444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The America air traffic control market represents a critical infrastructure sector that ensures the safe and efficient movement of aircraft throughout North American airspace. This sophisticated ecosystem encompasses advanced radar systems, communication technologies, navigation equipment, and surveillance solutions that collectively manage millions of flights annually across the United States, Canada, and Mexico. Market dynamics indicate robust growth driven by increasing air traffic volumes, modernization initiatives, and the integration of next-generation technologies.

Aviation authorities across America are investing heavily in upgrading legacy systems to meet growing demand and enhance operational efficiency. The market demonstrates significant expansion potential with air traffic volumes projected to grow at approximately 4.2% annually over the next decade. Technological advancement remains a primary catalyst, with artificial intelligence, machine learning, and automation technologies revolutionizing traditional air traffic management approaches.

Infrastructure modernization programs, particularly the Federal Aviation Administration’s NextGen initiative, are driving substantial investments in advanced air traffic control systems. These comprehensive upgrades encompass satellite-based navigation, digital communication protocols, and enhanced surveillance capabilities that collectively improve airspace capacity and safety margins. Regional integration efforts between American nations further amplify market opportunities as cross-border air traffic coordination becomes increasingly sophisticated.

The America air traffic control market refers to the comprehensive ecosystem of technologies, services, and infrastructure solutions designed to manage and coordinate aircraft movements within American airspace. This market encompasses radar systems, communication equipment, navigation aids, surveillance technologies, and software platforms that enable air traffic controllers to safely guide aircraft from departure to destination.

Core components include primary and secondary radar systems, automatic dependent surveillance systems, voice communication networks, flight data processing systems, and weather monitoring equipment. The market also covers training services, maintenance solutions, and consulting services that support air traffic management operations. Integration capabilities between different systems and technologies form a crucial aspect of modern air traffic control solutions.

Operational scope extends beyond traditional airport environments to include en-route traffic management, approach and departure control, and terminal area operations. The market addresses both civilian and military aviation requirements, encompassing commercial airlines, private aircraft, cargo operations, and government flights. Safety standards and regulatory compliance requirements significantly influence market development and technology adoption patterns.

Strategic analysis reveals the America air traffic control market experiencing unprecedented transformation driven by technological innovation and increasing aviation demand. The market demonstrates strong fundamentals with consistent growth patterns supported by government modernization programs and private sector investments in advanced aviation technologies. Key growth drivers include rising passenger traffic, cargo volume expansion, and the need for enhanced operational efficiency.

Technology integration emerges as a defining characteristic, with artificial intelligence and machine learning applications gaining substantial adoption rates of approximately 28% annually among major air traffic control centers. Cloud-based solutions and digital transformation initiatives are reshaping traditional operational models, enabling more flexible and scalable air traffic management approaches. Regulatory support from aviation authorities accelerates market development through favorable policies and funding mechanisms.

Competitive dynamics showcase established aerospace companies alongside emerging technology providers, creating a diverse ecosystem of solution providers. Market consolidation trends indicate strategic partnerships and acquisitions as companies seek to expand their technological capabilities and market reach. Innovation focus centers on automation, predictive analytics, and real-time decision support systems that enhance controller efficiency and safety outcomes.

Market intelligence reveals several critical insights that shape the America air traffic control landscape:

Primary growth catalysts propelling the America air traffic control market include increasing aviation demand, technological advancement requirements, and regulatory modernization mandates. Passenger traffic growth continues expanding at steady rates, necessitating enhanced air traffic management capabilities to accommodate higher flight volumes without compromising safety standards.

Infrastructure aging creates urgent replacement needs as many air traffic control systems approach end-of-life status. Legacy equipment limitations restrict operational efficiency and capacity expansion, driving authorities to invest in next-generation technologies. Safety enhancement requirements mandate advanced surveillance and communication systems that provide controllers with improved situational awareness and decision-making tools.

Economic factors support market growth through increased business travel, tourism expansion, and cargo transportation demand. E-commerce growth particularly drives air freight volumes, requiring sophisticated traffic management solutions to handle diverse aircraft types and operational requirements. Government initiatives provide funding mechanisms and regulatory frameworks that facilitate technology adoption and system modernization programs.

Technological convergence enables integration of previously separate systems, creating comprehensive air traffic management platforms that improve operational efficiency. Artificial intelligence applications offer predictive capabilities that enhance traffic flow optimization and reduce delays. Environmental pressures drive adoption of technologies that minimize fuel consumption and emissions through more efficient routing and spacing algorithms.

Implementation challenges present significant obstacles to market expansion, particularly regarding the complexity of integrating new technologies with existing infrastructure. Budget constraints at government levels can delay modernization programs and limit the scope of technology upgrades, especially during economic downturns or competing priority situations.

Regulatory complexity creates lengthy approval processes for new technologies and systems, potentially slowing market adoption rates. Safety certification requirements, while necessary, can extend development timelines and increase costs for technology providers. Interoperability concerns between different systems and vendors complicate integration efforts and may require additional customization investments.

Workforce challenges include controller shortages and the need for extensive training on new technologies. The specialized nature of air traffic control requires significant time investments for personnel development, potentially creating implementation bottlenecks. Cybersecurity risks introduce additional complexity and costs as systems require robust protection against evolving digital threats.

Technical limitations of existing infrastructure may constrain the implementation of advanced technologies without substantial supporting upgrades. Legacy system dependencies can create compatibility issues that require expensive bridging solutions or complete system replacements. Stakeholder coordination challenges arise when multiple agencies and organizations must collaborate on complex modernization initiatives.

Emerging opportunities within the America air traffic control market span multiple technological and operational domains. Artificial intelligence integration presents substantial potential for enhancing predictive capabilities, optimizing traffic flows, and reducing controller workload through intelligent automation systems.

Urban air mobility represents a transformative opportunity as drone operations, air taxis, and unmanned aircraft systems require sophisticated traffic management solutions. This emerging sector demands innovative approaches to airspace integration and conflict resolution that traditional systems cannot adequately address. Market expansion potential in this segment could reach significant adoption levels within the next decade.

Cloud computing adoption enables scalable, flexible air traffic control solutions that can adapt to varying demand patterns and operational requirements. Software-as-a-service models reduce infrastructure costs while providing access to advanced capabilities for smaller airports and regional facilities. Data monetization opportunities emerge through analytics services and operational insights that benefit multiple aviation stakeholders.

International expansion possibilities exist as American technology providers export advanced air traffic control solutions to developing aviation markets. Partnership opportunities with emerging economies seeking to modernize their aviation infrastructure create new revenue streams and market presence expansion potential.

Dynamic interactions between technology advancement, regulatory requirements, and operational demands create a complex market environment that continuously evolves. Innovation cycles accelerate as competition intensifies among solution providers seeking to differentiate their offerings through advanced capabilities and superior performance metrics.

Supply chain considerations influence market dynamics through component availability, manufacturing capacity, and delivery timelines. Global semiconductor shortages and supply chain disruptions can impact system deployment schedules and project costs. Vendor relationships become increasingly strategic as long-term partnerships enable better integration and support capabilities.

Regulatory evolution shapes market dynamics through changing standards, certification requirements, and operational procedures. Aviation authorities continuously update guidelines to address new technologies and operational concepts, creating both opportunities and challenges for market participants. Safety culture remains paramount, influencing technology adoption patterns and implementation approaches.

Economic fluctuations affect market dynamics through budget allocations, investment priorities, and project timelines. Economic downturns may delay discretionary upgrades while economic growth periods accelerate modernization initiatives. Competitive pressures drive continuous innovation and cost optimization efforts among solution providers.

Comprehensive analysis of the America air traffic control market employs multiple research methodologies to ensure accurate and reliable insights. Primary research includes extensive interviews with industry executives, aviation authorities, technology providers, and end-users to gather firsthand perspectives on market trends and challenges.

Secondary research encompasses analysis of government publications, industry reports, regulatory documents, and technical specifications to understand market structure and dynamics. Data triangulation methods validate findings across multiple sources to ensure accuracy and reliability of market intelligence.

Quantitative analysis utilizes statistical modeling and trend analysis to project market growth patterns and identify key performance indicators. Qualitative assessment provides contextual understanding of market drivers, challenges, and opportunities through expert opinions and industry insights.

Market segmentation analysis examines different technology categories, application areas, and regional markets to provide granular insights into specific market segments. Competitive intelligence gathering includes analysis of company strategies, product portfolios, and market positioning to understand competitive dynamics and market structure.

United States dominance characterizes the America air traffic control market, accounting for approximately 78% of regional market activity due to its extensive aviation infrastructure and substantial modernization investments. The Federal Aviation Administration leads global air traffic control innovation through the NextGen program, driving technology adoption and setting international standards.

Canada represents the second-largest regional market with Nav Canada demonstrating leadership in air navigation services and technology implementation. Canadian investments in advanced air traffic control systems support both domestic operations and international aviation services. Market share distribution shows Canada holding approximately 15% of regional market activity.

Mexico’s growing aviation sector creates expanding opportunities for air traffic control solutions as passenger traffic and cargo operations increase. Infrastructure development programs focus on modernizing airports and air traffic management systems to support tourism growth and economic development. Mexican market participation represents approximately 7% of regional activity.

Regional integration initiatives enhance cross-border coordination and operational efficiency through harmonized procedures and compatible technologies. MarkWide Research analysis indicates increasing collaboration between American nations on air traffic management standards and best practices, creating opportunities for technology providers serving multiple markets simultaneously.

Market leadership within the America air traffic control sector features established aerospace and defense companies alongside specialized technology providers. The competitive environment demonstrates both collaboration and competition as companies pursue different market segments and technological approaches.

Strategic partnerships characterize competitive dynamics as companies collaborate to deliver comprehensive solutions that meet complex customer requirements. Innovation competition drives continuous technology advancement and feature enhancement across all market segments.

Technology-based segmentation reveals distinct market categories with varying growth patterns and application requirements:

By Technology:

By Application:

By End User:

Radar systems category maintains market leadership through continuous technology advancement and reliability requirements. Next-generation radar technologies incorporate digital signal processing and enhanced detection capabilities that improve aircraft tracking accuracy and reduce false alarms. Market adoption rates for advanced radar systems show steady growth of approximately 6.5% annually.

Communication systems segment experiences transformation through digital technology adoption and IP-based networking solutions. Voice over IP implementations reduce infrastructure costs while improving communication quality and system flexibility. Integration with mobile devices and remote access capabilities enhance operational efficiency and controller mobility.

Surveillance technology category demonstrates rapid growth driven by automatic dependent surveillance-broadcast (ADS-B) mandate compliance and enhanced tracking requirements. Multilateration systems provide cost-effective surveillance solutions for airports and terminal areas where traditional radar may be impractical or expensive.

Automation systems segment shows the highest growth potential as artificial intelligence and machine learning applications mature. Predictive analytics capabilities enable proactive traffic management and conflict resolution, reducing controller workload and improving safety margins. Advanced automation adoption rates reach approximately 32% among major facilities.

Aviation authorities benefit from enhanced operational efficiency, improved safety margins, and reduced operational costs through advanced air traffic control technologies. Capacity optimization enables handling of increased traffic volumes without proportional infrastructure expansion, maximizing return on investment for modernization programs.

Airlines and operators experience reduced delays, optimized flight paths, and improved fuel efficiency through advanced traffic management systems. Predictive capabilities enable better flight planning and resource allocation, reducing operational costs and improving customer satisfaction. Enhanced communication systems facilitate better coordination and information sharing.

Technology providers access expanding market opportunities through innovation and specialization in emerging technology areas. Long-term contracts with aviation authorities provide stable revenue streams and opportunities for ongoing system support and enhancement services. Partnership opportunities enable market expansion and capability development.

Passengers and cargo customers benefit from improved on-time performance, enhanced safety, and more efficient travel experiences. Environmental benefits include reduced fuel consumption and emissions through optimized routing and spacing algorithms. Economic benefits extend to reduced travel costs and improved service reliability.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as the most significant trend reshaping air traffic control operations. Machine learning algorithms enable predictive traffic management, automated conflict detection, and optimized routing decisions that enhance both safety and efficiency. AI adoption rates in air traffic control applications show accelerating growth of approximately 35% annually.

Cloud-based solutions gain traction as aviation authorities seek scalable, flexible alternatives to traditional on-premises systems. Software-as-a-service models reduce infrastructure costs and enable rapid deployment of new capabilities. Cloud adoption facilitates better data sharing and collaboration between different air traffic control facilities.

Cybersecurity enhancement becomes paramount as air traffic control systems face increasing digital threats. Zero-trust architectures and advanced threat detection systems protect critical infrastructure from cyberattacks. Security investment priorities shift toward proactive threat prevention and rapid incident response capabilities.

Sustainability focus drives adoption of technologies that minimize environmental impact through optimized flight paths and reduced fuel consumption. Green aviation initiatives influence technology selection and operational procedures. Environmental considerations increasingly factor into system procurement and deployment decisions.

NextGen program advancement continues transforming American air traffic control through comprehensive modernization initiatives. Satellite-based navigation implementation progresses across major airports and air traffic control centers, enabling more precise aircraft guidance and reduced separation requirements.

Remote tower technology deployment expands operational flexibility and cost-effectiveness for smaller airports. Digital tower solutions enable centralized control of multiple airports from single facilities, improving resource utilization and operational efficiency. Remote operations capability proves particularly valuable for airports with limited traffic volumes.

Unmanned aircraft integration programs develop frameworks for incorporating drones and autonomous aircraft into controlled airspace. UTM (Unmanned Traffic Management) systems create parallel infrastructure for managing low-altitude operations while maintaining separation from traditional aviation.

International cooperation initiatives enhance cross-border air traffic coordination and harmonize operational procedures. MWR analysis indicates increasing collaboration between American nations on technology standards and best practices, facilitating seamless international flight operations and improved efficiency.

Strategic recommendations for market participants emphasize the importance of embracing emerging technologies while maintaining focus on safety and reliability. Investment priorities should target artificial intelligence capabilities, cybersecurity enhancements, and cloud-based solutions that provide competitive advantages and operational benefits.

Partnership strategies become increasingly important as system complexity requires collaboration between multiple technology providers. Ecosystem approaches that integrate various components and services offer superior value propositions compared to standalone solutions. Companies should develop strategic alliances that complement their core capabilities.

Workforce development investments are essential for successful technology implementation and ongoing operations. Training programs must evolve to address new technologies and operational procedures while maintaining safety standards. Organizations should prioritize change management and user adoption strategies.

Market expansion opportunities exist through international partnerships and technology export initiatives. Emerging markets seeking to modernize their aviation infrastructure represent significant growth potential for American technology providers. Companies should develop market entry strategies that address local requirements and regulatory frameworks.

Long-term projections indicate continued robust growth for the America air traffic control market driven by technological advancement and increasing aviation demand. Market evolution will be characterized by greater automation, enhanced integration, and improved operational efficiency across all segments.

Technology convergence will create more comprehensive and capable air traffic control systems that seamlessly integrate multiple functions and capabilities. Artificial intelligence maturation will enable autonomous decision-making capabilities that reduce controller workload while maintaining safety standards. AI-enhanced systems may achieve widespread deployment reaching 60% of facilities within the next decade.

Urban air mobility integration will fundamentally change air traffic control requirements as new aircraft types and operational concepts enter the airspace. Three-dimensional traffic management systems will coordinate traditional aviation with emerging mobility solutions, creating complex but efficient airspace utilization patterns.

Sustainability imperatives will drive continued innovation in fuel-efficient routing, emission reduction technologies, and environmental impact minimization. MarkWide Research projects that environmental considerations will become primary factors in technology selection and operational procedure development, influencing market dynamics and competitive positioning throughout the forecast period.

The America air traffic control market stands at a transformative juncture where technological innovation, operational demands, and regulatory requirements converge to create unprecedented opportunities for growth and advancement. Market fundamentals remain strong with consistent demand drivers, substantial investment commitments, and clear regulatory support for modernization initiatives.

Technology leadership positions American companies and institutions at the forefront of global air traffic control innovation, creating competitive advantages and export opportunities. The integration of artificial intelligence, cloud computing, and advanced automation technologies promises to revolutionize traditional operational models while maintaining the safety standards that define aviation excellence.

Strategic success in this evolving market requires balanced approaches that embrace innovation while respecting the critical safety requirements inherent in air traffic control operations. Companies that effectively combine technological advancement with operational reliability will capture the greatest market opportunities and establish sustainable competitive positions in this essential infrastructure sector.

What is Air Traffic Control?

Air Traffic Control (ATC) refers to the service that manages the safe and orderly flow of air traffic in the skies and at airports. It involves coordinating the movement of aircraft to prevent collisions and ensure efficient use of airspace.

What are the key players in the America Air Traffic Control Market?

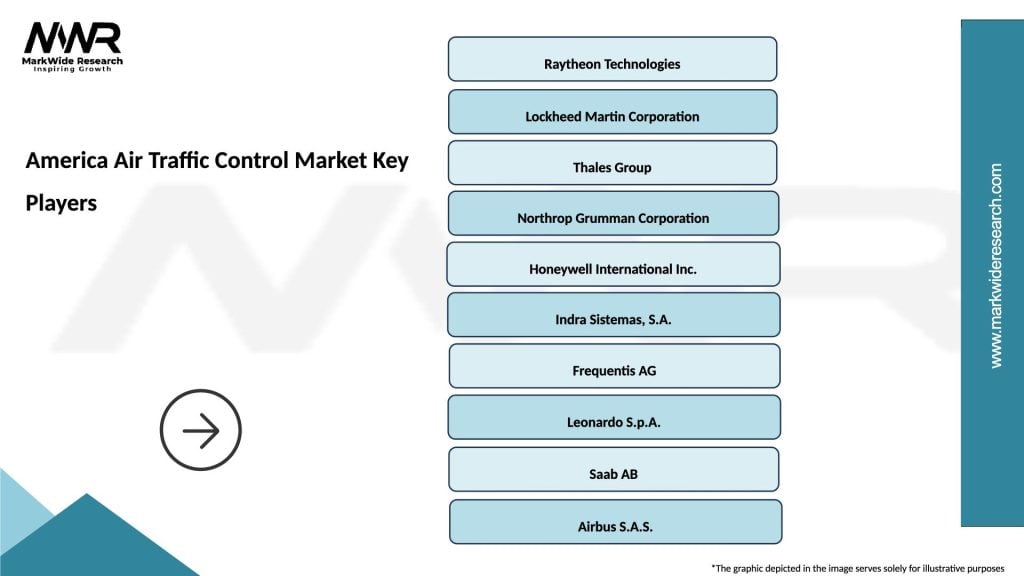

Key players in the America Air Traffic Control Market include the Federal Aviation Administration (FAA), Raytheon Technologies, and Thales Group, among others. These companies provide various technologies and services essential for air traffic management.

What are the main drivers of growth in the America Air Traffic Control Market?

The main drivers of growth in the America Air Traffic Control Market include the increasing air traffic volume, advancements in air traffic management technologies, and the need for enhanced safety and efficiency in air travel.

What challenges does the America Air Traffic Control Market face?

The America Air Traffic Control Market faces challenges such as aging infrastructure, the high cost of technology upgrades, and the need for skilled personnel to manage complex air traffic systems.

What opportunities exist in the America Air Traffic Control Market?

Opportunities in the America Air Traffic Control Market include the integration of artificial intelligence and machine learning for improved decision-making, the expansion of drone traffic management, and the development of next-generation air traffic control systems.

What trends are shaping the America Air Traffic Control Market?

Trends shaping the America Air Traffic Control Market include the adoption of satellite-based navigation systems, increased automation in air traffic management, and a focus on sustainability initiatives to reduce the environmental impact of air travel.

America Air Traffic Control Market

| Segmentation Details | Description |

|---|---|

| Product Type | Radar Systems, Communication Equipment, Navigation Aids, Surveillance Tools |

| Technology | Satellite-Based, Ground-Based, Automation Systems, Data Analytics |

| End User | Airports, Airlines, Government Agencies, Military |

| Service Type | Maintenance, Consulting, Training, Integration |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the America Air Traffic Control Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at