444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Africa ready-to-drink (RTD) coffee market is witnessing significant growth in recent years, driven by the increasing popularity of coffee consumption among the region’s population. Ready-to-drink coffee refers to packaged coffee beverages that are conveniently available for immediate consumption without the need for any additional preparation. This category of coffee products has gained traction due to its convenience, variety of flavors, and the growing demand for on-the-go beverages.

Meaning

Ready-to-drink coffee is a type of beverage that offers the taste and benefits of coffee in a convenient, pre-packaged format. It eliminates the need for brewing or grinding coffee beans, making it a quick and easy option for coffee enthusiasts. Ready-to-drink coffee is typically sold in bottles or cans and can be consumed directly from the packaging. It is available in various flavors, including classic black coffee, iced coffee, mocha, and latte, catering to different consumer preferences.

Executive Summary

The Africa ready-to-drink coffee market has witnessed robust growth in recent years, driven by factors such as changing consumer lifestyles, urbanization, and the rising demand for convenience beverages. The market has witnessed the introduction of innovative flavors, improved packaging, and aggressive marketing campaigns by key players, further fueling the market’s growth. Additionally, the increasing penetration of e-commerce platforms has made these products easily accessible to consumers, boosting market expansion.

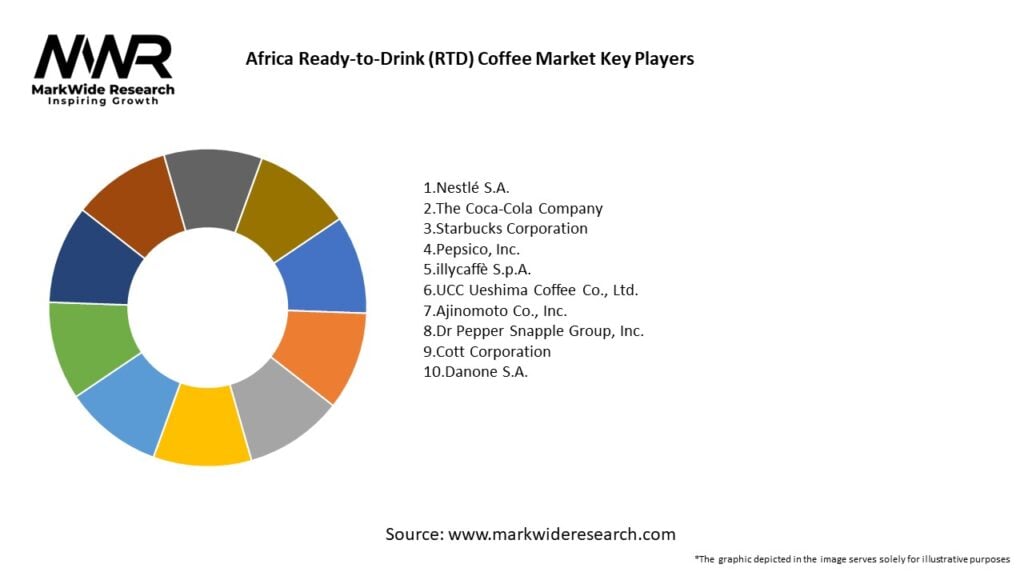

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Africa ready-to-drink coffee market is characterized by intense competition among key players, who are continuously innovating to gain a competitive edge. The market is witnessing partnerships, acquisitions, and collaborations between manufacturers, distributors, and retailers to expand their product portfolios and geographical presence. Additionally, the market is influenced by changing consumer preferences, evolving lifestyles, and advancements in packaging technologies.

Regional Analysis

The Africa ready-to-drink coffee market can be segmented into various regions, including North Africa, West Africa, East Africa, Central Africa, and Southern Africa. Each region exhibits unique consumer preferences, cultural influences, and market dynamics that shape the demand for ready-to-drink coffee. North Africa, for example, has a strong coffee culture, while East Africa is known for its coffee production.

Competitive Landscape

Leading Companies in the Africa Ready-to-Drink (RTD) Coffee Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Africa RTD coffee market can be segmented as follows:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had both positive and negative impacts on the Africa ready-to-drink coffee market. On one hand, the increased focus on hygiene and safety measures led to a surge in demand for packaged beverages, including ready-to-drink coffee. Consumers, confined to their homes during lockdowns, sought convenient and comforting options. However, the closure of cafes, restaurants, and reduced footfall in retail stores affected the out-of-home consumption of ready-to-drink coffee. The market also faced supply chain disruptions, impacting production and distribution.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Africa ready-to-drink coffee market is expected to continue its growth trajectory in the coming years. Factors such as increasing urbanization, changing consumer lifestyles, and the convenience-seeking behavior of consumers will drive market expansion. Innovation, product diversification, and sustainability will remain key focus areas for industry players. The market is likely to witness a rise in demand for premium and functional variants, as well as a greater emphasis on health and wellness. Geographic expansion and e-commerce will play vital roles in reaching a wider consumer base, while regulatory compliance and addressing price sensitivity will continue to be challenges to overcome.

Conclusion

The Africa ready-to-drink coffee market is experiencing significant growth, driven by changing consumer preferences, urbanization, and the demand for convenient beverages. The market offers opportunities for innovation, expansion of distribution networks, and the development of healthier variants. While facing challenges such as competition from traditional coffee, price sensitivity, and regulatory compliance, the market is poised for future expansion. Industry participants should focus on continuous innovation, branding, and marketing strategies to differentiate themselves and capitalize on the market’s potential. With the right strategies and product offerings, the Africa ready-to-drink coffee market is expected to witness continued growth in the coming years.

What is Ready-to-Drink (RTD) Coffee?

Ready-to-Drink (RTD) Coffee refers to pre-packaged coffee beverages that are ready for consumption without the need for brewing. These products are often available in various flavors and formats, catering to the growing demand for convenient coffee options among consumers.

What are the key players in the Africa Ready-to-Drink (RTD) Coffee Market?

Key players in the Africa Ready-to-Drink (RTD) Coffee Market include Nestlé, Coca-Cola, and Starbucks, among others. These companies are actively involved in product innovation and expanding their distribution networks to capture a larger market share.

What are the growth factors driving the Africa Ready-to-Drink (RTD) Coffee Market?

The growth of the Africa Ready-to-Drink (RTD) Coffee Market is driven by increasing consumer demand for convenient beverage options, the rising popularity of coffee culture, and the expansion of retail channels. Additionally, the introduction of new flavors and health-oriented products is attracting more consumers.

What challenges does the Africa Ready-to-Drink (RTD) Coffee Market face?

The Africa Ready-to-Drink (RTD) Coffee Market faces challenges such as high production costs, competition from other beverage segments, and varying consumer preferences across different regions. These factors can impact market growth and profitability.

What opportunities exist in the Africa Ready-to-Drink (RTD) Coffee Market?

Opportunities in the Africa Ready-to-Drink (RTD) Coffee Market include the potential for product diversification, such as introducing organic or functional coffee drinks, and expanding into untapped markets. Additionally, increasing urbanization and changing lifestyles present avenues for growth.

What trends are shaping the Africa Ready-to-Drink (RTD) Coffee Market?

Trends shaping the Africa Ready-to-Drink (RTD) Coffee Market include the rise of cold brew coffee, the incorporation of natural ingredients, and the growing interest in sustainable packaging. These trends reflect changing consumer preferences towards healthier and environmentally friendly options.

Africa Ready-to-Drink (RTD) Coffee Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cold Brew, Nitro Coffee, Iced Coffee, Espresso Drinks |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Cafés |

| Packaging Type | Cans, Bottles, Tetra Packs, Pouches |

| End User | Office Workers, Students, Athletes, Health Enthusiasts |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Africa Ready-to-Drink (RTD) Coffee Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at