cultural diversity and regulatory complexity.

Success factors in this market include deep understanding of local consumer preferences, flexible product development capabilities, efficient distribution strategies, and strong brand building efforts that resonate with target audiences. Companies that invest in sustainable practices, health-focused innovation, and digital engagement strategies are well-positioned to capture disproportionate growth and market share expansion.

Future prospects remain highly attractive, with continued economic development, demographic advantages, and increasing consumer sophistication supporting sustained market expansion across multiple product categories and geographic regions. Strategic positioning for long-term success requires balanced approaches that combine global scale advantages with local market responsiveness and cultural sensitivity to build lasting competitive advantages in this dynamic and rewarding market environment.

What is Confectionery?

Confectionery refers to a category of food items that are primarily made of sugar and are often sweet in taste. This includes candies, chocolates, and other sweet treats that are popular across various cultures and age groups.

What are the key players in the APAC Confectionery Market?

Key players in the APAC Confectionery Market include companies like Mars, Nestlé, and Mondelez International, which are known for their diverse product offerings in chocolates and candies. Other notable companies include Ferrero and Meiji, among others.

What are the growth factors driving the APAC Confectionery Market?

The APAC Confectionery Market is driven by factors such as increasing disposable incomes, changing consumer preferences towards premium and innovative products, and the growing popularity of gifting confectionery items during festivals and celebrations.

What challenges does the APAC Confectionery Market face?

Challenges in the APAC Confectionery Market include rising health consciousness among consumers, which leads to a demand for healthier alternatives, and regulatory pressures regarding sugar content and labeling. Additionally, competition from local brands can impact market share.

What opportunities exist in the APAC Confectionery Market?

Opportunities in the APAC Confectionery Market include the expansion of e-commerce platforms for better distribution, the introduction of organic and sugar-free products, and the potential for growth in emerging markets where confectionery consumption is on the rise.

What trends are shaping the APAC Confectionery Market?

Trends in the APAC Confectionery Market include the increasing demand for artisanal and handcrafted products, the rise of plant-based and healthier options, and innovative packaging solutions that enhance consumer experience and sustainability.

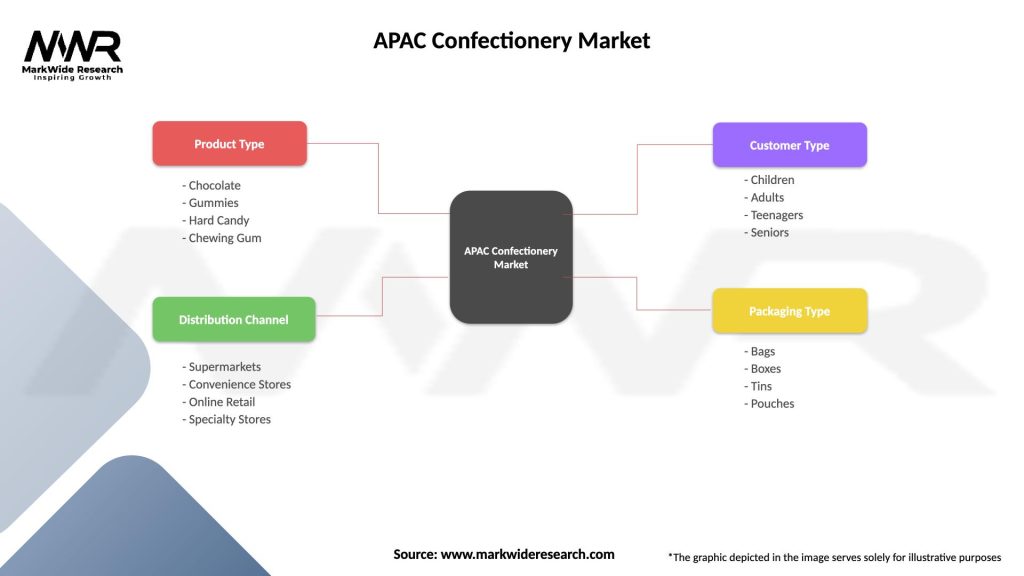

APAC Confectionery Market

| Segmentation Details | Description |

|---|---|

| Product Type | Chocolate, Gummies, Hard Candy, Chewing Gum |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Specialty Stores |

| Customer Type | Children, Adults, Teenagers, Seniors |

| Packaging Type | Bags, Boxes, Tins, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Confectionery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at