444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The agricultural pathogen detection service market plays a crucial role in ensuring the health and productivity of crops worldwide. These services encompass a range of diagnostic techniques and technologies aimed at identifying pathogens that threaten agricultural produce. Pathogens can include bacteria, viruses, fungi, and other microorganisms that cause diseases leading to crop losses. Detection services help farmers and agricultural stakeholders to implement timely and effective disease management strategies, thereby safeguarding crop yields and quality.

Meaning

Agricultural pathogen detection services refer to specialized diagnostics and testing procedures designed to identify pathogens affecting plants and crops. These services are essential for early detection of diseases, allowing farmers to implement preventive measures and treatments promptly. By pinpointing the specific pathogens present in crops, these services enable targeted interventions that minimize the spread of diseases and mitigate potential economic losses. Agricultural pathogen detection contributes significantly to sustainable agriculture practices by promoting proactive disease management and reducing reliance on broad-spectrum pesticides.

Executive Summary

The agricultural pathogen detection service market has witnessed substantial growth driven by increasing global demand for safe and high-quality agricultural products. This market offers significant opportunities for service providers and stakeholders involved in agriculture, including farmers, agribusinesses, and research institutions. Key insights into market trends, technological advancements, regulatory landscapes, and competitive dynamics are critical for navigating this evolving sector. Understanding these factors is essential for stakeholders to make informed decisions, optimize resource allocation, and capitalize on emerging opportunities.

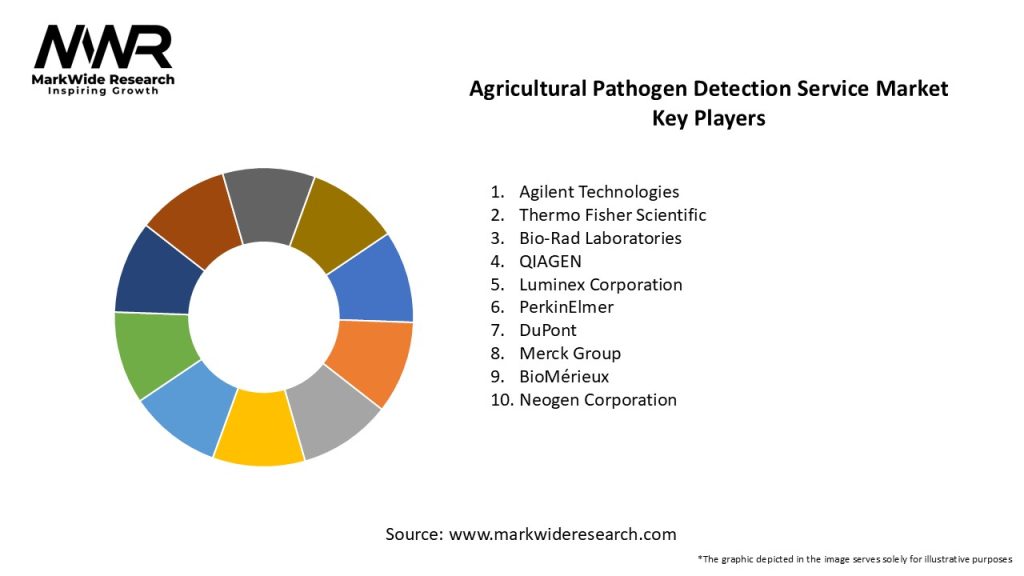

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The agricultural pathogen detection service market operates within a dynamic ecosystem shaped by technological advancements, regulatory landscapes, consumer preferences, and global trade dynamics. These dynamics influence market behavior, growth trajectories, and strategic decision-making among industry participants. Understanding the interconnectedness of these factors is essential for adapting to market shifts, mitigating risks, and capitalizing on emerging opportunities in agricultural diagnostics.

Regional Analysis

Competitive Landscape

Leading Companies in the Agricultural Pathogen Detection Service Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

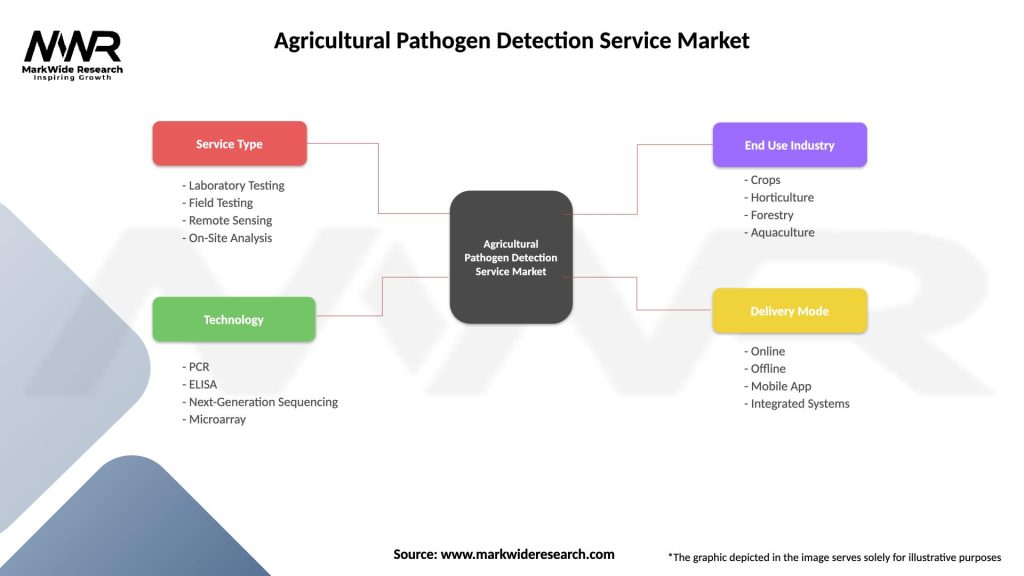

The agricultural pathogen detection service market can be segmented based on several criteria, including:

Segmentation facilitates a deeper understanding of market dynamics, customer preferences, and demand patterns, enabling stakeholders to tailor their strategies and offerings accordingly.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

COVID-19 Impact

The COVID-19 pandemic has underscored the importance of resilient food supply chains, food safety, and agricultural sustainability. Despite initial disruptions in supply chains and labor shortages, the agricultural pathogen detection service market has witnessed accelerated adoption of digital solutions, remote monitoring technologies, and contactless diagnostics. Enhanced focus on food security, biosecurity measures, and resilient agricultural systems has further reinforced the relevance of pathogen detection services in safeguarding global food production and supply.

Key Industry Developments

Analyst Suggestions

Future Outlook

The agricultural pathogen detection service market is poised for robust growth driven by technological advancements, regulatory compliance mandates, and increasing global demand for safe and sustainable agricultural products. Innovations in diagnostic methodologies, expanding application of precision agriculture technologies, and rising investments in research and development initiatives will shape the market landscape. Strategic partnerships, market diversification strategies, and proactive adaptation to evolving consumer preferences and regulatory frameworks will be pivotal in sustaining long-term growth and competitive advantage in the global agricultural diagnostics sector.

Conclusion

In conclusion, the agricultural pathogen detection service market represents a critical component of modern agriculture, safeguarding crop health, food safety, and global food security. Rapid advancements in diagnostic technologies, coupled with regulatory support and industry collaborations, propel market innovation and expansion. Stakeholders across the agricultural value chain stand to benefit from enhanced productivity, sustainability, and market competitiveness facilitated by pathogen detection services. Continued investments in technological infrastructure, market diversification strategies, and consumer education initiatives will underpin the industry’s resilience and growth in the foreseeable future.

What is Agricultural Pathogen Detection Service?

Agricultural Pathogen Detection Service refers to the methods and technologies used to identify pathogens that affect crops and livestock. This service is crucial for ensuring food safety, enhancing crop yield, and preventing the spread of diseases in agriculture.

What are the key players in the Agricultural Pathogen Detection Service Market?

Key players in the Agricultural Pathogen Detection Service Market include companies like Neogen Corporation, Bio-Rad Laboratories, and Agilent Technologies, which provide innovative solutions for pathogen detection in agriculture, among others.

What are the growth factors driving the Agricultural Pathogen Detection Service Market?

The growth of the Agricultural Pathogen Detection Service Market is driven by increasing demand for food safety, the rise in crop diseases, and advancements in detection technologies. Additionally, the need for sustainable agricultural practices is pushing the adoption of these services.

What challenges does the Agricultural Pathogen Detection Service Market face?

Challenges in the Agricultural Pathogen Detection Service Market include the high costs associated with advanced detection technologies and the complexity of pathogen identification. Furthermore, regulatory hurdles can also impede market growth.

What opportunities exist in the Agricultural Pathogen Detection Service Market?

Opportunities in the Agricultural Pathogen Detection Service Market include the development of rapid testing methods and the integration of artificial intelligence for better data analysis. There is also potential for expansion into emerging markets where agricultural practices are evolving.

What trends are shaping the Agricultural Pathogen Detection Service Market?

Trends in the Agricultural Pathogen Detection Service Market include the increasing use of molecular techniques for pathogen detection and the growing emphasis on precision agriculture. Additionally, there is a shift towards more environmentally friendly detection methods.

Agricultural Pathogen Detection Service Market

| Segmentation Details | Description |

|---|---|

| Service Type | Laboratory Testing, Field Testing, Remote Sensing, On-Site Analysis |

| Technology | PCR, ELISA, Next-Generation Sequencing, Microarray |

| End Use Industry | Crops, Horticulture, Forestry, Aquaculture |

| Delivery Mode | Online, Offline, Mobile App, Integrated Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Agricultural Pathogen Detection Service Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at