444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC advanced building materials market represents one of the most dynamic and rapidly evolving sectors within the global construction industry. This comprehensive market encompasses innovative materials that offer superior performance characteristics compared to traditional building components, including enhanced durability, energy efficiency, and sustainability features. Advanced building materials in the Asia-Pacific region include high-performance concrete, smart glass, advanced composites, nanomaterials, and bio-based construction materials that are revolutionizing modern architecture and infrastructure development.

Market dynamics indicate robust growth driven by increasing urbanization, government infrastructure investments, and growing environmental consciousness across APAC nations. The region’s construction sector is experiencing unprecedented expansion, with countries like China, India, Japan, and Australia leading the adoption of innovative building technologies. Current growth trajectories suggest the market is expanding at a compound annual growth rate of 8.2%, reflecting strong demand for sustainable and high-performance construction solutions.

Regional variations demonstrate diverse adoption patterns, with developed markets like Japan and South Korea focusing on smart building technologies, while emerging economies prioritize cost-effective yet durable materials. The market’s evolution is characterized by increasing integration of digital technologies, sustainable manufacturing processes, and performance-driven material selection criteria that align with modern construction requirements.

The APAC advanced building materials market refers to the comprehensive ecosystem of innovative construction materials and technologies that offer enhanced performance characteristics beyond conventional building components across the Asia-Pacific region. These materials incorporate cutting-edge technologies, sustainable manufacturing processes, and superior functional properties to meet evolving construction industry demands.

Advanced building materials encompass a broad spectrum of products including high-strength concrete formulations, energy-efficient insulation systems, smart glass technologies, composite materials, and bio-based alternatives. These materials are characterized by their ability to provide improved structural integrity, energy efficiency, environmental sustainability, and long-term durability compared to traditional construction materials.

Market scope extends beyond simple material supply to include integrated solutions that combine multiple advanced materials with digital monitoring systems, predictive maintenance capabilities, and lifecycle optimization features. The definition encompasses both the physical materials and the technological ecosystem that supports their development, manufacturing, distribution, and application in modern construction projects.

Strategic market analysis reveals the APAC advanced building materials sector as a cornerstone of regional construction industry transformation. The market demonstrates exceptional growth potential driven by urbanization trends, infrastructure modernization initiatives, and increasing emphasis on sustainable construction practices. Key growth drivers include government policy support, technological innovation, and rising consumer awareness of environmental impact.

Market segmentation shows diverse applications across residential, commercial, and infrastructure sectors, with each segment exhibiting unique growth patterns and material preferences. The residential segment leads in volume consumption, while commercial applications drive premium material adoption. Infrastructure projects represent the fastest-growing segment, supported by massive government investment programs across the region.

Competitive landscape features a mix of established global players and innovative regional manufacturers, creating a dynamic environment for technological advancement and market expansion. Leading companies are investing heavily in research and development, with innovation spending increasing by 15% annually to maintain competitive advantages in this rapidly evolving market.

Future projections indicate continued robust growth with expanding applications in smart cities, green building initiatives, and resilient infrastructure development. The market is expected to benefit from increasing integration of Internet of Things technologies and artificial intelligence in building material performance monitoring and optimization.

Primary market insights reveal several critical trends shaping the APAC advanced building materials landscape:

Regional insights demonstrate varying adoption patterns across APAC markets, with developed economies leading in premium material adoption while emerging markets focus on cost-effective performance improvements. This diversity creates opportunities for tailored product development and market-specific strategies.

Urbanization acceleration serves as the primary catalyst for advanced building materials adoption across the APAC region. Rapid urban population growth necessitates innovative construction solutions that can accommodate higher density living while maintaining quality of life standards. Smart city initiatives in major metropolitan areas drive demand for intelligent building materials that integrate with urban infrastructure systems.

Government infrastructure investment programs provide substantial market momentum through large-scale projects requiring high-performance materials. National development plans across China, India, Indonesia, and other APAC countries prioritize infrastructure modernization, creating sustained demand for advanced construction technologies. These investments often mandate specific performance standards that favor innovative material solutions.

Environmental regulations increasingly influence material selection criteria, with governments implementing stricter building codes and sustainability requirements. Carbon footprint reduction targets and energy efficiency mandates drive adoption of green building materials and technologies. The growing emphasis on circular economy principles encourages development of recyclable and bio-based material alternatives.

Technological advancement in material science enables development of products with superior performance characteristics. Breakthroughs in nanotechnology, composite materials, and smart material systems create new possibilities for construction applications. Digital manufacturing processes improve material quality consistency while reducing production costs, making advanced materials more accessible to broader market segments.

Economic development across emerging APAC markets increases construction activity and quality expectations. Rising disposable incomes enable consumers to invest in higher-quality building materials that offer long-term value. Commercial sector expansion drives demand for premium materials that enhance building performance and occupant experience.

High initial costs represent the most significant barrier to widespread adoption of advanced building materials. Premium pricing compared to conventional alternatives creates budget constraints, particularly for cost-sensitive residential and small commercial projects. Return on investment calculations often favor traditional materials despite long-term performance advantages of advanced alternatives.

Technical complexity in installation and maintenance procedures requires specialized expertise that may not be readily available in all markets. The learning curve associated with new materials can slow adoption rates and increase project risks. Contractor training and certification requirements add implementation costs and timeline considerations.

Supply chain limitations affect material availability and delivery reliability, particularly in emerging markets with developing distribution networks. Quality control challenges in manufacturing and transportation can impact material performance and customer confidence. Limited local production capabilities in some regions create dependency on imports and associated cost implications.

Regulatory uncertainties regarding new material approvals and building code compliance create market hesitation. Lengthy certification processes delay product launches and increase development costs. Standardization gaps between different APAC markets complicate regional expansion strategies for material manufacturers.

Market fragmentation across diverse APAC economies creates challenges for achieving economies of scale. Varying technical standards, cultural preferences, and economic conditions require customized approaches that increase operational complexity. Currency fluctuations and trade policy changes add financial risks to cross-border material supply chains.

Green building certification programs create substantial opportunities for advanced material suppliers as construction projects increasingly pursue sustainability credentials. LEED, BREEAM, and local green building standards drive demand for materials with verified environmental performance characteristics. The growing emphasis on carbon-neutral construction opens markets for innovative low-carbon and carbon-negative materials.

Smart city development initiatives across major APAC urban centers present significant growth opportunities for intelligent building materials. Integration with Internet of Things platforms and urban management systems creates demand for materials with embedded sensing and communication capabilities. These applications command premium pricing while offering substantial market expansion potential.

Infrastructure resilience requirements driven by climate change concerns create demand for materials with enhanced durability and adaptive capabilities. Disaster-resistant construction standards in earthquake and typhoon-prone regions favor advanced materials with superior structural performance. This trend is particularly relevant in Japan, Philippines, and other disaster-prone APAC markets.

Emerging market expansion offers opportunities for cost-effective advanced material solutions tailored to local requirements. Localized manufacturing strategies can reduce costs while improving supply chain reliability. Partnership opportunities with regional developers and contractors facilitate market entry and expansion.

Technology integration opportunities include development of materials that interface with building automation systems, energy management platforms, and predictive maintenance applications. Artificial intelligence and machine learning applications in material performance optimization create new value propositions for advanced building materials.

Supply-demand equilibrium in the APAC advanced building materials market reflects complex interactions between rapid demand growth and evolving supply capabilities. Demand acceleration driven by urbanization and infrastructure development often outpaces supply expansion, creating temporary shortages and price pressures. However, increasing manufacturing investments and capacity expansions are gradually improving supply-demand balance.

Price dynamics demonstrate volatility influenced by raw material costs, energy prices, and currency fluctuations. Premium pricing for advanced materials reflects their superior performance characteristics, but competitive pressures and scale economies are gradually reducing price premiums. According to MarkWide Research analysis, price gaps between advanced and conventional materials have narrowed by 18% over the past three years.

Innovation cycles accelerate as companies invest heavily in research and development to maintain competitive advantages. Product lifecycle compression requires continuous innovation and rapid market introduction of new material technologies. This dynamic environment rewards companies with strong R&D capabilities and agile commercialization processes.

Market consolidation trends include strategic acquisitions and partnerships that combine complementary technologies and market access capabilities. Vertical integration strategies help companies control supply chains and improve cost competitiveness. These consolidation activities reshape competitive dynamics while potentially improving market efficiency.

Regulatory evolution continues influencing market dynamics through updated building codes, environmental standards, and safety requirements. Policy support for sustainable construction and smart building technologies creates favorable market conditions for advanced materials. However, regulatory complexity and compliance costs also present ongoing challenges for market participants.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the APAC advanced building materials market. Primary research includes extensive interviews with industry executives, technical experts, and key stakeholders across the construction value chain. These interviews provide firsthand insights into market trends, challenges, and opportunities from diverse perspectives.

Secondary research encompasses analysis of industry reports, government publications, academic studies, and company financial statements. Data triangulation techniques validate findings across multiple sources to ensure accuracy and reliability. Patent analysis and technology trend monitoring provide insights into innovation directions and competitive positioning.

Market modeling utilizes statistical analysis and forecasting techniques to project future market developments. Scenario analysis considers various economic, regulatory, and technological factors that could influence market evolution. Sensitivity analysis evaluates the impact of key variables on market projections and identifies critical success factors.

Regional analysis includes country-specific studies that account for local market conditions, regulatory environments, and cultural factors. Cross-regional comparisons identify best practices and successful strategies that could be applicable across different APAC markets. This approach ensures comprehensive understanding of market diversity and regional opportunities.

Industry validation processes include expert review panels and stakeholder feedback sessions to verify research findings and conclusions. Continuous monitoring systems track market developments and update analysis as new information becomes available. This methodology ensures research remains current and relevant to market participants’ decision-making needs.

China dominates the APAC advanced building materials market with approximately 45% market share, driven by massive infrastructure investments and urbanization programs. Government initiatives including the Belt and Road Initiative and smart city development projects create substantial demand for high-performance materials. The country’s manufacturing capabilities and scale economies provide competitive advantages in material production and cost optimization.

Japan represents the technology leadership segment, focusing on innovative materials with smart building integration capabilities. Seismic resistance requirements drive demand for advanced structural materials, while energy efficiency mandates favor high-performance insulation and building envelope solutions. The market emphasizes quality and technological sophistication over volume growth.

India demonstrates rapid growth potential with expanding urban populations and infrastructure modernization needs. Government programs including Smart Cities Mission and Housing for All create significant market opportunities. The focus on cost-effective solutions drives demand for locally manufactured advanced materials with competitive pricing structures.

South Korea emphasizes green building technologies and sustainable construction practices. Digital integration with building automation systems creates demand for intelligent materials with connectivity features. The market benefits from strong government support for environmental initiatives and technological innovation.

Australia and New Zealand focus on sustainable building materials and climate-resilient construction solutions. Stringent environmental regulations drive adoption of eco-friendly materials and technologies. These markets demonstrate willingness to pay premium prices for materials with verified sustainability credentials.

Southeast Asian markets including Indonesia, Thailand, and Vietnam show emerging growth potential driven by economic development and urbanization. Infrastructure investment programs create opportunities for advanced materials, though price sensitivity remains a key consideration. Regional manufacturing capabilities are expanding to serve local market needs.

Market leadership in the APAC advanced building materials sector features a diverse mix of global corporations and innovative regional players. Competitive dynamics emphasize technological innovation, manufacturing scale, and regional market access capabilities. Leading companies invest heavily in research and development to maintain technological advantages and expand product portfolios.

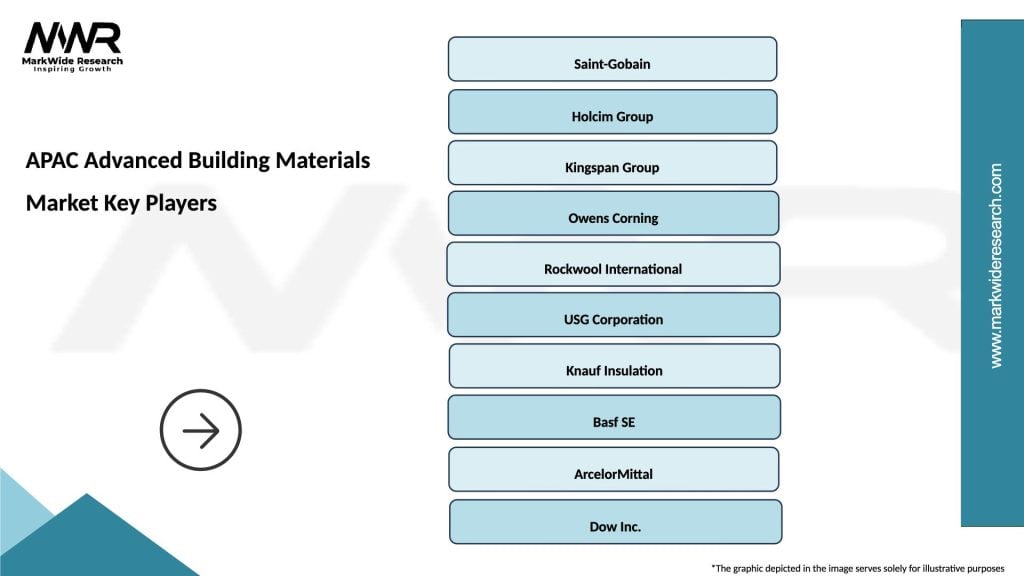

Key market players include:

Regional competitors include established Asian companies with strong local market knowledge and cost advantages. Strategic partnerships between global and regional players create hybrid business models that combine technological expertise with local market access. These collaborations often result in customized product development for specific regional requirements.

Innovation strategies focus on sustainability, smart building integration, and performance optimization. Digital transformation initiatives include development of connected materials and predictive maintenance capabilities. Companies increasingly emphasize lifecycle value propositions rather than initial cost advantages.

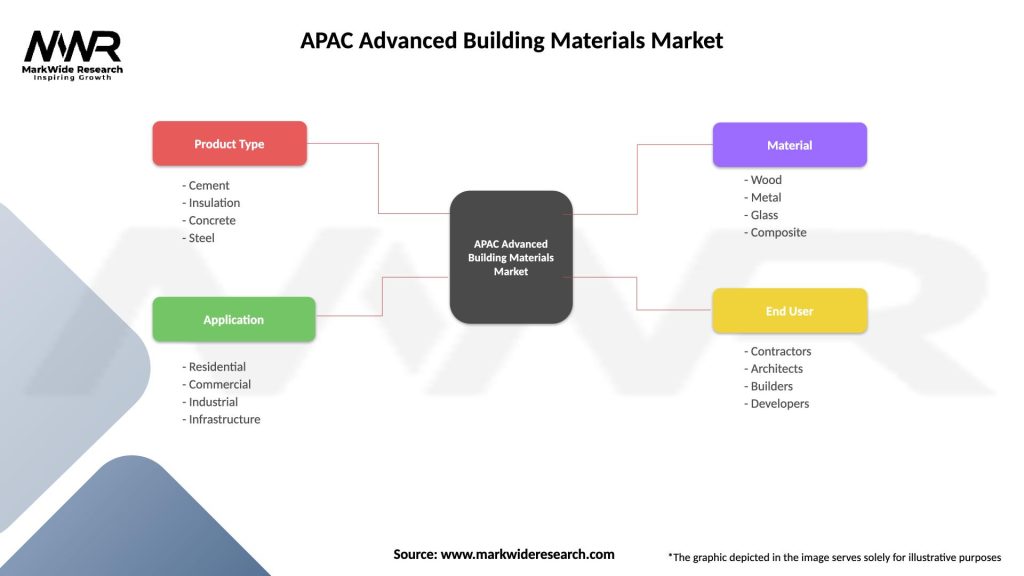

By Material Type:

By Application:

By End-User:

High-Performance Concrete represents the largest segment by volume, driven by infrastructure development and high-rise construction projects. Self-healing concrete and ultra-high-performance formulations demonstrate significant growth potential. The segment benefits from established supply chains and widespread contractor familiarity with concrete applications.

Smart Glass Technologies show rapid growth in commercial applications, with energy savings of 20-30% driving adoption in premium building projects. Electrochromic glass leads in office building applications, while thermochromic solutions gain traction in residential markets. Cost reduction through manufacturing scale improvements expands market accessibility.

Advanced Composites demonstrate strong growth in specialized applications requiring lightweight, high-strength materials. Carbon fiber and glass fiber reinforced polymers find increasing use in architectural elements and structural reinforcement. The segment benefits from aerospace and automotive industry technology transfer.

Nanomaterials represent the fastest-growing segment, with applications in coatings, concrete additives, and insulation systems. Nanocellulose and carbon nanotube applications show particular promise for sustainable construction solutions. Regulatory approval processes remain a key consideration for market expansion.

Bio-based Materials gain momentum through sustainability mandates and environmental consciousness. Bamboo composites, hemp-based insulation, and bio-concrete applications demonstrate commercial viability. The segment benefits from government incentives and green building certification programs.

Construction Companies benefit from improved project efficiency, reduced maintenance costs, and enhanced building performance through advanced material adoption. Lifecycle cost savings often offset higher initial material costs, improving overall project profitability. Advanced materials enable construction of more complex and innovative architectural designs that differentiate companies in competitive markets.

Building Owners realize significant operational cost savings through improved energy efficiency, reduced maintenance requirements, and extended building lifecycles. Smart building materials provide real-time performance monitoring and predictive maintenance capabilities that optimize building operations. Enhanced occupant comfort and productivity contribute to higher property values and rental rates.

Material Manufacturers access premium market segments with higher profit margins compared to commodity building materials. Innovation leadership creates competitive advantages and market differentiation opportunities. Strong growth in advanced materials markets provides expansion opportunities and improved financial performance.

Government Agencies achieve policy objectives related to sustainability, energy efficiency, and infrastructure resilience through advanced material adoption. Smart city initiatives benefit from intelligent building materials that integrate with urban management systems. Improved building performance contributes to economic development and quality of life improvements.

Environmental Stakeholders benefit from reduced construction industry environmental impact through sustainable material alternatives and improved building efficiency. Carbon footprint reduction and circular economy principles align with environmental protection goals. Advanced materials often incorporate recycled content and enable end-of-life recycling.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration dominates market trends as environmental considerations become central to material selection processes. Circular economy principles drive development of recyclable and bio-based materials that minimize environmental impact. Life cycle assessment becomes standard practice in material evaluation, with carbon footprint reduction emerging as a key performance metric.

Digital Transformation revolutionizes building materials through smart technology integration and data-driven performance optimization. Internet of Things connectivity enables real-time monitoring of material performance and building conditions. Artificial intelligence applications optimize material selection and predict maintenance requirements, enhancing building lifecycle management.

Modular Construction trends favor materials optimized for prefabricated and modular building systems. Standardization efforts improve compatibility and reduce assembly complexity. This trend particularly benefits composite materials and engineered wood products that offer consistent quality and dimensional stability.

Energy Efficiency requirements drive adoption of materials with superior thermal performance and energy management capabilities. Phase change materials and advanced insulation systems gain prominence in energy-efficient building designs. Smart glass technologies demonstrate 30-40% energy savings in commercial applications, accelerating market adoption.

Resilience Focus emphasizes materials that enhance building resistance to natural disasters and climate change impacts. Disaster-resistant construction standards in earthquake and typhoon-prone regions favor advanced materials with superior structural performance. This trend is particularly relevant in Japan, Philippines, and other disaster-prone APAC markets.

Manufacturing Expansion initiatives across APAC regions improve material availability and reduce costs through local production capabilities. Capacity investments by major manufacturers establish regional manufacturing hubs that serve multiple country markets. These developments reduce supply chain risks and improve customer service capabilities.

Technology Partnerships between material manufacturers and technology companies accelerate development of smart building materials. Collaborative research programs combine material science expertise with digital technology capabilities. These partnerships often result in breakthrough products that create new market categories.

Regulatory Developments include updated building codes that mandate or incentivize advanced material adoption. Green building standards increasingly require specific material performance characteristics related to sustainability and energy efficiency. These regulatory changes create market opportunities while establishing minimum performance requirements.

Acquisition Activities reshape competitive dynamics as companies seek to expand technological capabilities and market access. Strategic acquisitions often combine complementary technologies or provide entry into new geographic markets. According to MWR analysis, merger and acquisition activity in the sector increased by 25% over the past two years.

Innovation Breakthroughs in nanotechnology, biotechnology, and material science create new product categories and application possibilities. Self-healing materials, bio-based composites, and smart responsive materials demonstrate commercial potential. These innovations often require significant development investment but offer substantial competitive advantages.

Market Entry Strategies should prioritize regional partnerships and localized manufacturing to overcome cost and supply chain barriers. Joint ventures with established regional players provide market access and local expertise while sharing investment risks. Companies should focus on markets with supportive regulatory environments and strong infrastructure investment programs.

Product Development priorities should emphasize sustainability, smart technology integration, and cost optimization. Modular design approaches enable customization for different regional requirements while maintaining manufacturing efficiencies. Companies should invest in digital capabilities that enhance material performance monitoring and optimization.

Investment Focus areas include manufacturing capacity expansion, research and development, and digital technology integration. Automation investments improve manufacturing efficiency and product quality consistency. Companies should also invest in customer education and technical support capabilities to accelerate market adoption.

Partnership Opportunities exist with construction companies, architects, and technology providers to develop integrated solutions. Ecosystem partnerships create comprehensive value propositions that address multiple customer needs. Collaboration with academic institutions and research organizations accelerates innovation and technology development.

Risk Management strategies should address supply chain vulnerabilities, regulatory compliance, and market volatility. Diversification approaches across multiple markets and applications reduce concentration risks. Companies should maintain flexible manufacturing capabilities that can adapt to changing market conditions and requirements.

Long-term growth prospects for the APAC advanced building materials market remain exceptionally positive, driven by sustained urbanization, infrastructure modernization, and environmental sustainability requirements. Market evolution will likely accelerate through technological convergence, with materials increasingly incorporating digital capabilities and smart functionality. The next decade promises significant transformation as traditional construction practices adapt to advanced material capabilities.

Technology integration will deepen as building materials become integral components of smart building ecosystems. Artificial intelligence and machine learning applications will optimize material performance and predict maintenance requirements. Internet of Things connectivity will enable real-time monitoring and adaptive material behavior based on environmental conditions and usage patterns.

Sustainability imperatives will drive continued innovation in bio-based materials, recycling technologies, and carbon-negative construction solutions. Circular economy principles will become standard practice, with materials designed for disassembly and reuse. Government policies and consumer preferences will increasingly favor materials with verified environmental credentials and lifecycle sustainability.

Regional market development will see emerging economies gradually adopting advanced materials as economic development progresses and infrastructure investment increases. Technology transfer from developed to emerging markets will accelerate through partnerships and local manufacturing initiatives. Cost reduction through scale economies will make advanced materials accessible to broader market segments.

Innovation trajectories suggest breakthrough developments in self-assembling materials, bio-responsive systems, and quantum-enhanced material properties. Nanotechnology applications will expand beyond current limitations, creating materials with unprecedented performance characteristics. These innovations will likely create entirely new market categories and application possibilities that are currently inconceivable.

The APAC advanced building materials market represents a transformative force in the global construction industry, driven by technological innovation, sustainability imperatives, and unprecedented urbanization across the region. Market dynamics demonstrate robust growth potential supported by government infrastructure investments, environmental regulations, and increasing consumer awareness of building performance and sustainability.

Strategic opportunities abound for companies that can successfully navigate the complex regional landscape while delivering innovative solutions that address local market needs. The convergence of digital technologies, sustainable materials, and smart building systems creates unprecedented possibilities for market expansion and value creation. Success factors include technological leadership, regional partnerships, and comprehensive understanding of diverse market requirements across APAC economies.

Future market evolution will likely accelerate as traditional construction practices transform to accommodate advanced material capabilities and smart building requirements. Companies that invest in innovation, sustainability, and regional market development are positioned to capture significant growth opportunities in this dynamic and rapidly expanding market. The APAC advanced building materials market stands at the forefront of construction industry transformation, promising continued growth and innovation for decades to come.

What is Advanced Building Materials?

Advanced Building Materials refer to innovative materials that enhance the performance, sustainability, and efficiency of buildings. These materials include high-performance insulation, smart glass, and eco-friendly composites, which are designed to meet modern construction demands.

What are the key players in the APAC Advanced Building Materials Market?

Key players in the APAC Advanced Building Materials Market include BASF SE, Saint-Gobain, and Kingspan Group, among others. These companies are known for their innovative products and solutions that cater to the growing demand for sustainable and efficient building materials.

What are the growth factors driving the APAC Advanced Building Materials Market?

The APAC Advanced Building Materials Market is driven by increasing urbanization, a growing focus on energy efficiency, and stringent building regulations. Additionally, the rising demand for sustainable construction practices is propelling market growth.

What challenges does the APAC Advanced Building Materials Market face?

Challenges in the APAC Advanced Building Materials Market include high initial costs of advanced materials and the need for skilled labor for installation. Furthermore, fluctuating raw material prices can impact production and pricing strategies.

What opportunities exist in the APAC Advanced Building Materials Market?

The APAC Advanced Building Materials Market presents opportunities in the development of smart materials and green building technologies. As governments promote sustainable construction, there is potential for innovation in materials that reduce environmental impact.

What trends are shaping the APAC Advanced Building Materials Market?

Trends in the APAC Advanced Building Materials Market include the increasing use of prefabricated materials and the integration of IoT technologies in building systems. Additionally, there is a growing emphasis on circular economy practices within the construction industry.

APAC Advanced Building Materials Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cement, Insulation, Concrete, Steel |

| Application | Residential, Commercial, Industrial, Infrastructure |

| Material | Wood, Metal, Glass, Composite |

| End User | Contractors, Architects, Builders, Developers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Advanced Building Materials Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at