444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The alarm management in pharmaceutical market represents a critical segment within the broader pharmaceutical manufacturing and quality assurance ecosystem. This specialized market encompasses sophisticated systems designed to monitor, prioritize, and manage alarms across pharmaceutical manufacturing facilities, ensuring compliance with stringent regulatory requirements and maintaining optimal operational efficiency. The market has experienced substantial growth driven by increasing regulatory scrutiny, the need for enhanced patient safety, and the growing complexity of pharmaceutical manufacturing processes.

Pharmaceutical companies are increasingly investing in advanced alarm management solutions to address the challenges of alarm fatigue, improve response times, and ensure regulatory compliance. The market encompasses various technologies including distributed control systems (DCS), supervisory control and data acquisition (SCADA) systems, and specialized pharmaceutical alarm management software. With the pharmaceutical industry’s growing emphasis on digital transformation and Industry 4.0 adoption, alarm management systems have become essential components of modern pharmaceutical manufacturing infrastructure.

Market dynamics indicate robust expansion with a projected CAGR of 8.2% over the forecast period, driven by increasing pharmaceutical production volumes, stringent regulatory requirements, and the growing adoption of automated manufacturing processes. The integration of artificial intelligence and machine learning technologies into alarm management systems is creating new opportunities for predictive maintenance and enhanced operational efficiency.

The alarm management in pharmaceutical market refers to the comprehensive ecosystem of technologies, software solutions, and services designed to effectively monitor, prioritize, and respond to alarms generated across pharmaceutical manufacturing and quality control processes. These systems serve as critical safety and operational efficiency tools, ensuring that potential issues are identified, categorized, and addressed according to their severity and regulatory requirements.

Alarm management systems in pharmaceutical environments encompass multiple layers of functionality, including real-time monitoring of manufacturing equipment, environmental conditions, quality parameters, and safety systems. The technology integrates with existing manufacturing execution systems (MES), enterprise resource planning (ERP) platforms, and regulatory compliance frameworks to provide comprehensive oversight of pharmaceutical operations. These solutions are designed to reduce alarm fatigue, improve response times, and ensure that critical alerts receive appropriate attention while minimizing false positives and non-essential notifications.

Market expansion in the alarm management pharmaceutical sector is being driven by several converging factors, including increased regulatory oversight, growing manufacturing complexity, and the need for enhanced operational efficiency. The market encompasses a diverse range of stakeholders, from pharmaceutical manufacturers and contract manufacturing organizations to technology providers and regulatory consultants.

Key market segments include large pharmaceutical companies, biotechnology firms, generic drug manufacturers, and contract development and manufacturing organizations (CDMOs). The technology landscape spans traditional alarm management systems, cloud-based solutions, and emerging AI-powered platforms that offer predictive capabilities and advanced analytics. According to MarkWide Research analysis, the adoption rate of advanced alarm management solutions has increased by 34% among pharmaceutical manufacturers over the past three years.

Regional distribution shows strong market presence across North America, Europe, and Asia-Pacific, with emerging markets demonstrating significant growth potential. The competitive landscape features established industrial automation companies, specialized pharmaceutical software providers, and emerging technology startups focused on digital transformation solutions for the pharmaceutical industry.

Strategic insights reveal several critical trends shaping the alarm management pharmaceutical market landscape:

Primary market drivers propelling the alarm management pharmaceutical market include stringent regulatory requirements that mandate comprehensive monitoring and documentation of manufacturing processes. The pharmaceutical industry faces increasing scrutiny from regulatory bodies worldwide, necessitating robust alarm management systems that can provide detailed audit trails and ensure compliance with Good Manufacturing Practices (GMP).

Operational efficiency demands represent another significant driver, as pharmaceutical manufacturers seek to optimize production processes, reduce downtime, and minimize waste. Advanced alarm management systems enable predictive maintenance capabilities, allowing companies to address potential issues before they impact production schedules or product quality. The growing complexity of pharmaceutical manufacturing processes, particularly in biologics and personalized medicine, requires sophisticated monitoring and alarm management capabilities.

Patient safety considerations continue to drive market growth, with pharmaceutical companies recognizing that effective alarm management directly impacts product quality and patient outcomes. The increasing adoption of continuous manufacturing processes in pharmaceutical production creates additional demand for real-time monitoring and alarm management solutions that can ensure process stability and product consistency.

Implementation challenges pose significant restraints to market growth, particularly the high initial investment costs associated with comprehensive alarm management system deployment. Many pharmaceutical companies, especially smaller organizations, face budget constraints that limit their ability to invest in advanced alarm management technologies. The complexity of integrating new systems with existing legacy infrastructure creates additional barriers to adoption.

Technical limitations include the challenge of managing alarm fatigue, where operators become overwhelmed by excessive alarms, potentially leading to delayed responses to critical issues. The lack of standardization across different pharmaceutical manufacturing environments creates compatibility issues and increases implementation complexity. Cybersecurity concerns also present restraints, as pharmaceutical companies must balance the need for connectivity and remote access with the requirement to protect sensitive manufacturing data.

Regulatory complexity can also serve as a restraint, as pharmaceutical companies must navigate varying requirements across different markets and ensure that their alarm management systems comply with multiple regulatory frameworks simultaneously. The need for extensive validation and documentation processes can extend implementation timelines and increase costs.

Emerging opportunities in the alarm management pharmaceutical market are driven by the increasing adoption of Industry 4.0 technologies and the growing emphasis on digital transformation within the pharmaceutical sector. The integration of Internet of Things (IoT) devices and sensors throughout pharmaceutical manufacturing facilities creates new opportunities for comprehensive monitoring and alarm management solutions.

Artificial intelligence and machine learning technologies present significant opportunities for developing more sophisticated alarm management systems that can learn from historical data, predict potential issues, and automatically adjust alarm thresholds based on operating conditions. The growing market for personalized medicine and cell and gene therapies requires specialized monitoring and alarm management capabilities, creating niche opportunities for technology providers.

Cloud-based solutions offer opportunities for smaller pharmaceutical companies and contract manufacturing organizations to access advanced alarm management capabilities without significant upfront infrastructure investments. The increasing focus on sustainability and environmental monitoring in pharmaceutical manufacturing creates additional opportunities for alarm management systems that can monitor and manage environmental parameters and energy consumption.

Market dynamics in the alarm management pharmaceutical sector are characterized by rapid technological evolution and increasing integration with broader pharmaceutical manufacturing ecosystems. The shift toward continuous manufacturing processes is fundamentally changing alarm management requirements, with systems needing to provide real-time monitoring and rapid response capabilities to maintain process stability.

Competitive pressures are driving innovation in alarm management solutions, with vendors focusing on developing more intuitive user interfaces, advanced analytics capabilities, and seamless integration with existing pharmaceutical manufacturing systems. The market is experiencing consolidation as larger industrial automation companies acquire specialized pharmaceutical software providers to expand their capabilities and market reach.

Technological convergence is creating new market dynamics, with alarm management systems increasingly incorporating elements of artificial intelligence, predictive analytics, and cloud computing. The growing emphasis on data integrity and audit trail capabilities is shaping product development priorities, with vendors investing heavily in features that support regulatory compliance and quality assurance requirements.

Comprehensive market research methodology employed for analyzing the alarm management pharmaceutical market encompasses both primary and secondary research approaches. Primary research includes extensive interviews with pharmaceutical manufacturing executives, quality assurance professionals, regulatory compliance specialists, and technology vendors specializing in alarm management solutions.

Secondary research components include analysis of regulatory guidelines, industry reports, patent filings, and technology trend assessments. The research methodology incorporates quantitative analysis of market trends, adoption rates, and growth projections, combined with qualitative insights from industry experts and stakeholders. Market segmentation analysis examines various dimensions including technology type, application area, company size, and geographic region.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, expert review panels, and statistical analysis techniques. The methodology includes assessment of competitive landscapes, technology roadmaps, and regulatory impact analysis to provide comprehensive market insights and future outlook projections.

North America dominates the alarm management pharmaceutical market, accounting for approximately 42% of global adoption, driven by stringent FDA regulations and the presence of major pharmaceutical companies. The region benefits from advanced technological infrastructure, significant R&D investments, and early adoption of digital manufacturing technologies. United States pharmaceutical companies are leading the implementation of sophisticated alarm management systems to ensure compliance with evolving regulatory requirements.

Europe represents the second-largest market segment with approximately 35% market share, characterized by strong regulatory frameworks and emphasis on quality assurance. The European Medicines Agency (EMA) guidelines and individual country regulations drive demand for comprehensive alarm management solutions. Countries such as Germany, Switzerland, and United Kingdom demonstrate particularly strong adoption rates among pharmaceutical manufacturers.

Asia-Pacific emerges as the fastest-growing regional market, with projected growth rates exceeding 12% CAGR, driven by expanding pharmaceutical manufacturing capacity and increasing regulatory sophistication. China and India are experiencing rapid market expansion as domestic pharmaceutical companies invest in advanced manufacturing technologies and international companies establish regional production facilities. According to MWR analysis, the region’s market share is expected to reach 28% by the end of the forecast period.

Market leadership in the alarm management pharmaceutical sector is characterized by a mix of established industrial automation companies and specialized pharmaceutical software providers. The competitive landscape features both global technology giants and niche players focused specifically on pharmaceutical manufacturing requirements.

Competitive strategies focus on developing industry-specific solutions, enhancing integration capabilities, and providing comprehensive regulatory compliance support. Companies are investing heavily in artificial intelligence and machine learning technologies to differentiate their offerings and provide advanced predictive capabilities.

Technology segmentation reveals diverse approaches to alarm management in pharmaceutical environments:

Application segmentation encompasses various pharmaceutical manufacturing areas:

By Technology: Cloud-based alarm management solutions are experiencing the highest growth rates, with adoption increasing by 45% annually among pharmaceutical companies seeking scalable and cost-effective monitoring capabilities. Traditional DCS-based systems continue to dominate in large pharmaceutical manufacturing facilities due to their proven reliability and comprehensive integration capabilities.

By Application: Biologics production represents the fastest-growing application segment, driven by the increasing complexity of biological manufacturing processes and stringent monitoring requirements. Quality control applications demonstrate steady growth as pharmaceutical companies invest in comprehensive laboratory monitoring and alarm management systems.

By Company Size: Large pharmaceutical companies account for the majority of market demand, with 68% of implementations occurring in organizations with annual revenues exceeding $1 billion. However, mid-size companies and contract manufacturing organizations are increasingly adopting cloud-based solutions to access advanced alarm management capabilities.

By Deployment Model: On-premises deployments remain prevalent in highly regulated pharmaceutical environments, while hybrid cloud solutions are gaining traction as companies seek to balance security requirements with scalability and cost considerations.

Pharmaceutical manufacturers benefit significantly from advanced alarm management systems through improved operational efficiency, reduced downtime, and enhanced regulatory compliance. These systems enable predictive maintenance capabilities that can reduce unplanned equipment failures by up to 40%, resulting in substantial cost savings and improved production reliability.

Quality assurance teams gain enhanced visibility into manufacturing processes, enabling faster identification and resolution of quality issues. The comprehensive audit trail capabilities provided by modern alarm management systems support regulatory inspections and compliance documentation requirements. Regulatory compliance benefits include automated documentation, real-time monitoring of critical parameters, and standardized response procedures.

Technology vendors benefit from the growing market demand and opportunities for innovation in artificial intelligence and machine learning applications. The increasing complexity of pharmaceutical manufacturing creates opportunities for specialized solutions and value-added services. System integrators and consulting firms benefit from growing demand for implementation services and ongoing support for alarm management systems.

Patients and healthcare providers ultimately benefit from improved pharmaceutical product quality and safety resulting from enhanced monitoring and alarm management capabilities throughout the manufacturing process.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend shaping the alarm management pharmaceutical market, with systems increasingly incorporating machine learning algorithms to improve alarm prioritization and reduce false positives. These AI-powered systems can analyze historical alarm data to identify patterns and optimize alarm thresholds based on operating conditions and equipment performance.

Cloud-based deployment is accelerating as pharmaceutical companies recognize the benefits of scalable, cost-effective alarm management solutions. Hybrid cloud architectures are becoming particularly popular, allowing companies to maintain sensitive data on-premises while leveraging cloud capabilities for analytics and remote monitoring.

Mobile accessibility is becoming increasingly important, with alarm management systems providing comprehensive mobile applications that enable remote monitoring and response capabilities. The COVID-19 pandemic has accelerated this trend as pharmaceutical companies seek to enable remote operations and reduce on-site personnel requirements.

Predictive analytics capabilities are evolving beyond traditional alarm management to provide insights into equipment performance, process optimization, and maintenance scheduling. These advanced analytics help pharmaceutical companies transition from reactive to proactive maintenance strategies.

Recent industry developments highlight the dynamic nature of the alarm management pharmaceutical market. Major technology vendors are investing heavily in artificial intelligence and machine learning capabilities to enhance their alarm management offerings. Several companies have announced strategic partnerships with pharmaceutical manufacturers to develop industry-specific solutions and accelerate digital transformation initiatives.

Regulatory developments continue to shape market requirements, with agencies worldwide updating guidelines for pharmaceutical manufacturing monitoring and documentation. The FDA’s emphasis on data integrity and the European Union’s updated GMP guidelines are driving demand for more sophisticated alarm management and audit trail capabilities.

Merger and acquisition activity in the market includes major industrial automation companies acquiring specialized pharmaceutical software providers to expand their capabilities and market reach. These consolidation trends are creating more comprehensive solution portfolios and enhanced integration capabilities for pharmaceutical customers.

Technology innovations include the development of edge computing solutions that enable real-time alarm processing at the manufacturing facility level, reducing latency and improving response times. The integration of augmented reality and virtual reality technologies is beginning to emerge for alarm visualization and operator training applications.

Strategic recommendations for pharmaceutical companies include prioritizing alarm management system investments that align with broader digital transformation initiatives and regulatory compliance requirements. Companies should focus on solutions that offer comprehensive integration capabilities with existing manufacturing infrastructure while providing scalability for future growth.

Technology selection should emphasize platforms that incorporate artificial intelligence and machine learning capabilities to address alarm fatigue and improve operational efficiency. MarkWide Research analysis suggests that companies implementing AI-powered alarm management systems achieve 25% better response times and 30% reduction in false alarms compared to traditional systems.

Implementation strategies should include comprehensive change management programs to ensure successful adoption and maximize return on investment. Companies should invest in operator training and establish clear procedures for alarm response and escalation. The development of key performance indicators (KPIs) for alarm management effectiveness is essential for measuring success and identifying improvement opportunities.

Vendor selection should consider not only technical capabilities but also industry expertise, regulatory compliance support, and long-term partnership potential. Companies should evaluate vendors’ ability to provide ongoing support, system updates, and adaptation to evolving regulatory requirements.

Market projections indicate continued robust growth in the alarm management pharmaceutical market, with increasing adoption of advanced technologies and expanding regulatory requirements driving demand. The market is expected to experience accelerated growth in cloud-based solutions, with adoption rates projected to increase by 55% over the next five years.

Technology evolution will focus on enhanced artificial intelligence capabilities, improved integration with Internet of Things devices, and advanced analytics for predictive maintenance and process optimization. The convergence of alarm management with broader pharmaceutical manufacturing execution systems will create more comprehensive and integrated solutions.

Regulatory trends suggest increasing emphasis on data integrity, cybersecurity, and comprehensive audit trail capabilities, driving demand for more sophisticated alarm management systems. The growing focus on sustainability and environmental monitoring will create new requirements for alarm management systems to monitor and manage environmental parameters and energy consumption.

Geographic expansion will continue in emerging markets as pharmaceutical manufacturing capacity grows and regulatory frameworks become more sophisticated. The Asia-Pacific region is expected to demonstrate the highest growth rates, driven by expanding pharmaceutical manufacturing and increasing regulatory requirements.

The alarm management in pharmaceutical market represents a critical and rapidly evolving segment of the pharmaceutical manufacturing technology landscape. With increasing regulatory scrutiny, growing manufacturing complexity, and the need for enhanced operational efficiency, alarm management systems have become essential components of modern pharmaceutical operations.

Market growth is being driven by multiple converging factors, including stringent regulatory requirements, the adoption of continuous manufacturing processes, and the increasing complexity of pharmaceutical products such as biologics and personalized medicines. The integration of artificial intelligence and machine learning technologies is transforming traditional alarm management approaches, enabling predictive capabilities and improved operational efficiency.

Future success in this market will depend on the ability of technology providers to deliver comprehensive solutions that address the unique requirements of pharmaceutical manufacturing while providing scalability, regulatory compliance, and integration capabilities. Companies that can effectively combine advanced technology with deep pharmaceutical industry expertise will be best positioned to capitalize on the significant growth opportunities in this dynamic market.

What is Alarm Management in Pharmaceutical?

Alarm Management in Pharmaceutical refers to the systematic approach to managing alarms in pharmaceutical manufacturing and healthcare settings. It involves the identification, prioritization, and response to alarms to ensure safety, compliance, and operational efficiency.

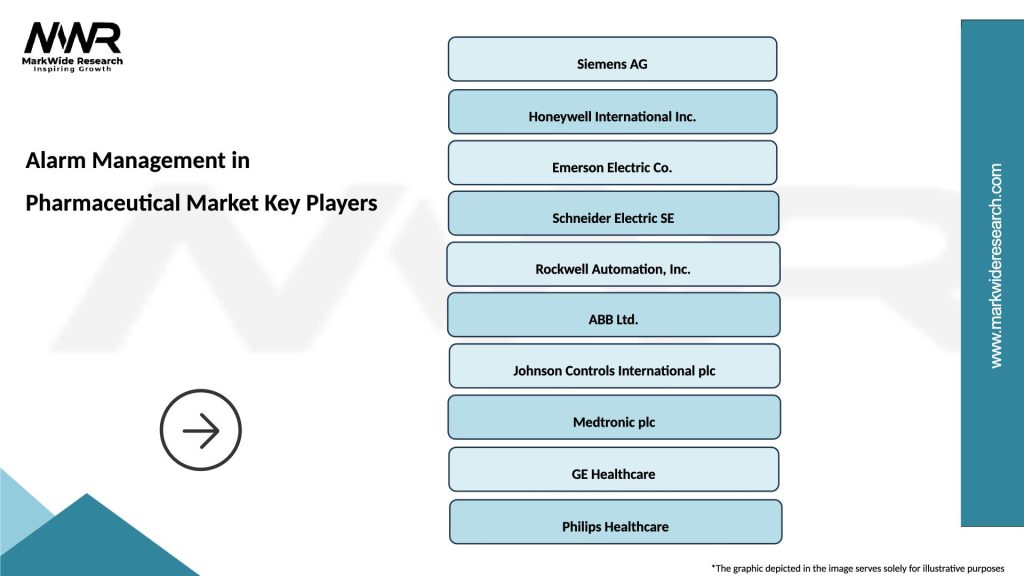

What are the key companies in Alarm Management in Pharmaceutical Market?

Key companies in the Alarm Management in Pharmaceutical Market include Siemens, Honeywell, and Emerson. These companies provide solutions that enhance alarm systems, improve response times, and ensure regulatory compliance, among others.

What are the drivers of growth in the Alarm Management in Pharmaceutical Market?

The growth of the Alarm Management in Pharmaceutical Market is driven by the increasing need for regulatory compliance, the rise in automation in pharmaceutical processes, and the demand for improved patient safety in healthcare environments.

What challenges does the Alarm Management in Pharmaceutical Market face?

Challenges in the Alarm Management in Pharmaceutical Market include the complexity of integrating alarm systems with existing technologies, the potential for alarm fatigue among staff, and the need for continuous training and updates to maintain system effectiveness.

What opportunities exist in the Alarm Management in Pharmaceutical Market?

Opportunities in the Alarm Management in Pharmaceutical Market include the development of advanced analytics for alarm data, the integration of artificial intelligence to reduce false alarms, and the expansion of alarm management solutions into emerging markets.

What trends are shaping the Alarm Management in Pharmaceutical Market?

Trends in the Alarm Management in Pharmaceutical Market include the increasing adoption of cloud-based solutions, the focus on real-time monitoring and analytics, and the integration of alarm management with broader digital transformation initiatives in healthcare and manufacturing.

Alarm Management in Pharmaceutical Market

| Segmentation Details | Description |

|---|---|

| Product Type | Software, Hardware, Cloud Solutions, Integrated Systems |

| End User | Pharmaceutical Manufacturers, Contract Research Organizations, Regulatory Agencies, Quality Control Labs |

| Technology | Real-Time Monitoring, Predictive Analytics, Data Visualization, Alert Management |

| Deployment | On-Premises, Cloud-Based, Hybrid, Mobile Solutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Alarm Management in Pharmaceutical Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at