444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The AI in video surveillance market represents a transformative sector that combines artificial intelligence technologies with traditional security monitoring systems to create intelligent, automated surveillance solutions. This rapidly evolving market encompasses machine learning algorithms, computer vision, facial recognition, behavioral analytics, and deep learning technologies integrated into video surveillance infrastructure. Market dynamics indicate substantial growth driven by increasing security concerns, smart city initiatives, and technological advancements in AI capabilities.

Industry adoption has accelerated significantly across various sectors including retail, transportation, healthcare, government, and residential applications. The integration of AI technologies enables real-time threat detection, automated incident response, and predictive analytics that enhance overall security effectiveness. Growth projections suggest the market will expand at a compound annual growth rate (CAGR) of 23.6% through the forecast period, reflecting strong demand for intelligent surveillance solutions.

Technological convergence between AI algorithms and video surveillance hardware has created opportunities for enhanced security capabilities, reduced false alarms, and improved operational efficiency. The market benefits from continuous improvements in processing power, cloud computing infrastructure, and edge computing technologies that enable sophisticated AI applications in surveillance systems.

The AI in video surveillance market refers to the comprehensive ecosystem of artificial intelligence technologies, software solutions, hardware components, and services designed to enhance traditional video monitoring systems with intelligent capabilities. This market encompasses machine learning algorithms that can automatically detect, analyze, and respond to various events and behaviors captured through surveillance cameras and monitoring equipment.

Core components include computer vision systems that interpret visual data, facial recognition technologies for identity verification, behavioral analytics for anomaly detection, and predictive algorithms that anticipate potential security threats. These AI-powered solutions transform passive video recording systems into proactive security platforms capable of real-time decision-making and automated response protocols.

Market applications span across multiple industries and use cases, from retail loss prevention and traffic monitoring to perimeter security and crowd management. The integration of AI technologies enables surveillance systems to process vast amounts of video data, identify patterns, and provide actionable insights that enhance security effectiveness while reducing human monitoring requirements.

Market leadership in the AI video surveillance sector is characterized by rapid technological innovation, increasing adoption across diverse industries, and substantial investment in research and development. The market demonstrates strong growth momentum driven by escalating security concerns, smart city development projects, and the need for automated monitoring solutions that can operate efficiently with minimal human intervention.

Key growth drivers include the rising demand for intelligent security systems, government initiatives promoting smart infrastructure, and technological advancements that have made AI solutions more accessible and cost-effective. The market benefits from increasing adoption rates of 34% annually among enterprise customers seeking advanced surveillance capabilities.

Competitive dynamics reveal a landscape populated by established technology companies, specialized AI firms, and traditional security equipment manufacturers expanding their portfolios to include intelligent surveillance solutions. Market participants are focusing on developing comprehensive platforms that integrate multiple AI technologies while ensuring compatibility with existing surveillance infrastructure.

Regional distribution shows strong market presence across North America, Europe, and Asia-Pacific regions, with emerging markets demonstrating significant growth potential as infrastructure development accelerates and security awareness increases among businesses and government organizations.

Strategic insights reveal several critical factors shaping the AI video surveillance market landscape:

Market penetration analysis indicates that retail and commercial sectors lead adoption rates, followed by government and transportation applications. The integration of AI technologies has resulted in detection accuracy improvements of 87% compared to traditional surveillance systems, demonstrating significant value proposition for end users.

Primary market drivers propelling growth in the AI video surveillance sector include escalating security threats, technological advancement, and increasing demand for automated monitoring solutions. The rise in criminal activities, terrorism concerns, and workplace security incidents has created urgent need for intelligent surveillance systems capable of real-time threat detection and response.

Smart city initiatives represent a significant growth catalyst, as governments worldwide invest in intelligent infrastructure that includes AI-powered surveillance networks. These projects drive demand for integrated security solutions that can monitor traffic, detect incidents, and coordinate emergency responses across urban environments.

Technological maturation of AI algorithms has made sophisticated surveillance capabilities more accessible and cost-effective for organizations of all sizes. Improvements in machine learning accuracy, processing speed, and deployment flexibility have reduced barriers to adoption while enhancing system performance and reliability.

Regulatory requirements in various industries mandate enhanced security monitoring, driving organizations to adopt AI-powered surveillance solutions that can ensure compliance while providing comprehensive coverage. The need for detailed incident documentation and automated reporting capabilities further supports market growth.

Cost reduction benefits associated with AI automation attract organizations seeking to optimize security operations while maintaining high effectiveness levels. Automated monitoring reduces personnel requirements and improves response times, delivering measurable return on investment that justifies technology adoption.

Implementation challenges pose significant barriers to market growth, particularly regarding integration complexity and technical expertise requirements. Organizations often struggle with incorporating AI surveillance systems into existing security infrastructure, requiring substantial technical knowledge and potential system modifications that can delay deployment timelines.

Privacy concerns and regulatory restrictions create obstacles for AI surveillance adoption, especially in regions with strict data protection laws. The use of facial recognition and behavioral analytics raises questions about individual privacy rights, leading to regulatory scrutiny that can limit deployment options and increase compliance costs.

High initial investment requirements for comprehensive AI surveillance systems can deter smaller organizations from adopting these technologies. The costs associated with hardware upgrades, software licensing, training, and ongoing maintenance create financial barriers that limit market penetration in price-sensitive segments.

Technical limitations in AI accuracy and reliability continue to challenge market growth, particularly in complex environments with varying lighting conditions, weather factors, and crowded scenarios. False positive rates and system errors can undermine user confidence and require ongoing refinement efforts.

Cybersecurity vulnerabilities associated with connected AI surveillance systems create additional concerns for potential adopters. The risk of system breaches, data theft, and unauthorized access to surveillance networks requires robust security measures that add complexity and cost to implementations.

Emerging applications in healthcare, education, and retail sectors present substantial growth opportunities for AI video surveillance solutions. Healthcare facilities require intelligent monitoring for patient safety and security, while educational institutions seek advanced systems for campus protection and emergency response capabilities.

Edge computing advancement creates opportunities for deploying AI surveillance systems in remote locations and bandwidth-constrained environments. Local processing capabilities reduce dependency on cloud connectivity while enabling real-time analysis and response in distributed security networks.

Integration possibilities with Internet of Things (IoT) devices and smart building systems offer comprehensive security solutions that combine video surveillance with environmental monitoring, access control, and automated response systems. This convergence creates new market segments and revenue opportunities.

Developing markets in Asia-Pacific, Latin America, and Africa represent significant expansion opportunities as infrastructure development accelerates and security awareness increases. Government investments in smart city projects and public safety initiatives drive demand for intelligent surveillance solutions.

Artificial intelligence advancement continues to create new capabilities and applications for video surveillance systems. Developments in natural language processing, predictive analytics, and autonomous response systems expand the potential use cases and value propositions for AI-powered surveillance platforms.

Competitive dynamics in the AI video surveillance market reflect intense innovation competition among technology providers, traditional security companies, and emerging AI specialists. Market participants are investing heavily in research and development to create differentiated solutions that address specific industry requirements and use cases.

Technology evolution drives continuous market transformation as AI algorithms become more sophisticated and hardware capabilities expand. The integration of 5G connectivity, improved camera sensors, and advanced processing units enables new surveillance applications and enhanced system performance.

Customer expectations continue to evolve toward more intelligent, automated, and user-friendly surveillance solutions. Organizations seek systems that provide actionable insights, reduce false alarms, and integrate seamlessly with existing security infrastructure while delivering measurable operational improvements.

Partnership strategies between AI technology providers and traditional security equipment manufacturers create comprehensive solution offerings that combine hardware expertise with advanced software capabilities. These collaborations accelerate market development and expand distribution channels.

Regulatory landscape changes influence market dynamics as governments establish guidelines for AI surveillance deployment, data privacy protection, and ethical use of intelligent monitoring systems. Compliance requirements shape product development priorities and market entry strategies.

Comprehensive analysis of the AI video surveillance market employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes interviews with industry executives, technology providers, end users, and regulatory officials to gather firsthand perspectives on market trends and challenges.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and regulatory documents to understand market structure, competitive positioning, and technological developments. This approach provides historical context and identifies emerging trends that influence market evolution.

Market modeling techniques utilize statistical analysis and forecasting methods to project market growth, segment performance, and regional trends. These models incorporate multiple variables including technological advancement rates, adoption patterns, and economic factors that impact market development.

Expert validation processes ensure research accuracy through consultation with industry specialists, academic researchers, and technology experts who provide insights into market dynamics and validate analytical findings. This approach enhances the reliability and credibility of market assessments.

Data triangulation methods cross-reference information from multiple sources to verify market data and eliminate inconsistencies. This rigorous approach ensures that market insights accurately reflect industry conditions and provide reliable foundation for strategic decision-making.

North American markets demonstrate strong leadership in AI video surveillance adoption, driven by advanced technology infrastructure, high security awareness, and substantial investment in smart city initiatives. The region accounts for approximately 42% of global market share, with the United States leading deployment across government, retail, and transportation sectors.

European markets show significant growth potential despite regulatory challenges related to privacy protection and data governance. Countries like the United Kingdom, Germany, and France are investing in intelligent surveillance systems for public safety and critical infrastructure protection, representing 28% of market distribution.

Asia-Pacific region exhibits the fastest growth rates, fueled by rapid urbanization, infrastructure development, and government initiatives promoting smart city technologies. China, Japan, and India lead regional adoption with substantial investments in AI-powered surveillance networks, capturing 25% of market presence.

Middle East and Africa markets demonstrate emerging opportunities as governments prioritize security infrastructure and smart city development projects. The region shows increasing adoption of AI surveillance technologies for border security, critical infrastructure protection, and urban monitoring applications.

Latin American markets present growth potential driven by urbanization trends and increasing security concerns. Countries like Brazil and Mexico are implementing intelligent surveillance systems for public safety and crime prevention, though adoption rates remain below global averages due to economic constraints.

Market leadership in the AI video surveillance sector is distributed among several categories of companies, each bringing distinct capabilities and market approaches:

Competitive strategies focus on technological differentiation, comprehensive solution offerings, and strategic partnerships that combine hardware expertise with advanced AI capabilities. Companies are investing in research and development to create proprietary algorithms and maintain competitive advantages in specific market segments.

Market consolidation trends indicate increasing merger and acquisition activity as companies seek to expand capabilities, enter new markets, and achieve economies of scale in AI surveillance technology development and deployment.

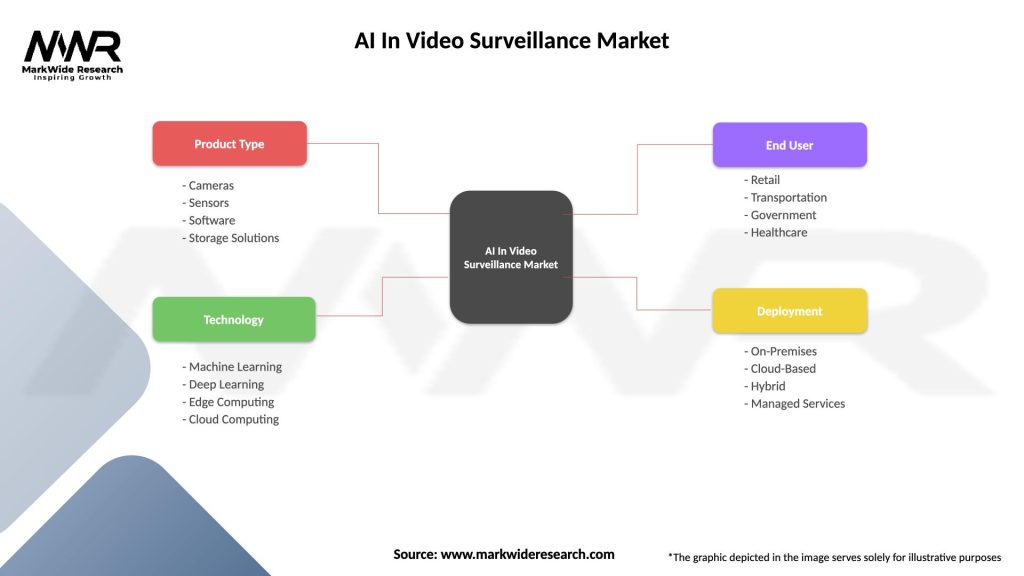

Technology-based segmentation reveals distinct market categories based on AI capabilities and implementation approaches:

Application-based segmentation demonstrates diverse use cases across multiple industries:

Deployment model segmentation includes cloud-based solutions, on-premises systems, and hybrid implementations that combine local processing with cloud analytics capabilities.

Computer vision category represents the largest segment within AI video surveillance, accounting for significant market share due to widespread applicability across various security scenarios. These systems excel in object detection, motion tracking, and scene analysis, providing foundational capabilities for intelligent surveillance applications.

Facial recognition segment demonstrates rapid growth driven by access control applications and identity verification requirements. Despite privacy concerns in some regions, this category shows strong adoption in commercial and government sectors where security requirements justify implementation.

Behavioral analytics category exhibits substantial potential for reducing false alarms and improving threat detection accuracy. These systems learn normal behavior patterns and identify anomalies that may indicate security threats, providing proactive monitoring capabilities that enhance overall system effectiveness.

Predictive analytics segment represents an emerging category with significant growth potential as AI algorithms become more sophisticated. These systems analyze historical data and current conditions to anticipate potential security incidents, enabling preventive measures and resource optimization.

Integration platforms that combine multiple AI technologies show increasing market demand as organizations seek comprehensive solutions rather than point products. These unified systems provide enhanced capabilities while simplifying management and reducing complexity for end users.

Security organizations benefit from enhanced threat detection capabilities, reduced false alarm rates, and improved operational efficiency through AI automation. These advantages enable security teams to focus on high-priority incidents while maintaining comprehensive monitoring coverage across large areas and multiple locations.

Technology providers gain opportunities to differentiate their offerings through advanced AI capabilities, create recurring revenue streams through software licensing, and expand market reach by addressing diverse industry requirements with intelligent surveillance solutions.

End-user organizations achieve improved security effectiveness, reduced operational costs, and enhanced compliance capabilities through AI-powered surveillance systems. The automation of routine monitoring tasks allows personnel to focus on strategic security activities while maintaining high levels of protection.

System integrators benefit from expanded service opportunities, higher-value project implementations, and ongoing support requirements associated with AI surveillance deployments. These complex systems require specialized expertise that creates sustainable business opportunities for qualified integration partners.

Government agencies achieve enhanced public safety capabilities, improved emergency response coordination, and better resource utilization through intelligent surveillance networks that provide real-time situational awareness and automated incident detection across urban environments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Edge computing integration represents a transformative trend enabling real-time AI processing at surveillance locations, reducing latency and bandwidth requirements while improving system responsiveness. This approach allows complex analytics to operate independently of cloud connectivity, enhancing reliability and performance in distributed surveillance networks.

Multi-modal AI systems that combine video, audio, and sensor data are becoming increasingly prevalent, providing comprehensive situational awareness that surpasses single-mode surveillance capabilities. These integrated platforms deliver enhanced threat detection accuracy and reduce false alarm rates through correlated analysis across multiple data streams.

Privacy-preserving technologies are gaining importance as organizations seek to balance security requirements with privacy protection obligations. Advanced AI systems now incorporate features like automatic face blurring, selective data retention, and anonymization capabilities that maintain surveillance effectiveness while addressing privacy concerns.

Autonomous response systems that can initiate predetermined actions based on AI analysis are emerging as a significant trend. These systems can automatically lock doors, alert security personnel, or activate emergency protocols without human intervention, providing faster response times and improved security effectiveness.

Cloud-native AI platforms are transforming surveillance deployment models by providing scalable, cost-effective solutions that eliminate the need for extensive on-premises infrastructure. These platforms offer deployment flexibility improvements of 56% compared to traditional systems while reducing total cost of ownership.

Technological breakthroughs in deep learning algorithms have significantly improved AI surveillance accuracy and reduced false positive rates. Recent developments in neural network architectures enable more sophisticated pattern recognition and behavioral analysis capabilities that enhance overall system performance.

Strategic partnerships between AI technology companies and traditional security equipment manufacturers are accelerating market development by combining software innovation with hardware expertise. These collaborations create comprehensive solutions that address diverse customer requirements while expanding market reach for participating companies.

Regulatory developments in various regions are establishing frameworks for ethical AI surveillance deployment, creating clearer guidelines for organizations while addressing public concerns about privacy and data protection. These regulations are shaping product development priorities and market entry strategies across the industry.

Investment activity in AI surveillance startups and established companies continues to accelerate, with venture capital and private equity firms recognizing the significant growth potential in intelligent security technologies. This funding supports research and development efforts that drive continued innovation and market expansion.

Standards development initiatives are establishing interoperability requirements and performance benchmarks for AI surveillance systems, promoting market maturation and facilitating integration across diverse technology platforms and vendor ecosystems.

MarkWide Research analysis indicates that organizations considering AI surveillance implementation should prioritize solutions that offer strong integration capabilities with existing security infrastructure while providing clear upgrade paths for future technology enhancements. The focus should be on platforms that demonstrate proven accuracy in specific use case scenarios rather than generic solutions.

Investment strategies should emphasize vendors that combine proprietary AI algorithms with comprehensive support services, as the complexity of these systems requires ongoing expertise for optimal performance. Organizations should evaluate total cost of ownership including training, maintenance, and upgrade requirements when making technology selections.

Deployment approaches should consider hybrid models that combine edge processing for real-time response with cloud analytics for advanced pattern recognition and historical analysis. This strategy provides operational flexibility while optimizing performance and cost-effectiveness across diverse surveillance requirements.

Privacy compliance considerations should be integrated into AI surveillance planning from the initial stages, with organizations selecting solutions that incorporate privacy-preserving features and provide clear audit trails for regulatory compliance. Proactive privacy protection reduces implementation risks and ensures sustainable deployment success.

Vendor evaluation criteria should include assessment of algorithm transparency, system explainability, and ongoing support capabilities, as these factors significantly impact long-term system effectiveness and user confidence in AI-powered surveillance decisions.

Market evolution projections indicate continued strong growth driven by technological advancement, expanding application areas, and increasing security requirements across multiple industries. The integration of AI capabilities with surveillance systems will become increasingly sophisticated, enabling new use cases and enhanced performance levels.

Technology development trends suggest that AI surveillance systems will become more autonomous, accurate, and user-friendly over the forecast period. Advances in machine learning algorithms, processing power, and sensor technologies will enable more comprehensive and reliable security monitoring capabilities.

Adoption patterns are expected to expand beyond traditional security applications into operational intelligence, business analytics, and customer experience optimization. This broader application scope will drive market growth and create new revenue opportunities for technology providers and system integrators.

Regional growth projections indicate that emerging markets will experience the fastest expansion rates as infrastructure development accelerates and security awareness increases. Developed markets will focus on system upgrades and advanced capability integration to maintain competitive advantages.

MWR forecasts suggest that the market will achieve penetration rates of 78% in enterprise security applications by the end of the forecast period, reflecting widespread acceptance of AI surveillance technologies as essential components of comprehensive security strategies. This growth will be supported by continued cost reductions and improved ease of deployment.

Market assessment reveals that the AI in video surveillance sector represents a dynamic and rapidly expanding market with substantial growth potential across multiple industries and regions. The convergence of artificial intelligence technologies with traditional surveillance systems creates compelling value propositions that address evolving security requirements while providing operational efficiency benefits.

Growth drivers including increasing security threats, smart city initiatives, and technological advancement will continue to propel market expansion throughout the forecast period. The demonstrated benefits of AI-powered surveillance systems in improving detection accuracy, reducing false alarms, and enabling automated response capabilities justify continued investment and adoption across diverse market segments.

Competitive dynamics indicate a healthy market environment with opportunities for both established technology companies and innovative startups to succeed through differentiated offerings and specialized expertise. The complexity of AI surveillance systems creates sustainable competitive advantages for companies that can deliver comprehensive solutions with proven performance and reliable support.

Future prospects remain highly positive as technological capabilities continue to advance and new applications emerge across healthcare, retail, transportation, and government sectors. The market will benefit from continued investment in research and development, strategic partnerships, and expanding deployment of intelligent infrastructure that supports AI-powered surveillance applications.

What is AI In Video Surveillance?

AI in video surveillance refers to the integration of artificial intelligence technologies into video monitoring systems to enhance security and operational efficiency. This includes features like facial recognition, behavior analysis, and anomaly detection.

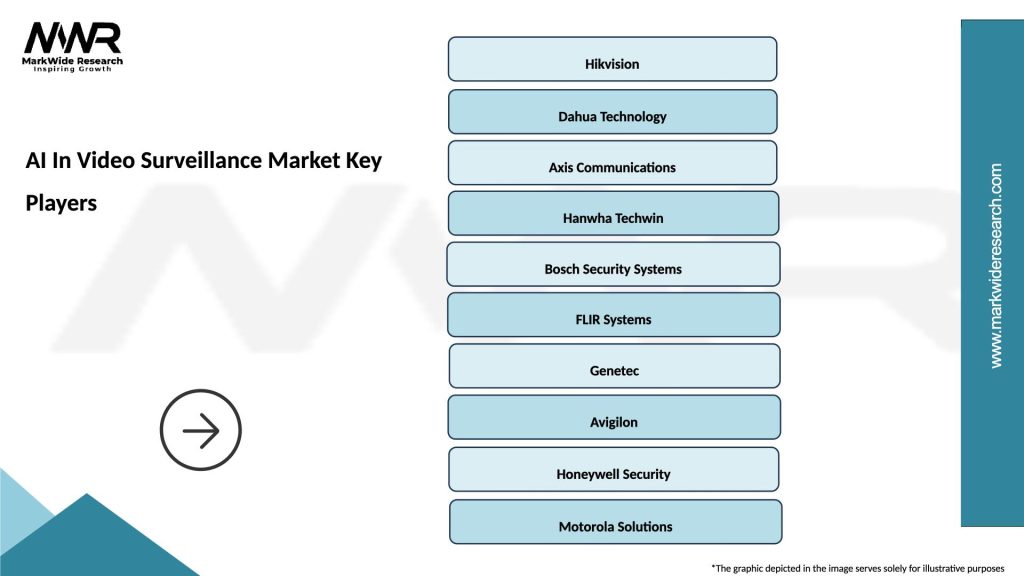

What are the key players in the AI In Video Surveillance Market?

Key players in the AI in video surveillance market include companies like Hikvision, Dahua Technology, and Axis Communications, which provide advanced surveillance solutions. These companies are known for their innovative technologies and extensive product offerings, among others.

What are the main drivers of growth in the AI In Video Surveillance Market?

The growth of the AI in video surveillance market is driven by increasing security concerns, advancements in AI technology, and the rising demand for smart city initiatives. Additionally, the need for real-time monitoring and data analysis is propelling market expansion.

What challenges does the AI In Video Surveillance Market face?

Challenges in the AI in video surveillance market include privacy concerns, regulatory compliance issues, and the high costs associated with implementing advanced AI systems. These factors can hinder widespread adoption and deployment.

What opportunities exist in the AI In Video Surveillance Market?

Opportunities in the AI in video surveillance market include the development of more sophisticated algorithms, integration with IoT devices, and expansion into new sectors such as retail and transportation. These advancements can enhance surveillance capabilities and user experience.

What trends are shaping the AI In Video Surveillance Market?

Current trends in the AI in video surveillance market include the increasing use of cloud-based solutions, the rise of edge computing for real-time processing, and the growing emphasis on cybersecurity measures. These trends are transforming how surveillance systems operate and are managed.

AI In Video Surveillance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cameras, Sensors, Software, Storage Solutions |

| Technology | Machine Learning, Deep Learning, Edge Computing, Cloud Computing |

| End User | Retail, Transportation, Government, Healthcare |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the AI In Video Surveillance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at