444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Anti-Money Laundering (AML) systems market is witnessing robust growth as financial institutions and regulatory authorities intensify their efforts to combat financial crime, terrorist financing, and money laundering activities. AML systems play a crucial role in detecting and preventing illicit financial transactions by analyzing vast amounts of data, identifying suspicious patterns and behaviors, and ensuring compliance with regulatory requirements. With the increasing sophistication of financial crimes, the emergence of new technologies, and the evolving regulatory landscape, the AML systems market is experiencing rapid innovation and expansion, driving demand for advanced solutions and services.

Meaning

Anti-Money Laundering (AML) systems are software solutions and platforms designed to help financial institutions and other organizations detect, prevent, and report suspicious activities related to money laundering, terrorist financing, and other financial crimes. These systems leverage advanced analytics, machine learning, and artificial intelligence to analyze transaction data, customer information, and other relevant data sources, flagging potential risks and anomalies for further investigation. AML systems enable organizations to comply with regulatory requirements, mitigate financial crime risks, and safeguard their reputation and integrity.

Executive Summary

The Anti-Money Laundering (AML) systems market is experiencing significant growth driven by factors such as increasing regulatory scrutiny, rising financial crime risks, technological advancements, and the growing adoption of digital banking and payment solutions. Financial institutions are under pressure to strengthen their AML compliance programs, enhance their detection capabilities, and improve their operational efficiency in response to evolving threats and regulatory requirements. As a result, the demand for AML systems and solutions is expected to continue growing, presenting lucrative opportunities for vendors and service providers in the market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The AML systems market operates in a dynamic and evolving environment characterized by changing regulatory requirements, technological advancements, emerging threats, and shifting market trends. Organizations must navigate these dynamics by investing in advanced AML solutions, enhancing their AML capabilities, and adapting their compliance strategies to address evolving risks and regulatory expectations effectively. Collaboration, innovation, and strategic partnerships are essential for organizations to stay ahead of financial crime risks and maintain trust and confidence in the integrity of the financial system.

Regional Analysis

The AML systems market exhibits regional variations in adoption rates, regulatory frameworks, and market maturity, reflecting differences in regulatory requirements, enforcement practices, and financial crime risks across jurisdictions. While developed markets such as North America and Europe lead in terms of AML compliance standards and technology adoption, emerging markets in Asia Pacific, Latin America, and Africa present significant growth opportunities for AML solution providers as regulatory scrutiny increases, financial markets develop, and organizations seek to enhance their AML capabilities to combat money laundering and other financial crimes effectively.

Competitive Landscape

Leading Companies in the Anti-Money Laundering Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

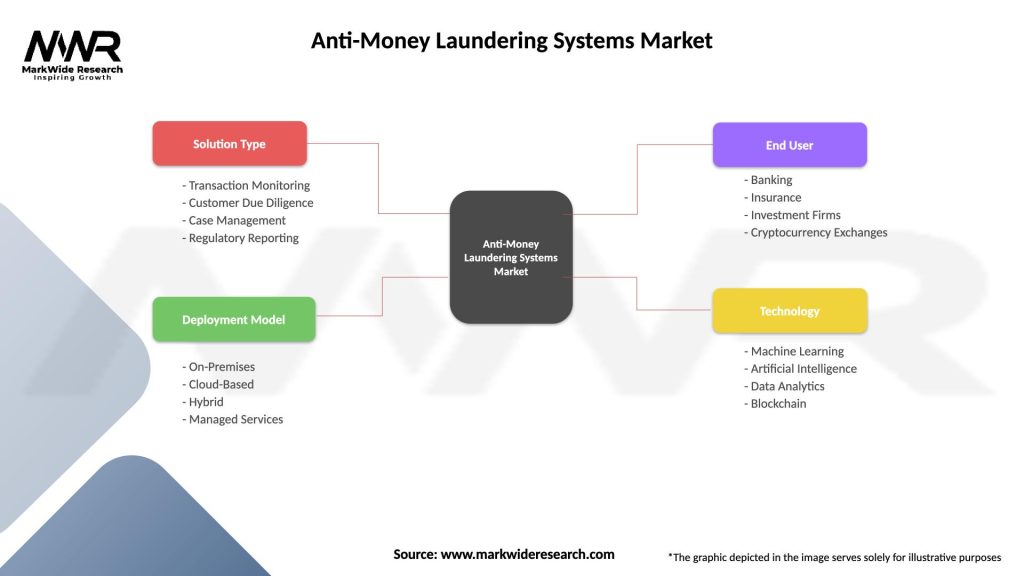

The AML systems market can be segmented based on various factors such as:

Segmentation provides insights into market dynamics, customer needs, and competitive trends, enabling AML solution providers to tailor their products, services, and go-to-market strategies to specific market segments effectively.

Category-wise Insights

Key Benefits for Organizations

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated the adoption of AML systems as organizations seek to mitigate financial crime risks, comply with regulatory requirements, and adapt to remote working environments. The shift towards digital banking, online payments, and mobile financial services has increased the volume and complexity of financial transactions, making it essential for organizations to enhance their AML capabilities and invest in advanced AML solutions that can effectively monitor and analyze digital transactions, detect suspicious activities, and ensure regulatory compliance in the digital environment.

Key Industry Developments

Analyst Suggestions

Future Outlook

The AML systems market is poised for continued growth and innovation as organizations seek to strengthen their AML compliance programs, enhance their detection capabilities, and adapt to evolving financial crime risks and regulatory requirements. Key drivers of market growth include increasing regulatory scrutiny, rising financial crime risks, technological advancements, and the growing adoption of digital banking and payment solutions. However, organizations must navigate challenges such as regulatory uncertainty, cybersecurity risks, and competition from non-traditional players to capitalize on opportunities for market expansion and differentiation. Collaboration, innovation, and strategic partnerships will be essential for AML solution providers to thrive in the dynamic and competitive landscape and contribute to the fight against financial crime effectively.

Conclusion

The Anti-Money Laundering (AML) systems market is witnessing robust growth and innovation driven by increasing regulatory scrutiny, rising financial crime risks, technological advancements, and the growing adoption of digital banking and payment solutions. AML systems play a critical role in helping organizations detect, prevent, and report suspicious activities related to money laundering, terrorist financing, and other financial crimes by analyzing transaction data, identifying suspicious patterns and anomalies, and ensuring compliance with regulatory requirements. As organizations seek to strengthen their AML compliance programs, enhance their detection capabilities, and adapt to evolving financial crime risks and regulatory requirements, the demand for advanced AML solutions and services is expected to continue growing, presenting lucrative opportunities for vendors and service providers in the market. By investing in technology, enhancing collaboration, focusing on regulatory compliance, and expanding market reach, AML solution providers can position themselves for success in the dynamic and competitive landscape and contribute to the fight against financial crime effectively.

What is Anti-Money Laundering Systems?

Anti-Money Laundering Systems refer to the technologies and processes used by financial institutions and other regulated entities to detect and prevent money laundering activities. These systems help in monitoring transactions, identifying suspicious activities, and ensuring compliance with legal regulations.

What are the key players in the Anti-Money Laundering Systems Market?

Key players in the Anti-Money Laundering Systems Market include companies like FICO, SAS Institute, Oracle, and Amlify, which provide various solutions for transaction monitoring and compliance management, among others.

What are the main drivers of growth in the Anti-Money Laundering Systems Market?

The growth of the Anti-Money Laundering Systems Market is driven by increasing regulatory requirements, the rise in financial crimes, and the need for enhanced security measures in financial transactions. Additionally, advancements in technology, such as AI and machine learning, are also contributing to market expansion.

What challenges does the Anti-Money Laundering Systems Market face?

The Anti-Money Laundering Systems Market faces challenges such as the high cost of implementation, the complexity of regulatory compliance, and the need for continuous updates to combat evolving money laundering techniques. Additionally, there is often a shortage of skilled professionals to manage these systems effectively.

What opportunities exist in the Anti-Money Laundering Systems Market?

Opportunities in the Anti-Money Laundering Systems Market include the integration of advanced technologies like blockchain for enhanced transparency, the growing demand for cloud-based solutions, and the expansion of services to emerging markets. These factors can lead to innovative solutions and increased market penetration.

What trends are shaping the Anti-Money Laundering Systems Market?

Trends in the Anti-Money Laundering Systems Market include the adoption of artificial intelligence for better risk assessment, the use of big data analytics for improved transaction monitoring, and a shift towards automated compliance processes. These trends are helping organizations to enhance their detection capabilities and streamline operations.

Anti-Money Laundering Systems Market

| Segmentation Details | Description |

|---|---|

| Solution Type | Transaction Monitoring, Customer Due Diligence, Case Management, Regulatory Reporting |

| Deployment Model | On-Premises, Cloud-Based, Hybrid, Managed Services |

| End User | Banking, Insurance, Investment Firms, Cryptocurrency Exchanges |

| Technology | Machine Learning, Artificial Intelligence, Data Analytics, Blockchain |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Anti-Money Laundering Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at