444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

Aircraft radomes play a crucial role in aviation by providing protection to radar systems and other electronic components housed inside an aircraft’s nose cone. These structures are designed to be aerodynamically efficient, minimizing the impact on the aircraft’s performance while ensuring the integrity of the installed equipment. The aircraft radome market has witnessed significant growth in recent years, driven by advancements in radar technology, increasing air travel, and the rising demand for military and commercial aircraft.

Meaning

A radome, short for radar dome, is a weatherproof housing that protects radar systems from the elements and minimizes their impact on the aircraft’s aerodynamics. It acts as a transparent cover, allowing electromagnetic signals to pass through without significant signal loss or distortion. Radomes are typically made from composite materials that offer high strength-to-weight ratios, as they need to withstand various environmental conditions, including extreme temperatures, lightning strikes, and bird impacts. These structures are available in different shapes, such as spherical, ogival, or cylindrical, depending on the specific aircraft requirements.

Executive Summary

The aircraft radome market has been experiencing steady growth, driven by the increasing need for efficient radar systems in both military and commercial aircraft. The market is expected to witness further expansion in the coming years, with advancements in radar technology and the growing demand for air travel. Additionally, the rising focus on enhancing aircraft performance and reducing fuel consumption has led to increased adoption of lightweight radomes with improved aerodynamic properties.

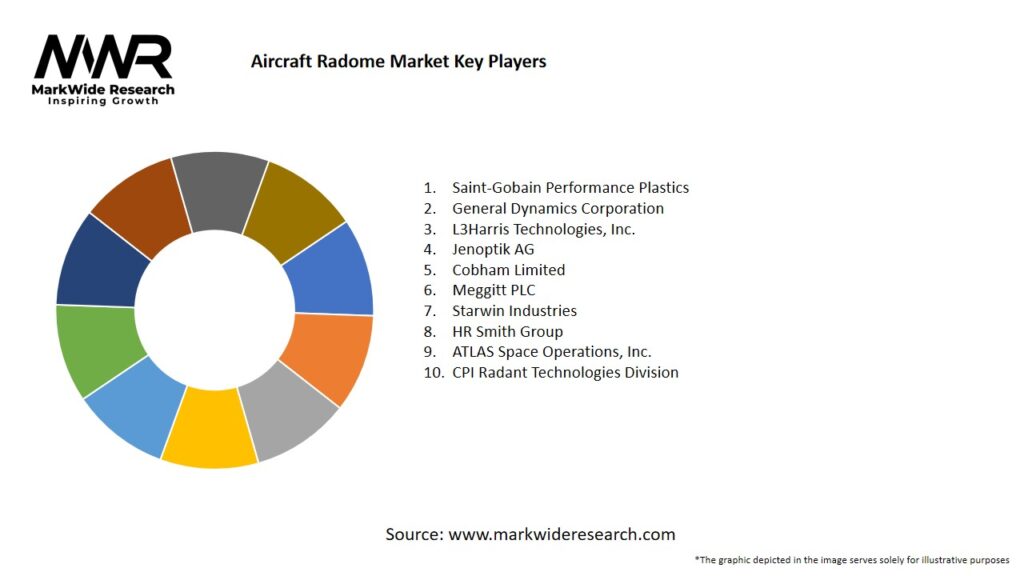

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

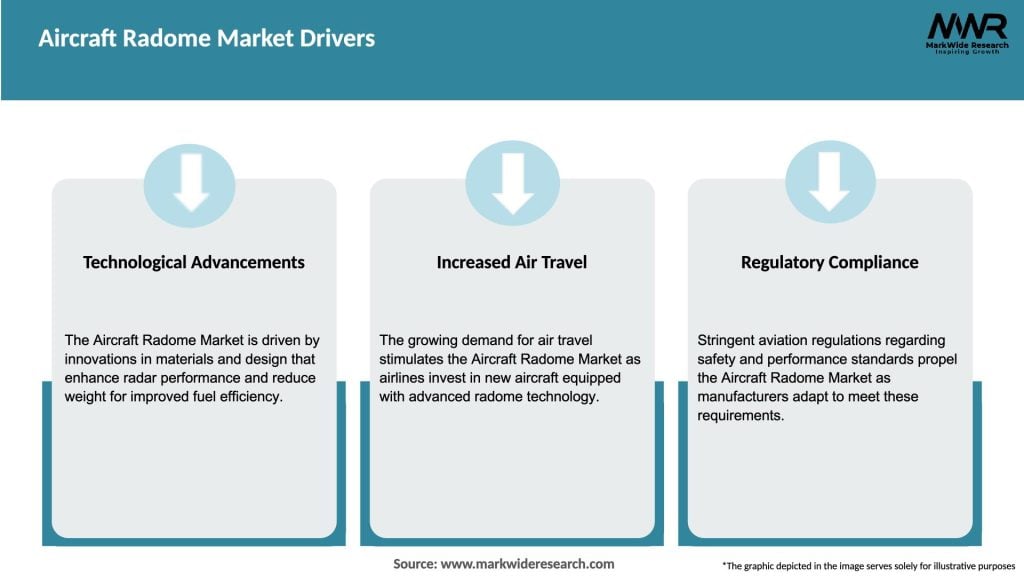

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The aircraft radome market is influenced by several dynamic factors, including technological advancements, regulatory requirements, market competition, and customer preferences. Manufacturers need to stay abreast of these dynamics to capitalize on market opportunities, adapt to changing industry landscapes, and sustain their competitive edge.

Regional Analysis

The aircraft radome market can be segmented into several regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. North America currently holds a significant market share due to the presence of major aircraft manufacturers, technological advancements, and defense spending. Europe and the Asia-Pacific region are also prominent markets, driven by the expanding commercial aviation sector and military modernization initiatives.

Competitive Landscape

Leading companies in the Aircraft Radome market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

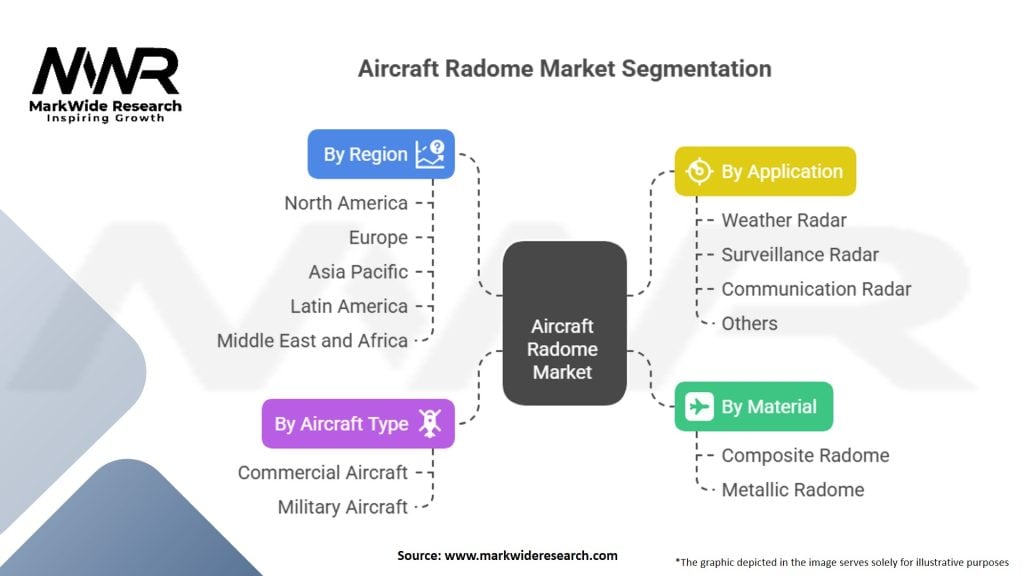

The aircraft radome market can be segmented based on the following criteria:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the global aviation industry, resulting in reduced air travel, grounded fleets, and financial challenges for airlines. This led to a temporary slowdown in the aircraft radome market, as aircraft deliveries were postponed or canceled. However, with the gradual recovery of the aviation industry, the market is expected to regain momentum, driven by the resumption of aircraft manufacturing, modernization programs, and the growing demand for advanced radar systems.

Key Industry Developments

Analyst Suggestions

Future Outlook

The aircraft radome market is expected to witness significant growth in the coming years, driven by the increasing adoption of advanced radar systems, expanding commercial aviation sector, and military modernization programs. Technological advancements in materials, manufacturing processes, and radar technology will continue to shape the market landscape. Manufacturers who can offer lightweight, durable, and aerodynamically optimized radomes while meeting stringent regulatory requirements will be well-positioned to capitalize on the growing market opportunities.

Conclusion

The aircraft radome market plays a critical role in ensuring the aerodynamic efficiency and protection of radar systems in aircraft. With advancements in radar technology, increasing air travel, and the growing demand for military and commercial aircraft, the market has experienced significant growth. However, challenges such as high development costs, complexity in integration and maintenance, and vulnerability to environmental damage exist. Nevertheless, the market offers opportunities for manufacturers, including the rapidly growing UAV market, technological advancements, and expansion of commercial aviation in emerging economies. By focusing on key trends, investing in advanced manufacturing techniques, and exploring partnerships and collaborations, manufacturers can position themselves for success in the dynamic aircraft radome market.

What is Aircraft Radome?

An Aircraft Radome is a protective structure that houses and shields radar equipment on an aircraft. It is designed to minimize the impact of aerodynamic forces while allowing radar signals to pass through with minimal interference.

What are the key players in the Aircraft Radome Market?

Key players in the Aircraft Radome Market include companies like Northrop Grumman, Honeywell Aerospace, and GKN Aerospace, which are known for their innovative designs and manufacturing capabilities in aerospace components, among others.

What are the growth factors driving the Aircraft Radome Market?

The Aircraft Radome Market is driven by the increasing demand for advanced radar systems in commercial and military aircraft, the rise in air travel, and the need for enhanced safety and navigation systems.

What challenges does the Aircraft Radome Market face?

Challenges in the Aircraft Radome Market include the high costs associated with research and development, stringent regulatory requirements, and the need for materials that can withstand extreme environmental conditions.

What opportunities exist in the Aircraft Radome Market?

Opportunities in the Aircraft Radome Market include the development of lightweight materials for improved fuel efficiency, advancements in radar technology, and the growing trend of unmanned aerial vehicles (UAVs) requiring specialized radomes.

What trends are shaping the Aircraft Radome Market?

Trends in the Aircraft Radome Market include the increasing use of composite materials for better performance, the integration of smart technologies in radomes, and a focus on sustainability in manufacturing processes.

Aircraft Radome Market:

| Segmentation Details | Description |

|---|---|

| By Material | Composite Radome, Metallic Radome |

| By Aircraft Type | Commercial Aircraft, Military Aircraft |

| By Application | Weather Radar, Surveillance Radar, Communication Radar, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Aircraft Radome market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at