444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Africa oil and gas industry market represents one of the most dynamic and rapidly evolving energy sectors globally, characterized by substantial reserves, emerging technologies, and significant investment opportunities. Africa’s energy landscape encompasses diverse geological formations across the continent, from the prolific offshore fields of West Africa to the emerging discoveries in East Africa and the established production centers in North Africa. The continent holds approximately 8% of global oil reserves and 7% of natural gas reserves, positioning it as a critical player in global energy security.

Market dynamics in the African oil and gas sector are influenced by a complex interplay of factors including technological advancement, regulatory frameworks, infrastructure development, and international investment flows. The industry has witnessed remarkable transformation over the past decade, with deepwater exploration activities intensifying and liquefied natural gas (LNG) projects gaining momentum across multiple countries. Countries such as Nigeria, Angola, Algeria, and Libya continue to dominate production volumes, while emerging markets like Ghana, Mozambique, and Tanzania are establishing themselves as significant contributors to the continental energy portfolio.

Investment patterns in the African oil and gas market reflect growing confidence in the continent’s potential, with international oil companies and national oil companies collaborating on major projects. The sector is experiencing a compound annual growth rate (CAGR) of 4.2% in production capacity, driven by new field developments and enhanced recovery techniques. Technological innovation continues to unlock previously inaccessible reserves, particularly in challenging offshore environments and unconventional formations.

The Africa oil and gas industry market refers to the comprehensive ecosystem of exploration, production, processing, transportation, and distribution activities related to petroleum and natural gas resources across the African continent. This market encompasses upstream activities including seismic surveys, drilling operations, and field development, midstream operations involving pipeline networks and processing facilities, and downstream activities covering refining, marketing, and distribution of petroleum products.

Market scope extends beyond traditional extraction activities to include supporting services such as oilfield services, equipment manufacturing, logistics, and technology solutions. The industry operates within a complex regulatory environment that varies significantly across the 54 African countries, each with distinct legal frameworks, fiscal regimes, and investment policies. Regional integration initiatives and continental trade agreements are increasingly shaping market dynamics and cross-border collaboration opportunities.

Strategic importance of the African oil and gas market extends to energy security, economic development, and geopolitical considerations. The industry serves as a primary revenue source for many African governments, contributing significantly to national budgets, foreign exchange earnings, and employment generation. Value chain integration across the continent is creating new opportunities for local content development and regional energy trade.

Africa’s oil and gas industry stands at a pivotal juncture, balancing traditional hydrocarbon development with evolving energy transition considerations. The continent’s proven oil reserves exceed 125 billion barrels, while natural gas reserves surpass 620 trillion cubic feet, representing substantial untapped potential for future development. Production growth is projected to continue at a steady pace, with new discoveries and field developments contributing to increased output capacity.

Key market drivers include rising global energy demand, technological advancement in exploration and production techniques, and increasing investment in infrastructure development. The sector benefits from 65% of African countries actively pursuing oil and gas exploration activities, creating a diverse and competitive landscape. Natural gas development is experiencing particular momentum, with LNG projects representing over 40% of new investment commitments in the sector.

Challenges facing the industry include infrastructure constraints, regulatory complexity, security concerns in certain regions, and the global transition toward renewable energy sources. However, strategic positioning of African oil and gas resources in global supply chains, combined with improving business environments and technological capabilities, continues to attract significant international investment and partnership opportunities.

Strategic insights into the African oil and gas market reveal several critical trends shaping industry development:

Market intelligence indicates that the African oil and gas industry is experiencing a fundamental shift toward more sustainable and technologically advanced operations. Innovation adoption is accelerating across all segments of the value chain, from enhanced oil recovery techniques to advanced gas processing technologies.

Primary drivers propelling the African oil and gas market include robust global energy demand, particularly from emerging economies seeking reliable energy sources. Population growth across Africa, combined with increasing urbanization and industrialization, is creating substantial domestic energy demand that supports market expansion. The continent’s strategic geographic position provides advantageous access to major energy-consuming markets in Europe, Asia, and the Americas.

Technological advancement serves as a crucial market driver, enabling the development of previously uneconomical reserves through enhanced exploration techniques, improved drilling technologies, and advanced production methods. Digitalization initiatives are transforming operational efficiency and reducing development costs, making marginal fields commercially viable. The adoption of artificial intelligence, machine learning, and IoT technologies is revolutionizing asset management and predictive maintenance practices.

Investment climate improvements across many African countries are attracting increased foreign direct investment and international partnerships. Regulatory reforms aimed at streamlining licensing processes, improving transparency, and creating more favorable fiscal terms are encouraging exploration activities. The development of local content policies is fostering indigenous capacity building while maintaining international competitiveness.

Infrastructure development initiatives, including pipeline networks, processing facilities, and transportation systems, are creating enabling environments for market growth. Regional cooperation through organizations such as the African Union and regional economic communities is facilitating cross-border projects and harmonizing regulatory frameworks.

Significant challenges constraining the African oil and gas market include infrastructure deficits that limit the efficient transportation and processing of hydrocarbons. Capital intensity requirements for oil and gas projects often exceed the financial capabilities of local companies, creating dependency on international funding sources that may be subject to global economic fluctuations and geopolitical considerations.

Regulatory complexity across different African jurisdictions creates operational challenges for companies operating in multiple countries. Policy inconsistency and frequent changes in fiscal regimes can undermine long-term investment planning and project economics. Bureaucratic processes and lengthy approval procedures often delay project implementation and increase development costs.

Security concerns in certain regions pose significant risks to operations and personnel safety, potentially deterring investment and disrupting production activities. Political instability and governance challenges in some countries create uncertain business environments that complicate long-term planning and investment decisions.

Environmental considerations and increasing global focus on climate change are creating pressure for more sustainable energy solutions. Energy transition trends toward renewable sources may impact long-term demand projections for hydrocarbons, influencing investment strategies and project development timelines.

Substantial opportunities exist within the African oil and gas market, particularly in natural gas development and LNG export projects. Untapped reserves across the continent offer significant potential for new discoveries and field development, especially in frontier basins and deepwater areas. The growing global demand for cleaner-burning natural gas positions African gas resources favorably in international markets.

Downstream development presents considerable opportunities for value addition and economic diversification. Refinery expansion and petrochemical development can reduce import dependence while creating employment and industrial linkages. The establishment of regional refining hubs could serve multiple markets and optimize resource utilization across the continent.

Technology partnerships and knowledge transfer initiatives offer opportunities for capacity building and innovation adoption. Digital transformation programs can significantly improve operational efficiency and reduce environmental impact while creating new business models and service opportunities.

Regional integration initiatives provide platforms for developing cross-border infrastructure projects and harmonizing regulatory frameworks. Continental trade agreements such as the African Continental Free Trade Area (AfCFTA) create opportunities for expanded energy trade and investment flows within Africa.

Market dynamics in the African oil and gas industry are characterized by the interplay between global energy trends and local development priorities. Supply-demand balance is influenced by both international market conditions and domestic consumption patterns, creating complex pricing and investment dynamics across different market segments.

Competitive landscape features a mix of international oil companies, national oil companies, and emerging independent operators, each bringing different capabilities and strategic approaches to market development. Partnership models are evolving to incorporate risk-sharing arrangements, technology transfer agreements, and local content requirements.

Price volatility in global oil and gas markets significantly impacts project economics and investment decisions across Africa. Market participants are increasingly adopting flexible development strategies and cost optimization measures to maintain competitiveness across different price scenarios.

Regulatory evolution continues to shape market dynamics as governments balance revenue generation objectives with the need to attract investment and promote sustainable development. Fiscal regime optimization and contract terms are being refined to reflect changing market conditions and development priorities.

Comprehensive research methodology employed in analyzing the African oil and gas market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research activities include extensive interviews with industry executives, government officials, and technical experts across key African markets to gather firsthand insights into market conditions and development trends.

Secondary research encompasses analysis of government publications, industry reports, regulatory filings, and technical literature to establish baseline data and validate primary research findings. Quantitative analysis involves statistical modeling of production data, investment flows, and market indicators to identify trends and project future developments.

Market segmentation analysis examines different aspects of the industry including upstream, midstream, and downstream activities across various geographic regions and product categories. Competitive intelligence gathering focuses on major market participants, their strategies, and performance indicators to understand competitive dynamics.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification. Analytical frameworks incorporate both quantitative and qualitative assessment methodologies to provide comprehensive market insights and strategic recommendations.

West Africa dominates the continental oil and gas landscape, accounting for approximately 60% of total production and hosting some of the world’s most prolific offshore fields. Nigeria leads regional production with substantial onshore and offshore operations, while Angola has established itself as a major deepwater oil producer. Ghana’s emerging oil sector and Senegal’s developing gas resources are contributing to regional growth dynamics.

North Africa represents a mature oil and gas region with established infrastructure and production systems. Algeria serves as a major natural gas supplier to European markets through extensive pipeline networks, while Libya possesses substantial oil reserves despite ongoing political challenges. Egypt’s recent gas discoveries in the Mediterranean are transforming its energy profile and export potential.

East Africa is emerging as a significant natural gas province with major discoveries offshore Tanzania and Mozambique. LNG development projects in this region are attracting substantial international investment and positioning East Africa as a future major gas exporter. Uganda’s oil development and Kenya’s exploration activities are expanding the regional energy footprint.

Central Africa offers considerable untapped potential with countries like Chad, Cameroon, and Equatorial Guinea contributing to regional production. Cross-border collaboration and infrastructure development initiatives are creating opportunities for enhanced resource development and market integration across the region.

Competitive dynamics in the African oil and gas market feature a diverse array of participants ranging from global energy majors to regional specialists and national oil companies. Market leadership is distributed across different segments and geographic regions, creating opportunities for various competitive strategies and business models.

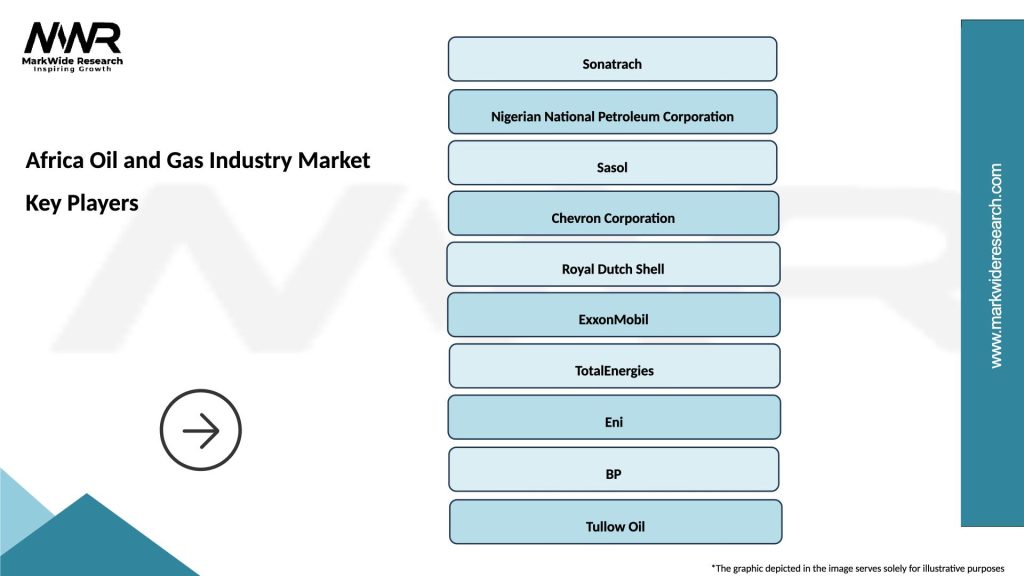

Major international players operating in the African market include:

National oil companies play increasingly important roles in their respective markets, with organizations such as Nigerian National Petroleum Corporation (NNPC), Sonatrach of Algeria, and Sonangol of Angola leading domestic development efforts while partnering with international companies on major projects.

Independent operators and specialized service companies are gaining market share through focused strategies and innovative approaches to resource development. Technology companies are becoming increasingly important partners in digital transformation initiatives and operational optimization programs.

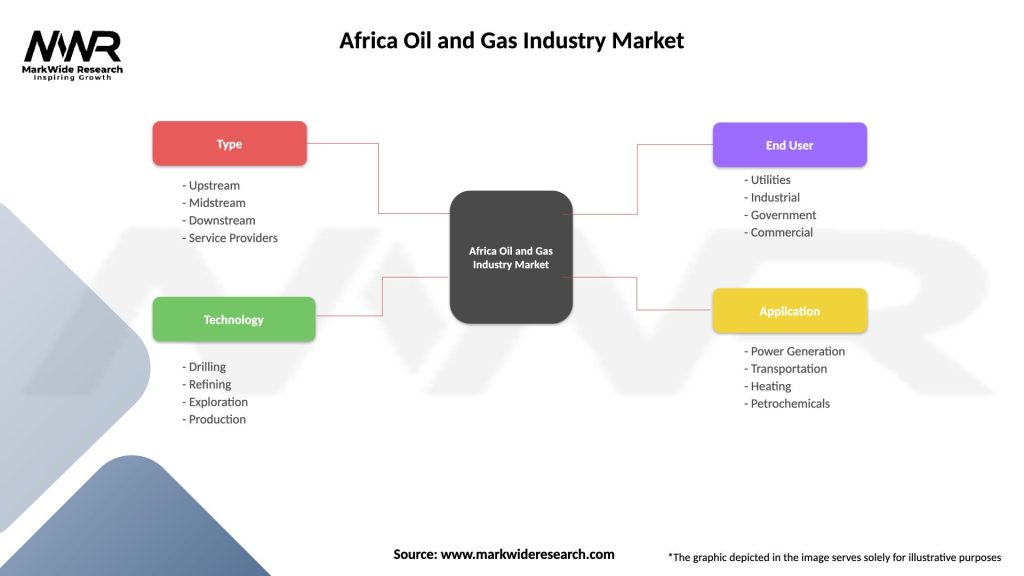

Market segmentation of the African oil and gas industry reveals distinct characteristics across multiple dimensions:

By Activity Type:

By Resource Type:

By Geographic Region:

Upstream category dominates the African oil and gas market in terms of investment and activity levels. Exploration activities are intensifying across frontier basins, with particular focus on deepwater and ultra-deepwater opportunities. Advanced seismic technologies and drilling techniques are enabling access to previously challenging reserves, expanding the resource base and extending field life cycles.

Production optimization initiatives are improving recovery rates and operational efficiency across existing fields. Enhanced oil recovery techniques and artificial intelligence applications are maximizing asset value while reducing environmental impact. Digital oilfield technologies are transforming production monitoring and control systems.

Midstream development is experiencing significant growth as countries invest in pipeline infrastructure and processing facilities. Gas processing plants and LNG facilities are being developed to monetize natural gas resources and serve both domestic and export markets. Cross-border pipeline projects are enhancing regional energy trade and market integration.

Downstream expansion focuses on refinery upgrades and new facility development to meet growing domestic demand and reduce import dependence. Petrochemical integration is creating additional value streams and supporting industrial development objectives. Marketing and distribution networks are being modernized to improve service quality and market reach.

Industry participants in the African oil and gas market benefit from substantial resource endowments and growing energy demand across the continent. International oil companies gain access to world-class reserves and development opportunities while leveraging their technical expertise and financial capabilities. Partnership arrangements with national oil companies provide market access and local knowledge while sharing development risks and rewards.

National oil companies benefit from technology transfer, capacity building, and revenue generation opportunities that support national development objectives. Local content development creates employment opportunities and builds indigenous capabilities across the energy value chain. Joint venture structures enable knowledge sharing and skill development while maintaining national ownership of resources.

Service companies benefit from growing demand for specialized technical services and equipment across all segments of the industry. Technology providers find expanding markets for innovative solutions that improve operational efficiency and environmental performance. Local service companies gain opportunities for capacity building and market participation through partnership arrangements.

Government stakeholders benefit from increased revenue generation, employment creation, and economic diversification opportunities. Regulatory frameworks that balance investor attraction with national interests create sustainable development models. Infrastructure development associated with oil and gas projects provides broader economic benefits and supports other sectors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents a fundamental trend reshaping the African oil and gas industry. Advanced analytics, artificial intelligence, and machine learning applications are optimizing exploration success rates, improving production efficiency, and reducing operational costs. Digital oilfield technologies are enabling remote monitoring and control of operations, particularly valuable in challenging or remote locations.

Sustainability focus is becoming increasingly important as companies adopt environmental, social, and governance (ESG) principles in their operations. Carbon footprint reduction initiatives, waste minimization programs, and community development projects are becoming standard components of project development. Gas flaring reduction and methane emission control are receiving particular attention.

Local content development continues to gain momentum as governments implement policies requiring increased local participation in oil and gas projects. Capacity building programs, technology transfer initiatives, and local supplier development are creating opportunities for indigenous companies while building national capabilities.

Regional cooperation is expanding through cross-border infrastructure projects and harmonized regulatory frameworks. Pipeline interconnections and shared processing facilities are optimizing resource utilization and reducing development costs. Continental initiatives such as the African Energy Commission are promoting coordinated energy development strategies.

Recent developments in the African oil and gas industry reflect the dynamic nature of the market and evolving strategic priorities. Major discoveries continue to be announced across the continent, with significant finds in deepwater areas offshore West and East Africa expanding the resource base and attracting international investment.

Infrastructure investments are accelerating with several major pipeline projects under development or recently completed. LNG facilities in Mozambique, Nigeria, and other countries are progressing toward production, positioning Africa as a growing supplier to global gas markets. Refinery modernization and expansion projects are improving product quality and reducing import dependence.

Technology partnerships between international and local companies are facilitating knowledge transfer and capability building. Digital innovation centers and research facilities are being established to support technology development and adaptation to local conditions. Artificial intelligence and automation technologies are being deployed across operations to improve efficiency and safety.

Regulatory reforms in several countries are streamlining licensing processes and improving transparency in the sector. Fiscal regime adjustments are being implemented to balance government revenue objectives with investor attraction. Regional harmonization initiatives are reducing regulatory complexity for companies operating across multiple jurisdictions.

Strategic recommendations for success in the African oil and gas market emphasize the importance of long-term commitment and local partnership development. Market entry strategies should prioritize relationship building with government stakeholders and national oil companies while demonstrating commitment to local content development and capacity building.

Technology investment should focus on solutions that address specific African challenges such as remote operations, infrastructure constraints, and environmental considerations. Digital transformation initiatives should be tailored to local conditions and capabilities while providing clear value propositions for operational improvement and cost reduction.

Risk management strategies should incorporate comprehensive political, security, and operational risk assessments while developing mitigation measures appropriate to local conditions. Insurance and financing arrangements should be structured to address specific African market risks and opportunities.

Sustainability integration should be embedded in all aspects of operations from project design through decommissioning. Community engagement and environmental stewardship programs should be developed in consultation with local stakeholders and aligned with national development priorities. According to MarkWide Research analysis, companies that successfully integrate sustainability considerations achieve better long-term performance and stakeholder relationships.

Future prospects for the African oil and gas industry remain positive despite global energy transition trends and market volatility. Natural gas development is expected to drive growth over the next decade, with LNG projects positioned to capture expanding global demand for cleaner-burning fossil fuels. The continent’s gas reserves provide substantial opportunities for both domestic energy security and export revenue generation.

Technology advancement will continue to unlock new resources and improve operational efficiency across the industry. Enhanced oil recovery techniques and unconventional resource development may expand the recoverable resource base significantly. Digital technologies will enable more efficient and sustainable operations while reducing environmental impact.

Regional integration initiatives are expected to accelerate, creating larger and more efficient energy markets across Africa. Infrastructure development will continue to improve connectivity and reduce transportation costs, making previously stranded resources commercially viable. The African Continental Free Trade Area is expected to facilitate increased energy trade and investment flows.

Investment flows are projected to remain strong, particularly in natural gas development and infrastructure projects. MWR projections indicate continued growth in exploration activities and field development across multiple African countries. The industry is expected to maintain its position as a critical contributor to African economic development while adapting to evolving global energy market conditions.

Africa’s oil and gas industry represents a dynamic and evolving market with substantial potential for continued growth and development. The continent’s significant hydrocarbon reserves, improving business environments, and growing energy demand create favorable conditions for sustained industry expansion. Strategic positioning of African resources in global energy markets, combined with advancing technology and infrastructure development, supports optimistic long-term prospects.

Market participants who successfully navigate the complex regulatory landscape, build strong local partnerships, and invest in sustainable operations are well-positioned to capitalize on emerging opportunities. The industry’s evolution toward more efficient, environmentally responsible, and technologically advanced operations aligns with global trends while addressing local development priorities.

Future success in the African oil and gas market will depend on balancing commercial objectives with sustainability considerations, regulatory compliance, and community engagement. Companies that demonstrate long-term commitment to African markets while contributing to local capacity building and economic development are likely to achieve the strongest performance and stakeholder relationships in this dynamic and promising industry.

What is Africa Oil and Gas?

Africa Oil and Gas refers to the exploration, extraction, and production of oil and natural gas resources across the African continent. This sector plays a crucial role in the economic development of many African nations, contributing to energy supply and job creation.

What are the key players in the Africa Oil and Gas Industry Market?

Key players in the Africa Oil and Gas Industry Market include companies such as TotalEnergies, Shell, and Eni, which are involved in various stages of oil and gas production. Additionally, local companies like Sonangol and PetroSA also play significant roles in their respective countries, among others.

What are the main drivers of the Africa Oil and Gas Industry Market?

The main drivers of the Africa Oil and Gas Industry Market include the increasing demand for energy, the discovery of new oil and gas reserves, and investments in infrastructure development. Additionally, technological advancements in extraction methods are enhancing production efficiency.

What challenges does the Africa Oil and Gas Industry Market face?

The Africa Oil and Gas Industry Market faces several challenges, including political instability in key producing regions, fluctuating oil prices, and environmental concerns related to extraction processes. These factors can hinder investment and operational efficiency.

What opportunities exist in the Africa Oil and Gas Industry Market?

Opportunities in the Africa Oil and Gas Industry Market include the potential for renewable energy integration, the development of local supply chains, and the expansion of natural gas as a cleaner energy source. These factors can lead to sustainable growth in the sector.

What trends are shaping the Africa Oil and Gas Industry Market?

Trends shaping the Africa Oil and Gas Industry Market include a shift towards cleaner energy solutions, increased investment in technology for enhanced oil recovery, and a focus on local content policies to boost domestic economies. These trends are influencing how companies operate within the sector.

Africa Oil and Gas Industry Market

| Segmentation Details | Description |

|---|---|

| Type | Upstream, Midstream, Downstream, Service Providers |

| Technology | Drilling, Refining, Exploration, Production |

| End User | Utilities, Industrial, Government, Commercial |

| Application | Power Generation, Transportation, Heating, Petrochemicals |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Africa Oil and Gas Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at