444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Americas industrial bags and sacks market represents a dynamic and rapidly evolving sector that serves as a critical component in packaging solutions across diverse industries. This comprehensive market encompasses a wide range of flexible packaging products designed to meet the demanding requirements of industrial applications throughout North, Central, and South America. Industrial bags and sacks have become indispensable for transporting, storing, and protecting various materials including chemicals, food products, agricultural commodities, construction materials, and pharmaceuticals.

Market growth in the Americas has been particularly robust, driven by expanding manufacturing activities, increased agricultural production, and growing demand for sustainable packaging solutions. The region’s industrial bags and sacks market is experiencing significant expansion at a compound annual growth rate (CAGR) of 6.2%, reflecting the strong underlying demand from key end-user industries. This growth trajectory is supported by technological advancements in manufacturing processes, innovative material developments, and increasing adoption of eco-friendly packaging alternatives.

Regional dynamics play a crucial role in shaping market trends, with North America leading in terms of technological innovation and premium product adoption, while Latin American markets demonstrate substantial growth potential driven by industrial development and infrastructure investments. The market’s resilience and adaptability have been evident through various economic cycles, positioning it as a stable and attractive sector for continued investment and development.

The Americas industrial bags and sacks market refers to the comprehensive ecosystem of flexible packaging solutions specifically designed for industrial applications across the American continents. These specialized packaging products are engineered to withstand demanding industrial environments while providing efficient containment, protection, and transportation capabilities for a diverse range of materials and products.

Industrial bags and sacks encompass various product categories including woven polypropylene bags, paper sacks, plastic bags, bulk bags (FIBCs), and specialty packaging solutions. These products are characterized by their durability, strength, and ability to maintain product integrity under challenging conditions such as moisture exposure, temperature variations, and mechanical stress during handling and transportation.

Key characteristics that define this market include the focus on functionality over aesthetics, emphasis on cost-effectiveness, compliance with industry-specific regulations, and the ability to handle large volumes efficiently. The market serves as a vital link in supply chains across industries, enabling efficient movement of raw materials, intermediate products, and finished goods throughout the Americas region.

Market dynamics in the Americas industrial bags and sacks sector reflect a mature yet evolving industry characterized by steady growth, technological innovation, and increasing sustainability focus. The market demonstrates remarkable resilience with consistent demand from established industries while simultaneously adapting to emerging market requirements and environmental considerations.

Key growth drivers include expanding agricultural production, increased construction activities, growing chemical industry output, and rising demand for bulk packaging solutions. The market benefits from approximately 78% of demand originating from traditional industries such as agriculture, chemicals, and construction, while emerging sectors contribute to diversification and growth opportunities.

Technological advancements have revolutionized product offerings, with manufacturers developing enhanced barrier properties, improved strength characteristics, and innovative closure systems. The integration of sustainable materials and recyclable options has become increasingly important, with eco-friendly products representing approximately 35% of new product developments in recent years.

Regional distribution shows North America maintaining market leadership through technological innovation and premium product adoption, while Latin American markets demonstrate accelerating growth rates driven by industrial expansion and infrastructure development. The market’s competitive landscape features a mix of established multinational corporations and regional specialists, creating a dynamic environment for innovation and market development.

Strategic insights reveal several critical factors shaping the Americas industrial bags and sacks market landscape. Understanding these key insights provides valuable perspective on market dynamics, competitive positioning, and future growth opportunities across the region.

Primary market drivers propelling growth in the Americas industrial bags and sacks market stem from fundamental economic and industrial trends that create sustained demand for flexible packaging solutions. These drivers represent both immediate opportunities and long-term growth catalysts that shape market development strategies.

Agricultural expansion serves as a cornerstone driver, with increasing crop production, grain exports, and agricultural processing activities generating substantial demand for industrial packaging solutions. The region’s position as a major agricultural producer and exporter creates consistent requirements for high-quality bags and sacks capable of protecting products during storage and transportation.

Industrial growth across key sectors including chemicals, construction materials, and food processing drives demand for specialized packaging solutions. Manufacturing expansion in emerging markets within Latin America contributes significantly to market growth, with industrial production increases of approximately 8.5% annually in key markets creating new packaging requirements.

Infrastructure development throughout the Americas generates substantial demand for construction materials packaging, including cement, aggregates, and building supplies. Major infrastructure projects and urbanization trends create sustained demand for durable, cost-effective packaging solutions capable of handling heavy materials and challenging environmental conditions.

Sustainability initiatives increasingly drive market demand as companies seek environmentally responsible packaging alternatives. Regulatory pressures and corporate sustainability commitments create opportunities for manufacturers offering recyclable, biodegradable, and reduced-impact packaging solutions that meet both performance and environmental requirements.

Market challenges in the Americas industrial bags and sacks sector present obstacles that manufacturers and stakeholders must navigate to maintain growth momentum and competitive positioning. Understanding these restraints enables strategic planning and risk mitigation approaches.

Raw material volatility represents a significant constraint, with fluctuating prices for key inputs including polypropylene, polyethylene, and paper affecting production costs and profit margins. Price instability creates challenges for long-term contract negotiations and budget planning, particularly impacting smaller manufacturers with limited hedging capabilities.

Environmental regulations increasingly impose restrictions on certain materials and manufacturing processes, requiring substantial investments in compliance measures and alternative technologies. Regulatory complexity across different jurisdictions within the Americas creates additional compliance burdens and operational challenges for manufacturers serving multiple markets.

Competition from alternatives including rigid packaging solutions, bulk handling systems, and reusable containers presents ongoing challenges to market growth. Technological advances in alternative packaging methods and changing customer preferences toward different packaging formats create competitive pressures that require continuous innovation and value proposition enhancement.

Economic uncertainty in various regional markets affects customer investment decisions and demand patterns, creating volatility in order volumes and market growth rates. Currency fluctuations and trade policy changes add complexity to cross-border operations and pricing strategies, particularly impacting manufacturers with significant export activities.

Emerging opportunities in the Americas industrial bags and sacks market present substantial potential for growth, innovation, and market expansion. These opportunities reflect evolving customer needs, technological capabilities, and market dynamics that create new avenues for business development.

Sustainable packaging solutions represent the most significant growth opportunity, with increasing demand for eco-friendly alternatives driving innovation in biodegradable materials, recyclable designs, and reduced environmental impact products. Market research indicates that 67% of industrial buyers are willing to pay premium prices for sustainable packaging options that meet their performance requirements.

Smart packaging integration offers opportunities for value-added solutions incorporating tracking technologies, condition monitoring, and supply chain optimization features. The integration of IoT sensors, RFID tags, and other smart technologies creates opportunities for differentiated products that provide enhanced functionality and customer value.

Emerging market expansion throughout Latin America presents substantial growth potential as industrial development accelerates and infrastructure investments increase. Countries experiencing rapid economic growth demonstrate increasing demand for industrial packaging solutions, creating opportunities for market entry and capacity expansion.

Specialty applications in niche industries including pharmaceuticals, food processing, and hazardous materials handling offer opportunities for high-value, specialized products with enhanced performance characteristics and regulatory compliance features. These applications typically command premium pricing and provide opportunities for long-term customer relationships.

Complex market dynamics shape the Americas industrial bags and sacks market through interconnected factors that influence supply, demand, pricing, and competitive positioning. Understanding these dynamics provides insight into market behavior and strategic decision-making considerations.

Supply chain integration has become increasingly important as manufacturers seek to optimize efficiency and reduce costs through vertical integration and strategic partnerships. Companies are investing in upstream raw material capabilities and downstream distribution networks to enhance control over their value chains and improve customer service capabilities.

Technology convergence drives innovation through the combination of traditional manufacturing expertise with advanced materials science, automation technologies, and digital capabilities. This convergence enables the development of enhanced products with improved performance characteristics while maintaining cost competitiveness.

Customer consolidation trends affect market dynamics as large industrial customers increasingly prefer working with fewer, more capable suppliers who can provide comprehensive solutions across multiple locations and applications. This trend favors larger manufacturers with broad capabilities and extensive geographic coverage.

Regulatory evolution continues to shape market requirements through changing environmental standards, safety regulations, and industry-specific compliance requirements. Manufacturers must continuously adapt their products and processes to meet evolving regulatory demands while maintaining operational efficiency and cost competitiveness.

Comprehensive research methodology employed in analyzing the Americas industrial bags and sacks market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of market insights and projections.

Primary research forms the foundation of market analysis through extensive interviews with industry executives, key customers, suppliers, and market participants across the Americas region. This primary data collection provides firsthand insights into market trends, competitive dynamics, customer requirements, and future growth expectations from industry stakeholders.

Secondary research encompasses comprehensive analysis of industry publications, government statistics, trade association data, and company financial reports to validate primary findings and provide broader market context. This secondary analysis ensures comprehensive coverage of market segments, geographic regions, and competitive landscape dynamics.

Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting techniques to project market growth, segment performance, and regional development patterns. Advanced analytical methods enable accurate assessment of market size, growth rates, and competitive positioning across different market segments and geographic regions.

Validation processes include cross-referencing multiple data sources, expert review panels, and market participant feedback to ensure accuracy and reliability of research findings. MarkWide Research employs rigorous quality control measures throughout the research process to maintain high standards of analytical accuracy and market insight reliability.

Regional market dynamics across the Americas demonstrate distinct characteristics, growth patterns, and competitive landscapes that reflect local economic conditions, industrial development levels, and market maturity stages. This regional analysis provides comprehensive insight into geographic market opportunities and challenges.

North America maintains market leadership through technological innovation, premium product adoption, and established industrial infrastructure. The United States and Canada demonstrate mature markets with steady growth rates of approximately 4.8% annually, driven by agricultural exports, chemical production, and construction activities. Advanced manufacturing capabilities and stringent quality standards characterize the North American market segment.

Latin America represents the fastest-growing regional market, with countries including Brazil, Mexico, Argentina, and Chile demonstrating accelerating demand for industrial packaging solutions. Economic development, infrastructure investments, and expanding agricultural production drive growth rates exceeding 9.2% annually in key Latin American markets, creating substantial opportunities for market expansion.

Central America and the Caribbean markets show emerging potential driven by agricultural development, tourism infrastructure, and manufacturing growth. These markets demonstrate increasing sophistication in packaging requirements and growing adoption of international quality standards, creating opportunities for specialized products and services.

Regional specialization reflects local industry concentrations, with agricultural packaging dominating in grain-producing regions, chemical packaging concentrated in industrial centers, and construction materials packaging aligned with infrastructure development activities. This specialization creates opportunities for targeted market strategies and localized product development approaches.

Competitive dynamics in the Americas industrial bags and sacks market feature a diverse mix of multinational corporations, regional specialists, and local manufacturers competing across different market segments and geographic regions. This competitive environment drives innovation, quality improvements, and customer service enhancements.

Competitive strategies emphasize differentiation through product innovation, sustainability initiatives, customer service excellence, and geographic expansion. Leading companies invest heavily in research and development, manufacturing technology upgrades, and market expansion to maintain competitive positioning and capture growth opportunities.

Market segmentation analysis reveals distinct categories within the Americas industrial bags and sacks market, each characterized by specific requirements, growth patterns, and competitive dynamics. Understanding these segments enables targeted strategies and optimized resource allocation.

By Material Type:

By Application:

By Capacity:

Detailed category analysis provides comprehensive understanding of specific market segments, their unique characteristics, growth drivers, and competitive dynamics within the Americas industrial bags and sacks market.

Woven Polypropylene Category: This dominant category represents the largest market share due to its versatility, durability, and cost-effectiveness. Woven polypropylene bags excel in applications requiring high strength-to-weight ratios and resistance to moisture and chemicals. Market growth in this category reaches approximately 5.8% annually, driven by expanding agricultural and construction applications.

Paper Sacks Category: Traditional paper sacks maintain market relevance through sustainability advantages and specific application requirements where biodegradability is essential. This category demonstrates steady performance with particular strength in food-grade applications and environmentally conscious market segments.

Flexible Intermediate Bulk Containers (FIBCs): The FIBC category serves specialized applications requiring high-capacity, heavy-duty packaging solutions. Growth in this category is driven by chemical industry expansion and bulk material handling efficiency requirements, with adoption rates increasing by approximately 12.3% annually in key industrial segments.

Specialty Bags Category: This high-value category includes products with enhanced barrier properties, anti-static features, and specialized closure systems. Specialty bags command premium pricing and serve niche applications in pharmaceuticals, hazardous materials, and high-performance industrial applications.

Comprehensive benefits accrue to various stakeholders participating in the Americas industrial bags and sacks market, creating value through improved efficiency, cost optimization, and enhanced operational capabilities across the supply chain.

For Manufacturers:

For End Users:

For Investors:

Strategic analysis of the Americas industrial bags and sacks market through SWOT framework provides comprehensive assessment of internal capabilities and external market conditions affecting industry development and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the Americas industrial bags and sacks market reflect evolving customer requirements, technological capabilities, and environmental considerations that drive innovation and market development strategies.

Sustainability Integration represents the most significant trend, with manufacturers increasingly developing biodegradable, recyclable, and reduced-impact packaging solutions. This trend is driven by regulatory requirements, corporate sustainability commitments, and growing environmental awareness among industrial customers. Approximately 58% of new product development now incorporates sustainability considerations as primary design criteria.

Smart Packaging Adoption emerges as companies integrate digital technologies including RFID tags, QR codes, and IoT sensors to provide enhanced tracking, monitoring, and supply chain optimization capabilities. These technologies enable real-time visibility into product location, condition, and handling history, creating value for customers through improved logistics efficiency.

Customization Demand increases as customers seek packaging solutions tailored to specific applications, handling requirements, and branding needs. This trend drives manufacturers to develop flexible production capabilities and customer-specific design services that differentiate their offerings from commodity products.

Regional Localization becomes increasingly important as companies establish local manufacturing and distribution capabilities to serve regional markets more effectively. This trend is driven by transportation cost optimization, supply chain resilience requirements, and customer preferences for local suppliers.

Significant industry developments demonstrate the dynamic nature of the Americas industrial bags and sacks market, with companies investing in capacity expansion, technology upgrades, and strategic partnerships to capture growth opportunities and enhance competitive positioning.

Capacity Expansion Initiatives reflect growing market confidence, with major manufacturers announcing substantial investments in new production facilities and equipment upgrades throughout the Americas region. These investments focus on high-growth segments including sustainable packaging, specialty applications, and emerging market opportunities.

Technology Advancement Programs drive innovation through research and development investments, partnerships with technology providers, and acquisition of specialized capabilities. Companies are investing in advanced manufacturing technologies, material science research, and digital integration capabilities to enhance product performance and operational efficiency.

Sustainability Commitments shape industry development as companies establish ambitious environmental goals, invest in sustainable materials research, and develop circular economy solutions. These commitments reflect both regulatory requirements and market demand for environmentally responsible packaging alternatives.

Strategic Partnerships enable companies to access new technologies, expand geographic coverage, and enhance customer service capabilities through collaboration with suppliers, customers, and technology providers. These partnerships create synergies that accelerate innovation and market development.

Strategic recommendations for stakeholders in the Americas industrial bags and sacks market focus on positioning for long-term success through innovation, sustainability leadership, and market expansion strategies that capitalize on emerging opportunities while addressing industry challenges.

Innovation Investment should prioritize sustainable materials development, smart packaging integration, and specialized application solutions that provide differentiation and premium positioning opportunities. Companies should allocate significant resources to research and development activities that create competitive advantages and address evolving customer requirements.

Geographic Expansion strategies should focus on high-growth Latin American markets where industrial development creates substantial demand for packaging solutions. MarkWide Research analysis indicates that companies establishing early market presence in emerging regions achieve superior long-term market positions and growth rates.

Sustainability Leadership becomes essential for long-term competitiveness as environmental considerations increasingly influence purchasing decisions. Companies should develop comprehensive sustainability strategies encompassing material selection, manufacturing processes, and end-of-life product management to meet evolving market requirements.

Customer Partnership Development enables deeper market penetration through collaborative relationships that provide insights into customer requirements, application challenges, and innovation opportunities. Long-term partnerships create competitive barriers and provide platforms for premium product development and market expansion.

Future market prospects for the Americas industrial bags and sacks market remain highly positive, with multiple growth drivers, innovation opportunities, and market expansion possibilities creating favorable conditions for continued development and investment.

Growth Trajectory projections indicate sustained market expansion driven by industrial development, agricultural growth, and infrastructure investments throughout the Americas region. Market growth rates are expected to maintain momentum at approximately 6.8% annually over the next five years, with Latin American markets demonstrating particularly strong performance.

Technology Evolution will continue transforming the market through advanced materials, smart packaging integration, and manufacturing process improvements that enhance product performance while reducing environmental impact. These technological advances create opportunities for differentiation and premium positioning in competitive markets.

Sustainability Transformation will accelerate as regulatory requirements, customer demands, and corporate commitments drive adoption of environmentally responsible packaging solutions. Companies successfully navigating this transformation will achieve competitive advantages and market leadership positions.

Market Consolidation trends may emerge as companies seek scale advantages, technology capabilities, and geographic coverage through strategic acquisitions and partnerships. This consolidation will create opportunities for market leaders to strengthen their competitive positions while providing exit opportunities for smaller players.

The Americas industrial bags and sacks market represents a dynamic and evolving sector with substantial growth potential, driven by fundamental economic trends, technological innovation, and increasing sustainability focus. Market participants who successfully navigate the complex landscape of customer requirements, regulatory changes, and competitive pressures will achieve superior performance and market positioning.

Key success factors include innovation leadership, sustainability commitment, geographic diversification, and customer partnership development. Companies that invest in these strategic priorities while maintaining operational excellence and cost competitiveness will capture the most attractive growth opportunities and achieve sustainable competitive advantages.

Market outlook remains highly favorable, with multiple growth drivers supporting continued expansion across diverse applications and geographic regions. The combination of established market foundations, emerging opportunities, and technological advancement creates an attractive environment for continued investment and development in the Americas industrial bags and sacks market.

What is Industrial Bags and Sacks?

Industrial Bags and Sacks are packaging solutions designed for the storage and transportation of bulk materials. They are commonly used in various sectors such as agriculture, construction, and food processing.

What are the key players in the Americas Industrial Bags and Sacks Market?

Key players in the Americas Industrial Bags and Sacks Market include Berry Global, Mondi Group, and Sealed Air Corporation, among others. These companies are known for their innovative packaging solutions and extensive distribution networks.

What are the main drivers of the Americas Industrial Bags and Sacks Market?

The main drivers of the Americas Industrial Bags and Sacks Market include the growing demand for sustainable packaging solutions, the expansion of the e-commerce sector, and the increasing need for efficient bulk material handling in industries such as agriculture and construction.

What challenges does the Americas Industrial Bags and Sacks Market face?

Challenges in the Americas Industrial Bags and Sacks Market include fluctuating raw material prices, stringent environmental regulations, and competition from alternative packaging solutions. These factors can impact production costs and market dynamics.

What opportunities exist in the Americas Industrial Bags and Sacks Market?

Opportunities in the Americas Industrial Bags and Sacks Market include the rising trend of eco-friendly packaging, advancements in manufacturing technologies, and the potential for growth in emerging markets. Companies can leverage these trends to innovate and expand their product offerings.

What trends are shaping the Americas Industrial Bags and Sacks Market?

Trends shaping the Americas Industrial Bags and Sacks Market include the increasing adoption of biodegradable materials, the shift towards automation in packaging processes, and the growing focus on supply chain efficiency. These trends are influencing product development and consumer preferences.

Americas Industrial Bags and Sacks Market

| Segmentation Details | Description |

|---|---|

| Product Type | Woven Bags, Non-Woven Bags, Paper Sacks, Plastic Sacks |

| Material | Polyethylene, Polypropylene, Kraft Paper, Biodegradable Materials |

| End User | Agriculture, Food & Beverage, Chemicals, Construction |

| Packaging Type | Bulk Bags, Retail Bags, Custom Bags, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

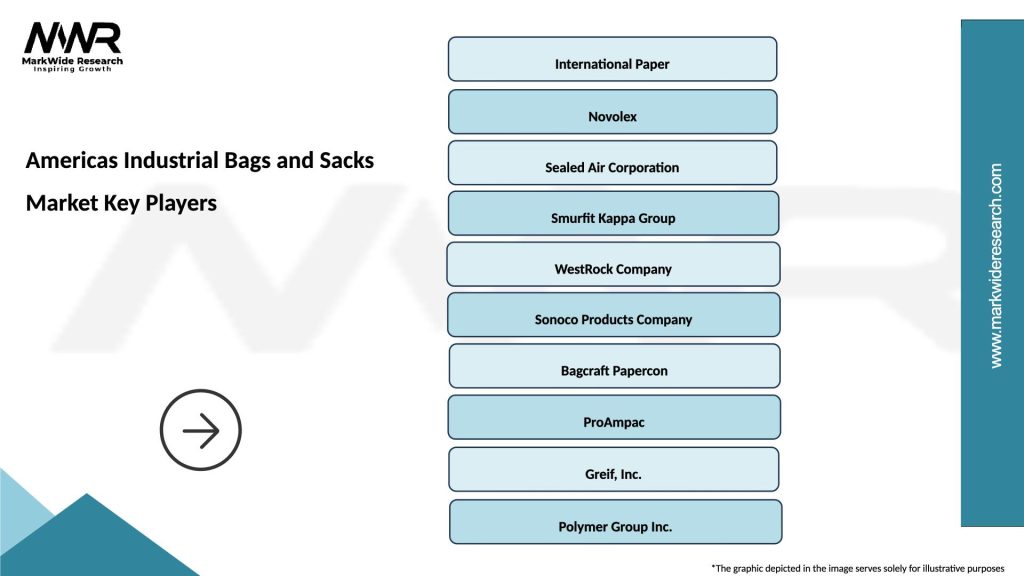

Leading companies in the Americas Industrial Bags and Sacks Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at