444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Airborne UHF-band SATCOM Market refers to the market for airborne communication systems that operate within the Ultra-High Frequency (UHF) band. These systems are specifically designed for communication and data transfer between airborne platforms, such as aircraft, helicopters, and unmanned aerial vehicles (UAVs), and ground-based stations. Airborne UHF-band SATCOM systems enable reliable and secure voice, data, and video communication for military, government, and commercial applications.

Meaning

Airborne UHF-band SATCOM systems play a crucial role in ensuring effective communication between airborne platforms and ground stations. These systems utilize the UHF frequency band, typically ranging from 225 MHz to 400 MHz, to facilitate reliable and long-range communication. They enable real-time situational awareness, command and control capabilities, and seamless data exchange, thus enhancing operational efficiency and safety for various airborne missions.

Executive Summary

The Airborne UHF-band SATCOM Market has been witnessing significant growth in recent years. The increasing adoption of unmanned aerial vehicles for military and commercial applications, along with the rising demand for secure and uninterrupted communication in airborne platforms, is driving the market’s expansion. Furthermore, advancements in technology, such as the integration of advanced encryption techniques and the development of lightweight and compact SATCOM systems, are further fueling market growth.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Airborne UHF-band SATCOM Market is driven by various dynamics. Technological advancements, such as the integration of AI and ML algorithms, are enhancing the capabilities of these systems and expanding their application areas. The market is also influenced by government initiatives and defense modernization programs, which aim to enhance communication capabilities in airborne platforms. Moreover, the growing demand for commercial applications, including surveillance, border control, and disaster management, is opening up new opportunities for market players. However, challenges such as high costs, limited bandwidth availability, and regulatory restrictions pose obstacles to market growth.

Regional Analysis

The market for airborne UHF-band SATCOM systems is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America holds a significant market share due to the presence of key manufacturers and high defense spending in the region. Europe is also a prominent market, driven by increasing investments in defense and homeland security. The Asia Pacific region is witnessing rapid growth due to the rising adoption of UAVs and the increasing need for advanced communication systems in defense and commercial applications. Latin America and the Middle East and Africa are expected to offer substantial growth opportunities, primarily driven by defense modernization programs and increasing investments in aerospace and defense infrastructure.

Competitive Landscape

Leading Companies in the Airborne UHF-band SATCOM Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

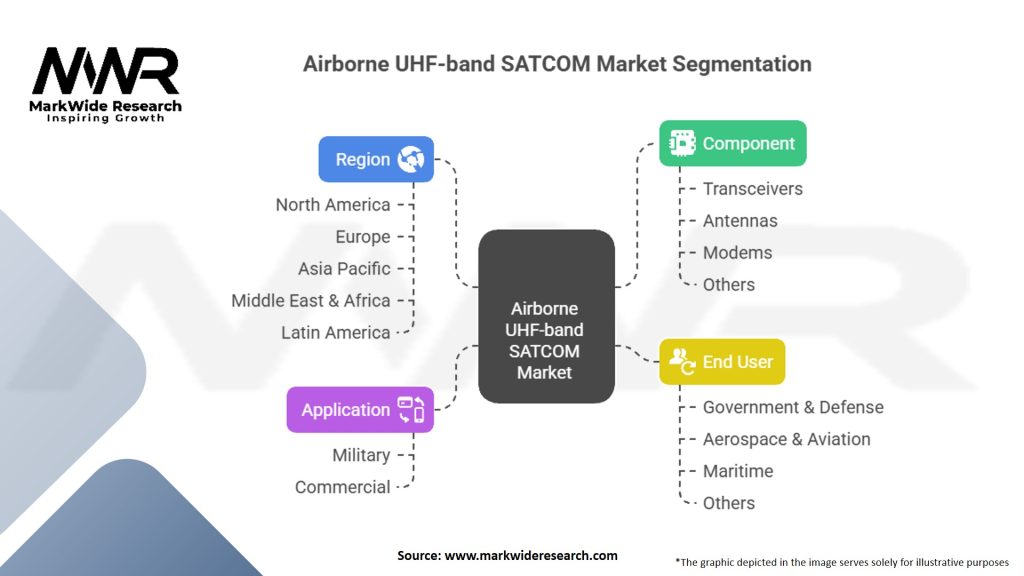

Segmentation

The market for airborne UHF-band SATCOM systems can be segmented based on platform type, component, frequency range, end-user, and geography.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the Airborne UHF-band SATCOM Market. While the market witnessed a temporary slowdown during the initial phases of the pandemic due to supply chain disruptions and economic uncertainties, it has shown resilience and demonstrated a quick recovery. The demand for secure communication systems in defense and emergency response applications remained strong, driving market growth. The pandemic also highlighted the importance of effective communication and data transfer capabilities in airborne platforms, leading to increased investments in advanced SATCOM systems. However, challenges such as budget constraints and delayed procurement decisions by governments have affected the market to some extent.

Key Industry Developments

Several recent developments in technology, partnerships, and market dynamics are shaping the future of the airborne UHF-band SATCOM market.

Analyst Suggestions

Future Outlook

The Airborne UHF-band SATCOM Market is poised for substantial growth in the coming years. The increasing adoption of UAVs, advancements in satellite communication technology, and the growing demand for secure and reliable communication in airborne platforms are expected to drive market expansion. The integration of AI and ML algorithms, the development of lightweight and compact systems, and the deployment of High-Throughput Satellites (HTS) will further enhance the capabilities of airborne UHF-band SATCOM systems. However, market players need to address challenges such as cost-effectiveness, limited bandwidth availability, and cybersecurity concerns to fully capitalize on the market’s potential.

Conclusion

The Airborne UHF-band SATCOM Market is witnessing significant growth driven by the increasing demand for secure and reliable communication systems in airborne platforms. The market offers lucrative opportunities for industry participants and stakeholders, particularly in military, defense, and commercial sectors. Technological advancements, such as the integration of AI and ML algorithms, lightweight and compact system development, and advancements in satellite communication technology, are key trends shaping the market’s future. While challenges exist, strategic measures and collaborations can help overcome these obstacles and propel the market towards a promising future.

What is Airborne UHF-band SATCOM?

Airborne UHF-band SATCOM refers to satellite communication systems that operate in the UHF frequency band, specifically designed for airborne platforms such as military aircraft, drones, and helicopters. These systems enable secure and reliable communication for various applications, including tactical operations and real-time data transmission.

What are the key players in the Airborne UHF-band SATCOM Market?

Key players in the Airborne UHF-band SATCOM Market include companies like Harris Corporation, L3 Technologies, Northrop Grumman, and Thales Group. These companies are known for their advanced satellite communication technologies and solutions for military and commercial applications, among others.

What are the growth factors driving the Airborne UHF-band SATCOM Market?

The growth of the Airborne UHF-band SATCOM Market is driven by increasing demand for secure communication in military operations, advancements in satellite technology, and the rising need for real-time data exchange in defense applications. Additionally, the expansion of unmanned aerial vehicles (UAVs) is contributing to market growth.

What challenges does the Airborne UHF-band SATCOM Market face?

The Airborne UHF-band SATCOM Market faces challenges such as high development costs, regulatory hurdles, and the need for interoperability among different communication systems. Additionally, the increasing competition from alternative communication technologies can pose a threat to market growth.

What opportunities exist in the Airborne UHF-band SATCOM Market?

Opportunities in the Airborne UHF-band SATCOM Market include the growing adoption of satellite communication in commercial aviation, the integration of advanced technologies like AI and machine learning for enhanced communication capabilities, and the increasing focus on modernization of military communication systems.

What trends are shaping the Airborne UHF-band SATCOM Market?

Trends shaping the Airborne UHF-band SATCOM Market include the shift towards smaller, more efficient satellite systems, the development of multi-band communication solutions, and the increasing use of software-defined radios. These trends are enhancing the flexibility and capability of airborne communication systems.

Airborne UHF-band SATCOM Market

| Segmentation | Details |

|---|---|

| Component | Transceivers, Antennas, Modems, Others |

| Application | Military, Commercial |

| End User | Government & Defense, Aerospace & Aviation, Maritime, Others |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Airborne UHF-band SATCOM Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at