444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The animal hospitals and veterinary clinics services market is an essential component of the global veterinary healthcare industry, providing a wide range of medical, surgical, and diagnostic services for companion animals, livestock, and exotic pets. These facilities serve as primary care providers, offering preventive care, treatment of illnesses and injuries, surgical procedures, and specialized medical services, thereby ensuring the health and well-being of animals and fostering the human-animal bond. With a growing emphasis on pet ownership, animal welfare, and preventive healthcare, the demand for veterinary services continues to rise, driving market growth and innovation.

Meaning

Animal hospitals and veterinary clinics provide comprehensive healthcare services for animals, ranging from routine wellness exams and vaccinations to advanced surgical procedures and emergency care. These facilities are staffed by veterinarians, veterinary technicians, and support staff trained in animal medicine and surgery, equipped with state-of-the-art diagnostic equipment and treatment modalities. They play a crucial role in promoting animal health, preventing the spread of diseases, and addressing the medical needs of pets, livestock, and exotic animals, contributing to the overall well-being of communities and society.

Executive Summary

The animal hospitals and veterinary clinics services market is experiencing steady growth, driven by factors such as increasing pet ownership, rising demand for preventive healthcare, advancements in veterinary medicine, and growing awareness of animal welfare. With a diverse range of services catering to companion animals, livestock, and specialty pets, veterinary facilities play a pivotal role in meeting the healthcare needs of animals and fostering responsible pet ownership. As the market continues to evolve, stakeholders must adapt to changing consumer preferences, technological advancements, and regulatory requirements to sustain growth and enhance service quality.

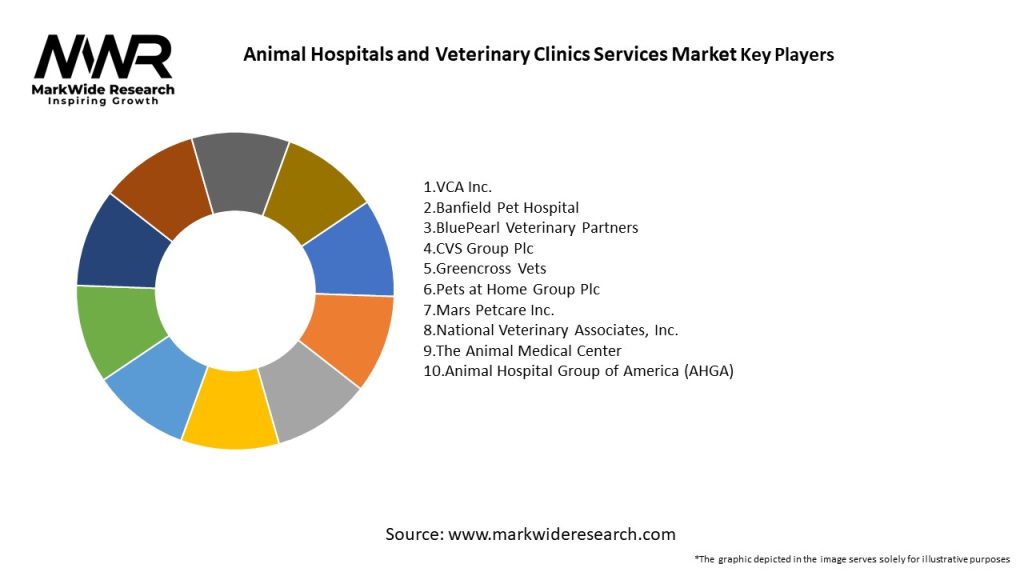

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The animal hospitals and veterinary clinics services market operates within a dynamic landscape shaped by various internal and external factors:

Regional Analysis

The animal hospitals and veterinary clinics services market exhibits regional variations in market size, growth trajectory, and competitive landscape:

Competitive Landscape

Leading Companies in the Animal Hospitals and Veterinary Clinics Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

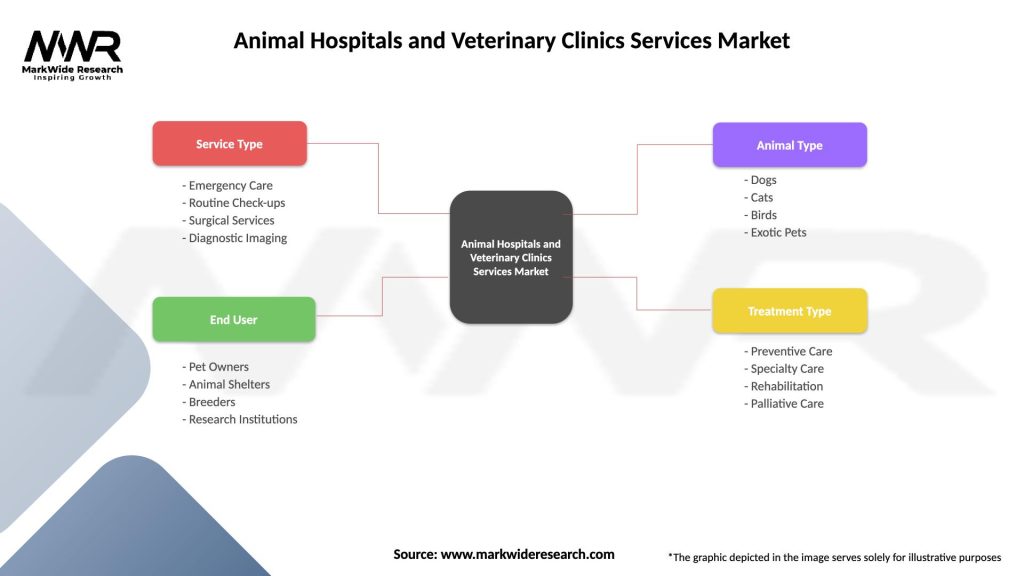

Segmentation

The animal hospitals and veterinary clinics services market can be segmented based on various factors, including:

Segmentation facilitates targeted market analysis, enabling stakeholders to identify niche opportunities, tailor product offerings, and devise region-specific marketing strategies.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Understanding these factors through a SWOT analysis enables veterinary practices to capitalize on strengths, address weaknesses, leverage opportunities, and mitigate threats, optimizing their competitive positioning and strategic decision-making.

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has reshaped the landscape of the animal hospitals and veterinary clinics services market, leading to significant shifts in service delivery, client engagement, and practice operations:

Key Industry Developments

Analyst Suggestions

Future Outlook

The animal hospitals and veterinary clinics services market is poised for continued growth and innovation, driven by factors such as pet humanization, advances in veterinary medicine, and evolving consumer preferences:

By embracing technological advancements, client-centered care models, and workforce development initiatives, veterinary practices can navigate market dynamics, seize growth opportunities, and deliver superior healthcare services, ensuring the health, welfare, and happiness of animals worldwide.

Conclusion

The animal hospitals and veterinary clinics services market plays a pivotal role in safeguarding the health, welfare, and well-being of animals, promoting responsible pet ownership, and advancing veterinary medicine. With a commitment to clinical excellence, client satisfaction, and continuous innovation, veterinary practices are poised to thrive in a dynamic and evolving healthcare landscape, addressing the diverse needs of animals and their human companions. As the market continues to evolve, stakeholders must adapt to changing consumer preferences, technological advancements, and regulatory requirements, leveraging collaboration, innovation, and compassion to shape the future of veterinary healthcare.

What is Animal Hospitals and Veterinary Clinics Services?

Animal Hospitals and Veterinary Clinics Services refer to the range of medical and surgical care provided to pets and other animals. This includes routine check-ups, emergency care, vaccinations, and specialized treatments for various health conditions.

What are the key players in the Animal Hospitals and Veterinary Clinics Services Market?

Key players in the Animal Hospitals and Veterinary Clinics Services Market include Banfield Pet Hospital, VCA Animal Hospitals, and PetSmart Veterinary Services, among others. These companies provide a variety of services, including preventive care, diagnostics, and surgical procedures.

What are the growth factors driving the Animal Hospitals and Veterinary Clinics Services Market?

The growth of the Animal Hospitals and Veterinary Clinics Services Market is driven by increasing pet ownership, rising awareness of animal health, and advancements in veterinary technology. Additionally, the growing trend of pet humanization is leading to higher spending on veterinary services.

What challenges does the Animal Hospitals and Veterinary Clinics Services Market face?

The Animal Hospitals and Veterinary Clinics Services Market faces challenges such as the high cost of veterinary care, a shortage of qualified veterinary professionals, and increasing competition among clinics. These factors can impact service accessibility and affordability for pet owners.

What opportunities exist in the Animal Hospitals and Veterinary Clinics Services Market?

Opportunities in the Animal Hospitals and Veterinary Clinics Services Market include the expansion of telemedicine services, the development of specialized veterinary services, and the integration of wellness programs. These trends can enhance service delivery and improve animal health outcomes.

What trends are shaping the Animal Hospitals and Veterinary Clinics Services Market?

Trends shaping the Animal Hospitals and Veterinary Clinics Services Market include the increasing use of technology in diagnostics and treatment, the rise of pet insurance, and a focus on preventive care. These trends are influencing how veterinary services are delivered and accessed.

Animal Hospitals and Veterinary Clinics Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Emergency Care, Routine Check-ups, Surgical Services, Diagnostic Imaging |

| End User | Pet Owners, Animal Shelters, Breeders, Research Institutions |

| Animal Type | Dogs, Cats, Birds, Exotic Pets |

| Treatment Type | Preventive Care, Specialty Care, Rehabilitation, Palliative Care |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Animal Hospitals and Veterinary Clinics Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at