444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The aircraft brake linings market occupies a critical niche within the aviation industry, providing essential components for the safe and efficient operation of aircraft braking systems. Brake linings are integral to ensuring precise control and stopping power, thereby safeguarding passengers, cargo, and aircraft integrity. This market encompasses a diverse array of products tailored to varying aircraft types and operational requirements, reflecting stringent quality standards and regulatory compliance mandates inherent to the aviation sector.

Meaning

Aircraft brake linings constitute specialized friction materials engineered to withstand the extreme operating conditions encountered during aircraft landing and deceleration. These linings interface with brake discs or drums, converting kinetic energy into thermal energy through friction, thereby facilitating controlled deceleration and stopping. As a critical safety component, aircraft brake linings undergo rigorous testing and certification to ensure compliance with stringent aviation regulations and industry standards.

Executive Summary

The aircraft brake linings market has witnessed steady growth in tandem with the burgeoning aviation sector, driven by factors such as expanding air travel demand, fleet modernization initiatives, and emphasis on safety and operational efficiency. This market presents lucrative opportunities for manufacturers and suppliers, albeit amid challenges pertaining to material advancements, regulatory compliance, and evolving aircraft design paradigms. A nuanced understanding of market dynamics, technological trends, and competitive landscape is imperative for stakeholders to navigate complexities and capitalize on growth prospects.

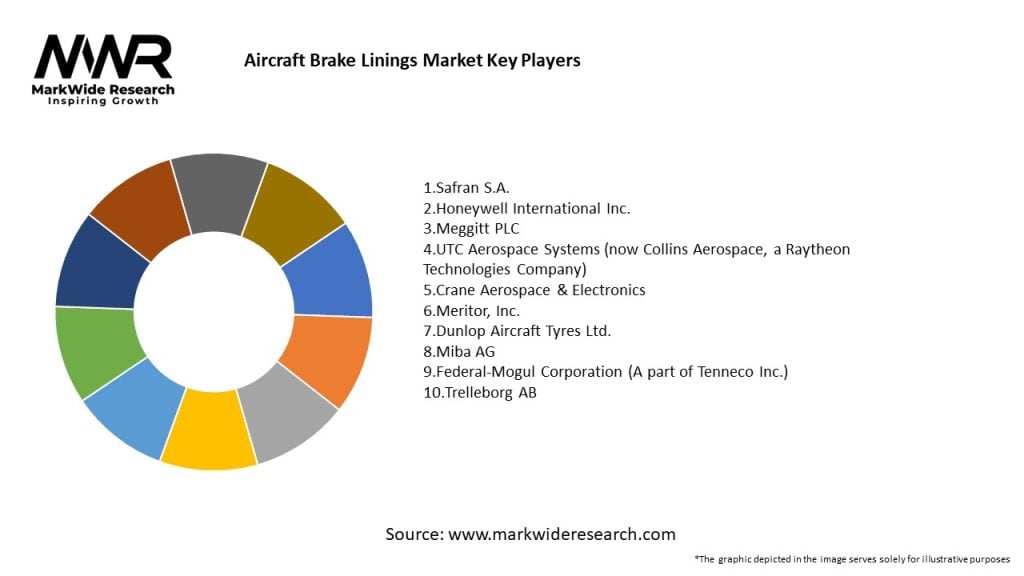

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The aircraft brake linings market operates within a dynamic ecosystem shaped by technological innovation, regulatory mandates, market trends, and competitive forces. These dynamics underscore the importance of agility, adaptability, and strategic foresight in navigating challenges and capitalizing on growth opportunities within the aviation industry.

Regional Analysis

The regional landscape of the aircraft brake linings market exhibits variability influenced by factors such as aerospace manufacturing capabilities, fleet composition, regulatory frameworks, and air travel demand. Notable regional nuances encompass:

Competitive Landscape

Leading Companies in the Aircraft Brake Linings Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The aircraft brake linings market lends itself to segmentation based on various parameters, including aircraft type, brake system configuration, material type, and end-user application. Segmentation facilitates targeted marketing strategies, product customization, and alignment with specific customer requirements, thereby enhancing market penetration and competitiveness.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Stakeholders within the aircraft brake linings market derive several benefits from their involvement, including:

SWOT Analysis

A SWOT analysis provides a holistic assessment of the aircraft brake linings market’s:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic precipitated unprecedented disruptions within the aviation industry, profoundly impacting the aircraft brake linings market:

Key Industry Developments

Analyst Suggestions

Future Outlook

The aircraft brake linings market is poised for gradual recovery and resurgence in the post-pandemic era, propelled by factors such as resurgent air travel demand, fleet modernization initiatives, and technological innovation. However, ongoing challenges pertaining to material advancements, regulatory compliance, and market volatility necessitate proactive risk management and strategic foresight. The industry’s future trajectory will be shaped by resilience, innovation, and adaptive responses to evolving market dynamics and customer expectations.

Conclusion

In conclusion, the aircraft brake linings market occupies a pivotal position within the aviation industry, underpinning safety, reliability, and operational efficiency across diverse aircraft platforms. Despite prevailing challenges stemming from the COVID-19 pandemic and broader market uncertainties, the market presents ample opportunities for innovation, growth, and differentiation. By embracing technological advancements, fostering strategic partnerships, and prioritizing customer-centricity, stakeholders can navigate complexities and position themselves for sustained success and leadership within the dynamic landscape of the aircraft brake linings market.

What is Aircraft Brake Linings?

Aircraft brake linings are components used in the braking systems of aircraft, designed to provide friction and ensure effective stopping power. They are critical for safety and performance in various types of aircraft, including commercial, military, and private planes.

What are the key players in the Aircraft Brake Linings Market?

Key players in the Aircraft Brake Linings Market include Honeywell International Inc., Safran S.A., and UTC Aerospace Systems, among others. These companies are known for their innovative products and contributions to aviation safety.

What are the growth factors driving the Aircraft Brake Linings Market?

The Aircraft Brake Linings Market is driven by factors such as the increasing demand for air travel, advancements in aviation technology, and the need for enhanced safety standards. Additionally, the growth of the aerospace industry contributes to the rising demand for high-performance brake linings.

What challenges does the Aircraft Brake Linings Market face?

Challenges in the Aircraft Brake Linings Market include stringent regulatory requirements, high manufacturing costs, and the need for continuous innovation. These factors can impact the development and adoption of new brake lining technologies.

What opportunities exist in the Aircraft Brake Linings Market?

Opportunities in the Aircraft Brake Linings Market include the development of lightweight materials and eco-friendly alternatives. Additionally, the expansion of the aerospace sector in emerging markets presents potential growth avenues for manufacturers.

What trends are shaping the Aircraft Brake Linings Market?

Trends in the Aircraft Brake Linings Market include the increasing use of composite materials for improved performance and reduced weight. Furthermore, advancements in manufacturing processes and a focus on sustainability are influencing product development.

Aircraft Brake Linings Market

| Segmentation Details | Description |

|---|---|

| Product Type | Organic, Semi-Metallic, Ceramic, Carbon-Carbon |

| End User | Commercial Aviation, Military Aviation, General Aviation, Cargo Aviation |

| Installation Type | Retrofitting, OEM, Maintenance, Overhaul |

| Material | Phenolic, Aramid, Metal Matrix, Composite |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Aircraft Brake Linings Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at