444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The African food flavor and enhancer market represents a dynamic and rapidly evolving sector that reflects the continent’s rich culinary heritage while embracing modern food processing technologies. This market encompasses traditional spices, herbs, natural flavor extracts, and contemporary food enhancers that cater to both local consumption patterns and international export opportunities. Market growth is driven by increasing urbanization, changing dietary preferences, and the rising demand for authentic African flavors in global cuisine.

Regional diversity characterizes this market significantly, with each African nation contributing unique flavor profiles and enhancement techniques. From the berbere spice blends of Ethiopia to the harissa preparations of North Africa, the market showcases an extraordinary range of products. Growth projections indicate the sector is expanding at a robust CAGR of 8.2%, reflecting strong domestic demand and increasing international recognition of African culinary traditions.

Consumer preferences are shifting toward natural and organic flavor enhancers, creating opportunities for traditional producers to modernize their operations while maintaining authenticity. The market benefits from growing food processing industries across major African economies, with South Africa, Nigeria, Kenya, and Egypt leading in both production and consumption volumes.

The African food flavor and enhancer market refers to the comprehensive ecosystem of businesses, products, and services involved in producing, processing, distributing, and marketing flavor-enhancing ingredients derived from or inspired by African culinary traditions. This market encompasses both traditional spice and herb preparations that have been used for centuries across the continent, as well as modern food enhancement technologies adapted to African taste preferences and ingredient availability.

Market scope includes natural spices, dried herbs, flavor extracts, seasoning blends, fermented flavor enhancers, and processed condiments that enhance the taste, aroma, and overall sensory experience of food products. The sector serves diverse customer segments ranging from household consumers and traditional food vendors to large-scale food manufacturers and international exporters seeking authentic African flavor profiles.

Market dynamics in the African food flavor and enhancer sector demonstrate strong growth momentum driven by urbanization trends, increasing disposable incomes, and evolving consumer preferences toward convenient yet authentic flavor solutions. The market benefits from abundant raw material availability across the continent, with many regions serving as both production centers and consumption markets.

Key growth drivers include the expansion of organized retail channels, increasing penetration of processed foods, and growing international demand for African cuisine. Traditional knowledge combined with modern processing techniques creates competitive advantages for local producers, while international players are increasingly investing in African flavor development to capture authentic taste profiles.

Regional leadership varies by product category, with North African countries dominating spice blend exports, West African nations leading in fermented flavor enhancers, and East African countries excelling in herb and aromatic plant production. Market penetration rates show that 73% of urban households regularly use commercial flavor enhancers, indicating substantial room for further growth in rural markets.

Consumer behavior analysis reveals several critical insights shaping market development:

Urbanization acceleration across African countries creates fundamental shifts in food consumption patterns, driving increased demand for convenient flavor solutions. Urban consumers seek products that deliver traditional tastes without requiring extensive preparation time or specialized cooking knowledge. This trend particularly benefits pre-mixed spice blends and ready-to-use flavor enhancers that simplify meal preparation while maintaining authentic taste profiles.

Rising disposable incomes in key African markets enable consumers to prioritize food quality and flavor enhancement over basic sustenance. Middle-class expansion creates demand for premium flavor products, organic alternatives, and imported specialty ingredients. Consumer spending patterns show that 42% of food budgets in urban areas now include flavor enhancement products, representing significant growth from previous decades.

Food processing industry growth creates substantial B2B demand for flavor enhancers as manufacturers seek to differentiate their products in competitive markets. Local food companies increasingly incorporate traditional African flavors into processed foods, snacks, and beverages to appeal to domestic consumers and international markets seeking authentic experiences.

International cuisine popularity drives global demand for African flavors, creating export opportunities for local producers. Restaurants worldwide increasingly feature African-inspired dishes, while food manufacturers incorporate African spices and flavor profiles into mainstream products targeting adventurous consumers.

Supply chain challenges significantly impact market development, particularly for rural producers lacking access to modern transportation and storage infrastructure. Seasonal availability of raw materials creates price volatility and supply disruptions that affect both domestic and export markets. Post-harvest losses remain substantial, with estimates indicating 25-30% of spice and herb production is lost due to inadequate storage and processing facilities.

Quality standardization issues limit market access, particularly for international exports requiring compliance with strict food safety regulations. Many traditional producers lack the technical knowledge and financial resources necessary to implement quality management systems, laboratory testing, and certification processes demanded by modern retail channels.

Limited processing infrastructure constrains value addition opportunities, forcing many producers to sell raw materials rather than finished products. This limitation reduces profit margins and limits market positioning options, particularly affecting smallholder farmers and cooperative organizations.

Competition from synthetic alternatives poses ongoing challenges as artificial flavor enhancers often offer cost advantages and consistent availability. Consumer education about natural product benefits requires sustained marketing investments that many local producers cannot afford.

Export market expansion presents substantial opportunities as global interest in African cuisine continues growing. International markets increasingly value authentic, natural flavor products, creating premium positioning opportunities for African producers. Diaspora communities in North America, Europe, and Asia provide established customer bases for traditional African flavor products.

Technology integration enables traditional producers to scale operations while maintaining product authenticity. Modern extraction techniques, packaging technologies, and quality control systems allow small-scale producers to access larger markets while preserving traditional flavor profiles and production methods.

Organic certification opportunities create premium market segments as many traditional African farming practices align with organic production standards. Organic market penetration in African flavor products remains below 15%, indicating substantial growth potential as consumer awareness increases.

Value chain integration opportunities enable producers to capture greater profit margins by controlling multiple production stages. Cooperative organizations and producer groups can develop processing facilities, branding initiatives, and direct marketing channels to improve profitability and market positioning.

Competitive landscape evolution reflects the interplay between traditional producers maintaining authentic production methods and modern companies leveraging technology for scale and consistency. Market consolidation occurs gradually as successful traditional producers expand operations while maintaining quality standards, creating regional leaders in specific flavor categories.

Consumer preference shifts toward natural and organic products benefit traditional African flavor enhancers, which often rely on minimal processing and natural ingredients. This trend creates competitive advantages for authentic producers while challenging synthetic alternative manufacturers to develop more natural formulations.

Regulatory environment changes across African countries increasingly support local food industries through favorable policies, reduced import duties on processing equipment, and export promotion initiatives. These developments create enabling environments for market growth while encouraging quality improvements and international competitiveness.

Innovation adoption rates vary significantly across market segments, with urban-focused companies embracing modern technologies more rapidly than rural producers. However, technology transfer programs and cooperative initiatives help bridge this gap, enabling broader market participation in modernization efforts.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the African food flavor and enhancer market. Primary research includes extensive interviews with industry stakeholders, including producers, distributors, retailers, and consumers across major African markets. This approach provides firsthand insights into market dynamics, consumer preferences, and industry challenges.

Secondary research incorporates analysis of industry reports, government statistics, trade data, and academic studies to establish market context and validate primary research findings. Data triangulation ensures accuracy by comparing information from multiple sources and identifying consistent trends and patterns across different data sets.

Market segmentation analysis examines the market across multiple dimensions, including product categories, geographic regions, distribution channels, and consumer demographics. This multifaceted approach enables comprehensive understanding of market structure and growth opportunities across different segments.

Quantitative analysis incorporates statistical modeling to project market trends, growth rates, and future opportunities. Qualitative insights from industry experts and market participants provide context for quantitative findings and help identify emerging trends and potential market disruptions.

North African markets demonstrate strong performance in spice blend production and export, with Morocco, Tunisia, and Egypt leading in traditional spice processing and international market penetration. Regional market share indicates North Africa accounts for approximately 35% of continental production, benefiting from established trade relationships with European and Middle Eastern markets.

West African countries excel in fermented flavor enhancer production, with Nigeria, Ghana, and Senegal developing sophisticated traditional fermentation techniques that create unique flavor profiles. The region shows particular strength in locust bean fermentation, palm wine processing, and traditional seasoning cube manufacturing.

East African markets focus on herb and aromatic plant production, with Ethiopia, Kenya, and Tanzania leading in coffee-related flavor products, berbere spice blends, and medicinal herb processing. The region benefits from diverse climatic conditions supporting varied agricultural production and traditional knowledge systems.

Southern African countries demonstrate advanced processing capabilities and quality standards, with South Africa leading in modern food processing technology adoption and export market development. Regional integration initiatives facilitate cross-border trade and knowledge transfer, supporting overall market development across the continent.

Market leadership varies by product category and geographic region, with both traditional producers and modern companies competing across different market segments:

Competitive strategies focus on balancing authenticity with modern convenience, quality consistency, and market accessibility. Traditional producers emphasize heritage and natural production methods, while modern companies leverage technology for scale and distribution efficiency.

Product category segmentation reveals distinct market dynamics across different flavor enhancer types:

By Product Type:

By Application:

By Distribution Channel:

Traditional spice blends represent the largest market segment, benefiting from strong cultural connections and authentic flavor profiles that cannot be easily replicated by synthetic alternatives. Consumer loyalty remains high for established regional brands, with brand recognition rates exceeding 80% in traditional markets. This segment shows particular strength in export markets where diaspora communities seek authentic taste experiences.

Seasoning cubes demonstrate rapid growth in urban markets, driven by convenience factors and consistent flavor delivery. This category benefits from strong marketing investments and wide distribution networks, making it accessible to consumers across different income levels. Market penetration in urban areas reaches 65% of households, indicating substantial market maturity in key segments.

Natural extracts represent emerging opportunities as food processors seek clean-label ingredients and authentic flavor profiles for product differentiation. This segment requires significant technical expertise and quality control systems, creating barriers to entry that benefit established producers with processing capabilities.

Fermented enhancers maintain strong positions in traditional markets while gaining recognition in international markets for their unique flavor contributions and potential health benefits. This category benefits from traditional knowledge systems and established production methods that create competitive advantages for authentic producers.

Producers benefit from multiple value creation opportunities across the African food flavor and enhancer market. Traditional knowledge monetization enables communities to generate income from ancestral recipes and production techniques while preserving cultural heritage. Modern processing technologies allow producers to scale operations, improve product consistency, and access broader markets without compromising authenticity.

Distributors and retailers benefit from strong consumer demand and relatively stable market growth. Product differentiation opportunities enable retailers to offer unique products that distinguish their offerings from competitors while building customer loyalty through authentic flavor experiences.

Food manufacturers gain access to authentic African flavors that enable product innovation and market differentiation. Clean-label trends favor natural African flavor enhancers over synthetic alternatives, creating opportunities for manufacturers to improve product positioning while meeting consumer preferences for natural ingredients.

Export market participants benefit from growing international demand for authentic African flavors and increasing recognition of African cuisine globally. Premium positioning opportunities enable producers to capture higher margins in international markets while building brand recognition for African food products.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural and organic movement significantly influences market development as consumers increasingly prefer products with minimal processing and natural ingredients. This trend particularly benefits traditional African flavor enhancers, which often rely on natural fermentation, sun-drying, and traditional preparation methods that align with clean-label preferences.

Convenience integration drives product innovation as manufacturers develop ready-to-use formats that maintain traditional flavor profiles while simplifying meal preparation. Product development focuses on creating convenient packaging, portion control, and multi-use applications that appeal to modern lifestyles without compromising authenticity.

Premium positioning trends create opportunities for artisanal producers to command higher prices through storytelling, heritage marketing, and quality differentiation. Consumer willingness to pay premiums for authentic, traditional products reaches 45% in urban markets, indicating substantial opportunities for quality-focused producers.

Technology adoption acceleration enables traditional producers to modernize operations while preserving traditional methods. Digital marketing and e-commerce platforms provide direct market access, while modern packaging and quality control systems enable broader distribution without compromising product integrity.

Investment increases in African food processing infrastructure support market development through improved production capabilities and quality standards. Government initiatives across multiple African countries promote local food industries through favorable policies, tax incentives, and export promotion programs that benefit flavor enhancer producers.

International partnerships between African producers and global food companies create opportunities for technology transfer, market access, and quality improvement. These collaborations enable traditional producers to access international markets while maintaining authentic production methods and cultural connections.

Certification program expansion helps producers meet international quality standards and access premium markets. Organic certification adoption increases as producers recognize market premiums available for certified products, with certification rates growing by 12% annually across key producing regions.

Research and development investments focus on improving traditional production methods through modern technology while preserving authentic flavor profiles. MarkWide Research indicates that innovation investments in traditional food processing have increased substantially, supporting both quality improvements and production efficiency gains.

Market participants should prioritize quality standardization and certification to access broader markets while maintaining competitive positioning. Investment priorities should focus on processing infrastructure, quality control systems, and packaging technologies that enable market expansion without compromising product authenticity.

Traditional producers should consider cooperative organizations and group certification approaches to achieve economies of scale in quality improvement and market access initiatives. Collaboration strategies can help small-scale producers access modern technologies and international markets while preserving traditional knowledge and production methods.

Technology adoption should balance modernization with authenticity preservation, focusing on improvements that enhance quality and efficiency without altering traditional flavor profiles. Gradual implementation of modern processing techniques can help producers maintain consumer trust while improving market competitiveness.

Export market development requires sustained investment in quality systems, international marketing, and distribution partnerships. MWR analysis suggests that successful export development typically requires 3-5 years of consistent quality delivery and market relationship building before achieving substantial market penetration.

Market growth projections indicate continued expansion driven by urbanization, income growth, and international market development. Long-term trends favor natural and authentic products, creating sustainable competitive advantages for traditional African flavor enhancer producers who can maintain quality while scaling operations.

Technology integration will accelerate as costs decrease and benefits become more apparent to traditional producers. Digital transformation in marketing, distribution, and customer engagement will enable direct market access and improved profitability for producers willing to embrace modern business practices.

International market expansion will continue as global interest in African cuisine grows and diaspora communities maintain cultural connections through food. Export growth rates are projected to reach 15% annually for authentic African flavor products, driven by increasing international recognition and premium positioning opportunities.

Sustainability focus will create additional market opportunities as consumers increasingly value environmentally responsible production methods. Traditional African production techniques often align with sustainability principles, creating competitive advantages for authentic producers in environmentally conscious markets.

The African food flavor and enhancer market represents a dynamic sector with substantial growth potential driven by cultural authenticity, natural ingredients, and increasing global recognition of African cuisine. Market fundamentals remain strong, supported by urbanization trends, rising disposable incomes, and growing consumer preference for natural flavor solutions.

Success factors in this market include maintaining authenticity while embracing quality improvements, developing efficient distribution channels, and building brand recognition through consistent quality delivery. Traditional producers who can balance heritage preservation with modern business practices are well-positioned to capture growth opportunities in both domestic and international markets.

Future market development will depend on continued investment in infrastructure, quality systems, and market development initiatives that support both traditional producers and modern companies serving this diverse and growing market. The combination of rich cultural heritage, abundant natural resources, and increasing market demand creates a foundation for sustained growth and development across the African food flavor and enhancer market.

What is African Food Flavor and Enhancer?

African Food Flavor and Enhancer refers to a variety of ingredients and additives used to enhance the taste and aroma of food products originating from Africa. These flavors can include spices, herbs, and other natural extracts that are integral to traditional African cuisine.

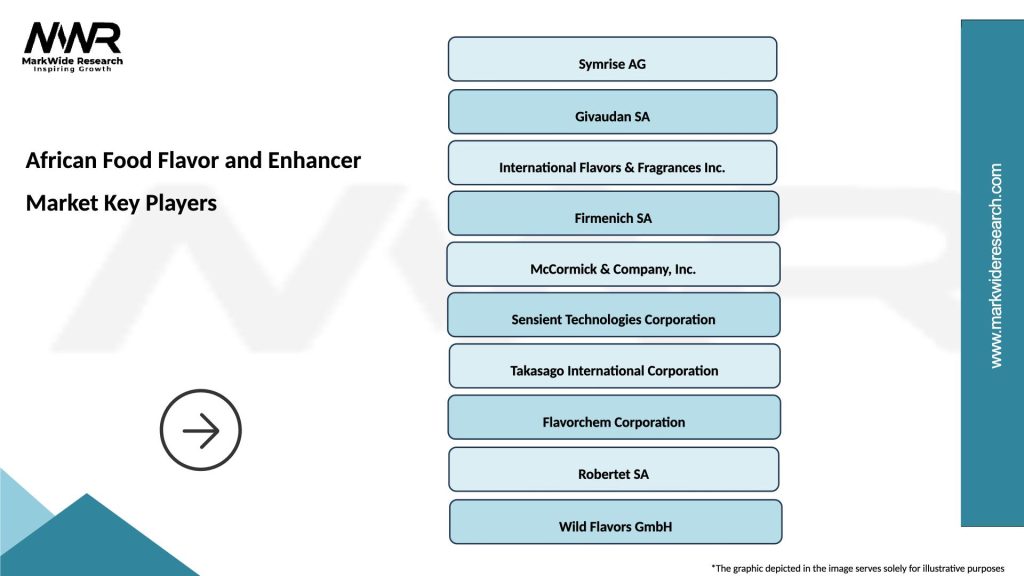

What are the key players in the African Food Flavor and Enhancer Market?

Key players in the African Food Flavor and Enhancer Market include companies like Afrikoko, Flavormatic, and AAK, which specialize in producing natural flavors and enhancers tailored to African culinary preferences, among others.

What are the growth factors driving the African Food Flavor and Enhancer Market?

The growth of the African Food Flavor and Enhancer Market is driven by increasing consumer demand for authentic flavors, the rise of the food processing industry, and the growing popularity of African cuisine globally. Additionally, the trend towards natural and organic ingredients is also contributing to market expansion.

What challenges does the African Food Flavor and Enhancer Market face?

The African Food Flavor and Enhancer Market faces challenges such as the availability of raw materials, fluctuating prices of spices, and competition from synthetic flavoring agents. These factors can impact the consistency and quality of flavor products.

What opportunities exist in the African Food Flavor and Enhancer Market?

Opportunities in the African Food Flavor and Enhancer Market include the potential for product innovation, expansion into international markets, and the increasing interest in health-conscious and natural food products. Companies can leverage these trends to develop new flavor profiles and enhance their product offerings.

What trends are shaping the African Food Flavor and Enhancer Market?

Trends shaping the African Food Flavor and Enhancer Market include a growing preference for plant-based and organic flavors, the fusion of traditional and modern culinary practices, and the rise of online food retailing. These trends are influencing consumer choices and driving demand for diverse flavor options.

African Food Flavor and Enhancer Market

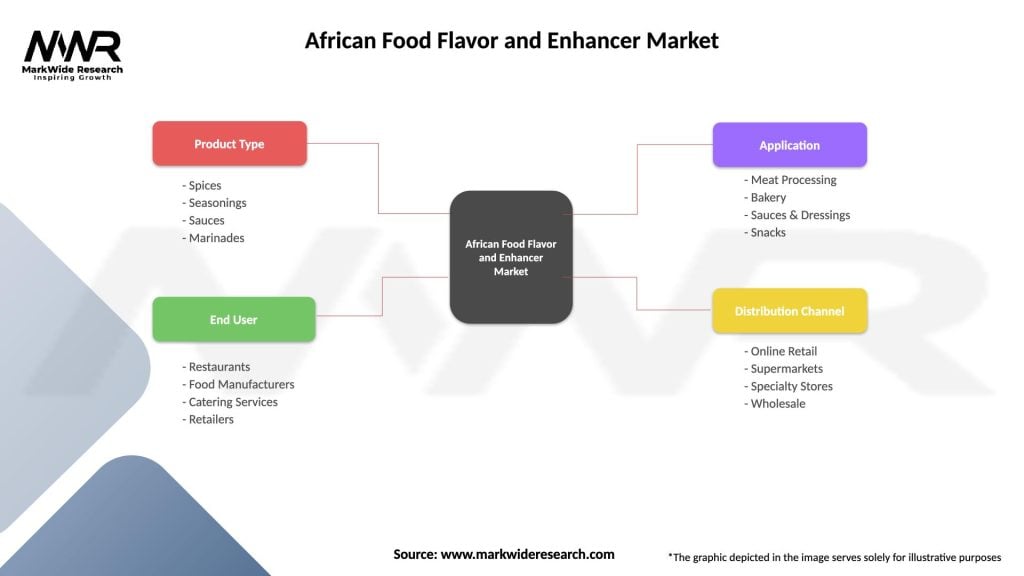

| Segmentation Details | Description |

|---|---|

| Product Type | Spices, Seasonings, Sauces, Marinades |

| End User | Restaurants, Food Manufacturers, Catering Services, Retailers |

| Application | Meat Processing, Bakery, Sauces & Dressings, Snacks |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the African Food Flavor and Enhancer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at