444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Algeria agriculture market represents a cornerstone of the nation’s economic development and food security strategy. As one of Africa’s largest countries by land area, Algeria possesses substantial agricultural potential across diverse climatic zones, from Mediterranean coastal regions to semi-arid inland territories. The agricultural sector continues to evolve through modernization initiatives, technological adoption, and sustainable farming practices that address both domestic food requirements and export opportunities.

Market dynamics indicate significant transformation occurring within Algeria’s agricultural landscape, driven by government investment programs, climate adaptation strategies, and increasing focus on agricultural productivity enhancement. The sector encompasses diverse crop production including cereals, citrus fruits, olives, and vegetables, alongside livestock farming and dairy operations. Growth trajectories show promising developments with agricultural productivity improving by approximately 12% annually in key crop segments.

Regional distribution of agricultural activities spans from the fertile coastal plains suitable for intensive cultivation to the highland plateaus supporting extensive grain production. The sector benefits from ongoing infrastructure development, irrigation system expansion, and agricultural technology integration that collectively strengthen market competitiveness and sustainability.

The Algeria agriculture market refers to the comprehensive ecosystem encompassing crop production, livestock farming, agricultural technology adoption, and food processing activities within Algeria’s territorial boundaries. This market includes traditional farming practices, modern agricultural techniques, irrigation systems, and the entire value chain from farm production to market distribution.

Agricultural significance extends beyond primary production to include agribusiness development, rural employment generation, and food security enhancement for Algeria’s growing population. The market encompasses both subsistence farming in rural communities and commercial agricultural operations targeting domestic and international markets.

Algeria’s agricultural sector demonstrates robust potential for expansion and modernization, supported by favorable geographic conditions, government policy initiatives, and increasing investment in agricultural infrastructure. The market exhibits strong performance in traditional crops while diversifying into high-value agricultural products and sustainable farming practices.

Key performance indicators reveal agricultural output growth of approximately 8.5% CAGR across major crop categories, with particularly strong performance in citrus production, olive cultivation, and vegetable farming. The sector benefits from strategic location advantages for Mediterranean and European market access, combined with domestic market expansion driven by population growth and changing dietary preferences.

Investment flows into agricultural modernization, irrigation infrastructure, and technology adoption continue strengthening market fundamentals. Government support programs, international development partnerships, and private sector engagement collectively contribute to agricultural productivity enhancement and market competitiveness improvement.

Strategic insights reveal several critical factors shaping Algeria’s agricultural market development:

Government policy support serves as a primary driver for agricultural market expansion, with comprehensive development programs targeting agricultural modernization, infrastructure improvement, and farmer support initiatives. Policy frameworks emphasize food security enhancement, agricultural productivity growth, and rural development acceleration.

Population growth and urbanization trends create expanding domestic demand for agricultural products, driving market growth across diverse crop categories and livestock products. Changing consumer preferences toward fresh produce, organic foods, and processed agricultural products further stimulate market development.

Geographic advantages including diverse climate zones, extensive arable land, and strategic location for international trade provide fundamental support for agricultural market expansion. Mediterranean climate conditions in coastal regions support high-value crop production, while inland areas offer opportunities for extensive grain cultivation.

Technology advancement in agricultural equipment, irrigation systems, and farming techniques enables productivity improvements and cost optimization. Modern farming methods, precision agriculture adoption, and mechanization contribute to enhanced agricultural output and market competitiveness.

Water scarcity challenges represent significant constraints on agricultural expansion, particularly in arid and semi-arid regions where irrigation infrastructure requires substantial investment. Climate variability and drought conditions periodically impact agricultural productivity and market stability.

Infrastructure limitations in rural areas, including transportation networks, storage facilities, and processing capabilities, constrain market development and value chain efficiency. Limited access to modern agricultural equipment and technology in some regions affects productivity potential.

Financial constraints facing smallholder farmers limit access to modern farming inputs, equipment, and technology adoption. Credit availability and agricultural financing mechanisms require further development to support comprehensive market growth.

Market access challenges for small-scale farmers, including limited marketing channels and price volatility, affect income stability and investment capacity. Export market development requires continued infrastructure investment and quality standard compliance.

Export market expansion presents substantial opportunities for Algerian agricultural products, particularly in European markets where demand for Mediterranean agricultural products continues growing. Citrus fruits, olive oil, and specialty crops offer significant export potential with proper market development.

Agribusiness development opportunities include food processing, agricultural equipment manufacturing, and agricultural services provision. Value-added agricultural products and processed foods represent growing market segments with strong domestic and export potential.

Sustainable agriculture adoption creates opportunities for organic farming, environmentally friendly practices, and climate-smart agriculture implementation. Growing consumer demand for sustainable agricultural products supports premium pricing and market differentiation.

Technology integration opportunities encompass precision agriculture, smart irrigation systems, and digital farming solutions that enhance productivity and resource efficiency. Agricultural technology adoption rates show potential for 25% annual growth in key farming regions.

Supply chain evolution reflects ongoing transformation from traditional agricultural practices toward modern, integrated farming systems. Market dynamics demonstrate increasing coordination between producers, processors, and distributors, creating more efficient value chains and improved market access for farmers.

Competitive landscape includes both traditional farming operations and modern agricultural enterprises adopting advanced technologies and sustainable practices. Market consolidation trends show larger agricultural operations gaining 18% market share through efficiency improvements and scale advantages.

Price dynamics reflect both domestic demand patterns and international market influences, with agricultural commodity prices showing increased stability through improved market infrastructure and storage capabilities. Seasonal price variations continue affecting farmer income patterns and market planning.

Innovation adoption accelerates across the agricultural sector, with farmers increasingly embracing modern farming techniques, improved seed varieties, and efficient irrigation systems. Technology penetration rates indicate 35% adoption of modern farming practices among commercial agricultural operations.

Comprehensive market analysis employs multiple research approaches including primary data collection from agricultural producers, government agencies, and industry stakeholders. Field surveys, farmer interviews, and agricultural cooperative consultations provide direct insights into market conditions and development trends.

Secondary research incorporates government agricultural statistics, international development organization reports, and academic research on Algerian agriculture. Data validation processes ensure accuracy and reliability of market information and trend analysis.

Quantitative analysis includes agricultural production data, crop yield statistics, and market price trends across different regions and crop categories. Statistical modeling techniques project future market developments and identify key growth drivers.

Qualitative assessment encompasses stakeholder perspectives, policy impact analysis, and market opportunity evaluation. Expert interviews with agricultural specialists, government officials, and industry leaders provide strategic insights into market dynamics and future prospects.

Northern coastal regions dominate high-value agricultural production, accounting for approximately 45% of total agricultural output through intensive cultivation of citrus fruits, vegetables, and specialty crops. Mediterranean climate conditions support year-round production and multiple cropping seasons.

Central plateau areas focus primarily on cereal production, particularly wheat and barley cultivation, representing significant portions of national grain production. These regions benefit from extensive land availability and mechanized farming operations.

Eastern regions demonstrate strong performance in olive cultivation and livestock farming, with traditional agricultural practices complemented by modernization initiatives. Regional specialization in olive oil production shows 22% annual growth in production capacity.

Western agricultural zones exhibit diversified production patterns including cereals, legumes, and livestock farming. Infrastructure development programs support market access improvement and agricultural productivity enhancement in these regions.

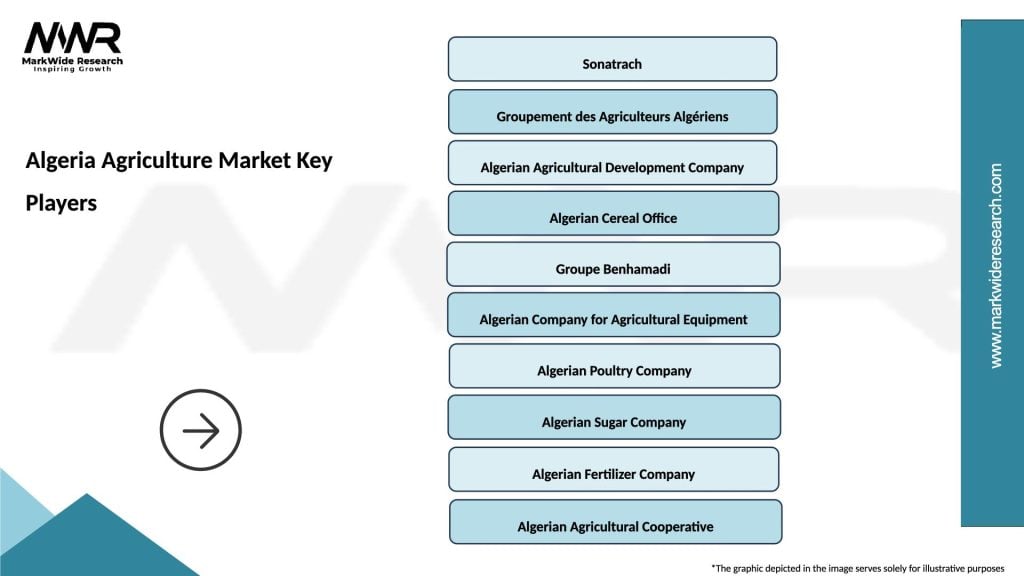

Market structure encompasses diverse participant categories from smallholder farmers to large agricultural enterprises and cooperatives. Key players in Algeria’s agricultural market include:

Competitive advantages vary across different market segments, with larger operations benefiting from economies of scale, technology adoption, and market access capabilities. Smaller farmers compete through specialized production, local market knowledge, and traditional crop varieties.

By Crop Type:

By Farming System:

Cereal production remains fundamental to Algeria’s agricultural sector, with wheat cultivation covering extensive areas across central and eastern regions. Government support programs encourage domestic wheat production to reduce import dependency, though productivity improvements require continued investment in modern farming techniques and irrigation infrastructure.

Citrus cultivation represents a high-value agricultural segment with strong export potential, particularly to European markets. Production efficiency improvements show 15% annual increases through modern orchard management, drip irrigation adoption, and post-harvest handling improvements.

Olive production combines traditional cultivation methods with modern processing techniques, creating opportunities for premium olive oil production and export market development. Ancient olive groves receive modernization support while new plantations adopt intensive cultivation practices.

Vegetable farming serves both domestic consumption and processing industries, with greenhouse production expanding to ensure year-round supply and quality consistency. Protected cultivation techniques enable 40% higher yields compared to traditional open-field production.

Farmers benefit from government support programs, improved access to modern farming inputs, and enhanced market linkages that increase income potential and production efficiency. Technical assistance programs and agricultural extension services provide knowledge transfer and capacity building opportunities.

Agribusiness companies gain access to diverse agricultural raw materials, expanding domestic markets, and export opportunities through strategic partnerships with local producers. Value chain integration opportunities create competitive advantages and market positioning benefits.

Government stakeholders achieve food security objectives, rural development goals, and economic diversification targets through agricultural sector growth. Employment generation in rural areas supports social stability and regional development initiatives.

International partners access growing agricultural markets, investment opportunities, and strategic partnerships for agricultural technology transfer and development cooperation. MarkWide Research analysis indicates increasing international interest in Algeria’s agricultural development potential.

Strengths:

Weaknesses:

Opportunities:

Threats:

Precision agriculture adoption accelerates across commercial farming operations, with GPS-guided equipment, soil sensors, and data analytics improving farming efficiency and resource utilization. Technology integration shows 30% annual growth in adoption rates among larger agricultural operations.

Sustainable farming practices gain prominence as environmental awareness increases and export markets demand sustainable production methods. Organic certification programs and environmentally friendly farming techniques attract premium pricing and market differentiation opportunities.

Value chain integration trends show increasing coordination between agricultural producers, processors, and retailers, creating more efficient market systems and improved price stability for farmers. Contract farming arrangements provide production security and quality assurance.

Export market development focuses on high-value agricultural products including citrus fruits, olive oil, and processed foods targeting European and regional markets. Quality improvement initiatives and international certification compliance support export growth objectives.

Infrastructure investment programs include irrigation system expansion, rural road development, and agricultural storage facility construction supporting market access and post-harvest loss reduction. Government investment priorities emphasize agricultural productivity enhancement and rural development.

Technology transfer initiatives bring advanced farming techniques, improved seed varieties, and modern equipment to Algerian agriculture through international cooperation programs and private sector partnerships. Agricultural research institutions collaborate with international organizations for knowledge exchange.

Market liberalization measures encourage private sector participation in agricultural input supply, equipment provision, and market development activities. Regulatory reforms support agricultural investment and business development in rural areas.

Climate adaptation programs develop drought-resistant crop varieties, water-efficient irrigation systems, and sustainable farming practices addressing climate change challenges. Research and development efforts focus on agricultural resilience and environmental sustainability.

Investment priorities should focus on irrigation infrastructure development, agricultural technology adoption, and value chain enhancement to maximize agricultural productivity and market competitiveness. MWR analysis suggests prioritizing water-efficient farming systems and modern storage facilities.

Market development strategies should emphasize export market cultivation, quality improvement initiatives, and agricultural product diversification to capture higher-value market segments. International market access requires continued investment in quality standards compliance and certification programs.

Technology adoption acceleration through farmer training programs, equipment financing schemes, and technical assistance services will enhance agricultural productivity and sustainability. Digital agriculture solutions offer significant potential for farming efficiency improvements.

Policy recommendations include agricultural financing system development, rural infrastructure investment continuation, and international trade facilitation to support comprehensive agricultural sector growth and competitiveness enhancement.

Growth projections indicate continued expansion of Algeria’s agricultural sector, with productivity improvements expected to achieve 10% annual growth through technology adoption, infrastructure development, and sustainable farming practices implementation. Market diversification toward high-value crops and processed agricultural products supports long-term development objectives.

Export potential remains substantial, particularly for citrus fruits, olive oil, and specialty agricultural products targeting European and regional markets. Quality improvement initiatives and international certification compliance will strengthen export competitiveness and market access.

Sustainability trends will increasingly influence agricultural practices, with organic farming, water conservation, and climate-smart agriculture becoming standard practices. Environmental considerations and sustainable development goals will shape future agricultural policies and investment priorities.

Technology integration will accelerate agricultural modernization, with precision farming, smart irrigation, and digital agriculture solutions becoming widespread across commercial farming operations. MarkWide Research projects technology adoption rates reaching 60% penetration among commercial agricultural enterprises within the next decade.

Algeria’s agriculture market demonstrates significant potential for continued growth and development, supported by favorable geographic conditions, government policy support, and increasing investment in agricultural modernization. The sector’s evolution from traditional farming practices toward modern, sustainable agricultural systems positions Algeria for enhanced food security, rural development, and export market participation.

Strategic opportunities in export market development, value chain enhancement, and sustainable agriculture adoption provide pathways for comprehensive agricultural sector transformation. Technology integration, infrastructure development, and market access improvement will continue driving agricultural productivity and competitiveness enhancement.

Future success depends on continued investment in agricultural infrastructure, technology adoption acceleration, and sustainable farming practices implementation. The Algeria agriculture market represents a cornerstone of national economic development with substantial potential for growth, innovation, and international market integration.

What is Agriculture?

Agriculture refers to the practice of cultivating soil, growing crops, and raising animals for food, fiber, and other products. It plays a crucial role in the economy and food security of countries, including Algeria.

What are the key players in the Algeria Agriculture Market?

Key players in the Algeria Agriculture Market include companies like Agro-Industrie, Cevital, and Groupe Benhamadi, which are involved in various agricultural activities such as crop production and food processing, among others.

What are the main drivers of growth in the Algeria Agriculture Market?

The main drivers of growth in the Algeria Agriculture Market include increasing domestic food demand, government initiatives to boost agricultural productivity, and advancements in agricultural technology.

What challenges does the Algeria Agriculture Market face?

The Algeria Agriculture Market faces challenges such as water scarcity, land degradation, and limited access to modern farming techniques, which can hinder productivity and sustainability.

What opportunities exist in the Algeria Agriculture Market?

Opportunities in the Algeria Agriculture Market include the potential for organic farming, investment in agro-tech innovations, and the expansion of export markets for agricultural products.

What trends are shaping the Algeria Agriculture Market?

Trends shaping the Algeria Agriculture Market include a shift towards sustainable farming practices, increased use of digital agriculture technologies, and a growing focus on food security and self-sufficiency.

Algeria Agriculture Market

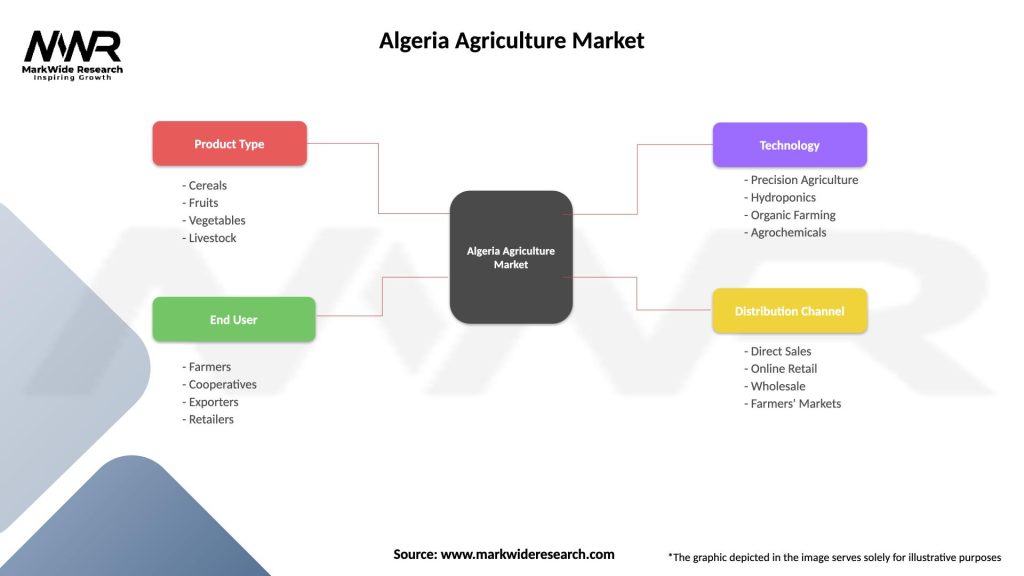

| Segmentation Details | Description |

|---|---|

| Product Type | Cereals, Fruits, Vegetables, Livestock |

| End User | Farmers, Cooperatives, Exporters, Retailers |

| Technology | Precision Agriculture, Hydroponics, Organic Farming, Agrochemicals |

| Distribution Channel | Direct Sales, Online Retail, Wholesale, Farmers’ Markets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Algeria Agriculture Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at