444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The market for alternatives in injectable diabetes care has been experiencing significant growth in recent years. Diabetes is a chronic metabolic disorder characterized by high blood glucose levels, and injectable medications are commonly used for its management. However, the demand for alternative methods of diabetes care has been rising due to various factors such as needle phobia, convenience, and advancements in technology.

Meaning

Alternatives for injectable diabetes care refer to non-injectable methods and devices used for managing diabetes. These alternatives aim to provide effective glucose control, reduce the need for injections, and improve the overall quality of life for individuals with diabetes. They include devices such as insulin pumps, continuous glucose monitoring (CGM) systems, and oral medications that can replace or supplement injectable therapies.

Executive Summary

The market for alternatives in injectable diabetes care is witnessing substantial growth due to the increasing prevalence of diabetes worldwide and the growing demand for more patient-friendly treatment options. With advancements in technology, alternative devices are becoming more sophisticated, accurate, and user-friendly, leading to improved glycemic control and enhanced patient satisfaction.

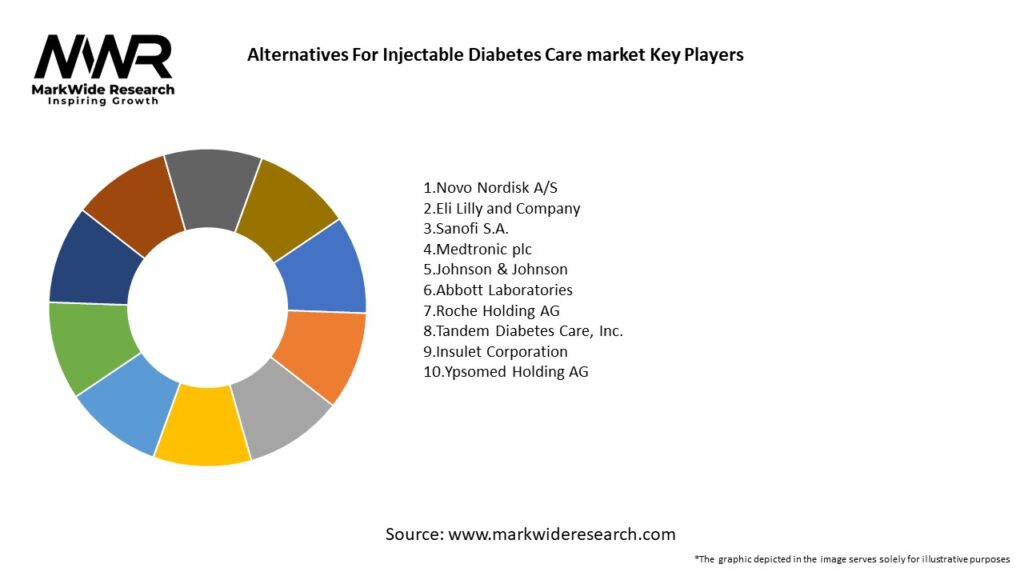

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The market for alternatives in injectable diabetes care is dynamic and influenced by various factors, including technological advancements, regulatory landscape, reimbursement policies, and patient preferences. As new devices and therapies enter the market, competition intensifies, driving manufacturers to innovate and differentiate their products based on efficacy, convenience, and cost-effectiveness.

Regional Analysis

The market for alternatives in injectable diabetes care exhibits regional variations in terms of market size, adoption rates, and healthcare infrastructure. North America and Europe currently dominate the market due to the high prevalence of diabetes, advanced healthcare systems, and favorable reimbursement policies. However, the market in Asia-Pacific is expected to witness rapid growth due to the rising diabetic population and increasing healthcare expenditure in countries like China and India.

Competitive Landscape

Leading Companies in the Alternatives for Injectable Diabetes Care Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The market for alternatives in injectable diabetes care can be segmented based on device type, end-user, and region. Device types include insulin pumps, continuous glucose monitoring (CGM) systems, oral medications, and others. End-users primarily consist of hospitals, homecare settings, and specialty clinics. Geographically, the market can be divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the alternatives for injectable diabetes care market. The increased focus on reducing hospital visits and minimizing direct contact with healthcare providers has accelerated the adoption of remote monitoring and telehealth solutions. Individuals with diabetes have sought alternative devices such as CGM systems and telemedicine consultations to manage their condition safely from home. The pandemic has also highlighted the importance of continuous glucose monitoring and precise insulin dosing to maintain optimal glycemic control, reducing the risk of complications and severe illness.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the alternatives for injectable diabetes care market looks promising, with steady growth anticipated. Technological advancements will continue to shape the market landscape, with AI, ML, and digital health solutions playing a pivotal role in device development. The integration of advanced sensor technologies, closed-loop systems, and personalized treatment algorithms will enhance glucose monitoring accuracy and insulin delivery, leading to improved patient outcomes. The market will also witness increased collaborations and partnerships, driving innovation and expanding market reach. With the rising prevalence of diabetes and the growing demand for patient-centric care, alternatives in injectable diabetes care will continue to gain traction and transform the way diabetes is managed.

Conclusion

The alternatives for injectable diabetes care market is experiencing substantial growth, driven by factors such as needle phobia, convenience, and technological advancements. Alternative devices, including insulin pumps, CGM systems, and oral medications, offer improved glycemic control, patient satisfaction, and treatment adherence. While the market presents opportunities for industry participants and stakeholders, challenges such as high costs, limited reimbursement coverage, and lack of awareness need to be addressed. Continued innovation, collaborative partnerships, and increased education and awareness will contribute to the future success of the market, ensuring that individuals with diabetes have access to effective and patient-friendly alternatives to injectable therapies.

Alternatives For Injectable Diabetes Care market

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin Pens, Insulin Pumps, Smart Injectors, Prefilled Syringes |

| Delivery Mode | Subcutaneous, Intravenous, Intramuscular, Transdermal |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Technology | Continuous Glucose Monitoring, Automated Insulin Delivery, Mobile Health Apps, Wearable Devices |

Leading Companies in the Alternatives for Injectable Diabetes Care Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at