444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The aircraft pneumatic actuators market is a vital segment of the aerospace industry, responsible for the control and movement of various components in an aircraft using compressed air. Pneumatic actuators play a crucial role in the functioning of systems such as landing gear, flight control surfaces, thrust reversers, and brakes. They provide reliable and efficient control, ensuring the safe and smooth operation of these critical aircraft functions.

Meaning

Aircraft pneumatic actuators are mechanical devices that convert compressed air into mechanical motion. They are designed to perform specific tasks within an aircraft, such as extending or retracting landing gear, adjusting flight control surfaces, and enabling the operation of other systems. These actuators rely on the principles of fluid dynamics and utilize the force generated by compressed air to move various aircraft components.

Executive Summary

The aircraft pneumatic actuators market has witnessed significant growth in recent years, driven by increasing aircraft production, technological advancements, and the growing demand for fuel-efficient aircraft. The market is highly competitive, with several key players focusing on innovation and product development to gain a competitive edge. The COVID-19 pandemic had a temporary impact on the market, but the industry is now on a path to recovery, fueled by the resumption of air travel and the gradual return of passenger confidence.

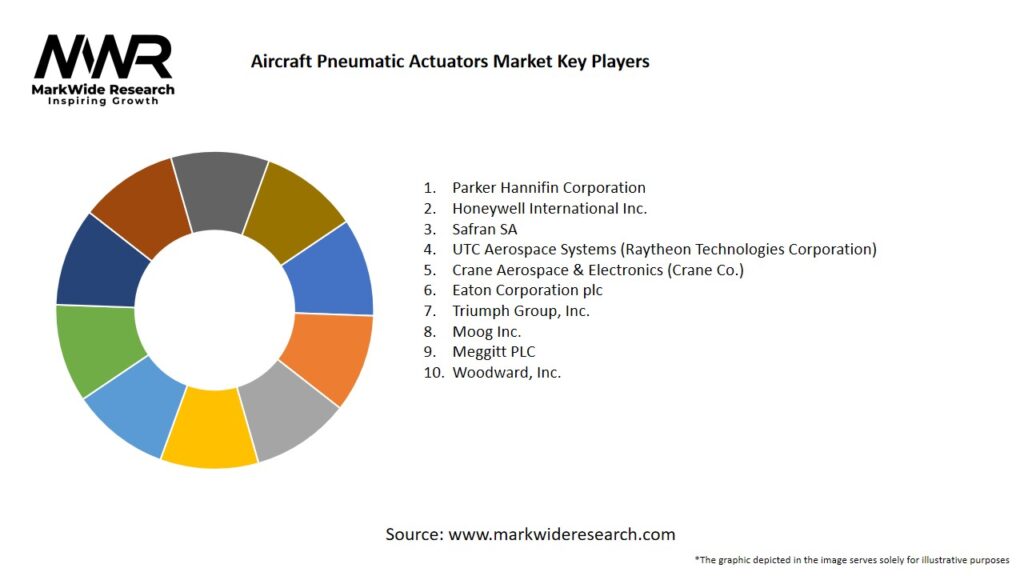

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Fleet Modernization: Airlines are replacing or retrofitting pneumatic actuators on aging fleets to improve reliability, fuel efficiency, and maintenance intervals.

Cabin Pressurization & ECS: Growth in cabin comfort systems—pressurization, temperature control, and air circulation—drives demand for precise, responsive pneumatic valves and actuators.

Emerging Aircraft Programs: New defense platforms and regional jets incorporate advanced pneumatic actuation for stealth-compatible doors and rapid control surface deployment.

Lightweight Materials: Adoption of aluminum-lithium alloys and reinforced polymers reduces actuator mass without compromising strength or durability.

Health Monitoring: Integrated sensors and IoT connectivity enable predictive maintenance, reducing unscheduled removals by up to 30%.

Market Drivers

Rising Air Passenger Traffic: IATA forecasts a doubling of global air travelers over the next 20 years, spurring airline orders for new aircraft equipped with modern pneumatic systems.

Military Modernization: Defense budgets allocated to next-generation fighter jets, transport aircraft, and unmanned aerial vehicles (UAVs) demand robust pneumatic actuators for mission-critical systems.

Regulatory Compliance: Aviation authorities mandate redundant, fail-safe actuation for flight controls, landing gear, and emergency systems, favoring pneumatic options for their inherent safety.

Cost Optimization: Pneumatic actuators offer lower life-cycle costs due to simpler maintenance, fewer leak points, and compatibility with existing bleed-air architectures.

Technological Innovation: Advances in additive manufacturing enable complex internal geometries and rapid prototyping of actuator components, shortening development cycles.

Market Restraints

Bleed Air Efficiency: Reliance on engine bleed air can reduce overall propulsion efficiency; growing pressure to minimize bleed usage in new aircraft may limit pneumatic actuation.

Noise & Vibration: Pneumatic systems can generate noise and pulsation, requiring dampers and silencers that add weight and complexity.

System Integration Complexity: Coordinating pneumatic actuators with electronic flight control systems (fly-by-wire) demands rigorous testing and certification, extending time-to-market.

Supply Chain Constraints: Availability of specialized alloys and precision machining capabilities can bottleneck actuator production during peak demand.

Competition from Electric Actuators: Emerging electro-mechanical actuators (EMAs) offer comparable performance without bleed-air dependency, attracting interest for “more-electric” aircraft architectures.

Market Opportunities

More-Electric Aircraft (MEA): Hybrid actuation models combining electric drive and pneumatic brake back-up offer balanced system efficiency and redundancy.

Retrofit Programs: Large installed base of legacy aircraft represents a significant aftermarket for actuator upgrades incorporating digital health monitoring and improved seals.

Civil UAVs & Urban Air Mobility (UAM): Small-scale pneumatic actuators for rotor tilt, air inlet vanes, and cargo doors address scaling in commercial drone and air taxi applications.

Climate Adaptation Systems: As climate control systems become more sophisticated—humidification, rapid temperature cycling—precision pneumatic valves and actuators see increased penetration.

Advanced Seal Technologies: Development of self-lubricating, composite seals reduces maintenance intervals and extends actuator lifespan by up to 40%.

Market Dynamics

Collaborative Innovation: Partnerships between actuator OEMs, material suppliers, and airlines accelerate certification of next-generation components, leveraging co-funded R&D.

Lifecycle Services: End-to-end actuator service offerings—from condition monitoring to predictive overhaul scheduling—generate stable, recurring revenue streams.

Standardization Efforts: Industry consortia developing common interface and mounting standards simplify actuator interchangeability across aircraft platforms.

Digital Twin Adoption: Creation of virtual actuator models enables performance optimization and rapid troubleshooting via maintenance simulators.

Mergers & Acquisitions: Consolidation among specialized actuator manufacturers broadens product portfolios and global footprint, enhancing supply resilience.

Regional Analysis

North America: Largest share, driven by the U.S. aerospace industry’s leadership in commercial and defense aircraft production, and substantial aftermarket services.

Europe: Strong presence of major OEMs (Airbus, Dassault, Rolls-Royce) fosters domestic actuator manufacturing and collaborative R&T programs under Clean Sky initiatives.

Asia Pacific: Fastest CAGR, led by Chinese and Indian regional jet programs, defense modernization, and increasing MRO capacities targeting pneumatic system upgrades.

Latin America: Emerging MRO and airline growth—particularly in Brazil and Mexico—fuels demand for actuator spares and overhaul services.

Middle East & Africa: Investment in national carriers and defense fleets in GCC countries drives selective procurement of advanced actuators for harsh environment performance.

Competitive Landscape

Leading companies in the Aircraft Pneumatic Actuators market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

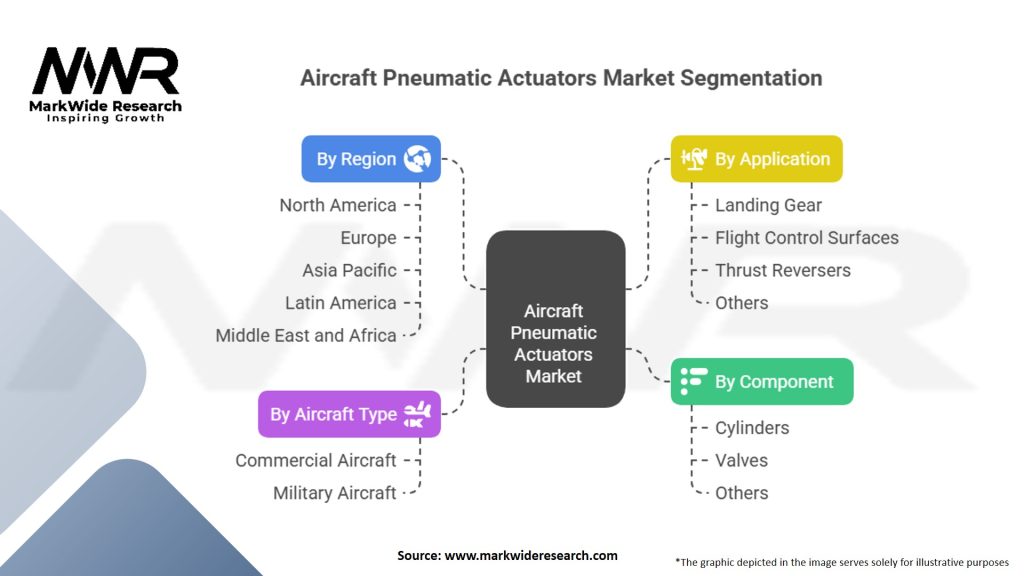

Segmentation

The aircraft pneumatic actuators market can be segmented based on actuator type, aircraft type, application, and region.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the aircraft pneumatic actuators market, primarily due to the sharp decline in air travel and the temporary grounding of fleets. The aerospace industry faced immense challenges as airlines scaled back operations and postponed aircraft deliveries. This resulted in a decrease in new orders and affected the production and demand for pneumatic actuators.

However, as vaccination efforts progressed and travel restrictions were gradually lifted, the industry started witnessing signs of recovery. The resumption of air travel, along with the increasing passenger confidence, has led to a gradual revival of the market. Additionally, the focus on regional travel and cargo operations during the pandemic has increased the demand for certain aircraft types, contributing to the recovery of the market.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the aircraft pneumatic actuators market appears positive, with steady growth expected in the coming years. The increasing demand for air travel, expansion of commercial aviation, and the development of next-generation aircraft will drive the market’s growth. Technological advancements, including the adoption of electric and hybrid actuation systems, lightweight materials, and digital control systems, will shape the future of pneumatic actuators. Industry participants that focus on innovation, collaboration, and sustainability will be well-positioned to thrive in this evolving market.

Conclusion

The aircraft pneumatic actuators market plays a critical role in ensuring the safe and efficient operation of various aircraft systems. Technological advancements, the focus on fuel efficiency, and the increasing demand for lightweight aircraft components are driving the market’s growth. Although the COVID-19 pandemic posed challenges, the industry is now on a path to recovery, fueled by the resumption of air travel. The future outlook for the market is promising, with opportunities arising from the adoption of advanced actuation systems, emerging markets, and the growing demand for sustainable aerospace solutions. Industry participants that embrace innovation, strengthen customer relationships, and stay compliant with regulatory standards will thrive in this competitive market.

What is Aircraft Pneumatic Actuators?

Aircraft pneumatic actuators are devices that convert pneumatic energy into mechanical motion, commonly used in various aircraft systems for controlling surfaces such as flaps, landing gear, and brakes.

What are the key players in the Aircraft Pneumatic Actuators Market?

Key players in the Aircraft Pneumatic Actuators Market include Honeywell International Inc., Parker Hannifin Corporation, Moog Inc., and Eaton Corporation, among others.

What are the drivers of growth in the Aircraft Pneumatic Actuators Market?

The growth of the Aircraft Pneumatic Actuators Market is driven by the increasing demand for lightweight and efficient aircraft systems, advancements in aerospace technology, and the rising need for automation in aircraft operations.

What challenges does the Aircraft Pneumatic Actuators Market face?

Challenges in the Aircraft Pneumatic Actuators Market include stringent regulatory requirements, high manufacturing costs, and the need for continuous innovation to meet evolving industry standards.

What opportunities exist in the Aircraft Pneumatic Actuators Market?

Opportunities in the Aircraft Pneumatic Actuators Market include the development of smart actuators with integrated sensors, the expansion of electric and hybrid aircraft, and increasing investments in aerospace R&D.

What trends are shaping the Aircraft Pneumatic Actuators Market?

Trends in the Aircraft Pneumatic Actuators Market include the shift towards more sustainable aviation solutions, the integration of advanced materials for improved performance, and the growing focus on reducing aircraft weight for enhanced fuel efficiency.

Aircraft Pneumatic Actuators Market:

| Segmentation Details | Description |

|---|---|

| By Component | Cylinders, Valves, Others |

| By Aircraft Type | Commercial Aircraft, Military Aircraft |

| By Application | Landing Gear, Flight Control Surfaces, Thrust Reversers, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Aircraft Pneumatic Actuators market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at