444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The aircraft tube and duct assemblies market plays a crucial role in the aviation industry. These assemblies are essential components used in aircraft systems to transport various fluids, including fuel, hydraulic fluids, air, and gases. The market for aircraft tube and duct assemblies encompasses both commercial and military aviation sectors, with a wide range of applications in aircraft systems such as fuel systems, air conditioning systems, hydraulic systems, and environmental control systems.

Meaning

Aircraft tube and duct assemblies are intricate systems that are designed to ensure the safe and efficient transportation of fluids and gases within an aircraft. These assemblies are typically made from materials like aluminum, stainless steel, titanium, and composite materials, which offer high strength, corrosion resistance, and lightweight properties. The tubes and ducts are carefully designed and engineered to meet stringent safety and performance requirements, ensuring the reliability and functionality of the aircraft systems.

Executive Summary

The aircraft tube and duct assemblies market is witnessing steady growth due to the increasing demand for air travel, rising aircraft deliveries, and the modernization of existing aircraft fleets. The market is highly competitive, with several established players as well as new entrants vying for a larger market share. Key market players are focusing on product innovation, strategic partnerships, and mergers and acquisitions to gain a competitive edge and expand their market presence.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Lightweight Materials Adoption: Titanium and advanced composites are increasingly used to reduce weight by up to 30% compared to traditional aluminum assemblies.

Automation & Precision: CNC tube bending and hydroforming technologies improve consistency, reduce lead times, and lower scrap rates.

Regulatory Compliance: EASA and FAA mandates on bleed-air contamination and hydraulic fluid fire-resistance require specialized coatings and ventilation duct designs.

Aftermarket Growth: Aging fleets and MRO contracts for narrow-body and wide-body airliners drive steady replacement and upgrade cycles.

Integration Trends: Suppliers increasingly offer fully integrated assemblies with embedded sensors, quick-disconnect fittings, and modular duct panels for rapid swaps.

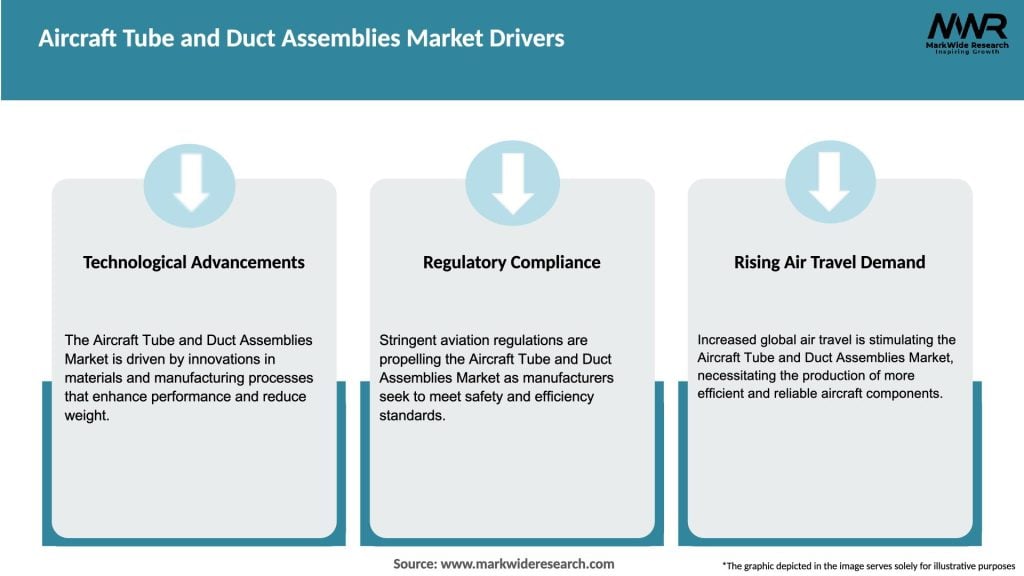

Market Drivers

Fleet Expansion: Airlines’ continued purchase of fuel-efficient aircraft boosts production of tube and duct assemblies.

MRO Demand: Aging airframes and mandated inspection intervals generate aftermarket requirements for refurbishment and spares.

Weight Reduction Initiatives: OEMs’ goals to improve fuel burn and emissions accelerate adoption of lightweight alloys and composites.

Complex Subsystems: Next-gen ECS, fuel-cooling, and hybrid-electric propulsion systems require advanced tubing architectures.

Defense Modernization: Military programs—such as F-35 sustainment and helicopter upgrades—drive demand for ruggedized tube and duct assemblies.

Market Restraints

High Entry Barriers: Certification requirements and capital investment in precision forming equipment limit new entrants.

Raw Material Volatility: Price fluctuations in aluminum, titanium, and specialty composites impact margins.

Supply Chain Complexity: Long lead times for strategic alloys and fittings can constrain production schedules.

Labor Skill Shortages: Skilled craftsmen for manual routing and assembly are in short supply, despite automation gains.

Regulatory Delays: Certification of new materials or processes (e.g., additive manufacturing for ducts) can extend time to market.

Market Opportunities

Additive Manufacturing: 3D printing of complex duct geometries with integrated brackets and flow-control features reduces part count.

Smart Assemblies: Embedding pressure and temperature sensors in tubes enables predictive maintenance and real-time diagnostics.

Sustainable Materials: Development of recyclable composites and bio-based insulation wraps aligns with aerospace sustainability goals.

Regional MRO Hubs: Establishing localized assembly and repair centers in Asia Pacific and Latin America to serve growing fleets cost-effectively.

Retrofit Programs: Lightweight tube and duct replacement kits for older aircraft improve performance and extend service life.

Market Dynamics

Industry Consolidation: Mergers and acquisitions among tier-2 and tier-3 suppliers enhance scale and technical capabilities.

Collaborative R&D: Partnerships between OEMs, materials firms, and equipment vendors accelerate development of next-gen assembly technologies.

Digital Twins & Simulation: Virtual prototyping of tube routing and duct airflow optimizes designs prior to physical testing.

Modular Design: Standardized quick-change modules reduce aircraft downtime during maintenance events.

Regulatory Evolution: New environmental and safety standards (e.g., flame-propagation, erodibility) drive continuous product refinement.

Regional Analysis

The aircraft tube and duct assemblies market is segmented into several regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America holds a significant market share due to the presence of major aircraft manufacturers and a robust aviation industry. Europe is also a prominent market, driven by the presence of key aerospace companies and increasing aircraft deliveries. The Asia Pacific region is witnessing substantial growth due to rising air travel, increasing defense budgets, and the emergence of new low-cost carriers.

Competitive Landscape

Leading companies in the Aircraft Tube and Duct Assemblies market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

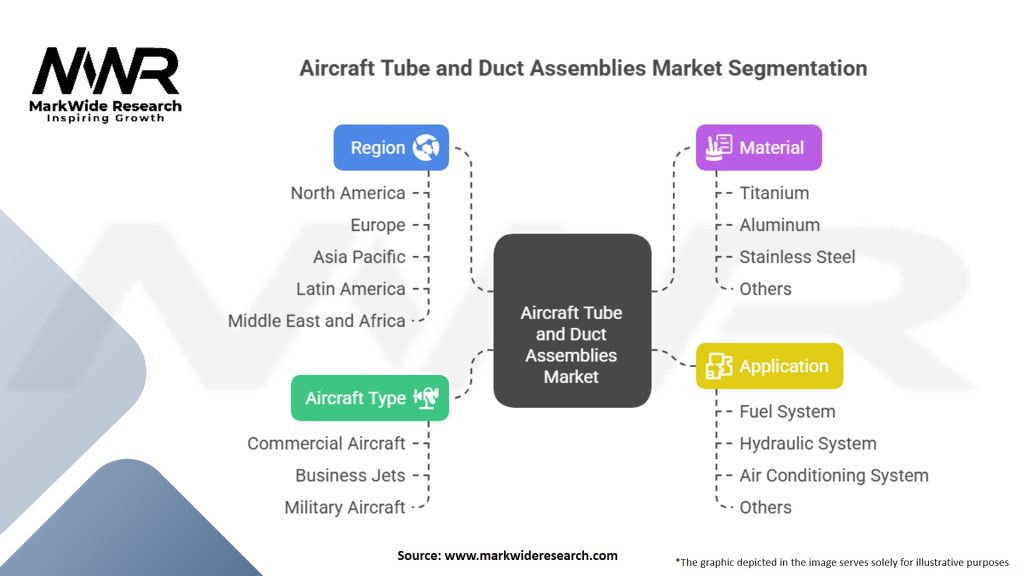

Segmentation

The aircraft tube and duct assemblies market can be segmented based on the type of aircraft, material type, application, and region. By aircraft type, the market can be divided into commercial aircraft, regional aircraft, and military aircraft. Based on material type, the market can be categorized into aluminum, stainless steel, titanium, and composites. By application, the market can be segmented into fuel systems, air conditioning systems, hydraulic systems, and environmental control systems.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The aircraft tube and duct assemblies market experienced a significant impact from the COVID-19 pandemic. The global aviation industry faced a severe downturn as travel restrictions, reduced passenger demand, and grounded fleets affected the market. The decline in aircraft deliveries and retrofit projects had a direct impact on the demand for tube and duct assemblies. However, as travel restrictions are gradually lifted and the aviation industry recovers, the market is expected to regain momentum, driven by the need for fleet modernization and the resumption of aircraft production.

Key Industry Developments

Analyst Suggestions

Future Outlook

The aircraft tube and duct assemblies market is poised for steady growth in the coming years. The increasing demand for air travel, fleet modernization initiatives, and technological advancements will be the key driving factors. The adoption of lightweight materials, integration of advanced technologies, and the focus on sustainability will shape the market landscape. Companies that can adapt to these market trends, innovate their products, and forge strategic partnerships will have a competitive advantage and thrive in the evolving aviation industry.

Conclusion

The aircraft tube and duct assemblies market is a vital component of the aviation industry, ensuring the safe and efficient transportation of fluids and gases within aircraft systems. The market offers significant opportunities for growth, driven by factors such as increasing air travel, fleet modernization, and technological advancements. However, industry participants need to navigate challenges such as stringent regulations, raw material price volatility, and intense competition. By focusing on product innovation, collaboration, and market trends, companies can position themselves for success and capitalize on the future growth prospects of the aircraft tube and duct assemblies market.

What is Aircraft Tube and Duct Assemblies?

Aircraft Tube and Duct Assemblies are components used in aircraft systems to transport air, fluids, and other materials. They play a crucial role in various applications, including environmental control systems, fuel systems, and pneumatic systems.

Who are the key players in the Aircraft Tube and Duct Assemblies Market?

Key players in the Aircraft Tube and Duct Assemblies Market include companies like Parker Hannifin Corporation, Triumph Group, and Spirit AeroSystems, among others. These companies are known for their innovative solutions and extensive product offerings in the aerospace sector.

What are the growth factors driving the Aircraft Tube and Duct Assemblies Market?

The Aircraft Tube and Duct Assemblies Market is driven by factors such as the increasing demand for lightweight materials, advancements in aerospace technology, and the growth of the commercial aviation sector. Additionally, the rise in aircraft production rates contributes to market expansion.

What challenges does the Aircraft Tube and Duct Assemblies Market face?

Challenges in the Aircraft Tube and Duct Assemblies Market include stringent regulatory requirements, high manufacturing costs, and the need for continuous innovation. These factors can hinder market growth and affect the competitiveness of manufacturers.

What opportunities exist in the Aircraft Tube and Duct Assemblies Market?

Opportunities in the Aircraft Tube and Duct Assemblies Market include the increasing focus on sustainable aviation practices and the development of advanced materials. Additionally, the rise of electric and hybrid aircraft presents new avenues for growth in this sector.

What trends are shaping the Aircraft Tube and Duct Assemblies Market?

Trends in the Aircraft Tube and Duct Assemblies Market include the adoption of composite materials for improved performance and weight reduction, as well as the integration of smart technologies for enhanced monitoring and maintenance. These innovations are expected to drive future developments in the industry.

Aircraft Tube and Duct Assemblies Market:

| Segmentation Details | Description |

|---|---|

| By Aircraft Type | Commercial Aircraft, Business Jets, Military Aircraft |

| By Material | Titanium, Aluminum, Stainless Steel, Others |

| By Application | Fuel System, Hydraulic System, Air Conditioning System, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Aircraft Tube and Duct Assemblies market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at