444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The ANZ satellite-based earth observation market represents a rapidly expanding sector within the Asia-Pacific region, encompassing Australia and New Zealand’s growing demand for advanced geospatial intelligence solutions. This market has experienced remarkable transformation as organizations across various industries increasingly recognize the strategic value of satellite-derived data for decision-making processes. The region’s unique geographical characteristics, including vast agricultural lands, extensive coastlines, and diverse environmental conditions, create substantial opportunities for satellite-based monitoring and analysis applications.

Market dynamics in the ANZ region are driven by technological advancements in satellite imaging capabilities, increasing government investments in space infrastructure, and growing awareness of climate change impacts. The market encompasses various satellite technologies, including optical imaging, synthetic aperture radar (SAR), and hyperspectral sensors, each serving distinct applications across agriculture, environmental monitoring, defense, and commercial sectors. Recent developments indicate that the market is experiencing significant growth momentum, with adoption rates accelerating across both public and private sector organizations.

Regional characteristics play a crucial role in shaping market demand, as Australia’s mining industry, agricultural sector, and environmental monitoring requirements drive substantial investment in earth observation capabilities. New Zealand’s focus on sustainable agriculture, disaster management, and marine resource monitoring further contributes to market expansion. The integration of artificial intelligence and machine learning technologies with satellite data processing has enhanced the value proposition of earth observation solutions, enabling more sophisticated analysis and predictive capabilities.

The ANZ satellite-based earth observation market refers to the comprehensive ecosystem of satellite technologies, data processing services, and analytical solutions designed to monitor, analyze, and interpret Earth’s surface conditions across Australia and New Zealand. This market encompasses the deployment of various satellite systems, including government-operated and commercial satellites, that capture high-resolution imagery and sensor data for diverse applications ranging from agricultural monitoring to urban planning and environmental assessment.

Earth observation capabilities in this context involve the systematic collection of geospatial data through satellite-mounted sensors that can detect changes in land use, vegetation health, water resources, atmospheric conditions, and human activities. The market includes both upstream activities, such as satellite manufacturing and launch services, and downstream applications involving data processing, analysis, and the development of specialized software solutions for end-users across multiple industries.

Technological integration within this market extends beyond traditional satellite imagery to include advanced analytics, cloud-based processing platforms, and real-time monitoring systems that enable organizations to make data-driven decisions. The market serves various stakeholders, including government agencies, agricultural enterprises, mining companies, environmental consultancies, and research institutions, each requiring tailored solutions to address specific operational challenges and regulatory requirements.

Strategic market positioning of the ANZ satellite-based earth observation sector demonstrates robust growth potential driven by increasing demand for precision agriculture solutions, environmental monitoring capabilities, and disaster management applications. The market benefits from strong government support for space industry development, particularly in Australia’s space agency initiatives and New Zealand’s focus on sustainable resource management. Key growth drivers include technological advancements in satellite miniaturization, improved data processing capabilities, and growing awareness of climate change impacts requiring continuous monitoring.

Market segmentation reveals diverse application areas with agriculture representing the largest segment, followed by environmental monitoring, defense and security, and urban planning applications. The commercial satellite data segment is experiencing particularly strong growth as organizations seek cost-effective alternatives to government-operated systems. According to MarkWide Research analysis, the adoption of cloud-based earth observation platforms has increased by 78% over the past three years, indicating strong market momentum toward accessible, scalable solutions.

Competitive landscape features a mix of international satellite operators, local service providers, and technology integrators working to address region-specific requirements. The market is characterized by increasing collaboration between government agencies and private sector organizations, fostering innovation in data processing techniques and application development. Future growth prospects remain positive, supported by ongoing investments in satellite infrastructure and expanding use cases across traditional and emerging industry sectors.

Primary market drivers include the following critical factors shaping the ANZ satellite-based earth observation landscape:

Technology trends indicate significant advancement in satellite capabilities, with new-generation satellites offering improved resolution, faster revisit times, and enhanced spectral capabilities. The integration of artificial intelligence and machine learning algorithms with satellite data processing has created opportunities for automated analysis and predictive modeling applications.

Government initiatives serve as primary catalysts for market growth, with Australia’s space agency actively promoting domestic space industry development and New Zealand’s investment in earth observation capabilities for environmental monitoring. These initiatives include funding programs, regulatory framework development, and international collaboration agreements that enhance market accessibility for local organizations. The establishment of ground stations and data processing facilities within the region has reduced dependency on overseas infrastructure while improving data access and processing capabilities.

Agricultural sector demand represents a significant growth driver as farming operations increasingly adopt precision agriculture techniques to optimize productivity and resource utilization. Satellite-based monitoring enables farmers to assess crop health, optimize irrigation systems, and implement variable-rate application of fertilizers and pesticides. The growing focus on sustainable farming practices and carbon credit programs has further increased demand for accurate monitoring and verification capabilities that satellite systems can provide.

Climate change awareness has intensified demand for comprehensive environmental monitoring solutions across both countries. Organizations require detailed information about changing weather patterns, sea level variations, vegetation changes, and ecosystem health to develop appropriate adaptation and mitigation strategies. The increasing frequency and intensity of natural disasters in the region have highlighted the importance of early warning systems and rapid response capabilities that rely heavily on satellite-based earth observation data.

Technological advancement in satellite miniaturization and cost reduction has made earth observation capabilities more accessible to smaller organizations and specialized applications. The emergence of small satellite constellations and cube satellite technologies has democratized access to space-based monitoring capabilities while reducing operational costs and improving temporal resolution for critical applications.

High implementation costs continue to present significant barriers for many potential users, particularly smaller organizations and specialized applications with limited budgets. The initial investment required for satellite data subscriptions, processing software, and technical expertise can be substantial, limiting market penetration in certain sectors. Additionally, the ongoing costs associated with data storage, processing, and analysis require sustained financial commitment that may challenge organizations with fluctuating revenue streams.

Technical complexity associated with satellite data interpretation and analysis requires specialized expertise that may not be readily available within many organizations. The learning curve for effectively utilizing earth observation data can be steep, requiring investment in training and skill development. Integration challenges with existing information systems and workflows can further complicate implementation efforts, particularly for organizations with legacy technology infrastructure.

Data quality concerns including cloud cover limitations, temporal resolution constraints, and atmospheric interference can impact the reliability and usefulness of satellite-based observations for certain applications. Weather conditions in the ANZ region, including frequent cloud cover and seasonal variations, can limit the availability of optical satellite imagery for time-sensitive applications. These limitations may require organizations to invest in multiple data sources or alternative monitoring technologies to ensure comprehensive coverage.

Regulatory challenges related to data privacy, national security considerations, and cross-border data sharing can complicate market development and limit access to certain types of satellite information. Export control regulations and licensing requirements for high-resolution imagery may restrict availability for some applications, while evolving privacy regulations require careful consideration of data handling and sharing practices.

Emerging applications in carbon monitoring and environmental, social, and governance (ESG) reporting present substantial growth opportunities as organizations face increasing pressure to demonstrate sustainability commitments. Satellite-based monitoring can provide objective, verifiable data for carbon sequestration projects, deforestation monitoring, and biodiversity assessment, supporting compliance with emerging regulatory requirements and voluntary sustainability initiatives. The growing carbon credit market requires accurate monitoring and verification capabilities that satellite systems are uniquely positioned to provide.

Smart city development initiatives across major ANZ urban centers create opportunities for integrated earth observation solutions that support urban planning, traffic management, and infrastructure monitoring applications. The combination of satellite data with Internet of Things (IoT) sensors and urban analytics platforms can enable comprehensive city management systems that optimize resource utilization and improve quality of life for residents. Population growth and urbanization trends in the region support continued investment in these capabilities.

Maritime domain awareness represents an expanding opportunity as both countries seek to enhance monitoring of their extensive maritime territories. Applications include illegal fishing detection, search and rescue operations, oil spill monitoring, and marine protected area management. The vast ocean areas under ANZ jurisdiction require cost-effective monitoring solutions that satellite systems can provide more efficiently than traditional patrol methods.

Integration opportunities with emerging technologies such as drone systems, artificial intelligence, and blockchain platforms can create new value propositions and market segments. The combination of satellite data with unmanned aerial vehicle (UAV) capabilities can provide multi-scale monitoring solutions, while AI integration enables automated analysis and predictive modeling applications. Blockchain technology can enhance data integrity and enable new business models for data sharing and monetization.

Supply chain evolution within the ANZ satellite-based earth observation market reflects increasing localization of capabilities and reduced dependency on international suppliers. The development of domestic satellite manufacturing capabilities, ground station infrastructure, and data processing facilities has enhanced market resilience while creating opportunities for local technology companies. This trend toward regional self-sufficiency has been accelerated by supply chain disruptions and national security considerations.

Competitive dynamics are characterized by increasing collaboration between traditional aerospace companies and technology startups, creating hybrid business models that combine established satellite operations with innovative data processing and application development capabilities. The market has seen significant consolidation activity, with larger organizations acquiring specialized service providers to expand their capability portfolios and market reach.

Customer behavior patterns indicate a shift toward subscription-based service models and cloud-based data access platforms, reducing the need for substantial upfront investments in infrastructure and software. Organizations increasingly prefer integrated solutions that combine data acquisition, processing, and analysis capabilities rather than managing multiple vendor relationships. This trend has driven service providers to develop comprehensive platforms that address end-to-end customer requirements.

Innovation cycles in satellite technology continue to accelerate, with new satellite launches occurring regularly and technological capabilities improving rapidly. The emergence of small satellite constellations has increased data availability and reduced costs, while advances in sensor technology have enhanced the quality and variety of available information. These technological improvements have enabled new applications and expanded the addressable market for earth observation solutions.

Data collection approaches for analyzing the ANZ satellite-based earth observation market incorporate multiple research methodologies to ensure comprehensive coverage and accuracy. Primary research activities include structured interviews with industry executives, government officials, and end-users across various application sectors. These interviews provide insights into market trends, technology adoption patterns, and future requirements that quantitative data alone cannot capture.

Secondary research components involve analysis of government publications, industry reports, academic research, and company financial statements to establish market context and validate primary research findings. Satellite launch databases, technology patent filings, and regulatory documentation provide additional data sources for understanding market development patterns and competitive positioning. Trade publication analysis and conference proceedings offer insights into emerging trends and technology developments.

Market sizing methodologies utilize bottom-up and top-down approaches to estimate market segments and growth projections. Bottom-up analysis involves detailed assessment of individual market segments, application areas, and customer categories to build comprehensive market models. Top-down analysis uses macroeconomic indicators, government spending patterns, and industry growth rates to validate bottom-up estimates and identify potential gaps in market coverage.

Validation processes include cross-referencing multiple data sources, conducting follow-up interviews with key stakeholders, and comparing findings with international market trends to ensure accuracy and reliability. Expert panels and advisory groups provide additional validation of research findings and help identify potential biases or limitations in the analysis. Continuous monitoring of market developments ensures that research findings remain current and relevant.

Australia dominates the regional market with approximately 75% market share, driven by its larger economy, extensive agricultural sector, and significant mining industry requirements. The country’s vast geographical area and diverse climate conditions create substantial demand for satellite-based monitoring across multiple applications. Government investment in space infrastructure, including the Australian Space Agency’s initiatives, has accelerated market development and attracted international satellite operators to establish local operations.

New Zealand represents approximately 25% of the regional market, with strong focus on agricultural applications, environmental monitoring, and disaster management capabilities. The country’s commitment to sustainable agriculture and carbon neutrality goals has driven investment in earth observation technologies for monitoring and verification purposes. New Zealand’s unique geographical characteristics, including mountainous terrain and extensive coastlines, require specialized monitoring solutions that satellite systems can effectively provide.

Urban concentration patterns show that major metropolitan areas in both countries serve as primary hubs for earth observation service providers and technology companies. Sydney, Melbourne, and Auckland host the majority of market participants, benefiting from proximity to customers, research institutions, and government agencies. However, the applications for satellite-based earth observation extend throughout both countries, with rural and remote areas often representing the most critical use cases.

Cross-border collaboration between Australia and New Zealand has increased significantly, with shared research initiatives, joint procurement programs, and coordinated disaster response capabilities. This collaboration has created opportunities for service providers to develop regional solutions that address common challenges and leverage economies of scale. The similar regulatory environments and cultural factors facilitate market integration and technology sharing between the two countries.

Market leadership in the ANZ satellite-based earth observation sector is distributed among several key categories of organizations, each bringing distinct capabilities and market positioning:

Strategic partnerships between international satellite operators and local service providers have become increasingly common, enabling global companies to access regional market knowledge while local organizations gain access to advanced satellite capabilities. These partnerships often involve technology transfer, joint product development, and shared market development activities that benefit both parties.

Innovation focus areas among competitive organizations include artificial intelligence integration, automated analysis capabilities, and real-time processing systems that can deliver actionable insights more rapidly than traditional approaches. Companies are investing heavily in cloud-based platforms and software-as-a-service (SaaS) models to improve accessibility and reduce customer implementation barriers.

By Technology: The market segments into several distinct technology categories, each serving specific application requirements and customer needs:

By Application: Market applications span diverse industry sectors with varying requirements and growth patterns:

By End User: Customer segments demonstrate distinct purchasing patterns and requirements:

Agricultural applications represent the largest market segment, driven by the region’s significant agricultural sector and increasing adoption of precision farming techniques. Farmers utilize satellite data for crop health monitoring, irrigation optimization, and yield prediction, with adoption rates reaching 62% among large-scale agricultural operations. The integration of satellite data with farm management systems has enabled more sophisticated decision-making processes and improved operational efficiency.

Environmental monitoring applications have experienced rapid growth as organizations face increasing regulatory requirements and sustainability reporting obligations. Government agencies utilize satellite data for compliance monitoring, while private organizations use earth observation capabilities to support ESG reporting and environmental impact assessments. The market for carbon monitoring and verification services has shown particularly strong growth potential.

Defense and security applications maintain steady demand driven by national security requirements and border monitoring needs. Both Australia and New Zealand have invested in satellite-based surveillance capabilities to monitor their extensive maritime territories and remote land areas. The integration of satellite data with other intelligence sources has enhanced situational awareness and response capabilities.

Urban planning applications are expanding rapidly as cities seek to optimize infrastructure development and manage population growth. Satellite data supports traffic analysis, urban heat island monitoring, and infrastructure planning activities. The growing focus on smart city initiatives has created new opportunities for integrated earth observation solutions that combine satellite data with other urban sensing technologies.

Mining and energy sectors utilize satellite capabilities for exploration activities, environmental compliance monitoring, and operational oversight of remote facilities. The ability to monitor large areas cost-effectively makes satellite-based solutions particularly attractive for these industries, which often operate in challenging and remote locations throughout the ANZ region.

Operational efficiency gains represent primary benefits for organizations implementing satellite-based earth observation solutions. Users report average efficiency improvements of 35% in monitoring and analysis activities compared to traditional ground-based methods. The ability to monitor large areas simultaneously and access historical data for trend analysis enables more informed decision-making and proactive management approaches.

Cost reduction opportunities emerge from reduced need for field surveys, aerial photography, and manual monitoring activities. Organizations can achieve significant cost savings by replacing expensive ground-based data collection with satellite-based alternatives, particularly for routine monitoring applications. The scalability of satellite data allows organizations to expand monitoring coverage without proportional increases in operational costs.

Risk management enhancement through early warning capabilities and continuous monitoring helps organizations identify potential problems before they become critical issues. Environmental monitoring applications can detect pollution incidents, vegetation stress, or infrastructure problems in their early stages, enabling prompt response and mitigation actions. This proactive approach reduces potential damages and associated costs.

Competitive advantage development through access to unique insights and analytical capabilities that may not be available to competitors. Organizations using satellite data can identify market opportunities, optimize resource allocation, and improve operational planning based on comprehensive geospatial intelligence. This information advantage can translate into improved business performance and market positioning.

Regulatory compliance support through objective, verifiable data that meets government reporting requirements and industry standards. Satellite-based monitoring provides auditable evidence of environmental performance, land use changes, and resource management activities. This capability is particularly valuable for organizations operating in highly regulated industries or those seeking certification for sustainability programs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration has emerged as a dominant trend, with organizations increasingly utilizing machine learning algorithms to automate satellite data analysis and extract actionable insights. This trend has reduced the technical expertise required for effective utilization of earth observation data while improving the speed and accuracy of analysis processes. AI-powered platforms can now identify patterns, detect changes, and generate alerts automatically, making satellite data more accessible to non-technical users.

Small satellite proliferation continues to reshape the market landscape, with numerous small satellite constellations providing increased temporal resolution and reduced costs compared to traditional large satellite systems. These developments have democratized access to earth observation capabilities and enabled new applications that require frequent revisit times. The trend toward smaller, more numerous satellites has also improved market resilience and reduced dependency on individual satellite systems.

Cloud-based platforms have become the preferred delivery method for earth observation services, eliminating the need for customers to invest in substantial computing infrastructure and software licenses. Cloud platforms enable scalable processing capabilities, collaborative analysis environments, and integration with other business systems. According to MWR analysis, cloud-based earth observation platforms have achieved 89% adoption rates among new customers over the past two years.

Real-time monitoring capabilities are increasingly demanded by customers who require immediate access to satellite data for time-sensitive applications such as disaster response, security monitoring, and operational decision-making. This trend has driven investment in rapid data processing systems and direct satellite-to-user communication capabilities that bypass traditional ground station infrastructure.

Sustainability focus has created new market opportunities as organizations seek to demonstrate environmental responsibility and comply with emerging regulations related to climate change and environmental protection. Satellite-based monitoring provides objective, verifiable data for sustainability reporting and carbon credit verification, supporting the growing emphasis on environmental, social, and governance (ESG) performance metrics.

Government space initiatives have accelerated significantly, with Australia’s space agency launching multiple programs to support domestic space industry development and New Zealand increasing investment in earth observation capabilities. These initiatives include funding for satellite development, ground infrastructure, and research programs that enhance regional capabilities and reduce dependence on international suppliers.

Commercial partnerships between international satellite operators and local service providers have expanded market access and improved service delivery capabilities. Recent partnerships have focused on developing region-specific applications and establishing local data processing facilities that reduce latency and improve service quality for ANZ customers.

Technology acquisitions and mergers have consolidated market capabilities while expanding service portfolios. Major satellite operators have acquired specialized analytics companies and software developers to offer more comprehensive solutions that address end-to-end customer requirements. These consolidation activities have created larger, more capable organizations while potentially reducing competition in some market segments.

Research collaborations between universities, government agencies, and private companies have accelerated innovation in earth observation applications and data processing techniques. These collaborations have produced new analytical methods, improved sensor technologies, and novel applications that expand the addressable market for satellite-based solutions.

Infrastructure investments in ground stations, data processing facilities, and communication networks have improved market accessibility and service quality. Recent investments have focused on establishing redundant capabilities and improving data security to meet growing customer requirements for reliable, secure earth observation services.

Market participants should prioritize development of integrated platforms that combine satellite data with complementary technologies such as artificial intelligence, Internet of Things sensors, and predictive analytics capabilities. Organizations that can offer comprehensive solutions addressing specific industry challenges will be better positioned to capture market opportunities and build sustainable competitive advantages. Investment in user-friendly interfaces and automated analysis capabilities will be critical for expanding market reach beyond traditional technical users.

Government agencies should continue supporting domestic space industry development while fostering public-private partnerships that leverage both sectors’ capabilities. Coordinated procurement programs and shared infrastructure development can reduce costs while improving service availability for all market participants. Regulatory frameworks should balance national security requirements with market development needs to ensure continued growth and innovation.

End-user organizations should develop clear strategies for integrating earth observation capabilities with existing business processes and decision-making frameworks. Successful implementation requires investment in staff training, system integration, and change management processes that enable effective utilization of satellite-derived insights. Organizations should start with pilot projects that demonstrate value before expanding to comprehensive earth observation programs.

Technology providers should focus on developing solutions that address specific regional challenges and requirements rather than generic global offerings. Understanding local market conditions, regulatory requirements, and customer preferences will be essential for successful market penetration. Partnerships with local organizations can provide market access and customer relationships that would be difficult to develop independently.

Investment strategies should consider the long-term nature of space infrastructure development and the importance of sustained commitment to market development activities. Organizations entering this market should prepare for extended development timelines and substantial initial investments while building capabilities that can adapt to rapidly evolving technology and customer requirements.

Market growth projections indicate continued expansion driven by increasing adoption across traditional application areas and emergence of new use cases related to climate change monitoring, carbon verification, and sustainability reporting. The market is expected to maintain strong growth momentum with projected CAGR of 12.4% over the next five years, supported by government investment, technology advancement, and expanding commercial applications.

Technology evolution will continue to enhance satellite capabilities while reducing costs and improving accessibility for smaller organizations and specialized applications. Next-generation satellites will offer improved resolution, faster revisit times, and enhanced spectral capabilities that enable new applications and improve existing ones. The integration of satellite systems with other technologies will create comprehensive monitoring and analysis platforms that address complex customer requirements.

Application expansion into new market segments and use cases will drive continued growth, with particular opportunities in urban planning, infrastructure monitoring, and environmental compliance applications. The growing focus on climate change adaptation and mitigation will create substantial demand for monitoring and verification services that satellite systems are uniquely positioned to provide.

Regional development will likely see increased collaboration between Australia and New Zealand, with potential expansion into broader Asia-Pacific markets as regional capabilities mature. The development of domestic satellite assets and ground infrastructure will reduce dependence on international suppliers while creating opportunities for technology export and service delivery to neighboring countries.

Market structure evolution may see continued consolidation among service providers while new entrants focus on specialized applications and niche markets. The balance between large, comprehensive service providers and specialized niche players will likely determine competitive dynamics and innovation patterns in the coming years.

The ANZ satellite-based earth observation market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological advancement, increasing government support, and expanding commercial applications. The market benefits from strong fundamentals including vast geographical areas requiring monitoring, diverse industry sectors with earth observation needs, and supportive policy environments in both Australia and New Zealand. Key success factors for market participants include developing integrated solutions that combine satellite data with advanced analytics, building strong customer relationships based on demonstrated value delivery, and maintaining technological capabilities that adapt to evolving market requirements.

Strategic positioning within this market requires understanding of regional characteristics, customer needs, and regulatory requirements that differentiate the ANZ market from other global regions. Organizations that can effectively address local challenges while leveraging international technological capabilities will be best positioned to capture market opportunities and build sustainable competitive advantages. The growing emphasis on sustainability, climate change monitoring, and environmental compliance creates substantial opportunities for earth observation solutions that provide objective, verifiable data for decision-making and reporting purposes.

Future market development will be shaped by continued technological innovation, expanding application areas, and increasing integration with other technologies and business processes. The market’s evolution toward cloud-based platforms, artificial intelligence integration, and real-time monitoring capabilities will continue to improve accessibility and value delivery for customers across all sectors. As the market matures, successful organizations will be those that can demonstrate clear return on investment, provide comprehensive solutions addressing specific customer challenges, and maintain technological leadership in rapidly evolving competitive landscape.

What is Satellite-based Earth Observation?

Satellite-based Earth Observation refers to the collection and analysis of data about the Earth’s surface and atmosphere using satellite technology. This includes applications in agriculture, forestry, urban planning, and environmental monitoring.

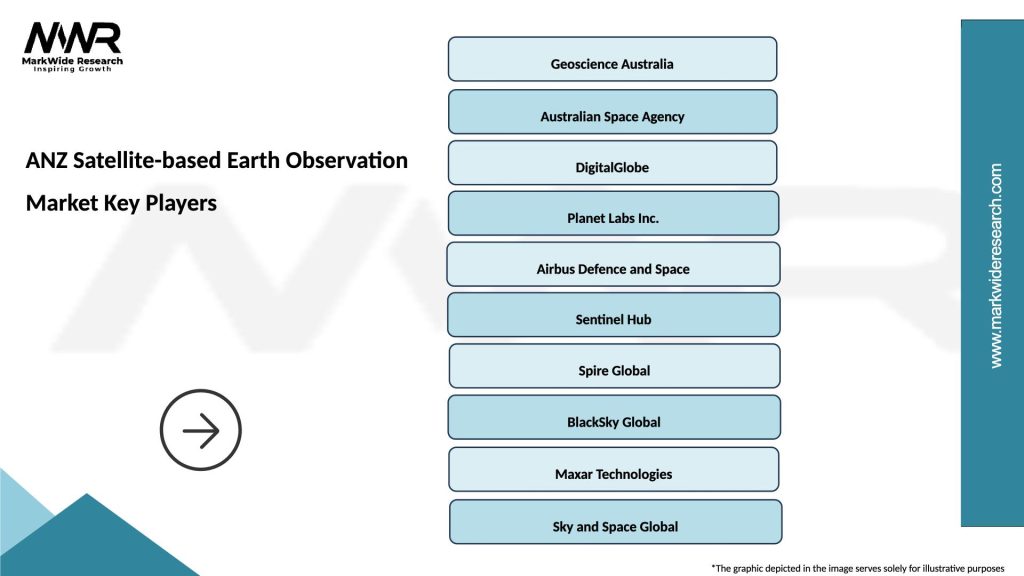

What are the key players in the ANZ Satellite-based Earth Observation Market?

Key players in the ANZ Satellite-based Earth Observation Market include companies like Airbus, Maxar Technologies, and Planet Labs, which provide satellite imagery and data analytics services, among others.

What are the main drivers of the ANZ Satellite-based Earth Observation Market?

The main drivers of the ANZ Satellite-based Earth Observation Market include the increasing demand for accurate environmental monitoring, advancements in satellite technology, and the growing need for data in sectors such as agriculture and disaster management.

What challenges does the ANZ Satellite-based Earth Observation Market face?

Challenges in the ANZ Satellite-based Earth Observation Market include high costs associated with satellite launches and maintenance, regulatory hurdles, and the need for advanced data processing capabilities to handle large volumes of data.

What opportunities exist in the ANZ Satellite-based Earth Observation Market?

Opportunities in the ANZ Satellite-based Earth Observation Market include the potential for new applications in climate change monitoring, urban development, and resource management, as well as partnerships between private companies and government agencies.

What trends are shaping the ANZ Satellite-based Earth Observation Market?

Trends shaping the ANZ Satellite-based Earth Observation Market include the rise of small satellite constellations, increased use of artificial intelligence for data analysis, and a growing emphasis on sustainability and environmental protection.

ANZ Satellite-based Earth Observation Market

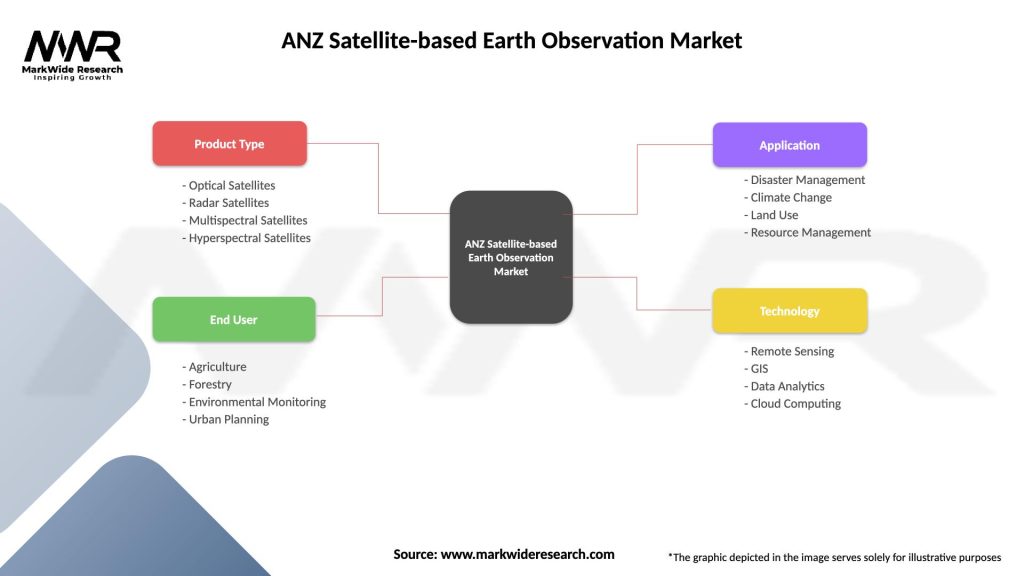

| Segmentation Details | Description |

|---|---|

| Product Type | Optical Satellites, Radar Satellites, Multispectral Satellites, Hyperspectral Satellites |

| End User | Agriculture, Forestry, Environmental Monitoring, Urban Planning |

| Application | Disaster Management, Climate Change, Land Use, Resource Management |

| Technology | Remote Sensing, GIS, Data Analytics, Cloud Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the ANZ Satellite-based Earth Observation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at