444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview:

The Africa Online Trading Platform market is experiencing significant growth, driven by the increasing digitization of financial services and a growing interest in online investment opportunities across the continent. Online trading platforms provide individuals with access to various financial instruments, including stocks, cryptocurrencies, forex, and commodities, fostering a democratization of financial markets. This market overview delves into the key aspects shaping the Africa Online Trading Platform market.

Meaning:

Online trading platforms refer to digital platforms that enable users to buy and sell financial instruments through the internet. These platforms provide a user-friendly interface, real-time market data, and tools for analysis, allowing investors to execute trades and manage their investment portfolios conveniently.

Executive Summary:

The Africa Online Trading Platform market has witnessed a surge in popularity, driven by factors such as increased internet penetration, a growing tech-savvy population, and a desire for financial inclusion. Online trading platforms offer users the ability to engage in financial markets without the need for traditional brick-and-mortar brokerage services. This executive summary provides an overview of the market’s growth trajectory, opportunities, and challenges.

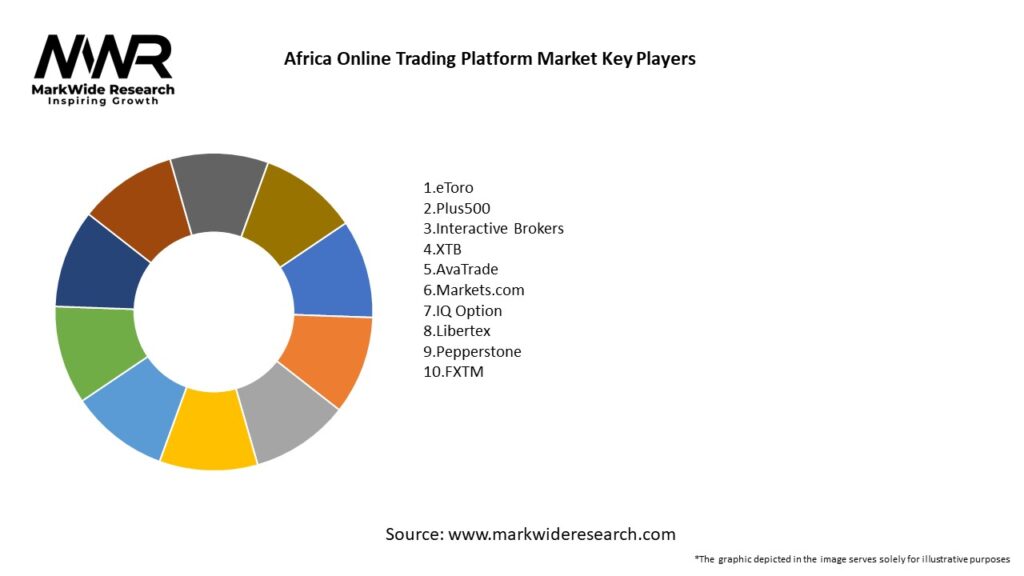

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The Africa Online Trading Platform market operates in a dynamic environment shaped by technological advancements, regulatory changes, and socio-economic factors. Understanding these dynamics is essential for market participants to adapt and capitalize on emerging trends.

Regional Analysis:

The online trading platform market in Africa exhibits regional variations influenced by factors such as economic conditions, regulatory environments, and technological infrastructure. Let’s explore key regions:

Competitive Landscape:

Leading Companies in Africa Online Trading Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

The Africa Online Trading Platform market can be segmented based on various factors:

Category-wise Insights:

Key Benefits for Users:

SWOT Analysis:

A SWOT analysis provides an overview of the Africa Online Trading Platform market’s strengths, weaknesses, opportunities, and threats:

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic had both positive and negative impacts on the Africa Online Trading Platform market:

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The future outlook for the Africa Online Trading Platform market is optimistic, with several factors contributing to its continued growth:

Conclusion:

In conclusion, the Africa Online Trading Platform market represents a dynamic landscape with significant growth potential. The market’s evolution is driven by factors such as increasing internet penetration, a youthful population, and a growing interest in financial markets. While challenges related to regulatory variations and cybersecurity persist, ongoing efforts in regulatory collaboration, technological innovation, and user education are shaping the market’s trajectory. The future holds opportunities for further expansion, increased financial inclusion, and the continued integration of technology to enhance the overall online trading experience in Africa.

What is Africa Online Trading Platform?

Africa Online Trading Platform refers to digital platforms that facilitate trading of financial instruments such as stocks, commodities, and currencies over the internet, specifically catering to the African market.

What are the key players in the Africa Online Trading Platform Market?

Key players in the Africa Online Trading Platform Market include companies like Jumia, TradeDepot, and Flutterwave, which provide various trading and financial services, among others.

What are the main drivers of growth in the Africa Online Trading Platform Market?

The main drivers of growth in the Africa Online Trading Platform Market include increasing internet penetration, a growing middle class with disposable income, and the rising popularity of mobile trading applications.

What challenges does the Africa Online Trading Platform Market face?

Challenges in the Africa Online Trading Platform Market include regulatory hurdles, limited financial literacy among potential users, and concerns over cybersecurity and data privacy.

What opportunities exist in the Africa Online Trading Platform Market?

Opportunities in the Africa Online Trading Platform Market include the expansion of fintech solutions, the potential for partnerships with local banks, and the increasing demand for investment education and resources.

What trends are shaping the Africa Online Trading Platform Market?

Trends shaping the Africa Online Trading Platform Market include the rise of social trading, the integration of artificial intelligence for personalized trading experiences, and the growing emphasis on sustainable investing practices.

Africa Online Trading Platform Market

| Segmentation Details | Description |

|---|---|

| Platform Type | Web-Based, Mobile App, Desktop Software, Hybrid |

| Asset Class | Equities, Forex, Commodities, Cryptocurrencies |

| Client Type | Retail Investors, Institutional Investors, Day Traders, Long-Term Investors |

| Service Model | Commission-Based, Subscription-Based, Freemium, Managed Accounts |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Africa Online Trading Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at