444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Africa insurance market is a dynamic and rapidly growing industry that plays a crucial role in the continent’s economic development. Insurance companies in Africa provide a wide range of insurance products and services, including life insurance, health insurance, property and casualty insurance, and reinsurance.

Meaning

Insurance is a financial mechanism that helps individuals and businesses mitigate the financial risks associated with unexpected events or losses. It provides protection and peace of mind by transferring the risks from policyholders to insurance companies in exchange for regular premium payments.

Executive Summary

The Africa insurance market has witnessed significant growth in recent years, driven by factors such as population growth, increasing awareness of insurance products, and favorable regulatory reforms. Despite the challenges posed by socio-economic conditions and infrastructure limitations in some regions, the market presents immense opportunities for both local and international insurers.

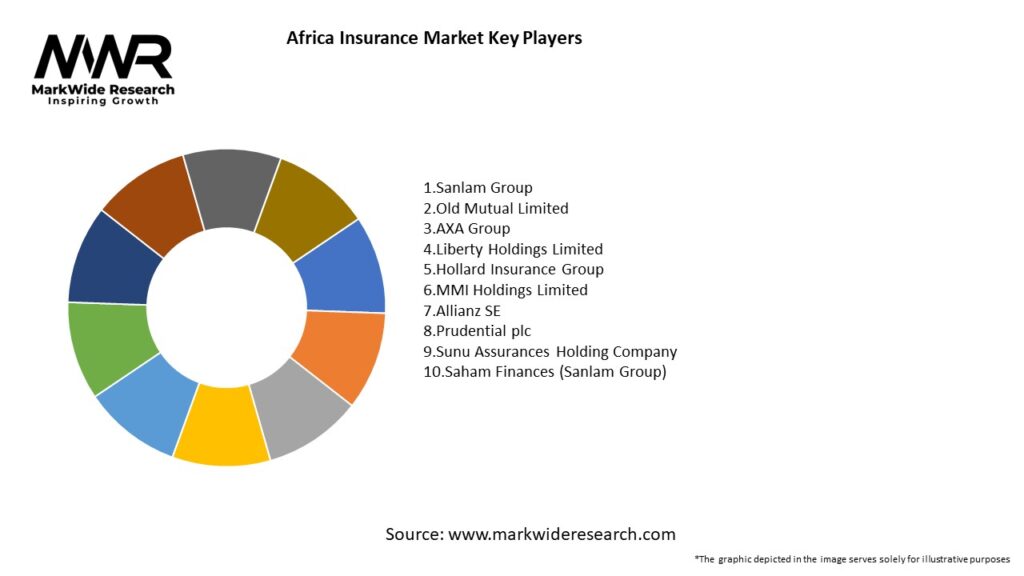

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Africa insurance market is characterized by intense competition, the entry of foreign insurers, and a growing focus on customer-centric strategies. Insurers are investing in technology, expanding distribution networks, and developing innovative products to differentiate themselves in the market. Additionally, partnerships with other industry players, such as banks and telecom companies, are becoming more prevalent to leverage existing customer relationships.

Regional Analysis

The African insurance market exhibits variations across regions due to differences in economic development, regulatory frameworks, and consumer preferences. North Africa has a more mature insurance market, with a higher penetration rate and greater product diversity. West Africa is experiencing rapid growth, driven by economic expansion and increased insurance awareness. East Africa presents untapped opportunities, particularly in microinsurance and agriculture insurance. Southern Africa has a mix of developed and emerging markets, with a growing middle class driving demand for various insurance products.

Competitive Landscape

Leading Companies in the Africa Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

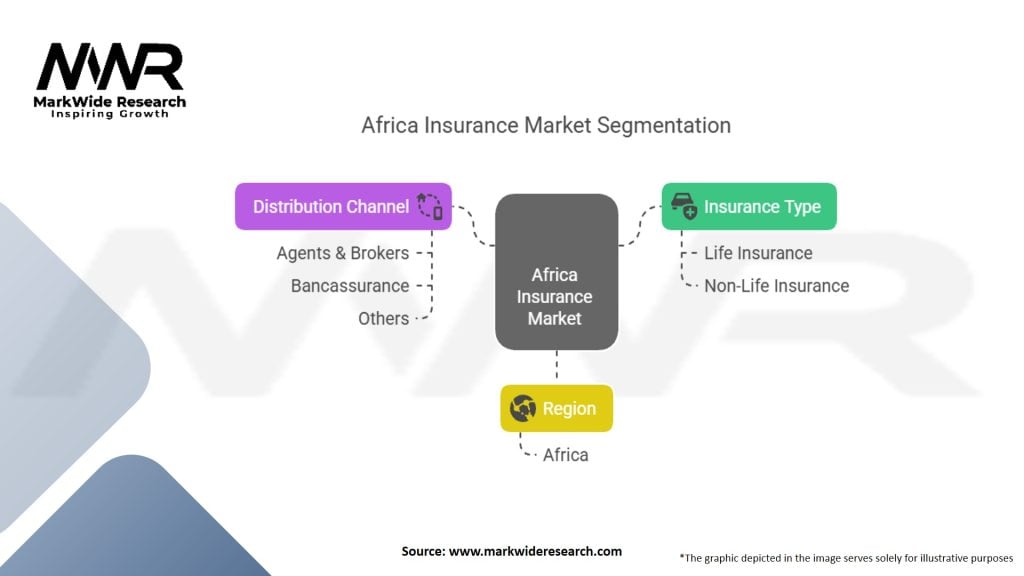

Segmentation

The Africa insurance market can be segmented based on the type of insurance products offered, including life insurance, health insurance, property and casualty insurance, and reinsurance. Each segment has its unique characteristics and growth drivers, catering to different customer needs and risk profiles.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the Africa insurance market. The pandemic highlighted the importance of insurance in providing financial protection against health risks and business interruptions. However, the economic slowdown and disruptions caused by the pandemic posed challenges for insurers, including increased claims, investment market volatility, and changes in consumer behavior. Insurers have responded by enhancing their digital capabilities, expanding telehealth services, and offering pandemic-specific coverage options.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Africa insurance market is promising. The continent’s economic growth, population dynamics, and increasing awareness of insurance products provide a favorable environment for market expansion. Technological advancements, regulatory reforms, and product innovation are expected to drive further growth and penetration. However, addressing challenges such as low insurance penetration, infrastructure limitations, and political risks will be crucial to unlocking the market’s full potential.

Conclusion

The Africa insurance market is poised for significant growth and presents numerous opportunities for insurers and industry stakeholders. With a large and growing consumer base, favorable regulatory reforms, and technological advancements, the market offers immense potential. However, addressing challenges such as low insurance penetration, infrastructure limitations, and political risks will require collaborative efforts from insurers, regulators, and other stakeholders. By embracing innovation, enhancing product offerings, and leveraging partnerships, insurers can navigate the market dynamics and contribute to the economic development and financial security of individuals and businesses across Africa.

What is the Africa insurance?

The Africa insurance refers to the various insurance products and services offered across the continent, including life, health, property, and auto insurance. This market is characterized by a growing demand for risk management solutions among individuals and businesses in diverse sectors.

Who are the major players in the Africa Insurance Market?

Major players in the Africa Insurance Market include Sanlam, Old Mutual, and Allianz, which provide a range of insurance products tailored to local needs. These companies are expanding their presence to capture the growing demand for insurance services across the continent, among others.

What are the key drivers of growth in the Africa Insurance Market?

Key drivers of growth in the Africa Insurance Market include increasing urbanization, rising disposable incomes, and a growing awareness of the importance of insurance. Additionally, the expansion of digital platforms is facilitating access to insurance products for a broader audience.

What challenges does the Africa Insurance Market face?

The Africa Insurance Market faces challenges such as low penetration rates, regulatory hurdles, and a lack of consumer trust in insurance products. Additionally, economic instability in certain regions can hinder market growth and investment.

What opportunities exist in the Africa Insurance Market?

Opportunities in the Africa Insurance Market include the potential for microinsurance products tailored to low-income populations and the integration of technology to enhance service delivery. The growing middle class also presents a significant opportunity for life and health insurance products.

What trends are shaping the Africa Insurance Market?

Trends shaping the Africa Insurance Market include the increasing adoption of digital insurance solutions, the rise of insurtech startups, and a focus on sustainability in insurance practices. These trends are driving innovation and improving customer engagement in the sector.

Africa Insurance Market:

| Segmentation Details | Information |

|---|---|

| Insurance Type | Life Insurance, Non-Life Insurance |

| Distribution Channel | Agents & Brokers, Bancassurance, Others |

| Region | Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Africa Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at