444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Angola lubricants market represents a dynamic and rapidly evolving sector within the country’s industrial landscape, driven by expanding oil and gas operations, growing automotive sector, and increasing industrial activities. Angola’s position as one of Africa’s leading oil producers has created substantial demand for high-quality lubricants across various applications, from automotive to heavy industrial machinery. The market demonstrates robust growth potential with increasing infrastructure development and foreign investment in the country’s energy sector.

Market dynamics in Angola are significantly influenced by the country’s oil-rich economy, where lubricants play a crucial role in maintaining operational efficiency across petroleum extraction, refining, and transportation activities. The automotive sector’s expansion, coupled with growing mining operations and manufacturing activities, has created diverse demand patterns for specialized lubricant products. Growth projections indicate the market is expanding at a compound annual growth rate of 6.2%, reflecting strong underlying demand fundamentals.

Regional characteristics of the Angola lubricants market include heavy reliance on imported products, though local blending and distribution capabilities are gradually developing. The market serves various end-use industries including automotive, marine, aviation, industrial machinery, and power generation sectors. Quality standards and regulatory compliance have become increasingly important as international oil companies and multinational corporations establish operations in Angola, driving demand for premium lubricant products.

The Angola lubricants market refers to the comprehensive ecosystem of lubricating oil products, greases, and specialty fluids used across automotive, industrial, and marine applications within Angola’s economy. This market encompasses the import, distribution, blending, and retail of various lubricant categories designed to reduce friction, protect equipment, and enhance operational efficiency across diverse industrial sectors.

Market scope includes engine oils for passenger cars and commercial vehicles, hydraulic fluids for industrial machinery, marine lubricants for offshore operations, aviation lubricants for the growing air transport sector, and specialized greases for mining and construction equipment. The market also covers synthetic and semi-synthetic lubricants that offer superior performance characteristics required by modern equipment and harsh operating conditions prevalent in Angola’s climate.

Value chain components within the Angola lubricants market include international suppliers, local importers and distributors, blending facilities, retail networks, and end-user industries. The market’s structure reflects Angola’s position as a developing economy with significant natural resource extraction activities, requiring reliable lubricant supply chains to support critical infrastructure and industrial operations.

Strategic positioning of the Angola lubricants market reflects the country’s economic transformation and industrial diversification efforts. The market benefits from substantial oil and gas sector activities, growing automotive ownership, and increasing foreign direct investment in various industrial sectors. Market penetration of premium lubricant brands has reached approximately 35% of total consumption, indicating growing quality consciousness among consumers and industrial users.

Key market drivers include expanding petroleum exploration and production activities, infrastructure development projects, growing vehicle fleet, and increasing industrial automation. The market faces challenges related to foreign exchange availability, import dependency, and competition from low-cost products. However, opportunities exist in developing local blending capabilities, expanding distribution networks, and introducing environmentally friendly lubricant solutions.

Competitive landscape features a mix of international lubricant manufacturers, regional distributors, and local importers. Major global brands maintain significant market presence through established distribution partnerships, while local companies focus on cost-effective solutions for price-sensitive segments. Market consolidation trends suggest increasing collaboration between international suppliers and local partners to enhance market reach and service capabilities.

Primary market insights reveal several critical factors shaping the Angola lubricants market landscape:

Economic expansion serves as the primary driver for Angola’s lubricants market, with increasing industrial activities across multiple sectors creating sustained demand for various lubricant categories. The country’s position as a major oil producer generates substantial requirements for drilling fluids, hydraulic oils, and specialized lubricants used in petroleum extraction and processing operations. Infrastructure development projects, including road construction, port facilities, and power generation, contribute significantly to lubricant consumption.

Automotive sector growth represents another crucial market driver, with increasing vehicle ownership rates and expanding commercial transportation networks. The growing middle class and improving economic conditions have led to higher car ownership, while commercial vehicle fleets supporting mining, agriculture, and logistics sectors require regular lubricant maintenance. Fleet modernization initiatives by major companies have increased demand for high-quality engine oils and transmission fluids.

Industrial diversification efforts by the Angolan government have encouraged foreign investment in manufacturing, mining, and processing industries, each requiring specific lubricant solutions. The development of special economic zones and industrial parks has attracted international companies that maintain strict equipment maintenance standards, driving demand for premium lubricant products. Technology transfer and knowledge sharing initiatives have also increased awareness of proper lubrication practices and product quality importance.

Foreign exchange constraints pose significant challenges for the Angola lubricants market, as most products require importation using hard currency. Fluctuating exchange rates and periodic foreign currency shortages can disrupt supply chains and increase product costs, affecting market accessibility for price-sensitive consumers. Import dependency creates vulnerability to international price volatility and supply disruptions, limiting market stability and predictability.

Infrastructure limitations throughout Angola restrict efficient distribution and market penetration, particularly in rural and remote areas where transportation costs can significantly increase product prices. Poor road conditions, limited storage facilities, and inadequate cold chain capabilities for certain specialized lubricants create operational challenges for distributors and suppliers. Logistical complexities often result in higher costs and reduced product availability in secondary markets.

Economic volatility related to oil price fluctuations affects overall market demand, as reduced industrial activity and consumer spending during economic downturns directly impact lubricant consumption. The country’s heavy dependence on oil revenues creates cyclical demand patterns that can challenge long-term market planning and investment decisions. Regulatory uncertainties and changing import policies can also create market instability and affect business planning for lubricant suppliers and distributors.

Local manufacturing development presents substantial opportunities for the Angola lubricants market, with potential for establishing blending facilities and packaging operations that could reduce import dependency and create employment opportunities. Government initiatives supporting local content development in the oil and gas sector could favor domestic lubricant production capabilities. Strategic partnerships between international lubricant manufacturers and local companies could facilitate technology transfer and market expansion.

Renewable energy expansion in Angola creates new market segments for specialized lubricants used in wind turbines, solar panel tracking systems, and hydroelectric facilities. The government’s commitment to diversifying energy sources beyond oil presents opportunities for lubricant suppliers to develop products tailored to renewable energy applications. Green lubricant solutions could capture market share as environmental awareness increases among industrial users.

Mining sector growth offers significant opportunities, with Angola’s mineral wealth attracting international mining companies that require high-performance lubricants for heavy equipment and processing machinery. Diamond mining, iron ore extraction, and other mineral processing activities create demand for specialized lubricants capable of operating in challenging conditions. Agricultural mechanization initiatives also present opportunities for tractor oils, hydraulic fluids, and other agricultural lubricants as farming practices modernize.

Supply chain dynamics in the Angola lubricants market are characterized by complex import procedures, multiple distribution layers, and varying service levels across different regions. International suppliers typically work through local importers and distributors who maintain inventory and provide customer service, creating a multi-tiered distribution structure. Inventory management becomes critical due to long lead times and potential supply disruptions, requiring distributors to maintain adequate stock levels while managing working capital constraints.

Pricing mechanisms reflect international crude oil prices, exchange rate fluctuations, import duties, and local distribution costs, creating dynamic pricing structures that can vary significantly across different market segments. Premium products command higher margins but require extensive technical support and customer education, while commodity lubricants compete primarily on price and availability. Market segmentation has evolved to serve different customer needs, from cost-conscious consumers to quality-focused industrial users.

Competitive dynamics involve both global lubricant brands and local distributors, with competition based on product quality, technical support, distribution coverage, and pricing strategies. MarkWide Research analysis indicates that market leadership often depends on establishing strong local partnerships and maintaining consistent product availability. Brand loyalty varies across segments, with industrial users typically prioritizing performance and reliability over price considerations.

Comprehensive research approach for analyzing the Angola lubricants market incorporates multiple data collection methodologies to ensure accuracy and reliability of market insights. Primary research involves direct interviews with key market participants including importers, distributors, end-users, and industry experts to gather firsthand information about market trends, challenges, and opportunities. Secondary research utilizes government statistics, industry reports, trade publications, and company financial statements to validate primary findings and provide historical context.

Data triangulation techniques ensure research reliability by cross-referencing information from multiple sources and validating findings through different research methods. Quantitative analysis includes statistical modeling of market trends, consumption patterns, and growth projections, while qualitative research provides insights into market dynamics, competitive positioning, and strategic considerations. Field research conducted across major Angolan cities provides regional market perspectives and identifies local market characteristics.

Market sizing methodology combines top-down and bottom-up approaches, analyzing overall economic indicators and industry-specific consumption patterns to develop comprehensive market assessments. Regular market monitoring and periodic research updates ensure that findings remain current and relevant to market participants. Expert validation processes involve review by industry specialists and market participants to confirm research accuracy and practical applicability.

Luanda Province dominates the Angola lubricants market, accounting for approximately 45% of total consumption due to its concentration of economic activity, automotive density, and industrial facilities. The capital city serves as the primary import and distribution hub, with major lubricant suppliers maintaining headquarters and main distribution centers in Luanda. Port facilities and transportation infrastructure provide advantages for product importation and distribution to other regions.

Cabinda Province represents a significant market segment driven by intensive oil and gas operations, requiring specialized lubricants for drilling, production, and transportation activities. The province’s offshore petroleum operations create demand for marine lubricants, hydraulic fluids, and high-performance engine oils. Industrial concentration in Cabinda results in higher per-capita lubricant consumption compared to other provinces.

Interior provinces including Huambo, Benguela, and Huíla show growing lubricant demand driven by agricultural activities, mining operations, and transportation networks. These regions face distribution challenges due to infrastructure limitations but represent significant growth opportunities as economic development expands beyond coastal areas. Regional distribution strategies must account for varying infrastructure quality and market accessibility across different provinces.

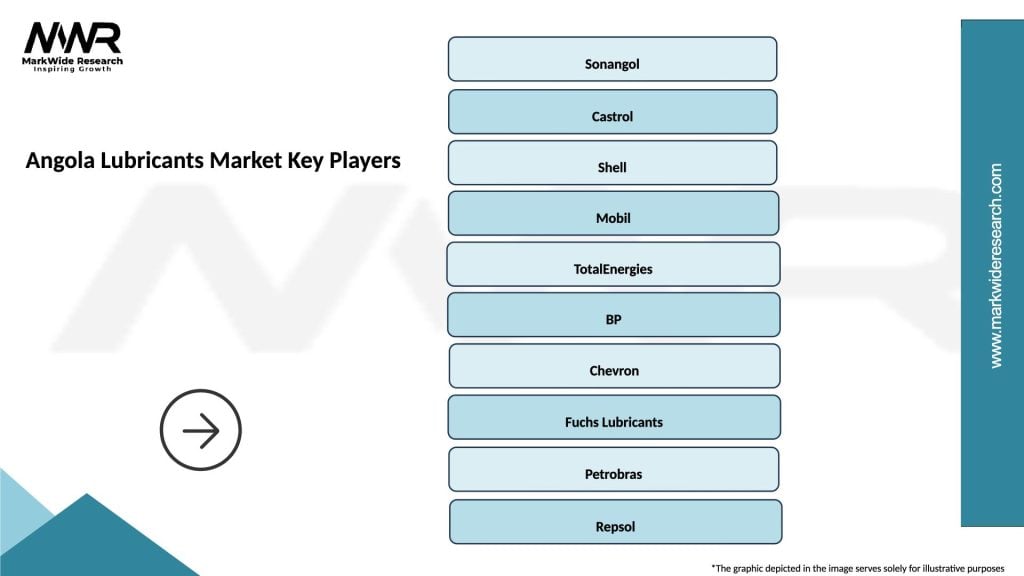

Market leadership in the Angola lubricants sector is shared among several international and regional players, each with distinct competitive advantages and market positioning strategies:

Competitive strategies vary across market segments, with premium brands emphasizing product quality, technical support, and brand reputation, while value-oriented suppliers focus on competitive pricing and broad market coverage. Partnership approaches between international suppliers and local distributors have become increasingly important for market success, combining global expertise with local market knowledge and relationships.

By Product Type:

By End-Use Industry:

By Distribution Channel:

Automotive lubricants represent the largest category within the Angola market, driven by increasing vehicle ownership and growing awareness of proper maintenance practices. Engine oils dominate this segment, with multigrade products gaining popularity due to Angola’s varying climate conditions. Premium synthetic oils are experiencing growth among affluent consumers and commercial fleet operators who prioritize equipment protection and extended service intervals.

Industrial lubricants constitute a critical market category, particularly hydraulic fluids and gear oils used in mining, construction, and manufacturing operations. The oil and gas sector’s requirements for specialized drilling fluids and equipment lubricants create a high-value niche market with stringent performance specifications. Quality standards in this category are typically higher due to equipment criticality and harsh operating conditions.

Marine lubricants serve Angola’s significant offshore petroleum operations and fishing industry, requiring products capable of performing in saltwater environments and extreme conditions. This category includes cylinder oils for large marine engines, hydraulic fluids for offshore equipment, and specialized greases for marine applications. Environmental regulations increasingly influence product selection in marine applications, driving demand for biodegradable and low-toxicity formulations.

Manufacturers and suppliers benefit from Angola’s growing industrial base and increasing quality consciousness among consumers, creating opportunities for premium product positioning and technical service differentiation. The market’s import-dependent structure provides advantages for established international brands with proven supply chain capabilities and product quality. Local partnership opportunities enable global companies to leverage local market knowledge while providing technology transfer and capacity building benefits.

Distributors and retailers gain from expanding market demand and opportunities to develop specialized service offerings for different customer segments. The fragmented distribution landscape allows for regional market development and customer relationship building. Value-added services such as technical support, training, and equipment maintenance consulting create additional revenue streams and customer loyalty.

End-users benefit from improving product availability, competitive pricing, and enhanced technical support as the market develops. Industrial customers gain access to specialized lubricants that improve equipment reliability and operational efficiency. Total cost of ownership improvements through proper lubrication practices provide significant economic benefits, particularly for capital-intensive industries like mining and petroleum extraction.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability focus is emerging as a significant trend in the Angola lubricants market, with increasing awareness of environmental impact and regulatory pressure driving demand for biodegradable and low-toxicity formulations. Industrial users are showing growing interest in lubricants that reduce environmental footprint while maintaining performance standards. Circular economy principles are gaining attention, with some companies exploring used oil recycling and re-refining opportunities.

Digitalization adoption is transforming lubricant supply chains and customer service approaches, with companies implementing digital platforms for order management, inventory tracking, and technical support. Mobile applications and online portals are improving customer access to product information and services. Predictive maintenance technologies using oil analysis and condition monitoring are creating new service opportunities for lubricant suppliers.

Quality premiumization continues as industrial users recognize the total cost benefits of high-performance lubricants, despite higher initial costs. Synthetic and semi-synthetic lubricants are gaining market share in critical applications where equipment protection and extended service intervals provide economic advantages. Technical service integration is becoming a key differentiator, with suppliers offering comprehensive lubrication management programs to industrial customers.

Infrastructure investments by major lubricant suppliers include establishment of new distribution centers and storage facilities to improve market coverage and service levels. Several international companies have announced plans to develop local blending capabilities, which could reduce import dependency and improve supply chain resilience. Partnership agreements between global suppliers and local distributors continue to reshape competitive dynamics and market access strategies.

Regulatory developments include implementation of new quality standards and environmental regulations that affect product specifications and market requirements. The government’s local content initiatives in the oil and gas sector are creating opportunities for domestic lubricant suppliers and service providers. MWR research indicates that regulatory alignment with international standards is improving market access for premium lubricant products.

Technology introductions include advanced synthetic lubricants designed for extreme operating conditions common in Angola’s industrial sectors. New product launches focus on extended service intervals, improved equipment protection, and environmental compatibility. Training and education programs by lubricant suppliers are improving market understanding of proper lubrication practices and total cost of ownership benefits.

Market entry strategies for new participants should focus on establishing strong local partnerships and developing comprehensive distribution networks that can serve diverse geographic markets. Companies should prioritize building technical service capabilities and customer education programs to differentiate from commodity suppliers. Investment priorities should include local blending facilities and strategic inventory positioning to improve supply chain resilience and cost competitiveness.

Product portfolio optimization should emphasize high-performance lubricants that address specific challenges in Angola’s operating environment, including extreme temperatures, dusty conditions, and equipment stress. Companies should consider developing specialized formulations for key industries such as mining, petroleum, and marine applications. Sustainability initiatives will become increasingly important as environmental awareness grows among industrial users and regulatory requirements evolve.

Customer relationship management should focus on providing value-added services beyond product supply, including technical support, training, and lubrication management programs. Building long-term partnerships with key industrial customers and fleet operators can provide stable demand and premium pricing opportunities. Digital transformation investments in customer service platforms and supply chain management systems will become essential for competitive positioning.

Growth trajectory for the Angola lubricants market appears positive, supported by continued economic development, infrastructure expansion, and industrial diversification initiatives. The market is expected to maintain steady growth rates of 6-8% annually over the next five years, driven by expanding automotive ownership, industrial activities, and mining operations. MarkWide Research projections suggest that premium lubricant segments will experience above-average growth as quality consciousness increases among consumers and industrial users.

Structural evolution of the market will likely include development of local manufacturing capabilities, improved distribution infrastructure, and enhanced technical service offerings. The government’s economic diversification efforts should create new market segments and reduce dependence on oil sector demand. Regional integration opportunities may emerge as Angola develops into a lubricant distribution hub for Central and Southern Africa.

Technology advancement will continue driving product innovation, with synthetic lubricants, bio-based formulations, and smart lubrication systems gaining market acceptance. Environmental regulations and sustainability requirements will increasingly influence product development and market positioning strategies. Digital integration throughout the supply chain will improve efficiency, customer service, and market responsiveness, creating competitive advantages for early adopters.

Angola’s lubricants market presents significant opportunities for growth and development, supported by the country’s natural resource wealth, expanding industrial base, and improving economic conditions. While challenges related to import dependency, infrastructure limitations, and economic volatility persist, the market’s fundamental drivers remain strong and supportive of continued expansion. Strategic positioning in this market requires understanding of local conditions, strong distribution capabilities, and commitment to quality and service excellence.

Success factors for market participants include developing comprehensive local partnerships, investing in technical service capabilities, and maintaining consistent product availability across diverse geographic markets. The evolution toward premium products and value-added services creates opportunities for differentiation and margin improvement. Long-term prospects remain favorable as Angola continues its economic development and industrial diversification efforts, creating sustained demand for high-quality lubricant products and services across multiple sectors.

What is Lubricants?

Lubricants are substances used to reduce friction between surfaces in mutual contact, which ultimately reduces the heat generated when the surfaces move. They are essential in various applications, including automotive, industrial machinery, and manufacturing processes.

What are the key players in the Angola Lubricants Market?

Key players in the Angola Lubricants Market include TotalEnergies, Castrol, and Mobil, which provide a range of lubricants for automotive and industrial applications, among others.

What are the growth factors driving the Angola Lubricants Market?

The Angola Lubricants Market is driven by the increasing demand for automotive lubricants due to rising vehicle ownership and the growth of the industrial sector, which requires high-performance lubricants for machinery.

What challenges does the Angola Lubricants Market face?

Challenges in the Angola Lubricants Market include fluctuating crude oil prices, which can impact production costs, and the need for compliance with environmental regulations regarding lubricant formulations.

What opportunities exist in the Angola Lubricants Market?

Opportunities in the Angola Lubricants Market include the growing trend towards synthetic lubricants, which offer better performance and environmental benefits, as well as the expansion of the automotive sector in the region.

What trends are shaping the Angola Lubricants Market?

Trends in the Angola Lubricants Market include the increasing adoption of bio-based lubricants and advancements in lubricant technology that enhance performance and sustainability, catering to both automotive and industrial sectors.

Angola Lubricants Market

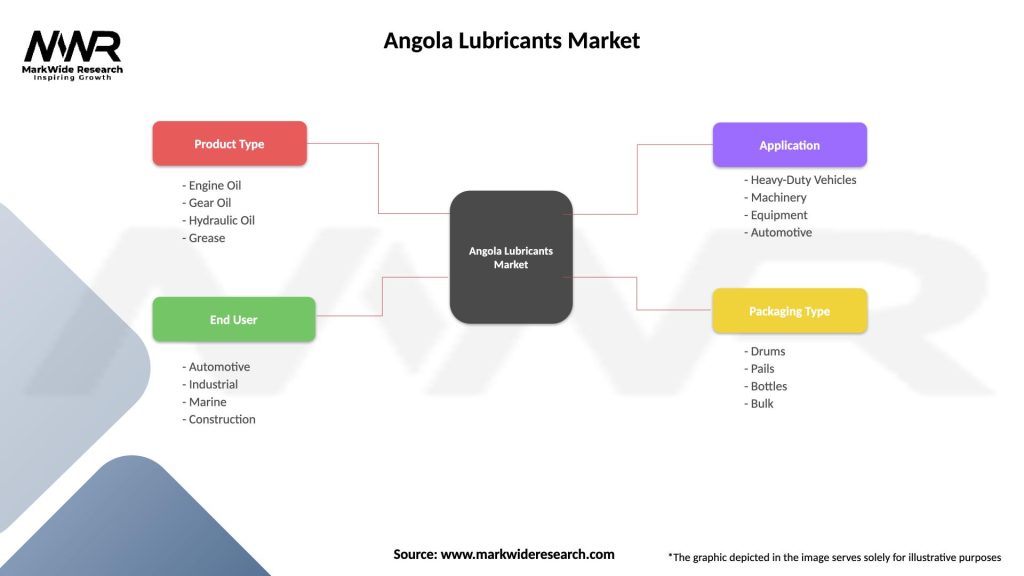

| Segmentation Details | Description |

|---|---|

| Product Type | Engine Oil, Gear Oil, Hydraulic Oil, Grease |

| End User | Automotive, Industrial, Marine, Construction |

| Application | Heavy-Duty Vehicles, Machinery, Equipment, Automotive |

| Packaging Type | Drums, Pails, Bottles, Bulk |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Angola Lubricants Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at