444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The aircraft leasing and rental market is a thriving sector within the aviation industry. It involves the leasing and renting of aircraft to airlines, charter companies, and other organizations in need of temporary or long-term aircraft solutions. This market provides flexibility and cost-effective alternatives to aircraft ownership, allowing businesses to access a wide range of aircraft types and models without the substantial upfront investment.

Meaning

Aircraft leasing and rental refer to the process of renting or leasing aircraft to operators, allowing them to meet their fleet requirements without the need for outright purchase. Lessors or rental companies acquire aircraft from manufacturers or other owners and lease them out for specific periods, generally ranging from a few months to several years. This arrangement enables lessees to meet their operational demands while avoiding the financial burden of acquiring and maintaining their own aircraft.

Executive Summary

The aircraft leasing and rental market has experienced significant growth in recent years, driven by various factors such as increasing air travel demand, cost advantages, and a growing preference for flexible fleet management. The market offers numerous benefits to both lessors and lessees, including reduced capital expenditure, access to a diverse fleet, and the ability to adapt to changing market conditions. However, the market also faces challenges, including regulatory complexities and economic uncertainties that can impact its growth trajectory.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Aircraft Leasing and Rental Mar

Market Dynamics

The aircraft leasing and rental market is characterized by dynamic factors that shape its growth trajectory. The market dynamics include the interplay between supply and demand, regulatory frameworks, technological advancements, and economic conditions. Understanding these dynamics is crucial for market participants to identify opportunities, mitigate risks, and optimize their operations.

Regional Analysis

The aircraft leasing and rental market exhibit regional variations in terms of demand, regulations, and market players’ presence. The market’s regional analysis provides insights into the growth potential and market dynamics across different geographical areas. Major regions in the market include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Competitive Landscape

Leading Companies in the Aircraft Leasing and Rental Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

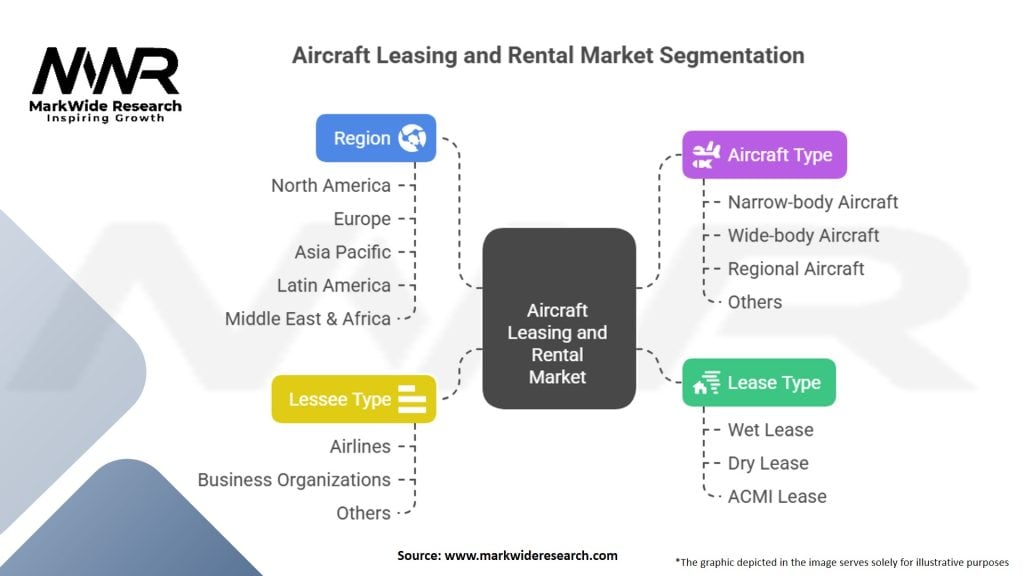

Segmentation

The aircraft leasing and rental market can be segmented based on various criteria, including aircraft type, lease duration, customer type, and geographical region. Segmenting the market enables a deeper understanding of specific market segments’ characteristics and requirements, facilitating targeted strategies and customized offerings.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic severely impacted the aviation industry, including the aircraft leasing and rental market. The widespread travel restrictions, reduced passenger demand, and financial strains on airlines resulted in lease cancellations, deferrals, and renegotiations. The market experienced a significant downturn during the pandemic, with reduced aircraft utilization and delays in new lease agreements. However, as the industry recovers and air travel demand gradually rebounds, the aircraft leasing and rental market is expected to regain momentum.

Key Industry Developments

Analyst Suggestions

Future Outlook

The aircraft leasing and rental market is expected to witness steady growth in the coming years, driven by factors such as increasing air travel demand, cost advantages, and technological advancements. The recovery from the Covid-19 pandemic and the gradual resumption of international travel are likely to contribute to the market’s expansion. The market’s future outlook remains positive, with opportunities for industry participants to capitalize on emerging markets, sustainable aviation initiatives, and evolving customer needs.

Conclusion

The aircraft leasing and rental market provides a flexible and cost-effective solution for operators in need of aircraft without the financial burden of ownership. It offers numerous benefits, including reduced capital expenditure, fleet flexibility, and access to a diverse range of aircraft types and models. Despite challenges such as regulatory complexities and economic uncertainties, the market presents opportunities for expansion into emerging markets, technological innovations, and ancillary services. By understanding market dynamics, embracing industry trends, and adopting strategic approaches, industry participants can navigate the competitive landscape and capitalize on the market’s growth potential.

What is Aircraft Leasing and Rental?

Aircraft leasing and rental refers to the practice of renting or leasing aircraft to airlines, cargo operators, and other entities for a specified period. This arrangement allows companies to access aircraft without the significant capital investment required for outright purchase.

What are the key players in the Aircraft Leasing and Rental Market?

Key players in the Aircraft Leasing and Rental Market include companies like AerCap, Avolon, and GECAS, which provide a range of leasing options for commercial and cargo aircraft. These companies often compete on factors such as fleet diversity, customer service, and lease terms, among others.

What are the growth factors driving the Aircraft Leasing and Rental Market?

The Aircraft Leasing and Rental Market is driven by factors such as the increasing demand for air travel, the need for airlines to optimize their fleet management, and the rising costs of aircraft ownership. Additionally, the growth of low-cost carriers has further fueled the demand for leasing options.

What challenges does the Aircraft Leasing and Rental Market face?

Challenges in the Aircraft Leasing and Rental Market include fluctuating fuel prices, regulatory changes affecting leasing agreements, and the impact of economic downturns on air travel demand. These factors can create uncertainty for lessors and lessees alike.

What opportunities exist in the Aircraft Leasing and Rental Market?

Opportunities in the Aircraft Leasing and Rental Market include the expansion of emerging markets, the introduction of more fuel-efficient aircraft, and the potential for innovative leasing models. These trends can help companies adapt to changing market conditions and customer needs.

What trends are shaping the Aircraft Leasing and Rental Market?

Trends in the Aircraft Leasing and Rental Market include a shift towards more flexible leasing arrangements, increased focus on sustainability, and the adoption of advanced technologies for fleet management. These trends are influencing how companies approach aircraft leasing and rental strategies.

Aircraft Leasing and Rental Market

| Segmentation | Details |

|---|---|

| Lease Type | Wet Lease, Dry Lease, ACMI Lease |

| Aircraft Type | Narrow-body Aircraft, Wide-body Aircraft, Regional Aircraft, Others |

| Lessee Type | Airlines, Business Organizations, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Aircraft Leasing and Rental Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at