444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC cereal bars market represents one of the most dynamic and rapidly evolving segments within the Asia-Pacific region’s broader snack food industry. This market encompasses a diverse range of nutritious, convenient food products that combine cereals, grains, nuts, fruits, and various binding agents to create portable nutrition solutions. The region’s growing health consciousness, coupled with increasingly busy lifestyles, has positioned cereal bars as an essential component of modern dietary habits across major economies including China, Japan, India, Australia, and Southeast Asian nations.

Market dynamics in the APAC region reflect a significant shift toward healthier snacking alternatives, with cereal bars experiencing robust adoption rates of approximately 12.5% annually across key demographics. The convergence of traditional Asian dietary preferences with Western convenience food concepts has created unique opportunities for product innovation and market expansion. Consumer preferences increasingly favor products that offer functional benefits, including protein enrichment, fiber content, and natural ingredient profiles.

Regional diversity within the APAC cereal bars market presents both opportunities and challenges for manufacturers and distributors. Countries like Japan and South Korea demonstrate sophisticated consumer preferences for premium, health-focused products, while emerging markets such as India and Indonesia show growing demand for affordable, accessible nutrition options. This heterogeneous landscape requires tailored marketing strategies and product formulations to address varying cultural preferences, economic conditions, and regulatory environments across the region.

The APAC cereal bars market refers to the comprehensive commercial ecosystem encompassing the production, distribution, and consumption of cereal-based nutrition bars across Asia-Pacific territories. These products typically consist of processed cereals, grains, and complementary ingredients formed into convenient bar formats designed for on-the-go consumption. The market includes various product categories ranging from basic granola bars to sophisticated functional nutrition bars targeting specific health and wellness objectives.

Product classification within this market spans multiple categories including breakfast bars, protein bars, energy bars, and specialty dietary bars designed for specific nutritional requirements. The definition encompasses both mass-market products available through conventional retail channels and premium offerings distributed through health food stores, fitness centers, and e-commerce platforms. Manufacturing processes vary from simple binding and forming techniques to advanced extrusion and coating technologies that enhance product texture, flavor, and nutritional profiles.

Market scope extends beyond traditional retail boundaries to include institutional sales channels such as schools, offices, healthcare facilities, and fitness centers. The integration of cereal bars into various consumption occasions, from breakfast replacement to post-workout recovery, demonstrates the versatility and broad appeal of these products across diverse consumer segments throughout the Asia-Pacific region.

Strategic positioning of the APAC cereal bars market reflects a mature yet rapidly evolving industry characterized by intense competition, continuous innovation, and expanding consumer acceptance. The market demonstrates exceptional resilience and growth potential, driven by fundamental shifts in consumer behavior, urbanization trends, and increasing health awareness across the region. Key performance indicators suggest sustained momentum with penetration rates reaching 34% among urban consumers in major metropolitan areas.

Competitive landscape features a diverse mix of multinational corporations, regional specialists, and emerging local brands competing across multiple price points and product categories. Market leaders leverage sophisticated distribution networks, brand recognition, and research capabilities to maintain competitive advantages, while smaller players focus on niche segments, innovative formulations, and localized marketing approaches. Innovation cycles continue accelerating with approximately 28% of annual revenue invested in new product development and market expansion initiatives.

Consumer adoption patterns reveal significant variations across demographic segments, with millennials and Generation Z consumers demonstrating the highest engagement rates and willingness to experiment with new flavors and functional ingredients. The integration of digital marketing strategies and e-commerce platforms has enhanced market accessibility and consumer education, contributing to broader market acceptance and repeat purchase behavior throughout the region.

Consumer behavior analysis reveals several critical insights that shape market dynamics and future growth trajectories. The following key insights provide strategic direction for industry participants:

Health and wellness trends represent the primary driving force behind sustained market growth throughout the APAC region. Increasing awareness of lifestyle-related health issues, including obesity, diabetes, and cardiovascular disease, has prompted consumers to seek healthier snacking alternatives. Nutritional education initiatives and government health campaigns have enhanced consumer understanding of the benefits associated with whole grains, fiber, and natural ingredients commonly found in cereal bars.

Urbanization and lifestyle changes continue accelerating across major APAC markets, creating substantial demand for convenient, portable nutrition solutions. The growing prevalence of dual-income households, extended commuting times, and demanding work schedules has positioned cereal bars as practical meal supplements and snacking options. Time constraints associated with modern urban living drive consistent demand for products that offer nutritional value without requiring preparation or cleanup.

Rising disposable incomes across emerging APAC economies enable consumers to prioritize quality and convenience over price considerations. The expanding middle class demonstrates increasing willingness to invest in premium food products that align with health and lifestyle objectives. Economic development in countries such as India, Vietnam, and Indonesia has created new consumer segments with purchasing power sufficient to support regular cereal bar consumption.

Fitness and sports participation trends throughout the region have created specialized demand for energy and protein bars designed to support athletic performance and recovery. The proliferation of fitness centers, sports clubs, and recreational activities has established cereal bars as essential components of active lifestyle nutrition strategies. Sports marketing and athlete endorsements further reinforce the association between cereal bars and fitness-oriented consumption patterns.

Price sensitivity remains a significant constraint limiting market penetration, particularly in price-conscious segments and emerging economies throughout the APAC region. Many consumers perceive cereal bars as premium products with pricing that exceeds traditional snacking alternatives, creating barriers to widespread adoption. Economic fluctuations and currency volatility can exacerbate affordability challenges, forcing consumers to prioritize essential purchases over convenience foods.

Cultural dietary preferences and traditional eating habits present ongoing challenges for market expansion in certain APAC territories. Many consumers maintain strong preferences for fresh, locally prepared foods and may view processed cereal bars as inferior alternatives to traditional snacks and meals. Generational differences in food acceptance create market segmentation challenges, with older demographics often demonstrating resistance to Western-style convenience foods.

Regulatory complexities across diverse APAC markets create compliance challenges and increased operational costs for manufacturers and distributors. Varying food safety standards, labeling requirements, and import regulations necessitate significant investments in regulatory expertise and market-specific product modifications. Certification processes for organic, halal, and other specialty designations add complexity and expense to market entry strategies.

Supply chain constraints including ingredient availability, transportation infrastructure, and cold storage limitations can impact product quality, availability, and pricing throughout the region. Seasonal variations in agricultural production affect ingredient costs and availability, creating challenges for maintaining consistent product formulations and pricing strategies across diverse geographic markets.

Product innovation opportunities abound throughout the APAC cereal bars market, particularly in the development of region-specific flavors and functional ingredients that resonate with local consumer preferences. The integration of traditional Asian ingredients such as matcha, goji berries, and various seeds and nuts creates differentiation opportunities for brands seeking to establish unique market positions. Functional enhancement through probiotics, adaptogens, and specialized nutritional compounds offers pathways for premium product development.

E-commerce expansion presents substantial growth opportunities as digital commerce platforms continue gaining traction across APAC markets. Online retail channels enable brands to reach consumers in remote areas, provide detailed product information, and build direct relationships with customers. Subscription models and personalized nutrition programs create opportunities for recurring revenue streams and enhanced customer loyalty.

Institutional market development offers significant untapped potential through partnerships with schools, offices, healthcare facilities, and fitness centers. Corporate wellness programs increasingly incorporate healthy snacking options, creating bulk purchase opportunities and brand exposure among target demographics. Vending machine placement and automated retail solutions expand accessibility and convenience for consumers across various locations.

Emerging market penetration in countries such as Bangladesh, Myanmar, and Cambodia presents substantial growth opportunities as economic development and urbanization create new consumer segments. Market entry strategies focused on affordability, local partnerships, and culturally appropriate product formulations can establish competitive advantages in these developing markets.

Competitive intensity within the APAC cereal bars market continues escalating as established multinational brands compete with emerging local players and private label offerings. This dynamic environment drives continuous innovation, aggressive pricing strategies, and sophisticated marketing campaigns designed to capture and retain consumer attention. Market consolidation trends suggest potential acquisition opportunities as larger companies seek to expand their product portfolios and geographic reach.

Consumer education initiatives play crucial roles in market development, as many potential customers require information about nutritional benefits, ingredient quality, and consumption occasions. Digital marketing strategies leveraging social media platforms, influencer partnerships, and content marketing help build awareness and drive trial among target demographics. According to MarkWide Research analysis, consumer education campaigns contribute to approximately 18% improvement in product trial rates.

Supply chain optimization efforts focus on reducing costs, improving product freshness, and enhancing distribution efficiency across diverse APAC markets. Vertical integration strategies enable some manufacturers to control ingredient quality and costs while reducing dependence on external suppliers. Technology adoption including inventory management systems and demand forecasting tools helps optimize operations and reduce waste throughout the distribution network.

Seasonal demand patterns create both challenges and opportunities for market participants, with peak consumption periods typically coinciding with back-to-school seasons, fitness resolutions, and summer outdoor activities. Promotional strategies and seasonal product launches help capitalize on these cyclical trends while maintaining consistent revenue streams throughout the year.

Primary research methodologies employed in analyzing the APAC cereal bars market include comprehensive consumer surveys, focus group discussions, and in-depth interviews with industry stakeholders across multiple countries and demographic segments. These qualitative and quantitative research approaches provide insights into consumer preferences, purchase behaviors, and market trends that inform strategic decision-making processes.

Secondary research sources encompass industry reports, government statistics, trade association data, and academic publications that provide context and validation for primary research findings. Market intelligence gathering includes analysis of competitor activities, pricing strategies, product launches, and marketing campaigns across key APAC markets.

Data collection protocols ensure representative sampling across urban and rural populations, various income levels, and diverse age groups to capture comprehensive market perspectives. Statistical analysis techniques including regression analysis, correlation studies, and trend projections help identify significant relationships and forecast future market developments.

Validation processes involve cross-referencing multiple data sources, conducting follow-up interviews, and engaging industry experts to verify research findings and conclusions. Quality assurance measures ensure data accuracy, reliability, and relevance to current market conditions and future projections.

China represents the largest individual market within the APAC cereal bars landscape, accounting for approximately 42% of regional consumption volume. The Chinese market demonstrates sophisticated consumer preferences for premium products, innovative flavors, and functional ingredients that support health and wellness objectives. E-commerce penetration in China significantly exceeds other regional markets, with online sales channels contributing substantial revenue growth and market expansion opportunities.

Japan maintains its position as a mature, high-value market characterized by consumer willingness to pay premium prices for quality, innovation, and unique product attributes. Japanese consumers demonstrate strong preferences for seasonal flavors, limited edition products, and sophisticated packaging designs. Convenience store distribution plays a crucial role in market accessibility and consumer trial, with major chains serving as primary retail channels for cereal bar products.

India presents exceptional growth potential driven by rapid urbanization, expanding middle class, and increasing health consciousness among younger demographics. The Indian market requires careful attention to price sensitivity, cultural preferences, and regional taste variations. Local manufacturing and ingredient sourcing strategies help address affordability concerns while maintaining product quality and nutritional standards.

Southeast Asian markets including Thailand, Malaysia, Indonesia, and the Philippines demonstrate diverse consumption patterns and growth trajectories. These markets benefit from increasing tourism, expatriate populations, and growing exposure to international food trends. Halal certification requirements in Muslim-majority countries create both opportunities and compliance challenges for market participants.

Australia and New Zealand represent mature markets with sophisticated consumer preferences for organic, natural, and sustainably produced cereal bars. These markets demonstrate strong growth in premium and specialty product categories, with consumers willing to invest in products that align with environmental and health values.

Market leadership within the APAC cereal bars industry is distributed among several key players, each leveraging distinct competitive advantages and market positioning strategies. The competitive environment features both global multinational corporations and regional specialists competing across various product categories and price points.

Competitive strategies vary significantly across market participants, with larger companies leveraging economies of scale, research capabilities, and marketing resources, while smaller players focus on niche segments, innovation, and localized approaches. Brand differentiation efforts emphasize unique ingredients, functional benefits, sustainability credentials, and cultural relevance to target consumer segments.

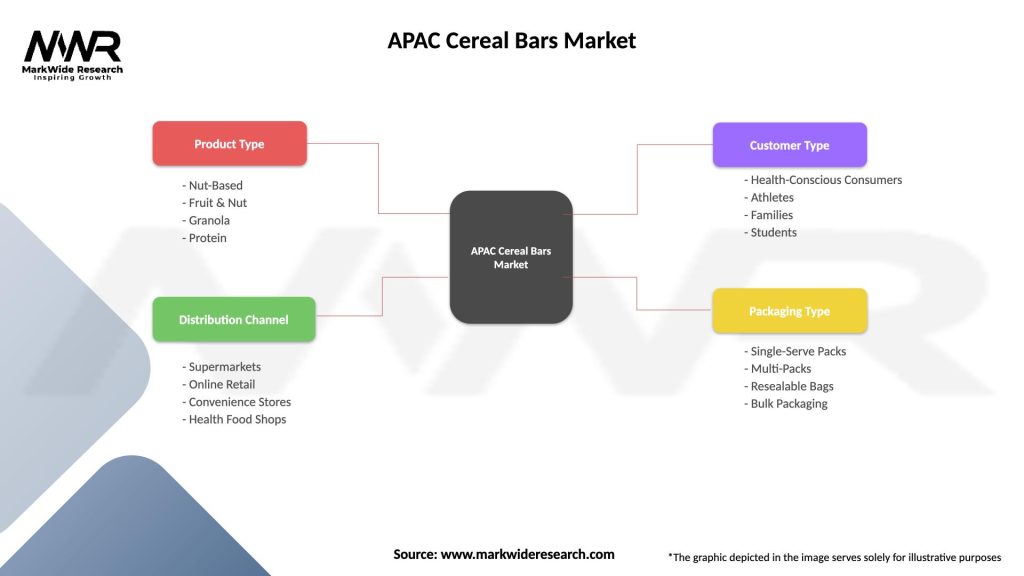

Product type segmentation reveals distinct categories within the APAC cereal bars market, each addressing specific consumer needs and consumption occasions. The primary segmentation includes:

Distribution channel segmentation encompasses various retail and institutional channels that serve different consumer segments and purchase occasions:

Granola bars category maintains the largest market share within the APAC region, representing approximately 38% of total category volume. This traditional segment benefits from broad consumer acceptance, familiar ingredients, and positioning as wholesome snacking options. Innovation opportunities within granola bars focus on exotic fruit inclusions, ancient grain integration, and reduced sugar formulations that address evolving health concerns.

Protein bars segment demonstrates the fastest growth trajectory, driven by increasing fitness participation and awareness of protein’s role in muscle development and weight management. This category attracts premium pricing and loyal consumer followings, particularly among millennials and fitness enthusiasts. Flavor innovation and texture improvements continue driving category expansion and consumer trial.

Breakfast bars category addresses the growing trend toward convenient morning nutrition solutions for time-constrained consumers. Products in this segment emphasize sustained energy release, fiber content, and essential vitamins and minerals. Marketing strategies focus on positioning these products as healthy alternatives to traditional breakfast options while maintaining convenience and portability.

Organic and natural bars represent the premium segment with highest growth potential among affluent, health-conscious consumers. This category commands premium pricing while addressing concerns about artificial ingredients, pesticide residues, and environmental sustainability. Certification requirements and supply chain transparency create barriers to entry while supporting brand differentiation and consumer trust.

Manufacturers benefit from expanding market opportunities, diversified revenue streams, and potential for premium pricing through product innovation and brand development. The cereal bars market offers scalable production processes, efficient ingredient utilization, and opportunities for vertical integration that enhance profitability and competitive positioning. Brand building opportunities enable manufacturers to establish consumer loyalty and command premium pricing for differentiated products.

Retailers gain from high-margin product categories that generate consistent consumer demand and frequent repeat purchases. Cereal bars offer excellent shelf stability, attractive packaging, and strong impulse purchase potential that enhance overall store profitability. Category management opportunities enable retailers to optimize product mix, pricing strategies, and promotional activities that maximize revenue per square foot.

Consumers receive convenient, nutritious snacking options that support busy lifestyles while addressing health and wellness objectives. The variety of available products enables consumers to select options that align with specific dietary requirements, taste preferences, and functional needs. Nutritional benefits include fiber, protein, vitamins, and minerals that contribute to overall dietary quality and health outcomes.

Supply chain partners including ingredient suppliers, packaging companies, and logistics providers benefit from stable demand patterns and growth opportunities within the expanding cereal bars market. Partnership opportunities enable specialized suppliers to develop innovative ingredients and packaging solutions that support product differentiation and market expansion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement continues gaining momentum throughout the APAC cereal bars market, with consumers increasingly demanding products featuring recognizable, natural ingredients and minimal processing. This trend drives reformulation efforts focused on eliminating artificial preservatives, colors, and flavors while maintaining product quality and shelf life. Transparency initiatives including detailed ingredient sourcing information and production process disclosure help build consumer trust and brand loyalty.

Personalized nutrition represents an emerging trend as consumers seek products tailored to individual dietary needs, health goals, and lifestyle requirements. Technology integration including mobile apps and online assessment tools enables brands to recommend specific products and create customized nutrition programs. Subscription services and direct-to-consumer models support personalized approaches while building recurring revenue streams.

Sustainable packaging innovations address growing environmental concerns while maintaining product protection and shelf appeal. Biodegradable wrappers, recyclable materials, and reduced packaging waste initiatives resonate with environmentally conscious consumers. Circular economy principles influence packaging design decisions and supply chain optimization strategies throughout the industry.

Functional ingredient integration expands beyond basic nutrition to include specialized compounds targeting specific health benefits such as immune support, cognitive enhancement, and stress management. Adaptogenic herbs, probiotics, and plant-based proteins create differentiation opportunities and justify premium pricing strategies.

Strategic partnerships between cereal bar manufacturers and fitness brands, health organizations, and technology companies create new distribution channels and marketing opportunities. These collaborations enable brands to access target demographics more effectively while providing credible endorsements for health and performance benefits. Co-branding initiatives leverage complementary brand strengths to enhance market positioning and consumer appeal.

Manufacturing technology advances including improved extrusion processes, coating techniques, and packaging automation enhance product quality while reducing production costs. Quality control systems utilizing artificial intelligence and machine learning optimize consistency and reduce waste throughout manufacturing operations.

Regulatory developments across APAC markets continue evolving, with governments implementing stricter labeling requirements, nutritional standards, and food safety protocols. MWR data indicates that regulatory compliance costs have increased by approximately 15% annually across major regional markets, requiring strategic investments in quality assurance and documentation systems.

Market consolidation activities including acquisitions, mergers, and strategic investments reshape competitive dynamics while creating opportunities for smaller brands to access larger distribution networks and resources. Private equity involvement in the sector provides capital for expansion and innovation while driving operational efficiency improvements.

Product innovation strategies should focus on addressing unmet consumer needs through functional ingredients, unique flavor profiles, and convenient packaging formats. Companies should invest in research and development capabilities that enable rapid response to emerging trends and consumer preferences. Localization efforts incorporating regional flavors and cultural preferences can create competitive advantages in specific geographic markets.

Distribution channel diversification represents a critical success factor, with companies needing to establish presence across multiple retail formats and emerging channels such as e-commerce and institutional sales. Digital marketing investments should prioritize social media engagement, influencer partnerships, and content marketing that educates consumers about product benefits and usage occasions.

Supply chain optimization initiatives should focus on ingredient sourcing reliability, cost management, and sustainability credentials that resonate with environmentally conscious consumers. Vertical integration opportunities in key ingredient categories can provide cost advantages and quality control benefits while reducing supply chain risks.

Market entry strategies for emerging APAC markets should emphasize affordability, local partnerships, and culturally appropriate product formulations. Companies should consider joint ventures or licensing agreements that provide market access while minimizing investment risks and regulatory complexities.

Growth projections for the APAC cereal bars market remain highly optimistic, with industry analysts forecasting sustained expansion driven by demographic trends, urbanization, and increasing health consciousness. The market is expected to maintain robust growth rates of approximately 8.5% annually over the next five years, with premium and functional product categories demonstrating even stronger performance trajectories.

Technology integration will play increasingly important roles in product development, manufacturing efficiency, and consumer engagement. Artificial intelligence applications in flavor development, demand forecasting, and supply chain optimization will create competitive advantages for early adopters. Digital platforms will continue expanding their influence on consumer discovery, education, and purchasing decisions.

Sustainability initiatives will become essential competitive requirements rather than optional differentiators, with consumers and regulators demanding environmental responsibility throughout the value chain. Circular economy principles will influence packaging design, ingredient sourcing, and waste reduction strategies across the industry.

Market maturation in developed APAC countries will drive focus toward premium positioning, functional benefits, and personalized nutrition solutions. Meanwhile, emerging markets will continue offering substantial growth opportunities for companies able to address affordability concerns while maintaining quality standards. MarkWide Research projections suggest that emerging markets will contribute approximately 65% of incremental growth over the forecast period.

The APAC cereal bars market represents a dynamic and rapidly evolving industry with substantial growth potential driven by fundamental shifts in consumer behavior, lifestyle patterns, and health consciousness throughout the region. The convergence of traditional dietary preferences with modern convenience requirements creates unique opportunities for product innovation and market expansion across diverse geographic and demographic segments.

Strategic success in this competitive landscape requires comprehensive understanding of regional variations, consumer preferences, and regulatory requirements combined with investments in product innovation, distribution capabilities, and brand development. Companies that effectively balance global scale advantages with local market adaptation will be best positioned to capture growth opportunities and build sustainable competitive advantages.

Future market development will be characterized by continued premiumization, functional ingredient integration, and sustainability focus, creating opportunities for brands that can deliver authentic value propositions aligned with evolving consumer expectations. The integration of digital technologies and direct-to-consumer strategies will reshape traditional distribution models while enabling more personalized and engaging consumer relationships throughout the APAC cereal bars market.

What is Cereal Bars?

Cereal bars are convenient snack options made primarily from grains, nuts, and sweeteners, often fortified with vitamins and minerals. They are popular for their portability and are commonly consumed as on-the-go meals or healthy snacks.

What are the key players in the APAC Cereal Bars Market?

Key players in the APAC Cereal Bars Market include companies like Nestlé, Kellogg’s, and General Mills, which offer a variety of products catering to different consumer preferences. These companies focus on innovation and health-oriented formulations to capture market share, among others.

What are the growth factors driving the APAC Cereal Bars Market?

The APAC Cereal Bars Market is driven by increasing health consciousness among consumers, the demand for convenient snack options, and the rise in on-the-go lifestyles. Additionally, the growing trend of fitness and wellness is contributing to the market’s expansion.

What challenges does the APAC Cereal Bars Market face?

The APAC Cereal Bars Market faces challenges such as intense competition among brands, fluctuating raw material prices, and changing consumer preferences towards healthier and more natural ingredients. These factors can impact product formulation and pricing strategies.

What opportunities exist in the APAC Cereal Bars Market?

Opportunities in the APAC Cereal Bars Market include the potential for product diversification, such as gluten-free and organic options, and the expansion into emerging markets where demand for healthy snacks is rising. Additionally, e-commerce platforms present new distribution channels.

What trends are shaping the APAC Cereal Bars Market?

Trends in the APAC Cereal Bars Market include the increasing popularity of plant-based ingredients, the incorporation of superfoods, and the focus on sustainable packaging solutions. These trends reflect a shift towards healthier and environmentally friendly consumer choices.

APAC Cereal Bars Market

| Segmentation Details | Description |

|---|---|

| Product Type | Nut-Based, Fruit & Nut, Granola, Protein |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Health Food Shops |

| Customer Type | Health-Conscious Consumers, Athletes, Families, Students |

| Packaging Type | Single-Serve Packs, Multi-Packs, Resealable Bags, Bulk Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Cereal Bars Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at