444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The America airport passenger screening equipment market represents a critical component of the nation’s aviation security infrastructure, encompassing advanced technologies designed to detect threats and ensure passenger safety. This market has experienced substantial growth driven by increasing air travel volumes, evolving security threats, and stringent regulatory requirements imposed by the Transportation Security Administration (TSA) and other federal agencies.

Market dynamics indicate robust expansion across multiple technology segments, including X-ray screening systems, millimeter wave scanners, explosive detection systems, and biometric identification technologies. The market demonstrates strong growth momentum with a projected CAGR of 6.8% through the forecast period, reflecting continuous investments in next-generation security technologies and infrastructure modernization initiatives.

Regional distribution shows concentrated activity in major metropolitan areas, with significant installations at hub airports including Atlanta, Los Angeles, Chicago, and New York. The market benefits from federal funding programs, public-private partnerships, and ongoing technology refresh cycles that drive consistent demand for advanced screening equipment.

Technology adoption rates reveal accelerating implementation of artificial intelligence-enhanced screening systems, with approximately 78% of major airports planning upgrades to automated threat detection capabilities within the next three years. This technological evolution addresses growing passenger volumes while maintaining security effectiveness and operational efficiency.

The America airport passenger screening equipment market refers to the comprehensive ecosystem of security technologies, systems, and devices deployed across American airports to screen passengers, carry-on luggage, and checked baggage for prohibited items, weapons, and explosive materials. This market encompasses hardware, software, integration services, and maintenance solutions that collectively ensure aviation security compliance.

Core components include advanced imaging technology (AIT) scanners, computed tomography (CT) baggage screening systems, explosive trace detection (ETD) equipment, walk-through metal detectors, handheld screening devices, and biometric verification systems. These technologies work in integrated configurations to create layered security protocols that meet federal aviation security standards.

Market participants range from global technology manufacturers and system integrators to specialized security equipment providers and maintenance service companies. The ecosystem includes both established defense contractors and innovative technology startups developing next-generation screening solutions powered by artificial intelligence and machine learning algorithms.

Strategic analysis reveals the America airport passenger screening equipment market is positioned for sustained growth, driven by increasing passenger traffic, evolving threat landscapes, and continuous technology advancement. The market benefits from strong government support through federal funding programs and regulatory mandates that ensure consistent demand for security equipment upgrades.

Key growth drivers include the modernization of aging screening infrastructure, implementation of enhanced security protocols, and adoption of automated screening technologies that improve both security effectiveness and passenger experience. Approximately 85% of screening equipment installations now incorporate some form of artificial intelligence or automated threat recognition capabilities.

Market segmentation shows diversified demand across multiple technology categories, with CT-based baggage screening systems experiencing the highest growth rates due to their superior threat detection capabilities and reduced manual inspection requirements. The passenger screening segment maintains steady growth supported by ongoing deployments of advanced imaging technology and biometric systems.

Competitive dynamics feature established market leaders alongside emerging technology providers, creating an environment of continuous innovation and technological advancement. Market consolidation trends indicate strategic partnerships between equipment manufacturers and system integrators to deliver comprehensive security solutions.

Technology evolution represents the most significant market driver, with artificial intelligence and machine learning transforming traditional screening processes into automated, high-efficiency security systems. These advancements enable faster passenger processing while maintaining enhanced threat detection capabilities.

Regulatory compliance continues driving market demand as federal agencies implement updated security standards and equipment certification requirements. These mandates ensure consistent technology adoption across the national airport network while maintaining interoperability and security effectiveness.

Passenger volume growth serves as the primary market driver, with American airports handling increasing numbers of travelers annually. This growth necessitates expanded screening capacity and more efficient processing technologies to maintain security standards without creating operational bottlenecks.

Regulatory mandates from the TSA and Department of Homeland Security establish minimum security standards and drive periodic equipment upgrades. These requirements ensure airports maintain current technology capabilities and implement enhanced screening protocols as threats evolve.

Technological advancement creates opportunities for improved security effectiveness and operational efficiency. Advanced imaging technologies, artificial intelligence integration, and automated threat detection systems enable faster processing times while maintaining comprehensive security coverage.

Infrastructure modernization programs support market growth as airports upgrade aging screening equipment and expand security checkpoints. Federal funding initiatives and airport improvement grants provide financial support for technology deployments and facility enhancements.

Threat landscape evolution requires continuous adaptation of screening technologies and procedures. Emerging security challenges drive demand for advanced detection capabilities and multi-layered security approaches that address diverse threat scenarios.

Operational efficiency requirements push airports toward automated screening solutions that reduce manual intervention while maintaining security effectiveness. These systems help address staffing challenges and improve passenger experience through faster processing times.

High capital costs represent a significant barrier to market expansion, particularly for smaller airports with limited budgets. Advanced screening equipment requires substantial upfront investments that may strain airport financial resources and delay technology adoption.

Complex integration requirements challenge airports implementing new screening technologies within existing infrastructure. Legacy systems compatibility, facility modifications, and operational workflow changes create implementation complexities that can extend deployment timelines.

Regulatory approval processes can slow market growth as new technologies undergo extensive testing and certification procedures. Federal approval requirements ensure security effectiveness but may delay commercial availability of innovative screening solutions.

Maintenance and operational costs create ongoing financial burdens for airport operators. Sophisticated screening equipment requires specialized maintenance, regular calibration, and trained personnel, adding to total cost of ownership considerations.

Privacy concerns surrounding advanced imaging technologies and biometric systems may create resistance to deployment. Balancing security requirements with passenger privacy expectations requires careful consideration of technology implementation approaches.

Training requirements for security personnel add complexity and cost to technology deployments. New screening systems often require extensive operator training and certification programs that can strain airport resources and extend implementation periods.

Artificial intelligence integration presents significant opportunities for market expansion through enhanced threat detection capabilities and automated screening processes. AI-powered systems can improve security effectiveness while reducing operational costs and processing times.

Biometric technology adoption offers opportunities for seamless passenger processing and enhanced security verification. Integration of facial recognition, fingerprint scanning, and other biometric modalities can streamline checkpoint operations while strengthening identity verification protocols.

Cloud-based solutions enable centralized monitoring, data analytics, and threat intelligence sharing across airport networks. These platforms provide opportunities for improved security coordination and operational efficiency through real-time information sharing.

Mobile screening capabilities create opportunities for flexible security deployment and enhanced operational adaptability. Portable screening equipment enables airports to adjust security configurations based on passenger volumes and threat levels.

International expansion opportunities exist as American technology providers export screening solutions to global markets. Advanced screening technologies developed for domestic applications can address international airport security requirements and drive export growth.

Public-private partnerships offer opportunities for innovative financing and deployment models. Collaborative arrangements between government agencies and private companies can accelerate technology adoption while sharing implementation costs and risks.

Supply chain considerations significantly impact market dynamics as screening equipment manufacturers navigate component availability, production capacity, and delivery schedules. Global supply chain disruptions can affect equipment availability and project timelines, influencing market growth patterns.

Technology refresh cycles create predictable demand patterns as airports periodically upgrade screening equipment to maintain compliance and operational effectiveness. These cycles typically span 7-10 years for major equipment categories, providing visibility into future market opportunities.

Competitive positioning among market participants drives continuous innovation and technology advancement. Companies compete on detection capabilities, processing speed, operational efficiency, and total cost of ownership to secure airport contracts and market share.

Regulatory influence shapes market dynamics through equipment certification requirements, security standards updates, and compliance mandates. Federal agencies play a central role in determining technology adoption patterns and market demand characteristics.

Budget allocation patterns at federal, state, and local levels influence market timing and growth rates. Airport improvement grants, federal security funding, and infrastructure investment programs provide financial support that drives market demand.

Operational integration challenges affect deployment timelines and market adoption rates. Successful technology implementations require careful coordination between equipment suppliers, system integrators, and airport operators to ensure seamless operational transitions.

Primary research methodologies employed comprehensive interviews with airport security officials, equipment manufacturers, system integrators, and federal agency representatives. These discussions provided insights into current market conditions, technology trends, and future requirements that shape market development.

Secondary research analyzed federal procurement data, airport improvement grant allocations, TSA equipment deployment statistics, and industry reports to establish market sizing and growth projections. This analysis incorporated historical trends and regulatory developments affecting market dynamics.

Market modeling techniques utilized statistical analysis of passenger traffic patterns, security equipment replacement cycles, and technology adoption rates to develop growth forecasts. The modeling incorporated multiple scenarios reflecting varying levels of federal funding and regulatory requirements.

Technology assessment evaluated emerging screening technologies, their development status, and potential market impact. This analysis considered factors such as detection capabilities, operational efficiency, cost considerations, and regulatory approval timelines.

Competitive analysis examined market participants, their product portfolios, market positioning, and strategic initiatives. This research identified key success factors, competitive advantages, and market share dynamics among leading suppliers.

Validation processes included cross-referencing multiple data sources, expert review panels, and sensitivity analysis to ensure research accuracy and reliability. The methodology incorporated feedback from industry stakeholders to refine market projections and insights.

Northeast region demonstrates strong market activity concentrated around major metropolitan airports including New York, Boston, and Washington D.C. This region accounts for approximately 28% of total market activity, driven by high passenger volumes and significant federal government presence requiring enhanced security measures.

Southeast region shows robust growth led by Atlanta’s Hartsfield-Jackson International Airport and expanding aviation hubs in Florida and North Carolina. The region benefits from increasing passenger traffic and ongoing airport expansion projects that drive screening equipment demand.

West Coast markets feature significant activity in California airports, particularly Los Angeles and San Francisco, along with growing demand in Seattle and Portland. Technology adoption rates in this region exceed national averages, with 82% of major airports implementing advanced screening technologies.

Central region encompasses major hub airports in Chicago, Denver, and Dallas, representing critical connection points in the national aviation network. These airports require high-capacity screening systems capable of processing large passenger volumes efficiently.

Mountain West and other regions show steady growth supported by tourism-related travel and regional airport expansion. Smaller airports in these areas often adopt scalable screening solutions that can accommodate varying passenger volumes and operational requirements.

Market concentration patterns reveal that the top 50 airports account for approximately 75% of screening equipment deployments, reflecting the importance of major hubs in driving market demand and technology adoption trends.

Market leadership is established by companies with comprehensive product portfolios, strong government relationships, and proven track records in airport security deployments. The competitive environment features both large defense contractors and specialized security technology providers.

Competitive strategies focus on technology innovation, cost competitiveness, and comprehensive service offerings. Companies invest heavily in research and development to maintain technological leadership and meet evolving security requirements.

Strategic partnerships between equipment manufacturers and system integrators create comprehensive solution offerings that address complete airport security requirements. These collaborations enhance market competitiveness and customer value propositions.

By Technology: The market segments into multiple technology categories, each addressing specific screening requirements and operational environments. Advanced imaging technology maintains the largest market share, while CT-based systems show the highest growth rates.

By Application: Market segmentation reflects diverse screening requirements across different airport operational areas and security checkpoint configurations.

By Airport Size: Different airport categories require varying screening capabilities and equipment configurations based on passenger volumes and operational complexity.

Advanced Imaging Technology represents the largest market segment, driven by TSA deployment mandates and proven effectiveness in threat detection. These systems provide comprehensive passenger screening while maintaining acceptable processing speeds for high-volume operations.

Computed Tomography systems demonstrate the highest growth potential as airports transition from traditional X-ray to three-dimensional imaging capabilities. CT technology offers superior threat detection and reduced false alarm rates, improving both security and operational efficiency.

Explosive Detection Systems maintain steady demand driven by evolving threat landscapes and regulatory requirements for comprehensive explosive screening capabilities. These systems provide critical security layers for both passenger and baggage screening operations.

Biometric technologies show accelerating adoption as airports implement identity verification systems and access control measures. Integration with existing screening processes creates seamless security workflows while enhancing overall system effectiveness.

Mobile screening solutions address growing demand for flexible security deployment capabilities. These systems enable airports to adapt screening configurations based on operational requirements and threat levels while maintaining security standards.

Artificial intelligence integration across all technology categories represents a transformative trend that improves detection accuracy while reducing operational costs. AI-enhanced systems demonstrate 35% improvement in threat recognition capabilities compared to traditional screening methods.

Airport operators benefit from enhanced security capabilities, improved operational efficiency, and reduced staffing requirements through automated screening technologies. Advanced systems enable faster passenger processing while maintaining comprehensive threat detection capabilities.

Passengers experience improved travel convenience through faster screening processes, reduced wait times, and less intrusive security procedures. Modern screening technologies minimize physical contact requirements while maintaining thorough security coverage.

Security personnel gain enhanced threat detection tools, automated alarm resolution capabilities, and improved situational awareness through integrated monitoring systems. These technologies reduce manual inspection requirements while improving overall security effectiveness.

Equipment manufacturers access growing market opportunities driven by technology refresh cycles, regulatory mandates, and expanding airport infrastructure. Continuous innovation requirements create sustainable competitive advantages for technology leaders.

System integrators benefit from complex deployment requirements that demand specialized expertise in airport operations, security protocols, and technology integration. These projects provide high-value service opportunities and long-term customer relationships.

Federal agencies achieve improved national security through enhanced screening capabilities, standardized technology deployments, and comprehensive threat detection coverage across the aviation network. Advanced systems provide better intelligence gathering and incident response capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation advancement represents the most significant market trend, with artificial intelligence and machine learning transforming screening operations. Automated threat recognition systems reduce human intervention requirements while improving detection accuracy and processing speed.

Biometric integration accelerates across airport security systems, creating seamless identity verification processes that enhance both security and passenger experience. Facial recognition and other biometric technologies enable contactless screening procedures.

Cloud connectivity enables centralized monitoring, data analytics, and threat intelligence sharing across airport networks. Cloud-based platforms provide real-time security oversight and coordinated incident response capabilities.

Contactless screening technologies gain importance as health and safety considerations drive demand for reduced physical contact during security processes. These systems maintain security effectiveness while addressing passenger health concerns.

Predictive maintenance capabilities improve equipment reliability and reduce operational disruptions through IoT sensors and data analytics. These systems predict equipment failures before they occur, minimizing downtime and maintenance costs.

Mobile screening solutions provide operational flexibility for varying security requirements and passenger volumes. Portable equipment enables dynamic security deployment based on threat levels and operational needs.

Technology certifications by federal agencies validate new screening capabilities and enable commercial deployment. Recent approvals for advanced CT systems and AI-enhanced screening technologies expand available solutions for airport operators.

Major contract awards demonstrate market confidence and drive technology adoption across the airport network. Significant deployments at major hub airports create reference installations that influence broader market adoption patterns.

Strategic acquisitions among market participants consolidate capabilities and create comprehensive solution portfolios. These transactions combine complementary technologies and market positions to strengthen competitive capabilities.

Research partnerships between equipment manufacturers and academic institutions advance screening technology development. Collaborative programs focus on artificial intelligence, advanced materials, and detection algorithms that improve system performance.

International collaborations expand market opportunities through technology sharing agreements and joint development programs. These partnerships enable American companies to access global markets while advancing screening technology capabilities.

Regulatory updates establish new security standards and equipment requirements that drive market demand. Recent policy changes emphasize automated screening capabilities and enhanced threat detection performance standards.

MarkWide Research analysis indicates that airport operators should prioritize investments in artificial intelligence-enhanced screening systems to achieve optimal security effectiveness and operational efficiency. These technologies provide the best return on investment through reduced staffing requirements and improved threat detection capabilities.

Technology integration strategies should focus on comprehensive security solutions rather than individual equipment deployments. Integrated systems provide better security coverage while simplifying operations and maintenance requirements.

Funding optimization requires strategic planning to maximize federal grant utilization and coordinate technology deployments with infrastructure improvement projects. Airports should align screening equipment upgrades with broader facility modernization initiatives.

Vendor selection criteria should emphasize long-term technology roadmaps, service capabilities, and integration expertise rather than initial equipment costs. Total cost of ownership considerations include maintenance, training, and upgrade requirements over system lifecycles.

Staff training programs must accompany technology deployments to ensure effective system utilization and maintain security standards. Comprehensive training reduces operational risks and maximizes equipment performance capabilities.

Performance monitoring systems should track security effectiveness, operational efficiency, and passenger satisfaction metrics to optimize screening operations. Data-driven management approaches enable continuous improvement and system optimization.

Market growth projections indicate sustained expansion driven by increasing passenger volumes, technology advancement, and regulatory requirements. The market is expected to maintain strong growth momentum with projected expansion rates of 6.8% CAGR through the forecast period.

Technology evolution will focus on artificial intelligence integration, biometric capabilities, and automated screening processes. These advancements will improve security effectiveness while reducing operational costs and enhancing passenger experience.

Regulatory developments will continue shaping market demand through updated security standards and equipment certification requirements. Federal agencies will likely emphasize automated screening capabilities and enhanced threat detection performance.

Investment patterns suggest continued federal support for airport security infrastructure through grant programs and direct funding initiatives. Public-private partnerships may become more prevalent as financing mechanisms for large-scale technology deployments.

MWR projections indicate that approximately 90% of major airports will implement some form of artificial intelligence-enhanced screening technology within the next five years. This adoption rate reflects the compelling operational and security benefits of advanced screening systems.

International opportunities will expand as American screening technology providers leverage domestic expertise to address global airport security requirements. Export growth will contribute significantly to overall market expansion and technology advancement.

The America airport passenger screening equipment market demonstrates strong growth potential driven by increasing passenger volumes, evolving security threats, and continuous technology advancement. Market dynamics favor companies that can deliver comprehensive security solutions combining advanced detection capabilities with operational efficiency improvements.

Technology trends clearly indicate artificial intelligence and automation will dominate future market development, creating opportunities for enhanced security effectiveness while reducing operational costs. Biometric integration and contactless screening capabilities will become standard features as airports balance security requirements with passenger experience expectations.

Strategic positioning requires market participants to focus on innovation, integration capabilities, and long-term customer relationships. Success factors include technology leadership, comprehensive service offerings, and the ability to navigate complex regulatory environments while delivering proven security solutions.

Market outlook remains positive with sustained growth expected across all major technology segments. Federal support through funding programs and regulatory mandates ensures consistent demand, while technology advancement creates opportunities for improved security capabilities and operational efficiency. The America airport passenger screening equipment market will continue serving as a critical component of national aviation security infrastructure while adapting to emerging threats and operational requirements.

What is Airport Passenger Screening Equipment?

Airport Passenger Screening Equipment refers to the tools and technologies used to ensure the safety of passengers and their belongings at airports. This includes devices such as metal detectors, X-ray machines, and body scanners that help identify prohibited items and enhance security measures.

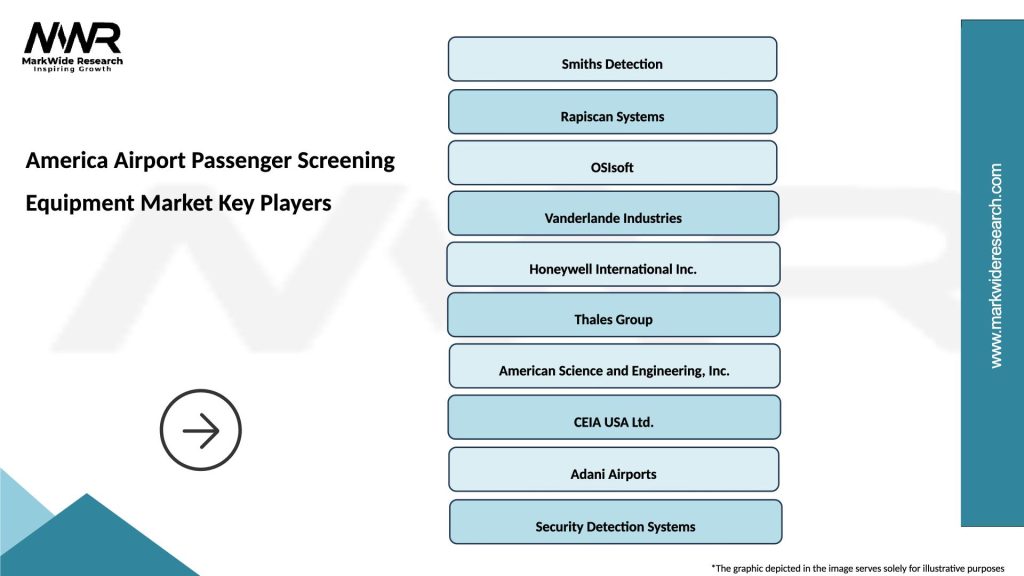

What are the key players in the America Airport Passenger Screening Equipment Market?

Key players in the America Airport Passenger Screening Equipment Market include companies like Smiths Detection, L3Harris Technologies, and Rapiscan Systems, among others. These companies are known for their innovative security solutions and play a significant role in enhancing airport safety.

What are the main drivers of growth in the America Airport Passenger Screening Equipment Market?

The main drivers of growth in the America Airport Passenger Screening Equipment Market include increasing passenger traffic, heightened security concerns, and advancements in screening technology. These factors contribute to the demand for more efficient and effective screening solutions at airports.

What challenges does the America Airport Passenger Screening Equipment Market face?

The America Airport Passenger Screening Equipment Market faces challenges such as the high cost of advanced screening technologies and the need for continuous updates to comply with evolving security regulations. Additionally, there is a growing concern about passenger privacy and the potential for delays in screening processes.

What opportunities exist in the America Airport Passenger Screening Equipment Market?

Opportunities in the America Airport Passenger Screening Equipment Market include the integration of artificial intelligence and machine learning to improve screening efficiency and accuracy. Furthermore, the increasing focus on automation in airport operations presents avenues for innovative screening solutions.

What trends are shaping the America Airport Passenger Screening Equipment Market?

Trends shaping the America Airport Passenger Screening Equipment Market include the adoption of biometric screening technologies and the development of more compact and efficient screening devices. Additionally, there is a growing emphasis on sustainability and eco-friendly materials in the manufacturing of screening equipment.

America Airport Passenger Screening Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | X-Ray Machines, Metal Detectors, Body Scanners, Explosive Trace Detectors |

| Technology | Computed Tomography, Millimeter Wave, Backscatter, Dual-Energy |

| End User | Airports, Airlines, Security Agencies, Government Facilities |

| Installation | Fixed, Portable, Mobile, Temporary |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the America Airport Passenger Screening Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at