444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Africa maize market holds significant importance in the continent’s agricultural sector. Maize, also known as corn, is a staple crop for many African countries, serving as a primary source of food and income for millions of people. The market encompasses various activities related to the production, consumption, and trade of maize across different African regions.

Meaning

Maize is a cereal grain that originated in Mesoamerica and was introduced to Africa several centuries ago. It is a versatile crop with numerous applications, including human consumption, animal feed, and industrial uses such as biofuels and starch production. The Africa maize market refers to the entire value chain associated with the cultivation, processing, distribution, and utilization of maize in the continent.

Executive Summary

The Africa maize market has witnessed substantial growth over the years, driven by factors such as population growth, increasing demand for maize-based products, and favorable climatic conditions for cultivation. However, the market also faces challenges in the form of pests, diseases, and climate change impacts. Nonetheless, it presents significant opportunities for market participants to tap into the vast potential of the African maize industry.

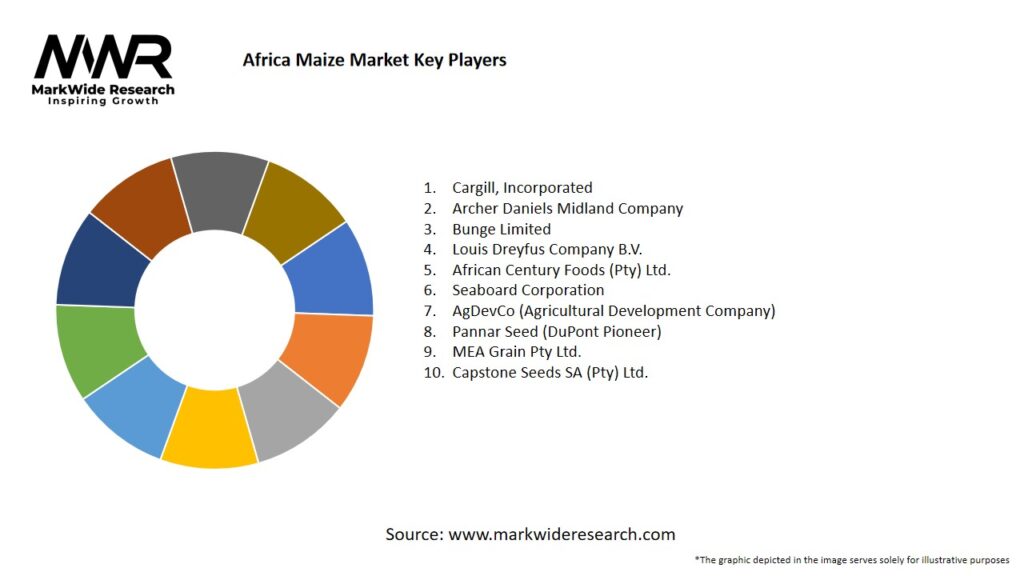

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Africa maize market operates in a dynamic environment influenced by multiple factors, including climate, policies, market forces, and technological advancements. The interplay of these dynamics shapes production volumes, market prices, and trade patterns. As the market evolves, stakeholders need to adapt to changing dynamics and embrace strategies that enhance productivity, value addition, and market access.

Regional Analysis

The Africa maize market exhibits regional variations in terms of production, consumption, and trade patterns. Key maize-producing regions include East Africa, Southern Africa, and West Africa. Each region has unique agro-ecological conditions, market dynamics, and consumption preferences, which influence maize cultivation practices and market structure.

In East Africa, countries such as Kenya, Tanzania, and Uganda are major maize producers, with a significant portion of production consumed domestically. East Africa also serves as an important maize-exporting region, with Kenya being a key exporter to neighboring countries.

Southern Africa, including South Africa, Zambia, and Zimbabwe, has a well-developed maize industry, characterized by large-scale commercial farming and substantial maize exports. The region benefits from favorable climatic conditions and advanced agricultural practices.

West Africa, encompassing countries like Nigeria, Ghana, and Côte d’Ivoire, experiences high maize consumption due to its large population. The region relies on imports to meet domestic demand, making it a potential market for exporters.

Understanding these regional dynamics is crucial for market participants to identify opportunities, establish strategic partnerships, and tailor their products and marketing strategies to specific regional requirements.

Competitive Landscape

Leading Companies in the Africa Maize Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Africa maize market can be segmented based on various factors, including:

Segmentation allows market participants to tailor their strategies, target specific customer segments, and address their unique needs effectively.

Category-wise Insights

By categorizing the content, readers can easily navigate to their areas of interest and gain in-depth insights specific to their sector or role.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis helps industry participants identify their strengths, overcome weaknesses, exploit opportunities, and mitigate threats, enabling them to develop effective strategies and achieve sustainable growth.

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the Africa maize market. The pandemic disrupted supply chains, affected labor availability, and led to shifts in consumer behavior. Key impacts include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Africa maize market is promising, with several trends shaping its trajectory. The growing population, increasing urbanization, and rising incomes will continue to drive demand for maize and maize-based products. However, climate change impacts and the need for sustainable agriculture practices will remain key challenges.

Investments in research, technology, and infrastructure development will play a crucial role in enhancing productivity, value addition, and market access. The adoption of digital solutions and e-commerce platforms will further facilitate trade and market transparency.

To harness the full potential of the Africa maize market, stakeholders need to embrace innovation, collaboration, and sustainable practices, ensuring food security, economic growth, and environmental sustainability for the continent.

Conclusion

The Africa maize market is a dynamic and vital sector, serving as a key source of food, income, and employment for millions of people. The market offers numerous opportunities for industry participants to expand their market presence, enhance profitability, and contribute to food security and economic growth.

However, challenges such as climate change impacts, quality concerns, and limited infrastructure need to be addressed. By adopting sustainable practices, investing in research and development, and strengthening market linkages, stakeholders can navigate the market dynamics and unlock the immense potential of the Africa maize market.

What is Maize?

Maize, also known as corn, is a cereal grain first domesticated by indigenous peoples in southern Mexico. It is a staple food in many African countries, used for various applications including food products, animal feed, and industrial uses.

What are the key players in the Africa Maize Market?

Key players in the Africa Maize Market include companies like Pioneer Hi-Bred, Syngenta, and Bayer Crop Science, which are involved in seed production and agricultural technology, among others.

What are the growth factors driving the Africa Maize Market?

The Africa Maize Market is driven by factors such as increasing population demand for food, rising adoption of modern agricultural practices, and the growing use of maize in biofuel production.

What challenges does the Africa Maize Market face?

Challenges in the Africa Maize Market include climate change impacts on crop yields, pest and disease pressures, and inadequate infrastructure for storage and distribution.

What opportunities exist in the Africa Maize Market?

Opportunities in the Africa Maize Market include advancements in biotechnology for higher yield varieties, increasing investment in agricultural research, and expanding export markets for maize products.

What trends are shaping the Africa Maize Market?

Trends in the Africa Maize Market include a shift towards sustainable farming practices, the integration of digital agriculture technologies, and a growing focus on value-added maize products.

Africa Maize Market

| Segmentation Details | Description |

|---|---|

| Product Type | White Maize, Yellow Maize, Sweet Maize, Flint Maize |

| End Use | Food Products, Animal Feed, Industrial Applications, Biofuels |

| Distribution Channel | Wholesale, Retail, Direct Sales, Online |

| Packaging Type | Bags, Bulk, Cans, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Africa Maize Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at