Market Overview

The Ammonium Bromide market is experiencing steady growth driven by its diverse applications across the oil & gas, photography, pharmaceuticals, and chemical synthesis industries. As an inorganic compound combining ammonia and hydrobromic acid, ammonium bromide appears as a white crystalline powder highly soluble in water. Its unique properties—such as acting as a flame retardant, corrosion inhibitor, and catalyst in organic reactions—have led to increased demand. In oilfield operations, it serves as a dense weighting agent in drilling fluids; in photography, it has historically been used in silver bromide-based emulsions; and in pharmaceuticals, it finds roles in sedatives and anti-asthmatic formulations. Emerging uses in flame-retardant textiles and specialty chemical manufacturing are further expanding the market’s scope.

Meaning

Ammonium bromide (NH₄Br) is a salt formed by the reaction of ammonia (NH₃) with hydrobromic acid (HBr). It exists as odorless, white crystals that dissolve readily in water to yield ammonium (NH₄⁺) and bromide (Br⁻) ions. The ionic nature grants it high thermal stability and reactivity in aqueous and non-aqueous systems. In industrial contexts, its primary functions include increasing drilling fluid density, catalyzing organic transformations (such as alkylation), and serving as a precursor for other bromide-containing compounds. Its compatibility with acidic and basic environments makes it a versatile additive in formulations requiring precise ionic strength and density control.

Executive Summary

The Ammonium Bromide market is projected to grow at a moderate CAGR over the next five years, fueled by ongoing expansion in global drilling activities, renewed interest in analog photography, and increasing research into specialty chemical applications. Asia Pacific dominates consumption due to rapid oilfield development in China and India, while North America and the Middle East drive demand through rig count and shale gas operations. Pharmaceutical and specialty chemical sectors in Europe and North America are pursuing ammonium bromide derivatives for advanced drug delivery and flame-retardant materials. Supply dynamics remain balanced, but volatility in raw material pricing (ammonia and bromine) poses margin challenges for producers. Strategic partnerships and capacity expansions are underway to meet region-specific regulations and application requirements.

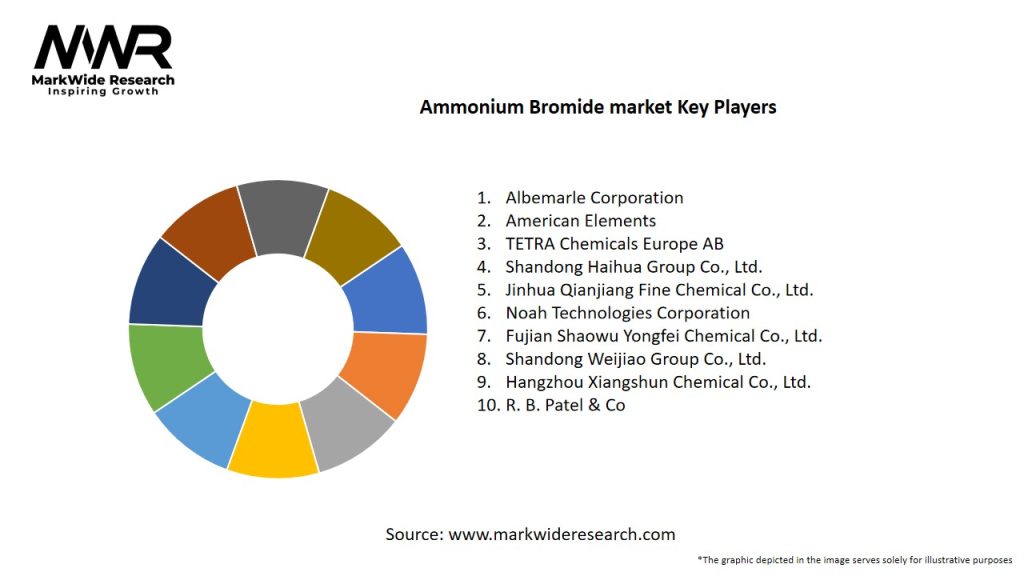

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Oil & Gas Dominance: Over 40% of global ammonium bromide production is consumed in drilling fluids, where its high specific gravity (approx. 1.54 g/cm³ in saturated solutions) helps control wellbore stability.

-

Asia Pacific Leadership: China accounts for nearly 30% of demand, driven by state-backed oil & gas exploration and growing photographic art communities.

-

Pharmaceutical Growth: Emerging markets in India and Brazil are increasing R&D in exotic potassium and ammonium halide complexes, boosting specialty ammonium bromide usage.

-

Supply Concentration: A handful of chemical manufacturers in China and Germany produce over 60% of the world’s ammonium bromide, making geographic supply disruptions a risk.

-

Price Sensitivity: Raw material costs for ammonia and elemental bromine fluctuate with global energy prices, affecting ammonium bromide pricing by ±15% annually.

Market Drivers

-

Rising Drilling Activities: Expansion of offshore and onshore drilling projects worldwide necessitates high-density brines, with ammonium bromide offering stability at elevated temperatures and pressures.

-

Specialty Chemical Research: Increased exploration of bromide salts in flame-retardant polymer blends and ionic liquids is opening new end-use avenues.

-

Pharmaceutical Developments: Demand for novel sedative and anti-convulsant compounds using bromide intermediates is rising in emerging healthcare markets.

-

Analog Photography Revival: Niche film photography communities in Europe and North America are driving small-scale demand for silver bromide emulsions, of which ammonium bromide is a precursor.

-

Regulatory Shifts: Stricter environmental rules on chromate-based corrosion inhibitors are prompting adoption of more benign ammonium bromide–based alternatives.

Market Restraints

-

Raw Material Volatility: Price swings in ammonia (tied to natural gas) and bromine (tied to salt lake production) impact production costs.

-

Health & Safety Concerns: Bromide toxicity and handling protocols limit use in consumer-facing applications without rigorous controls.

-

Emerging Substitutes: Novel weighting agents such as zinc bromide and calcium bromide brines offer performance benefits, threatening market share.

-

Stringent Disposal Regulations: Disposal of bromide-laden drilling fluids under environmental regulations increases operational complexity and cost.

-

Limited Photographic Volume: Analog photography remains niche, capping large-scale demand in imaging applications.

Market Opportunities

-

Green Drilling Technologies: Development of mixed-ammonium brine formulations with biodegradable additives to meet eco-friendly drilling standards.

-

Flame-Retardant Textiles: Use of ammonium bromide complexes in polymer backbones for next-generation fire-resistant fabrics.

-

Specialty Ionic Liquids: Formulating bromide-based ionic liquids for high-performance electrolytes in batteries and capacitors.

-

Pharmaceutical Synthesis: Licensing proprietary ammonium bromide routes for active pharmaceutical ingredient (API) manufacturing.

-

Value-Added Services: Offering custom brine blending and onsite mixing solutions for remote drilling operations to enhance service portfolios.

Market Dynamics

-

Consolidation Trends: Key players are merging to secure bromine feedstocks and downstream distribution networks, optimizing supply chains.

-

Technological Innovation: Academic-industry collaborations are focusing on greener synthesis methods, such as electrochemical bromide generation.

-

Regulatory Environment: New chemical registration requirements (REACH in Europe, TSCA in the U.S.) necessitate rigorous product dossiers and safety data.

-

Customer Education: End-users require training on handling high-density brines and fluid disposal best practices, driving service-based differentiation.

-

Cost-Plus Contracting: Producers are increasingly adopting cost-plus pricing models for large drilling contracts to share raw material risk with clients.

Regional Analysis

-

Asia Pacific: Market leader with >35% share; robust oilfield activity in China, India, and Southeast Asia; growing specialty chemicals sector.

-

North America: Second-largest, anchored by U.S. shale operations in the Permian and Eagle Ford basins; resurgence in boutique photographic film production.

-

Europe: Mature market with specialty demand in pharmaceuticals and textiles; stringent environmental regulations shaping brine disposal solutions.

-

Middle East & Africa: Steady growth driven by Middle Eastern offshore exploration; local bromine producers in Israel and Jordan support regional manufacturing.

-

Latin America: Emerging consumption in Brazil and Argentina for both drilling fluids and pharmaceutical intermediates; infrastructure investment fueling demand.

Competitive Landscape

Leading Companies in the Ammonium Bromide Market:

- Albemarle Corporation

- American Elements

- TETRA Chemicals Europe AB

- Shandong Haihua Group Co., Ltd.

- Jinhua Qianjiang Fine Chemical Co., Ltd.

- Noah Technologies Corporation

- Fujian Shaowu Yongfei Chemical Co., Ltd.

- Shandong Weijiao Group Co., Ltd.

- Hangzhou Xiangshun Chemical Co., Ltd.

- R. B. Patel & Co

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

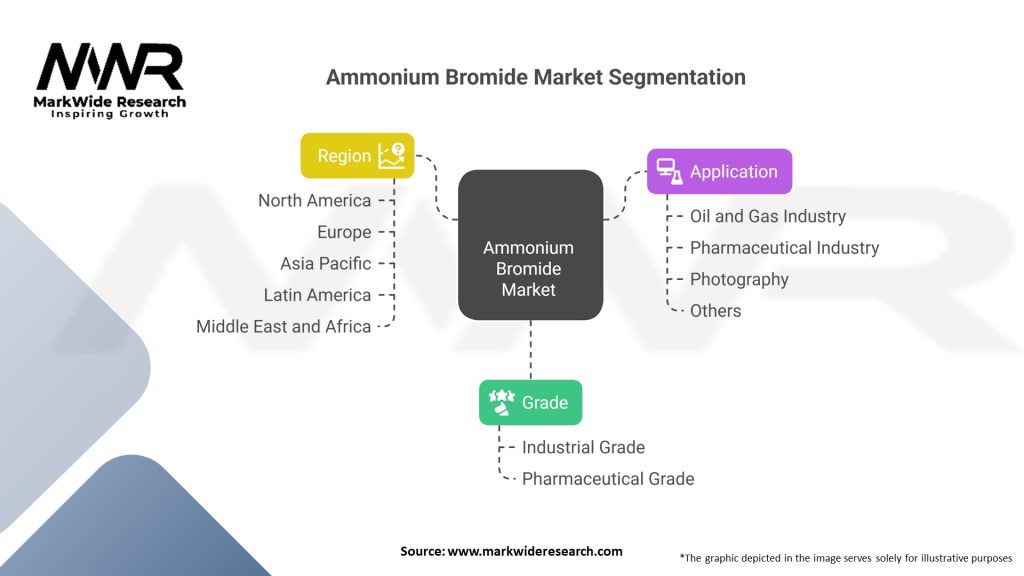

Segmentation

-

By Grade: Industrial Grade (drilling fluids, emulsions), Pharmaceutical Grade (API intermediates), Photography Grade (emulsion precursors), Specialty Grade (flame retardants).

-

By Application: Oil & Gas Drilling, Pharmaceuticals, Photography, Flame Retardants, Chemical Synthesis.

-

By Form: Powdered Crystals, Granular, Aqueous Solutions.

-

By Distribution: Direct OEM Supply, Chemical Distributors, Onsite Mixing Services.

Category-wise Insights

-

Oil & Gas Drilling: Largest segment; requires brines with densities up to 1.54 g/cm³ and thermal stability to 150 °C.

-

Pharmaceuticals: Demands <0.005% heavy metal impurities and precise pH control for safe API production.

-

Photography: Small-batch, ultra-high-purity ammonium bromide crystals (<5 ppm metal residues) for silver halide emulsions.

-

Flame Retardants: Emerging niche; ammonium bromide acts synergistically with nitrogen- and phosphorus-based retardants in polymer matrices.

-

Chemical Synthesis: Used as catalyst or bromide source in various organic reactions, including bromination and alkylation processes.

Key Benefits for Industry Participants and Stakeholders

-

Versatility: Single compound serving multiple high-value applications reduces supplier complexity.

-

High Purity Options: Tailored grades allow penetration into sensitive pharmaceutical and photographic markets.

-

Onsite Blending Services: Value-added logistics and mixing reduce customer handling risks and downtime.

-

Regulatory Compliance: Established supply chains with REACH and TSCA registrations minimize market-entry barriers.

-

Collaborative R&D: Partnerships between producers and end-users accelerate custom application development.

SWOT Analysis

Strengths:

-

Multifunctional compound with established industrial uses.

-

High solubility and density for critical drilling applications.

-

Diverse purity grades catering to varied industries.

Weaknesses:

-

Raw material price volatility.

-

Toxicity concerns limiting consumer-facing applications.

-

Dependence on energy-intensive synthesis.

Opportunities:

-

Development of greener electrochemical production routes.

-

Expansion into advanced materials (ionic liquids, flame-retardant polymers).

-

Service-based models for remote drilling and specialty chemical projects.

Threats:

-

Substitute materials (e.g., zinc bromide brines, non-halide flame retardants).

-

Regulatory tightening on halogenated compounds.

-

Geopolitical risks affecting bromine-rich salt lake access.

Market Key Trends

-

Green Bromide Synthesis: Pilots for electrochemical bromine generation reduce reliance on bromine extraction from salt lakes.

-

Integrated Supply Chains: Vertical integration from bromine extraction to ammonium bromide formulation lowers costs and lead times.

-

Digital Mixing Platforms: IoT-enabled onsite blending systems ensure precise brine densities and real-time quality monitoring.

-

High-Performance Additives: Co-formulation with corrosion inhibitors and shale stabilizers enhances drilling fluid performance.

-

Photographic Resurgence: Artisan film makers drive demand for boutique, ultra-pure ammonium bromide, sustaining small-scale production.

Covid-19 Impact

The pandemic temporarily disrupted supply chains for ammonia and bromine, causing spot shortages of ammonium bromide in 2020–21. However, robust demand from essential oilfield services and pharmaceutical manufacturing stabilized volumes. Producers accelerated digital ordering platforms and local warehouse expansions to mitigate future disruptions. Research into antiviral bromide complexes also briefly spiked academic and specialty chemical interest.

Key Industry Developments

-

BASF commissioned an electrochemical bromide plant in Germany (2023) aiming to halve carbon footprint per ton of ammonium bromide.

-

Lanxess partnered with Halliburton to co-develop environmentally friendly drilling brines based on mixed ammonium bromide formulations.

-

Mitsubishi Gas Chemical launched a pharmaceutical-grade ammonium bromide line with sub-1 ppm heavy metal certification in 2024.

-

Tianjin Dagu Chemical introduced IoT-enabled mixing stations at major Chinese oilfields, reducing on-site brine prep time by 30%.

Analyst Suggestions

-

Diversify Feedstocks: Invest in alternative bromine sources (e.g., ocean brine extraction) to hedge against salt lake supply risks.

-

Expand Specialty Grades: Grow pharmaceutical and photographic-grade capacities through dedicated purification units.

-

Emphasize Green Chemistry: Market electrochemical synthesis and low-carbon products to environmentally conscious customers.

-

Develop Service Ecosystems: Bundle onsite brine mixing, quality analytics, and technical support for premium pricing.

-

Monitor Regulatory Changes: Stay ahead of halogen substance regulations by engaging in policymaker consultations and pre-registrations.

Future Outlook

The Ammonium Bromide market is set for modest but resilient growth, anchored by oil & gas drilling demand and specialty chemical innovations. Green production methods and expanding high-purity segments will drive incremental volume and margin expansion. Regional diversification of supply—particularly in North America and the Middle East—will enhance resilience. End-user education and partnership-driven R&D will be crucial for unlocking novel applications in flame retardancy, ionic liquids, and advanced pharmaceutical synthesis.

Conclusion

In summary, ammonium bromide remains a foundational chemical in several high-value industries. Success in the evolving market will come from balancing core drilling fluid requirements with emerging specialty and sustainable applications. Producers who integrate green synthesis, localized services, and strategic partnerships will lead the market, delivering both reliability and innovation in this versatile inorganic compound.