444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC collagen supplement market represents one of the fastest-growing segments within the Asia-Pacific nutraceutical industry, driven by increasing consumer awareness about skin health, aging concerns, and overall wellness. This dynamic market encompasses a diverse range of products including collagen peptides, hydrolyzed collagen, marine collagen, and bovine collagen supplements across various forms such as powders, capsules, tablets, and liquid formulations.

Market dynamics in the Asia-Pacific region are particularly influenced by the region’s aging population, rising disposable incomes, and growing beauty consciousness among consumers. Countries like Japan, South Korea, China, and Australia lead the market adoption, with Japan accounting for approximately 35% of regional market share due to its advanced nutraceutical industry and consumer acceptance of functional foods.

Consumer preferences in the APAC region show a strong inclination toward marine-derived collagen products, particularly in coastal nations, while bovine and porcine collagen supplements maintain significant market presence in countries with established livestock industries. The market experiences robust growth with projected CAGR of 8.2% over the forecast period, driven by increasing health consciousness and expanding distribution channels across both urban and rural markets.

The APAC collagen supplement market refers to the comprehensive ecosystem of collagen-based nutritional products manufactured, distributed, and consumed across Asia-Pacific countries, encompassing various collagen types, delivery formats, and application segments designed to support skin health, joint function, and overall wellness.

Collagen supplements in this market context include hydrolyzed collagen peptides, marine collagen, bovine collagen, porcine collagen, and chicken collagen products formulated as dietary supplements. These products are specifically designed to supplement the body’s natural collagen production, which typically decreases with age, leading to visible signs of aging and joint discomfort.

Regional market dynamics encompass the unique cultural preferences, regulatory frameworks, and consumer behaviors across diverse APAC countries, from highly developed markets like Japan and South Korea to emerging economies such as India, Thailand, and Vietnam. The market includes both traditional collagen sources and innovative formulations incorporating advanced extraction and processing technologies.

Strategic market analysis reveals that the APAC collagen supplement market demonstrates exceptional growth potential, driven by demographic shifts, lifestyle changes, and increasing consumer sophistication regarding health and beauty products. The market benefits from strong cultural emphasis on maintaining youthful appearance and preventive healthcare approaches prevalent across Asian societies.

Key growth drivers include the region’s rapidly aging population, with over 60% of consumers aged 35-55 representing the primary target demographic for anti-aging collagen products. Rising disposable incomes, urbanization, and exposure to Western beauty standards through social media and digital platforms significantly influence purchasing decisions and market expansion.

Market segmentation shows marine collagen leading in premium segments, while bovine collagen dominates volume sales due to cost-effectiveness. E-commerce channels experience the fastest growth, accounting for approximately 42% of total sales in major markets, reflecting changing consumer shopping behaviors and the impact of digital transformation on retail landscapes.

Competitive landscape features a mix of international brands, regional players, and local manufacturers, with Japanese and South Korean companies maintaining technological leadership in product innovation and quality standards. Market consolidation trends indicate increasing merger and acquisition activities as companies seek to expand geographic presence and product portfolios.

Consumer behavior analysis reveals distinct purchasing patterns across different APAC countries, with premium product segments showing strongest growth in developed markets while value-oriented products gain traction in emerging economies. The following insights highlight critical market dynamics:

Demographic transformation serves as the primary catalyst for APAC collagen supplement market growth, with aging populations across developed countries creating sustained demand for anti-aging and health maintenance products. The region’s demographic dividend in emerging markets simultaneously drives awareness and adoption among younger consumers focused on preventive health measures.

Beauty and wellness culture deeply embedded in Asian societies significantly influences market expansion, with consumers increasingly viewing collagen supplements as essential components of comprehensive beauty regimens. Social media influence and celebrity endorsements amplify product awareness, particularly among millennial and Gen Z demographics who prioritize appearance and wellness.

Economic prosperity across the region enables higher spending on premium health and beauty products, with rising middle-class populations in countries like China, India, and Southeast Asian nations driving market democratization. Increased disposable income allows consumers to invest in preventive healthcare and premium supplement products.

Scientific validation and clinical research supporting collagen supplement efficacy enhance consumer confidence and market credibility. Growing body of research demonstrating benefits for skin elasticity, joint health, and overall wellness provides scientific foundation for marketing claims and regulatory approval processes.

Lifestyle factors including urbanization, stress, pollution exposure, and dietary changes create increased need for nutritional supplementation. Modern lifestyle challenges contribute to accelerated aging processes, driving demand for collagen supplements as protective and restorative solutions.

High product costs particularly for premium marine collagen supplements limit market penetration in price-sensitive segments and emerging economies. Manufacturing complexity, raw material sourcing challenges, and quality control requirements contribute to elevated pricing that restricts accessibility for broader consumer bases.

Regulatory complexities across diverse APAC markets create barriers for manufacturers seeking regional expansion. Varying approval processes, labeling requirements, health claim regulations, and import restrictions complicate market entry strategies and increase compliance costs for companies operating across multiple countries.

Consumer skepticism regarding supplement efficacy and safety concerns about product quality pose ongoing challenges for market growth. Limited awareness about collagen supplement benefits in some regions, combined with cultural preferences for traditional remedies, may slow adoption rates among certain consumer segments.

Supply chain vulnerabilities including raw material availability, quality consistency, and logistics challenges impact market stability. Dependence on specific collagen sources, seasonal variations in marine collagen supply, and transportation costs across vast geographic distances create operational complexities.

Competition from alternatives including topical collagen products, cosmetic procedures, and other anti-aging solutions may limit market share growth. Traditional medicine practices and herbal supplements maintain strong cultural relevance, potentially constraining collagen supplement adoption in certain markets.

Emerging market expansion presents significant growth opportunities as countries like India, Indonesia, Thailand, and Vietnam experience economic development and rising health consciousness. These markets offer substantial untapped potential with growing middle-class populations and increasing exposure to global wellness trends.

Product innovation opportunities include development of specialized formulations targeting specific demographics, health conditions, and cultural preferences. Combination products featuring collagen with traditional Asian ingredients, personalized nutrition solutions, and sustainable sourcing initiatives represent promising growth avenues.

Digital transformation enables direct-to-consumer marketing, personalized product recommendations, and enhanced customer engagement through e-commerce platforms and social media channels. MarkWide Research indicates that digital marketing strategies show superior ROI of 3.2x compared to traditional advertising methods in the collagen supplement sector.

Strategic partnerships with healthcare providers, beauty clinics, fitness centers, and wellness platforms create new distribution channels and enhance product credibility. Collaborations with influencers, nutritionists, and medical professionals expand market reach and build consumer trust.

Sustainability initiatives including eco-friendly packaging, sustainable sourcing practices, and circular economy principles appeal to environmentally conscious consumers and create competitive differentiation opportunities. Marine collagen from sustainable fisheries and plant-based collagen alternatives represent emerging market segments.

Supply and demand equilibrium in the APAC collagen supplement market reflects complex interactions between raw material availability, manufacturing capacity, and consumer demand patterns. Market dynamics show seasonal variations with peak demand periods during winter months accounting for 35% higher sales as consumers focus on skin health during dry weather conditions.

Price sensitivity analysis reveals distinct market segments with premium consumers willing to pay higher prices for quality and efficacy, while value-conscious segments drive volume growth through competitive pricing strategies. Market dynamics indicate increasing price competition in standard segments while premium categories maintain stable margins.

Innovation cycles demonstrate accelerating product development timelines as companies compete for market share through differentiated offerings. Technology adoption in manufacturing processes, extraction methods, and delivery systems creates competitive advantages and influences market positioning strategies.

Regulatory evolution across APAC countries shows gradual harmonization trends that facilitate market integration and cross-border trade. Dynamic regulatory environment requires continuous adaptation of compliance strategies and influences product development priorities and market entry timing.

Consumer education initiatives by industry players, healthcare professionals, and regulatory bodies shape market dynamics by influencing awareness levels, purchasing decisions, and product expectations. Educational campaigns demonstrate correlation with 28% increase in market penetration in targeted regions.

Comprehensive market analysis employs multi-faceted research approaches combining primary and secondary research methodologies to ensure accuracy and reliability of market insights. Research methodology encompasses quantitative and qualitative analysis techniques designed to capture market complexities and emerging trends across diverse APAC markets.

Primary research components include structured surveys, in-depth interviews with industry stakeholders, consumer focus groups, and expert consultations with healthcare professionals, nutritionists, and industry executives. Data collection covers manufacturer perspectives, distributor insights, retailer feedback, and end-consumer preferences across major APAC countries.

Secondary research sources encompass industry reports, regulatory filings, company annual reports, trade publications, academic research, and government statistics. Market analysis incorporates historical data trends, current market conditions, and forward-looking projections based on identified growth drivers and market dynamics.

Data validation processes ensure information accuracy through triangulation methods, cross-referencing multiple sources, and verification with industry experts. Quality control measures include statistical analysis, trend validation, and consistency checks across different data sources and geographic markets.

Analytical frameworks utilize advanced statistical models, market sizing methodologies, competitive analysis tools, and forecasting techniques to generate actionable insights and strategic recommendations for market participants and stakeholders.

Japan market leadership continues with sophisticated consumer base demonstrating high acceptance of functional foods and premium collagen supplements. Japanese market shows strong preference for marine collagen products with market penetration rate of 47% among target demographics, supported by advanced research and development capabilities and established distribution networks.

South Korea’s innovation hub status drives market growth through K-beauty trends and technological advancement in collagen supplement formulations. Korean market demonstrates rapid adoption of new product formats and combination formulations, with beauty-focused collagen products showing exceptional growth rates and export potential to other APAC countries.

China’s massive market potential represents the largest growth opportunity with expanding middle class and increasing health consciousness among urban populations. Chinese market shows strong preference for premium imported products while domestic manufacturers rapidly improve quality standards and compete on price-value propositions.

Australia and New Zealand markets demonstrate mature consumer behavior with emphasis on quality, safety, and regulatory compliance. These markets serve as testing grounds for new products and formulations before broader APAC expansion, with consumers showing willingness to pay premium prices for certified organic and sustainable products.

Southeast Asian emerging markets including Thailand, Malaysia, Indonesia, and Vietnam show accelerating growth with combined market expansion rate of 12.5% annually. These markets benefit from increasing disposable incomes, urbanization trends, and growing exposure to international beauty and wellness standards through digital media and tourism.

Market leadership structure features diverse competitive dynamics with international brands, regional specialists, and local manufacturers competing across different market segments and price points. Competitive landscape shows increasing consolidation trends as companies seek scale advantages and geographic expansion opportunities.

Key market players demonstrate various competitive strategies including product innovation, strategic partnerships, vertical integration, and digital marketing excellence:

Competitive strategies focus on product differentiation through source quality, processing technology, delivery formats, and combination formulations. Companies invest heavily in research and development, clinical studies, and marketing campaigns to establish brand credibility and consumer loyalty in competitive market environment.

By Source Type:

By Product Form:

By Application:

Premium category performance shows exceptional growth with consumers increasingly willing to invest in high-quality collagen supplements featuring advanced processing, third-party testing, and sustainable sourcing. Premium products demonstrate brand loyalty rates of 72% compared to mass market alternatives, indicating strong consumer satisfaction and repeat purchase behavior.

Mass market segments focus on accessibility and value proposition, driving volume growth through competitive pricing and wide distribution coverage. These products emphasize basic collagen benefits and cost-effectiveness, appealing to price-conscious consumers and first-time users exploring collagen supplementation.

Specialty formulations including targeted solutions for specific demographics, health conditions, and lifestyle needs represent fastest-growing category segments. Products featuring collagen combinations with vitamins, minerals, antioxidants, and botanical ingredients show superior market performance and consumer acceptance.

Organic and natural categories demonstrate strong growth potential as consumers increasingly prioritize clean label products and sustainable sourcing practices. MWR analysis indicates that organic collagen supplements command premium pricing of 25-30% above conventional alternatives while maintaining strong demand growth.

Private label development shows increasing importance as retailers seek to capture higher margins and build customer loyalty through exclusive product offerings. Private label collagen supplements benefit from retailer marketing support and competitive pricing strategies while maintaining quality standards.

Manufacturers benefit from expanding market opportunities, diversified revenue streams, and potential for premium pricing through product innovation and quality differentiation. Collagen supplement manufacturing offers scalable business models with opportunities for vertical integration and value chain optimization.

Retailers and distributors gain access to high-margin product categories with strong consumer demand and repeat purchase patterns. Collagen supplements offer attractive inventory turnover rates and cross-selling opportunities with complementary health and beauty products.

Healthcare professionals can recommend evidence-based nutritional solutions for patients concerned about aging, joint health, and overall wellness. Collagen supplements provide non-pharmaceutical options for addressing common health concerns and supporting preventive care strategies.

Consumers receive convenient and effective solutions for addressing aging concerns, maintaining health, and supporting active lifestyles. Quality collagen supplements offer scientifically-supported benefits for skin elasticity, joint function, and overall wellness when used as part of comprehensive health regimens.

Investors and stakeholders benefit from exposure to rapidly growing market segments with strong demographic tailwinds and increasing consumer acceptance. The collagen supplement market offers attractive investment opportunities with potential for sustained growth and market expansion across emerging economies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization trend drives development of customized collagen supplement solutions based on individual needs, genetic profiles, and lifestyle factors. Advanced diagnostic tools and AI-powered recommendations enable personalized nutrition approaches that enhance efficacy and consumer satisfaction.

Sustainability focus influences sourcing decisions, packaging choices, and manufacturing processes as consumers increasingly prioritize environmental responsibility. Sustainable marine collagen from certified fisheries and biodegradable packaging solutions represent key trend developments.

Combination formulations featuring collagen with complementary ingredients like hyaluronic acid, vitamins, antioxidants, and botanical extracts show strong market acceptance. These comprehensive formulations address multiple health and beauty concerns while providing enhanced value propositions for consumers.

Digital integration transforms marketing, distribution, and customer engagement through social media platforms, influencer partnerships, and direct-to-consumer e-commerce strategies. Digital trends show mobile commerce accounting for 58% of online collagen supplement sales across major APAC markets.

Clean label movement drives demand for transparent ingredient lists, minimal processing, and natural formulations without artificial additives or preservatives. Consumers increasingly scrutinize product labels and seek brands that align with clean eating and natural wellness philosophies.

Technological advancement in collagen extraction and processing methods improves bioavailability, reduces molecular weight, and enhances absorption rates. Innovative hydrolysis techniques and enzymatic processing create superior collagen peptides with improved functional properties and consumer benefits.

Strategic partnerships between collagen suppliers, supplement manufacturers, and retail chains create integrated value chains and market expansion opportunities. Collaborative relationships enable shared research and development costs, improved quality control, and enhanced market penetration strategies.

Regulatory harmonization efforts across APAC countries facilitate cross-border trade and reduce compliance complexities for manufacturers operating in multiple markets. Standardization initiatives improve product quality, safety standards, and consumer confidence in collagen supplement categories.

Clinical research expansion provides stronger scientific evidence for collagen supplement benefits, supporting marketing claims and regulatory approvals. Increased investment in human clinical trials demonstrates efficacy for skin health, joint function, and overall wellness applications.

Sustainable sourcing initiatives address environmental concerns and consumer preferences for responsible manufacturing practices. Industry developments include marine stewardship certification, regenerative agriculture practices, and circular economy principles in collagen production processes.

Market entry strategies should prioritize understanding local consumer preferences, regulatory requirements, and cultural nuances across diverse APAC markets. MarkWide Research recommends phased expansion approaches starting with developed markets before entering emerging economies with different risk profiles and growth timelines.

Product development focus should emphasize quality, efficacy, and differentiation through innovative formulations, superior sourcing, and comprehensive testing protocols. Companies should invest in clinical research, third-party certifications, and transparent communication about product benefits and manufacturing processes.

Distribution strategy optimization requires multi-channel approaches combining traditional retail, e-commerce platforms, and direct-to-consumer models. Digital marketing capabilities and social media engagement become increasingly important for reaching target demographics and building brand awareness.

Partnership opportunities with healthcare providers, beauty professionals, fitness centers, and wellness platforms can enhance credibility and expand market reach. Strategic alliances with complementary brands and cross-promotional activities create synergistic marketing opportunities and cost-effective customer acquisition.

Investment priorities should focus on supply chain optimization, quality control systems, regulatory compliance capabilities, and digital marketing infrastructure. Companies should also consider sustainability initiatives and clean label formulations to meet evolving consumer expectations and regulatory requirements.

Long-term growth prospects remain highly favorable for the APAC collagen supplement market, driven by demographic trends, increasing health consciousness, and expanding middle-class populations across emerging economies. Market maturation in developed countries will be offset by rapid growth in emerging markets with substantial untapped potential.

Innovation trajectories point toward more sophisticated formulations, personalized nutrition solutions, and advanced delivery systems that enhance bioavailability and consumer experience. Technology integration including AI-powered recommendations and digital health monitoring will create new market opportunities and competitive advantages.

Market consolidation trends are expected to continue as companies seek scale advantages, geographic expansion, and vertical integration opportunities. Strategic mergers and acquisitions will reshape competitive landscape while creating more efficient supply chains and enhanced product portfolios.

Regulatory evolution will likely result in more standardized requirements across APAC countries, facilitating cross-border trade while maintaining safety and quality standards. Harmonization efforts will reduce compliance costs and enable more efficient market expansion strategies for manufacturers.

Sustainability imperatives will become increasingly important as consumers and regulators prioritize environmental responsibility. Companies that successfully integrate sustainable practices into their operations and product offerings will gain competitive advantages and access to environmentally conscious consumer segments showing projected growth rate of 15% annually.

The APAC collagen supplement market represents a dynamic and rapidly expanding sector with exceptional growth potential driven by favorable demographics, cultural alignment, and increasing consumer sophistication. Market success requires understanding diverse regional preferences, regulatory landscapes, and competitive dynamics across varied APAC countries.

Strategic opportunities abound for companies that can effectively navigate market complexities while delivering high-quality, differentiated products that meet evolving consumer needs. Success factors include innovation capabilities, quality assurance, regulatory compliance, and effective marketing strategies that resonate with target demographics.

Future market evolution will be shaped by technological advancement, sustainability trends, personalization demands, and digital transformation of commerce and marketing channels. Companies that adapt to these trends while maintaining focus on product quality and consumer satisfaction will be well-positioned for long-term success in this promising market segment.

What is Collagen Supplement?

Collagen supplements are products designed to enhance the body’s collagen levels, which is a vital protein for skin elasticity, joint health, and overall structural integrity. They are commonly derived from animal sources and are available in various forms such as powders, capsules, and drinks.

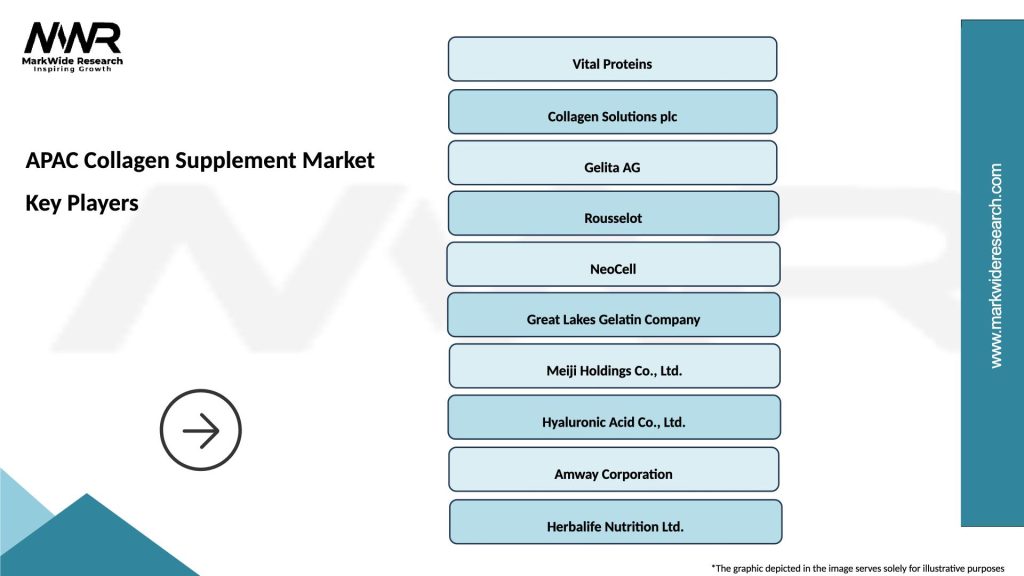

What are the key players in the APAC Collagen Supplement Market?

Key players in the APAC Collagen Supplement Market include companies like Vital Proteins, NeoCell, and Nitta Gelatin, which are known for their innovative products and strong market presence. These companies focus on various applications such as beauty, health, and wellness, among others.

What are the growth factors driving the APAC Collagen Supplement Market?

The APAC Collagen Supplement Market is driven by increasing consumer awareness of health benefits, rising demand for beauty and anti-aging products, and a growing trend towards preventive healthcare. Additionally, the popularity of collagen in functional foods and beverages is contributing to market growth.

What challenges does the APAC Collagen Supplement Market face?

Challenges in the APAC Collagen Supplement Market include regulatory hurdles regarding product claims, competition from alternative protein sources, and varying consumer perceptions about animal-derived products. These factors can impact market penetration and growth.

What opportunities exist in the APAC Collagen Supplement Market?

Opportunities in the APAC Collagen Supplement Market include the expansion of product lines targeting specific demographics, such as athletes and older adults, and the development of plant-based collagen alternatives. Additionally, increasing online retail channels present new avenues for reaching consumers.

What trends are shaping the APAC Collagen Supplement Market?

Trends in the APAC Collagen Supplement Market include the rise of clean label products, increased focus on sustainability in sourcing, and the integration of collagen into various food and beverage products. Innovations in delivery formats and formulations are also gaining traction among consumers.

APAC Collagen Supplement Market

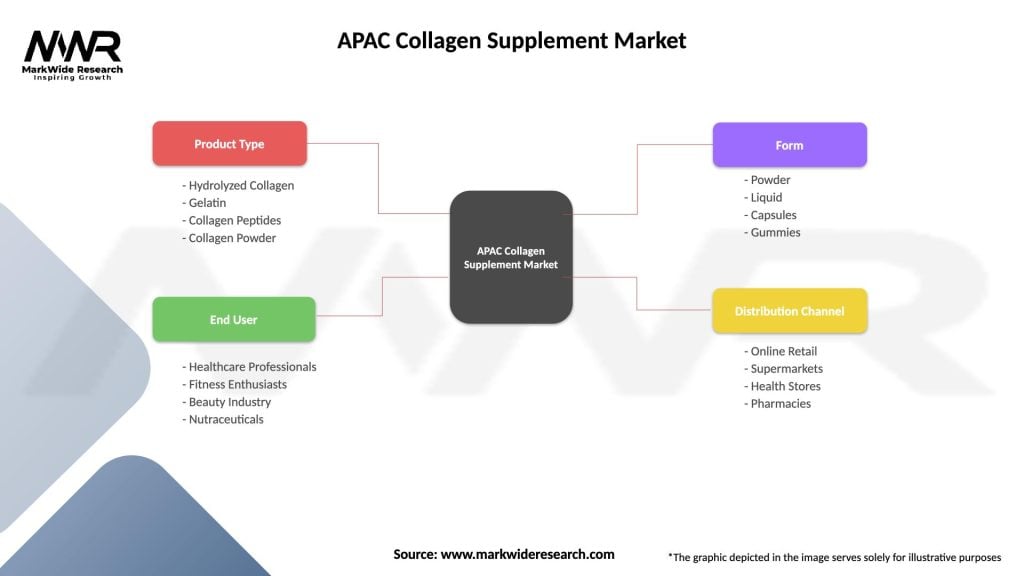

| Segmentation Details | Description |

|---|---|

| Product Type | Hydrolyzed Collagen, Gelatin, Collagen Peptides, Collagen Powder |

| End User | Healthcare Professionals, Fitness Enthusiasts, Beauty Industry, Nutraceuticals |

| Form | Powder, Liquid, Capsules, Gummies |

| Distribution Channel | Online Retail, Supermarkets, Health Stores, Pharmacies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Collagen Supplement Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at