444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The AI in precision medicine market represents a revolutionary convergence of artificial intelligence technologies and personalized healthcare approaches that is transforming how medical professionals diagnose, treat, and prevent diseases. This rapidly expanding sector encompasses machine learning algorithms, deep learning systems, natural language processing, and predictive analytics applications specifically designed to deliver tailored medical solutions based on individual patient characteristics, genetic profiles, and clinical data.

Market dynamics indicate unprecedented growth momentum driven by increasing healthcare digitization, growing demand for personalized treatment approaches, and significant advancements in genomic sequencing technologies. The integration of AI-powered solutions in precision medicine is experiencing robust adoption across hospitals, research institutions, pharmaceutical companies, and diagnostic laboratories worldwide, with growth rates reaching 42.8% CAGR in key segments.

Healthcare providers are increasingly recognizing the transformative potential of AI-driven precision medicine solutions to improve patient outcomes, reduce treatment costs, and accelerate drug discovery processes. The market encompasses various applications including genomic analysis, biomarker identification, clinical decision support systems, drug repurposing, and personalized therapy selection, each contributing to the sector’s comprehensive growth trajectory.

The AI in precision medicine market refers to the comprehensive ecosystem of artificial intelligence technologies, platforms, and solutions specifically designed to enable personalized healthcare delivery through data-driven insights, predictive modeling, and individualized treatment recommendations based on patient-specific biological, genetic, and clinical characteristics.

Precision medicine fundamentally shifts healthcare from a one-size-fits-all approach to highly individualized treatment strategies that consider genetic variations, environmental factors, lifestyle choices, and molecular profiles. When enhanced with AI capabilities, these personalized approaches become significantly more sophisticated, enabling healthcare providers to predict disease susceptibility, optimize treatment selection, and monitor therapeutic responses with unprecedented accuracy.

AI technologies in this context include machine learning algorithms that analyze vast genomic datasets, deep learning networks that identify complex biomarker patterns, natural language processing systems that extract insights from clinical literature, and predictive analytics platforms that forecast treatment outcomes. These technologies collectively enable healthcare professionals to make more informed decisions, reduce trial-and-error approaches, and deliver targeted interventions that maximize therapeutic efficacy while minimizing adverse effects.

Market expansion in AI-powered precision medicine is being driven by convergent factors including exponential growth in healthcare data generation, declining costs of genomic sequencing, and increasing regulatory support for personalized medicine initiatives. The sector demonstrates remarkable innovation velocity with continuous advancement in algorithmic sophistication, data integration capabilities, and clinical application breadth.

Key growth drivers include rising prevalence of chronic diseases requiring personalized treatment approaches, growing pharmaceutical industry investment in AI-driven drug discovery, and increasing healthcare provider adoption of precision medicine protocols. Market penetration rates show 67% adoption among leading healthcare institutions, with particularly strong growth in oncology, cardiology, and rare disease applications.

Technology segments experiencing the most significant expansion include genomic analysis platforms, clinical decision support systems, and drug discovery acceleration tools. The integration of AI with multi-omics data analysis is creating new opportunities for comprehensive patient profiling and treatment optimization, while cloud-based deployment models are democratizing access to sophisticated precision medicine capabilities across healthcare organizations of varying sizes.

Regional dynamics show North America maintaining market leadership through substantial research investments and regulatory framework development, while Asia-Pacific regions demonstrate the fastest growth rates driven by increasing healthcare digitization and government precision medicine initiatives. European markets are characterized by strong regulatory compliance frameworks and collaborative research programs that support sustainable market expansion.

Technological advancement in AI-powered precision medicine is accelerating through several critical developments that are reshaping healthcare delivery and patient outcomes:

Healthcare digitization serves as a primary catalyst for AI adoption in precision medicine, with electronic health records, wearable devices, and diagnostic equipment generating unprecedented volumes of patient data that require sophisticated analytical capabilities. This data explosion creates opportunities for AI systems to identify patterns, predict outcomes, and recommend personalized interventions that were previously impossible to achieve through traditional analytical methods.

Genomic sequencing cost reduction has made personalized genetic analysis accessible to broader patient populations, with sequencing costs declining by 78% over the past decade. This affordability expansion enables healthcare providers to incorporate genetic information into routine clinical decision-making, creating demand for AI systems capable of interpreting complex genomic data and translating findings into actionable treatment recommendations.

Pharmaceutical industry transformation toward precision medicine approaches is driving significant investment in AI-powered drug discovery and development platforms. Companies are recognizing that traditional drug development models are insufficient for creating targeted therapies, leading to increased adoption of AI systems that can identify novel therapeutic targets, predict drug efficacy, and optimize clinical trial designs for personalized medicine applications.

Regulatory support from healthcare authorities worldwide is accelerating market growth through favorable policies, funding initiatives, and approval pathways specifically designed for AI-enabled precision medicine solutions. Government programs are providing financial incentives for healthcare organizations to adopt personalized medicine protocols, while regulatory frameworks are evolving to accommodate innovative AI applications in clinical settings.

Implementation complexity presents significant challenges for healthcare organizations seeking to integrate AI-powered precision medicine solutions into existing clinical workflows. The technical sophistication required for successful deployment often exceeds internal capabilities, necessitating substantial investments in infrastructure upgrades, staff training, and system integration that can delay adoption timelines and increase implementation costs.

Data privacy concerns and regulatory compliance requirements create barriers to AI system deployment, particularly when handling sensitive genetic and clinical information. Healthcare organizations must navigate complex privacy regulations while ensuring data security, which can limit data sharing opportunities and reduce the effectiveness of AI algorithms that require large, diverse datasets for optimal performance.

Clinical validation requirements for AI-powered precision medicine solutions demand extensive testing and regulatory approval processes that can extend development timelines and increase costs. Healthcare providers require robust evidence of clinical efficacy and safety before adopting new AI systems, creating pressure on technology developers to conduct comprehensive validation studies that demonstrate measurable improvements in patient outcomes.

Interoperability challenges between different AI platforms, electronic health record systems, and diagnostic equipment can limit the effectiveness of precision medicine implementations. Healthcare organizations often struggle to integrate multiple AI solutions into cohesive workflows, reducing the potential benefits of personalized medicine approaches and creating inefficiencies in clinical operations.

Emerging market expansion presents substantial growth opportunities as developing regions invest in healthcare infrastructure modernization and precision medicine capabilities. Countries with large populations and growing healthcare budgets are creating demand for AI-powered solutions that can address local disease patterns and healthcare challenges while building domestic precision medicine expertise.

Rare disease applications represent a high-value market segment where AI-powered precision medicine can deliver exceptional impact through improved diagnosis, treatment selection, and drug development for conditions affecting small patient populations. The orphan drug market’s favorable regulatory environment and premium pricing models create attractive opportunities for specialized AI solutions targeting rare genetic disorders.

Preventive medicine integration offers significant expansion potential as healthcare systems shift focus toward disease prevention and early intervention strategies. AI systems capable of analyzing genetic predispositions, lifestyle factors, and environmental exposures can enable proactive healthcare approaches that reduce long-term treatment costs while improving population health outcomes.

Partnership opportunities between technology companies, pharmaceutical manufacturers, and healthcare providers are creating new business models and revenue streams. Collaborative approaches that combine AI expertise, clinical knowledge, and market access are accelerating innovation while reducing individual organization risks and investment requirements for precision medicine development.

Competitive landscape evolution is characterized by increasing collaboration between traditional healthcare companies and technology innovators, creating hybrid solutions that combine clinical expertise with advanced AI capabilities. This convergence is accelerating innovation cycles while enabling more comprehensive precision medicine offerings that address complex healthcare challenges through integrated approaches.

Technology maturation is driving improved AI algorithm performance and reliability, with recent advances achieving 92% accuracy rates in genetic variant classification and therapeutic response prediction. These improvements are building healthcare provider confidence in AI-powered solutions while expanding the range of clinical applications where precision medicine approaches can deliver measurable benefits.

Market consolidation trends are emerging as larger healthcare technology companies acquire specialized AI startups to expand their precision medicine capabilities. This consolidation is creating more comprehensive solution portfolios while providing smaller companies with resources needed for clinical validation and market expansion, ultimately accelerating overall market development.

Regulatory framework evolution is adapting to accommodate AI-powered precision medicine innovations while maintaining safety and efficacy standards. Regulatory agencies are developing new approval pathways and guidelines specifically designed for AI applications, creating clearer development paths for companies while ensuring appropriate oversight of emerging technologies in clinical settings.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into AI-powered precision medicine market dynamics. Primary research includes extensive interviews with healthcare providers, technology developers, pharmaceutical companies, and regulatory experts to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research integration incorporates analysis of scientific literature, clinical trial databases, patent filings, and regulatory submissions to understand technology advancement patterns and competitive positioning. This approach provides comprehensive coverage of market developments while identifying emerging trends and innovation opportunities that may not be apparent through primary research alone.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and statistical analysis of market trends. MarkWide Research employs rigorous quality control measures to verify data accuracy and eliminate potential biases that could affect market analysis conclusions and recommendations.

Quantitative analysis utilizes advanced statistical modeling to project market growth patterns, technology adoption rates, and competitive dynamics. These models incorporate multiple variables including healthcare spending trends, technology development cycles, regulatory changes, and demographic factors to provide comprehensive market forecasts and strategic insights for industry participants.

North America maintains market leadership through substantial research investments, advanced healthcare infrastructure, and supportive regulatory frameworks that encourage precision medicine innovation. The region demonstrates 45% market share globally, driven by strong pharmaceutical industry presence, leading academic medical centers, and government initiatives supporting personalized medicine development and adoption.

United States specifically leads in AI-powered precision medicine development through National Institutes of Health funding programs, Food and Drug Administration regulatory pathways, and private sector investment in healthcare technology innovation. Major healthcare systems are implementing comprehensive precision medicine programs that integrate AI capabilities across oncology, cardiology, and rare disease applications.

Europe demonstrates strong growth momentum through collaborative research programs, regulatory harmonization efforts, and increasing healthcare digitization initiatives. The European Medicines Agency’s adaptive pathways program is accelerating AI-powered precision medicine approvals, while Horizon Europe funding supports innovative research projects that advance personalized healthcare capabilities across member nations.

Asia-Pacific regions show the fastest growth rates with 38% annual expansion driven by government precision medicine initiatives, increasing healthcare investments, and growing pharmaceutical manufacturing capabilities. Countries like China, Japan, and South Korea are implementing national precision medicine strategies that incorporate AI technologies while building domestic expertise in personalized healthcare delivery.

Emerging markets in Latin America, Middle East, and Africa are beginning to adopt AI-powered precision medicine solutions through international partnerships, technology transfer programs, and targeted healthcare modernization initiatives. These regions represent significant long-term growth opportunities as healthcare infrastructure development accelerates and precision medicine awareness increases among healthcare providers and patients.

Market leaders in AI-powered precision medicine combine advanced technology capabilities with clinical expertise and regulatory experience to deliver comprehensive solutions for healthcare providers and pharmaceutical companies:

By Technology:

By Application:

By End User:

Oncology applications dominate the AI-powered precision medicine market with 52% segment share, driven by the complexity of cancer genetics, availability of genomic data, and established precision medicine protocols. AI systems in oncology focus on tumor profiling, treatment selection, drug resistance prediction, and clinical trial matching, delivering measurable improvements in patient outcomes and survival rates.

Rare disease segments demonstrate exceptional growth potential through AI applications that address diagnostic challenges, treatment development, and patient identification for conditions affecting small populations. These applications leverage AI’s pattern recognition capabilities to identify disease signatures in limited datasets while accelerating drug discovery for orphan indications.

Cardiovascular medicine is emerging as a high-growth application area where AI-powered precision approaches address genetic risk factors, treatment response prediction, and preventive care optimization. Advanced algorithms analyze genetic variants associated with cardiovascular disease while predicting medication efficacy and adverse reaction risks for individual patients.

Neurological disorders represent a challenging but promising application category where AI systems analyze complex genetic and clinical data to improve diagnosis accuracy, predict disease progression, and optimize treatment protocols for conditions like Alzheimer’s disease, Parkinson’s disease, and multiple sclerosis.

Healthcare Providers:

Pharmaceutical Companies:

Patients:

Strengths:

Weaknesses:

Opportunities:

Threats:

Multi-omics integration is emerging as a dominant trend where AI systems combine genomic, proteomic, metabolomic, and clinical data to create comprehensive patient profiles for precision medicine applications. This holistic approach enables more accurate disease prediction, treatment selection, and outcome monitoring while providing deeper insights into disease mechanisms and therapeutic responses.

Real-time clinical decision support is gaining momentum through AI systems that provide instant, evidence-based treatment recommendations during patient consultations. These systems integrate patient-specific data with current medical literature and clinical guidelines to support healthcare providers in making optimal treatment decisions while reducing diagnostic errors and improving care quality.

Federated learning approaches are addressing data privacy concerns while enabling AI systems to learn from distributed datasets without centralizing sensitive patient information. This technology allows healthcare organizations to collaborate on AI model development while maintaining data security and regulatory compliance, accelerating innovation while protecting patient privacy.

Edge computing deployment is enabling AI-powered precision medicine applications to operate locally within healthcare facilities, reducing latency and improving data security while maintaining high performance. This trend supports real-time clinical applications while addressing concerns about cloud-based data processing and connectivity requirements.

Explainable AI development is becoming increasingly important as healthcare providers require transparent, interpretable AI recommendations for clinical decision-making. Advanced algorithms are being designed to provide clear explanations for their recommendations, building trust among healthcare professionals while supporting regulatory compliance and clinical adoption.

Regulatory milestone achievements include FDA approvals for multiple AI-powered precision medicine applications, establishing precedents for future technology approvals while providing clear regulatory pathways for industry participants. These approvals demonstrate regulatory confidence in AI technology while encouraging continued investment and innovation in precision medicine applications.

Strategic partnership formations between major technology companies and healthcare organizations are accelerating AI-powered precision medicine development and deployment. Recent collaborations combine AI expertise with clinical knowledge and market access, creating comprehensive solutions that address complex healthcare challenges while reducing individual organization risks and investment requirements.

Clinical validation successes are demonstrating measurable improvements in patient outcomes through AI-powered precision medicine applications, with studies showing 73% improvement in treatment response rates and significant reductions in adverse reactions. These results are building healthcare provider confidence while supporting continued adoption and investment in precision medicine technologies.

Technology breakthrough announcements include advances in AI algorithm performance, data integration capabilities, and clinical application breadth that are expanding the potential impact of precision medicine approaches. Recent developments in deep learning, natural language processing, and predictive modeling are enabling more sophisticated applications while improving accuracy and reliability.

Investment prioritization should focus on AI technologies that demonstrate clear clinical utility and measurable patient outcome improvements, with particular emphasis on applications addressing high-value therapeutic areas like oncology, rare diseases, and chronic conditions. MWR analysis indicates that companies achieving clinical validation milestones experience significantly higher market success rates and investor confidence.

Partnership strategy development is essential for companies seeking to establish comprehensive precision medicine capabilities, as successful market participants typically combine AI expertise with clinical knowledge, regulatory experience, and market access capabilities. Strategic alliances can accelerate development timelines while reducing individual organization risks and investment requirements.

Regulatory engagement should begin early in the development process to ensure compliance with evolving guidelines and approval pathways for AI-powered precision medicine applications. Companies that proactively engage with regulatory agencies and participate in guidance development processes typically experience smoother approval processes and faster market access.

Data strategy optimization requires careful attention to data quality, interoperability, and privacy protection while building comprehensive datasets needed for AI system training and validation. Organizations should invest in data infrastructure and governance capabilities that support long-term precision medicine objectives while maintaining regulatory compliance and patient trust.

Market expansion is projected to continue at robust growth rates driven by increasing healthcare digitization, advancing AI capabilities, and growing recognition of precision medicine benefits among healthcare providers and patients. The sector is expected to maintain 35% annual growth over the next five years as technology maturation and clinical validation support broader adoption across therapeutic areas.

Technology evolution will focus on improving AI algorithm accuracy, expanding clinical applications, and enhancing integration capabilities with existing healthcare systems. Future developments are expected to include more sophisticated multi-omics analysis, real-time clinical decision support, and predictive modeling capabilities that enable proactive healthcare approaches and improved patient outcomes.

Geographic expansion will accelerate as emerging markets invest in healthcare infrastructure modernization and precision medicine capabilities, creating new growth opportunities for technology providers while addressing local healthcare challenges. International collaboration and technology transfer programs are expected to support global precision medicine adoption while building domestic expertise in developing regions.

Application diversification will extend AI-powered precision medicine beyond current focus areas to include preventive care, population health management, and chronic disease management applications. These expanded use cases will create additional market opportunities while demonstrating the broader potential of AI technologies to transform healthcare delivery and improve population health outcomes.

The AI in precision medicine market represents a transformative force in healthcare that is fundamentally changing how medical professionals approach diagnosis, treatment, and prevention of diseases. Through the integration of advanced artificial intelligence technologies with personalized medicine approaches, this sector is delivering measurable improvements in patient outcomes while creating new opportunities for healthcare innovation and market growth.

Market dynamics demonstrate strong momentum driven by technological advancement, increasing healthcare digitization, and growing recognition of precision medicine benefits among healthcare stakeholders. The convergence of AI capabilities with genomic analysis, clinical decision support, and drug discovery applications is creating comprehensive solutions that address complex healthcare challenges while improving treatment efficacy and reducing costs.

Future prospects indicate continued robust growth as technology maturation, regulatory support, and clinical validation drive broader adoption across therapeutic areas and geographic regions. The sector’s evolution toward more sophisticated applications, expanded use cases, and improved integration capabilities positions AI in precision medicine as a critical component of modern healthcare delivery and a significant driver of healthcare transformation in the coming decades.

What is AI in Precision Medicine?

AI in Precision Medicine refers to the integration of artificial intelligence technologies to enhance personalized healthcare. This includes applications in genomics, drug discovery, and patient management, aiming to tailor treatments based on individual patient data.

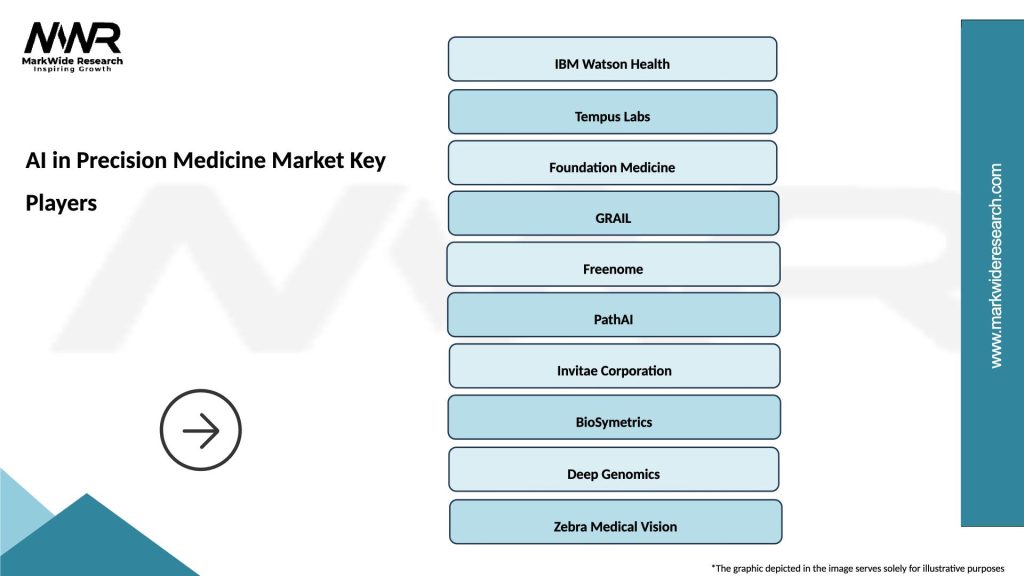

What are the key companies in the AI in Precision Medicine Market?

Key companies in the AI in Precision Medicine Market include IBM Watson Health, Tempus, and GRAIL, among others. These companies are leveraging AI to improve diagnostic accuracy and treatment efficacy in various medical fields.

What are the drivers of growth in the AI in Precision Medicine Market?

The growth of the AI in Precision Medicine Market is driven by advancements in machine learning algorithms, increasing availability of genomic data, and the rising demand for personalized healthcare solutions. These factors contribute to improved patient outcomes and more efficient healthcare delivery.

What challenges does the AI in Precision Medicine Market face?

The AI in Precision Medicine Market faces challenges such as data privacy concerns, the need for regulatory compliance, and the integration of AI systems into existing healthcare infrastructures. These issues can hinder the widespread adoption of AI technologies in clinical settings.

What opportunities exist in the AI in Precision Medicine Market?

Opportunities in the AI in Precision Medicine Market include the potential for breakthroughs in rare disease treatment, enhanced drug development processes, and the ability to provide real-time patient monitoring. These advancements can lead to more effective and tailored healthcare solutions.

What trends are shaping the AI in Precision Medicine Market?

Trends shaping the AI in Precision Medicine Market include the increasing use of big data analytics, the rise of telemedicine, and the growing emphasis on patient-centric care. These trends are transforming how healthcare providers approach diagnosis and treatment.

AI in Precision Medicine Market

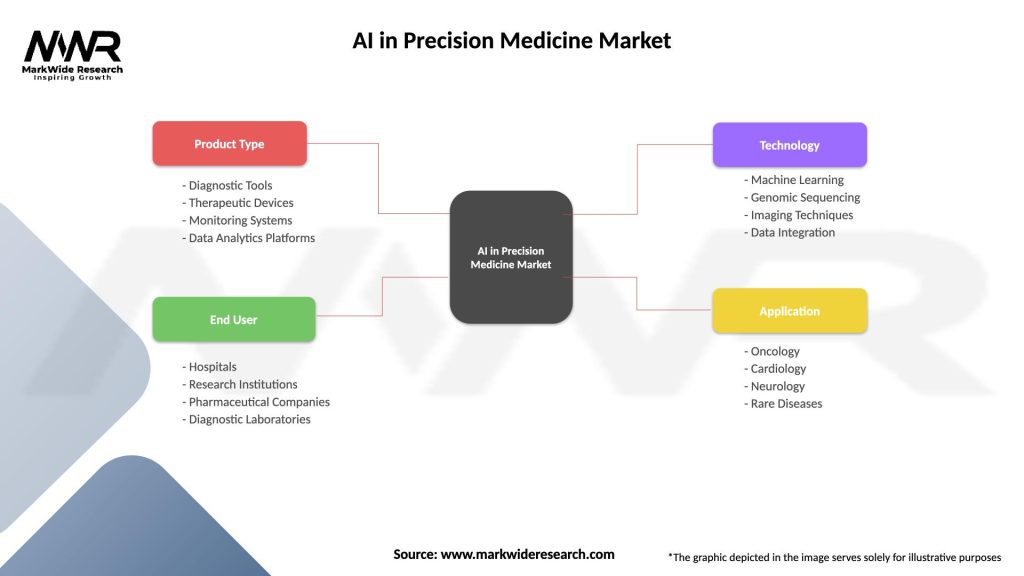

| Segmentation Details | Description |

|---|---|

| Product Type | Diagnostic Tools, Therapeutic Devices, Monitoring Systems, Data Analytics Platforms |

| End User | Hospitals, Research Institutions, Pharmaceutical Companies, Diagnostic Laboratories |

| Technology | Machine Learning, Genomic Sequencing, Imaging Techniques, Data Integration |

| Application | Oncology, Cardiology, Neurology, Rare Diseases |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the AI in Precision Medicine Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at