444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The animal complete feed market plays a crucial role in the global agricultural and livestock industries, providing essential nutrition for various animals, including poultry, cattle, swine, and aquaculture species. Complete feeds are formulated to meet the specific dietary requirements of animals at different stages of growth and production. This market encompasses a wide range of feed types, including pellets, mash, and extruded feeds, tailored to optimize animal health, performance, and overall productivity.

Meaning

Animal complete feed refers to nutritionally balanced feed formulations that contain all essential nutrients, vitamins, and minerals required by animals for growth, maintenance, and reproduction. These feeds are designed to provide a convenient and cost-effective solution for farmers and livestock producers, ensuring consistent nutritional intake and supporting optimal animal health.

Executive Summary

The animal complete feed market has witnessed steady growth driven by increasing global demand for protein-rich diets, rising meat consumption, and advancements in feed technology. Key market players are focusing on innovation, quality assurance, and sustainable practices to meet evolving consumer preferences and regulatory standards. Understanding market dynamics, consumer trends, and competitive landscapes is crucial for stakeholders aiming to capitalize on emerging opportunities and navigate challenges.

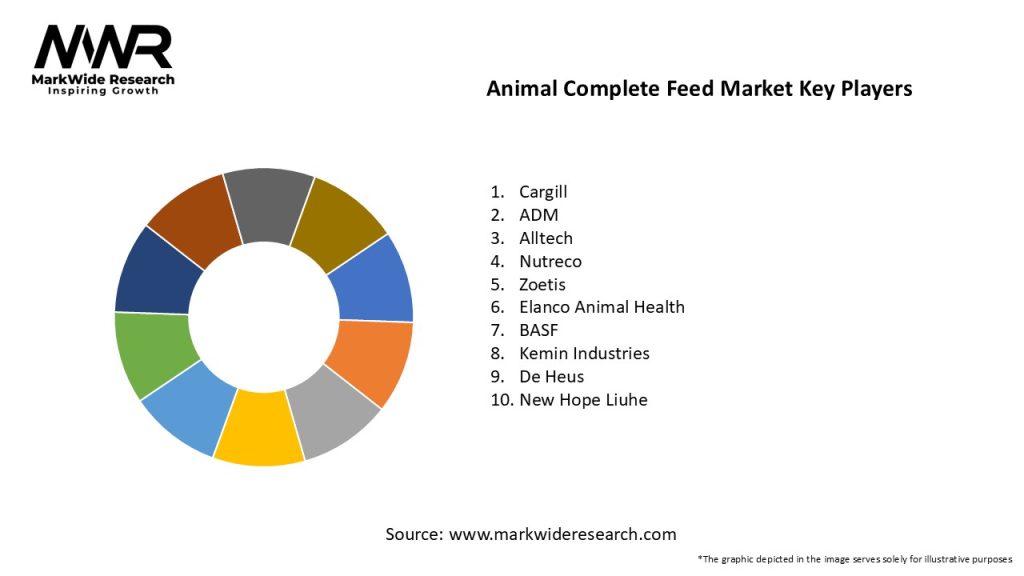

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The animal complete feed market operates in a dynamic environment influenced by economic trends, technological advancements, regulatory frameworks, and consumer behavior shifts. Understanding these dynamics is essential for stakeholders to innovate, adapt strategies, and capitalize on growth opportunities in the global agricultural and livestock sectors.

Regional Analysis

The market exhibits regional variations influenced by factors such as agricultural practices, livestock farming intensification, dietary habits, and regulatory landscapes. Key regions include North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, each presenting unique market dynamics and growth potential for animal complete feed manufacturers and suppliers.

Competitive Landscape

Leading Companies in the Animal Complete Feed Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

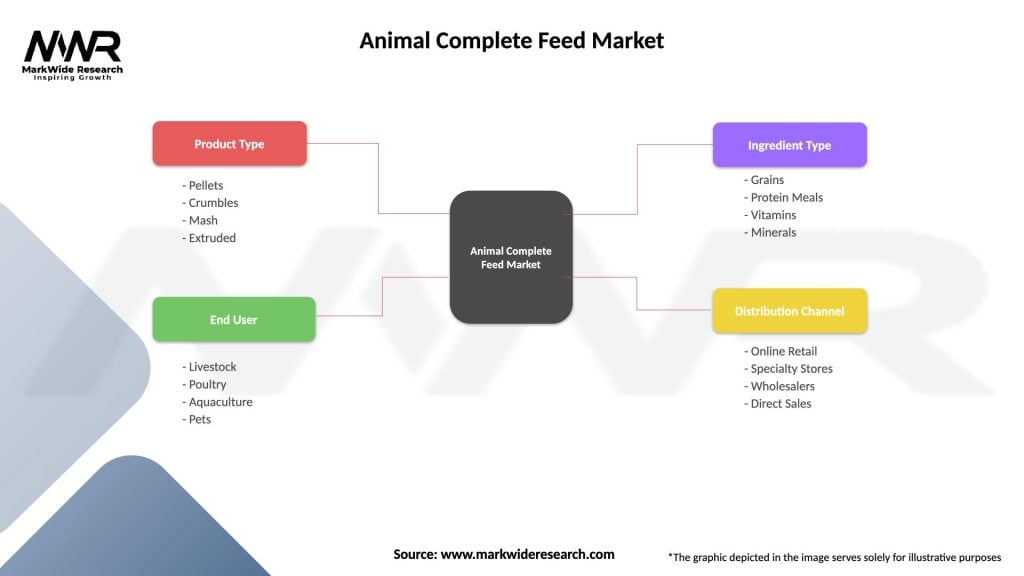

The market can be segmented based on:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic highlighted the resilience of the animal complete feed sector:

Key Industry Developments

Analyst Suggestions

Future Outlook

The animal complete feed market is poised for growth driven by increasing global protein demand, technological advancements, and sustainability imperatives. Continued focus on innovation, regulatory compliance, and market expansion strategies will be critical to navigating challenges and capitalizing on emerging opportunities in the dynamic agricultural and livestock sectors.

Conclusion

In conclusion, the animal complete feed market stands at a pivotal juncture characterized by dynamic growth opportunities and evolving challenges. The sector’s resilience during the COVID-19 pandemic underscored its critical role in sustaining global food security and animal nutrition. Looking ahead, the market is poised for continued expansion driven by escalating meat consumption, burgeoning aquaculture production, and the imperative shift towards sustainable agricultural practices.

The future landscape will be shaped by key trends such as personalized nutrition solutions, digital transformation, and the adoption of alternative proteins. Innovations in precision feeding technologies, blockchain-enabled traceability, and regenerative agriculture will redefine industry standards and operational efficiencies. Moreover, heightened consumer awareness regarding food safety, ethical sourcing, and environmental stewardship will necessitate stringent compliance and transparency across the supply chain.

To capitalize on emerging opportunities, industry stakeholders must prioritize strategic investments in research and development, forge collaborative partnerships, and embrace agile business models. Addressing challenges related to raw material volatility, regulatory complexities, and global economic uncertainties will be imperative for sustained market competitiveness.

What is Animal Complete Feed?

Animal Complete Feed refers to a type of animal nutrition product that provides all essential nutrients required for the growth, maintenance, and reproduction of livestock and pets. This feed is formulated to meet the dietary needs of various animals, including cattle, poultry, and companion animals.

What are the key players in the Animal Complete Feed Market?

Key players in the Animal Complete Feed Market include Cargill, Archer Daniels Midland Company, and Nutreco, among others. These companies are known for their extensive product lines and innovations in animal nutrition.

What are the main drivers of growth in the Animal Complete Feed Market?

The main drivers of growth in the Animal Complete Feed Market include the increasing demand for high-quality animal protein, the rise in livestock production, and advancements in feed formulation technologies. Additionally, consumer awareness regarding animal health and nutrition is contributing to market expansion.

What challenges does the Animal Complete Feed Market face?

The Animal Complete Feed Market faces challenges such as fluctuating raw material prices, regulatory compliance issues, and the need for sustainable sourcing practices. These factors can impact production costs and availability of feed ingredients.

What opportunities exist in the Animal Complete Feed Market?

Opportunities in the Animal Complete Feed Market include the development of organic and specialty feeds, increasing investments in research and development, and the growing trend of pet humanization. These factors are likely to drive innovation and product diversification.

What trends are shaping the Animal Complete Feed Market?

Trends shaping the Animal Complete Feed Market include the rising popularity of plant-based feed ingredients, advancements in precision nutrition, and a focus on sustainability in feed production. These trends reflect changing consumer preferences and environmental considerations.

Animal Complete Feed Market

| Segmentation Details | Description |

|---|---|

| Product Type | Pellets, Crumbles, Mash, Extruded |

| End User | Livestock, Poultry, Aquaculture, Pets |

| Ingredient Type | Grains, Protein Meals, Vitamins, Minerals |

| Distribution Channel | Online Retail, Specialty Stores, Wholesalers, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Animal Complete Feed Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at