444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Algeria telecom market represents one of North Africa’s most dynamic telecommunications landscapes, characterized by rapid digital transformation and increasing connectivity demands. Algeria’s telecommunications sector has experienced substantial growth driven by government initiatives to modernize infrastructure and expand digital services across urban and rural regions. The market encompasses mobile communications, fixed-line services, internet connectivity, and emerging technologies including 5G networks and fiber-optic infrastructure.

Market dynamics indicate strong momentum with mobile penetration rates reaching approximately 115% of the population, reflecting multiple device ownership and robust subscriber growth. The sector benefits from strategic investments in network modernization, with operators focusing on enhancing service quality and expanding coverage to underserved areas. Digital transformation initiatives by the Algerian government have created favorable conditions for telecom expansion, supporting economic diversification efforts and technological advancement.

Infrastructure development remains a key priority, with significant investments in fiber-optic networks and 4G/5G deployment. The market demonstrates resilience despite regional challenges, with operators adapting to evolving consumer preferences and business requirements. Competitive landscape features both domestic and international players, fostering innovation and service improvements across all telecommunications segments.

The Algeria telecom market refers to the comprehensive telecommunications ecosystem encompassing mobile network operators, fixed-line service providers, internet service providers, and infrastructure companies operating within Algeria’s regulatory framework. This market includes voice communications, data services, broadband internet, mobile applications, and emerging digital technologies serving residential, business, and government customers throughout the country.

Telecommunications services in Algeria span traditional voice calling, SMS messaging, mobile data, fixed broadband, enterprise solutions, and value-added services. The market operates under regulatory oversight from the Autorité de Régulation de la Poste et des Télécommunications (ARPT), ensuring fair competition and service quality standards. Market participants include major operators such as Mobilis, Djezzy, and Ooredoo Algeria, along with numerous smaller service providers and infrastructure companies.

Service offerings continue expanding beyond basic telecommunications to include digital banking, e-commerce platforms, cloud services, and IoT solutions. The market’s evolution reflects Algeria’s broader digital transformation strategy, positioning telecommunications as a foundation for economic modernization and social development across diverse sectors and regions.

Algeria’s telecommunications market demonstrates robust growth potential driven by increasing digitalization, government support, and rising consumer demand for advanced connectivity solutions. The sector has achieved significant milestones in network coverage and service quality, with mobile services leading market expansion and fixed broadband gaining momentum in urban areas.

Key performance indicators show impressive growth trajectories, with internet penetration rates reaching approximately 63% of the population and continuing to expand rapidly. Mobile data consumption has increased substantially, reflecting changing user behaviors and the proliferation of smartphones and connected devices. Operator investments in network infrastructure have enhanced service reliability and coverage, supporting both consumer and business market segments.

Market transformation is evident through the introduction of advanced technologies, improved service portfolios, and enhanced customer experiences. The sector contributes significantly to Algeria’s GDP while supporting employment and fostering innovation across related industries. Future prospects remain positive, with 5G deployment, fiber expansion, and digital service innovation expected to drive continued growth and market evolution.

Strategic analysis reveals several critical insights shaping Algeria’s telecommunications landscape:

Government digitalization initiatives serve as primary market drivers, with national strategies promoting digital transformation across public and private sectors. The Algerian government’s commitment to modernizing telecommunications infrastructure creates favorable conditions for sector growth and innovation. Regulatory support includes spectrum allocation, licensing frameworks, and investment incentives that encourage operator participation and network development.

Consumer demand evolution drives market expansion through increasing smartphone adoption, social media usage, and digital service consumption. Young demographics with high technology affinity contribute to growing data usage and demand for advanced telecommunications services. Business digitalization requirements fuel enterprise telecommunications demand, including cloud services, cybersecurity solutions, and managed connectivity services.

Economic diversification efforts position telecommunications as a key enabler for various industries, including banking, healthcare, education, and e-commerce. The sector’s role in supporting remote work, digital education, and online services has become increasingly important. Infrastructure development programs, including smart city initiatives and industrial modernization, create additional demand for advanced telecommunications capabilities and specialized services.

Economic challenges present significant constraints on market growth, including currency fluctuations, inflation pressures, and reduced consumer spending power. These factors impact both operator revenues and customer ability to afford premium telecommunications services. Infrastructure costs remain substantial, particularly for rural network expansion and advanced technology deployment, requiring significant capital investments with extended payback periods.

Regulatory complexities can slow market development through lengthy approval processes, licensing requirements, and compliance obligations that increase operational costs. Import restrictions on telecommunications equipment may limit technology choices and increase deployment timelines. Competition intensity among operators leads to price pressures and margin compression, potentially limiting investment capacity for network improvements and service innovation.

Technical challenges include spectrum limitations, network interference issues, and the complexity of integrating new technologies with existing infrastructure. Skills shortages in specialized telecommunications areas may constrain service quality and innovation capabilities. Security concerns related to cybersecurity threats and data protection requirements add operational complexity and compliance costs for service providers.

5G network deployment presents substantial opportunities for operators to differentiate services, attract enterprise customers, and enable new applications including IoT, smart cities, and industrial automation. Early 5G adoption could position Algeria as a regional technology leader while creating revenue streams from advanced services and partnerships.

Digital financial services offer significant growth potential through mobile money, digital payments, and fintech partnerships. The large unbanked population represents an addressable market for telecommunications-enabled financial services. Enterprise digital transformation creates opportunities for managed services, cloud solutions, cybersecurity offerings, and specialized connectivity services across various industry sectors.

Rural market expansion through government support programs and innovative service delivery models can extend telecommunications access to underserved populations. International connectivity improvements through submarine cable investments and regional partnerships can position Algeria as a telecommunications hub for North Africa and the Mediterranean region. Value-added services including content delivery, gaming, streaming, and digital platforms present additional revenue diversification opportunities.

Competitive dynamics in Algeria’s telecommunications market reflect intense rivalry among major operators, driving innovation, service improvements, and competitive pricing strategies. Market leaders continuously invest in network quality, coverage expansion, and customer experience enhancements to maintain market position. Technology evolution creates both opportunities and challenges, requiring operators to balance investment in new technologies with maintaining existing infrastructure and services.

Customer behavior patterns show increasing preference for data-centric services, mobile applications, and digital platforms, influencing operator service portfolios and network capacity planning. The shift toward postpaid services among higher-income segments reflects growing service sophistication and customer loyalty programs. Regulatory evolution continues shaping market structure through spectrum management, competition policies, and consumer protection measures.

Economic factors significantly impact market dynamics, with currency stability, inflation rates, and government spending affecting both operator performance and consumer demand patterns. MarkWide Research analysis indicates that market resilience depends on operators’ ability to adapt pricing strategies and service offerings to economic conditions while maintaining investment in network quality and coverage expansion.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Algeria’s telecommunications sector. Primary research includes structured interviews with industry executives, regulatory officials, and key stakeholders across the telecommunications value chain. Secondary research incorporates analysis of operator financial reports, regulatory publications, government statistics, and industry databases.

Data collection methods combine quantitative analysis of market metrics, subscriber statistics, and financial performance indicators with qualitative assessment of market trends, competitive dynamics, and regulatory developments. Market modeling utilizes statistical analysis, trend extrapolation, and scenario planning to project future market conditions and growth trajectories.

Validation processes include cross-referencing multiple data sources, expert consultations, and peer review to ensure research accuracy and reliability. Analytical frameworks incorporate Porter’s Five Forces analysis, SWOT assessment, and competitive positioning analysis to provide comprehensive market understanding. Regular research updates maintain current market intelligence and track evolving industry conditions.

Northern Algeria represents the most developed telecommunications region, encompassing major cities including Algiers, Oran, and Constantine. This region accounts for approximately 70% of total telecommunications revenue due to higher population density, economic activity, and advanced infrastructure deployment. Urban centers benefit from comprehensive 4G coverage, fiber-optic networks, and premium service availability across all major operators.

Central Algeria shows growing telecommunications development with expanding network coverage and increasing service adoption rates. The region benefits from government infrastructure programs and operator investments in network expansion. Southern Algeria presents both challenges and opportunities, with vast geographical areas requiring innovative solutions for cost-effective service delivery to dispersed populations.

Coastal regions demonstrate strong telecommunications performance due to economic activity, tourism, and international connectivity advantages. Border areas face unique challenges related to cross-border interference and security considerations but offer opportunities for international roaming and transit services. Regional development programs continue addressing connectivity gaps while supporting economic growth and social development across all geographical areas.

Market leadership is shared among three major operators, each with distinct competitive advantages and market positioning strategies:

Competitive strategies focus on network quality improvements, service innovation, customer experience enhancement, and market share expansion through targeted marketing and pricing initiatives. Smaller operators and MVNOs contribute to market competition through specialized services, niche market focus, and innovative business models.

Partnership strategies include infrastructure sharing agreements, technology collaborations, and content partnerships that enhance service capabilities while optimizing operational costs. Investment priorities emphasize 5G preparation, fiber expansion, and digital service development to maintain competitive positioning in an evolving market landscape.

Service-based segmentation reveals distinct market characteristics and growth patterns across telecommunications categories:

Customer segmentation identifies key market categories:

Mobile Communications dominates the telecommunications landscape with mobile penetration rates exceeding 115% of the population. This category shows continued growth through smartphone adoption, mobile internet usage, and value-added services. Data services represent the fastest-growing revenue segment, with mobile broadband usage increasing substantially year-over-year.

Fixed Broadband Services demonstrate strong growth potential, particularly in urban areas where fiber-optic infrastructure deployment enables high-speed internet access. Business demand for reliable broadband connectivity drives market expansion, while residential adoption increases with improved service quality and competitive pricing. Fiber-to-the-Home deployments show promising growth trajectories in major cities.

Enterprise Telecommunications represents a high-value market segment with growing demand for managed services, cloud connectivity, and cybersecurity solutions. Digital transformation initiatives across various industries create opportunities for specialized telecommunications services and partnerships. Government communications require secure, reliable services with specific compliance and performance requirements, representing a stable revenue source for qualified operators.

Telecommunications operators benefit from expanding market opportunities, government support for infrastructure development, and growing demand for digital services. Revenue diversification through value-added services, enterprise solutions, and digital platforms reduces dependence on traditional voice services while improving profit margins.

Equipment suppliers gain from network modernization investments, 5G deployment preparations, and fiber infrastructure expansion programs. Technology vendors benefit from increasing demand for software solutions, cybersecurity services, and digital transformation platforms across the telecommunications ecosystem.

Consumers enjoy improved service quality, expanded coverage, competitive pricing, and access to advanced digital services and applications. Businesses benefit from enhanced connectivity options, managed services, and digital solutions that support operational efficiency and growth. Government entities achieve digital transformation objectives while supporting economic development and social inclusion through improved telecommunications access and services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration represents the most significant trend shaping Algeria’s telecommunications market, with operators expanding beyond traditional services to offer comprehensive digital solutions. 5G network preparation involves spectrum planning, infrastructure upgrades, and partnership development to enable next-generation services and applications.

Fiber infrastructure expansion continues gaining momentum with government support and operator investments in high-speed broadband capabilities. Mobile financial services show strong growth potential as operators partner with financial institutions to serve the unbanked population through mobile money and digital payment solutions.

Enterprise digitalization drives demand for managed services, cloud connectivity, and cybersecurity solutions as businesses modernize operations and adopt digital technologies. IoT and smart city initiatives create opportunities for specialized telecommunications services supporting connected devices, sensors, and automated systems. Content and media services integration allows operators to offer entertainment, streaming, and digital content as value-added services to enhance customer engagement and revenue diversification.

Infrastructure modernization programs have accelerated across all major operators, with significant investments in 4G network expansion and 5G preparation activities. Fiber-optic deployment has increased substantially, particularly in urban areas, supporting high-speed broadband service delivery and network backhaul requirements.

Regulatory developments include updated spectrum allocation policies, competition framework enhancements, and consumer protection measures that shape market dynamics and operator strategies. International partnerships have expanded through submarine cable investments, roaming agreements, and technology collaboration initiatives with global telecommunications companies.

Digital service launches demonstrate operator evolution beyond traditional telecommunications, including mobile banking platforms, e-commerce solutions, and digital content services. MWR research indicates that these developments reflect broader industry transformation toward integrated digital service providers rather than traditional network operators. Cybersecurity investments have increased significantly in response to growing security threats and regulatory requirements for data protection and network security.

Strategic recommendations for telecommunications operators include prioritizing network quality improvements, expanding fiber infrastructure, and developing comprehensive digital service portfolios. Investment focus should emphasize 5G preparation, rural coverage expansion, and enterprise solution capabilities to capture emerging market opportunities.

Partnership strategies should leverage collaboration opportunities with technology vendors, content providers, and financial institutions to enhance service offerings and market reach. Customer experience improvements through digital channels, self-service platforms, and personalized services can drive customer satisfaction and loyalty in competitive market conditions.

Regulatory engagement remains crucial for operators to influence policy development, spectrum allocation, and market structure decisions that affect long-term business prospects. Innovation investments in emerging technologies, digital platforms, and value-added services can differentiate operators and create new revenue streams. Cost optimization through network sharing, operational efficiency improvements, and strategic partnerships can enhance profitability while maintaining service quality and competitive positioning.

Market projections indicate continued growth in Algeria’s telecommunications sector, driven by increasing digitalization, government infrastructure support, and evolving consumer demands. 5G deployment is expected to commence within the next few years, creating opportunities for advanced services and applications across consumer and enterprise segments.

Digital services expansion will likely accelerate, with operators developing comprehensive platforms for financial services, e-commerce, entertainment, and business solutions. Rural connectivity improvements through government programs and innovative service delivery models should reduce the digital divide and expand market reach to underserved populations.

Technology advancement will continue shaping market evolution, with artificial intelligence, IoT, and cloud services becoming integral to telecommunications service delivery. MarkWide Research analysis suggests that successful operators will be those that effectively balance traditional telecommunications excellence with digital innovation and customer-centric service development. Market consolidation possibilities may emerge as operators seek scale advantages and operational efficiencies in an increasingly competitive environment.

Algeria’s telecommunications market demonstrates strong growth potential and strategic importance for the country’s economic development and digital transformation objectives. The sector has achieved significant progress in network coverage, service quality, and technology adoption while maintaining competitive dynamics that benefit consumers and businesses.

Future success will depend on continued investment in infrastructure modernization, service innovation, and customer experience improvements. Regulatory support and government digitalization initiatives provide favorable conditions for market growth, while competitive pressures drive continuous improvement and innovation across all market segments.

Strategic positioning for long-term success requires operators to balance traditional telecommunications excellence with digital transformation capabilities, serving evolving customer needs while capturing emerging opportunities in 5G, digital services, and enterprise solutions. The Algeria telecom market is well-positioned to support the country’s broader economic diversification and modernization goals through continued development and innovation in telecommunications services and infrastructure.

What is Telecom?

Telecom refers to the transmission of information over significant distances by electronic means. It encompasses various services such as telephone, internet, and broadcasting, which are essential for communication in Algeria and globally.

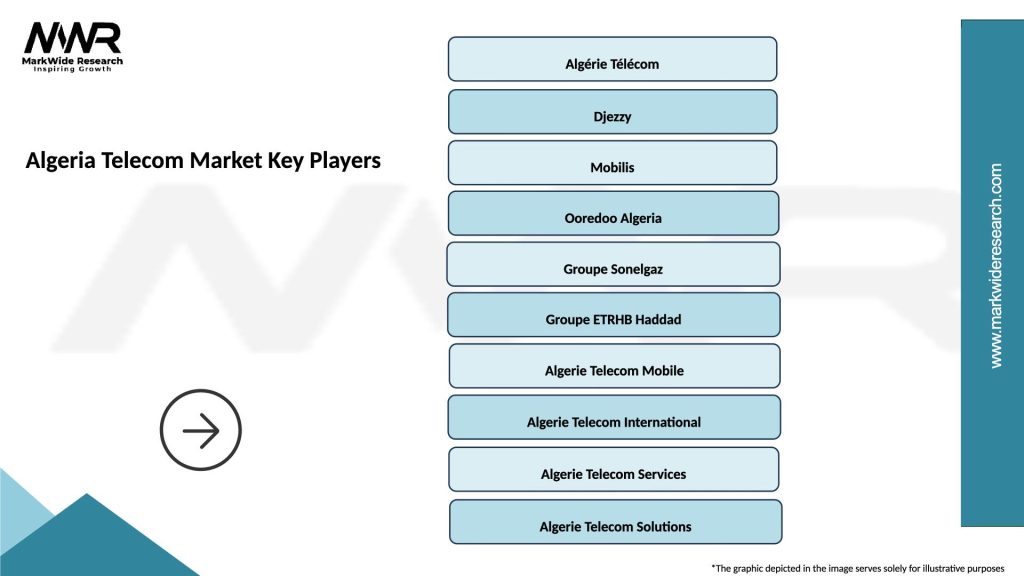

What are the key players in the Algeria Telecom Market?

Key players in the Algeria Telecom Market include Algerie Telecom, Djezzy, and Mobilis, which provide a range of services from mobile telephony to broadband internet. These companies compete to enhance service quality and expand their customer base, among others.

What are the growth factors driving the Algeria Telecom Market?

The Algeria Telecom Market is driven by increasing smartphone penetration, rising demand for high-speed internet, and government initiatives to improve digital infrastructure. These factors contribute to a more connected society and enhanced service offerings.

What challenges does the Algeria Telecom Market face?

Challenges in the Algeria Telecom Market include regulatory hurdles, competition from new entrants, and the need for continuous technological upgrades. These issues can hinder growth and service delivery in the sector.

What opportunities exist in the Algeria Telecom Market?

Opportunities in the Algeria Telecom Market include the expansion of mobile financial services, the rollout of 5G technology, and increasing investments in digital transformation. These trends can lead to enhanced connectivity and new service offerings.

What trends are shaping the Algeria Telecom Market?

Trends in the Algeria Telecom Market include the growing adoption of IoT devices, the shift towards digital services, and the increasing importance of cybersecurity. These trends are influencing how telecom companies operate and engage with customers.

Algeria Telecom Market

| Segmentation Details | Description |

|---|---|

| Service Type | Mobile, Fixed Line, Internet, VoIP |

| Customer Type | Residential, Business, Government, Educational |

| Technology | 4G, 5G, Fiber Optic, Satellite |

| Deployment | On-Premise, Cloud, Hybrid, Managed |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Algeria Telecom Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at