444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The antihypertensive market plays a crucial role in the healthcare industry, as it addresses one of the most prevalent and significant health concerns worldwide – hypertension. Hypertension, or high blood pressure, affects millions of people globally and is a major risk factor for cardiovascular diseases. The demand for antihypertensive medications continues to rise as the global population ages and the prevalence of hypertension increases. This market analysis provides a comprehensive overview of the antihypertensive market, examining its meaning, executive summary, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, COVID-19 impact, key industry developments, analyst suggestions, future outlook, and conclusion.

The term “antihypertensive” refers to medications or treatments used to manage high blood pressure. These medications work by relaxing blood vessels, reducing the volume of blood, or decreasing the force of blood against the arterial walls. By controlling blood pressure, antihypertensive drugs aim to reduce the risk of complications associated with hypertension, such as heart attacks, strokes, and kidney problems. The antihypertensive market encompasses a wide range of pharmaceuticals, including beta-blockers, angiotensin-converting enzyme (ACE) inhibitors, calcium channel blockers, diuretics, and others.

Executive Summary

The executive summary provides a concise overview of the antihypertensive market, highlighting key findings and insights. It summarizes the market size, growth rate, major players, and key trends. This section serves as a quick reference for readers seeking an overview of the market analysis.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

High Disease Burden: More than one in three adults globally has hypertension, with prevalence rising sharply in low- and middle-income countries.

Combination Therapy Uptake: Fixed-dose combinations now account for over 30% of prescriptions, improving control rates and simplifying regimens.

Generic Penetration: Off-patent drugs represent over 60% of market volume, driving affordability but pressuring branded revenues.

Digital Adherence Tools: The integration of mobile apps and connected pill packs is emerging to address non-compliance, which affects up to 50% of patients.

COVID-19 Influence: Although initial concerns about ACE inhibitor safety were dispelled, the pandemic highlighted the vulnerability of hypertensive patients and underscored the need for remote care solutions.

Market Drivers

Aging Populations: Increased longevity raises the incidence of age-related hypertension, expanding the patient pool.

Lifestyle Factors: Sedentary habits, poor diets, and rising obesity rates elevate hypertension prevalence worldwide.

Healthcare Access: Broader insurance coverage and government initiatives in emerging economies improve diagnosis and treatment rates.

Clinical Guidelines: Updated recommendations advocating earlier and more aggressive blood pressure targets boost therapy initiation.

Combination Products: Fixed-dose combinations simplify treatment, improve adherence, and reduce pill burden, driving prescription volumes.

Market Restraints

Adverse Effects: Side effects—such as cough with ACE inhibitors or electrolyte imbalances with diuretics—can limit patient compliance.

Cost Pressures: In mature markets, pricing reforms and reimbursement cuts strain profit margins, especially for branded products.

Therapeutic Inertia: Clinician reluctance to intensify therapy despite uncontrolled blood pressure hampers optimization of regimens.

Access Gaps: In rural or resource-limited settings, lack of diagnostic infrastructure and medication availability restrict treatment uptake.

Generic Competition: Once patents expire, rapid generic entry substantially reduces revenue potential for originator companies.

Market Opportunities

Novel Mechanisms: Emerging therapies—such as neprilysin inhibitors combined with ARBs—offer new avenues for better blood pressure control.

Digital Health Integration: Remote monitoring platforms and AI-driven risk stratification tools can enhance patient engagement and clinical decision-making.

Emerging Markets: Expanding middle-class populations in Asia, Africa, and Latin America present high-growth opportunities for both generics and branded therapies.

Personalized Medicine: Pharmacogenomic insights could tailor antihypertensive selection to individual patient profiles, optimizing efficacy and safety.

Preventive Cardiology: Collaborations with lifestyle-modification programs and telehealth platforms can position antihypertensives within holistic cardiovascular risk management.

Market Dynamics

Shift to Single-Pill Combinations: Growing clinician preference for multi-agent tablets to reduce complexity and improve adherence.

Value-Based Reimbursement: Payers are incentivizing outcomes over volume, rewarding therapies and support programs that demonstrably lower cardiovascular event rates.

M&A Activity: Consolidation among pharmaceutical companies drives portfolio expansion in cardiovascular and metabolic disease franchises.

Patient Empowerment: Wearable blood pressure monitors and digital coaching apps foster self-management and timely therapy adjustments.

Regulatory Evolution: Accelerated approval pathways and real-world evidence requirements are reshaping how new antihypertensives gain market access.

Regional Analysis

North America: Holds the largest revenue share due to high diagnosis rates, access to innovative therapies, and widespread use of digital health solutions.

Europe: Mature markets with robust generic uptake; Eastern European countries are witnessing accelerated growth as healthcare systems modernize.

Asia Pacific: Fastest-growing region driven by government screening programs, rising urbanization, and expanding pharmaceutical manufacturing capacity.

Latin America: Improving insurance coverage and local generic production support steady market expansion, though economic volatility can impact affordability.

Middle East & Africa: Nascent market development; growing awareness and infrastructure investments are needed to realize full potential.

Competitive Landscape

Leading Companies in the Antihypertensive Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

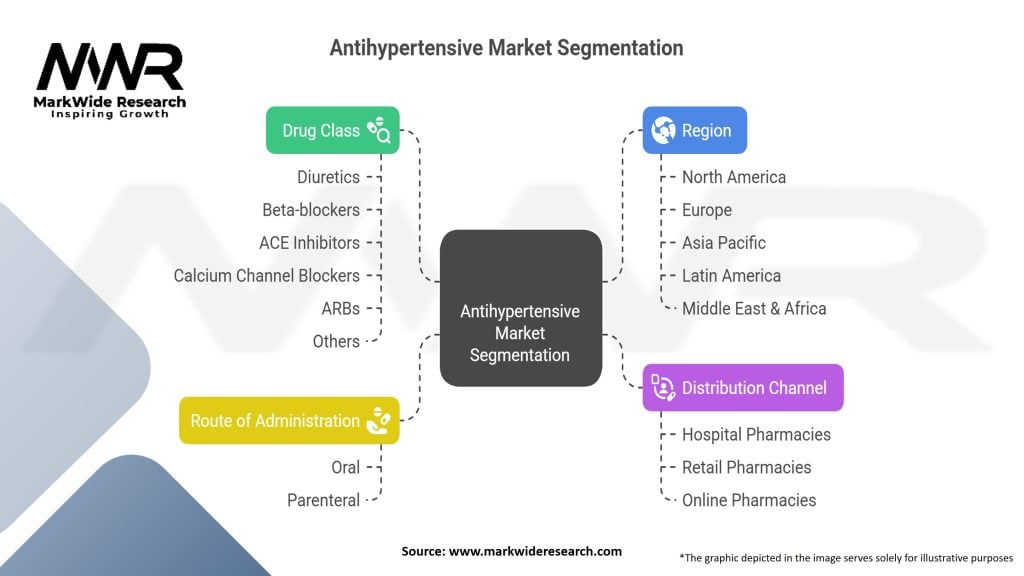

Segmentation

By Drug Class: ACE Inhibitors, ARBs, Calcium Channel Blockers, Beta-Blockers, Diuretics, Others (renin inhibitors, vasodilators).

By Therapy Type: Monotherapy, Combination Therapy (single-pill, co-pack).

By Distribution Channel: Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Clinics.

By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

Category-wise Insights

ACE Inhibitors: Remain first-line in many guidelines; generics dominate volume but branded enalapril-based combinations retain premium pricing.

ARBs: Widely prescribed due to favorable side-effect profiles; fixed combinations with diuretics are top sellers.

CCBs: Preferred in elderly and certain ethnic populations; long-acting formulations support once-daily dosing.

Beta-Blockers: Reserved for patients with comorbid cardiovascular conditions; usage declining as first-line therapy but stable in secondary prevention.

Diuretics: Thiazide diuretics remain low-cost backbone therapy, especially in resource-limited settings.

Key Benefits for Industry Participants and Stakeholders

Improved Outcomes: Effective antihypertensive regimens reduce hospitalizations for stroke and heart failure, lowering overall healthcare costs.

Affordability: Generic penetration expands access while branded companies leverage value-added services (e.g., digital adherence programs) to differentiate.

Portfolio Diversification: Combination products allow pharmaceutical firms to maintain market share post-patent expiry.

Regulatory Incentives: Orphan-drug and expedited-approval designations for novel agents can shorten time to market.

Cross-Sector Collaboration: Partnerships with technology providers and payers enable integrated care pathways and performance-based contracts.

SWOT Analysis

Strengths:

Extensive clinical evidence base and well-established treatment guidelines.

Diverse range of drug classes enabling personalized therapy.

Weaknesses:

High rates of non-adherence undermine therapeutic efficacy.

Side-effect profiles can necessitate frequent dose adjustments or class switching.

Opportunities:

Digital health innovations to monitor adherence, blood pressure control, and patient education.

Development of novel dual-action molecules and long-acting injectables for improved convenience.

Threats:

Pricing pressures and reimbursement challenges in mature markets.

Emergence of alternative therapies, such as device-based renal denervation, could disrupt pharmacotherapy.

Market Key Trends

Single-Pill Triple Combinations: Clinical trials of three-agent tablets show superior control rates and may redefine standard of care.

Renal Denervation Devices: Interventional procedures targeting sympathetic nerves are under evaluation as adjuncts or alternatives to lifelong medication.

Telemedicine Expansion: Virtual hypertension clinics and remote titration models are gaining acceptance among payers and providers.

Precision Medicine: Biomarker-driven approaches may identify patients who benefit most from specific antihypertensive classes.

Sustainability Initiatives: Eco-friendly packaging and carbon-neutral manufacturing processes are emerging in pharmaceutical supply chains.

COVID-19 Impact

The COVID-19 impact section discusses the effects of the pandemic on the antihypertensive market. It analyzes how the healthcare landscape has been transformed, the impact on drug development and approval processes, disruptions in the supply chain, and changes in patient behavior and treatment-seeking patterns. Understanding the COVID-19 impact is crucial for market participants to navigate the challenges posed by the pandemic and identify new growth opportunities.

Key Industry Developments

The key industry developments section provides insights into recent developments and innovations within the antihypertensive market. It covers topics such as new drug approvals, clinical trials, research findings, collaborations, and partnerships. Staying informed about key industry developments enables stakeholders to anticipate market trends and seize opportunities.

Analyst Suggestions

The analyst suggestions section offers recommendations and insights from industry experts and analysts. It provides guidance to market participants on strategies, such as product development, geographical expansion, marketing campaigns, and partnerships, to maximize their success in the antihypertensive market. This section serves as a valuable resource for decision-making and strategic planning.

Future Outlook

The future outlook section provides a forward-looking perspective on the antihypertensive market. It discusses anticipated market trends, growth opportunities, challenges, and technological advancements that are likely to shape the market in the coming years. This section helps market participants understand the long-term prospects of the market and make informed decisions regarding investments and business strategies.

Conclusion

In conclusion, the antihypertensive market is witnessing significant growth due to the increasing prevalence of hypertension worldwide. However, the market faces challenges such as stringent regulatory requirements and the availability of alternative treatments. Despite these challenges, there are numerous opportunities for market players to tap into emerging markets, innovate in drug delivery systems, and collaborate with key stakeholders. By understanding the market dynamics, leveraging key trends, and adapting to the evolving landscape, industry participants can capitalize on the growing demand for antihypertensive medications and contribute to improved patient outcomes and better cardiovascular health globally.

What is the definition of antihypertensive?

Antihypertensive refers to a class of medications used to treat high blood pressure, also known as hypertension. These drugs work by various mechanisms to lower blood pressure and reduce the risk of cardiovascular diseases.

Who are the key players in the antihypertensive market?

Key players in the antihypertensive market include Pfizer, Novartis, Merck, and AstraZeneca, among others. These companies are involved in the development and distribution of various antihypertensive medications.

What are the main drivers of growth in the antihypertensive market?

The main drivers of growth in the antihypertensive market include the increasing prevalence of hypertension, rising awareness about cardiovascular health, and advancements in drug formulations. Additionally, an aging population contributes to the demand for effective antihypertensive treatments.

What challenges does the antihypertensive market face?

The antihypertensive market faces challenges such as the emergence of generic drugs, which can reduce profit margins for branded medications. Furthermore, patient adherence to treatment regimens and potential side effects can hinder effective management of hypertension.

What opportunities exist in the antihypertensive market?

Opportunities in the antihypertensive market include the development of combination therapies that enhance treatment efficacy and patient compliance. Additionally, increasing investment in research and development for novel antihypertensive agents presents significant growth potential.

What trends are shaping the antihypertensive market?

Trends shaping the antihypertensive market include a shift towards personalized medicine, where treatments are tailored to individual patient profiles. There is also a growing focus on digital health solutions, such as mobile apps for monitoring blood pressure and medication adherence.

Antihypertensive Market:

| Segmentation Details | Description |

|---|---|

| Drug Class | Diuretics, Beta-blockers, ACE Inhibitors, Calcium Channel Blockers, Angiotensin II Receptor Blockers (ARBs), Others |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies |

| Route of Administration | Oral, Parenteral |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Antihypertensive Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at