444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The aircraft turbine engine market plays a vital role in the aviation industry, powering commercial and military aircraft worldwide. These engines are known for their efficiency, reliability, and power, enabling aircraft to operate at high altitudes and speeds. The global aircraft turbine engine market has witnessed significant growth over the years, driven by the increasing demand for air travel, rising defense budgets, and advancements in engine technology.

Meaning

An aircraft turbine engine, also known as a jet engine, is a type of internal combustion engine that generates thrust by expelling a high-velocity jet of gases. It operates on the principles of the Brayton cycle, which involves the compression, combustion, and expansion of air within the engine. Turbine engines are commonly used in commercial airliners, business jets, military aircraft, and helicopters.

Executive Summary

The aircraft turbine engine market has experienced robust growth in recent years, driven by the rising global demand for air travel and the modernization of military aircraft fleets. The market is characterized by intense competition among major engine manufacturers, who are constantly striving to develop more efficient and environmentally friendly engines. The COVID-19 pandemic had a significant impact on the market, leading to a temporary decline in demand due to travel restrictions and reduced air travel.

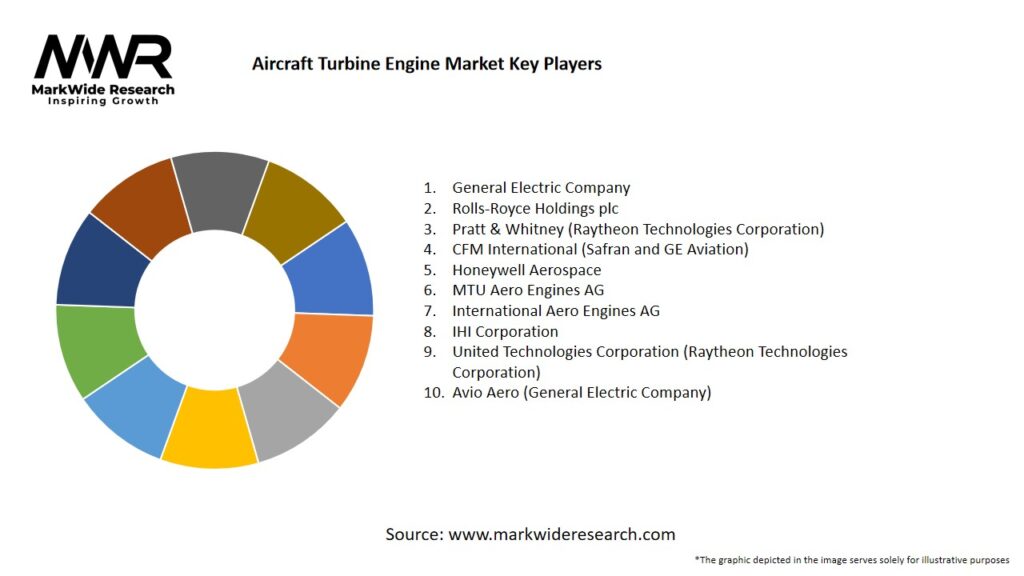

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

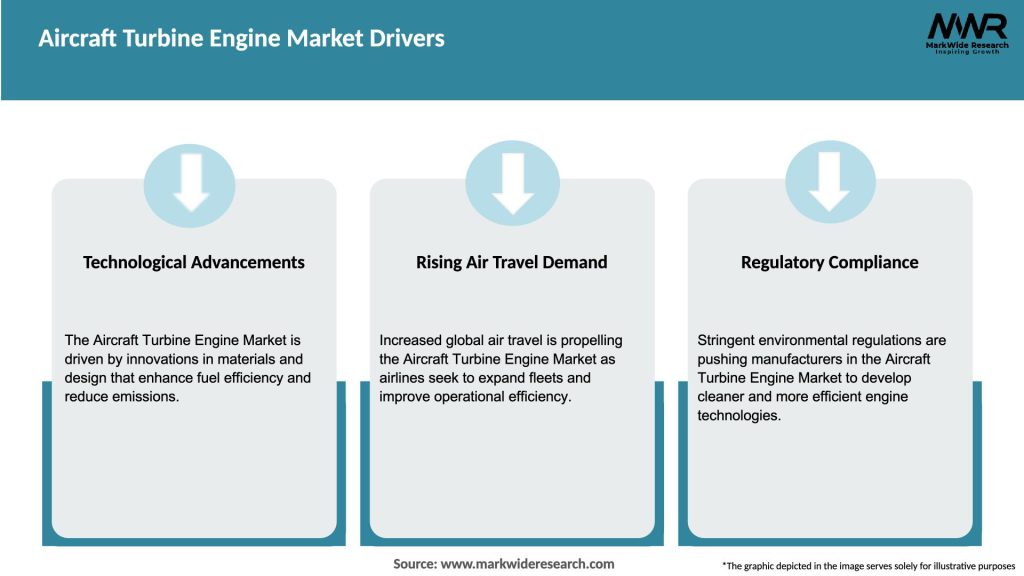

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The aircraft turbine engine market is highly dynamic, driven by technological advancements, changing market dynamics, and evolving customer requirements. Key market dynamics include:

Regional Analysis

The aircraft turbine engine market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Competitive Landscape

Leading Companies in the Aircraft Turbine Engine Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

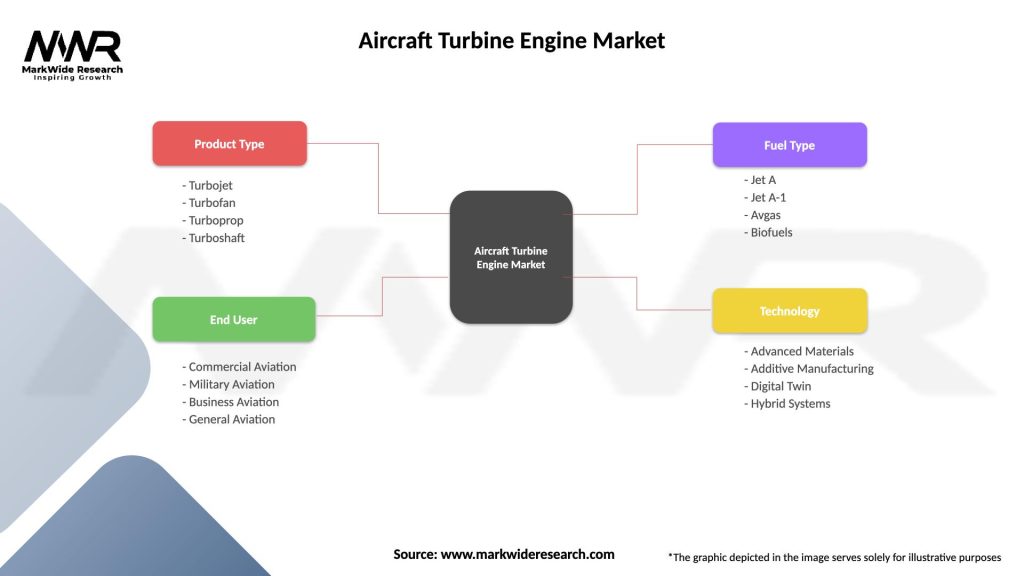

Segmentation

The aircraft turbine engine market can be segmented based on engine type, aircraft type, application, and region.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The aircraft turbine engine market offers several benefits for industry participants and stakeholders, including:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the aircraft turbine engine market. The aviation industry experienced a sharp decline in air travel demand due to travel restrictions, border closures, and reduced consumer confidence. This led to a temporary decline in new engine orders and delayed engine deliveries.

Airlines faced severe financial challenges, resulting in fleet groundings, aircraft retirements, and deferrals of new aircraft orders. This had a direct impact on the demand for new engines. Engine manufacturers faced a decrease in revenue and had to adjust their production and workforce accordingly.

However, as the aviation industry recovers from the pandemic, the market is expected to rebound. The gradual resumption of air travel, the easing of travel restrictions, and the increasing vaccination rates are expected to drive the demand for new aircraft and turbine engines.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the aircraft turbine engine market is positive, with steady growth expected in the coming years. The increasing demand for air travel, the modernization of military aircraft fleets, and the focus on sustainability will drive market growth. Engine manufacturers will continue to invest in research and development to develop more efficient, reliable, and environmentally friendly engines.

The industry will witness advancements in engine design, materials, and manufacturing processes, enabling engines to become lighter, more fuel-efficient, and durable. Electric and hybrid-electric propulsion systems will gain traction, offering additional opportunities for engine manufacturers. The market will also witness increased digitalization and connectivity, leading to improved engine performance monitoring and predictive maintenance capabilities.

Overall, the aircraft turbine engine market will continue to play a crucial role in the aviation industry, powering the next generation of aircraft and contributing to the growth and sustainability of the global aerospace sector.

Conclusion

The aircraft turbine engine market is a dynamic and competitive industry that plays a crucial role in powering commercial and military aircraft worldwide. With the increasing demand for air travel, technological advancements, and the focus on sustainability, the market is poised for steady growth in the coming years.

Engine manufacturers are investing in research and development to develop more efficient and environmentally friendly engines. Strategic partnerships and collaborations, as well as a customer-centric approach, are key factors for success in this market. The recovery from the COVID-19 pandemic presents both challenges and opportunities for the industry, and adapting to changing market dynamics will be crucial.

What is Aircraft Turbine Engine?

Aircraft turbine engines are a type of jet engine that converts fuel into mechanical energy to propel aircraft. They are widely used in commercial and military aviation due to their efficiency and power output.

What are the key players in the Aircraft Turbine Engine Market?

Key players in the Aircraft Turbine Engine Market include General Electric, Pratt & Whitney, Rolls-Royce, and Safran, among others. These companies are known for their innovative technologies and extensive product offerings in the aviation sector.

What are the main drivers of growth in the Aircraft Turbine Engine Market?

The growth of the Aircraft Turbine Engine Market is driven by increasing air travel demand, advancements in engine technology, and the need for fuel-efficient engines. Additionally, the rise in military spending and the expansion of the aerospace industry contribute to market growth.

What challenges does the Aircraft Turbine Engine Market face?

The Aircraft Turbine Engine Market faces challenges such as stringent environmental regulations, high development costs, and competition from alternative propulsion technologies. These factors can impact the pace of innovation and market entry for new players.

What opportunities exist in the Aircraft Turbine Engine Market?

Opportunities in the Aircraft Turbine Engine Market include the development of sustainable aviation fuels, advancements in hybrid-electric propulsion systems, and the increasing demand for regional and business jets. These trends present avenues for innovation and growth.

What are the current trends in the Aircraft Turbine Engine Market?

Current trends in the Aircraft Turbine Engine Market include a focus on reducing emissions, the integration of digital technologies for predictive maintenance, and the development of more efficient engine designs. These trends aim to enhance performance and sustainability in aviation.

Aircraft Turbine Engine Market

| Segmentation Details | Description |

|---|---|

| Product Type | Turbojet, Turbofan, Turboprop, Turboshaft |

| End User | Commercial Aviation, Military Aviation, Business Aviation, General Aviation |

| Fuel Type | Jet A, Jet A-1, Avgas, Biofuels |

| Technology | Advanced Materials, Additive Manufacturing, Digital Twin, Hybrid Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Aircraft Turbine Engine Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at