444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The AI in Defense market represents one of the most rapidly evolving sectors within the global defense industry, transforming traditional military operations through advanced artificial intelligence technologies. Defense organizations worldwide are increasingly adopting AI-powered solutions to enhance operational efficiency, improve threat detection capabilities, and maintain strategic advantages in modern warfare scenarios. The integration of machine learning algorithms, autonomous systems, and predictive analytics is revolutionizing how military forces approach intelligence gathering, logistics management, and tactical decision-making processes.

Market dynamics indicate substantial growth potential driven by increasing defense budgets, rising geopolitical tensions, and the urgent need for technological superiority in military operations. The sector encompasses various applications including autonomous weapons systems, cybersecurity solutions, surveillance technologies, and intelligent logistics platforms. Government investments in AI research and development continue to accelerate, with defense agencies recognizing the critical importance of artificial intelligence in maintaining national security and operational readiness.

Regional adoption patterns show significant variation, with developed nations leading the implementation of AI defense technologies while emerging markets are rapidly increasing their investments. The market demonstrates strong growth momentum with projected expansion at a compound annual growth rate of 13.8% over the forecast period, reflecting the strategic priority placed on AI integration across defense sectors globally.

The AI in Defense market refers to the comprehensive ecosystem of artificial intelligence technologies, solutions, and services specifically designed and implemented for military and defense applications. This market encompasses the development, deployment, and maintenance of intelligent systems that enhance military capabilities through automated decision-making, predictive analysis, and autonomous operations across various defense domains including land, sea, air, space, and cyber warfare environments.

Core components of this market include machine learning platforms, computer vision systems, natural language processing tools, robotics integration, and advanced analytics solutions tailored for defense requirements. The market also covers AI-enabled hardware such as processors, sensors, and communication systems optimized for military environments, along with specialized software applications that support intelligence analysis, threat assessment, and operational planning activities.

Strategic analysis reveals that the AI in Defense market is experiencing unprecedented growth driven by technological advancement and evolving security challenges. Defense contractors and government agencies are prioritizing AI investments to address complex threats, improve operational efficiency, and maintain competitive advantages in an increasingly digital battlefield environment. The market demonstrates strong fundamentals with government spending increases of 18% annually on AI defense initiatives across major military powers.

Key market segments include autonomous systems, cybersecurity applications, intelligence analysis platforms, and logistics optimization solutions. The integration of AI technologies is transforming traditional defense paradigms, enabling real-time threat assessment, predictive maintenance capabilities, and enhanced situational awareness for military personnel. Market participants range from established defense contractors to innovative technology startups specializing in AI applications for military use.

Competitive landscape analysis indicates intense innovation activity with significant research and development investments driving technological breakthroughs. The market benefits from strong government support, increasing defense budgets, and growing recognition of AI’s strategic importance in modern warfare scenarios.

Market intelligence reveals several critical insights shaping the AI in Defense sector’s trajectory. Technology adoption rates vary significantly across different military branches, with air force and naval operations leading in AI implementation due to their complex operational requirements and existing digital infrastructure capabilities.

Primary growth drivers propelling the AI in Defense market include escalating global security threats, increasing defense modernization initiatives, and the strategic imperative to maintain technological superiority in military operations. Geopolitical tensions worldwide are compelling nations to invest heavily in advanced defense technologies, with AI solutions offering significant advantages in threat detection, response coordination, and operational efficiency enhancement.

Technological advancement serves as another crucial driver, with rapid improvements in machine learning algorithms, processing power, and sensor technologies enabling more sophisticated AI applications in defense contexts. The growing availability of big data analytics capabilities allows military organizations to extract actionable intelligence from vast amounts of operational data, improving strategic planning and tactical execution effectiveness.

Cost optimization pressures are driving defense organizations to seek AI solutions that can reduce operational expenses while maintaining or improving capability levels. Automated systems offer potential for significant cost savings through reduced personnel requirements, improved resource utilization, and enhanced operational efficiency across various military functions.

Regulatory support from government agencies is accelerating market growth through favorable policies, increased funding allocations, and streamlined procurement processes for AI defense technologies. Military leadership recognition of AI’s strategic importance is translating into substantial budget allocations and organizational restructuring to support technology integration initiatives.

Significant challenges constrain the AI in Defense market’s growth potential, with cybersecurity concerns representing a primary restraint. Security vulnerabilities in AI systems pose risks of adversarial attacks, data breaches, and system compromises that could have severe consequences for national security operations. The complexity of securing AI algorithms against sophisticated threats requires substantial investments in cybersecurity infrastructure and expertise.

Ethical considerations surrounding autonomous weapons systems and AI decision-making in military contexts create regulatory uncertainties and public opposition that may limit market expansion. International debates about lethal autonomous weapons and the appropriate role of AI in warfare decisions are influencing policy development and procurement strategies across defense organizations globally.

Technical limitations of current AI technologies present operational constraints, including algorithm bias, limited adaptability to unexpected scenarios, and reliability concerns in critical military applications. The complexity of military environments often exceeds the capabilities of existing AI systems, requiring significant additional development and testing before deployment in operational contexts.

High implementation costs associated with AI system development, integration, and maintenance create budget constraints for many defense organizations. The substantial investments required for infrastructure upgrades, personnel training, and ongoing system support may limit adoption rates, particularly among smaller military organizations with constrained budgets.

Emerging opportunities in the AI in Defense market are creating substantial potential for growth and innovation across multiple application areas. The increasing focus on multi-domain operations presents opportunities for AI solutions that can coordinate activities across land, sea, air, space, and cyber domains simultaneously, offering integrated command and control capabilities that enhance operational effectiveness.

International collaboration initiatives are opening new market opportunities through joint development programs, technology sharing agreements, and cooperative procurement strategies. Allied nations are increasingly working together to develop interoperable AI systems that can support coalition operations and shared security objectives, creating opportunities for standardized solutions and expanded market reach.

Commercial technology adaptation offers significant opportunities for defense applications, with civilian AI advances in areas such as autonomous vehicles, natural language processing, and computer vision providing foundations for military system development. The dual-use nature of many AI technologies enables cost-effective adaptation of commercial innovations for defense requirements.

Edge computing integration presents opportunities for AI systems that can operate effectively in bandwidth-constrained and disconnected military environments. The development of lightweight AI algorithms optimized for edge deployment enables real-time decision-making capabilities in forward-deployed military units and remote operational areas.

Complex market dynamics shape the AI in Defense sector through the interplay of technological innovation, regulatory frameworks, and strategic military requirements. Technology evolution cycles in AI development are accelerating, with breakthrough innovations in machine learning, neural networks, and quantum computing creating new possibilities for defense applications while simultaneously obsoleting existing solutions.

Competitive pressures among nations to maintain technological superiority are driving rapid innovation and substantial investments in AI defense capabilities. The arms race dynamic in AI development is creating both opportunities and challenges, as countries seek to develop advanced capabilities while managing the risks associated with autonomous weapons systems and AI-enabled warfare.

Supply chain considerations are becoming increasingly important as defense organizations seek to ensure secure and reliable sources for AI technologies and components. The need for trusted suppliers and domestically produced AI solutions is influencing procurement strategies and creating opportunities for local technology providers in various markets.

Talent acquisition challenges in AI and machine learning expertise are constraining market growth, with intense competition for skilled professionals between defense organizations and commercial technology companies. The specialized knowledge requirements for defense AI applications are creating premium demand for experts who understand both AI technologies and military operational requirements.

Comprehensive research methodology employed in analyzing the AI in Defense market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. Primary research activities include structured interviews with defense industry executives, military procurement officials, and AI technology developers to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research components encompass analysis of government defense budgets, military procurement announcements, academic research publications, and industry reports to establish market sizing, growth projections, and competitive landscape assessments. Quantitative analysis techniques are applied to process statistical data from multiple sources and identify significant market trends and patterns.

Market validation processes include cross-referencing data from multiple sources, conducting expert reviews of findings, and applying statistical models to verify growth projections and market sizing estimates. The research methodology ensures comprehensive coverage of all major market segments, geographic regions, and application areas within the AI in Defense sector.

Analytical frameworks utilized include SWOT analysis, Porter’s Five Forces assessment, and technology adoption lifecycle modeling to provide strategic insights into market dynamics and competitive positioning. Continuous monitoring of market developments ensures that research findings remain current and relevant to stakeholder decision-making requirements.

North American markets dominate the AI in Defense sector, accounting for approximately 42% of global adoption, driven by substantial defense budgets, advanced technology infrastructure, and strong government support for AI research and development. The United States leads in autonomous systems deployment and AI-powered cybersecurity solutions, with significant investments from both government agencies and private defense contractors supporting market expansion.

European markets represent approximately 28% of global market share, with strong growth driven by increasing defense cooperation initiatives and rising security concerns. NATO alliance requirements are driving standardization efforts and interoperability investments, creating opportunities for AI solutions that can support coalition operations and shared defense objectives across member nations.

Asia-Pacific regions demonstrate the fastest growth rates, with market expansion projected at 16.2% annually, reflecting increasing defense modernization initiatives and rising geopolitical tensions. Countries such as China, India, and South Korea are making substantial investments in AI defense technologies, focusing on autonomous systems, surveillance capabilities, and cybersecurity applications.

Middle East and Africa markets show growing interest in AI defense solutions, particularly in areas of border security, surveillance systems, and threat detection capabilities. The region’s focus on homeland security applications is driving demand for AI-powered solutions that can address terrorism threats, border control challenges, and critical infrastructure protection requirements.

Market leadership in the AI in Defense sector is characterized by a mix of established defense contractors, technology giants, and specialized AI companies competing across various application segments. Strategic partnerships and joint ventures are common as companies seek to combine AI expertise with defense industry knowledge and government relationships.

Innovation strategies among market leaders focus on research and development investments, acquisition of AI startups, and partnerships with academic institutions to advance technology capabilities. The competitive environment emphasizes rapid innovation cycles and the ability to adapt commercial AI technologies for defense-specific requirements.

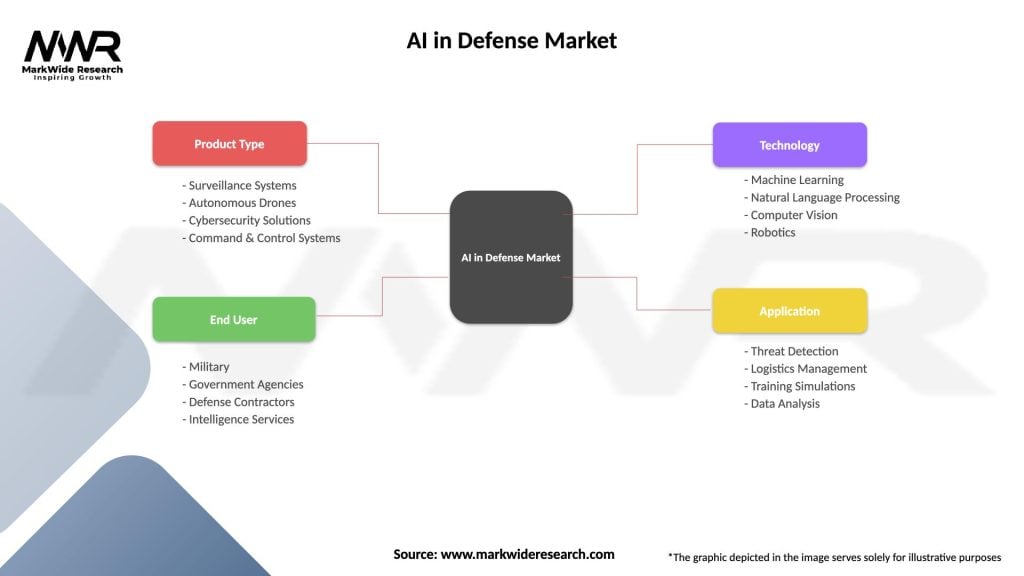

Market segmentation analysis reveals diverse application areas and technology categories within the AI in Defense sector. By Technology: The market encompasses machine learning platforms, computer vision systems, natural language processing tools, robotics integration, and neural network applications, each serving specific military operational requirements.

By Application: Key segments include autonomous weapons systems, cybersecurity solutions, intelligence analysis platforms, logistics optimization, predictive maintenance, surveillance systems, and training simulation technologies. Cybersecurity applications currently represent the largest segment, accounting for approximately 31% of market adoption due to increasing cyber threat concerns.

By Platform: The market divides into land-based systems, naval applications, airborne platforms, space-based solutions, and cyber domain applications. Airborne platforms demonstrate the highest growth rates due to the advanced integration of AI in unmanned aerial vehicles and autonomous flight systems.

By End User: Military organizations, defense contractors, government agencies, and homeland security departments represent the primary customer segments. Military end users account for approximately 67% of market demand, reflecting the direct operational focus of AI defense applications.

Autonomous Systems Category represents the most rapidly evolving segment within the AI in Defense market, encompassing unmanned aerial vehicles, ground robots, and autonomous naval vessels. Technology advancement in this category is driving significant capability improvements in reconnaissance, surveillance, and combat support operations, with adoption rates increasing by 22% annually across major military organizations.

Cybersecurity Applications constitute a critical category addressing the growing threat landscape in digital warfare environments. AI-powered threat detection systems are becoming essential for protecting military networks, communication systems, and critical infrastructure against sophisticated cyber attacks. This category demonstrates strong growth potential with investment increases of 25% in AI cybersecurity solutions.

Intelligence Analysis Platforms leverage AI technologies to process vast amounts of data from multiple sources, providing actionable intelligence for military decision-making. Natural language processing and computer vision capabilities are enhancing the speed and accuracy of intelligence analysis operations, with efficiency improvements of approximately 45% reported by early adopters.

Logistics and Supply Chain applications utilize AI for optimizing resource allocation, predicting maintenance requirements, and streamlining supply chain operations. Predictive analytics capabilities are reducing operational costs and improving readiness levels across military organizations, with documented cost savings of 15-20% in logistics operations.

Defense Organizations benefit from AI implementation through enhanced operational capabilities, improved threat detection accuracy, and reduced operational costs. Automated systems enable military personnel to focus on strategic decision-making while AI handles routine monitoring and analysis tasks, improving overall operational efficiency and effectiveness.

Technology Providers gain access to substantial market opportunities through government contracts, long-term partnership agreements, and the potential for technology scaling across multiple defense applications. The stable demand from defense customers provides predictable revenue streams and opportunities for sustained research and development investments.

Government Agencies achieve improved national security capabilities, better resource utilization, and enhanced interoperability between different military systems and allied forces. AI integration supports strategic objectives of maintaining technological superiority while optimizing defense spending effectiveness.

Strengths:

Weaknesses:

Opportunities:

Threats:

Autonomous Systems Evolution represents a dominant trend shaping the AI in Defense market, with increasing sophistication in unmanned platforms and autonomous decision-making capabilities. Machine learning algorithms are enabling more independent operation of military systems, reducing human intervention requirements and improving response times in critical situations.

Multi-Domain Integration is emerging as a critical trend, with AI systems designed to coordinate operations across land, sea, air, space, and cyber domains simultaneously. Integrated command systems are leveraging AI to provide unified situational awareness and coordinated response capabilities across different operational environments.

Edge AI Deployment is gaining momentum as military organizations seek to implement AI capabilities in bandwidth-constrained and disconnected operational environments. Lightweight algorithms optimized for edge computing are enabling real-time AI processing in forward-deployed units and remote locations.

Explainable AI Development is becoming increasingly important as military organizations require transparency in AI decision-making processes for critical applications. Algorithm interpretability is essential for maintaining human oversight and ensuring accountability in AI-assisted military operations.

Quantum-AI Integration represents an emerging trend with potential for revolutionary advances in military AI capabilities. Quantum computing applications could dramatically enhance AI processing power and enable new categories of defense applications previously considered impossible.

Recent industry developments highlight the rapid pace of innovation and deployment in the AI in Defense sector. Major defense contractors are announcing significant AI integration projects, autonomous system deployments, and next-generation platform developments that demonstrate the technology’s growing maturity and operational readiness.

Government initiatives are accelerating AI adoption through dedicated funding programs, research partnerships with academic institutions, and streamlined procurement processes for AI technologies. MarkWide Research analysis indicates that government AI investment commitments have increased substantially, reflecting the strategic priority placed on AI capabilities development.

International cooperation agreements are facilitating joint AI development projects and standardization efforts among allied nations. Technology sharing initiatives are creating opportunities for interoperable AI systems that can support coalition operations and shared security objectives.

Commercial partnerships between defense contractors and technology companies are accelerating AI innovation through the adaptation of commercial technologies for military applications. These collaborations are reducing development timelines and costs while leveraging civilian AI advances for defense purposes.

Regulatory developments are establishing frameworks for AI deployment in military contexts, addressing ethical considerations, safety requirements, and operational guidelines. Policy evolution is providing clearer guidance for AI development and deployment while maintaining necessary oversight and control mechanisms.

Strategic recommendations for market participants emphasize the importance of balanced AI development approaches that address both capability enhancement and risk mitigation requirements. Defense organizations should prioritize AI investments in areas with clear operational benefits and manageable implementation risks, focusing on applications that complement rather than replace human decision-making in critical situations.

Technology providers should invest in developing AI solutions that address specific military operational challenges while ensuring robust cybersecurity, reliability, and maintainability characteristics. Partnership strategies with established defense contractors can provide market access and operational expertise necessary for successful AI defense applications.

Government agencies should establish clear regulatory frameworks and ethical guidelines for AI deployment while maintaining flexibility to adapt to rapidly evolving technology capabilities. Investment coordination between different military branches and allied nations can optimize resource utilization and accelerate capability development timelines.

Risk management strategies should address cybersecurity vulnerabilities, algorithm bias concerns, and operational reliability requirements through comprehensive testing, validation, and monitoring programs. Human oversight mechanisms remain essential for maintaining accountability and control in AI-assisted military operations.

Long-term projections for the AI in Defense market indicate sustained growth driven by continuous technology advancement and evolving security challenges. Market expansion is expected to accelerate with projected growth rates of 14.5% annually over the next decade, reflecting increasing AI integration across all aspects of military operations and defense planning.

Technology evolution will likely focus on improving AI system reliability, reducing implementation costs, and enhancing interoperability between different platforms and systems. Next-generation AI applications may include quantum-enhanced processing capabilities, advanced autonomous systems, and integrated multi-domain command platforms that revolutionize military operational concepts.

Market maturation will bring standardization of AI technologies, established best practices for implementation, and clearer regulatory frameworks governing AI deployment in defense contexts. MWR analysis suggests that the market will transition from experimental deployments to widespread operational integration over the forecast period.

Global competition in AI defense capabilities will intensify, driving continued innovation and substantial investment commitments from major military powers. The strategic importance of AI superiority will likely result in increased research funding, international cooperation initiatives, and accelerated technology development timelines across the defense sector.

The AI in Defense market represents a transformative force reshaping military operations and national security strategies worldwide. Substantial growth potential exists across multiple application areas, driven by increasing defense budgets, evolving threat landscapes, and the strategic imperative to maintain technological superiority in modern warfare environments.

Market participants must navigate complex challenges including cybersecurity risks, ethical considerations, and technical limitations while capitalizing on opportunities for innovation and capability enhancement. Successful implementation requires balanced approaches that address both operational benefits and risk mitigation requirements through comprehensive planning and execution strategies.

Future success in this market will depend on continued technology advancement, effective government-industry collaboration, and the development of robust frameworks for AI deployment in defense contexts. The AI in Defense market will continue evolving as a critical component of national security infrastructure, offering significant opportunities for stakeholders who can effectively address the unique requirements and challenges of military AI applications.

What is AI in Defense?

AI in Defense refers to the integration of artificial intelligence technologies into military applications, enhancing capabilities such as surveillance, logistics, and decision-making processes.

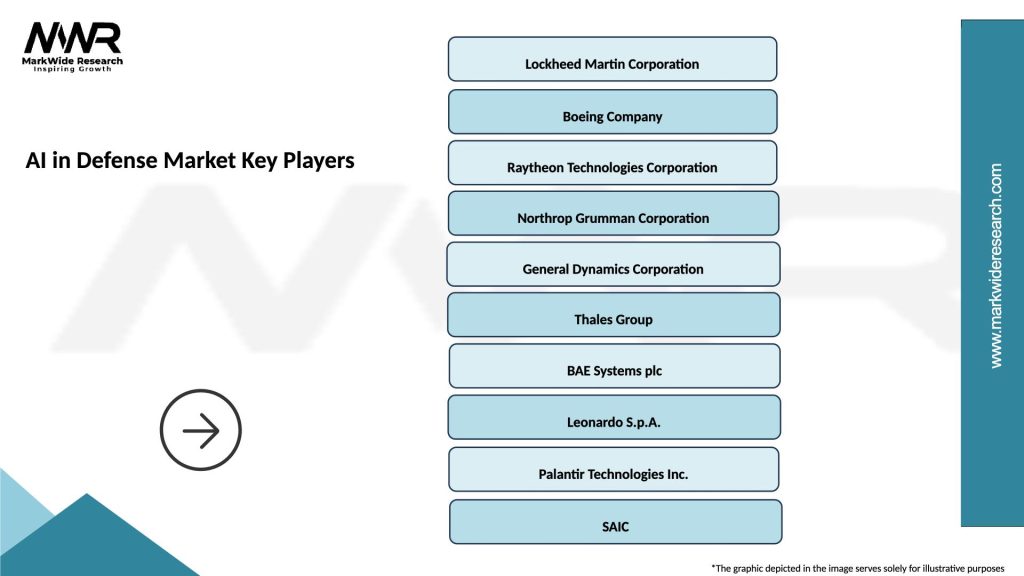

What are the key players in the AI in Defense Market?

Key players in the AI in Defense Market include companies like Lockheed Martin, Northrop Grumman, and Raytheon Technologies, among others.

What are the main drivers of growth in the AI in Defense Market?

The main drivers of growth in the AI in Defense Market include the increasing need for advanced military capabilities, the rise in defense budgets, and the demand for enhanced data analysis and decision-making tools.

What challenges does the AI in Defense Market face?

Challenges in the AI in Defense Market include ethical concerns regarding autonomous weapons, the complexity of integrating AI systems with existing military infrastructure, and potential cybersecurity threats.

What future opportunities exist in the AI in Defense Market?

Future opportunities in the AI in Defense Market include advancements in machine learning for predictive maintenance, the development of autonomous systems for reconnaissance, and improved cybersecurity measures.

What trends are shaping the AI in Defense Market?

Trends shaping the AI in Defense Market include the increasing use of drones for surveillance, the adoption of AI for logistics optimization, and the growing focus on AI ethics and regulations.

AI in Defense Market

| Segmentation Details | Description |

|---|---|

| Product Type | Surveillance Systems, Autonomous Drones, Cybersecurity Solutions, Command & Control Systems |

| End User | Military, Government Agencies, Defense Contractors, Intelligence Services |

| Technology | Machine Learning, Natural Language Processing, Computer Vision, Robotics |

| Application | Threat Detection, Logistics Management, Training Simulations, Data Analysis |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the AI in Defense Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at