444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The AI Finance Market represents the intersection of artificial intelligence (AI) technology and the financial services industry, revolutionizing the way financial institutions operate, make decisions, and interact with customers. AI-driven solutions encompass a wide range of applications, including risk management, fraud detection, algorithmic trading, customer service, credit scoring, and personalized financial advice. As financial firms increasingly adopt AI technologies to enhance efficiency, mitigate risks, and deliver superior customer experiences, the AI Finance Market is experiencing rapid growth and transformation.

Meaning

The AI Finance Market refers to the deployment of artificial intelligence technologies, such as machine learning, natural language processing, and predictive analytics, in the financial services sector to automate processes, analyze data, and optimize decision-making. AI-powered applications enable financial institutions to streamline operations, improve risk management practices, enhance regulatory compliance, and deliver personalized services to clients. By harnessing the power of AI, financial firms can gain actionable insights, reduce costs, and unlock new revenue streams in a highly competitive industry landscape.

Executive Summary

The AI Finance Market is witnessing significant momentum driven by factors such as increasing data volumes, technological advancements, regulatory pressures, and changing customer expectations. AI technologies offer immense potential to transform traditional financial processes, enabling institutions to automate routine tasks, detect patterns, and derive actionable insights from vast amounts of data. As financial firms embrace AI-driven innovations, they stand to gain competitive advantages in areas such as operational efficiency, risk management, customer engagement, and business growth.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The AI Finance Market operates in a dynamic and evolving landscape shaped by technological innovations, regulatory developments, market trends, and competitive forces. Financial institutions must navigate complex market dynamics, anticipate industry shifts, and leverage AI-driven solutions to adapt to changing customer preferences, regulatory requirements, and competitive pressures.

Regional Analysis

The adoption of AI in finance varies by region, influenced by factors such as regulatory frameworks, technological infrastructure, market maturity, and cultural attitudes towards innovation. Developed markets such as North America, Europe, and Asia Pacific lead in AI adoption, driven by advanced economies, supportive regulatory environments, and robust investment in research and development. Emerging markets in Latin America, Africa, and the Middle East present growth opportunities for AI Finance Market players, fueled by increasing digitalization, expanding financial inclusion, and rising demand for innovative financial services.

Competitive Landscape

Leading Companies in the AI Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

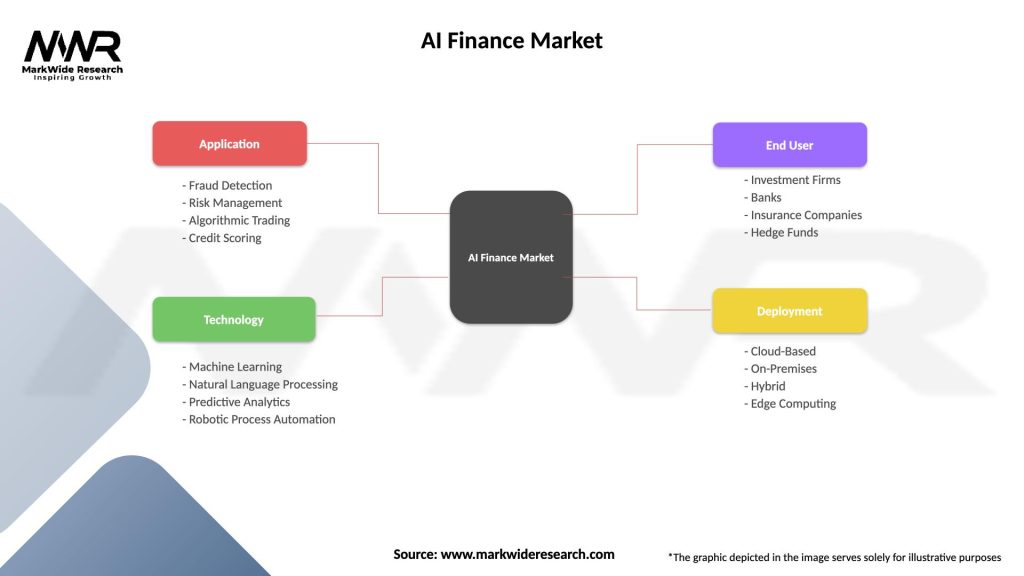

The AI Finance Market can be segmented based on various criteria, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated the adoption of AI in finance, driven by the need for remote operations, digital engagement, and agile decision-making in response to unprecedented market disruptions and economic uncertainties. Financial institutions have increasingly relied on AI-driven solutions for remote customer service, digital onboarding, fraud detection, and risk assessment to adapt to changing customer behaviors, market dynamics, and regulatory requirements amidst the pandemic-induced challenges.

Key Industry Developments

Analyst Suggestions

Future Outlook

The AI Finance Market is poised for continued growth and innovation, driven by technological advancements, regulatory reforms, and evolving customer expectations. Financial institutions that embrace AI-driven transformation, prioritize ethical considerations, and foster collaboration across stakeholders will be well-positioned to capitalize on emerging opportunities, navigate regulatory complexities, and drive sustainable growth in the dynamic landscape of AI-powered finance.

Conclusion

The AI Finance Market represents a paradigm shift in the financial services industry, enabling financial institutions to harness the power of artificial intelligence to drive innovation, enhance efficiency, and deliver superior customer experiences. As AI technologies continue to evolve and mature, financial firms must navigate regulatory challenges, ethical considerations, and market dynamics to realize the full potential of AI-driven transformation and remain competitive in a rapidly evolving landscape. By embracing AI-driven innovation, fostering responsible AI practices, and investing in talent and technology, financial institutions can unlock new opportunities, mitigate risks, and shape the future of finance in the digital age.

What is AI Finance?

AI Finance refers to the integration of artificial intelligence technologies into financial services, enhancing processes such as risk assessment, fraud detection, and customer service. It encompasses various applications, including algorithmic trading, credit scoring, and personalized financial advice.

What are the key players in the AI Finance Market?

Key players in the AI Finance Market include companies like IBM, Microsoft, and Goldman Sachs, which leverage AI for data analytics, investment strategies, and customer engagement. These firms are at the forefront of developing innovative solutions that transform traditional financial practices, among others.

What are the growth factors driving the AI Finance Market?

The AI Finance Market is driven by factors such as the increasing demand for automation in financial processes, the need for enhanced data analysis capabilities, and the growing focus on customer experience. Additionally, regulatory pressures for better compliance and risk management are also contributing to market growth.

What challenges does the AI Finance Market face?

Challenges in the AI Finance Market include data privacy concerns, the complexity of integrating AI systems with existing financial infrastructures, and the potential for algorithmic bias. These issues can hinder the adoption of AI technologies in finance and require careful management.

What opportunities exist in the AI Finance Market?

The AI Finance Market presents opportunities such as the development of advanced predictive analytics tools, personalized financial services, and improved fraud detection mechanisms. As technology evolves, there is potential for new business models and enhanced customer engagement strategies.

What trends are shaping the AI Finance Market?

Trends in the AI Finance Market include the increasing use of machine learning for credit scoring, the rise of robo-advisors for investment management, and the adoption of blockchain technology for secure transactions. These innovations are reshaping how financial services are delivered and consumed.

AI Finance Market

| Segmentation Details | Description |

|---|---|

| Application | Fraud Detection, Risk Management, Algorithmic Trading, Credit Scoring |

| Technology | Machine Learning, Natural Language Processing, Predictive Analytics, Robotic Process Automation |

| End User | Investment Firms, Banks, Insurance Companies, Hedge Funds |

| Deployment | Cloud-Based, On-Premises, Hybrid, Edge Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the AI Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at