444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Africa food additives market is witnessing significant growth, driven by the rising demand for processed and packaged food products. Food additives play a crucial role in enhancing the taste, appearance, texture, and shelf life of food products. They are used in various applications, including bakery, beverages, confectionery, dairy, and meat products. The market offers a wide range of food additives, such as preservatives, flavor enhancers, sweeteners, emulsifiers, and colorants, to cater to the diverse needs of the food industry.

Meaning

Food additives are substances added to food products during processing to improve their quality, safety, and sensory attributes. They serve various functions, including preservation, flavor enhancement, texture improvement, and color enhancement. Food additives undergo strict regulatory scrutiny to ensure their safety and compliance with quality standards. They are used in small quantities and undergo rigorous testing before being approved for use in food products.

Executive Summary

The Africa food additives market is experiencing steady growth, driven by the increasing consumption of processed and convenience foods. The demand for food additives is fueled by changing consumer lifestyles, urbanization, and the need for longer shelf life of food products. The market is characterized by the presence of both global and regional players, offering a wide range of additives to meet the diverse demands of the food industry. Regulatory bodies play a crucial role in ensuring the safety and quality of food additives in the market.

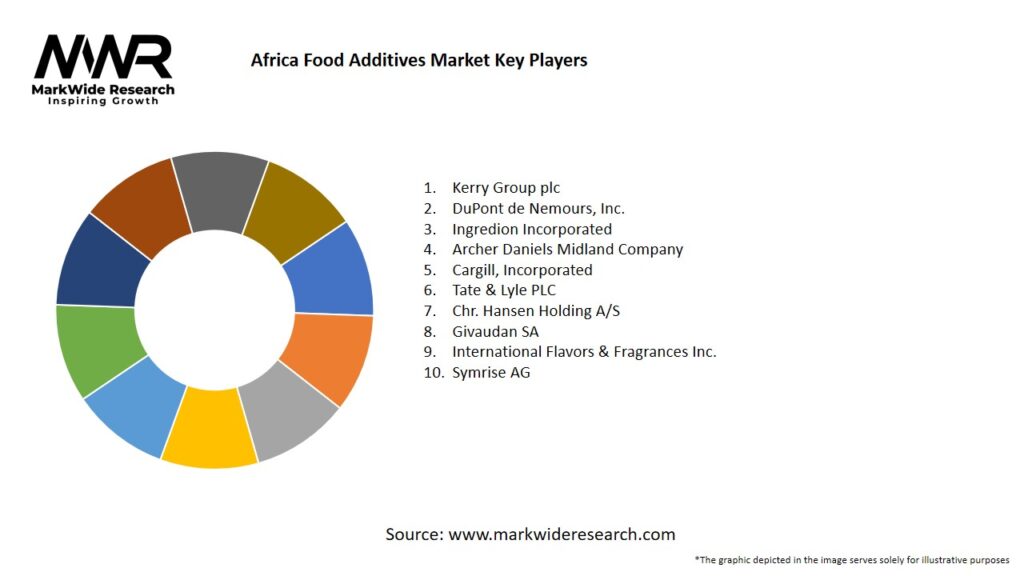

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Africa Food Additives market is influenced by several dynamic factors:

Regional Analysis

The Africa Food Additives market shows diverse growth patterns across the continent:

Competitive Landscape

Leading Companies in the Africa Food Additives Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

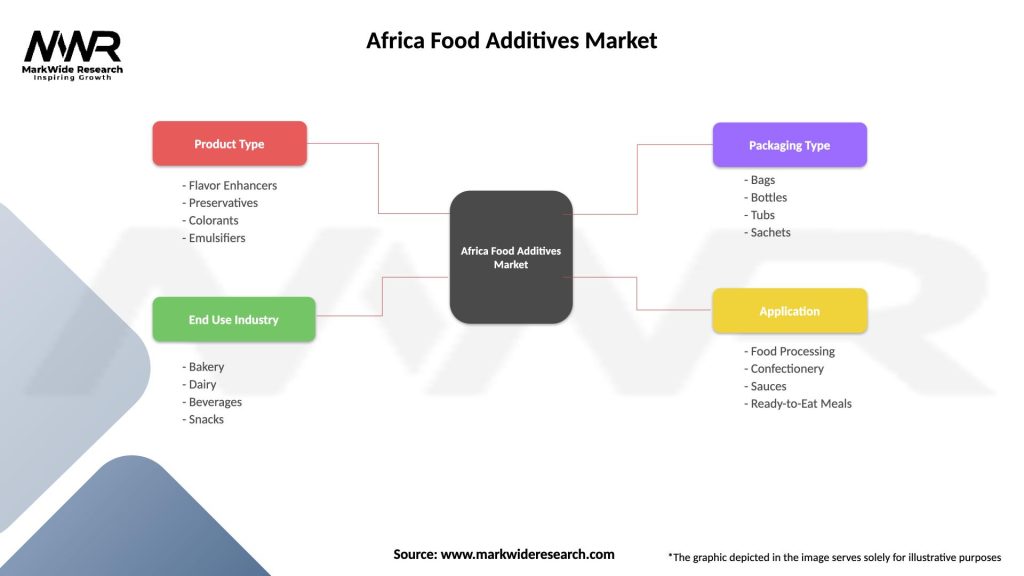

Segmentation

The Africa Food Additives market can be segmented as follows:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the Africa food additives market. While the initial lockdowns and supply chain disruptions affected the market, the subsequent increase in demand for packaged and processed foods supported the growth of the food additives industry. The pandemic highlighted the importance of food safety and longer shelf life, driving the need for preservatives and other food additives.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Africa food additives market is expected to witness steady growth in the coming years, driven by the increasing population, urbanization, and the growing demand for processed and convenience foods. The market will experience advancements in ingredient technologies, with a focus on natural and functional additives. Manufacturers need to adapt to changing consumer preferences, adhere to regulatory requirements, and invest in research and development to stay competitive in the evolving food additives landscape.

Conclusion

The Africa food additives market presents significant opportunities for manufacturers and stakeholders, driven by the rising demand for processed and convenience foods. The market is characterized by the need for natural, clean label, and functional additives, while regulatory compliance and consumer health concerns remain challenges. Continuous innovation, collaboration, and market expansion efforts will be key to capitalizing on the growing demand and ensuring long-term success in the African food additives market.

What is Food Additives?

Food additives are substances added to food to enhance its flavor, appearance, or preservation. They can include preservatives, colorants, flavor enhancers, and emulsifiers, among others.

What are the key players in the Africa Food Additives Market?

Key players in the Africa Food Additives Market include companies like DSM, BASF, and Kerry Group, which provide a range of additives for various food applications, among others.

What are the growth factors driving the Africa Food Additives Market?

The Africa Food Additives Market is driven by increasing consumer demand for processed foods, the rise in health consciousness leading to the use of natural additives, and the growth of the food and beverage industry.

What challenges does the Africa Food Additives Market face?

Challenges in the Africa Food Additives Market include regulatory hurdles regarding food safety, the need for consumer education on additives, and competition from natural alternatives.

What opportunities exist in the Africa Food Additives Market?

Opportunities in the Africa Food Additives Market include the growing trend towards clean label products, innovations in natural additives, and the expansion of the food processing sector.

What trends are shaping the Africa Food Additives Market?

Trends in the Africa Food Additives Market include a shift towards plant-based additives, increased focus on sustainability, and the development of innovative flavoring solutions to meet diverse consumer preferences.

Africa Food Additives Market

| Segmentation Details | Description |

|---|---|

| Product Type | Flavor Enhancers, Preservatives, Colorants, Emulsifiers |

| End Use Industry | Bakery, Dairy, Beverages, Snacks |

| Packaging Type | Bags, Bottles, Tubs, Sachets |

| Application | Food Processing, Confectionery, Sauces, Ready-to-Eat Meals |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Africa Food Additives Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at