444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC automotive engine industry market represents one of the most dynamic and rapidly evolving sectors in the global automotive landscape. This comprehensive market encompasses the design, manufacturing, and distribution of various engine technologies across the Asia-Pacific region, including traditional internal combustion engines, hybrid powertrains, and emerging electric motor systems. Market dynamics in this region are characterized by intense competition, technological innovation, and shifting consumer preferences toward more efficient and environmentally sustainable propulsion systems.

Regional dominance in the APAC automotive engine market is primarily driven by major manufacturing hubs in China, Japan, South Korea, and India, which collectively account for approximately 78% of regional production capacity. The market demonstrates remarkable resilience and adaptability, with manufacturers continuously investing in research and development to meet evolving emission standards and fuel efficiency requirements. Technological advancement remains a critical factor, as engine manufacturers integrate sophisticated features such as turbocharging, direct injection, and variable valve timing to optimize performance while reducing environmental impact.

Consumer demand patterns across the APAC region show increasing preference for fuel-efficient engines, with hybrid and electric powertrains gaining significant traction. The market experiences robust growth driven by expanding middle-class populations, urbanization trends, and government initiatives promoting cleaner transportation technologies. Manufacturing capabilities in the region continue to expand, supported by favorable investment policies and strategic partnerships between domestic and international automotive companies.

The APAC automotive engine industry market refers to the comprehensive ecosystem of companies, technologies, and supply chains involved in the development, production, and distribution of automotive propulsion systems across the Asia-Pacific region. This market encompasses various engine types, including gasoline engines, diesel engines, hybrid powertrains, and electric motors, along with associated components such as fuel injection systems, turbochargers, and emission control technologies.

Market scope extends beyond traditional internal combustion engines to include emerging technologies such as hydrogen fuel cells, advanced battery systems, and integrated electric drive units. The industry serves multiple vehicle segments, from passenger cars and commercial vehicles to motorcycles and specialty automotive applications. Value chain integration within this market includes raw material suppliers, component manufacturers, engine assembly facilities, and aftermarket service providers, creating a complex network of interdependent businesses focused on automotive propulsion solutions.

Strategic positioning of the APAC automotive engine industry market reflects the region’s critical role in global automotive manufacturing and innovation. The market demonstrates exceptional growth potential, driven by increasing vehicle production, technological advancement, and evolving regulatory frameworks promoting cleaner engine technologies. Key market drivers include rising disposable incomes, urbanization trends, and government incentives supporting the adoption of fuel-efficient and electric vehicles.

Competitive landscape features a diverse mix of established international manufacturers and emerging regional players, with companies investing heavily in research and development to maintain technological leadership. The market shows strong momentum toward electrification, with hybrid and electric powertrains expected to capture approximately 35% market share by the end of the forecast period. Manufacturing excellence remains a cornerstone of regional competitiveness, with APAC countries leveraging advanced production technologies and skilled workforce capabilities.

Market transformation is evident through increasing integration of digital technologies, artificial intelligence, and IoT connectivity in engine management systems. The industry faces both opportunities and challenges, including the need to balance performance requirements with environmental sustainability goals while maintaining cost competitiveness in diverse market segments.

Primary market insights reveal several critical trends shaping the APAC automotive engine industry landscape:

Economic prosperity across APAC countries serves as a fundamental driver for automotive engine market growth, with expanding middle-class populations increasing vehicle ownership rates. Rising disposable incomes enable consumers to purchase newer vehicles equipped with advanced engine technologies, creating sustained demand for innovative propulsion systems. Urbanization trends contribute significantly to market expansion, as growing cities require efficient transportation solutions and infrastructure development.

Government initiatives promoting clean transportation technologies provide substantial market stimulus through subsidies, tax incentives, and regulatory frameworks favoring fuel-efficient engines. Environmental consciousness among consumers drives demand for hybrid and electric powertrains, while stringent emission standards compel manufacturers to develop cleaner engine technologies. Technological advancement in engine design, materials science, and manufacturing processes enables the production of more efficient, reliable, and cost-effective propulsion systems.

Infrastructure development supporting electric vehicle adoption, including charging networks and smart grid integration, accelerates market growth for electric powertrains. The region’s strong manufacturing base and skilled workforce provide competitive advantages in engine production and innovation. Export opportunities to global markets further stimulate domestic production capacity and technological development initiatives.

High development costs associated with advanced engine technologies pose significant challenges for manufacturers, particularly smaller companies seeking to compete with established industry leaders. The complexity of modern engine systems requires substantial investments in research and development, testing facilities, and specialized manufacturing equipment. Regulatory uncertainty regarding future emission standards and fuel efficiency requirements creates planning difficulties for long-term product development strategies.

Supply chain disruptions and raw material price volatility impact production costs and delivery schedules, affecting market stability and profitability. The transition toward electrification creates challenges for traditional engine manufacturers who must adapt existing facilities and workforce capabilities to new technologies. Consumer price sensitivity in certain market segments limits the adoption of premium engine technologies despite their superior performance characteristics.

Technical complexity of modern engine systems increases maintenance requirements and service costs, potentially deterring some consumers from adopting advanced technologies. Competition from alternative transportation modes, including public transit and ride-sharing services, may reduce overall vehicle demand in urban areas. Skilled labor shortages in specialized engineering and manufacturing roles constrain industry growth potential and innovation capabilities.

Electrification transformation presents unprecedented opportunities for companies to develop innovative electric powertrains, battery management systems, and integrated propulsion solutions. The growing demand for hybrid vehicles creates market opportunities for manufacturers specializing in dual-powertrain technologies and energy management systems. Emerging markets within the APAC region offer significant growth potential as economic development drives increased vehicle ownership and infrastructure investment.

Aftermarket services represent expanding opportunities for engine manufacturers to develop comprehensive maintenance, upgrade, and retrofit solutions for existing vehicle fleets. The integration of digital technologies enables new business models based on predictive maintenance, performance optimization, and connected vehicle services. Export expansion to global markets provides opportunities for APAC manufacturers to leverage cost advantages and technological capabilities.

Partnership opportunities with technology companies, software developers, and energy providers enable engine manufacturers to create integrated solutions addressing broader mobility challenges. The development of alternative fuel engines, including hydrogen and biofuel systems, opens new market segments and applications. Government contracts for public transportation and commercial vehicle fleets provide stable demand for specialized engine solutions.

Competitive intensity in the APAC automotive engine market drives continuous innovation and technological advancement, with manufacturers competing on performance, efficiency, and cost-effectiveness. The market demonstrates cyclical patterns influenced by economic conditions, consumer confidence, and regulatory changes affecting vehicle sales and production volumes. Technology convergence between traditional automotive and electronics industries creates new competitive dynamics and partnership opportunities.

Supply and demand balance fluctuates based on vehicle production schedules, seasonal variations, and economic factors affecting consumer purchasing decisions. The market experiences ongoing consolidation as companies seek economies of scale and enhanced technological capabilities through mergers and acquisitions. Regional variations in market conditions, regulatory requirements, and consumer preferences create diverse opportunities and challenges across different APAC countries.

Innovation cycles in engine technology typically span 5-7 years, requiring substantial upfront investments and long-term strategic planning. The market shows increasing integration between hardware and software components, with engine management systems becoming more sophisticated and connected. Sustainability pressures drive fundamental changes in product development priorities and manufacturing processes throughout the industry.

Comprehensive analysis of the APAC automotive engine industry market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves extensive interviews with industry executives, technical experts, and market participants across major APAC countries to gather firsthand insights into market trends, challenges, and opportunities. Secondary research encompasses analysis of industry reports, government publications, company financial statements, and technical literature to validate primary findings and provide historical context.

Data collection methods include structured surveys of manufacturers, suppliers, and distributors to quantify market parameters and identify emerging trends. Market modeling techniques incorporate statistical analysis, trend extrapolation, and scenario planning to project future market developments. Expert validation ensures research findings align with industry knowledge and practical market realities through consultation with recognized industry authorities.

Regional analysis methodology involves country-specific research to account for local market conditions, regulatory environments, and consumer preferences across the diverse APAC region. Cross-validation of data sources and methodologies enhances research reliability and provides confidence in market projections and strategic recommendations.

China dominates the APAC automotive engine market with approximately 45% regional market share, driven by massive domestic vehicle production and growing export capabilities. The Chinese market demonstrates strong momentum toward electrification, with government policies promoting new energy vehicles and substantial investments in battery technology and charging infrastructure. Manufacturing scale in China provides significant cost advantages and enables rapid technology deployment across multiple vehicle segments.

Japan maintains technological leadership in engine innovation, particularly in hybrid powertrains and fuel efficiency technologies, holding roughly 22% regional market share. Japanese manufacturers focus on premium engine solutions and advanced manufacturing processes, leveraging decades of automotive engineering expertise. South Korea represents approximately 15% of the regional market, with companies emphasizing design innovation and integration of digital technologies in engine systems.

India’s market shows rapid growth potential, accounting for about 12% regional share with expanding domestic production and increasing vehicle ownership rates. The Indian market demonstrates strong demand for cost-effective engine solutions while gradually adopting cleaner technologies. Southeast Asian markets collectively represent the remaining market share, with countries like Thailand, Indonesia, and Malaysia serving as important manufacturing hubs and growing consumer markets for automotive engines.

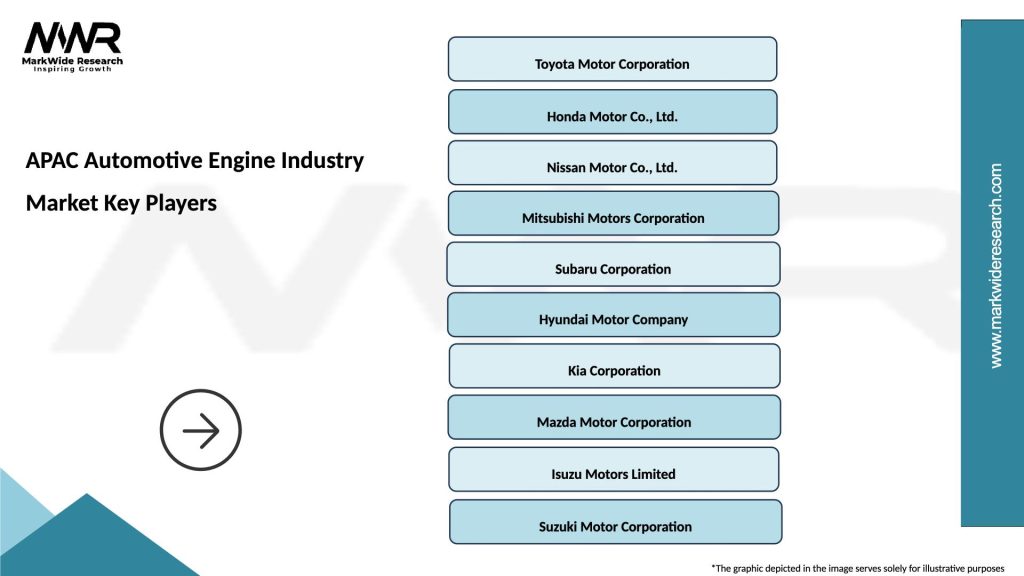

Market leadership in the APAC automotive engine industry is distributed among several key players, each bringing unique strengths and competitive advantages:

Competitive strategies focus on technological differentiation, cost optimization, and strategic partnerships to enhance market position and expand geographic reach.

By Engine Type:

By Vehicle Application:

By Technology Level:

Gasoline engine segment maintains the largest market share due to widespread adoption in passenger vehicles and established infrastructure support. These engines continue evolving with advanced technologies such as turbocharging and direct injection to improve fuel efficiency while maintaining performance standards. Market trends show increasing demand for smaller displacement engines with enhanced power output through forced induction systems.

Hybrid powertrain category experiences the fastest growth rate, driven by consumer preference for fuel-efficient vehicles and government incentives promoting cleaner technologies. According to MarkWide Research analysis, hybrid engines demonstrate approximately 25% better fuel efficiency compared to conventional powertrains. Technology integration in hybrid systems becomes increasingly sophisticated, with seamless transitions between electric and combustion power modes.

Electric motor segment shows exponential growth potential as battery technology improves and charging infrastructure expands across APAC countries. The category benefits from government mandates promoting electric vehicle adoption and substantial investments in battery manufacturing capabilities. Commercial vehicle applications for electric powertrains gain traction in urban delivery and public transportation segments, driven by emission reduction requirements and operational cost advantages.

Manufacturers benefit from expanding market opportunities across diverse vehicle segments and geographic regions within APAC. The growing demand for advanced engine technologies enables premium pricing for innovative solutions while economies of scale reduce production costs. Technology partnerships provide access to complementary capabilities and shared development costs for complex propulsion systems.

Suppliers gain from increased demand for specialized components such as turbochargers, fuel injection systems, and electric motor components. The market expansion creates opportunities for component manufacturers to develop long-term relationships with engine producers and participate in technology development initiatives. Service providers benefit from growing aftermarket demand for maintenance, repair, and upgrade services as engine systems become more sophisticated.

Consumers receive improved vehicle performance, fuel efficiency, and environmental benefits from advanced engine technologies. The competitive market environment drives continuous innovation and cost reduction, providing better value propositions for end users. Government stakeholders achieve environmental and energy security objectives through promotion of cleaner engine technologies and reduced dependence on imported fuels.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification acceleration represents the most significant trend reshaping the APAC automotive engine industry, with manufacturers investing heavily in electric powertrain development and production capabilities. The trend encompasses not only pure electric vehicles but also hybrid systems that combine traditional engines with electric motors for optimal efficiency. Battery technology advancement enables longer range and faster charging capabilities, making electric powertrains more attractive to consumers.

Digitalization integration transforms engine management systems through incorporation of artificial intelligence, machine learning, and IoT connectivity. Modern engines feature sophisticated control systems that optimize performance in real-time based on driving conditions, weather, and driver behavior patterns. Predictive maintenance capabilities reduce operational costs and improve reliability through early detection of potential issues.

Downsizing trend continues with manufacturers developing smaller displacement engines that deliver equivalent or superior performance through turbocharging and advanced combustion technologies. This approach reduces fuel consumption and emissions while maintaining vehicle performance standards. Alternative fuel adoption gains momentum with increasing interest in hydrogen fuel cells, compressed natural gas, and biofuel engines for specific applications and markets.

Strategic partnerships between traditional engine manufacturers and technology companies accelerate innovation in electric powertrains and connected vehicle systems. Major automotive groups establish joint ventures and collaborative research initiatives to share development costs and expertise in emerging technologies. Manufacturing investments focus on building new facilities dedicated to electric motor production and battery assembly capabilities.

Regulatory developments across APAC countries introduce stricter emission standards and fuel efficiency requirements, driving industry-wide technology upgrades and product development initiatives. Government incentive programs promote adoption of cleaner engine technologies through subsidies, tax benefits, and preferential policies. Infrastructure expansion for electric vehicle charging networks supports market growth for electric powertrains.

Technology breakthroughs in battery chemistry, electric motor design, and power electronics improve the performance and cost-effectiveness of electric powertrains. Research initiatives focus on solid-state batteries, wireless charging systems, and ultra-fast charging technologies. Supply chain localization efforts reduce dependence on global suppliers and improve supply security for critical engine components.

Strategic recommendations for industry participants emphasize the importance of balancing traditional engine business with investments in electrification technologies. Companies should develop comprehensive transition strategies that leverage existing capabilities while building new competencies in electric powertrains and digital systems. Partnership strategies prove essential for accessing complementary technologies and sharing development risks in rapidly evolving market conditions.

Investment priorities should focus on research and development capabilities, particularly in battery technology, electric motor design, and power electronics. Manufacturing flexibility becomes crucial as companies need to produce both traditional and electric powertrains during the transition period. Talent acquisition and training programs help address skill gaps in electric vehicle technologies and digital systems integration.

Market positioning strategies should consider regional variations in adoption rates, regulatory requirements, and consumer preferences across different APAC countries. Companies benefit from developing modular product architectures that enable customization for local market needs while maintaining economies of scale. MWR analysis suggests that successful companies will be those that can effectively manage the transition from traditional to electric powertrains while maintaining profitability and market share.

Market transformation toward electrification will accelerate significantly over the forecast period, with electric powertrains expected to achieve approximately 60% market penetration by 2030 across major APAC markets. Traditional internal combustion engines will continue serving specific applications and market segments, particularly in commercial vehicles and regions with limited charging infrastructure. Hybrid technologies will serve as crucial bridge solutions during the transition period.

Technology convergence between automotive and electronics industries will create new opportunities for innovation and market differentiation. Engine systems will become increasingly integrated with vehicle connectivity, autonomous driving capabilities, and energy management systems. Manufacturing evolution will emphasize flexibility, sustainability, and digital integration to meet changing market demands and regulatory requirements.

Regional leadership patterns may shift as countries with strong electric vehicle policies and infrastructure development gain competitive advantages. The market will likely see continued consolidation as companies seek scale advantages and technology capabilities necessary for success in the electrified future. Sustainable mobility concepts will drive development of comprehensive solutions addressing energy efficiency, environmental impact, and total cost of ownership considerations.

The APAC automotive engine industry market stands at a critical transformation point, balancing traditional internal combustion engine excellence with rapid advancement toward electrification and digital integration. The region’s strong manufacturing capabilities, technological innovation, and large consumer markets position it as a global leader in automotive propulsion system development and production. Market dynamics reflect the complex interplay between regulatory pressures, consumer preferences, and technological capabilities driving industry evolution.

Success factors for industry participants include strategic investment in electric powertrain technologies, maintenance of manufacturing excellence, and development of flexible business models accommodating diverse market requirements. The transition toward sustainable mobility creates both challenges and opportunities, requiring companies to balance short-term profitability with long-term strategic positioning. Collaborative approaches through partnerships and joint ventures will prove essential for managing development costs and accessing complementary capabilities in the rapidly evolving market landscape.

Future market leadership will belong to companies that successfully navigate the electrification transition while maintaining competitive advantages in traditional engine technologies during the extended transition period. The APAC automotive engine industry market represents a dynamic and opportunity-rich environment for stakeholders committed to innovation, sustainability, and customer-focused solutions in the evolving mobility ecosystem.

What is Automotive Engine?

The Automotive Engine refers to the machinery that converts fuel into mechanical energy to power vehicles. It plays a crucial role in the automotive sector, influencing performance, efficiency, and emissions.

What are the key players in the APAC Automotive Engine Industry Market?

Key players in the APAC Automotive Engine Industry Market include Toyota Motor Corporation, Honda Motor Co., Ltd., and Nissan Motor Co., Ltd., among others.

What are the main drivers of growth in the APAC Automotive Engine Industry Market?

The main drivers of growth in the APAC Automotive Engine Industry Market include increasing vehicle production, rising demand for fuel-efficient engines, and advancements in engine technology.

What challenges does the APAC Automotive Engine Industry Market face?

Challenges in the APAC Automotive Engine Industry Market include stringent emissions regulations, the shift towards electric vehicles, and fluctuating raw material prices.

What opportunities exist in the APAC Automotive Engine Industry Market?

Opportunities in the APAC Automotive Engine Industry Market include the development of hybrid and electric engines, innovations in engine design, and the growing trend of smart automotive technologies.

What trends are shaping the APAC Automotive Engine Industry Market?

Trends shaping the APAC Automotive Engine Industry Market include the increasing adoption of turbocharged engines, the integration of advanced materials for weight reduction, and the focus on sustainability and reduced emissions.

APAC Automotive Engine Industry Market

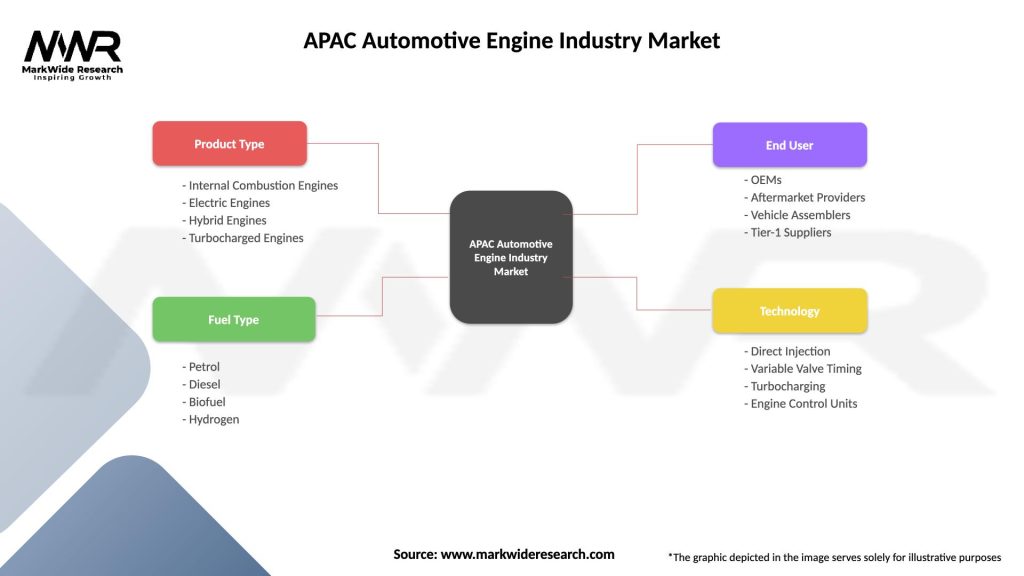

| Segmentation Details | Description |

|---|---|

| Product Type | Internal Combustion Engines, Electric Engines, Hybrid Engines, Turbocharged Engines |

| Fuel Type | Petrol, Diesel, Biofuel, Hydrogen |

| End User | OEMs, Aftermarket Providers, Vehicle Assemblers, Tier-1 Suppliers |

| Technology | Direct Injection, Variable Valve Timing, Turbocharging, Engine Control Units |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Automotive Engine Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at