444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The America AI in the retail market represents a transformative landscape where artificial intelligence technologies are revolutionizing traditional shopping experiences and operational efficiency. This dynamic sector encompasses machine learning algorithms, computer vision systems, natural language processing, and predictive analytics that enable retailers to enhance customer engagement, optimize inventory management, and streamline supply chain operations. North American retailers are increasingly adopting AI-powered solutions to remain competitive in an evolving digital marketplace, with adoption rates reaching 78% among major retail chains across the United States and Canada.

Market dynamics indicate substantial growth potential driven by consumer demand for personalized shopping experiences and retailers’ need for operational optimization. The integration of AI technologies spans multiple retail segments, from e-commerce platforms utilizing recommendation engines to brick-and-mortar stores implementing smart checkout systems. Customer experience enhancement remains the primary driver, with AI enabling personalized product recommendations, chatbot customer service, and dynamic pricing strategies that respond to market conditions in real-time.

Technological advancement continues to accelerate market expansion, with emerging applications in visual search, voice commerce, and augmented reality shopping experiences. The market demonstrates robust growth trajectory with projected expansion at 24.3% CAGR through the forecast period, supported by increasing digital transformation initiatives and consumer acceptance of AI-powered retail solutions.

The America AI in the retail market refers to the comprehensive ecosystem of artificial intelligence technologies, applications, and services specifically designed to enhance retail operations, customer experiences, and business intelligence within the North American retail sector. This market encompasses various AI technologies including machine learning algorithms, computer vision systems, natural language processing, predictive analytics, and robotic process automation that enable retailers to automate processes, personalize customer interactions, and optimize business decisions.

Core components of this market include recommendation engines that analyze customer behavior patterns, inventory management systems that predict demand fluctuations, chatbots that provide automated customer support, and pricing optimization tools that adjust product costs based on market dynamics. The market also encompasses AI-powered fraud detection systems, supply chain optimization platforms, and customer sentiment analysis tools that help retailers understand market trends and consumer preferences.

Market scope extends beyond traditional retail boundaries to include omnichannel experiences that seamlessly integrate online and offline shopping journeys, enabling retailers to provide consistent and personalized experiences across all customer touchpoints.

Strategic market positioning reveals that AI adoption in American retail has reached a critical inflection point, with major retailers investing heavily in artificial intelligence capabilities to maintain competitive advantages and meet evolving consumer expectations. The market demonstrates strong momentum across multiple retail categories, from fashion and electronics to grocery and automotive sectors, each leveraging AI technologies to address specific operational challenges and customer needs.

Key market drivers include the increasing demand for personalized shopping experiences, with 89% of consumers expressing preference for retailers that provide customized product recommendations and tailored marketing messages. Additionally, operational efficiency improvements through AI implementation have resulted in 35% reduction in inventory costs and 42% improvement in supply chain visibility among early adopters.

Competitive landscape features established technology giants alongside innovative startups, creating a diverse ecosystem of AI solution providers. Market leaders focus on developing comprehensive AI platforms that integrate multiple functionalities, while specialized vendors concentrate on niche applications such as visual search, voice commerce, or predictive analytics. The market continues to evolve rapidly, with new applications and use cases emerging regularly as AI technologies mature and become more accessible to retailers of all sizes.

Primary market insights reveal several critical trends shaping the America AI in retail landscape:

Market maturation indicates that AI adoption has moved beyond experimental phases to become integral to retail operations, with retailers viewing AI investments as strategic necessities rather than optional enhancements.

Consumer behavior evolution serves as the primary catalyst driving AI adoption in American retail markets. Modern consumers expect personalized, seamless, and efficient shopping experiences across all channels, pushing retailers to implement sophisticated AI systems that can analyze vast amounts of customer data and deliver tailored recommendations in real-time. The shift toward digital-first shopping behaviors, accelerated by recent global events, has created unprecedented demand for AI-powered e-commerce solutions and contactless shopping experiences.

Operational efficiency demands compel retailers to leverage AI technologies for cost reduction and process optimization. Inventory management challenges, particularly in fast-moving consumer goods sectors, require predictive analytics capabilities that can forecast demand patterns and optimize stock levels. AI-powered supply chain management systems enable retailers to reduce waste, minimize stockouts, and improve overall operational performance while maintaining customer satisfaction levels.

Competitive pressure intensifies as retailers recognize that AI capabilities have become differentiating factors in market positioning. Companies that successfully implement AI solutions gain significant advantages in customer acquisition, retention, and lifetime value optimization. The ability to provide superior customer experiences through AI-powered personalization, recommendation engines, and intelligent customer service has become essential for maintaining market share in increasingly competitive retail environments.

Technology accessibility improvements have democratized AI adoption, making sophisticated machine learning and analytics tools available to retailers of all sizes. Cloud-based AI platforms and software-as-a-service solutions reduce implementation barriers and enable smaller retailers to compete with larger enterprises through advanced AI capabilities.

Implementation complexity presents significant challenges for retailers attempting to integrate AI technologies into existing systems and workflows. Legacy infrastructure limitations often require substantial technological upgrades and system integrations that can be time-consuming and resource-intensive. Many retailers struggle with data quality issues, as AI systems require clean, structured, and comprehensive datasets to function effectively, necessitating significant data management investments.

Privacy and security concerns create hesitation among both retailers and consumers regarding AI implementation. Data protection regulations and consumer privacy expectations require retailers to implement robust security measures and transparent data usage policies. The complexity of managing customer data while ensuring compliance with various privacy laws adds operational overhead and potential legal risks that some retailers find challenging to navigate.

Skills shortage in AI and machine learning expertise limits market growth potential, as retailers struggle to find qualified professionals capable of implementing, managing, and optimizing AI systems. The specialized knowledge required for effective AI deployment often exceeds internal capabilities, forcing retailers to rely on external consultants or invest heavily in employee training and development programs.

Cost considerations remain significant barriers, particularly for smaller retailers with limited technology budgets. While AI solutions promise long-term returns on investment, the initial implementation costs, ongoing maintenance expenses, and required infrastructure upgrades can strain financial resources and delay adoption decisions.

Emerging technology integration presents substantial opportunities for market expansion as new AI capabilities become commercially viable. Advanced computer vision systems enable innovative applications such as automated checkout processes, real-time inventory tracking, and enhanced security monitoring. Natural language processing improvements create opportunities for more sophisticated chatbots and voice commerce applications that can handle complex customer interactions and transactions.

Omnichannel experience enhancement offers significant growth potential as retailers seek to create seamless customer journeys across online and offline touchpoints. AI technologies can unify customer data from multiple channels, enabling consistent personalization and service quality regardless of how customers choose to interact with retailers. This integration opportunity extends to mobile applications, social media platforms, and emerging channels such as virtual and augmented reality shopping experiences.

Small and medium enterprise adoption represents an underserved market segment with substantial growth potential. As AI solutions become more accessible and affordable, smaller retailers can implement sophisticated technologies previously available only to large enterprises. This democratization of AI capabilities creates opportunities for solution providers to develop specialized offerings tailored to the unique needs and constraints of smaller retail operations.

Industry-specific applications provide opportunities for specialized AI solutions designed for particular retail sectors. Fashion retailers benefit from AI-powered style recommendations and trend analysis, while grocery retailers leverage AI for fresh product management and meal planning suggestions. These vertical-specific opportunities enable solution providers to develop deep expertise and create highly targeted value propositions.

Technological evolution continues to reshape market dynamics as AI capabilities become more sophisticated and accessible. Machine learning algorithms demonstrate improved accuracy and efficiency, enabling more precise customer behavior predictions and inventory optimization. The integration of edge computing with AI systems allows for real-time processing and decision-making at the point of sale, reducing latency and improving customer experiences.

Competitive landscape shifts occur as traditional retailers compete with technology-native companies that have built AI capabilities into their core business models from inception. This competition drives innovation and forces established retailers to accelerate their digital transformation initiatives. Strategic partnerships between retailers and AI technology providers become increasingly common as companies seek to leverage specialized expertise while maintaining focus on their core retail competencies.

Consumer acceptance patterns influence market dynamics as shoppers become more comfortable with AI-powered retail experiences. Younger demographics demonstrate higher acceptance rates for AI applications, while older consumers show increasing adoption as systems become more intuitive and transparent. This generational shift creates opportunities for retailers to implement more advanced AI features while maintaining accessibility for all customer segments.

Regulatory environment evolution impacts market dynamics as governments develop frameworks for AI governance and data protection. These regulations create both challenges and opportunities, as compliance requirements may increase implementation costs while also establishing consumer trust and market standardization that can accelerate overall adoption.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the America AI in retail market. Primary research involves direct engagement with industry stakeholders, including retail executives, technology vendors, and AI solution providers, through structured interviews and surveys designed to capture current market conditions, adoption patterns, and future expectations.

Secondary research components include analysis of industry reports, company financial statements, technology patents, and regulatory filings to understand market trends, competitive positioning, and technological developments. This approach provides historical context and identifies emerging patterns that may not be immediately apparent through primary research alone.

Data validation processes ensure research accuracy through triangulation of multiple data sources and expert verification of findings. Market sizing and growth projections undergo rigorous validation through comparison with industry benchmarks and expert consensus to maintain reliability and credibility of research conclusions.

Analytical frameworks incorporate both quantitative and qualitative assessment methodologies to provide comprehensive market understanding. Statistical analysis of adoption rates, performance metrics, and market penetration data combines with qualitative insights regarding technology trends, customer preferences, and competitive strategies to create a holistic market perspective.

United States market leadership dominates the America AI in retail landscape, accounting for approximately 85% of regional market activity. Major metropolitan areas including New York, San Francisco, Seattle, and Chicago serve as innovation hubs where retailers and technology companies collaborate on AI development and implementation. The presence of leading technology companies and venture capital funding creates a favorable environment for AI retail innovation and startup development.

California’s technological ecosystem particularly influences market development, with Silicon Valley companies providing advanced AI platforms and solutions that retailers across the country adopt. The state’s concentration of AI talent and research institutions accelerates innovation cycles and creates competitive advantages for companies operating within this ecosystem.

Canadian market participation represents approximately 12% of regional activity, with major cities like Toronto, Vancouver, and Montreal demonstrating strong AI adoption rates among retailers. Canadian retailers often follow trends established in the United States while adapting solutions to meet local market conditions and regulatory requirements.

Regional adoption patterns vary based on local market characteristics, with urban areas showing higher AI implementation rates compared to rural regions. E-commerce penetration rates, consumer technology adoption, and local competition levels influence the pace of AI integration across different geographic areas within North America.

Cross-border collaboration between American and Canadian retailers and technology providers creates synergies that accelerate market development and knowledge sharing across the region.

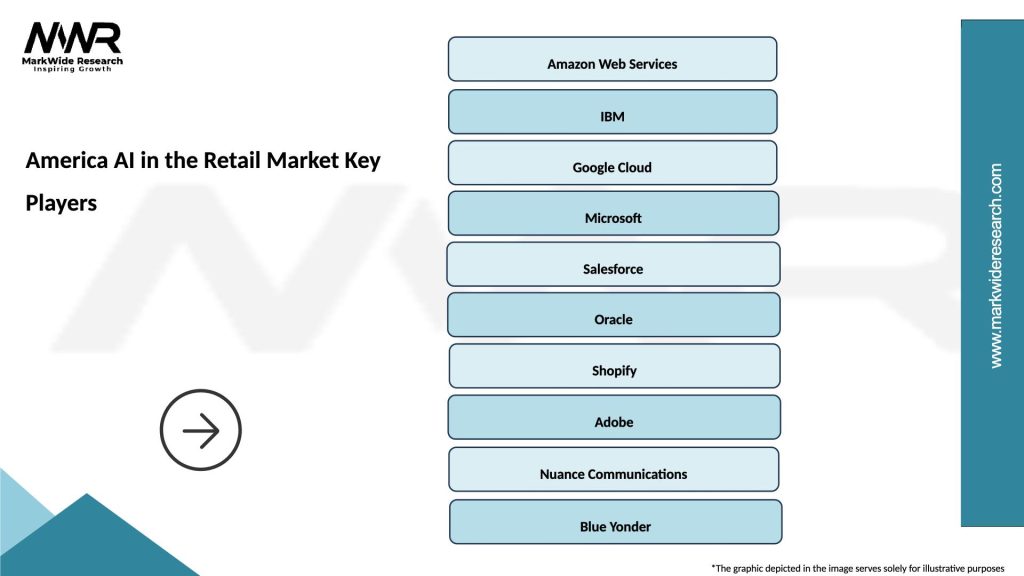

Market leadership features a diverse ecosystem of established technology giants, specialized AI companies, and innovative startups competing to provide comprehensive retail AI solutions. The competitive landscape continues to evolve as companies form strategic partnerships, acquire complementary technologies, and develop new capabilities to address emerging market needs.

Major technology providers include:

Specialized AI vendors focus on specific retail applications such as visual search, chatbot development, pricing optimization, and fraud detection, creating a competitive environment that drives innovation and specialization across various market segments.

Technology-based segmentation reveals distinct market categories based on AI application types and technological approaches:

By Technology Type:

By Application Area:

By Retail Channel:

By Company Size:

Fashion and Apparel segment demonstrates particularly strong AI adoption rates, with retailers leveraging computer vision for style recommendations, trend analysis, and virtual try-on experiences. AI-powered size recommendation systems reduce return rates while improving customer satisfaction, creating significant value for both retailers and consumers. Visual search capabilities enable customers to find similar products by uploading images, enhancing discovery and conversion rates.

Grocery and Food Retail applications focus on demand forecasting for perishable goods, automated inventory management, and personalized meal planning recommendations. AI systems help reduce food waste through precise demand predictions while optimizing supply chain logistics to ensure product freshness. Smart shopping cart technologies and automated checkout systems streamline the shopping experience while reducing operational costs.

Electronics and Consumer Goods retailers utilize AI for product comparison tools, technical support chatbots, and warranty management systems. Recommendation engines suggest complementary products and accessories based on purchase history and browsing behavior, increasing average order values and customer satisfaction levels.

Home and Garden retailers implement AI for project planning tools, seasonal demand forecasting, and visual search applications that help customers find specific products or design inspiration. These applications particularly benefit from computer vision technologies that can identify products from customer photos or room images.

Automotive Retail leverages AI for vehicle recommendation systems, predictive maintenance scheduling, and customer service automation. AI applications help match customers with appropriate vehicles based on preferences, budget, and usage patterns while streamlining the sales and service processes.

Retailers gain substantial advantages through AI implementation, including enhanced customer insights that enable more effective marketing strategies and product development decisions. Operational efficiency improvements reduce costs while improving service quality, creating competitive advantages that translate into increased market share and profitability. AI-powered analytics provide real-time visibility into business performance, enabling faster decision-making and more agile responses to market changes.

Customers benefit significantly from AI-enhanced retail experiences through personalized product recommendations that save time and improve satisfaction with purchases. Intelligent customer service systems provide faster resolution of inquiries and issues, while predictive inventory management ensures product availability when needed. Enhanced security through AI-powered fraud detection protects customer financial information and personal data.

Technology vendors find expanding market opportunities as retailers increasingly recognize AI as essential for competitive success. The growing demand for specialized AI solutions creates opportunities for both established companies and innovative startups to develop and market targeted applications for specific retail challenges and use cases.

Supply chain partners benefit from improved forecasting accuracy and logistics optimization that AI systems provide, enabling better resource planning and more efficient operations. Enhanced visibility into demand patterns and inventory levels facilitates better coordination between retailers and suppliers, reducing costs and improving service levels throughout the supply chain.

Investors recognize the substantial growth potential in AI retail applications, with successful implementations demonstrating clear returns on investment and competitive advantages that justify continued technology investments and market expansion initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Generative AI integration represents the most significant emerging trend, with retailers beginning to implement large language models for content creation, customer service, and product description generation. These applications enable more natural customer interactions and automated content creation that maintains brand consistency while reducing operational costs.

Edge AI deployment gains momentum as retailers seek to reduce latency and improve real-time decision-making capabilities. In-store AI processing enables instant product recognition, real-time inventory updates, and immediate customer service responses without relying on cloud connectivity, improving both performance and data security.

Sustainable retail AI emerges as retailers focus on environmental responsibility through AI-optimized supply chains, waste reduction algorithms, and energy-efficient operations. AI systems help retailers minimize their environmental impact while maintaining operational efficiency and customer satisfaction.

Conversational commerce expansion continues as voice assistants and chatbots become more sophisticated and capable of handling complex transactions. Integration with social media platforms and messaging applications creates new channels for AI-powered retail interactions and sales opportunities.

Predictive personalization evolves beyond traditional recommendation systems to anticipate customer needs and preferences before they are explicitly expressed. Advanced machine learning models analyze behavioral patterns, seasonal trends, and external factors to proactively suggest products and services.

Augmented reality integration with AI creates immersive shopping experiences that combine visual recognition, product information, and personalized recommendations in real-time, bridging the gap between online and offline retail experiences.

Strategic partnerships between major retailers and AI technology providers continue to reshape the competitive landscape, with companies forming alliances to accelerate development and deployment of innovative solutions. These collaborations combine retail expertise with technological capabilities to create more effective and targeted AI applications.

Acquisition activity intensifies as established companies seek to acquire AI startups and specialized technology providers to enhance their capabilities and market positioning. These transactions enable rapid capability expansion while providing startups with resources needed for scaling and market penetration.

Platform consolidation trends emerge as retailers seek integrated AI solutions rather than managing multiple point solutions. This shift drives technology providers to develop comprehensive platforms that address multiple retail use cases through unified interfaces and data management systems.

Regulatory compliance initiatives gain importance as governments develop AI governance frameworks and data protection requirements. Industry organizations collaborate to establish best practices and standards that ensure responsible AI implementation while maintaining innovation momentum.

Investment acceleration continues with venture capital and private equity firms increasing funding for AI retail startups and established companies expanding their AI development budgets. According to MarkWide Research analysis, investment in retail AI solutions has grown substantially, reflecting strong confidence in market potential and technological viability.

Implementation strategy recommendations emphasize the importance of starting with clearly defined use cases that address specific business challenges rather than attempting comprehensive AI transformations simultaneously. Retailers should focus on applications with measurable returns on investment and clear customer benefits to build internal support and expertise before expanding to more complex implementations.

Data management priorities require immediate attention, as AI system effectiveness depends heavily on data quality, consistency, and accessibility. Retailers should invest in data infrastructure and governance processes before implementing AI applications to ensure successful outcomes and avoid costly system failures or poor performance.

Partnership strategies should balance internal capability development with external expertise acquisition. Retailers benefit from partnering with specialized AI vendors while building internal knowledge and capabilities to maintain strategic control over critical business functions and customer relationships.

Customer communication approaches must address privacy concerns and explain AI benefits clearly to maintain customer trust and acceptance. Transparent communication about data usage, AI decision-making processes, and customer benefits helps build confidence and encourages adoption of AI-powered features and services.

Competitive differentiation requires focus on unique value propositions rather than simply implementing standard AI solutions. Retailers should identify specific customer needs and operational challenges where AI can create distinctive advantages that competitors cannot easily replicate.

Technology investment timing should consider market maturity and competitive pressures while avoiding premature adoption of unproven technologies. MarkWide Research suggests retailers evaluate AI solutions based on proven results and clear implementation pathways rather than theoretical capabilities or vendor promises.

Market trajectory indicates continued robust growth with AI becoming increasingly integral to retail operations across all segments and company sizes. The technology evolution from experimental implementations to core business capabilities suggests that AI adoption will become a competitive necessity rather than an optional enhancement for retailers seeking to maintain market position.

Technology advancement will likely focus on improving AI system accuracy, reducing implementation complexity, and expanding application capabilities. Emerging technologies such as quantum computing and advanced neural networks may create new possibilities for retail AI applications while making existing solutions more powerful and accessible.

Market consolidation may occur as successful AI implementations demonstrate clear competitive advantages, potentially creating market leaders that dominate specific retail segments through superior AI capabilities. This consolidation could drive further innovation while also creating challenges for retailers that lag in AI adoption.

Regulatory evolution will likely establish clearer frameworks for AI governance, data protection, and algorithmic transparency, creating both compliance requirements and consumer confidence that may accelerate adoption rates. These regulations may also standardize certain AI practices across the industry.

Global expansion opportunities will emerge as successful North American AI retail solutions are adapted for international markets, creating growth opportunities for both technology providers and retailers with strong AI capabilities. Cross-border knowledge transfer and technology sharing may accelerate global retail AI adoption.

Integration depth will increase as AI becomes embedded in all aspects of retail operations, from supply chain management and inventory optimization to customer service and marketing. This comprehensive integration will create more sophisticated and effective retail ecosystems that deliver superior customer experiences while optimizing operational efficiency.

The America AI in the retail market represents a transformative force that is fundamentally reshaping how retailers operate and engage with customers across North America. With adoption rates reaching 78% among major retail chains and projected growth at 24.3% CAGR, the market demonstrates both current momentum and substantial future potential. The comprehensive analysis reveals that AI technologies have evolved from experimental applications to essential business capabilities that drive competitive advantage, operational efficiency, and customer satisfaction.

Market dynamics indicate that successful AI implementation requires strategic planning, quality data management, and clear focus on measurable business outcomes. Retailers that approach AI adoption systematically, starting with well-defined use cases and building capabilities progressively, achieve better results than those attempting comprehensive transformations without adequate preparation. The importance of partnerships between retailers and technology providers continues to grow as the complexity and sophistication of AI applications increase.

Future success in the America AI retail market will depend on retailers’ ability to balance innovation with practical implementation, customer benefits with operational efficiency, and technological advancement with regulatory compliance. As MWR research indicates, the market will continue evolving rapidly, creating opportunities for companies that can adapt quickly while maintaining focus on core retail competencies and customer relationships. The integration of AI into retail operations is no longer a question of whether, but rather how quickly and effectively retailers can implement these transformative technologies to remain competitive in an increasingly digital marketplace.

What is AI in the Retail?

AI in the retail sector refers to the use of artificial intelligence technologies to enhance customer experiences, optimize inventory management, and improve sales forecasting. It encompasses various applications such as chatbots, personalized recommendations, and automated checkout systems.

What are the key companies in America AI in the Retail Market?

Key companies in America AI in the Retail Market include Amazon, Walmart, and Target, which leverage AI for inventory management, customer service, and personalized shopping experiences, among others.

What are the growth factors driving America AI in the Retail Market?

The growth of America AI in the Retail Market is driven by increasing consumer demand for personalized shopping experiences, advancements in machine learning technologies, and the need for efficient supply chain management. Retailers are adopting AI to enhance customer engagement and streamline operations.

What challenges does the America AI in the Retail Market face?

Challenges in the America AI in the Retail Market include data privacy concerns, the high cost of implementation, and the need for skilled personnel to manage AI systems. Retailers must navigate these issues while integrating AI into their operations.

What future opportunities exist in America AI in the Retail Market?

Future opportunities in America AI in the Retail Market include the expansion of AI-driven analytics for consumer behavior insights, the growth of autonomous delivery systems, and the potential for enhanced in-store experiences through augmented reality. These innovations can significantly transform retail operations.

What trends are shaping the America AI in the Retail Market?

Trends shaping the America AI in the Retail Market include the increasing use of AI for predictive analytics, the rise of voice-activated shopping, and the integration of AI with Internet of Things (IoT) devices. These trends are enhancing customer interactions and operational efficiencies.

America AI in the Retail Market

| Segmentation Details | Description |

|---|---|

| Product Type | Chatbots, Recommendation Engines, Inventory Management, Customer Analytics |

| Price Tier | Premium, Mid-range, Budget, Discount |

| Distribution Channel | Online, Brick-and-Mortar, Direct Sales, Wholesale |

| Customer Type | Small Businesses, Large Enterprises, E-commerce, Franchise |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the America AI in the Retail Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at