444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Americas optoelectronics market represents a dynamic and rapidly evolving sector that encompasses the development, manufacturing, and deployment of devices that source, detect, and control light. This comprehensive market spans across North America, Central America, and South America, with the United States and Canada leading technological advancement and market adoption. Optoelectronics technology serves as the backbone for numerous critical applications including telecommunications, consumer electronics, automotive systems, healthcare devices, and industrial automation.

Market dynamics indicate robust growth driven by increasing demand for high-speed data transmission, advanced display technologies, and sophisticated sensing applications. The region benefits from strong research and development infrastructure, established manufacturing capabilities, and significant investment in emerging technologies such as 5G networks, autonomous vehicles, and Internet of Things (IoT) applications. Current trends show the market expanding at a compound annual growth rate of 8.2%, reflecting the critical role of optoelectronics in modern technological ecosystems.

Regional distribution shows North America commanding approximately 78% market share, with the United States leading in both innovation and consumption. The market encompasses diverse product categories including light-emitting diodes (LEDs), laser diodes, photodetectors, optical sensors, and fiber optic components. Technology convergence continues to drive new applications, particularly in emerging sectors such as augmented reality, virtual reality, and advanced driver assistance systems.

The Americas optoelectronics market refers to the comprehensive ecosystem of companies, technologies, and applications involved in the design, manufacture, and deployment of electronic devices that interact with light across North, Central, and South America. Optoelectronics technology combines optical and electronic components to create devices that can generate, transmit, detect, and manipulate light for various commercial, industrial, and consumer applications.

Core technologies within this market include semiconductor devices that emit light (such as LEDs and laser diodes), devices that detect light (photodiodes and image sensors), and components that guide or manipulate light (optical fibers and waveguides). The market encompasses both discrete components and integrated systems that leverage these technologies for specific applications ranging from simple indicator lights to complex telecommunications infrastructure.

Market scope extends beyond traditional electronics to include emerging applications in biotechnology, environmental monitoring, security systems, and advanced manufacturing. The integration of optoelectronics with artificial intelligence, machine learning, and advanced materials continues to expand the market’s boundaries and create new opportunities for innovation and growth across the Americas region.

Strategic analysis reveals the Americas optoelectronics market as a cornerstone of modern technological infrastructure, experiencing sustained growth across multiple application sectors. The market demonstrates remarkable resilience and adaptability, with companies successfully navigating supply chain challenges while capitalizing on emerging opportunities in next-generation technologies. Innovation leadership from regional companies continues to drive global competitiveness and market expansion.

Key growth drivers include the accelerating deployment of 5G networks, increasing adoption of electric and autonomous vehicles, and growing demand for energy-efficient lighting solutions. The healthcare sector represents a particularly dynamic growth area, with medical device applications showing adoption rates exceeding 12% annually. Consumer electronics remain the largest application segment, while industrial automation and telecommunications infrastructure show the highest growth potential.

Competitive landscape features a mix of established multinational corporations and innovative startups, creating a dynamic ecosystem that fosters continuous technological advancement. Regional companies benefit from proximity to major technology hubs, access to skilled workforce, and strong collaboration between academic institutions and industry. Investment trends indicate continued capital allocation toward research and development, with particular emphasis on emerging applications and next-generation manufacturing capabilities.

Market intelligence reveals several critical insights that define the current state and future trajectory of the Americas optoelectronics market. These insights provide valuable guidance for stakeholders seeking to understand market dynamics and identify strategic opportunities:

Technological advancement serves as the primary driver for the Americas optoelectronics market, with continuous innovation creating new applications and improving existing solutions. The rapid deployment of 5G telecommunications infrastructure requires sophisticated optoelectronic components for high-speed data transmission, creating substantial demand for fiber optic systems, laser diodes, and photodetectors. This infrastructure development represents a multi-year growth opportunity that extends across the entire Americas region.

Automotive industry transformation toward electric and autonomous vehicles generates significant demand for optoelectronic sensors, LiDAR systems, and advanced lighting solutions. The integration of advanced driver assistance systems requires precise optical sensors and sophisticated image processing capabilities, driving innovation in semiconductor technologies and system integration. Electric vehicle adoption rates exceeding 25% annually in key markets create sustained demand for specialized optoelectronic components.

Consumer electronics evolution continues to drive market expansion through demand for high-resolution displays, advanced camera systems, and augmented reality applications. The proliferation of smart devices, wearable technology, and Internet of Things applications requires miniaturized, energy-efficient optoelectronic components. Healthcare digitization creates additional opportunities through demand for medical imaging systems, diagnostic equipment, and therapeutic devices that leverage optoelectronic technologies.

Supply chain complexity represents a significant challenge for the Americas optoelectronics market, with many critical components and raw materials sourced from global suppliers. Semiconductor shortages and geopolitical tensions have highlighted vulnerabilities in supply networks, leading to production delays and increased costs. Companies must navigate complex international trade relationships while maintaining competitive pricing and delivery schedules.

High development costs associated with advanced optoelectronic technologies create barriers for smaller companies and startups seeking to enter the market. The substantial investment required for research and development, specialized manufacturing equipment, and regulatory compliance can limit innovation and market competition. Technology complexity requires specialized expertise and sophisticated manufacturing capabilities that may not be readily available in all regions.

Regulatory challenges across different countries within the Americas create compliance complexity for companies operating in multiple markets. Varying standards for safety, environmental impact, and electromagnetic compatibility require significant resources to navigate effectively. Market fragmentation across different application sectors and geographic regions can limit economies of scale and increase operational complexity for market participants.

Emerging applications in quantum computing, advanced sensing, and biotechnology present substantial growth opportunities for the Americas optoelectronics market. Quantum photonics represents a particularly promising area, with potential applications in secure communications, advanced computing, and precision measurement systems. Early investment in these technologies positions regional companies to capture significant market share as these applications mature and commercialize.

Industrial automation and Industry 4.0 initiatives create demand for sophisticated optical sensors, machine vision systems, and laser-based manufacturing tools. The integration of artificial intelligence with optoelectronic systems enables new capabilities in predictive maintenance, quality control, and process optimization. Smart manufacturing adoption rates approaching 18% annually across the region indicate substantial market potential.

Sustainability initiatives drive opportunities in energy-efficient lighting, solar energy systems, and environmental monitoring applications. The transition toward renewable energy requires advanced optoelectronic components for solar panels, energy storage systems, and grid management technologies. Government incentives and corporate sustainability commitments create favorable market conditions for companies developing environmentally friendly optoelectronic solutions.

Competitive dynamics within the Americas optoelectronics market reflect a complex interplay between established industry leaders and emerging technology companies. Innovation cycles continue to accelerate, with new product introductions occurring more frequently and technology lifecycles becoming shorter. This dynamic environment rewards companies that can rapidly adapt to changing market conditions and customer requirements while maintaining operational efficiency.

Customer demands increasingly focus on integrated solutions rather than discrete components, driving companies to develop comprehensive system-level offerings. The shift toward customization and application-specific solutions requires closer collaboration between suppliers and end users, creating opportunities for companies that can provide specialized expertise and support services. Market participants must balance standardization for cost efficiency with customization for competitive differentiation.

Technology convergence creates both opportunities and challenges as traditional market boundaries blur and new competitive dynamics emerge. Companies must navigate the integration of optoelectronics with other technologies such as microelectronics, software, and mechanical systems. Partnership strategies become increasingly important as no single company can maintain expertise across all relevant technology domains, leading to strategic alliances and collaborative development programs.

Comprehensive analysis of the Americas optoelectronics market employs multiple research methodologies to ensure accuracy and completeness of market insights. Primary research includes extensive interviews with industry executives, technology experts, and key stakeholders across the value chain. This direct engagement provides real-time insights into market trends, competitive dynamics, and emerging opportunities that may not be captured through secondary sources.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and regulatory documents to establish market baselines and validate primary research findings. Quantitative analysis utilizes statistical modeling and trend analysis to project market growth patterns and identify key performance indicators. Data triangulation across multiple sources ensures reliability and reduces potential bias in market assessments.

Market segmentation analysis examines the market across multiple dimensions including technology type, application sector, geographic region, and customer segment. This multi-dimensional approach provides granular insights into market dynamics and enables identification of specific growth opportunities and competitive advantages. Scenario modeling evaluates potential market outcomes under different economic and technological conditions to support strategic planning and risk assessment.

North America dominates the Americas optoelectronics market, accounting for approximately 78% of regional market share, driven by strong technology infrastructure, substantial research and development investment, and diverse application markets. The United States leads in both innovation and consumption, with major technology hubs in Silicon Valley, Boston, and Austin fostering continuous advancement in optoelectronic technologies. Canada contributes significantly through specialized companies focused on telecommunications and industrial applications.

South America represents an emerging market with growing demand for optoelectronic solutions in telecommunications, automotive, and consumer electronics applications. Brazil leads regional adoption with increasing investment in telecommunications infrastructure and manufacturing capabilities. Argentina and Chile show particular strength in specialized applications such as mining automation and renewable energy systems, creating niche opportunities for optoelectronic solutions.

Central America and Caribbean markets demonstrate growing potential, particularly in telecommunications infrastructure and consumer electronics. The region benefits from proximity to North American technology centers and increasing foreign investment in manufacturing and assembly operations. Mexico serves as a key manufacturing hub for optoelectronic components, with significant production capacity supporting both regional and global markets. Regional integration initiatives facilitate technology transfer and market development across smaller economies.

Market leadership in the Americas optoelectronics sector is characterized by a diverse ecosystem of companies ranging from large multinational corporations to specialized technology startups. The competitive landscape reflects both horizontal integration across multiple technology platforms and vertical specialization in specific application areas.

Competitive strategies focus on technological innovation, strategic partnerships, and market expansion through both organic growth and acquisitions. Companies increasingly emphasize system-level solutions and customer-specific applications to differentiate their offerings and maintain competitive advantages.

Technology segmentation reveals distinct market dynamics across different optoelectronic device categories, each with unique growth drivers and competitive characteristics:

By Device Type:

By Application Sector:

LED technology continues to evolve beyond traditional lighting applications, with significant innovation in micro-LEDs for display applications and specialized LEDs for horticultural and medical applications. Efficiency improvements of approximately 15% annually drive continued market expansion and enable new application possibilities. The automotive segment shows particular promise with advanced lighting systems and interior applications requiring sophisticated LED solutions.

Laser diode applications expand rapidly in industrial processing, medical procedures, and defense systems. High-power laser diodes enable new manufacturing processes and materials processing capabilities, while precision laser systems support advanced medical procedures and scientific research. The integration of laser diodes with fiber optic systems creates opportunities in telecommunications and sensing applications.

Photodetector technology advances support growing demand for high-speed communications, precision sensing, and imaging applications. Silicon photonics integration enables new capabilities in data center applications and telecommunications infrastructure. Advanced photodetector arrays support emerging applications in autonomous vehicles, security systems, and scientific instrumentation.

Optical sensor integration with artificial intelligence and machine learning capabilities creates new possibilities in predictive maintenance, environmental monitoring, and process optimization. Miniaturization trends enable integration into consumer devices and wearable technologies, expanding market opportunities beyond traditional industrial applications.

Technology companies benefit from the Americas optoelectronics market through access to diverse application opportunities, strong intellectual property protection, and collaborative research environments. The region’s established technology infrastructure and skilled workforce enable rapid product development and market introduction. Innovation ecosystems in major technology hubs facilitate knowledge transfer and partnership opportunities that accelerate technological advancement.

Manufacturing companies gain advantages through proximity to major markets, established supply chains, and favorable business environments. The region’s manufacturing capabilities support both high-volume production and specialized custom solutions. Quality standards and regulatory frameworks provide market credibility and facilitate international expansion opportunities.

End-user industries benefit from access to cutting-edge optoelectronic technologies that enable new capabilities and competitive advantages. Close collaboration with technology suppliers supports customized solutions and rapid implementation of new technologies. The region’s diverse industrial base creates opportunities for cross-sector technology transfer and innovation.

Investors and stakeholders find attractive opportunities in a market characterized by strong growth fundamentals, technological innovation, and diverse application possibilities. Market resilience demonstrated through economic cycles and supply chain disruptions provides confidence in long-term investment prospects. Government support for advanced manufacturing and technology development creates favorable conditions for sustained growth.

Strengths:

Weaknesses:

Opportunities:

Threats:

Integration and miniaturization represent dominant trends shaping the Americas optoelectronics market, with companies developing increasingly compact and multifunctional devices. System-on-chip approaches combine multiple optoelectronic functions on single substrates, reducing size, power consumption, and cost while improving performance. This trend enables new applications in mobile devices, wearable technology, and IoT systems where space and power constraints are critical.

Artificial intelligence integration transforms optoelectronic systems from passive components to intelligent sensors and processors capable of real-time decision making. Edge computing capabilities embedded in optoelectronic devices enable local processing and reduce latency in critical applications. Machine learning algorithms optimize device performance and enable predictive maintenance capabilities that improve system reliability and reduce operational costs.

Sustainability focus drives development of energy-efficient optoelectronic solutions and environmentally responsible manufacturing processes. Circular economy principles influence product design with emphasis on recyclability and reduced environmental impact. Companies increasingly adopt green manufacturing practices and develop products that help customers achieve their sustainability objectives, creating competitive advantages in environmentally conscious markets.

Customization and application-specific solutions become increasingly important as markets mature and customer requirements become more sophisticated. Collaborative development approaches involve close partnership between suppliers and customers to develop optimized solutions for specific applications. This trend requires companies to develop deep application expertise and flexible manufacturing capabilities to serve diverse market needs effectively.

Strategic acquisitions continue to reshape the Americas optoelectronics landscape as companies seek to expand technological capabilities and market reach. MarkWide Research analysis indicates increasing consolidation activity focused on complementary technologies and vertical integration opportunities. Recent transactions demonstrate the industry’s focus on building comprehensive solution portfolios and expanding into high-growth application areas.

Research partnerships between industry and academia accelerate technology development and workforce preparation. Major universities establish specialized optoelectronics research centers with industry funding and collaboration. These partnerships facilitate technology transfer and ensure that academic research addresses real-world market needs while preparing students for industry careers.

Manufacturing investments focus on advanced production capabilities and supply chain resilience. Companies establish new facilities with state-of-the-art equipment and automation systems to improve efficiency and quality. Nearshoring initiatives bring production closer to major markets to reduce supply chain risks and improve customer responsiveness.

Standards development efforts address interoperability and safety requirements for emerging applications. Industry organizations work with regulatory bodies to establish appropriate standards for new technologies and applications. These efforts facilitate market development by providing clear technical requirements and ensuring product compatibility across different suppliers and systems.

Strategic positioning recommendations emphasize the importance of developing comprehensive technology portfolios that address multiple application areas while maintaining depth in core competencies. Companies should focus on platform approaches that leverage common technologies across different markets to achieve economies of scale and reduce development costs. Investment in emerging technologies such as quantum photonics and silicon photonics positions companies for future growth opportunities.

Partnership strategies become increasingly critical as technology complexity increases and market requirements become more sophisticated. Companies should develop ecosystem approaches that combine their core capabilities with complementary technologies from partners. Strategic alliances with software companies, system integrators, and end-user industries enable comprehensive solution development and market penetration.

Supply chain optimization requires balanced approaches that combine cost efficiency with resilience and flexibility. Companies should invest in supply chain visibility and diversification strategies that reduce dependency on single sources or geographic regions. Local sourcing initiatives and strategic inventory management help mitigate supply disruption risks while maintaining competitive cost structures.

Talent development initiatives should address the growing need for specialized skills in optoelectronics design, manufacturing, and applications. Companies should collaborate with educational institutions to develop relevant curricula and provide practical experience opportunities. Continuous learning programs help existing employees adapt to evolving technologies and market requirements while attracting new talent to the industry.

Long-term growth prospects for the Americas optoelectronics market remain highly positive, driven by fundamental technology trends and expanding application opportunities. Digital transformation across industries creates sustained demand for advanced optoelectronic solutions, while emerging technologies such as quantum computing and augmented reality represent substantial new market opportunities. The market is projected to maintain robust growth rates exceeding 8% annually over the next decade.

Technology evolution will focus on integration, intelligence, and sustainability as key differentiators. Photonic integrated circuits will enable new levels of functionality and performance while reducing size and power consumption. The convergence of optoelectronics with artificial intelligence, quantum technologies, and advanced materials will create entirely new product categories and application possibilities.

Market structure will likely see continued consolidation among larger players while maintaining space for specialized companies that serve niche applications or develop breakthrough technologies. MWR projections indicate that successful companies will be those that can balance scale advantages with innovation agility and customer responsiveness. Geographic expansion within the Americas region will create additional growth opportunities as emerging markets develop their technology infrastructure.

Investment priorities should focus on research and development, advanced manufacturing capabilities, and strategic partnerships that position companies for long-term success. The increasing importance of sustainability and circular economy principles will influence product development and manufacturing processes, creating competitive advantages for companies that proactively address these trends.

The Americas optoelectronics market stands at the forefront of technological innovation, representing a critical enabler for the digital transformation occurring across multiple industries. With strong fundamentals including robust research and development capabilities, diverse application markets, and supportive business environments, the region is well-positioned to maintain its leadership in global optoelectronics development and manufacturing.

Market dynamics reflect the increasing importance of optoelectronic technologies in modern society, from telecommunications infrastructure and consumer electronics to automotive systems and healthcare devices. The convergence of optoelectronics with artificial intelligence, quantum technologies, and advanced materials creates unprecedented opportunities for innovation and market expansion. Companies that successfully navigate this complex landscape through strategic positioning, technology investment, and partnership development will capture significant value in the evolving market.

Future success in the Americas optoelectronics market will require balanced approaches that combine technological excellence with market responsiveness, operational efficiency with innovation agility, and global competitiveness with regional advantages. The market’s continued evolution toward more integrated, intelligent, and sustainable solutions presents both challenges and opportunities that will define the industry’s trajectory for years to come. As the Americas optoelectronics market continues its dynamic growth, stakeholders who embrace these trends and invest in future capabilities will be best positioned to capitalize on the substantial opportunities ahead.

What is Optoelectronics?

Optoelectronics is a branch of technology that deals with the interaction between light and electronic devices. It encompasses a range of applications including light-emitting diodes (LEDs), laser diodes, and photodetectors, which are used in various industries such as telecommunications and consumer electronics.

What are the key players in the Americas Optoelectronics Market?

Key players in the Americas Optoelectronics Market include companies like Intel Corporation, Texas Instruments, and Broadcom Inc. These companies are involved in the development and manufacturing of optoelectronic components and systems, among others.

What are the growth factors driving the Americas Optoelectronics Market?

The Americas Optoelectronics Market is driven by factors such as the increasing demand for energy-efficient lighting solutions, advancements in telecommunications technology, and the growing adoption of optoelectronic devices in consumer electronics.

What challenges does the Americas Optoelectronics Market face?

Challenges in the Americas Optoelectronics Market include the high cost of advanced optoelectronic components and the rapid pace of technological change, which can lead to obsolescence. Additionally, regulatory hurdles and competition from alternative technologies pose significant challenges.

What opportunities exist in the Americas Optoelectronics Market?

Opportunities in the Americas Optoelectronics Market include the expansion of smart city initiatives, the growth of the Internet of Things (IoT), and the increasing use of optoelectronics in medical devices and automotive applications.

What trends are shaping the Americas Optoelectronics Market?

Trends in the Americas Optoelectronics Market include the development of organic light-emitting diodes (OLEDs), advancements in laser technology, and the integration of optoelectronic components in emerging technologies such as augmented reality and virtual reality.

Americas Optoelectronics Market

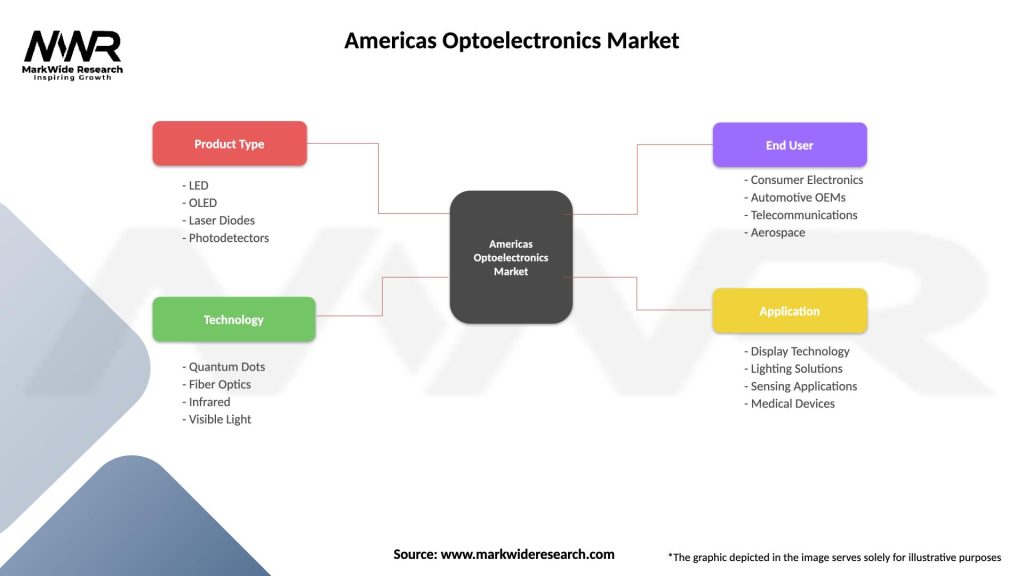

| Segmentation Details | Description |

|---|---|

| Product Type | LED, OLED, Laser Diodes, Photodetectors |

| Technology | Quantum Dots, Fiber Optics, Infrared, Visible Light |

| End User | Consumer Electronics, Automotive OEMs, Telecommunications, Aerospace |

| Application | Display Technology, Lighting Solutions, Sensing Applications, Medical Devices |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Americas Optoelectronics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at